INVESTOR PRESENTATION NYSE American: UMAC December 2025

FORWARD LOOKING STATEMENTS This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward - looking statements . These statements include : our expectation that we will commence warehouse fulfillment by the end of 2025 , our expectation that we will fulfill $ 16 million in enterprise purchase orders through Q 2 2026 , our ability to successfully implement our aggressive growth strategy, and our expectation that the regulatory environment, tariffs, legislation favoring NDAA - compliant drone supply chains, executive orders that unlock new federal funding streams for drones and DoD procurement will provide for growth drivers . The results expected by some or all of these forward - looking statements may not occur . Factors that affect our ability to achieve these results include the impact of and duration of the tariff policies, including (i) on the availability and cost of alternate supplies of drone parts, , (ii) on the economy, and (iii) the wars in Ukraine and Israel, as well as governmental delays, future interest rates, and our ability to enhance our existing products, develop new products and create new services for our customers and future customers, and the Risk Factors contained in our Form 10 - Q, filed with the SEC on November 6 , 2025 , Prospectus Supplement filed with the Securities and Exchange Commission (the “SEC”) on September 2 , 2025 and in our Form 10 - K for the year ended December 31 , 2024 . Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them . Any forward - looking statement made by us herein speaks only as of the date on which it is made . We undertake no obligation to update any forward - looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law .

INVESTMENT HIGHLIGHTS Component manufacturer for small drones with high market demand ● Multiple US - made and NDAA compliant products approved for Blue UAS Framework ● Orlando FL based - 62,500 sq ft ● Serving Retail, Enterprise, and Defense customers across high - volume drone platforms Accelerated growth strategy ● Aggressive inventory strategy to stay ahead of customer demand and be a vendor of choice ● Building specialized U.S. - based production lines for demand driving components ● Investing in automation to expand production scale ● Positioning the company to deliver quickly as procurement cycles evolve Legislation driving near and long - term opportunities ● Recent U.S. legislation increasingly favoring domestic, NDAA - compliant drone supply chains ● Global conflicts driving urgent government demand for U.S. - made components and full systems ● Executive Orders and DoD initiatives unlocking significant new federal funding streams ● Historic shift away from Chinese - made drones creating multi - year market expansion for U.S. suppliers Strong growth momentum & financial profile ● Quarter over quarter revenue and margin growth - 55% YoY growth at 35% margins ● $16M in enterprise purchase orders expected to fulfill through 1H 2026 ● $100M cash on hand + $10M in inventory balances + No debt ● $35M+ public company investment portfolio that enables the drone industry

