0 45 78 218 187 117 1 Burke & Herbert Financial Services Corp. (Nasdaq: BHRB) Acquisition of LINKBANCORP, Inc. (Nasdaq: LNKB) December 18, 2025

0 45 78 218 187 117 2 Disclaimer Forward-looking Statements This presentation includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including with respect to (or based on) the beliefs, goals, intentions, and expectations of Burke & Herbert Financial Services Corp. (“BHRB”) and LINKBANCORP, Inc. (“LNKB”) regarding the proposed transaction, revenues, earnings, earnings per share, loan production, asset quality, and capital levels, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of expected losses on loans; our assessments of interest rate and other market risks; our ability to achieve our financial and other strategic goals; the expected timing of completion of the proposed transaction; the expected cost savings, synergies, returns and other anticipated benefits from the proposed transaction; and other statements that are not historical facts. Forward-looking statements are typically identified by such words as "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "will," "should," and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Forward-looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction. Additionally, forward-looking statements speak only as of the date they are made; BHRB and LNKB do not assume any duty, and do not undertake, to update such forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Furthermore, because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those indicated in or implied by such forward-looking statements as a result of a variety of factors, many of which are beyond the control of BHRB and LNKB. Such statements are based upon the current beliefs and expectations of the management of BHRB and LNKB and are subject to significant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing undue reliance on forward-looking statements. The factors that could cause actual results to differ materially include the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between BHRB and LNKB; the outcome of any legal proceedings that may be instituted against BHRB or LNKB; the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated (and the risk that required regulatory approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); the ability of BHRB and LNKB to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of either or both parties to the proposed transaction; the possibility that the anticipated benefits of the proposed transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where BHRB and LNKB do business; certain restrictions during the pendency of the proposed transaction that may impact the parties' ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management's attention from ongoing business operations and opportunities; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate LNKB's operations and those of BHRB; such integration may be more difficult, time- consuming or costly than expected; revenues following the proposed transaction may be lower than expected; BHRB's and LNKB’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing; the dilution caused by BHRB's issuance of additional shares of its capital stock in connection with the proposed transaction; effects of the announcement, pendency or completion of the proposed transaction on the ability of BHRB and LNKB to retain customers and retain and hire key personnel and maintain relationships with their suppliers, and on their operating results and businesses generally; and risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction and other factors that may affect future results of BHRB and LNKB; and the other factors discussed in the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of each of BHRB's and LNKB's Quarterly Report on Form 10-Q for the quarters ended March 31, 2025, June 30, 2025 and September 30, 2025, and other reports BHRB and LNKB file with the SEC.

0 45 78 218 187 117 3 Disclaimer Additional Information and Where to Find It In connection with the proposed transaction, BHRB will file a registration statement on Form S-4 with the SEC to register the shares of BHRB common stock to be issued in connection with the proposed transaction. The registration statement will include a joint proxy statement of BHRB and LNKB, which also constitutes a prospectus of BHRB, that will be sent to shareholders of BHRB and shareholders of LNKB seeking certain approvals related to the proposed transaction. Each of BHRB and LNKB may file with the SEC other relevant documents concerning the proposed transaction. This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any offer or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended. INVESTORS AND SHAREHOLDERS OF BHRB AND LNKB AND THEIR RESPECTIVE AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS TO BE INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BHRB, LNKB AND THE PROPOSED TRANSACTION. Investors and shareholders will be able to obtain a free copy of the registration statement, including the joint proxy statement/prospectus, as well as other relevant documents filed with the SEC containing information about BHRB and LNKB, without charge, at the SEC's website www.sec.gov. Copies of documents filed with the SEC by BHRB will be made available free of charge in the "Investor Relations" section of BHRB's website, www.burkeandherbertbank.com, under the heading "Financials." Copies of documents filed with the SEC by LNKB will be made available free of charge in the "Investor Relations" section of LNKB's website, www.linkbank.com, under the heading "Financials." The information on BHRB's or LNKB's respective websites is not, and shall not be deemed to be, a part of this communication or incorporated into other filings either company makes with the SEC. Participants in Solicitation BHRB, LNKB, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of BHRB and shareholders of LNKB in respect of the proposed transaction under the rules of the SEC. Information regarding BHRB's directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 31, 2025, and certain other documents filed by BHRB with the SEC. Information regarding LNKB's directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 17, 2025, and certain other documents filed by LNKB with the SEC. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus related to the proposed transaction and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described in the preceding paragraph. Pro Forma Forward-Looking Data Neither BHRB's nor LNKB's independent registered public accounting firms have studied, reviewed or performed any procedures with respect to the pro forma forward-looking financial data for the purpose of inclusion in this presentation, and, accordingly, neither have expressed an opinion or provided any form of assurance with respect thereto for the purpose of this presentation. These pro forma forward-looking financial data are for illustrative purposes only and should not be relied on as necessarily being indicative of future results. The assumptions and estimates underlying the pro forma forward-looking financial data are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information, including those in the "Forward-Looking Statements" disclaimer on slide 2 of this presentation. Pro forma forward-looking financial data is inherently uncertain due to a number of factors outside of BHRB's and LNKB's control. Accordingly, there can be no assurance that the prospective results are indicative of future performance of the combined company after the proposed transaction or that actual results will not differ materially from those presented in the pro forma forward-looking financial data. Inclusion of pro forma forward- looking financial data in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved.

