1 January 2026 4Q25 Update (Nasdaq: BHRB)

2 Cautionary Statement Regarding Forward-Looking Information Cautionary Note Regarding Forward Looking Statements This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including with respect to (or based on) the beliefs, goals, intentions, and expectations of Burke & Herbert and LINK regarding the merger of LINK with and into Burke & Herbert announced on December 18, 2025 (the “proposed transaction”), revenues, earnings, earnings per share, loan production, asset quality, and capital levels, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of expected losses on loans; our assessments of interest rate and other market risks; our ability to achieve our financial and other strategic goals; the expected timing of completion of the proposed transaction; the expected cost savings, synergies, returns and other anticipated benefits from the proposed transaction; and other statements that are not historical facts. Forward–looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “will,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Forward-looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction. Additionally, forward–looking statements speak only as of the date they are made; Burke & Herbert and LINK do not assume any duty, and do not undertake, to update such forward–looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Furthermore, because forward–looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those indicated in or implied by such forward-looking statements as a result of a variety of factors, many of which are beyond the control of Burke & Herbert and LINK. Such statements are based upon the current beliefs and expectations of the management of Burke & Herbert and LINK and are subject to significant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing undue reliance on forward-looking statements. The factors that could cause actual results to differ materially include the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between Burke & Herbert and LINK; the outcome of any legal proceedings that may be instituted against Burke & Herbert or LINK; the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated (and the risk that required regulatory approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); the ability of Burke & Herbert and LINK to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of either or both parties to the proposed transaction; the possibility that the anticipated benefits of the proposed transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Burke & Herbert and LINK do business; certain restrictions during the pendency of the proposed transaction that may impact the parties’ ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate LINK’s operations and those of Burke & Herbert; such integration may be more difficult, time-consuming or costly than expected; revenues following the proposed transaction may be lower than expected; Burke & Herbert’s and LINK’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing; the dilution caused by Burke & Herbert’s issuance of additional shares of its capital stock in connection with the proposed transaction; effects of the announcement, pendency or completion of the proposed transaction on the ability of Burke & Herbert and LINK to retain customers and retain and hire key personnel and maintain relationships with their suppliers, and on their operating results and businesses generally; and risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction and other factors that may affect future results of Burke & Herbert and LINK; and the other factors discussed in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of each of Burke & Herbert’s and LINK’s Quarterly Report on Form 10–Q for the quarters ended March 31, 2025, June 30, 2025 and September 30, 2025, and other reports Burke & Herbert and LINK file with the SEC.

3 Cautionary Statement Regarding Forward-Looking Information Non-GAAP Financial Measures This presentation contains certain financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Such non-GAAP financial measures may include the following: fully tax-equivalent net interest margin, core operating earnings, core net income, tangible book value per common share, total risk-based capital ratio, tier one leverage ratio, tier one capital ratio, and the tangible common equity to tangible assets ratio. Management uses these non-GAAP financial measures to assess the performance of the Company’s core business and the strength of its capital position. Management believes that these non-GAAP financial measures provide meaningful additional information about the Company to assist investors in evaluating operating results, financial strength, and capitalization. The non-GAAP financial measures should be considered as additional views of the way our financial measures are affected by significant charges for credit costs and other factors. These non-GAAP financial measures should not be considered as a substitute for operating results determined in accordance with GAAP and may not be comparable to other similarly titled measures of other companies. The computations of the non-GAAP financial measures used in this presentation are referenced in a footnote or in the appendix to this presentation.

4 Introduction • Thank you for your interest in Burke & Herbert Financial Services Corp., and its wholly owned subsidiary Burke & Herbert Bank & Trust Company. As a community banking institution, we are headquartered in Old Town Alexandria, Virginia, and have served the banking, borrowing and investing needs of businesses, organizations, families, and individuals since 1852. • As a true community bank, we are deeply tied to the people, neighborhoods, and institutions where we live and work. Our employees form a diverse, dedicated, close-knit team that upholds a culture of customer service and forges strong and lasting relationships with our customers and shared communities. We are selective in our hiring, proud of the caliber of our people, and encourage a collegial environment in which each individual feels valued. • We strive to be your quintessential community bank that delivers extraordinary experiences and top-quartile results, while staying true to our values and remaining focused on what we can control.

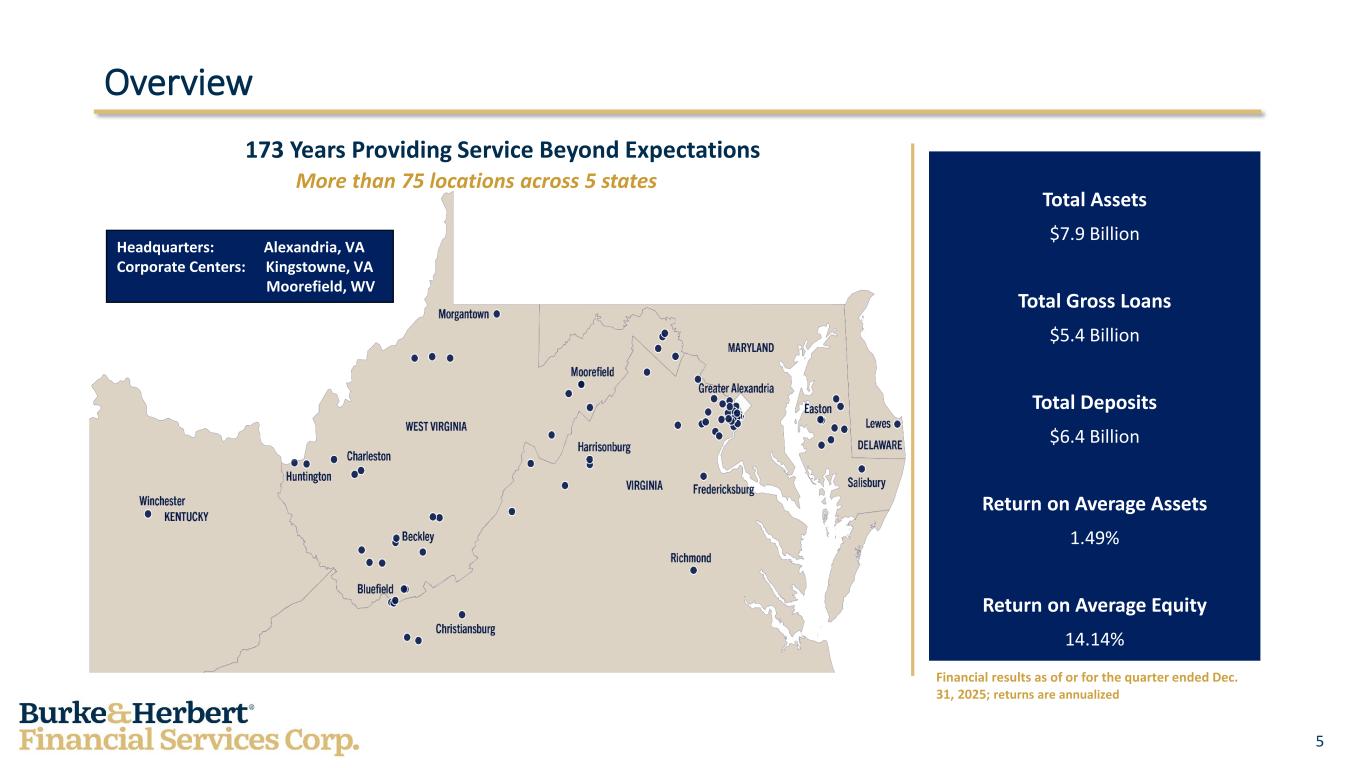

5 Overview Headquarters: Alexandria, VA Corporate Centers: Kingstowne, VA Moorefield, WV 173 Years Providing Service Beyond Expectations More than 75 locations across 5 states Total Assets $7.9 Billion Total Gross Loans $5.4 Billion Total Deposits $6.4 Billion Return on Average Assets 1.49% Return on Average Equity 14.14% Financial results as of or for the quarter ended Dec. 31, 2025; returns are annualized

6 Core Values Driven by our values, we endeavor to be your quintessential community bank — delivering service beyond expectations Serve & Lead We are dedicated to serving our customers and our teams, leading with quiet confidence and integrity to inspire the trust of all those we serve. Deliver More We're driven to go above and beyond, continually innovating and improving on how we deliver the best possible experiences and outcomes for all those we serve. Elevate Everyone We embrace our differences and respect everyone's unique contributions. We seek to empower individuals through our actions and words because we believe that when one succeeds, we all succeed. Always Invested We take ownership and responsibility for our work and are invested in the long-term success of our customers, colleagues, and communities.