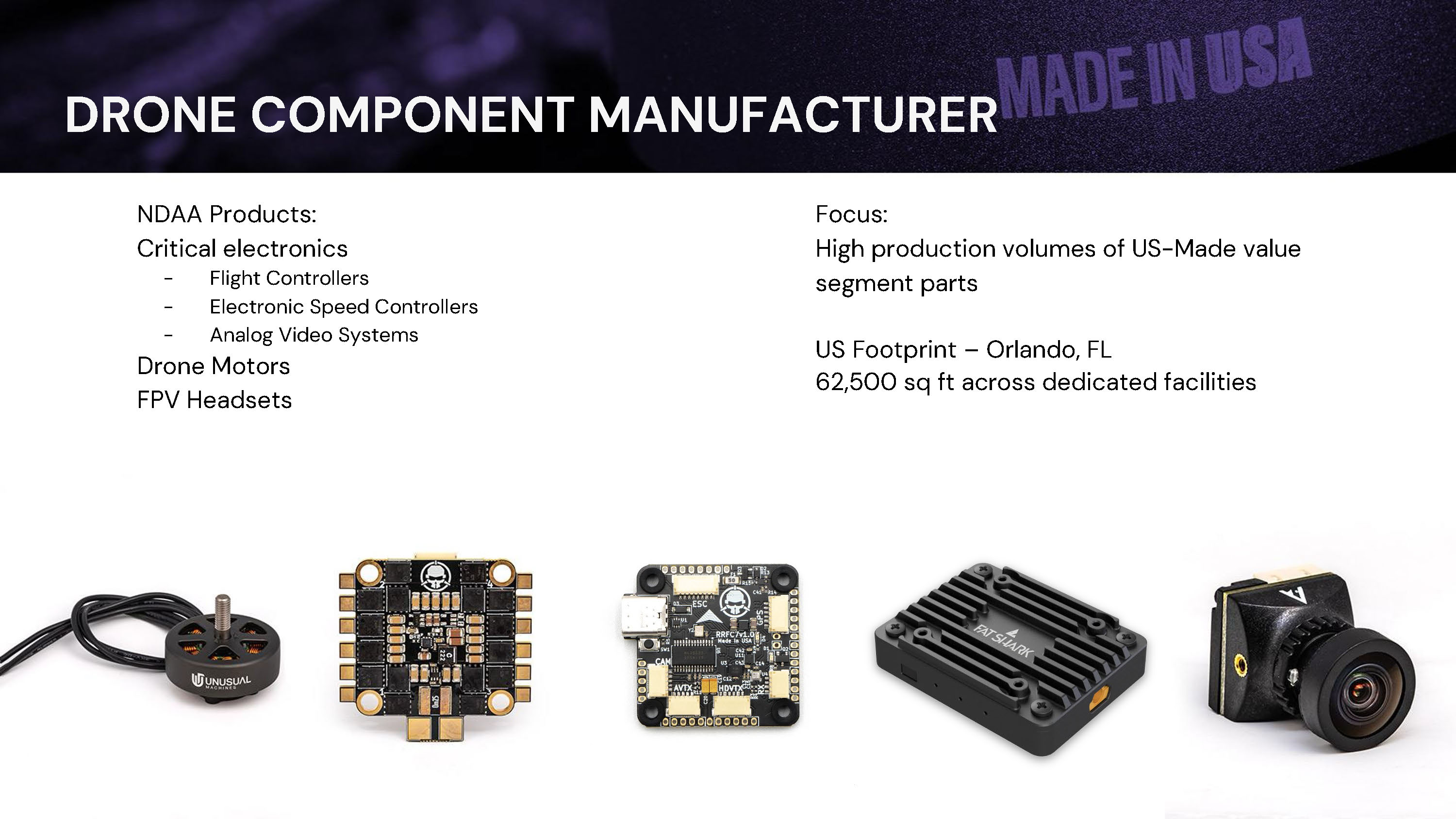

DRONE COMPONENT MANUFACTURER NDAA Products: Critical electronics - Flight Controllers - Electronic Speed Controllers - Analog Video Systems Drone Motors FPV Headsets Focus: High production volumes of US - Made value segment parts US Footprint – Orlando, FL 62,500 sq ft across dedicated facilities

sUAS: SMALL UNMANNED AIRCRAFT SYSTEMS ● Less than 55 lbs (typically 1 to 5 lbs) ● Dominant configuration: Multirotor ● 3 to 10 inch propellor size category ● FPV: First Person View ● Attritable Systems Low cost – acceptable to lose