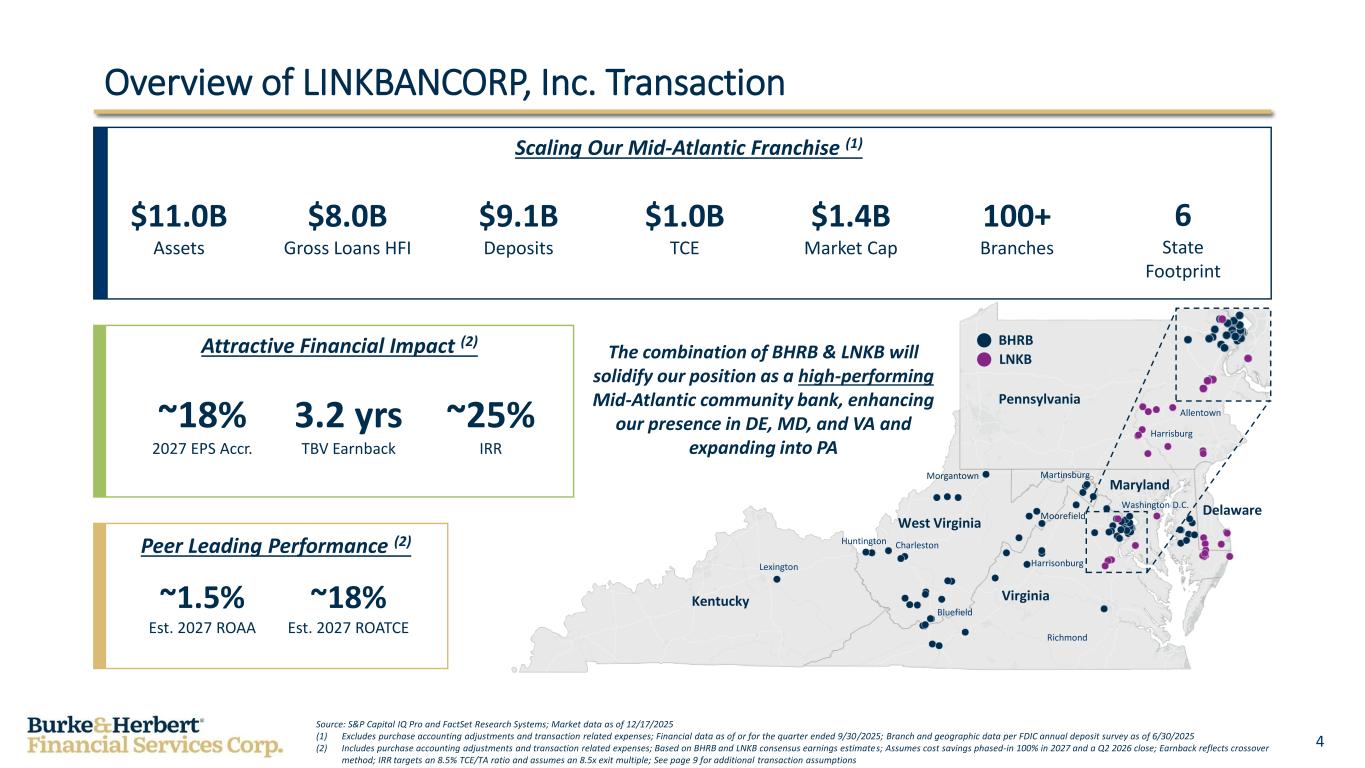

0 45 78 218 187 117 4 Delaware Maryland West Virginia Kentucky Virginia Overview of LINKBANCORP, Inc. Transaction The combination of BHRB & LNKB will solidify our position as a high-performing Mid-Atlantic community bank, enhancing our presence in DE, MD, and VA and expanding into PA Peer Leading Performance (2) ~1.5% Est. 2027 ROAA ~18% Est. 2027 ROATCE Source: S&P Capital IQ Pro and FactSet Research Systems; Market data as of 12/17/2025 (1) Excludes purchase accounting adjustments and transaction related expenses; Financial data as of or for the quarter ended 9/30/2025; Branch and geographic data per FDIC annual deposit survey as of 6/30/2025 (2) Includes purchase accounting adjustments and transaction related expenses; Based on BHRB and LNKB consensus earnings estimates; Assumes cost savings phased-in 100% in 2027 and a Q2 2026 close; Earnback reflects crossover method; IRR targets an 8.5% TCE/TA ratio and assumes an 8.5x exit multiple; See page 9 for additional transaction assumptions Attractive Financial Impact (2) ~18% 2027 EPS Accr. 3.2 yrs TBV Earnback ~25% IRR Scaling Our Mid-Atlantic Franchise (1) $11.0B Assets $8.0B Gross Loans HFI $9.1B Deposits $1.4B Market Cap LNKB BHRB Pennsylvania Lexington CharlestonHuntington Bluefield Richmond Harrisonburg Moorefield Morgantown Martinsburg Washington D.C. Harrisburg Allentown $1.0B TCE 100+ Branches 6 State Footprint

0 45 78 218 187 117 5 Strategic Rationale Strategically Compelling Creates an $11B Mid-Atlantic community bank with a growing regional footprint Deepens our presence in existing markets while expanding into demographically and culturally consistent Pennsylvania markets Compatible high-touch, relationship-based commercial focus and long-term relationships with LNKB management minimizes integration risk + Financially Attractive Meaningful EPS accretion with limited contribution from accretable yield / non-cash items IRR of approximately 25% Builds on our existing peer-leading profitability Leverages our infrastructure build and $10B asset threshold preparedness with limited Durbin impact Maintains Capital Strength and Flexibility Pro forma CET1 ratio of 11.4% and TRBC ratio of 13.9% (1) (1) Includes purchase accounting adjustments and transaction related expenses; See page 9 for transaction assumptions

0 45 78 218 187 117 6 LINKBANCORP, Inc. (LNKB) Financial Snapshot (Quarter Ended 9/30/2025) Company Highlights Source: S&P Capital IQ Pro, LNKB filings and LNKB management; Financial data as of or for the quarter ended 9/30/2025 unless otherwise specified (1) Deposit data as of 6/30/2025, projected growth rates estimated from 2026 to 2031 and demographic data per S&P Capital IQ Pro; Loan data as of 9/30/2025 per LNKB management (2) Cumberland, Dauphin, Northumberland and Schuylkill counties (3) Chester county (4) Lancaster and York counties; Population and population rankings shown on a combined basis (5) Anne Arundel county $3.1B Total Assets $2.5B Gross Loans $2.7B Total Deposits 3.75% NIM 1.03% ACL / Loans 0.05% NCOs / Avg. Loans 10.3% ROE Overview of New Regions (1) 0.77% NPAs / Assets Harrisburg (2) Delaware Valley (3) Lancaster & York (4) Annapolis (5) • Organized in 2018 and headquartered in Camp Hill, PA, LNKB is a premier Mid-Atlantic community bank serving clients throughout Central and SE Pennsylvania, Maryland, Delaware and Virginia • 24 full-service branches and 4 LPOs in attractive markets • A relationship-oriented business model drives a growing core deposit base, strong loan growth and consistent profitability • Growing professional services core deposit generation team • Regional model showcasing high-quality leadership and talent throughout the organization 1.04% ROA Gross Loans Deposits Banking Office Percentile ’26 HHI Nationwide Projected HHI Growth 98th9.3% $287M $21M 1 Gross Loans Deposits Banking Offices Percentile ’26 HHI Nationwide Projected Pop. Growth 99th3.8% $219M $328M 2 Gross Loans Deposits Banking Offices Largest PA MSA(4) Combined Population 3rd>1M $286M $148M 2 Gross Loans Deposits Banking Offices Cumberland: Pop. Growth in PA Dauphin: HHI Growth in PA #2#3 $594M $733M 7

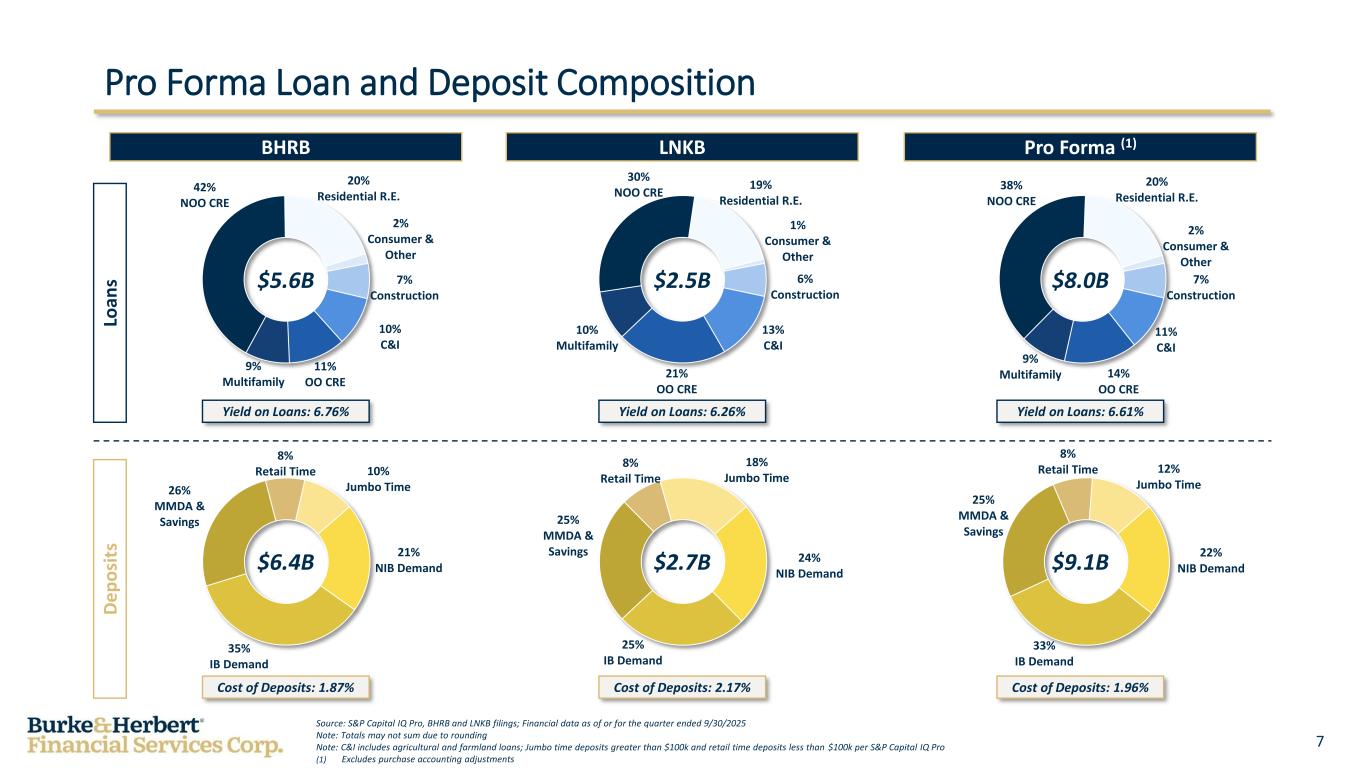

0 45 78 218 187 117 7 Yield on Loans: 6.26% 7% Construction 10% C&I 11% OO CRE 9% Multifamily 42% NOO CRE 20% Residential R.E. 2% Consumer & Other 21% NIB Demand 35% IB Demand 26% MMDA & Savings 8% Retail Time 10% Jumbo Time 6% Construction 13% C&I 21% OO CRE 10% Multifamily 30% NOO CRE 19% Residential R.E. 1% Consumer & Other 24% NIB Demand 25% IB Demand 25% MMDA & Savings 8% Retail Time 18% Jumbo Time 7% Construction 11% C&I 14% OO CRE 9% Multifamily 38% NOO CRE 20% Residential R.E. 2% Consumer & Other 22% NIB Demand 33% IB Demand 25% MMDA & Savings 8% Retail Time 12% Jumbo Time Pro Forma Loan and Deposit Composition Lo an s D e p o si ts $5.6B $2.5B $6.4B $2.7B $9.1B $8.0B Source: S&P Capital IQ Pro, BHRB and LNKB filings; Financial data as of or for the quarter ended 9/30/2025 Note: Totals may not sum due to rounding Note: C&I includes agricultural and farmland loans; Jumbo time deposits greater than $100k and retail time deposits less than $100k per S&P Capital IQ Pro (1) Excludes purchase accounting adjustments BHRB Pro Forma (1)LNKB Yield on Loans: 6.76% Cost of Deposits: 1.87% Cost of Deposits: 2.17% Yield on Loans: 6.61% Cost of Deposits: 1.96%