7 Investment Strategy Unmatched Legacy & Reputation Strong & Consistent Financial Performance Market Leadership in a High-Growth Region Community Banking with a Competitive Edge • Oldest continuously operated bank in Virginia with 170+ years of trust • Multi-generational customer relationships, deeply imbedded in the community • Publicly traded, yet maintains a family-owned culture with a long-term view • Well-capitalized and resilient with low earnings volatility across economic cycles • Desired moderate risk profile with a fortress balance sheet • Stable deposit base with loyal customer retention • Our goal is to consistently deliver top quartile returns relative to our peers • Headquartered in historic Alexandria, VA, a prime location in the D.C. metro area • Strong presence in Northern VA’s affluent, high-income markets • Significant M&A and organic opportunities for deeper market penetration • Relationship-driven banking model vs. larger impersonal regional and super- regional banks • Faster, local decision-making for businesses and individuals • Longstanding trust gives us a competitive edge in our markets • A seasoned management team with large bank experience Future Growth and Innovation – Three Pillars of our Strategic Plan Continue to Maintain & Expand Our Trusted Advisor Relationship Model Expand Existing Markets & Pursue New Market Opportunities Deliver our Full Suite of Market Expected Products & Services

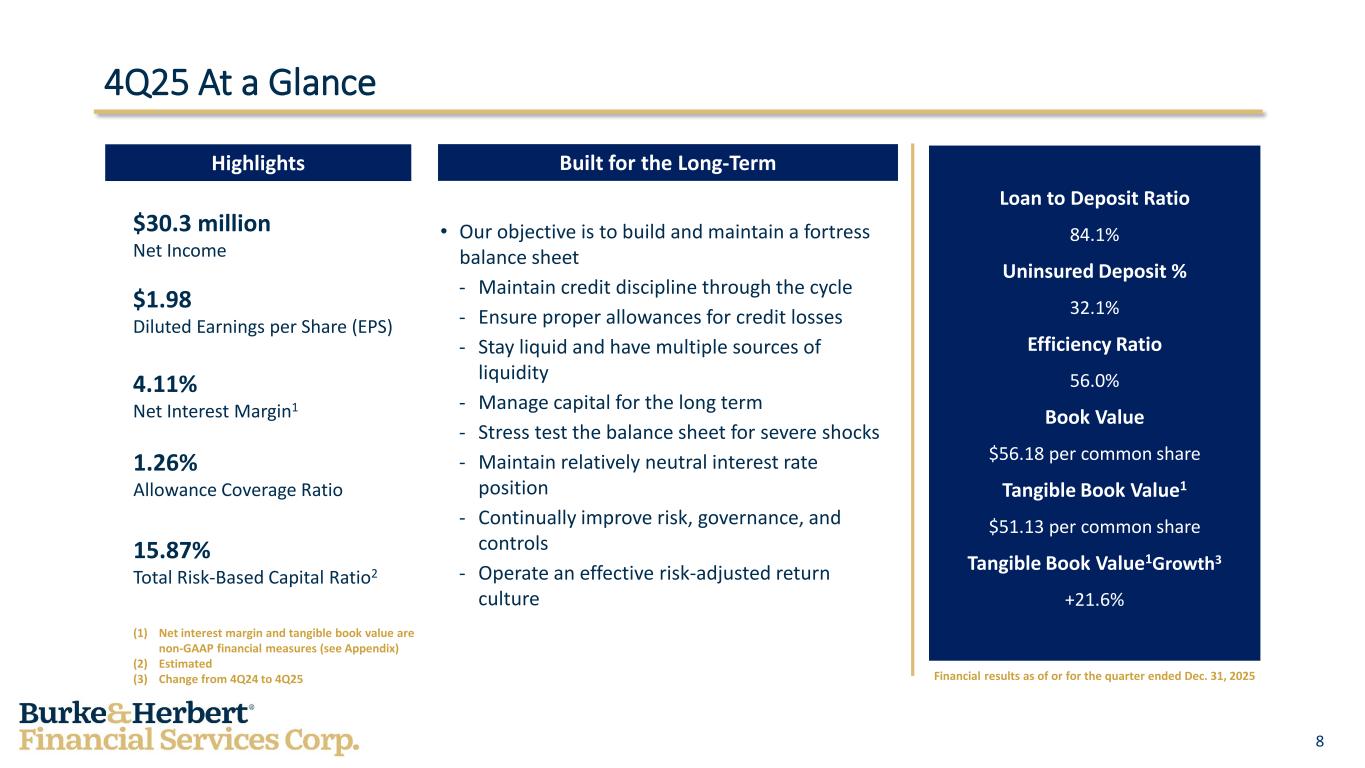

8 4Q25 At a Glance Highlights Built for the Long-Term $30.3 million Net Income $1.98 Diluted Earnings per Share (EPS) 4.11% Net Interest Margin1 1.26% Allowance Coverage Ratio 15.87% Total Risk-Based Capital Ratio2 (1) Net interest margin and tangible book value are non-GAAP financial measures (see Appendix) (2) Estimated (3) Change from 4Q24 to 4Q25 • Our objective is to build and maintain a fortress balance sheet - Maintain credit discipline through the cycle - Ensure proper allowances for credit losses - Stay liquid and have multiple sources of liquidity - Manage capital for the long term - Stress test the balance sheet for severe shocks - Maintain relatively neutral interest rate position - Continually improve risk, governance, and controls - Operate an effective risk-adjusted return culture Loan to Deposit Ratio 84.1% Uninsured Deposit % 32.1% Efficiency Ratio 56.0% Book Value $56.18 per common share Tangible Book Value1 $51.13 per common share Tangible Book Value1Growth3 +21.6% Financial results as of or for the quarter ended Dec. 31, 2025