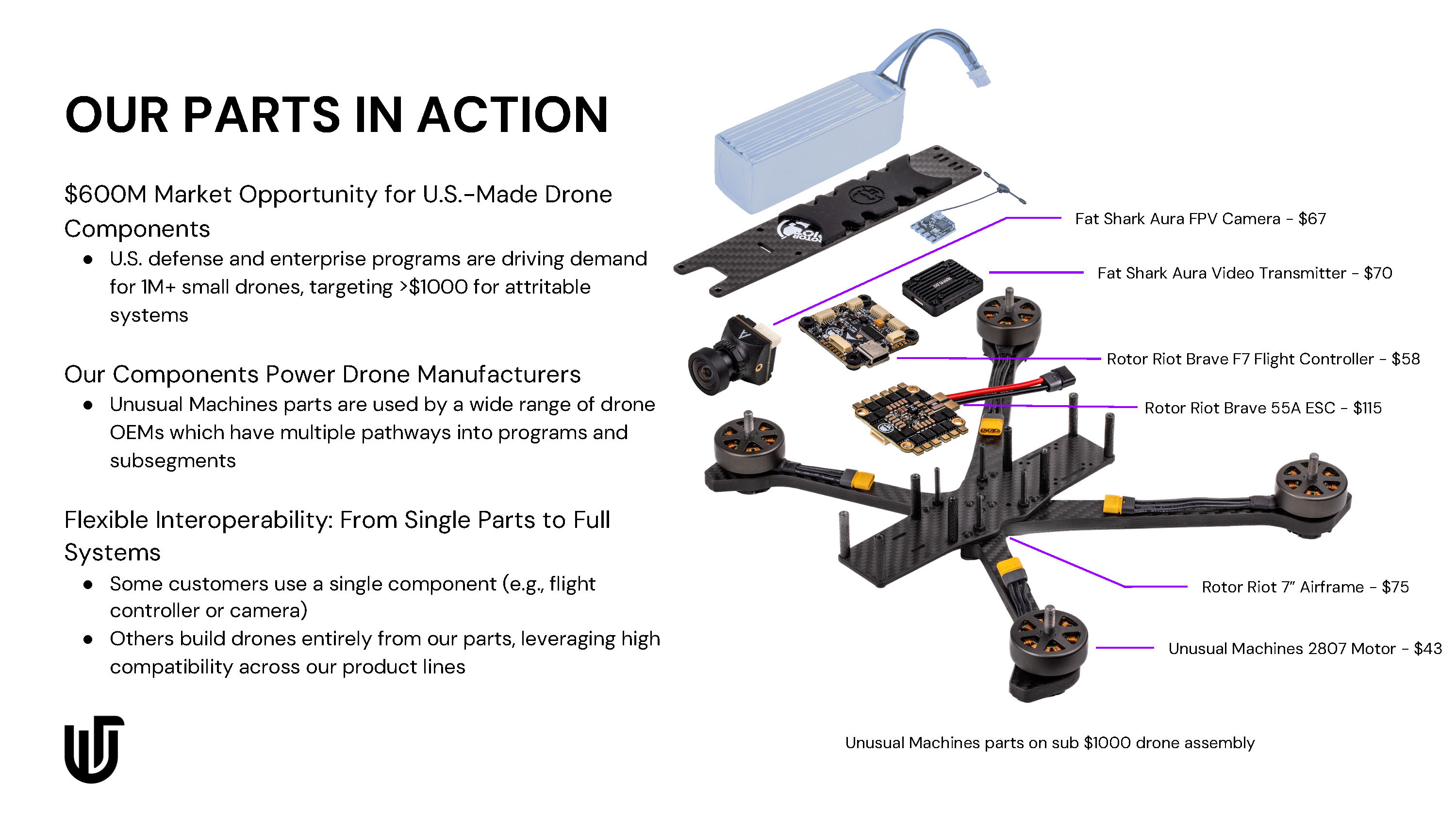

OUR PARTS IN ACTION $600M Market Opportunity for U.S. - Made Drone Components ● U.S. defense and enterprise programs are driving demand for 1M+ small drones, targeting >$1000 for attritable systems Our Components Power Drone Manufacturers ● Unusual Machines parts are used by a wide range of drone OEMs which have multiple pathways into programs and subsegments Flexible Interoperability: From Single Parts to Full Systems ● Some customers use a single component (e.g., flight controller or camera) ● Others build drones entirely from our parts, leveraging high compatibility across our product lines Unusual Machines parts on sub $1000 drone assembly Fat Shark Aura FPV Camera - $67 Fat Shark Aura Video Transmitter - $70 Rotor Riot Brave F7 Flight Controller - $58 Rotor Riot Brave 55A ESC - $115 Unusual Machines 2807 Motor - $43 Rotor Riot 7” Airframe - $75

