UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

First mailed to shareholders on or about December 1, 2025

Dear Shareholder:

We invite you to attend the virtual 2025 Annual Meeting of Shareholders of Tron Inc. to be held on December 16, 2025 at 10:00 a.m. Eastern Time at https://www.cleartrustonline.com/tron. The Notice of the Annual Meeting and Proxy Statement accompanying this letter provide information concerning matters to be considered and acted upon at the virtual meeting.

Your vote is important. We encourage you to read all of the information in the Proxy Statement and vote your shares as soon as possible. Whether or not you plan to virtually attend, you can be sure your shares are represented at the Annual Meeting by promptly submitting your vote by the Internet, by telephone or by mail.

On behalf of the Board of Directors, thank you for your continued confidence and investment in Tron Inc.

| Sincerely, | |

| /s/ Richard Miller | |

| Richard Miller | |

| Chief Executive Officer and Director |

TRON INC.

941 W. Morse Blvd., Suite 100

Winter Park FL 32789(407) 230-8100

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON

DECEMBER 16, 2025

To the shareholders of Tron Inc.:

You are cordially invited to attend the virtual Annual Meeting of Shareholders (the “Annual Meeting”) of Tron Inc., a Nevada corporation (together with its subsidiaries, the “Company,” “Tron,” “we,” “us” or “our”). The virtual Annual Meeting will be held on December 16, 2025, at 10:00 a.m. Eastern Time. The Annual Meeting will be held virtually. To participate in the meeting, click on https://www.cleartrustonline.com/tron. At the Annual Meeting, you will be asked to vote:

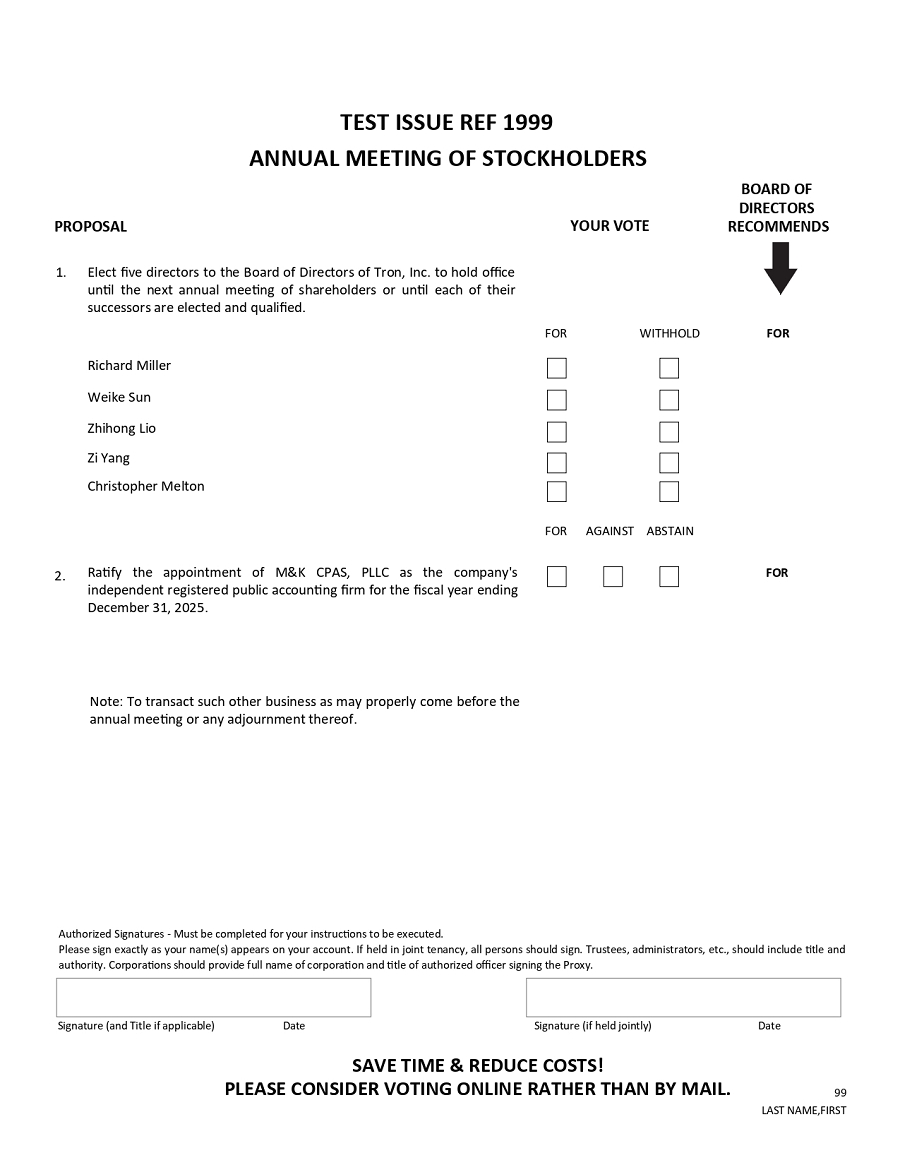

| 1. | To elect five directors to hold office until the next annual meeting of shareholders or until each of their successors are elected and qualified (Proposal No. 1); |

| 2. | To ratify the appointment of M&K CPAS, PLLC as our independent registered public accounting firm for the fiscal year ending December 31, 2025 (Proposal No. 2); |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement, which is attached and made a part of this Notice. Only shareholders of record of our common stock, par value $0.0001 per share, at the close of business on November 18, 2025 (the “Record Date”), will be entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

You are cordially invited to attend the virtual Annual Meeting.

Whether or not you expect to attend the virtual Annual Meeting, please submit a proxy to vote your shares either via Internet or by mail. If you choose to submit your proxy by mail, please complete, sign, date and return the enclosed proxy card in the enclosed postage-paid envelope in order to ensure representation of your shares. Your proxy is revocable in accordance with the procedures set forth in the Proxy Statement.

Accordingly, on or about December 1, 2025 we will begin mailing the Proxy Materials to all shareholders of record as of the Record Date.

| By Order of the Board of Directors | |

| /s/ Richard Miller | |

| Richard Miller | |

| Director and Chief Executive Officer | |

| November 26, 2025 | |

| Winter Park, Florida |

| 1 |

TRON INC.

PROXY STATEMENT

General Information

This Proxy Statement is being furnished to the shareholders of Tron Inc. (together with its subsidiary, the “Company,” “Tron,” “we,” “us” or “our”) in connection with the solicitation of proxies by our Board of Directors (the “Board of Directors” or the “Board”) for use at the virtual Annual Meeting of Shareholders to be held on December 16, 2025 at 10:00 a.m. Eastern Time, and at any and all adjournments or postponements thereof (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. To participate in the virtual meeting, click on https://www.cleartrustonline.com/tron. Accompanying this Proxy Statement is a proxy/voting instruction form (the “Proxy”) for the Annual Meeting, which you may use to indicate your vote as to the proposals described in this Proxy Statement. It is contemplated that this Proxy Statement and the accompanying form of Proxy will be mailed to the Company’s shareholders on or about December 1, 2025.

How do I attend the Annual Meeting?