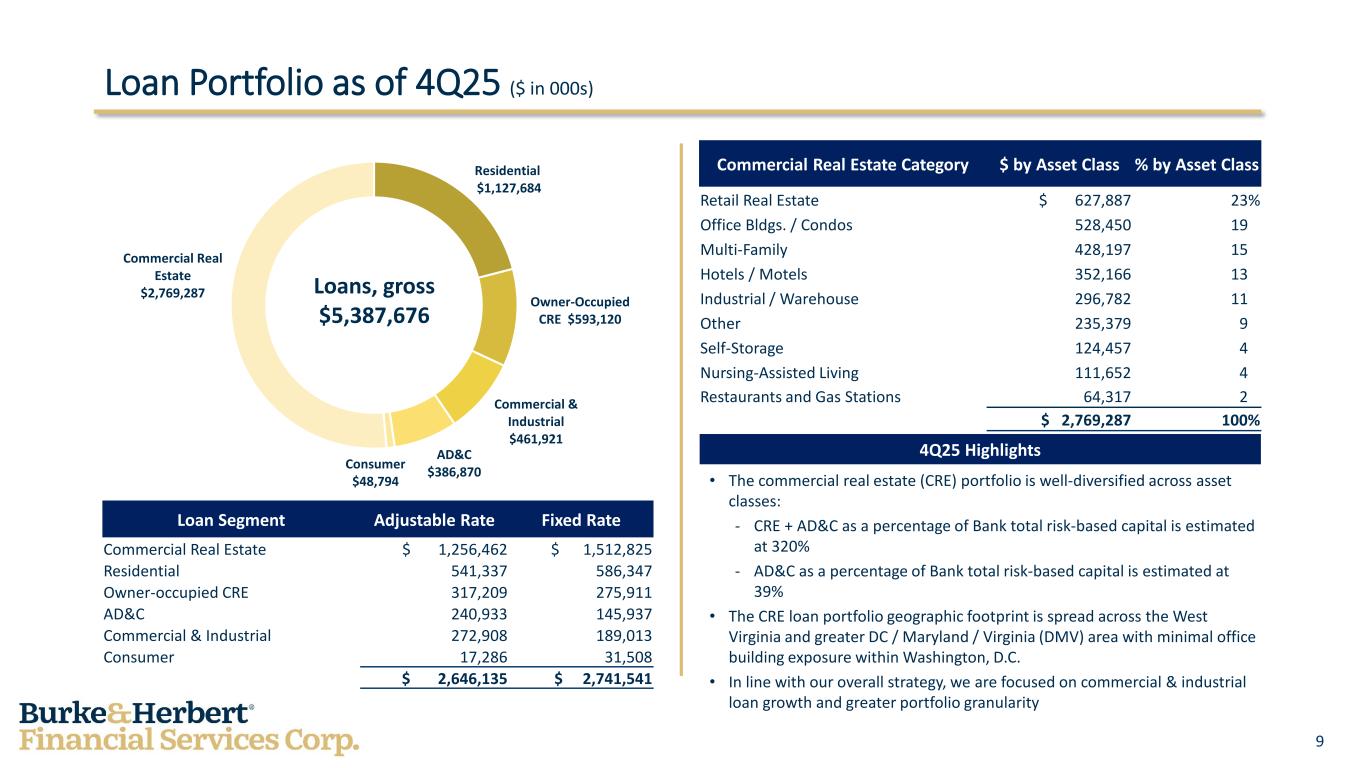

9 Loan Portfolio as of 4Q25 ($ in 000s) Residential $1,127,684 Owner-Occupied CRE $593,120 Commercial & Industrial $461,921 AD&C $386,870 Consumer $48,794 Commercial Real Estate $2,769,287 Loans, gross $5,387,676 Loan Segment Adjustable Rate Fixed Rate Commercial Real Estate $ 1,256,462 $ 1,512,825 Residential 541,337 586,347 Owner-occupied CRE 317,209 275,911 AD&C 240,933 145,937 Commercial & Industrial 272,908 189,013 Consumer 17,286 31,508 $ 2,646,135 $ 2,741,541 Commercial Real Estate Category $ by Asset Class % by Asset Class Retail Real Estate $ 627,887 23% Office Bldgs. / Condos 528,450 19% Multi-Family 428,197 15% Hotels / Motels 352,166 13% Industrial / Warehouse 296,782 11% Other 235,379 9% Self-Storage 124,457 4% Nursing-Assisted Living 111,652 4% Restaurants and Gas Stations 64,317 2% $ 2,769,287 100% 4Q25 Highlights • The commercial real estate (CRE) portfolio is well-diversified across asset classes: - CRE + AD&C as a percentage of Bank total risk-based capital is estimated at 320% - AD&C as a percentage of Bank total risk-based capital is estimated at 39% • The CRE loan portfolio geographic footprint is spread across the West Virginia and greater DC / Maryland / Virginia (DMV) area with minimal office building exposure within Washington, D.C. • In line with our overall strategy, we are focused on commercial & industrial loan growth and greater portfolio granularity

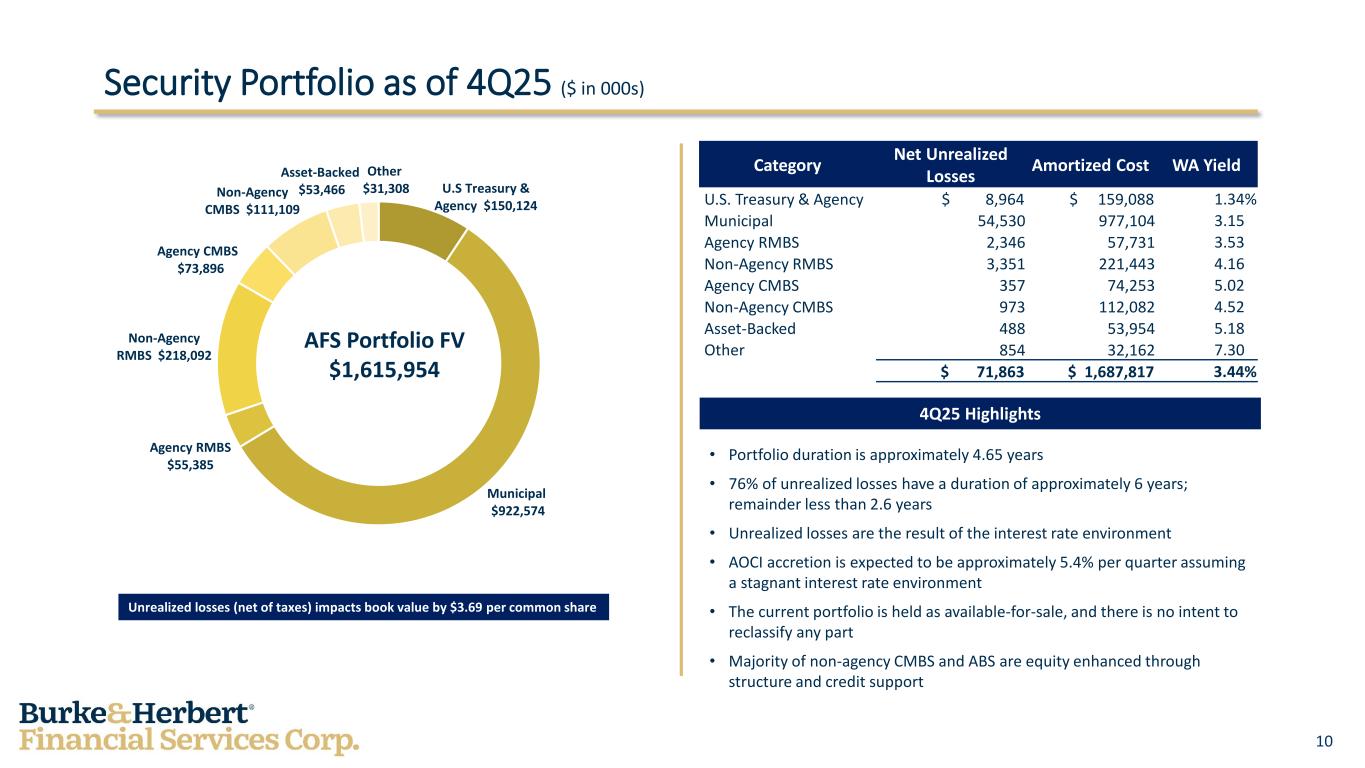

10 Security Portfolio as of 4Q25 ($ in 000s) U.S Treasury & Agency $150,124 Municipal $922,574 Agency RMBS $55,385 Non-Agency RMBS $218,092 Agency CMBS $73,896 Non-Agency CMBS $111,109 Asset-Backed $53,466 Other $31,308 AFS Portfolio FV $1,615,954 Unrealized losses (net of taxes) impacts book value by $3.69 per common share Category Net Unrealized Losses Amortized Cost WA Yield U.S. Treasury & Agency $ 8,964 $ 159,088 1.34% Municipal 54,530 977,104 3.15% Agency RMBS 2,346 57,731 3.53% Non-Agency RMBS 3,351 221,443 4.16% Agency CMBS 357 74,253 5.02% Non-Agency CMBS 973 112,082 4.52% Asset-Backed 488 53,954 5.18% Other 854 32,162 7.30% $ 71,863 $ 1,687,817 3.44% 4Q25 Highlights • Portfolio duration is approximately 4.65 years • 76% of unrealized losses have a duration of approximately 6 years; remainder less than 2.6 years • Unrealized losses are the result of the interest rate environment • AOCI accretion is expected to be approximately 5.4% per quarter assuming a stagnant interest rate environment • The current portfolio is held as available-for-sale, and there is no intent to reclassify any part • Majority of non-agency CMBS and ABS are equity enhanced through structure and credit support