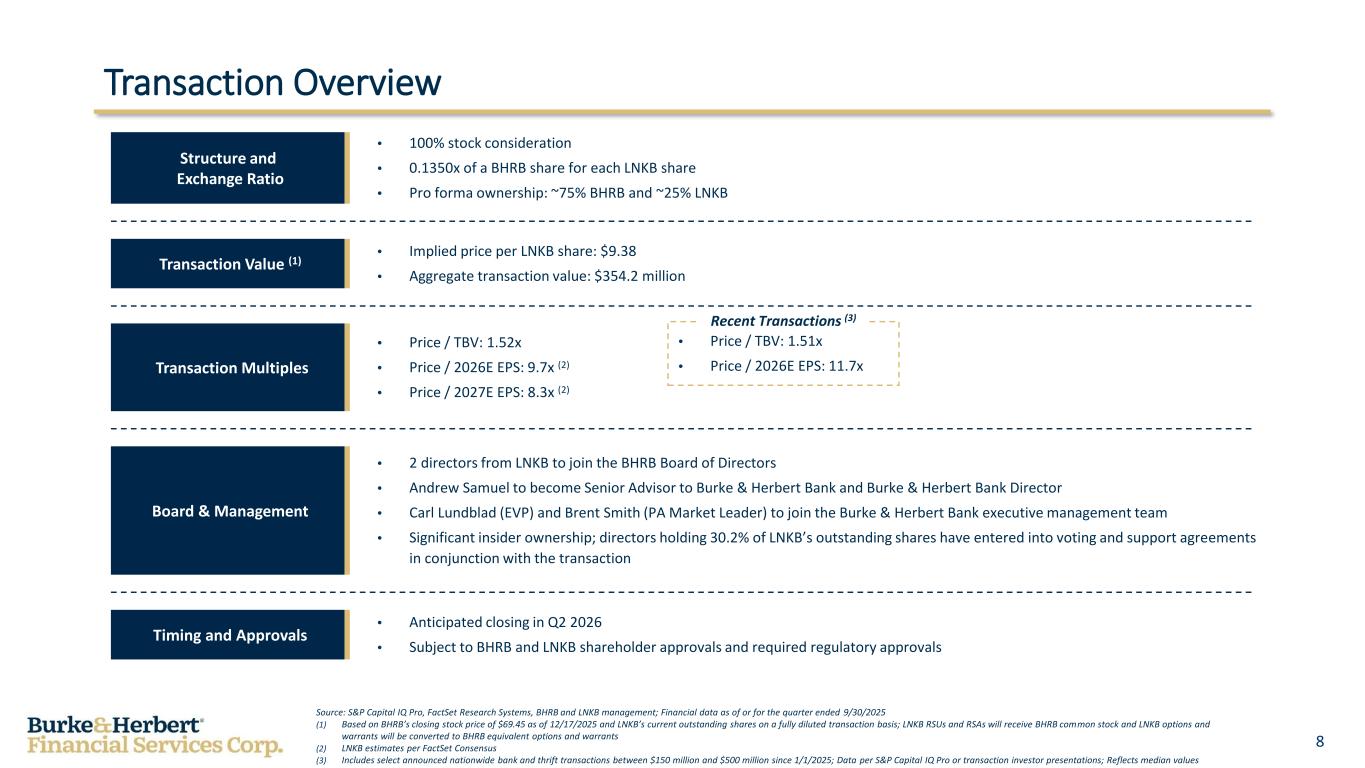

0 45 78 218 187 117 8 Transaction Overview Structure and Exchange Ratio Transaction Value (1) Transaction Multiples Board & Management Timing and Approvals • 100% stock consideration • 0.1350x of a BHRB share for each LNKB share • Pro forma ownership: ~75% BHRB and ~25% LNKB Source: S&P Capital IQ Pro, FactSet Research Systems, BHRB and LNKB management; Financial data as of or for the quarter ended 9/30/2025 (1) Based on BHRB’s closing stock price of $69.45 as of 12/17/2025 and LNKB’s current outstanding shares on a fully diluted transaction basis; LNKB RSUs and RSAs will receive BHRB common stock and LNKB options and warrants will be converted to BHRB equivalent options and warrants (2) LNKB estimates per FactSet Consensus (3) Includes select announced nationwide bank and thrift transactions between $150 million and $500 million since 1/1/2025; Data per S&P Capital IQ Pro or transaction investor presentations; Reflects median values • Implied price per LNKB share: $9.38 • Aggregate transaction value: $354.2 million • Price / TBV: 1.52x • Price / 2026E EPS: 9.7x (2) • Price / 2027E EPS: 8.3x (2) • 2 directors from LNKB to join the BHRB Board of Directors • Andrew Samuel to become Senior Advisor to Burke & Herbert Bank and Burke & Herbert Bank Director • Carl Lundblad (EVP) and Brent Smith (PA Market Leader) to join the Burke & Herbert Bank executive management team • Significant insider ownership; directors holding 30.2% of LNKB’s outstanding shares have entered into voting and support agreements in conjunction with the transaction • Anticipated closing in Q2 2026 • Subject to BHRB and LNKB shareholder approvals and required regulatory approvals • Price / TBV: 1.51x • Price / 2026E EPS: 11.7x Recent Transactions (3)