HOBBYIST DEFENSE ENTERPRISE CONSUMER CUSTOMER SEGMENTS

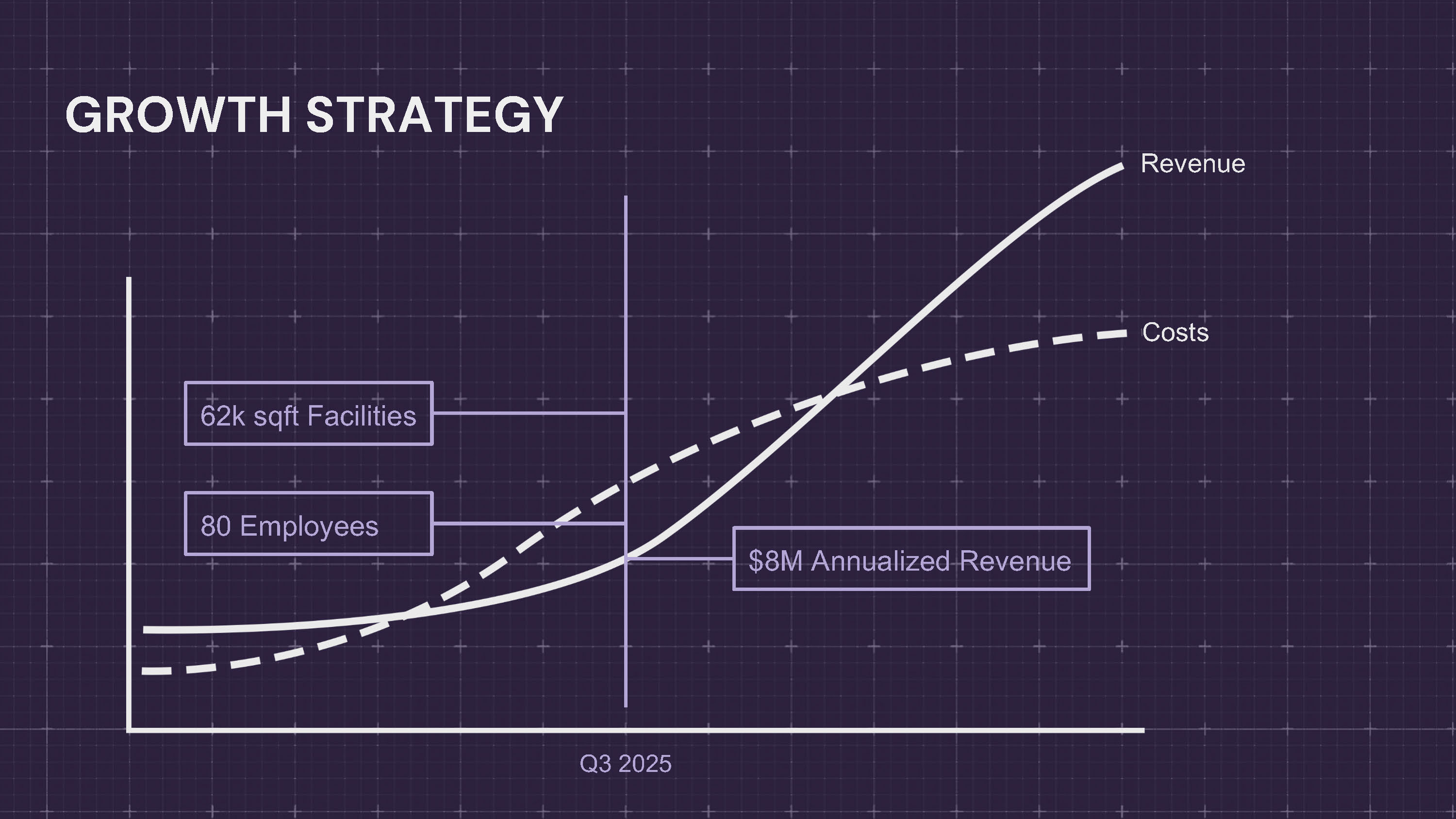

GROWTH STRATEGY $8M Annualized Revenue 80 Employees 62k sqft Facilities Q3 2025 Revenue Costs

OUR COMPETITIVE ADVANTAGE ● Regulatory: NDAA, Tariffs, CCP Drones Act, US Drone Dominance… ● Timing: US drone component thesis ● Working Capital: $100M+ ● Expertise and history ○ Fat Shark headsets since 2007 ○ OEM drone components since 2017 ○ Rotor Riot drones built in US since 2019 ○ Rotor Labs Motors made in Australia since 2022