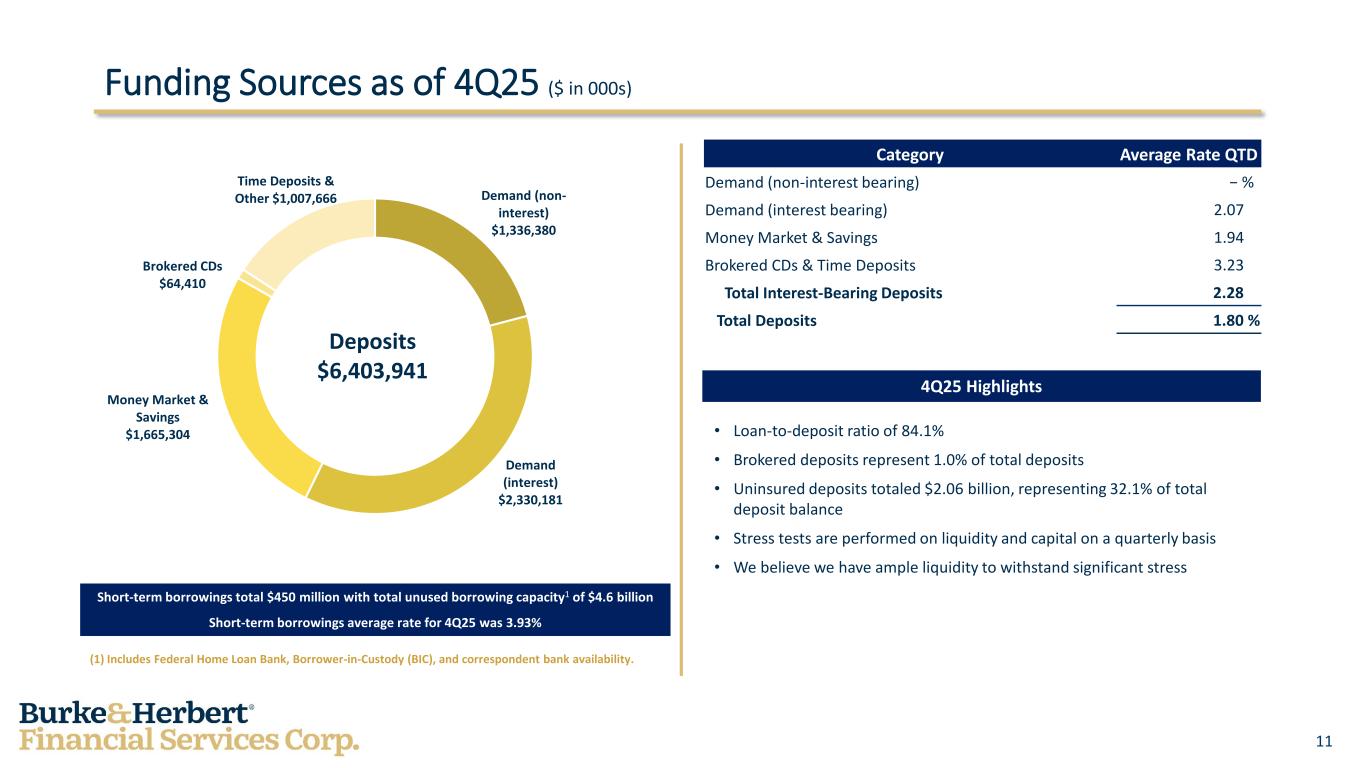

11 Funding Sources as of 4Q25 ($ in 000s) Demand (non- interest) $1,336,380 Demand (interest) $2,330,181 Money Market & Savings $1,665,304 Brokered CDs $64,410 Time Deposits & Other $1,007,666 Deposits $6,403,941 Short-term borrowings total $450 million with total unused borrowing capacity1 of $4.6 billion Short-term borrowings average rate for 4Q25 was 3.93% Category Average Rate QTD Demand (non-interest bearing) − % Demand (interest bearing) 2.07 % Money Market & Savings 1.94 % Brokered CDs & Time Deposits 3.23 % Total Interest-Bearing Deposits 2.28 % Total Deposits 1.80 % 4Q25 Highlights • Loan-to-deposit ratio of 84.1% • Brokered deposits represent 1.0% of total deposits • Uninsured deposits totaled $2.06 billion, representing 32.1% of total deposit balance • Stress tests are performed on liquidity and capital on a quarterly basis • We believe we have ample liquidity to withstand significant stress (1) Includes Federal Home Loan Bank, Borrower-in-Custody (BIC), and correspondent bank availability.