The Annual Meeting will take place virtually. To participate in the virtual meeting, click on https://www.cleartrustonline.com/tron. You are entitled to participate in the Annual Meeting only if you were a shareholder of the Company as of the close of business on November 18, 2025 (the “Record Date”). As of the Record Date, there were 257,115,400 shares of our common stock issued and outstanding and entitled to vote, which represented 24 holders of record. Each holder of shares of common stock is entitled to one vote for each share of stock held on the proposals presented in this Proxy Statement. Our bylaws, as amended, provide that a majority of the shares entitled to vote, represented in person or by proxy, shall constitute a quorum at a meeting of shareholders.

You will be able to attend the Annual Meeting online and submit questions during the meeting. To attend the Annual Meeting, you will need the control number included on your proxy card or on the virtual meeting instructions that accompanied your proxy materials or other information, as instructed, through your broker, bank or other holder of record. Shares held in your name as the shareholder of record may be voted during the Annual Meeting. If your shares are held in the name of a broker, bank, or other nominee, you should contact your broker, bank, or other nominee to obtain your control number or other instructions provided by your broker, bank or other holder of record. However, even if you plan to virtually attend the Annual Meeting, we recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to virtually attend the Annual Meeting.

How do I vote?

Record-date holders of our common stock have the following methods of voting:

| 1. | Vote by Internet. You may vote your shares by following the “Vote by Internet” instructions on the accompanying proxy card/voting instruction form. If you vote over the Internet, you do not need to vote electronically at the Annual Meeting or complete and mail your proxy card/voting instruction form. |

| 2. | Vote by Mail. To vote by mail, please mark, date, sign and promptly mail your proxy card/voting instruction form (a postage-paid envelope is provided for mailing in the United States). |

| 3. | Vote by Phone. The telephone number for voting by phone is on your proxy card/voting instruction form. |

| 4. | Vote at the Annual Meeting. Virtually attend and vote at the Annual Meeting per the virtual meeting instructions. |

Soliciting Proxies

We will solicit shareholders by mail through our employees and will request banks and brokers and other custodians, nominees and fiduciaries, to solicit their customers who have stock of the Company registered in the names of such persons and will reimburse them for reasonable, out-of-pocket costs. In addition, we may use the services of our officers and directors to solicit proxies, personally or by telephone, without additional compensation.

| 2 |

Why am I being provided with these proxy materials?

We have delivered printed versions of these proxy materials to you by mail in connection with the solicitation by our Board of proxies for the matters to be voted on at our Annual Meeting and at any adjournment or postponement thereof.

What do I do if my shares are held in “street name”?

If your shares are held in a brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in “street name.” As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by following their instructions for voting. Please refer to information from your bank, broker or other nominee on how to submit your voting instructions.

What if other matters come up at the Annual Meeting?

At the date this Proxy Statement went to press, we did not know of any matters to be properly presented at the Annual Meeting, other than those referred to in this Proxy Statement. If other matters are properly presented at the meeting or any adjournment or postponement thereof for consideration, and you are a shareholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

Voting of Proxies

All valid proxies received prior to the Annual Meeting will be voted. The Board of Directors recommends that you vote by proxy even if you plan to virtually attend the Annual Meeting. You can vote your shares by proxy via Internet or mail. To vote via Internet, go to www.proxyvote.com and follow the instructions. To vote by mail, fill out the enclosed proxy card, sign and date it, and return it in the enclosed postage-paid envelope. Voting by proxy will not limit your right to vote at the Annual Meeting if you virtually attend the Annual Meeting. However, if your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy executed in your favor, from the holder of record to be able to vote at the Annual Meeting.

We will provide Internet proxy voting to all shareholders and allow you to vote your shares at the Annual Meeting, with procedures designed to ensure the authenticity and correctness of your vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

Revocability of Proxies

All proxies which are properly completed, signed and returned prior to the Annual Meeting, and which have not been revoked, will be voted in favor of the proposals described in this Proxy Statement unless otherwise directed. A shareholder may revoke his or her proxy at any time before it is voted either by submitting to the Secretary of the Company, at its principal executive offices located at 941 W. Morse Blvd., Suite 100 Winter Park FL 32789, a written notice of revocation or a duly-executed proxy bearing a later date or by virtually attending the Annual Meeting and voting virtually.

| 3 |

Voting Procedures and Vote Required

A majority of the shares entitled to vote, represented in person or by proxy, shall constitute a quorum at the Annual Meeting of shareholders. Shares represented by proxies which contain an abstention, as well as “broker non-vote” shares (described below) are counted as present for purposes of determining the presence or absence of a quorum for the Annual Meeting. All properly executed proxies delivered pursuant to this solicitation and not revoked will be voted at the Annual Meeting as specified in such proxies.

Vote Required for Election of Directors (Proposal No. 1).

Pursuant to our Bylaws, as amended, the Company uses a plurality of votes cast by the stockholders entitled to vote for the election of directors. Plurality of the votes cast means that those director nominees receiving the most “FOR” votes cast in favor of their election to the Board will be elected to the Board. Proxies cannot be voted for a greater number of persons than the number of nominees named or for persons other than the named nominees. Withholding a vote from a director nominee will not be voted with respect to the director nominee indicated and will have no impact on the election of directors although it will be counted for the purposes of determining whether there is a quorum. Broker non-votes will have no effect on the outcome of this proposal.

Vote Required to Approve the Ratification of Appointment of Independent Registered Public Accounting Firm (Proposal No. 2)

Votes may be cast: “FOR,” “AGAINST” or “ABSTAIN.” Our Bylaws, as amended, provide that, on all matters (other than the election of directors and except to the extent otherwise required by our Articles of Incorporation, as amended, or applicable Nevada law), the affirmative vote of a majority of the shares represented at the Annual Meeting and entitled to vote, will be required for approval. Accordingly, the affirmative vote of a majority of the shares represented at the Annual Meeting and entitled to vote, will be required to approve the ratification of the appointment of the independent registered public accounting firm.

Shareholder List

For a period of at least 10 days prior to the Annual Meeting, a complete list of shareholders entitled to vote at the Annual Meeting will be available at our principal executive offices located at 941 W. Morse Blvd., Suite 100 Winter Park FL 32789, so that shareholders of record may inspect the list only for proper purposes.

Expenses of Solicitation

We will pay the cost of preparing, assembling and mailing this proxy-soliciting material, and all costs of solicitation, including certain expenses of brokers and nominees who mail proxy material to their customers or principals.

CORPORATE GOVERNANCE

Board of Directors

Members of Our Board of Directors

Set forth below are the names of and certain biographical information about each member of our Board of Directors. The information presented includes each director’s principal occupation and business experience for the past five years and the names of other public companies of which he or she has served as a director during the past five years.