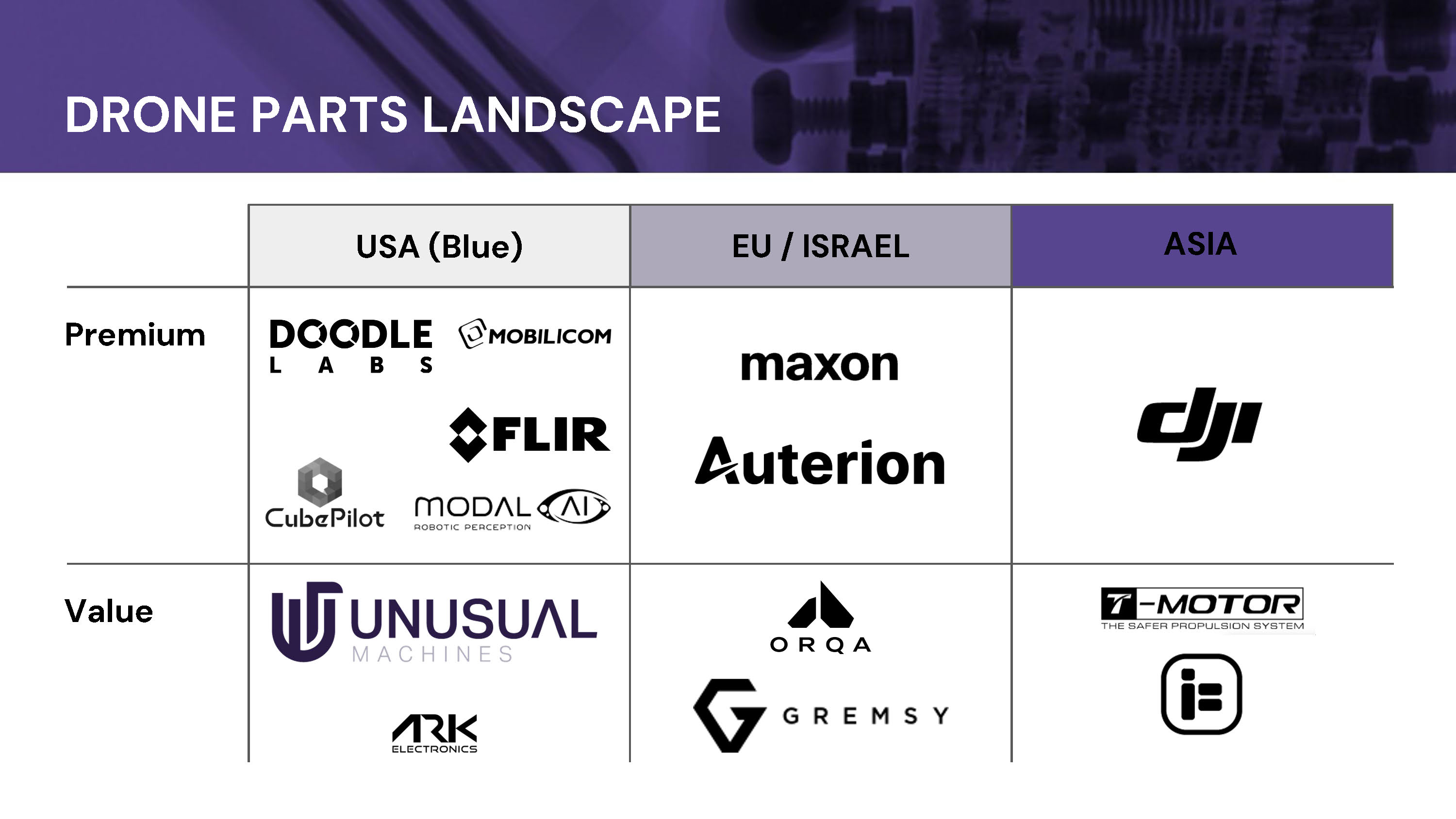

DRONE PARTS LANDSCAPE Premium Value USA (Blue) EU / ISRAEL ASIA

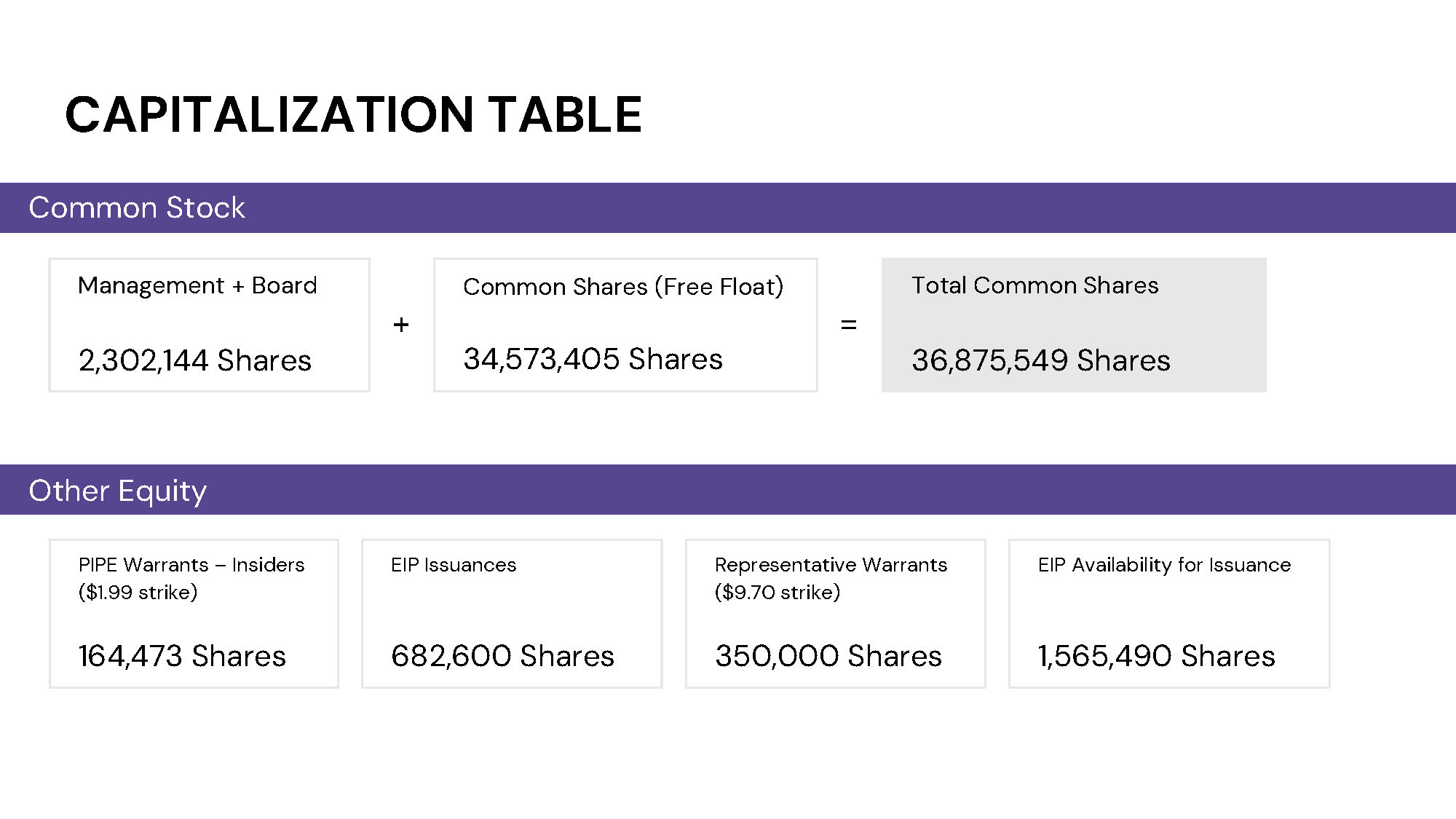

CAPITALIZATION TABLE Common Stock Management + Board 2,302,144 Shares + Common Shares (Free Float) 34,573,405 Shares = Total Common Shares 36,875,549 Shares Other Equity PIPE Warrants – Insiders ($1.99 strike) 164,473 Shares EIP Issuances 682,600 Shares Representative Warrants ($9.70 strike) 350,000 Shares EIP Availability for Issuance 1,565,490 Shares