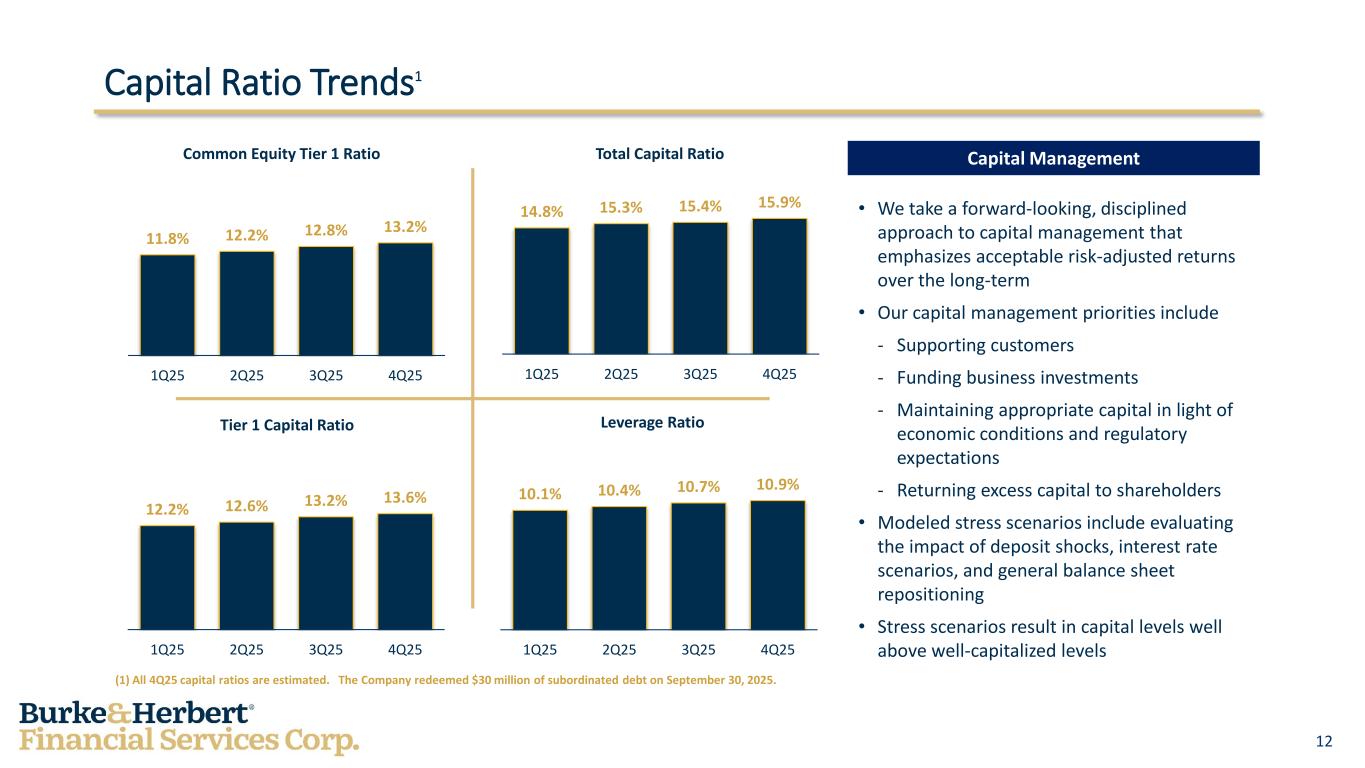

12 12.2% 12.6% 13.2% 13.6% 1Q25 2Q25 3Q25 4Q25 Tier 1 Capital Ratio Capital Ratio Trends1 11.8% 12.2% 12.8% 13.2% 1Q25 2Q25 3Q25 4Q25 Common Equity Tier 1 Ratio 14.8% 15.3% 15.4% 15.9% 1Q25 2Q25 3Q25 4Q25 Total Capital Ratio 10.1% 10.4% 10.7% 10.9% 1Q25 2Q25 3Q25 4Q25 Leverage Ratio Capital Management • We take a forward-looking, disciplined approach to capital management that emphasizes acceptable risk-adjusted returns over the long-term • Our capital management priorities include - Supporting customers - Funding business investments - Maintaining appropriate capital in light of economic conditions and regulatory expectations - Returning excess capital to shareholders • Modeled stress scenarios include evaluating the impact of deposit shocks, interest rate scenarios, and general balance sheet repositioning • Stress scenarios result in capital levels well above well-capitalized levels (1) All 4Q25 capital ratios are estimated. The Company redeemed $30 million of subordinated debt on September 30, 2025.

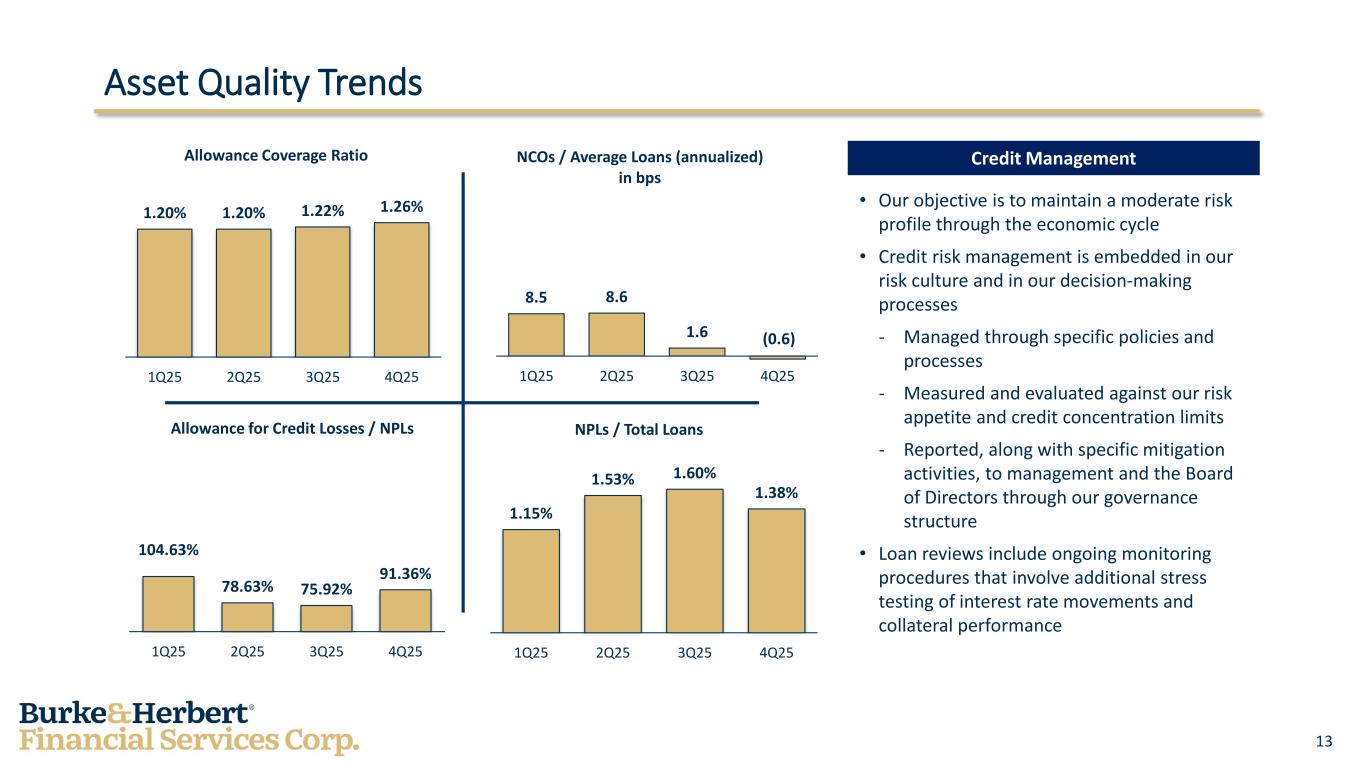

13 Asset Quality Trends 1.20% 1.20% 1.22% 1.26% 1Q25 2Q25 3Q25 4Q25 Allowance Coverage Ratio 8.5 8.6 1.6 (0.6) 1Q25 2Q25 3Q25 4Q25 NCOs / Average Loans (annualized) in bps 104.63% 78.63% 75.92% 91.36% 1Q25 2Q25 3Q25 4Q25 Allowance for Credit Losses / NPLs 1.15% 1.53% 1.60% 1.38% 1Q25 2Q25 3Q25 4Q25 NPLs / Total Loans Credit Management • Our objective is to maintain a moderate risk profile through the economic cycle • Credit risk management is embedded in our risk culture and in our decision-making processes - Managed through specific policies and processes - Measured and evaluated against our risk appetite and credit concentration limits - Reported, along with specific mitigation activities, to management and the Board of Directors through our governance structure • Loan reviews include ongoing monitoring procedures that involve additional stress testing of interest rate movements and collateral performance

14 Final Thoughts • Our business model is built on customer service and is designed to consistently deliver top quartile returns relative to our peers • Our approach is concentrated on growing and deepening relationships across our businesses that meet our risk/return measures • We are focused on our strategic priorities which are designed to enhance value over the long term - Being a trusted advisor - Growing fee revenue - Profitably expanding our markets • We take the long-view and maintain a moderate risk profile through the economic cycle