The Board, upon the recommendation of our Nominating and Governance Committee, has nominated: Richard Miller, Christopher Marc Melton, for election as directors, each to hold office until their successors are elected and qualified or until their earlier resignation or removal.

| Name | Age | Position(s) | ||

| Richard Miller | 58 | Chief Executive Officer and Director | ||

| Weike Sun | 66 | Chairman of the Board of Directors | ||

| Christopher Marc Melton | 54 | Independent Director | ||

| Zhihong Liu | 59 | Independent Director | ||

| Zi Yang | 27 | Independent Director |

The following describes the business experience of each of our directors and executive officers, including other directorships held in reporting companies:

| 4 |

Richard Miller, Chief Executive Officer and Director, has served as Chief Executive Officer and Director of the Company since November 2020. Previously, Mr. Miller served as the Chief Operating Officer of Jupiter Wellness, Inc. from November 2018 until November 2020. Mr. Miller served as president of Caro Consulting, Inc. a consulting firm that advises emerging growth companies. Over the last twenty years Mr. Miller has provided strategic advice to hundreds of companies across diverse industries. He has assisted C Level executives with expanding, financing and other challenges emerging companies face. Mr. Miller co-founded of Teeka Tan Suncare Products in 2004 and oversaw the development, design and launch of a diverse sun care product line along with the public offering of the company. He is an advocate for school safety and local schools through his grass roots group My School Counts.

Weike Sun, Chairman of the Board of Directors, has served as Chairman of the Board of Directors since June 2025. Mr. Sun began his career in journalism and public infrastructure administration in China. Following his extensive experience in the public sector, Mr. Sun transitioned to the private sector holding senior management and advisory role to several fintech companies since 2016, including Ruibo (Beijing) Technology and Peiwo Huanle (Beijing) Technology. He was the Chairman of Guangzhou Keyhiway Printing Technology, a listed company on China’s National Equities Exchange and Quotations (NEEQ) from March 2022 to July 2023. Mr. Sun holds a bachelor’s degree from Qinghai Normal College.

Christopher Marc Melton, Director, has served as one of our directors since April 2022. Mr. Melton has served as director of SG Blocks, Inc. since November of 2011 and currently serves as the Audit Committee Chairman. From 2000 to 2008, Mr. Melton was a Portfolio Manager for Kingdon Capital Management (“Kingdon”) in New York City, where he ran in excess of $1 Billion book in media, telecom, and Japanese investment. Mr. Melton opened Kingdon’s office in Japan, where he set up a Japanese research company. From 1997 to 2000, Mr. Melton served as a Vice President at JPMorgan Investment Management as an equity research analyst, where he helped manage $1 Billion plus in REIT funds under management. Mr. Melton was a Senior Real Estate Equity Analyst at RREEF Funds in Chicago from 1995 to 1997. Mr. Melton is Principal and co-founder of Callegro Investments, a specialist land investor. He currently serves on several Public and Private Boards as well as Chairman of the Audit Committee of a Nasdaq listed company.

Zhihong Liu, Director, has served on our Board since June 2025. Mr. Liu has been the senior advisor to Tron DAO since 2021, leading its strategic investment activities. Previously, Mr. Liu served as the board director of Valkyrie Investment helping to launch one of the first Bitcoin future ETFs in the US. Prior to joining the blockchain industry in 2021, he had held senior positions in the financial industry for over 20 years working for leading global firms including Ant Financial, NOMURA, Salomon Smith Barney and Fidelity Investment. Mr. Liu holds an MBA from Columbia University and a bachelor’s degree from Zhejiang University in China.

Zi Yang, Director, has served as a director of the Company since June 2025. Mr. Yang has been active in the blockchain industry for over 5 years. Mr. Yang currently holds senior positions for several leading blockchain projects including Tronscan, the official blockchain explorer for Tron protocol. Mr. Yang holds a bachelor’s degree in Human Resource Management from Guangdong University of Foreign Studies in China.

Term of Office

Our Board is elected annually by our stockholders. Each director shall hold office until a successor is duly elected and qualified or until his or her earlier death, resignation or removal.

Family Relationships

There are no family relationships among and between the issuer’s directors, officers, persons nominated or chosen by the issuer to become directors or officers, or beneficial owners of more than ten percent of any class of the issuer’s equity securities.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors and officers, and the persons who beneficially own more than 10% of our Common Stock, to file reports of ownership and changes in ownership with the SEC. Copies of all filed reports are required to be furnished to us pursuant to Rule 16a-3 promulgated under the Exchange Act. Based solely on the reports received by us and on the representations of the reporting persons, we believe that these persons have complied with all applicable filing requirements during the year ended December 31, 2024. Based on a review of Form 4s filed by Safety Shot, Inc., they filed one Form 4 late with regard to two transactions in December 2024.

| 5 |

Board Composition

Director Independence

Our business and affairs are managed under the direction of our Board, which consist of five members. Under Nasdaq rules, independent directors must comprise a majority of a listed company’s board of directors, subject to certain exceptions. In addition, Nasdaq rules require that each member of a listed company’s audit, compensation and nominating and governance committees be independent, subject to certain phase-ins for newly-public companies. Under Nasdaq rules, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries or (2) be an affiliated person of the listed company or any of its subsidiaries.

Our Board has undertaken a review of its composition, the composition of its committees and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board has determined that Messrs. Melton, Liu and Yang do not have any relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of Nasdaq. In making this determination, our Board considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

In making this determination, our Board considered the current and prior relationships that each non-employee director has with us and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Board Committees

Our Board has established Audit, Compensation, and Nominating and Corporative Governance Committees. Our Board may establish other committees to facilitate the management of our business. The composition and functions of the audit committee, compensation committee and nominating and corporate governance committee are described below. The charter of each committee is available on our corporate website at https://corporate.srmentertainment.com/corporate-governance. Members will serve on committees until their resignation or removal from the Board or until otherwise determined by our Board.

| 6 |

Audit Committee

Our audit committee consists of Messrs. Melton, Liu and Yang, with Mr. Melton serving as the chairman. Our Board has determined that Mr. Melton is an “audit committee financial expert” within the meaning of the SEC regulations. Our Board has also determined that each member of our audit committee can read and understand fundamental financial statements in accordance with applicable requirements. In arriving at these determinations, the Board has examined each audit committee member’s scope of experience and the nature of their employment in the corporate finance sector. The functions of this committee include:

| ● | selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; |

| ● | helping to ensure the independence and performance of the independent registered public accounting firm; |

| ● | discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent accountants, our interim and year-end operating results; |

| ● | developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| ● | reviewing our policies on risk assessment and risk management; |

| ● | reviewing related party transactions; |

| ● | obtaining and reviewing a report by the independent registered public accounting firm at least annually, that describes our internal quality-control procedures, any material issues with such procedures, and any steps taken to deal with such issues when required by applicable law; and |

| ● | approving (or, as permitted, pre-approving) all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm. |

Compensation Committee

Our compensation committee consists of Messrs. Melton, Liu and Yang with Mr. Liu serving as the chairman. The functions of the compensation committee include:

| ● | reviewing and approving, or recommending that our Board approve, the compensation of our executive officers; |

| ● | reviewing and recommending that our Board approve the compensation of our directors; |

| ● | reviewing and approving, or recommending that our Board approve, the terms of compensatory arrangements with our executive officers; |

| ● | administering our stock and equity incentive plans; |

| ● | selecting independent compensation consultants and assessing conflict of interest compensation advisers; |

| ● | reviewing and approving, or recommending that our Board approve, incentive compensation and equity plans; and |

| ● | reviewing and establishing general policies relating to compensation and benefits of our employees and reviewing our overall compensation philosophy. |

| 7 |

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Messrs. Melton and Liu and Yang, with Mr. Yang serving as the chairman. The functions of the nominating and governance committee include:

| ● | identifying and recommending candidates for membership on our Board; |

| ● | including nominees recommended by stockholders; |

| ● | reviewing and recommending the composition of our committees; |

| ● | overseeing our code of business conduct and ethics, corporate governance guidelines and reporting; and |

| ● | making recommendations to our Board concerning governance matters. |

The nominating and corporate governance committee also annually reviews the nominating and corporate governance committee charter and the committee’s performance.