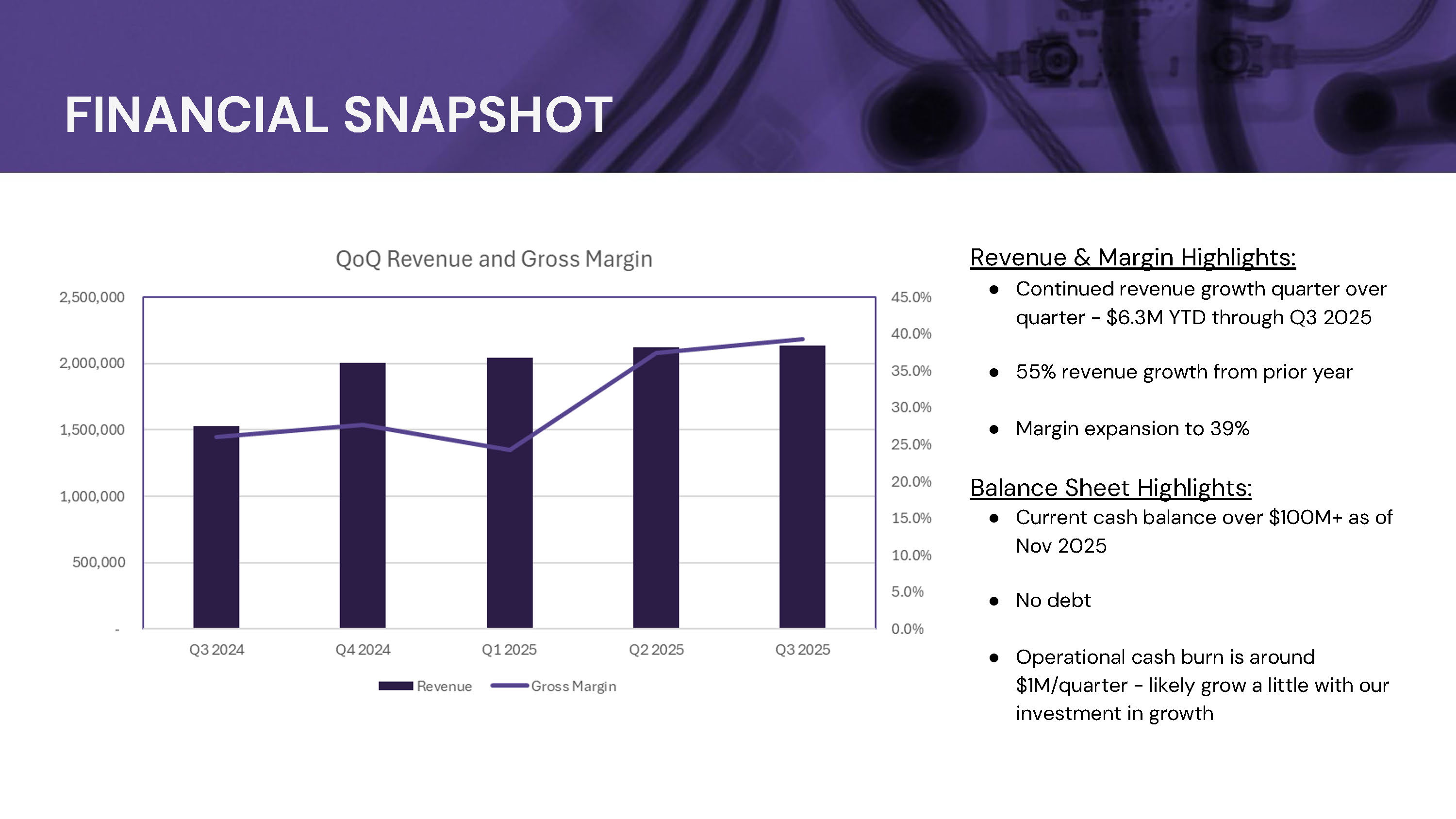

FINANCIAL SNAPSHOT Revenue & Margin Highlights: ● Continued revenue growth quarter over quarter - $6.3M YTD through Q3 2025 ● 55% revenue growth from prior year ● Margin expansion to 39% Balance Sheet Highlights: ● Current cash balance over $100M+ as of Nov 2025 ● No debt ● Operational cash burn is around $1M/quarter - likely grow a little with our investment in growth