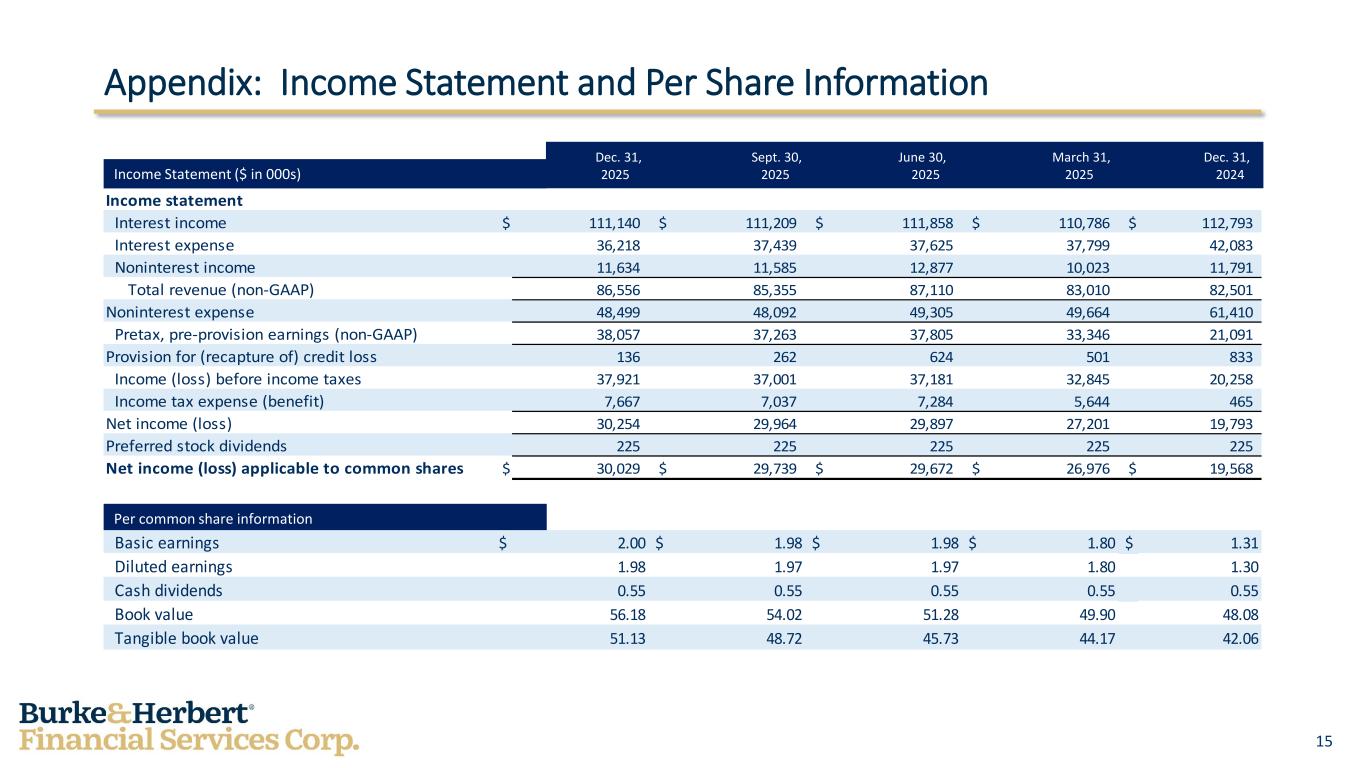

15 Appendix: Income Statement and Per Share Information Income Statement ($ in 000s) Dec. 31, Sept. 30, June 30, March 31, Dec. 31, 2025 2025 2025 2025 2024 Per common share information Income statement Interest income $ 111,140 $ 111,209 $ 111,858 $ 110,786 $ 112,793 Interest expense 36,218 37,439 37,625 37,799 42,083 Noninterest income 11,634 11,585 12,877 10,023 11,791 Total revenue (non-GAAP) 86,556 85,355 87,110 83,010 82,501 Noninterest expense 48,499 48,092 49,305 49,664 61,410 Pretax, pre-provision earnings (non-GAAP) 38,057 37,263 37,805 33,346 21,091 Provision for (recapture of) credit loss 136 262 624 501 833 Income (loss) before income taxes 37,921 37,001 37,181 32,845 20,258 Income tax expense (benefit) 7,667 7,037 7,284 5,644 465 Net income (loss) 30,254 29,964 29,897 27,201 19,793 Preferred stock dividends 225 225 225 225 225 Net income (loss) applicable to common shares $ 30,029 $ 29,739 $ 29,672 $ 26,976 $ 19,568 Basic earnings $ 2.00 $ 1.98 $ 1.98 $ 1.80 $ 1.31 Diluted earnings 1.98 1.97 1.97 1.80 1.30 Cash dividends 0.55 0.55 0.55 0.55 0.55 Book value 56.18 54.02 51.28 49.90 48.08 Tangible book value 51.13 48.72 45.73 44.17 42.06