Board Leadership Structure and Role in Risk Oversight

Our Board is primarily responsible for overseeing our risk management processes. Our Board receives and reviews periodic reports from management, auditors, legal counsel, and others, as considered appropriate regarding our assessment of risks. Our Board focuses on the most significant risks we face our general risk management strategy, and also ensures that risks we undertake are consistent with our Board’s appetite for risk. While our Board oversees our risk management, management is responsible for day-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks we face and that our Board leadership structure supports this approach.

| 8 |

Code of Ethics

We have adopted a code of ethics and conduct applicable to all of our directors, officers, employees and all persons performing similar functions. The code of ethics is available on our corporate website at https://srmentertainment.com/corporate-governance/. We expect that any amendments to the code, or any waivers of its requirements, will be disclosed in our public filings with the Commission.

Corporate Governance Guidelines

We have adopted a corporate governance guidelines that serve as a flexible framework within which our Board and its committees operate. These guidelines cover a number of areas including the size and composition of the Board, Board membership criteria and director qualifications, director responsibilities, Board agenda, roles of the chairman of the Board and Chief Executive Officer and Chief Financial Officer, meetings of independent directors, committee responsibilities and assignments, Board member access to management and independent advisors, director communications with third parties, director compensation, director orientation and continuing education, evaluation of senior management and management succession planning.

Involvement in Certain Legal Proceedings

To our knowledge, our directors and executive officers have not been involved in any of the following events during the past ten years:

1. any bankruptcy petition filed by or against such person or any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time;

2. any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

3.being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting his involvement in any type of business, securities or banking activities or to be associated with any person practicing in banking or securities activities;

4. being found by a court of competent jurisdiction in a civil action, the SEC or the Commodity Futures Trading Commission to have violated a Federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

5. being subject of, or a party to, any Federal or state judicial or administrative order, judgment decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of any Federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

6. being subject of or party to any sanction or order, not subsequently reversed, suspended, or vacated, of any self-regulatory organization, any registered entity or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

| 9 |

EXECUTIVE COMPENSATION

Summary Compensation Table

Compensation was paid to our principal executive officer and our two other most highly compensated executive officers (our named executive officers) during the fiscal years indicated below.

| Stock | Option | All Other | Total | |||||||||||||||||||||||

| Name and Principal | Salary | Bonus | Awards | Awards | Compensation | Compensation | ||||||||||||||||||||

| Position | Year | ($) | ($) | ($)(3) | ($)(3) | ($)(4) | ($) | |||||||||||||||||||

| Richard Miller (1)(4) | 2023 | $ | 175,000 | $ | 50,000 | $ | - | $ | - | $ | 25,000 | $ | 250,000 | |||||||||||||

| Chief Executive Officer | 2024 | $ | 201,979 | $ | - | $ | - | $ | - | $ | 25,000 | $ | 226,979 | |||||||||||||

| Douglas O. McKinnon(2)(4) | 2023 | $ | 61,875 | $ | 25,000 | $ | - | $ | - | $ | 12,500 | $ | 99,375 | |||||||||||||

| Chief Financial Officer | 2024 | $ | 181,500 | $ | - | $ | - | $ | - | $ | 25,000 | $ | 206,500 | |||||||||||||

| Taft Flitner | 2023 | $ | 100,000 | $ | 68,717 | $ | - | $ | - | $ | - | $ | 168,617 | |||||||||||||

| President | 2024 | $ | 103,000 | $ | 80,382 | $ | - | $ | - | $ | - | $ | 183,382 | |||||||||||||

| 1. | Mr. Miller was appointed as Chief Executive Officer on January 1, 2023. |

| 2. | Mr. McKinnon was appointed Chief Financial Officer on August 14, 2023. |

| 3. | There were no equity incentive plan compensation, option awards, nor stock awards in 2024 and 2023. |

| 4. | Mr. Miller and Mr. McKinnon were each paid $25,000 for Director fees in 2024. |

Employment Agreements with Named Officers

Richard Miller

We entered into an employment agreement with Richard Miller on September 10, 2024, pursuant to which we employ Mr. Miller as Chief Executive Officer. The agreement has a term of three years which automatically renews unless either party sends written notice of termination no less than 90 days prior to the then term and provides for an annual base salary (“Base”) of $225,000. The base salary will increase 10% annually over the previous year’s salary.

In addition to the foregoing, the Company shall make the following bonus to Mr. Miller with the following values upon the completion of the following goals: (a) the Company shall pay Mr. Miller a bonus based upon revenues generated from the pre-Tron Transaction businesses as follows: 1% of any revenues up to $5M; plus 1% of the second $5M in revenues; plus 2% of the third $5M in revenues; plus 2% of the fourth $5M in revenues; plus 2% of all revenues in excess of $20M; provided, that: (i) the bonus is subject to a cap of $2M; and (ii) the bonus may be paid, at the election of Mr. Miller, in cash or shares of common stock (calculated at the fair market value of such shares as determined by the Board).

Upon any termination of Mr. Miller’s employment with the Company for any reason, except for a termination for cause, the Mr. Miller shall be entitled to (a) a payment equal to the greater of (i) two (2) years’ worth of the then-existing base and the last year’s bonus or (ii) the Base payable through the remaining initial term, and (b) retain the benefits set forth in Article IV of Mr. Miller’s employment agreement for the remainder of the initial term or renewal term, as then applicable.

| 10 |

The agreement also contains the following material provisions: eligible to participate in pension and other retirement plans, group life insurance, hospitalization, surgical and major medical coverage, sick leave, disability and salary continuation, vacation and holidays, long-term disability, and other fringe benefits and entitled to reimbursement for all reasonable and necessary business expenses. Mr. Miller agreed to non-compete and non-solicit terms under his agreement.

Douglas McKinnon

We entered into an employment agreement with Douglas McKinnon on January 22, 2025, pursuant to which we employ Mr. McKinnon as Chief Financial Officer. The agreement has a term of three years which automatically renews unless either party sends written notice of termination no less than 90 days prior to the then term and provides for an annual base salary of $215,000. The base salary will increase 10% annually over the previous year’s salary.

In addition to the foregoing, the Company shall make the following bonus to Mr. McKinnon as follows: (a) as determined on a calendar year basis, that if management’s goals have been met which includes the target objectives of the CEO, the target bonus for the Mr. McKinnon shall be equal to 75% of the bonus paid to the CEO as determined by the Compensation Committee.

Upon any termination of Mr. McKinnon’s employment with the Company for any reason, except for a termination for cause, the Mr. McKinnon shall be entitled to (a) a payment equal to the greater of (i) two (2) years’ worth of the then-existing base and the last year’s bonus or (ii) the Base payable through the remaining initial term , and (b) retain the benefits set forth in Article IV of Mr. McKinnon’s employment agreement for the remainder of the initial term or renewal term, as then applicable.