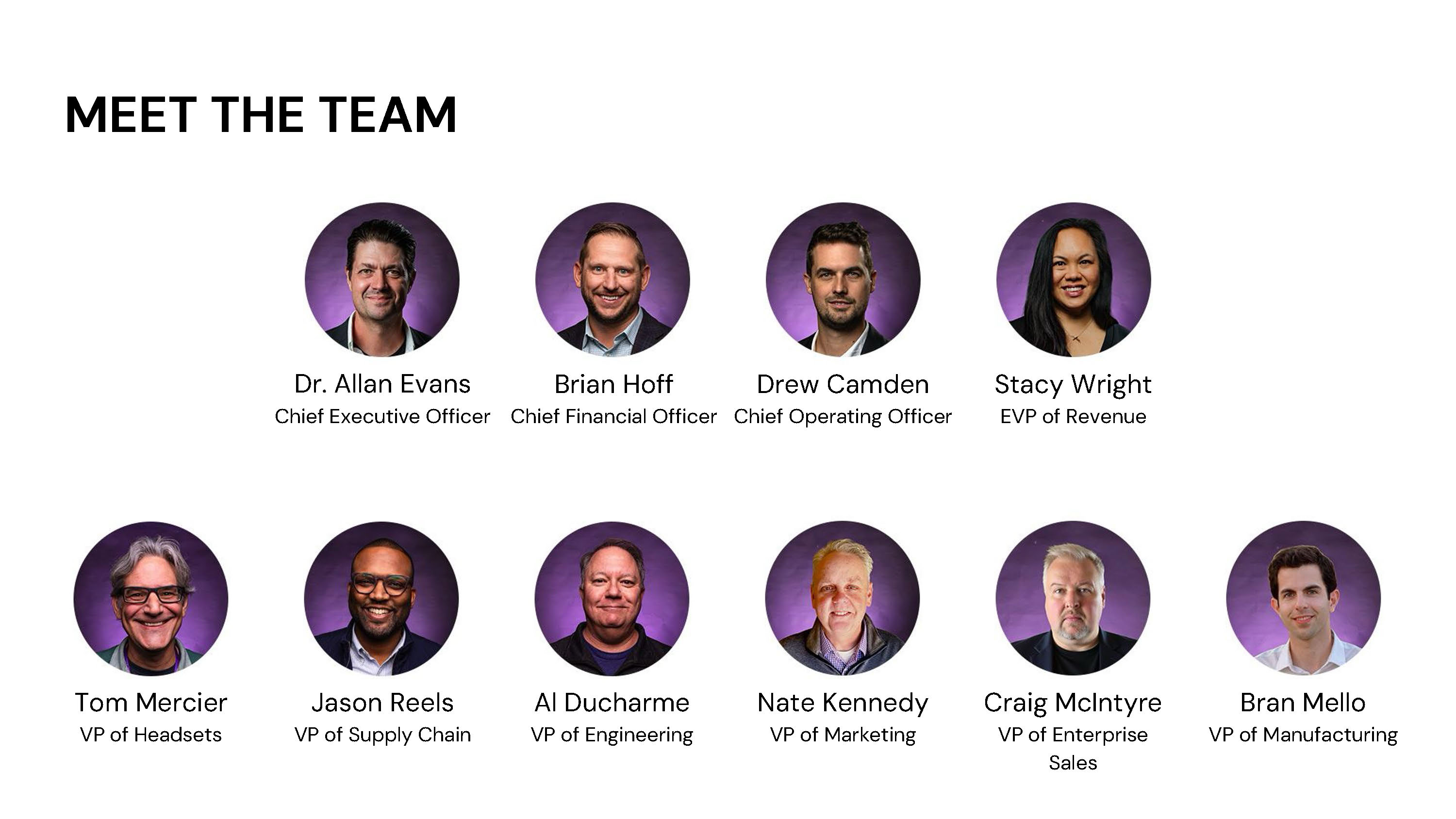

Stacy Wright EVP of Revenue MEET THE TEAM Dr. Allan Evans Chief Executive Officer Brian Hoff Chief Financial Officer Drew Camden Chief Operating Officer Tom Mercier VP of Headsets Jason Reels VP of Supply Chain Al Ducharme VP of Engineering Nate Kennedy VP of Marketing Craig McIntyre VP of Enterprise Sales Bran Mello VP of Manufacturing