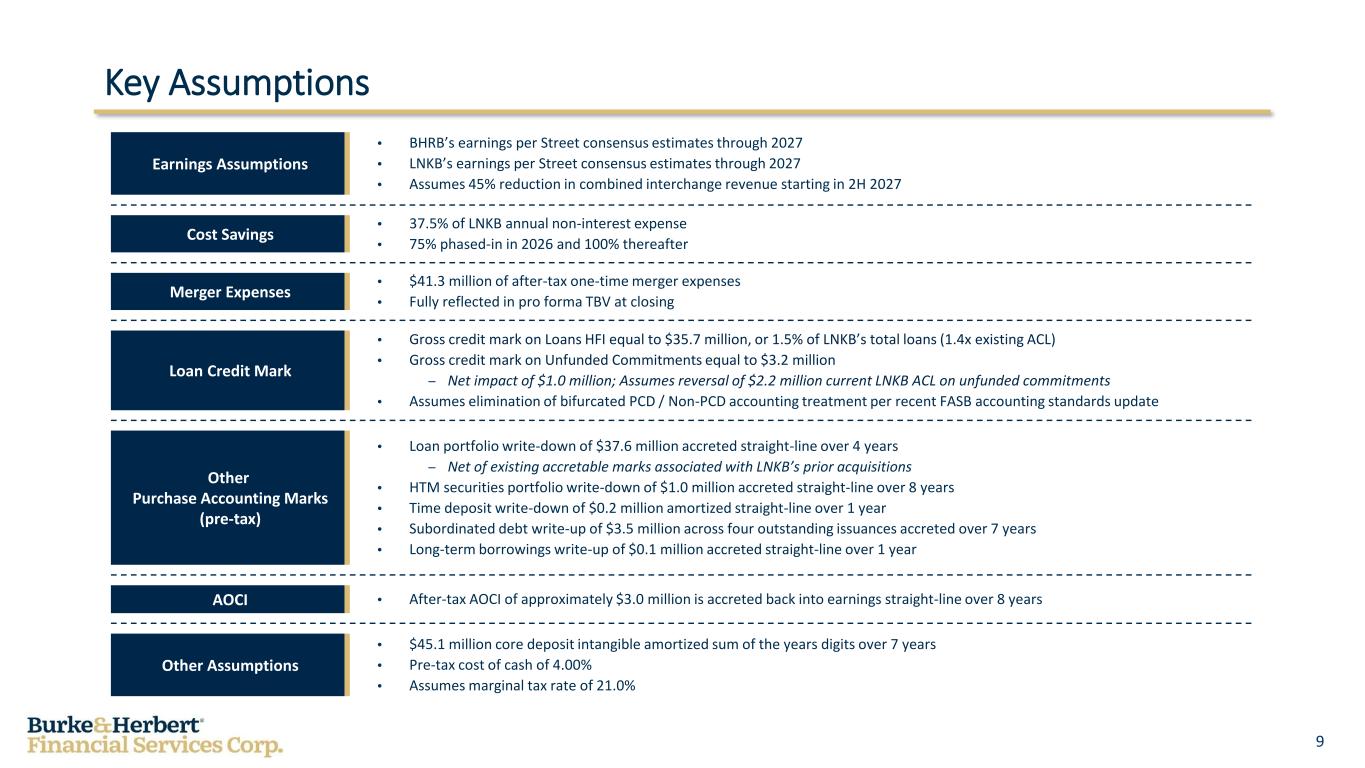

0 45 78 218 187 117 9 Key Assumptions Earnings Assumptions Cost Savings Loan Credit Mark • BHRB’s earnings per Street consensus estimates through 2027 • LNKB’s earnings per Street consensus estimates through 2027 • Assumes 45% reduction in combined interchange revenue starting in 2H 2027 • 37.5% of LNKB annual non-interest expense • 75% phased-in in 2026 and 100% thereafter • Gross credit mark on Loans HFI equal to $35.7 million, or 1.5% of LNKB’s total loans (1.4x existing ACL) • Gross credit mark on Unfunded Commitments equal to $3.2 million – Net impact of $1.0 million; Assumes reversal of $2.2 million current LNKB ACL on unfunded commitments • Assumes elimination of bifurcated PCD / Non-PCD accounting treatment per recent FASB accounting standards update Merger Expenses • $41.3 million of after-tax one-time merger expenses • Fully reflected in pro forma TBV at closing Other Purchase Accounting Marks (pre-tax) • Loan portfolio write-down of $37.6 million accreted straight-line over 4 years – Net of existing accretable marks associated with LNKB’s prior acquisitions • HTM securities portfolio write-down of $1.0 million accreted straight-line over 8 years • Time deposit write-down of $0.2 million amortized straight-line over 1 year • Subordinated debt write-up of $3.5 million across four outstanding issuances accreted over 7 years • Long-term borrowings write-up of $0.1 million accreted straight-line over 1 year AOCI • After-tax AOCI of approximately $3.0 million is accreted back into earnings straight-line over 8 years Other Assumptions • $45.1 million core deposit intangible amortized sum of the years digits over 7 years • Pre-tax cost of cash of 4.00% • Assumes marginal tax rate of 21.0%

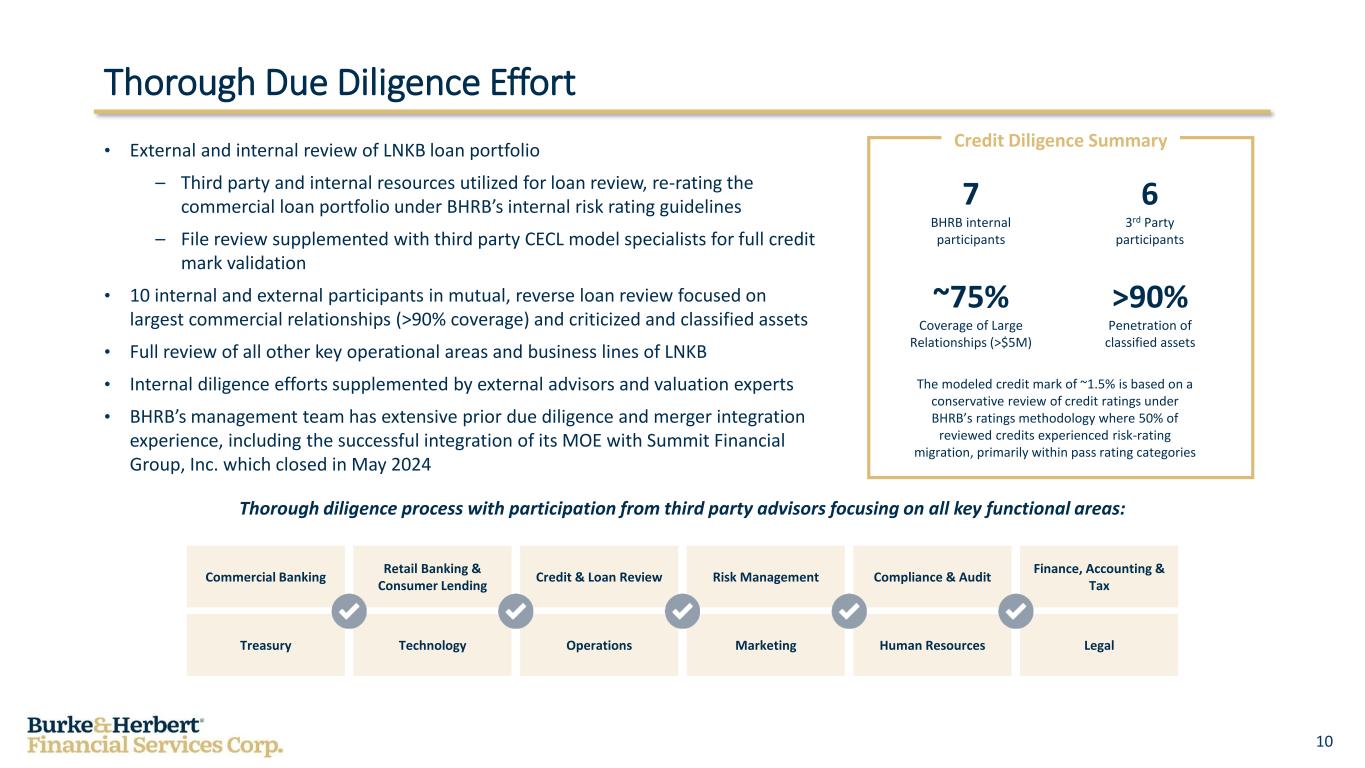

0 45 78 218 187 117 10 Thorough Due Diligence Effort • External and internal review of LNKB loan portfolio – Third party and internal resources utilized for loan review, re-rating the commercial loan portfolio under BHRB’s internal risk rating guidelines – File review supplemented with third party CECL model specialists for full credit mark validation • 10 internal and external participants in mutual, reverse loan review focused on largest commercial relationships (>90% coverage) and criticized and classified assets • Full review of all other key operational areas and business lines of LNKB • Internal diligence efforts supplemented by external advisors and valuation experts • BHRB’s management team has extensive prior due diligence and merger integration experience, including the successful integration of its MOE with Summit Financial Group, Inc. which closed in May 2024 Thorough diligence process with participation from third party advisors focusing on all key functional areas: Credit Diligence Summary ~75% Coverage of Large Relationships (>$5M) >90% Penetration of classified assets 7 BHRB internal participants 6 3rd Party participants Retail Banking & Consumer Lending Commercial Banking Legal Marketing Credit & Loan Review Human Resources Compliance & Audit Operations Risk Management Finance, Accounting & Tax Treasury Technology The modeled credit mark of ~1.5% is based on a conservative review of credit ratings under BHRB’s ratings methodology where 50% of reviewed credits experienced risk-rating migration, primarily within pass rating categories