The agreement also contains the following material provisions: eligible to participate in pension and other retirement plans, group life insurance, hospitalization, surgical and major medical coverage, sick leave, disability and salary continuation, vacation and holidays, long-term disability, and other fringe benefits and entitled to reimbursement for all reasonable and necessary business expenses. Mr. McKinnon agreed to non-compete and non-solicit terms under his agreement.

Taft Flittner

We entered into an employment agreement with Taft Flittner on January 1, 2023, pursuant to which we employ Mr. Flittner as President. This agreement provides for an annual base salary of $100,000 and fifty thousand (50,000) ISO options to purchase shares of the Company’s Common Stock pursuant to the 2022 Equity Incentive Plan. The ISO options will vest in annually tranches and be fully vested two years from the date of the agreement. The option’s strike price will be the closing price on the date of issuance. Mr. Flittner shall receive an annual bonus(s’) based on a percentage of EBITDA, growth and other factors which will be determined by the Board.

The agreement also contains the following material provisions: eligible to participate in pension and other retirement plans, group life insurance, hospitalization, surgical and major medical coverage, sick leave, disability and salary continuation, vacation and holidays, cellular telephone and all related costs and expenses, long-term disability, and other fringe benefits and entitled to reimbursement for all reasonable and necessary business expenses. Mr. Flittner agreed to non-compete and non-solicit terms under his agreement.

Board Meetings and Attendance

During fiscal 2024, our Board held three (3) meetings. While they served as directors, each director attended 100% of the total number of meetings of the Board. The members of the Audit Committee and Compensation Committee attended 100% of the respective committee meetings. The Board and each of the committees also acted at times by unanimous written consent, as authorized by our bylaws and the Nevada General Corporate Law.

| 11 |

Shareholder Communications with the Board

Shareholders wishing to communicate with the Board, the non-management directors, or with an individual Board member may do so by writing to the Board, to the non-management directors, or to the particular Board member, and mailing the correspondence to: c/o Secretary, Tron Inc. 941 W. Morse Blvd., Suite 100 Winter Park FL 32789. The envelope should indicate that it contains a shareholder communication. All such shareholder communications will be forwarded to the director or directors to whom the communications are addressed.

Director Independence

Our board of directors has determined that each of the current directors, with the exception of Mr. Miller and Mr. Sun. Mr. Liu, Mr. Melton and Mr. Yang, are “independent,” as defined by the listing rules of the Nasdaq Stock Market, or Nasdaq, and the rules and regulations of the SEC. Our board of directors has standing Audit, Compensation and Nominating and Governance Committees, each of which is comprised solely of independent directors in accordance with the Nasdaq listing rules. No director qualifies as independent unless the board of directors affirmatively determines that he has no direct or indirect relationship with us that would impair his independence. We independently review the relationship of the Company to any entity employing a director or on whose board of directors he or she is serving currently.

Stock Incentive Plan

On March 21, 2023, our Board of Directors and majority shareholders, respectively, approved the SRM Entertainment, Inc. 2023 Equity Incentive Plan (the “2023 Plan”), to be administered by our Compensation Committee. Pursuant to the 2023 Plan, we are authorized to grant options and other equity awards to officers, directors, employees and consultants. The purchase price of each share of common stock purchasable under an award issued pursuant to the 2023 Plan, shall be determined by our Compensation Committee, in its sole discretion, at the time of grant, but shall not be less than 100% of the fair market of such share of common stock on the date the award is granted, subject to adjustment. Our Compensation Committee shall also have sole authority to set the terms of all awards at the time of grant. Pursuant to the 2023 Plan, a maximum of 1,500,000 shares of our common stock shall be set aside and reserved for issuance, subject to adjustments as may be required in accordance with the terms of the 2023 Plan. During the year ended December 31, 2024, the Company granted a total of 1,020,000 options to officers, directors and employees of the Company and 100,000 options to a consultant under the 2023 Plan.

At the annual meeting held on December 4, 2024, the stockholders approved the Company’s 2024 Equity Incentive Plan (the “2024 Plan”), to be administered by our Compensation Committee. Pursuant to the 2024 Plan, we are authorized to grant options and other equity awards to officers, directors, employees and consultants. The purchase price of each share of common stock purchasable under an award issued pursuant to the 2024 Equity Plan, shall be determined by our Compensation Committee, in its sole discretion, at the time of grant, but shall not be less than 100% of the fair market of such share of common stock on the date the award is granted, subject to adjustment. Our Compensation Committee shall also have sole authority to set the terms of all awards at the time of grant. Pursuant to the 2024 Plan, a maximum of 2,250,000 shares of our common stock shall be set aside and reserved for issuance, subject to adjustments as may be required in accordance with the terms of the 2024 Plan. At December 31, 2024 no options or other equity awards had been granted under the 2024 Plan.

Director Compensation

The following table sets forth the amounts paid to Directors during the years ended

December 31, 2024 and 2023.

| Directors | 2024 | 2023 | ||||||

| Richard Miller | $ | 25,000 | $ | 25,000 | ||||

| Douglas O. McKinnon | $ | 25,000 | $ | 25,000 | ||||

| Christopher Marc Melton | $ | 25,000 | $ | 25,000 | ||||

| Gary Herman | $ | 25,000 | $ | 25,000 | ||||

| Hans Haywood | $ | 25,000 | $ | 25,000 | ||||

| 12 |

Equity Compensation Plan Information

The following table shows the number of securities to be issued upon exercise or vesting of outstanding equity awards under the 2023 Plan and 2024 as of December 31, 2024. The 2023 Plan reserved 1,500,000 shares that may be issued under the 2023 Plan, of which 1,210,000 have been granted. The 2024 Plan reserved 2,250,000 shares that may be issued under the 2024 Plan of which none have been granted.

Number of securities to be issued upon exercise or vesting of outstanding equity awards (a) | Weighted- average exercise price of outstanding options (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column(a)) (c) | ||||||||||

| Equity compensation plans not approved by security holders | 1,210,000 | $ | 1.20 | 2,615,000 | ||||||||

Certain Relationships and Related Party Transactions

The Company has established policies and other procedures regarding approval of transactions between the Company and any employee, officer, director, and certain of their family members and other related persons. These policies and procedures are generally not in writing but are evidenced by long standing principles adhered to by our Board. The disinterested members of the Board review, approve and ratify transactions that involve “related persons” and potential conflicts of interest. Related persons must disclose to the disinterested members of the Board any potential related person transactions and must disclose all material facts with respect to such transaction. All such transactions will be reviewed by the disinterested members of the Board and, in their discretion, approved or ratified. In determining whether to approve or ratify a related person transaction the disinterested members of the Board will consider the relevant facts and circumstances of the transaction, which may include factors such as the relationship of the related person with the Company, the materiality or significance of the transaction to the Company and the related person, the business purpose and reasonableness of the transaction, whether the transaction is comparable to a transaction that could be available to the Company on an arms-length basis, and the impact of the transaction on the Company’s business and operations.