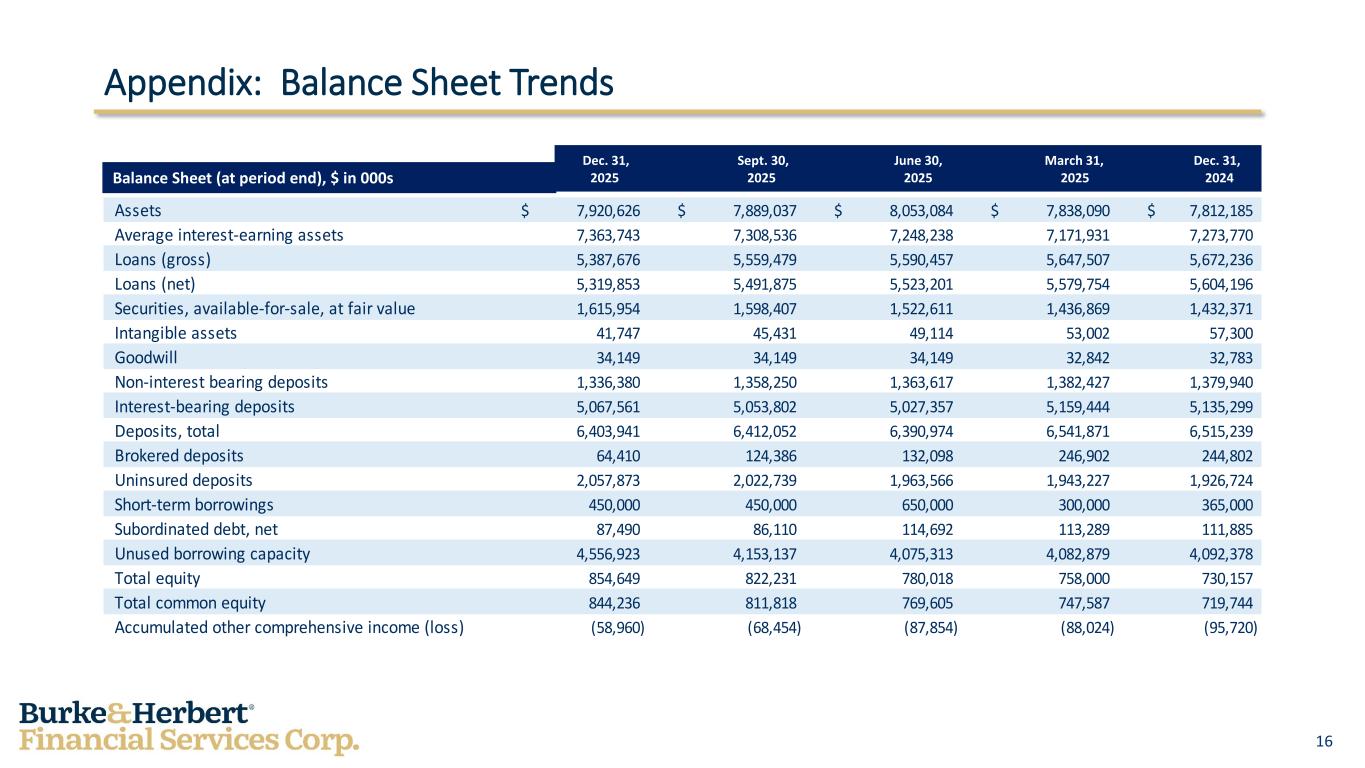

16 Appendix: Balance Sheet Trends Balance Sheet (at period end), $ in 000s Dec. 31, Sept. 30, June 30, March 31, Dec. 31, 2025 2025 2025 2025 2024 Assets 7,920,626$ 7,889,037$ 8,053,084$ 7,838,090$ 7,812,185$ Average interest-earning assets 7,363,743 7,308,536 7,248,238 7,171,931 7,273,770 Loans (gross) 5,387,676 5,559,479 5,590,457 5,647,507 5,672,236 Loans (net) 5,319,853 5,491,875 5,523,201 5,579,754 5,604,196 Securities, available-for-sale, at fair value 1,615,954 1,598,407 1,522,611 1,436,869 1,432,371 Intangible assets 41,747 45,431 49,114 53,002 57,300 Goodwill 34,149 34,149 34,149 32,842 32,783 Non-interest bearing deposits 1,336,380 1,358,250 1,363,617 1,382,427 1,379,940 Interest-bearing deposits 5,067,561 5,053,802 5,027,357 5,159,444 5,135,299 Deposits, total 6,403,941 6,412,052 6,390,974 6,541,871 6,515,239 Brokered deposits 64,410 124,386 132,098 246,902 244,802 Uninsured deposits 2,057,873 2,022,739 1,963,566 1,943,227 1,926,724 Short-term borrowings 450,000 450,000 650,000 300,000 365,000 Subordinated debt, net 87,490 86,110 114,692 113,289 111,885 Unused borrowing capacity 4,556,923 4,153,137 4,075,313 4,082,879 4,092,378 Total equity 854,649 822,231 780,018 758,000 730,157 Total common equity 844,236 811,818 769,605 747,587 719,744 Accumulated other comprehensive income (loss) (58,960) (68,454) (87,854) (88,024) (95,720)

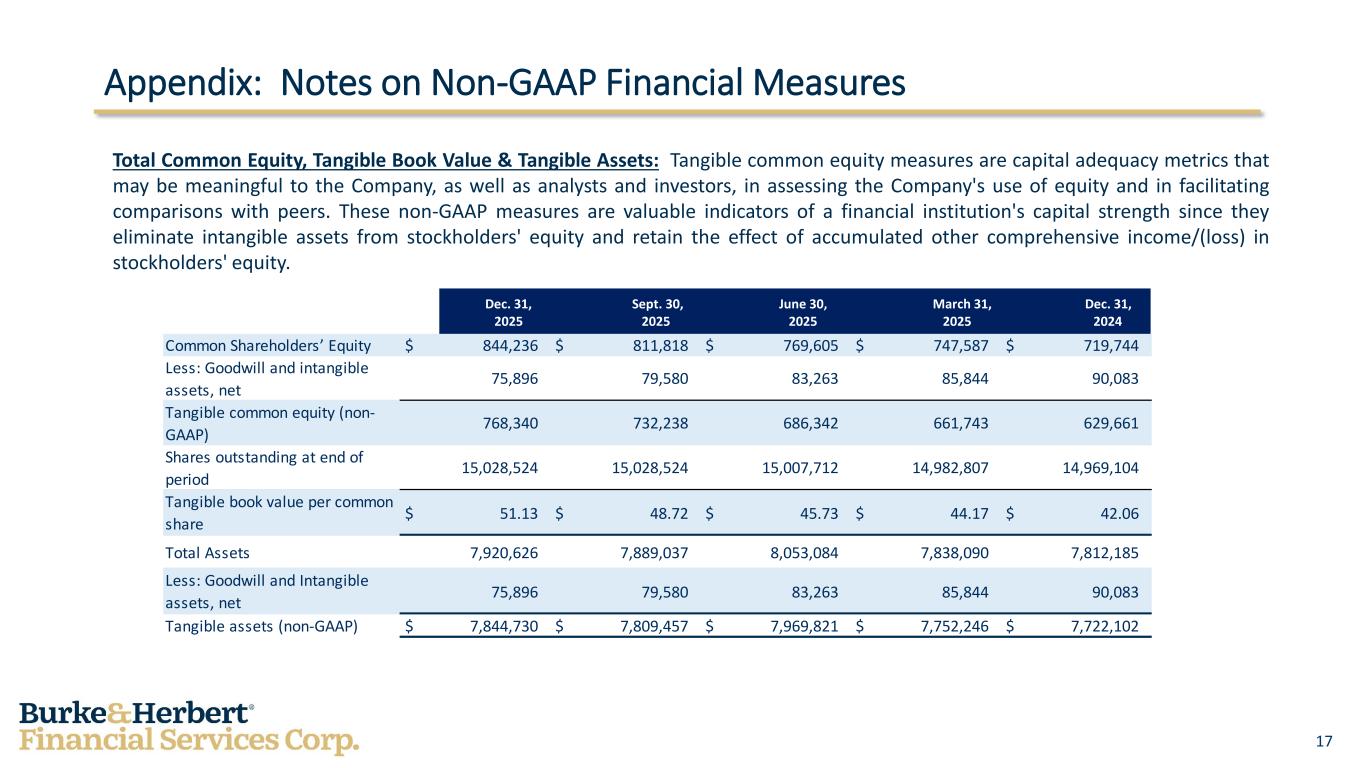

17 Appendix: Notes on Non-GAAP Financial Measures Total Common Equity, Tangible Book Value & Tangible Assets: Tangible common equity measures are capital adequacy metrics that may be meaningful to the Company, as well as analysts and investors, in assessing the Company's use of equity and in facilitating comparisons with peers. These non-GAAP measures are valuable indicators of a financial institution's capital strength since they eliminate intangible assets from stockholders' equity and retain the effect of accumulated other comprehensive income/(loss) in stockholders' equity. Dec. 31, Sept. 30, June 30, March 31, Dec. 31, 2025 2025 2025 2025 2024 Common Shareholders’ Equity $ 844,236 $ 811,818 $ 769,605 $ 747,587 $ 719,744 Less: Goodwill and intangible assets, net 75,896 79,580 83,263 85,844 90,083 Tangible common equity (non- GAAP) 768,340 732,238 686,342 661,743 629,661 Shares outstanding at end of period 15,028,524 15,028,524 15,007,712 14,982,807 14,969,104 Tangible book value per common share $ 51.13 $ 48.72 $ 45.73 $ 44.17 $ 42.06 Total Assets 7,920,626 7,889,037 8,053,084 7,838,090 7,812,185 Less: Goodwill and Intangible assets, net 75,896 79,580 83,263 85,844 90,083 Tangible assets (non-GAAP) $ 7,844,730 $ 7,809,457 $ 7,969,821 $ 7,752,246 $ 7,722,102