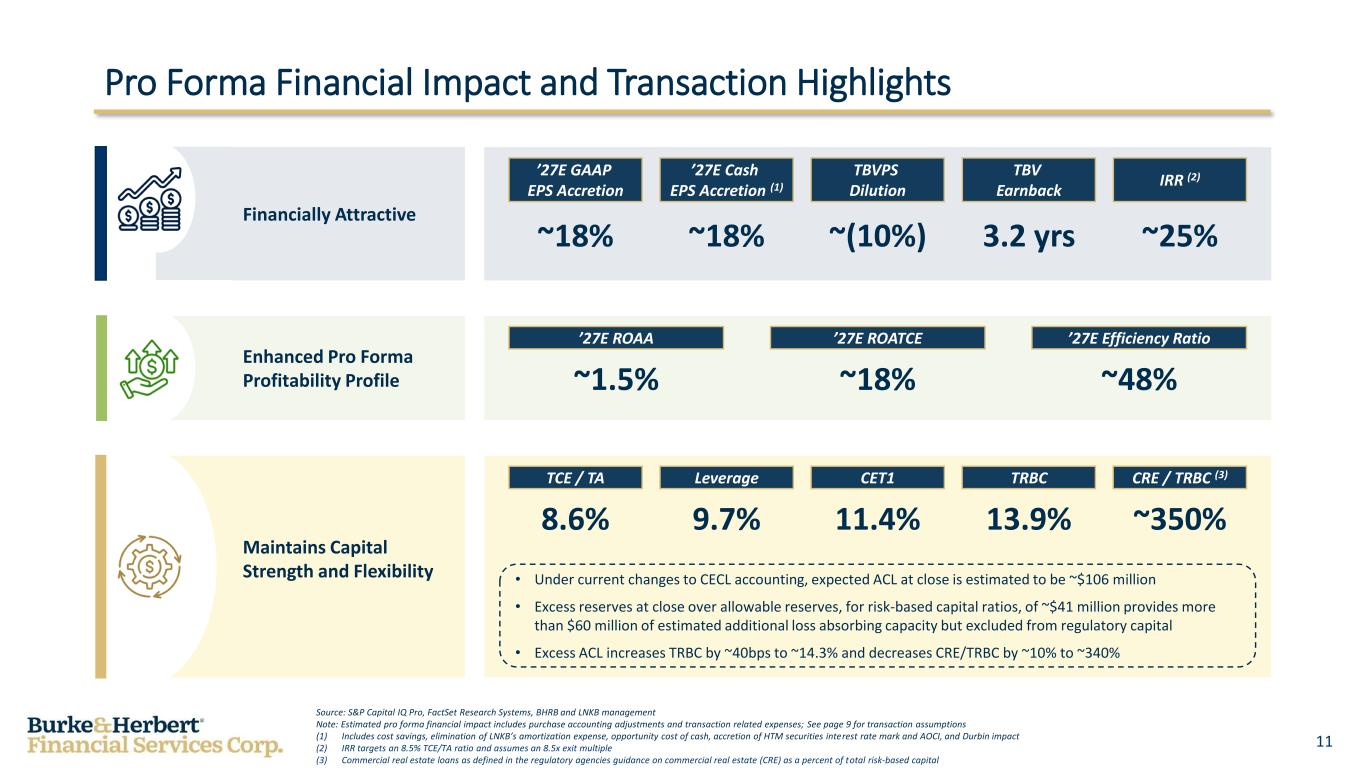

0 45 78 218 187 117 11 Maintains Capital Strength and Flexibility Pro Forma Financial Impact and Transaction Highlights Source: S&P Capital IQ Pro, FactSet Research Systems, BHRB and LNKB management Note: Estimated pro forma financial impact includes purchase accounting adjustments and transaction related expenses; See page 9 for transaction assumptions (1) Includes cost savings, elimination of LNKB’s amortization expense, opportunity cost of cash, accretion of HTM securities interest rate mark and AOCI, and Durbin impact (2) IRR targets an 8.5% TCE/TA ratio and assumes an 8.5x exit multiple (3) Commercial real estate loans as defined in the regulatory agencies guidance on commercial real estate (CRE) as a percent of total risk-based capital TCE / TA Leverage CET1 TRBC CRE / TRBC (3) 8.6% 9.7% 11.4% ~350%13.9% • Under current changes to CECL accounting, expected ACL at close is estimated to be ~$106 million • Excess reserves at close over allowable reserves, for risk-based capital ratios, of ~$41 million provides more than $60 million of estimated additional loss absorbing capacity but excluded from regulatory capital • Excess ACL increases TRBC by ~40bps to ~14.3% and decreases CRE/TRBC by ~10% to ~340% Financially Attractive TBVPS Dilution ~(10%) ’27E GAAP EPS Accretion ~18% IRR (2) ~25% TBV Earnback 3.2 yrs Enhanced Pro Forma Profitability Profile ’27E ROAA ’27E ROATCE ’27E Efficiency Ratio ~1.5% ~18% ~48% ’27E Cash EPS Accretion (1) ~18%

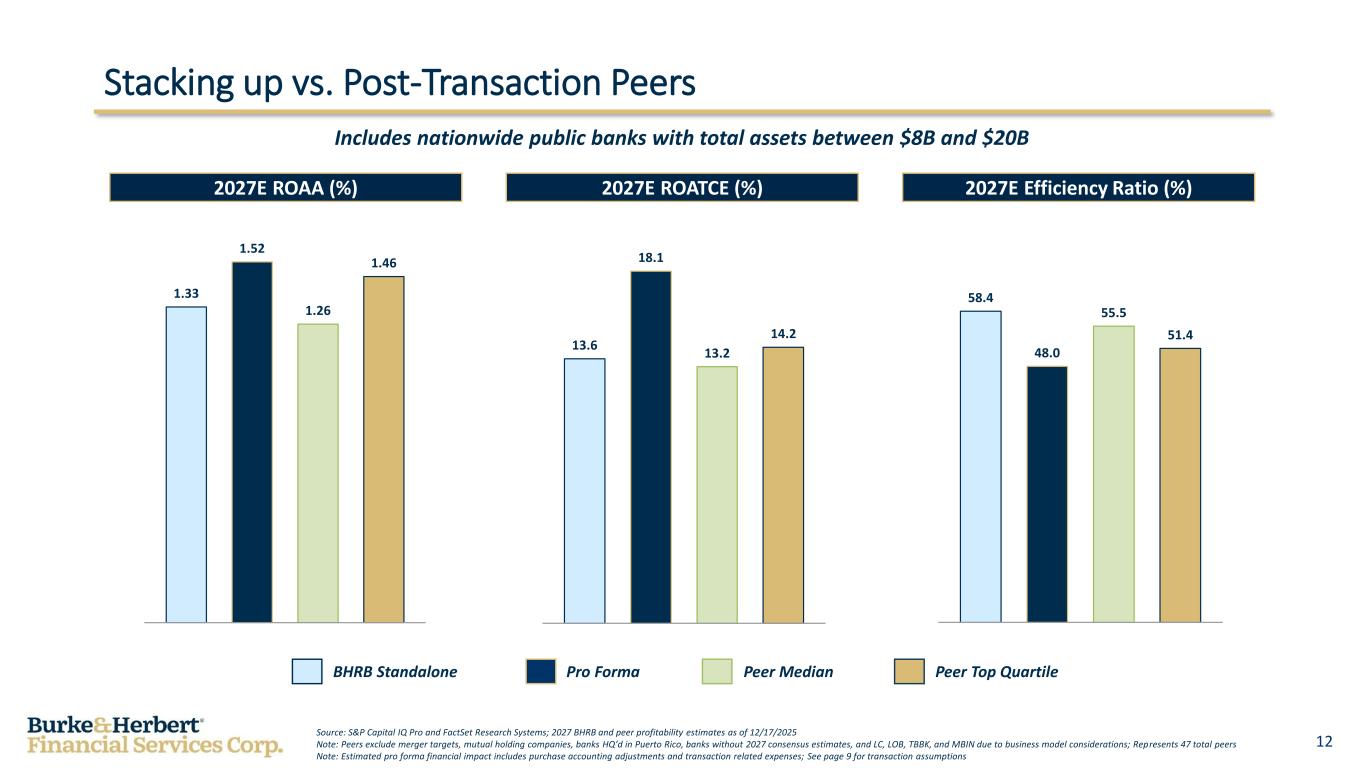

0 45 78 218 187 117 12 58.4 48.0 55.5 51.4 1.33 1.52 1.26 1.46 13.6 18.1 13.2 14.2 Stacking up vs. Post-Transaction Peers Includes nationwide public banks with total assets between $8B and $20B Source: S&P Capital IQ Pro and FactSet Research Systems; 2027 BHRB and peer profitability estimates as of 12/17/2025 Note: Peers exclude merger targets, mutual holding companies, banks HQ’d in Puerto Rico, banks without 2027 consensus estimates, and LC, LOB, TBBK, and MBIN due to business model considerations; Represents 47 total peers Note: Estimated pro forma financial impact includes purchase accounting adjustments and transaction related expenses; See page 9 for transaction assumptions 2027E ROAA (%) 2027E Efficiency Ratio (%)2027E ROATCE (%) BHRB Standalone Pro Forma Peer Median Peer Top Quartile