Since the beginning of fiscal year 2024, the Company did not have any transactions to which it has been a participant that involved amounts that exceeded or will exceed the lesser of (i) $120,000 or (ii) one percent of the average of the Company’s total assets at year-end for the last two completed fiscal years, and in which any of the Company’s directors, executive officers or any other “related person” as defined in Item 404(a) of Regulation S-K had or will have a direct or indirect material interest, except as described below

On June 16, 2025, Mr. Weike Sun, through an entity of which he is the sole shareholder, Bravemorning Limited (“Bravemorning”), purchased 100,000 shares of Series B Convertible Preferred Stock, par value $0.0001 per share (the “Series B Preferred Stock”), convertible into 200,000,000 shares of common stock, par value $0.0001 (the “Common Stock”), at a conversion price of $0.50 per share of Common Stock, and warrants (the “PIPE Warrants”) to acquire up to 220,000,000 shares of Common Stock. In connection with this investment, Mr. Sun was appointed as Chairman of the Board of Directors.

Furthermore, on August 27, 2025, Bravemorning exercised the PIPE Warrants in full and, on August 29, 2025, the Company issued 220,000,000 shares of Common Stock to Bravemorning. Bravemorning paid $110,000,000 to the Company in the form of 312,500,100 TRX as consideration for the issuance of these Common Stock shares.

| 13 |

Clawback Policy

We have adopted a compensation recovery (clawback) policy that states that, in the event we are required to prepare an accounting restatement, we will recover incentive-based compensation received by any current or former executive officer that was based upon the attainment of a financial reporting measure that was erroneously awarded during the three-year period preceding the date the restatement was required. The compensation recovery policy is available on our corporate website at https://corporate.srmentertainment.com/corporate-governance.

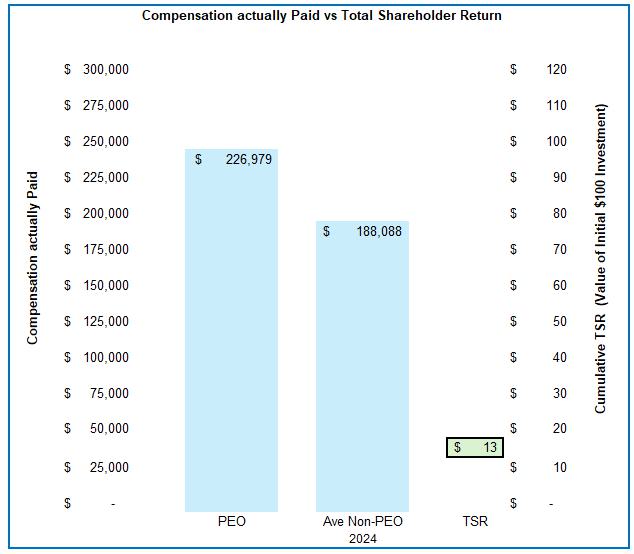

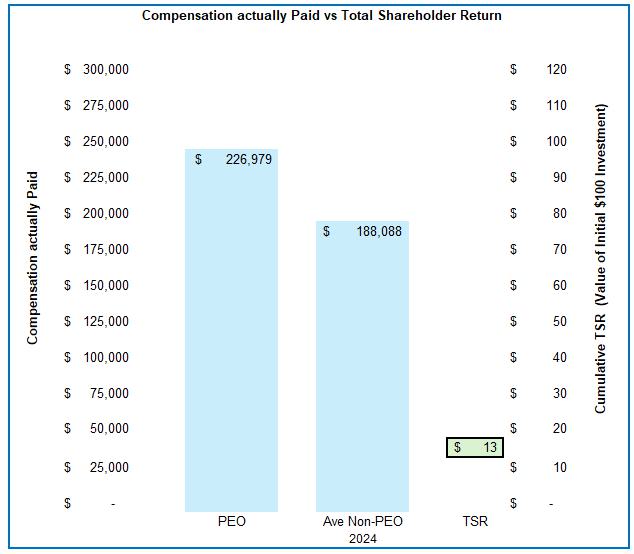

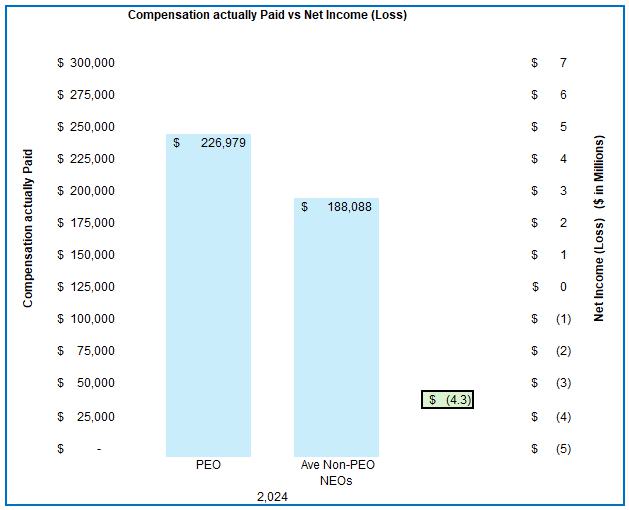

Pay Versus Performance

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, and Item 402(v) of Regulation S-K, which was adopted by the SEC in 2022, we are providing the following information regarding the relationship between “compensation actually paid” (“CAP”) to our principal executive officer (“PEO”), and non-PEO named executive officers (“NEOs”) and certain financial performance of the Company for the fiscal years listed below.

| Richard Miller – PEO | Non PEO NEOs | Value of Initial Fixed $100 Investment based | ||||||||||||||||||||||

| Fiscal Year | Summary Compensation Table Total(1) | Compensation Actually Paid(2) | Average Summary Compensation Table Total(3) | Average Compensation Actually Paid(4) | on Total Shareholder Return (“TSR”)(5) | Net Loss | ||||||||||||||||||

| 2024 | $ | $ | $ | $ | $ | $ | ( | ) | ||||||||||||||||

| 2023 | $ | $ | $ | $ | $ | $ | ( | ) | ||||||||||||||||

| (1) | |

| (2) |

| Fiscal Year | Summary compensation table total for Richard Miller (S) | Reported value of equity awards for Richard Miller ($) | Fair value as of year-end for awards granted during the year ($) | Fair value year-over- year increase or decrease in unvested awards granted in prior years ($) | Fair value of awards granted and vested during the year ($) | Fair value increase or decrease from prior year end for awards that vested during the year ($) | Compensation actually paid to Richard Miller ($) | |||||||||||||||||||||

| 2024 | $ | $ | ||||||||||||||||||||||||||

| 2023 | $ | $ | ||||||||||||||||||||||||||

| (3) | Represents the average of the amounts reported for our NEOs as a group (excluding our PEO) in each applicable year in the “Total” column of the Summary Compensation Table above. For fiscal 2024, this includes Douglas O. McKinnon, Taft Flitner, and Deborah McDaniel-Hand (the “Non-PEO NEOs”). |

| (4) | Represents the average amount of “compensation actually paid” to the Non-PEO NEOs, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual average compensation earned or paid to the Non-PEO NEOs during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to average total compensation for the Non-PEO NEOs for each year: |

| 14 |

| Fiscal Year | Average summary compensation table total for Non-PEO NEOs ($) | Reported value of equity awards for NEOs ($) | Fair value as of year-end for awards granted during the year ($) | Fair value year-over-year increase or decrease in unvested awards granted in prior years ($) | Fair value of awards granted and vested during the year ($) | Fair value increase or decrease from prior year end for awards that vested during the year ($) | Average compensation actually paid to Non-PEO NEOs ($) | |||||||||||||||||||||

| 2024 | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| 2023 | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