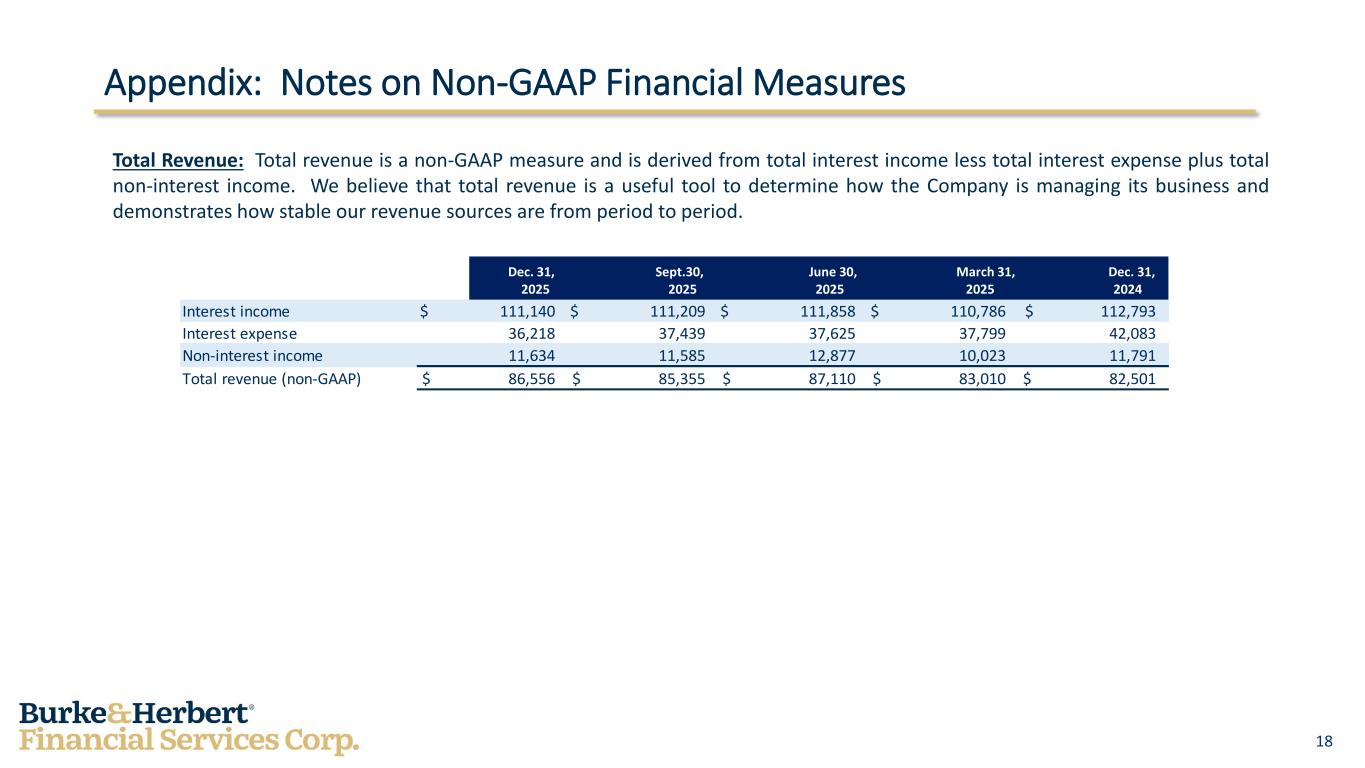

18 Appendix: Notes on Non-GAAP Financial Measures Total Revenue: Total revenue is a non-GAAP measure and is derived from total interest income less total interest expense plus total non-interest income. We believe that total revenue is a useful tool to determine how the Company is managing its business and demonstrates how stable our revenue sources are from period to period. Dec. 31, Sept.30, June 30, March 31, Dec. 31, 2025 2025 2025 2025 2024 Interest income $ 111,140 $ 111,209 $ 111,858 $ 110,786 $ 112,793 Interest expense 36,218 37,439 37,625 37,799 42,083 Non-interest income 11,634 11,585 12,877 10,023 11,791 Total revenue (non-GAAP) $ 86,556 $ 85,355 $ 87,110 $ 83,010 $ 82,501

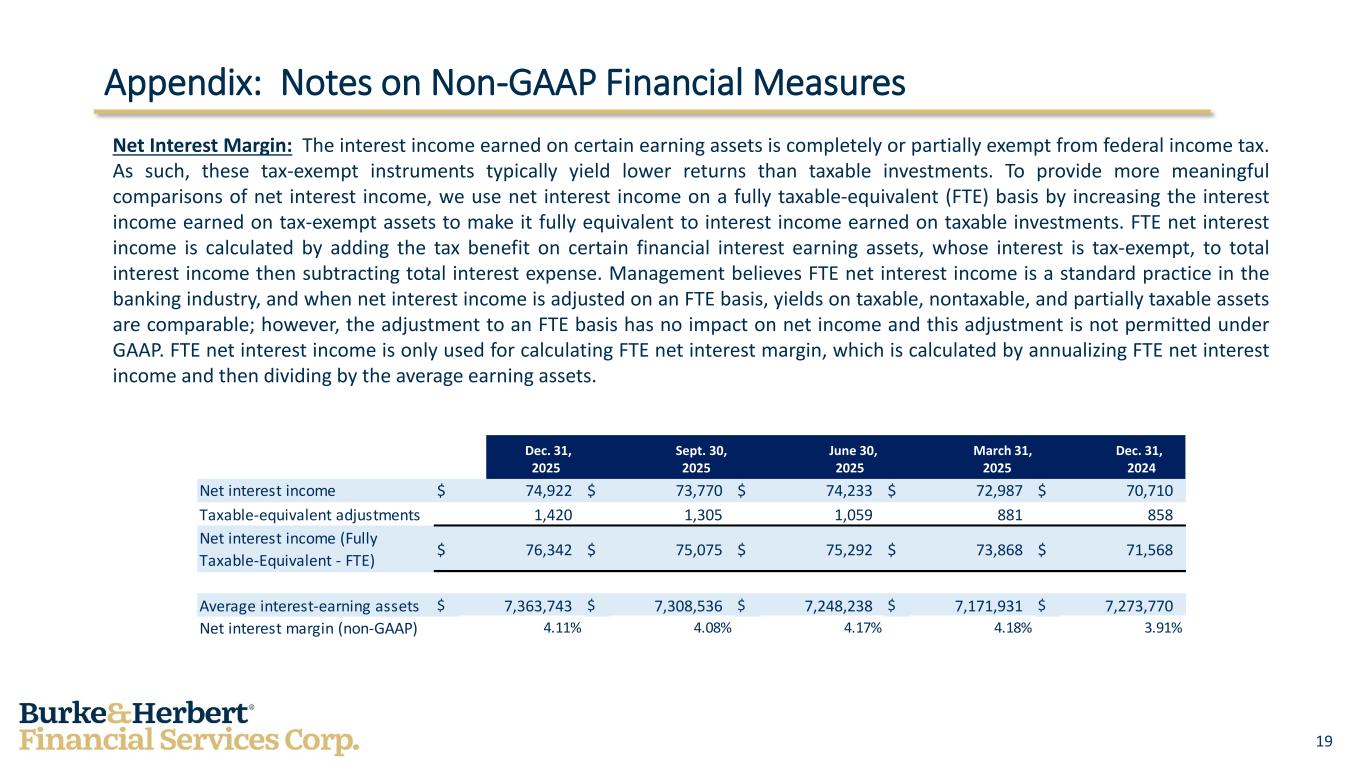

19 Appendix: Notes on Non-GAAP Financial Measures Net Interest Margin: The interest income earned on certain earning assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than taxable investments. To provide more meaningful comparisons of net interest income, we use net interest income on a fully taxable-equivalent (FTE) basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. FTE net interest income is calculated by adding the tax benefit on certain financial interest earning assets, whose interest is tax-exempt, to total interest income then subtracting total interest expense. Management believes FTE net interest income is a standard practice in the banking industry, and when net interest income is adjusted on an FTE basis, yields on taxable, nontaxable, and partially taxable assets are comparable; however, the adjustment to an FTE basis has no impact on net income and this adjustment is not permitted under GAAP. FTE net interest income is only used for calculating FTE net interest margin, which is calculated by annualizing FTE net interest income and then dividing by the average earning assets. Dec. 31, Sept. 30, June 30, March 31, Dec. 31, 2025 2025 2025 2025 2024 Net interest income $ 74,922 $ 73,770 $ 74,233 $ 72,987 $ 70,710 Taxable-equivalent adjustments 1,420 1,305 1,059 881 858 Net interest income (Fully Taxable-Equivalent - FTE) $ 76,342 $ 75,075 $ 75,292 $ 73,868 $ 71,568 Average interest-earning assets $ 7,363,743 $ 7,308,536 $ 7,248,238 $ 7,171,931 $ 7,273,770 Net interest margin (non-GAAP) 4.11% 4.08% 4.17% 4.18% 3.91%