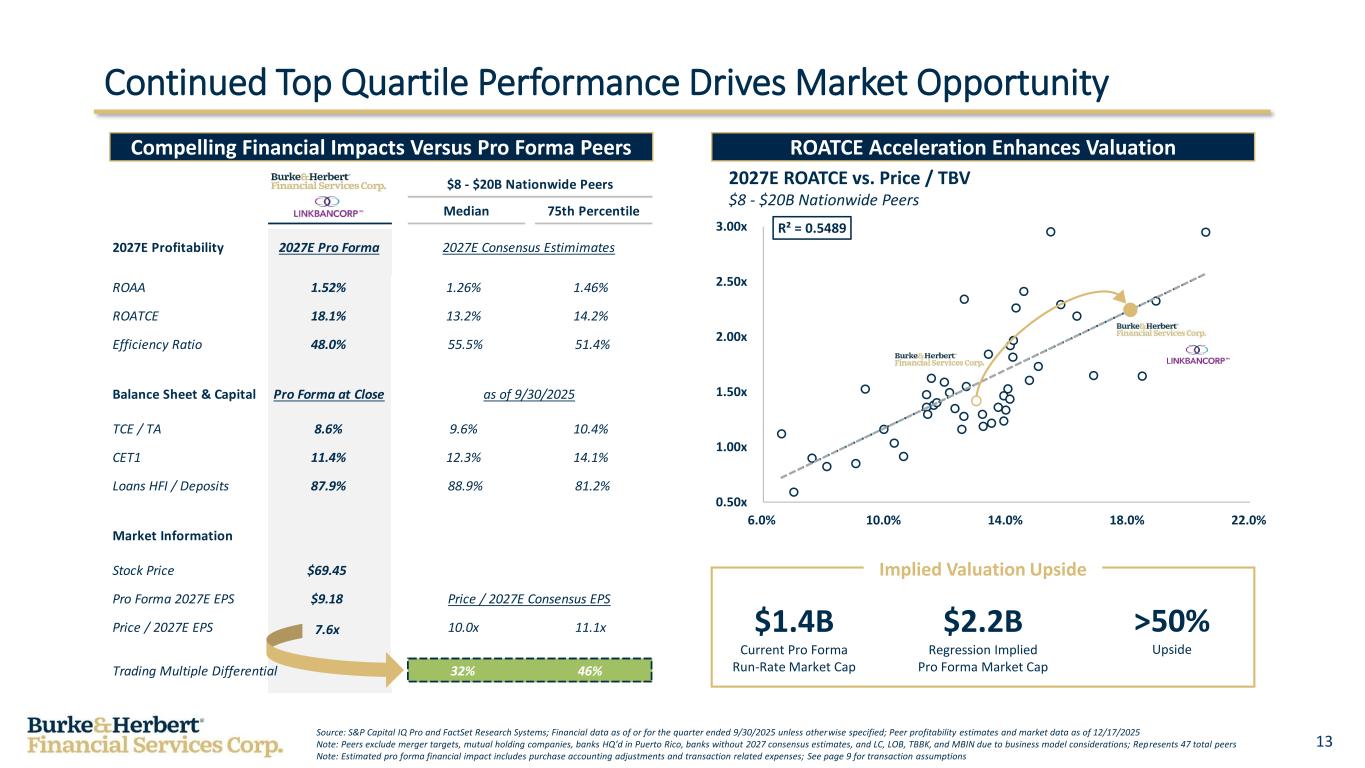

0 45 78 218 187 117 13 $8 - $20B Nationwide Peers Median 75th Percentile 2027E Profitability 2027E Pro Forma 2027E Consensus Estimimates ROAA 1.52% 1.26% 1.46% ROATCE 18.1% 13.2% 14.2% Efficiency Ratio 48.0% 55.5% 51.4% Balance Sheet & Capital Pro Forma at Close as of 9/30/2025 TCE / TA 8.6% 9.6% 10.4% CET1 11.4% 12.3% 14.1% Loans HFI / Deposits 87.9% 88.9% 81.2% Market Information Stock Price $69.45 Pro Forma 2027E EPS $9.18 Price / 2027E Consensus EPS Price / 2027E EPS 7.6x 10.0x 11.1x Trading Multiple Differential 32% 46% R² = 0.5489 0.50x 1.00x 1.50x 2.00x 2.50x 3.00x 6.0% 10.0% 14.0% 18.0% 22.0% Continued Top Quartile Performance Drives Market Opportunity Source: S&P Capital IQ Pro and FactSet Research Systems; Financial data as of or for the quarter ended 9/30/2025 unless otherwise specified; Peer profitability estimates and market data as of 12/17/2025 Note: Peers exclude merger targets, mutual holding companies, banks HQ’d in Puerto Rico, banks without 2027 consensus estimates, and LC, LOB, TBBK, and MBIN due to business model considerations; Represents 47 total peers Note: Estimated pro forma financial impact includes purchase accounting adjustments and transaction related expenses; See page 9 for transaction assumptions 2027E ROATCE vs. Price / TBV $8 - $20B Nationwide Peers Implied Valuation Upside $2.2B Regression Implied Pro Forma Market Cap $1.4B Current Pro Forma Run-Rate Market Cap >50% Upside Compelling Financial Impacts Versus Pro Forma Peers ROATCE Acceleration Enhances Valuation . x

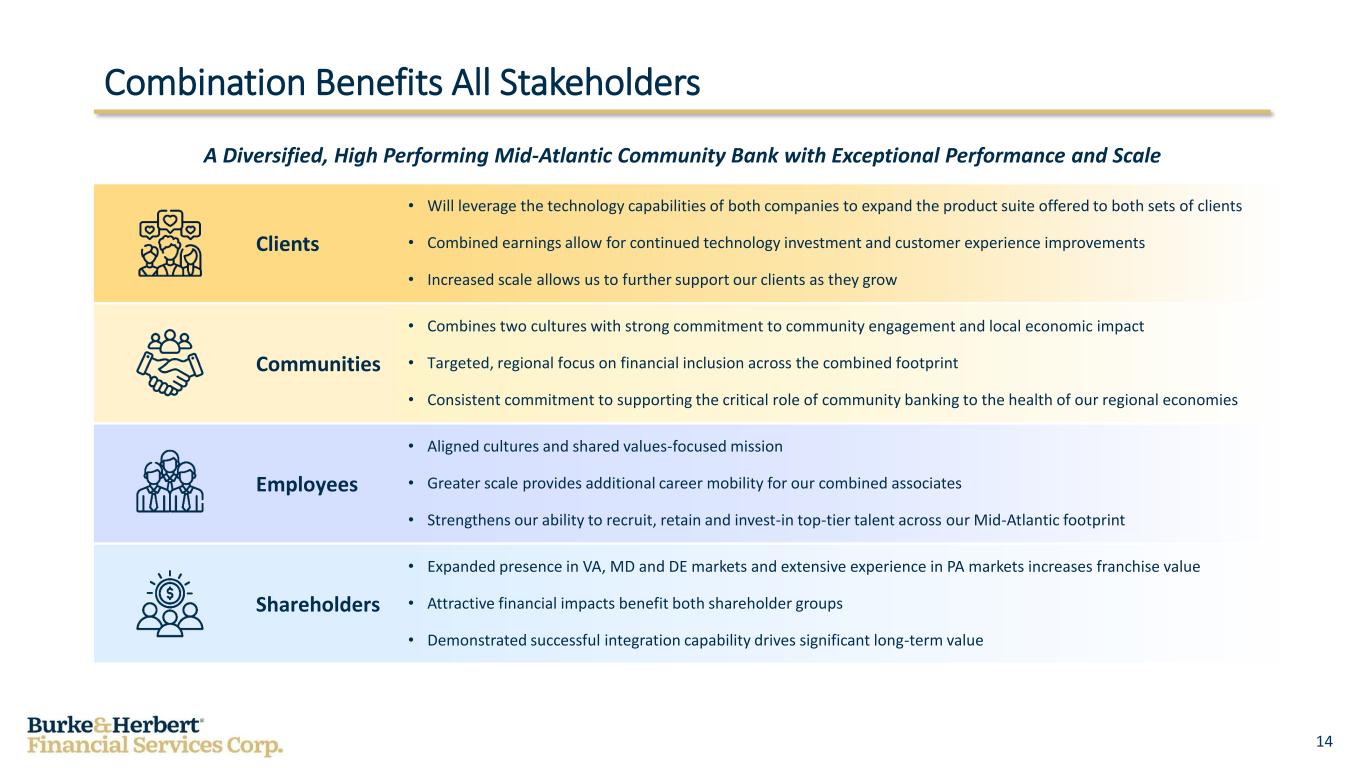

0 45 78 218 187 117 14 Combination Benefits All Stakeholders A Diversified, High Performing Mid-Atlantic Community Bank with Exceptional Performance and Scale Clients Communities Employees Shareholders • Will leverage the technology capabilities of both companies to expand the product suite offered to both sets of clients • Combined earnings allow for continued technology investment and customer experience improvements • Increased scale allows us to further support our clients as they grow • Combines two cultures with strong commitment to community engagement and local economic impact • Targeted, regional focus on financial inclusion across the combined footprint • Consistent commitment to supporting the critical role of community banking to the health of our regional economies • Aligned cultures and shared values-focused mission • Greater scale provides additional career mobility for our combined associates • Strengthens our ability to recruit, retain and invest-in top-tier talent across our Mid-Atlantic footprint • Expanded presence in VA, MD and DE markets and extensive experience in PA markets increases franchise value • Attractive financial impacts benefit both shareholder groups • Demonstrated successful integration capability drives significant long-term value