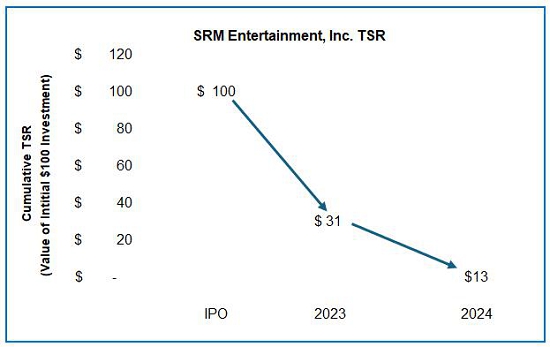

| (5) | TSR is cumulative for the measurement periods beginning on August 15, 2023 (the initial day of trading following the pricing of our initial public offering) and ending on December 31, 2024, calculated by dividing the difference between our share price at the end and the beginning of the measurement period by our share price at the end of the measurement period. No dividends were paid in fiscal 2024. |

| (6) | The dollar amounts reported represent the amount of net loss reflected in our consolidated audited financial statements for the applicable years. |

| The illustrations below provide an additional graphical description of CAP compared to both our cumulative TSR and our net loss. As the illustrations show, the compensation actually paid to our PEO and Former PEO and the average amount of compensation actually paid to our non-PEO NEOs during the periods presented are not directly correlated with TSR. We do utilize several performance measures to align executive compensation with our performance, but those tend not to be financial performance measures, such as TSR. Compensation actually paid is influenced by numerous factors including, but not limited to, the timing of new grant issuances and award vesting, NEO mix, share-price volatility during the fiscal year, our mix of performance metrics and other factors. |

| 15 |

The illustration below compares our cumulative TSR over the period from our initial public offering date to December 31, 2024.

| 16 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table as of November 18, 2025 sets forth certain information with respect to the beneficial ownership of our voting securities by (i) any person or group beneficially owning more than 5% of any class of voting securities; (ii) our directors, and; (iii) each of our named executive officers; and (iv) all executive officers and directors as a group. Percentages are based on 257,115,400 shares outstanding as of the Record Date. The information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the rules of the Securities and Exchange Commission and is not necessarily indicative of ownership for any other purpose. Under these rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares the power to vote or direct the voting of the security or the power to dispose or direct the disposition of the security. A person is deemed to own beneficially any security as to which such person has the right to acquire sole or shared voting or investment power within 60 days of November 18, 2025, through the conversion or exercise of any convertible security, warrant, option or other right. More than one person may be deemed to be a beneficial owner of the same securities. Unless otherwise indicated, the address of all listed stockholders is c/o Tron Inc., 941 W. Morse Blvd., Suite 100 Winter Park FL 32789.

| 17 |

| Shares of | % of Shares of | |||||||

| Common Stock | Common Stock | |||||||

| Beneficially | Beneficially | |||||||

| Name of Beneficial Owner | Owned | Owned | ||||||

| Directors and Officers: | ||||||||

| Richard Miller(1) | 1,637,500 | * | ||||||

| Chief Executive Officer and Director | ||||||||

| Douglas McKinnon (2) | 953,888 | * | ||||||

| Chief Financial Officer | ||||||||

| Taft Flittner (3) | 450,000 | * | ||||||

| President | ||||||||

| Weike Sun(4) | 220,000,000 | 85.0 | % | |||||

| Chairman of the Board of Directors | ||||||||

| Zhihong Liu | - | * | ||||||

| Director | ||||||||

| Zi Yang | - | * | ||||||

| Director | ||||||||

| Christopher Melton | - | * | ||||||

| Director | ||||||||

| Officers and Directors, as a group (8 persons) | 221,636,388 | 86.2 | % | |||||

* Less than 1% ownership

| (1) | Includes 537,500 shares issuable upon exercise of options. |

| (2) | Includes 437,500shares issuable upon exercise of options. |

| (3) | Includes 150,000 shares issuable upon exercise of options. |

| (4) | Held by Bravemorning Limited, an entity controlled by Mr. Sun. |

| 18 |

AUDIT COMMITTEE REPORT

The following Report of the Audit Committee (the “Audit Report”) does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates this Audit Report by reference therein.

Role of the Audit Committee

The Audit Committee’s primary responsibilities fall into three broad categories:

First, the Audit Committee is charged with monitoring the preparation of quarterly and annual financial reports by the Company’s management, including discussions with management and the Company’s outside auditors about draft annual financial statements and key accounting and reporting matters.

Second, the Audit Committee is responsible for matters concerning the relationship between the Company and its outside auditors, including recommending their appointment or removal; reviewing the scope of their audit services and related fees, as well as any other services being provided to the Company; and determining whether the outside auditors are independent (based in part on the annual letter provided to the Company pursuant to Independence Standards Board Standard No. 1).

Third, the Audit Committee reviews financial reporting, policies, procedures and internal controls of the Company. The Audit Committee has implemented procedures to ensure that during the course of each fiscal year it devotes the attention that it deems necessary or appropriate to each of the matters assigned to it under the Audit Committee’s charter. In overseeing the preparation of the Company’s financial statements, the Audit Committee met with management and the Company’s outside auditors, including meetings with the Company’s outside auditors without management present, to review and discuss all financial statements prior to their issuance and to discuss significant accounting issues. Management advised the Audit Committee that all financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee discussed the statements with both management and the outside auditors. The Audit Committee’s review included discussion with the outside auditors of matters required to be discussed pursuant to Statement on Auditing Standards No. 61 (Communication with Audit Committees).

With respect to the Company’s outside auditors, the Audit Committee, among other things, discussed with M&K CPAS, PLLC matters relating to its independence, including the disclosures made to the Audit Committee as required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees).

Recommendations of the Audit Committee. In reliance on the reviews and discussions referred to above, the Audit Committee, which at the time of the March 31, 2025 filing of the Form 10-K, consisted of Messrs. Melton, Herman, and Haywood, recommended to the Board that the Board approve the inclusion of the Company’s audited financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, for filing with the SEC.

This report has been furnished by the Audit Committee of the Board.