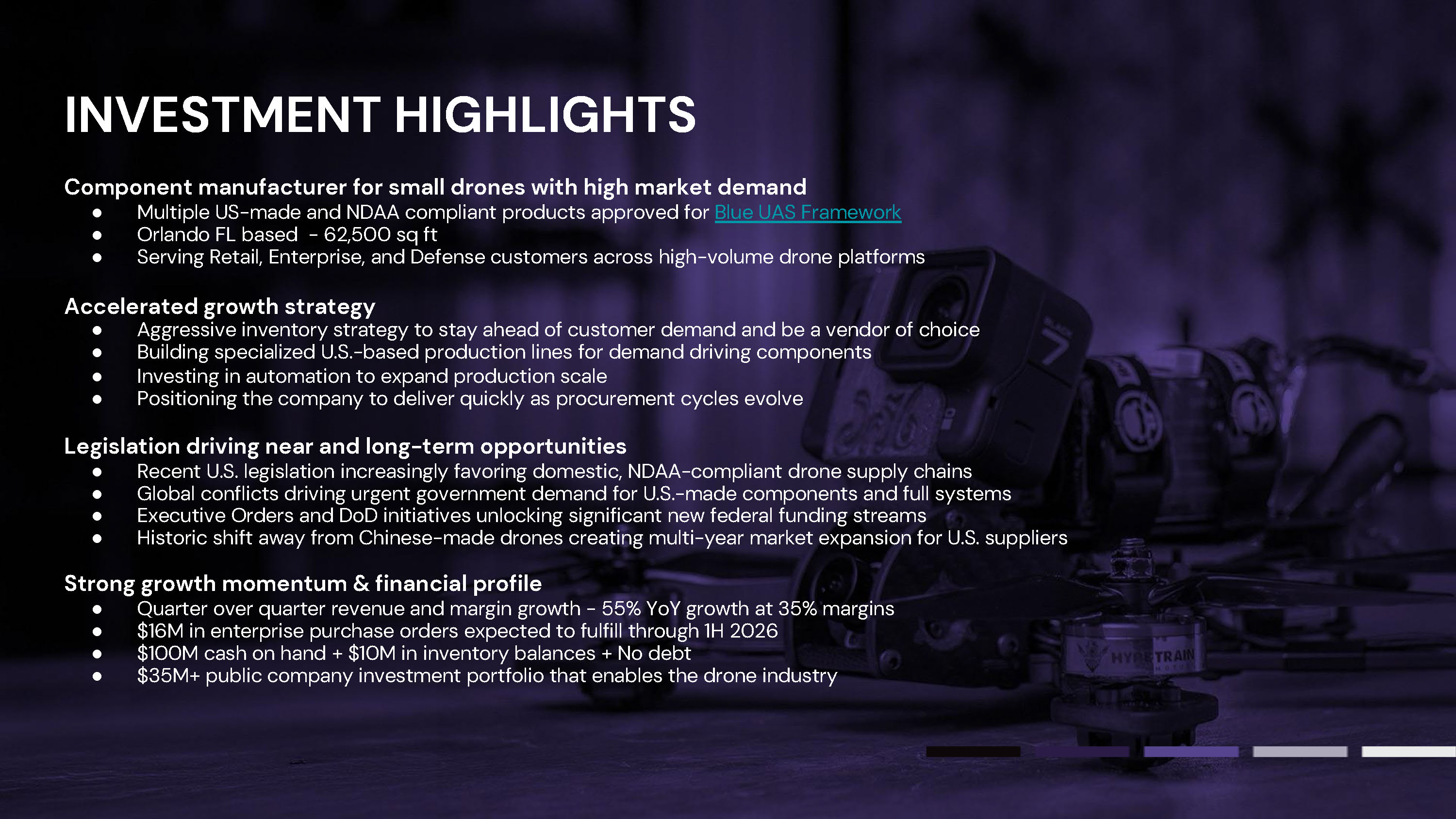

INVESTMENT HIGHLIGHTS Component manufacturer for small drones with high market demand ● Multiple US - made and NDAA compliant products approved for Blue UAS Framework ● Orlando FL based - 62,500 sq ft ● Serving Retail, Enterprise, and Defense customers across high - volume drone platforms Accelerated growth strategy ● Aggressive inventory strategy to stay ahead of customer demand and be a vendor of choice ● Building specialized U.S. - based production lines for demand driving components ● Investing in automation to expand production scale ● Positioning the company to deliver quickly as procurement cycles evolve Legislation driving near and long - term opportunities ● Recent U.S. legislation increasingly favoring domestic, NDAA - compliant drone supply chains ● Global conflicts driving urgent government demand for U.S. - made components and full systems ● Executive Orders and DoD initiatives unlocking significant new federal funding streams ● Historic shift away from Chinese - made drones creating multi - year market expansion for U.S. suppliers Strong growth momentum & financial profile ● Quarter over quarter revenue and margin growth - 55% YoY growth at 35% margins ● $16M in enterprise purchase orders expected to fulfill through 1H 2026 ● $100M cash on hand + $10M in inventory balances + No debt ● $35M+ public company investment portfolio that enables the drone industry

INVESTOR CONTACT Email: investors@unusualmachines.com 4677 L B McLeod Rd Suite J Orlando, FL 32811 United States