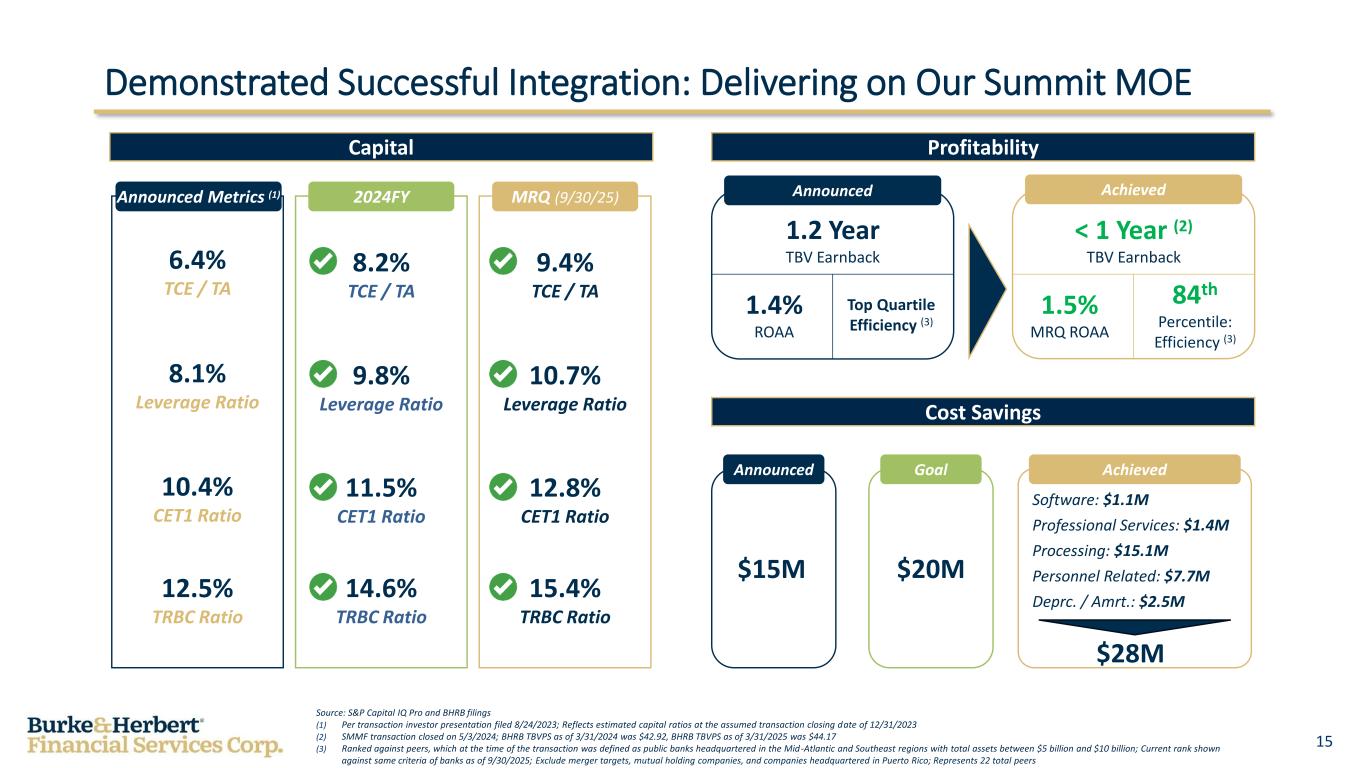

0 45 78 218 187 117 15 < 1 Year (2) TBV Earnback Demonstrated Successful Integration: Delivering on Our Summit MOE Profitability 1.2 Year TBV Earnback Top Quartile Efficiency (3) 1.4% ROAA 84th Percentile: Efficiency (3) 1.5% MRQ ROAA Announced Achieved Capital Cost Savings 8.1% Leverage Ratio 10.4% CET1 Ratio 12.5% TRBC Ratio 8.2% TCE / TA 9.8% Leverage Ratio 11.5% CET1 Ratio 14.6% TRBC Ratio 9.4% TCE / TA 10.7% Leverage Ratio 12.8% CET1 Ratio 15.4% TRBC Ratio Announced Metrics (1) 2024FY MRQ (9/30/25) 6.4% TCE / TA Announced $15M Goal $20M Achieved $28M Software: $1.1M Professional Services: $1.4M Processing: $15.1M Personnel Related: $7.7M Deprc. / Amrt.: $2.5M Source: S&P Capital IQ Pro and BHRB filings (1) Per transaction investor presentation filed 8/24/2023; Reflects estimated capital ratios at the assumed transaction closing date of 12/31/2023 (2) SMMF transaction closed on 5/3/2024; BHRB TBVPS as of 3/31/2024 was $42.92, BHRB TBVPS as of 3/31/2025 was $44.17 (3) Ranked against peers, which at the time of the transaction was defined as public banks headquartered in the Mid-Atlantic and Southeast regions with total assets between $5 billion and $10 billion; Current rank shown against same criteria of banks as of 9/30/2025; Exclude merger targets, mutual holding companies, and companies headquartered in Puerto Rico; Represents 22 total peers

0 45 78 218 187 117 16 Appendix

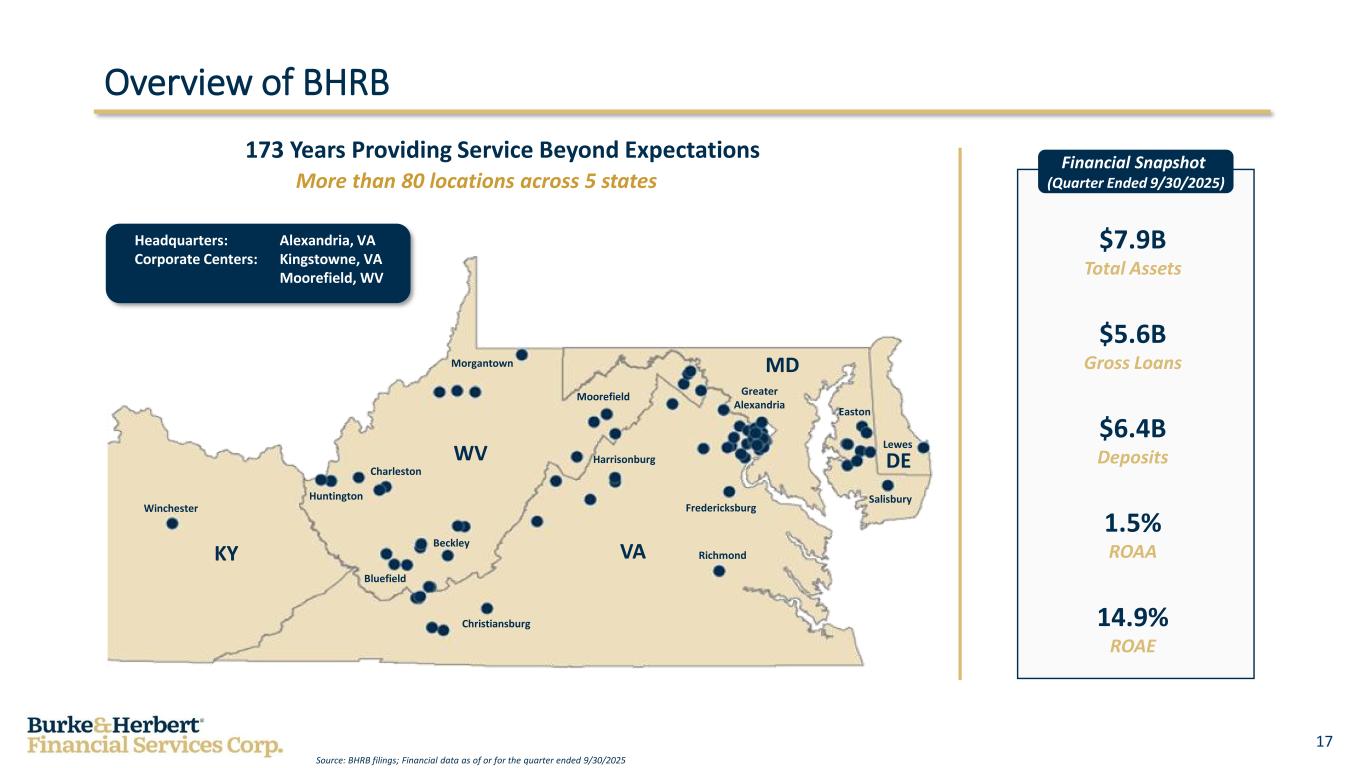

0 45 78 218 187 117 17 KY VA WV DE Winchester Huntington Bluefield Christiansburg Harrisonburg Morgantown Moorefield Greater Alexandria Easton MD Salisbury Lewes Richmond Fredericksburg Beckley Charleston Overview of BHRB 173 Years Providing Service Beyond Expectations More than 80 locations across 5 states Source: BHRB filings; Financial data as of or for the quarter ended 9/30/2025 Financial Snapshot (Quarter Ended 9/30/2025) $7.9B Total Assets $5.6B Gross Loans $6.4B Deposits 1.5% ROAA 14.9% ROAE Alexandria, VA Kingstowne, VA Moorefield, WV Headquarters: Corporate Centers:

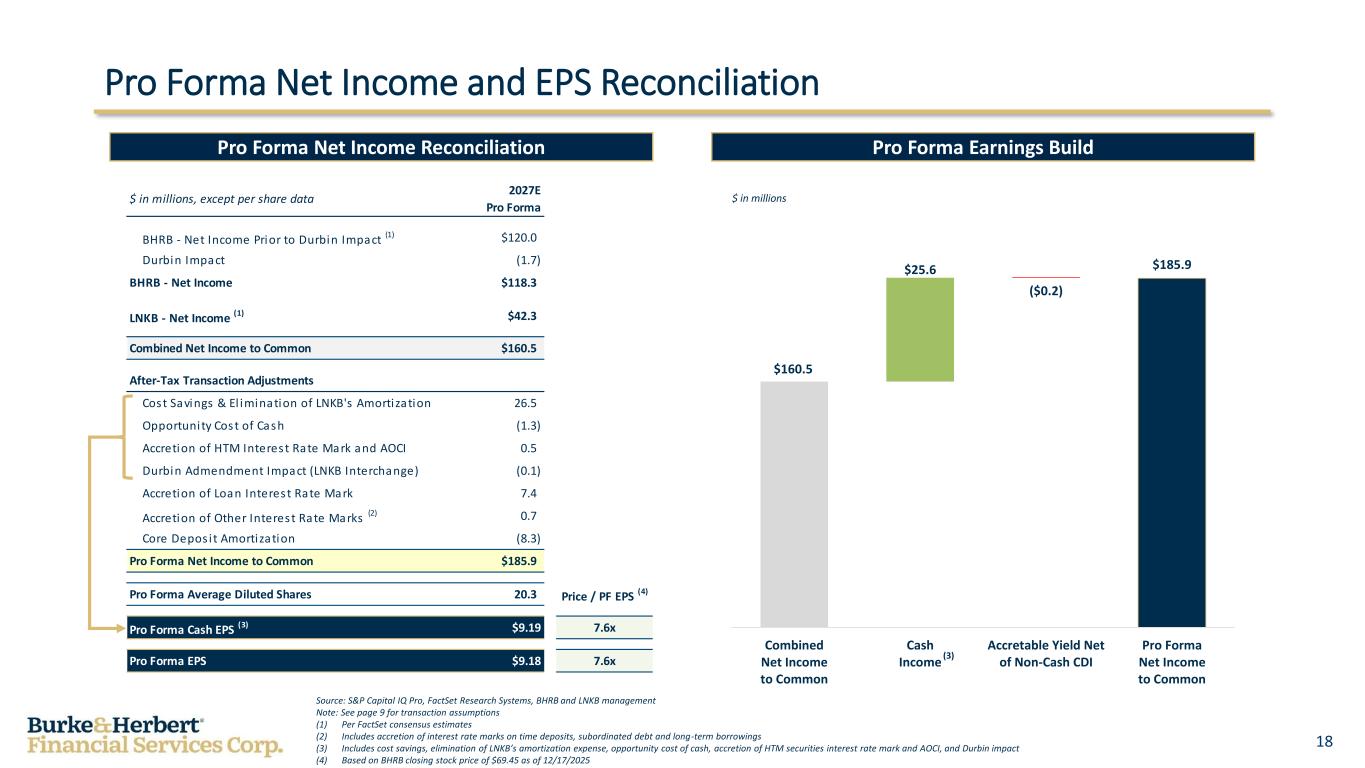

0 45 78 218 187 117 18 $160.5 $185.9 ($0.2) $25.6 Combined Net Income to Common Cash Income Accretable Yield Net of Non-Cash CDI Pro Forma Net Income to Common $ in millions, except per share data 2027E Pro Forma BHRB - Net Income Prior to Durbin Impact (1) $120.0 Durbin Impact (1.7) BHRB - Net Income $118.3 LNKB - Net Income (1) $42.3 Combined Net Income to Common $160.5 After-Tax Transaction Adjustments Cost Savings & El imination of LNKB's Amortization 26.5 Opportunity Cost of Cash (1.3) Accretion of HTM Interest Rate Mark and AOCI 0.5 Durbin Admendment Impact (LNKB Interchange) (0.1) Accretion of Loan Interest Rate Mark 7.4 Accretion of Other Interest Rate Marks (2) 0.7 Core Depos it Amortization (8.3) Pro Forma Net Income to Common $185.9 Pro Forma Average Diluted Shares 20.3 Price / PF EPS (4) Pro Forma Cash EPS (3) $9.19 7.6x Pro Forma EPS $9.18 7.6x Source: S&P Capital IQ Pro, FactSet Research Systems, BHRB and LNKB management Note: See page 9 for transaction assumptions (1) Per FactSet consensus estimates (2) Includes accretion of interest rate marks on time deposits, subordinated debt and long-term borrowings (3) Includes cost savings, elimination of LNKB’s amortization expense, opportunity cost of cash, accretion of HTM securities interest rate mark and AOCI, and Durbin impact (4) Based on BHRB closing stock price of $69.45 as of 12/17/2025 Pro Forma Net Income and EPS Reconciliation Pro Forma Net Income Reconciliation Pro Forma Earnings Build (3) $ in millions

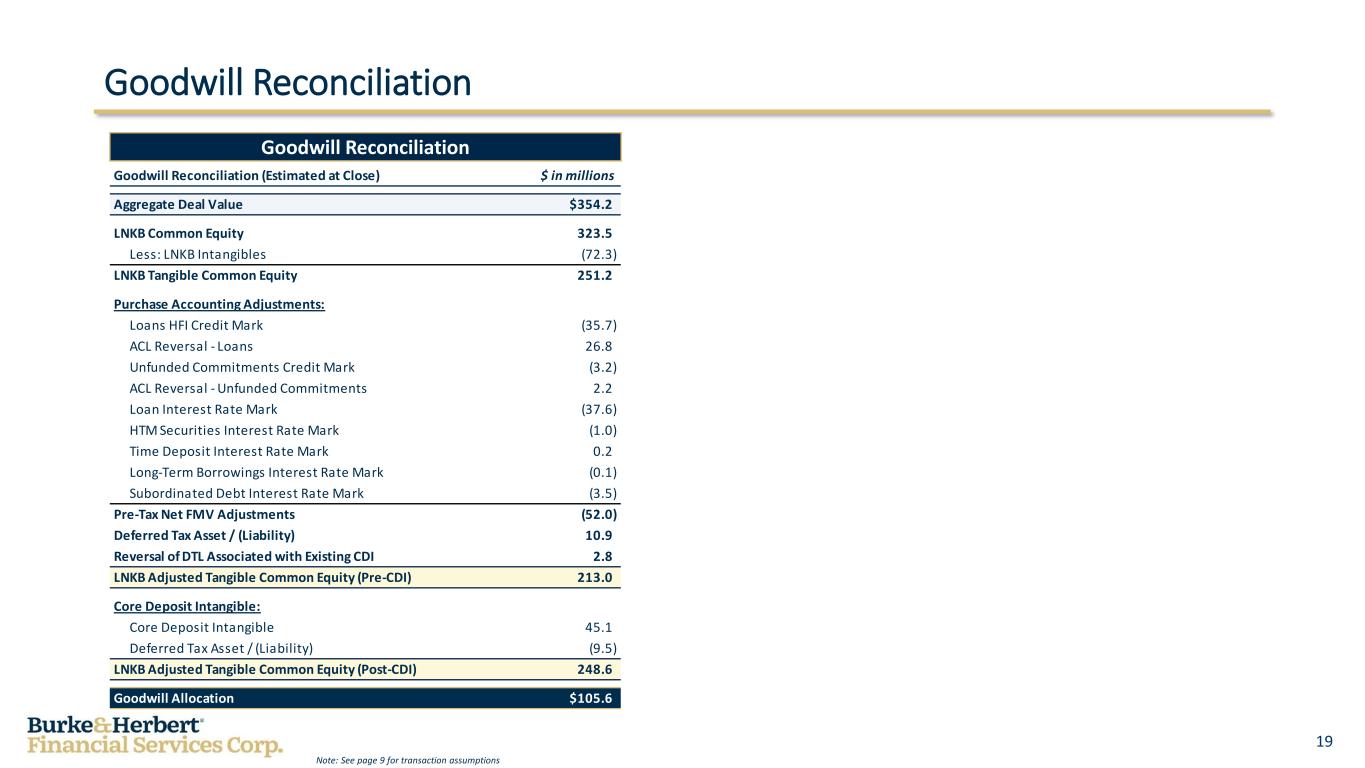

0 45 78 218 187 117 19 Goodwill Reconciliation (Estimated at Close) $ in millions Aggregate Deal Value $354.2 LNKB Common Equity 323.5 Less: LNKB Intangibles (72.3) LNKB Tangible Common Equity 251.2 Purchase Accounting Adjustments: Loans HFI Credit Mark (35.7) ACL Reversal - Loans 26.8 Unfunded Commitments Credit Mark (3.2) ACL Reversal - Unfunded Commitments 2.2 Loan Interest Rate Mark (37.6) HTM Securities Interest Rate Mark (1.0) Time Deposit Interest Rate Mark 0.2 Long-Term Borrowings Interest Rate Mark (0.1) Subordinated Debt Interest Rate Mark (3.5) Pre-Tax Net FMV Adjustments (52.0) Deferred Tax Asset / (Liability) 10.9 Reversal of DTL Associated with Existing CDI 2.8 LNKB Adjusted Tangible Common Equity (Pre-CDI) 213.0 Core Deposit Intangible: Core Deposit Intangible 45.1 Deferred Tax Asset / (Liability) (9.5) LNKB Adjusted Tangible Common Equity (Post-CDI) 248.6 Goodwill Allocation $105.6 Goodwill Reconciliation Goodwill Reconciliation Note: See page 9 for transaction assumptions