Christopher Marc Melton, Chairperson

Zhihong Liu

Zi Yang

| 19 |

MATTERS TO BE VOTED ON

PROPOSAL NO. 1: ELECTION OF DIRECTORS TO SERVE UNTIL THE NEXT ANNUAL MEETING OF SHAREHOLDERS OR

UNTIL THEIR RESPECTIVE SUCCESSORS SHALL HAVE BEEN DULY ELECTED

AND QUALIFIED

NOMINEES FOR ELECTION AS DIRECTOR

A total of five directors will be elected at the Annual Meeting to serve until the next annual meeting of shareholders, or until their successors are duly elected and qualified. Of the Board members whose term expires at the Annual Meeting, Richard Miller, Weike Sun, Christopher Marc Melton, Zhihong Liu and Zi Yang are all standing for re-election. The persons named as “Proxies” in the enclosed Proxy will vote the shares represented by all valid returned proxies in accordance with the specifications of the shareholders returning such proxies. If no choice has been specified by a shareholder, the shares will be voted FOR the nominees. If at the time of the Annual Meeting any of the nominees named below should be unable or unwilling to serve, which event is not expected to occur, the discretionary authority provided in the Proxy will be exercised to vote for such substitute nominee or nominees, if any, as shall be designated by the Board. If a quorum is present and voting, the nominees for directors receiving a majority of the votes of the shares present in person or represented by proxy at the Annual Meeting will be elected. Abstentions and broker non-votes will have no effect on the vote.

| 20 |

NOMINEES FOR ELECTION AS DIRECTOR

Nominees

Set forth below, and above under “Board of Directors,” is information regarding the five nominees for election to our Board:

| Name | Position with the Company | |

| Richard Miller | Chief Executive Officer, Treasurer and Director | |

| Weike Sun | Chairman of the Board of Directors | |

| Christopher Marc Melton | Independent Director | |

| Zhihong Liu | Independent Director | |

| Zi Yang | Independent Director |

Vote Required

The nominees for the five director seats who receive the largest number of votes cast “FOR” of the shares that are represented by proxy at the Annual Meeting and entitled to vote will be elected to serve as directors.

Recommendation of our Board

OUR BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF DIRECTORS RICHARD MILLER, WEIKE SUN, CHRISTOPHER MARC MELTON, ZHIHONG LIU, ZI YANG, AS DIRECTORS OF THE COMPANY.

PROPOSAL NO. 2: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2025

The Board has appointed M&K CPAS, PLLC (“M&K”) as our independent registered public accounting firm for the fiscal year ending December 31, 2025. The Board seeks an indication from shareholders of their approval or disapproval of the appointment.

M&K will audit our consolidated financial statements for the fiscal year ending December 31, 2025. We anticipate that a representative of M&K will be present by telephone at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions. Our consolidated financial statements for the fiscal years ended December 31, 2024 and 2023 were audited by M&K.

In the event shareholders fail to ratify the appointment of M&K, our Audit Committee will reconsider this appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its shareholders.

The Audit Committee meets with our independent registered public accounting firm at least four (4) times a year. At such times, the Audit Committee reviews both audit and non-audit services performed by the independent registered public accounting firm, as well as the fees charged for such services. The Audit Committee is responsible for pre-approving all auditing services and non-auditing services (other than non-audit services falling within the de minimis exception set forth in Section 10A(i)(1)(B) of the Exchange Act and non-audit services that independent auditors are prohibited from providing to us) in accordance with the following guidelines: (1) pre-approval policies and procedures must be detailed as to the particular services provided; (2) the Audit Committee must be informed about each service; and (3) the Audit Committee may delegate pre-approval authority to one or more of its members, whom shall report to the full committee, but shall not delegate its pre-approval authority to management. Among other things, the Audit Committee examines the effect that performance of non-audit services may have upon the independence of the auditors.

| 21 |

The table below sets forth the aggregate fees billed for each of the last two fiscal years for professional services rendered by M&K for the audits of the Company’s annual financial statements and review of financial statements included in the Company’s quarterly reports or services that are normally provided by the auditor in connection with statutory and regulatory filings or engagements for those fiscal years.

Audit-related fees consisted of fees related to the issuance of SEC registration statements and associated with the Company’s financing activities, including issuances of comfort letters.

Audit Fees totaling $68,274 and $65,000 were paid to M&K CPAS during the year ended December 31, 2024 and 2023, respectively.

No other fees were paid to M&K CPAS.

Required Vote

Ratification of the selection of M&K as our independent registered public accounting firm for the year ending December 31, 2025 requires the affirmative vote of the holders of a majority of the shares that are represented by proxy at the Annual Meeting and entitled to vote on such matter (meaning that of the shares represented at the Annual Meeting).

Recommendation of our Board

OUR BOARD RECOMMENDS THAT YOU VOTE “FOR” THIS PROPOSAL NO. 2 TO RATIFY THE APPOINTMENT OF M&K TO SERVE AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2025.

OTHER MATTERS

Our Board does not know of any other matters that may come before the Annual Meeting. However, if any other matters are properly presented to the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote, or otherwise act, in accordance with their judgment on such matters.

FUTURE SHAREHOLDER PROPOSALS

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), shareholders may present proper proposals for inclusion in the Company’s proxy statement for consideration at the 2025 annual meeting of shareholders by submitting their proposals to the Company in a timely manner. These proposals must meet the shareholders eligibility and other requirements of the SEC. To be considered for inclusion in next year’s proxy materials, you must submit your proposal in writing no later than August 3, 2026 to the Company at Tron Inc., 941 W. Morse Blvd., Suite 100 Winter Park FL 32789 provided, however, if the date of the Annual Meeting is convened more than 30 days before, or delayed by more than 30 days after the first anniversary of this Annual Meeting, a shareholder proposal must be submitted in writing to the Company not less than 10 calendar days after the date the Company shall have mailed notice to its shareholders of the date that the annual meeting of shareholders will be held or shall have issued a press release or otherwise publicly disseminated notice that an annual meeting of shareholders will be held and the date of the meeting.

| 22 |

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

In cases where multiple company stockholders share the same address, and the shares are held through a bank, broker, or other holder of record in a street-name account, only one copy of our proxy materials will be delivered to that address unless a stockholder at that address requests otherwise. This practice, known as “householding,” is intended to reduce our printing and postage costs. However, any street-name stockholders residing at the same address who wish to receive a separate copy of our proxy materials may request a copy by contacting their bank, broker or other holder of record, or by sending a written request to the Company at Tron Inc., 941 W. Morse Blvd., Suite 100 Winter Park FL 32789. The voting instruction form sent to a street-name stockholder should provide information on how to request a separate copy of future materials for each company stockholder at that address, if that is your preference. Similarly, if you currently receive separate copies of our proxy materials but wish to participate in householding, please contact us through the method described above.

OTHER BUSINESS

We have not received notice of and do not expect any matters to be presented for vote at the Annual Meeting, other than the proposals described in this Proxy Statement. If you grant a proxy, the person named as proxy holder or their nominees or substitutes, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If for any unforeseen reason, any of our nominees are not available as a candidate for director, the proxy holder will vote your proxy for such other candidate or candidates nominated by our Board.

ADDITIONAL INFORMATION

We are subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith, we file periodic reports, documents and other information with the SEC relating to our business, financial statements and other matters. Such reports and other information may be accessed at www.sec.gov. You are encouraged to review our Annual Report on Form 10-K, together with any subsequent information we filed or will file with the SEC and other publicly available information.

*************

It is important that the proxies be returned promptly and that your shares be represented. Shareholders are urged to mark, date, execute and promptly return the accompanying proxy card.

| November 26, 2025 | By Order of the Board of Directors, |

| /s/ Richard Miller | |

Richard Miller | |

| Chief Executive Officer and Director |

| 23 |