| December 17, 2025 River Bend Data Center Campus Transaction |

| Disclaimer Cautionary Note Regarding Forward-Looking Information This presentation includes “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities laws and United States securities laws, respectively (collectively, “forward looking information”). All information, other than statements of historical facts, included in this presentation that address activities, events or developments Hut 8 Corp. (“Hut 8” or the “Company”) expects or anticipates will or may occur in the future, including statements relating to the Company’s AI data center lease at River Bend, the total lease contract value over the lease term with and without extensions, the Company’s plan to implement and institutional-grade execution model designed to de-risk the project, expected NOI contribution of the lease, the potential extension of the lease term for up to three additional terms of five years each, Google’s commitment to backstop of the lease payments and related pass-through obligations under the lease, the anticipated delivery timeline for the site, the Company’s anticipated financing plan for the project, the potential execution of an additional Operations Services Agreement backed by an additional Google backstop of payment obligations, the Company’s potential expansion plans for the River Bend site, the Company’s development pipeline, and the Company’s future business strategy, competitive strengths, expansion, and growth of the business and operations more generally, and other such matters is forward-looking information. Forward-looking information is often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “allow”, “believe”, “estimate”, “expect”, “predict”, “can”, “might”, “potential”, “predict”, “is designed to”, “likely,” or similar expressions. In addition, any statements in this presentation that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts, but instead represent management’s expectations, estimates, and projections regarding future events based on certain material factors and assumptions at the time the statement was made. While considered reasonable by Hut 8 as of the date of this presentation, such statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance, or achievements to be materially different from those expressed or implied by such forward-looking information, including, but not limited to, risks relating to the construction of new data centers, including cost overruns, delays, supply chain issues, permitting or regulatory hurdles, unexpected technical challenges, and dependency on contractors; risks relating to the financing of new data centers, including the potential dilutive impact of equity issuances (if any), access to capital markets, timing and cost of financing, and market conditions such as increases in interest rates, declining equity valuations, volatility in credit markets, or tightening lending standards; risks impacting our ability to expand the power capacity at the River Bend campus, such as limitations of transmission and/or generation resources; failure of critical systems; geopolitical, social, economic, and other events and circumstances; competition from current and future competitors; risks related to power requirements; cybersecurity threats and breaches; hazards and operational risks; changes in leasing arrangements; Internet-related disruptions; dependence on key personnel; having a limited operating history; attracting and retaining customers; entering into new offerings or lines of business; price fluctuations and rapidly changing technologies; predicting facility requirements; strategic alliances or joint ventures; operating and expanding internationally; failing to grow hashrate; purchasing miners; relying on third-party mining pool service providers; uncertainty in the development and acceptance of the Bitcoin network; Bitcoin halving events; competition from other methods of investing in Bitcoin; concentration of Bitcoin holdings; hedging transactions; potential liquidity constraints; legal, regulatory, governmental, and technological uncertainties; physical risks related to climate change; involvement in legal proceedings; trading volatility; and other risks described from time to time in Company’s filings with the U.S. Securities and Exchange Commission. In particular, see the Company’s recent and upcoming annual and quarterly reports and other continuous disclosure documents, which are available under the Company’s EDGAR profile at sec.gov and SEDAR+ profile at sedarplus.ca. These factors are not intended to represent a complete list of the factors that could affect Hut 8; however, these factors should be considered carefully. There can be no assurance that such estimates and assumptions will prove to be correct. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described in this presentation as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected, projected or targeted and such forward-looking statements included in this presentation should not be unduly relied upon. The impact of any one assumption, risk, uncertainty, or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent and Hut 8’s future decisions and actions will depend on management’s assessment of all information at the relevant time. The forward-looking statements contained in this presentation are made as of the date of this presentation, and Hut 8 expressly disclaims any obligation to update or alter statements containing any forward-looking information, or the factors or assumptions underlying them, whether as a result of new information, future events or otherwise, except as required by law. Except where otherwise indicated herein, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date of preparation. No Offer or Solicitation This presentation is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”) or in a transaction exempt from the registration requirements of the Securities Act. Non-GAAP Financial Measures This presentation includes a non-GAAP financial measure, expected net operating income (NOI) contribution, which the Company defines as expected lease revenue for a particular lease less any non-reimbursable operating expenses attributable to the leased property. The Company’s management team uses expected NOI contribution to measure the expected operating performance of a particular lease. Operating income is the GAAP measure most directly comparable to expected NOI contribution. In evaluating expected NOI contribution, you should be aware that in the future the Company may incur non-reimbursable lease operating expenses that are not currently known. The Company’s presentation of expected NOI contribution should not be construed as an inference that its future results will be unaffected by unusual or non-recurring items. Expected NOI contribution has important limitations as an analytical tool and you should not consider expected NOI contribution in isolation or as a substitute for analysis of results as reported under GAAP. For example, expected NOI contribution excludes the impact of selling, general and administrative expenses and depreciation and amortization, which have real economic effect and could materially impact the Company’s consolidated financial results. Other companies, including Real Estate Investment Trusts, may calculate expected NOI contribution differently than the Company does and, accordingly, the Company’s expected NOI contribution may not be comparable to similar measures published by such companies. No reconciliation of expected NOI contribution is included in this press release because the Company is unable to quantify certain amounts that would be required to be included in operating income without unreasonable efforts as such quantification would imply a degree of precision that would be confusing or misleading to investors. Third Party Information This presentation includes market and industry data which was obtained from various publicly available sources and other sources believed by Hut 8 be true. Although Hut 8 believes it to be reliable, it has not independently verified any of the data from third party sources referred to in this presentation or analyzed or verified the underlying reports relied upon or referred to by such sources, or ascertained the underlying assumptions relied upon by such sources. Hut 8 does not make any representation as to the accuracy of such information. Notice Regarding Logos and Trademarks All logos, trademarks, and brand names used throughout this presentation belong to their respective owners. Hut 8 |

| Hut 8 River Bend Transaction |

| Hut 8 4 River Bend data center: Preliminary rendering |

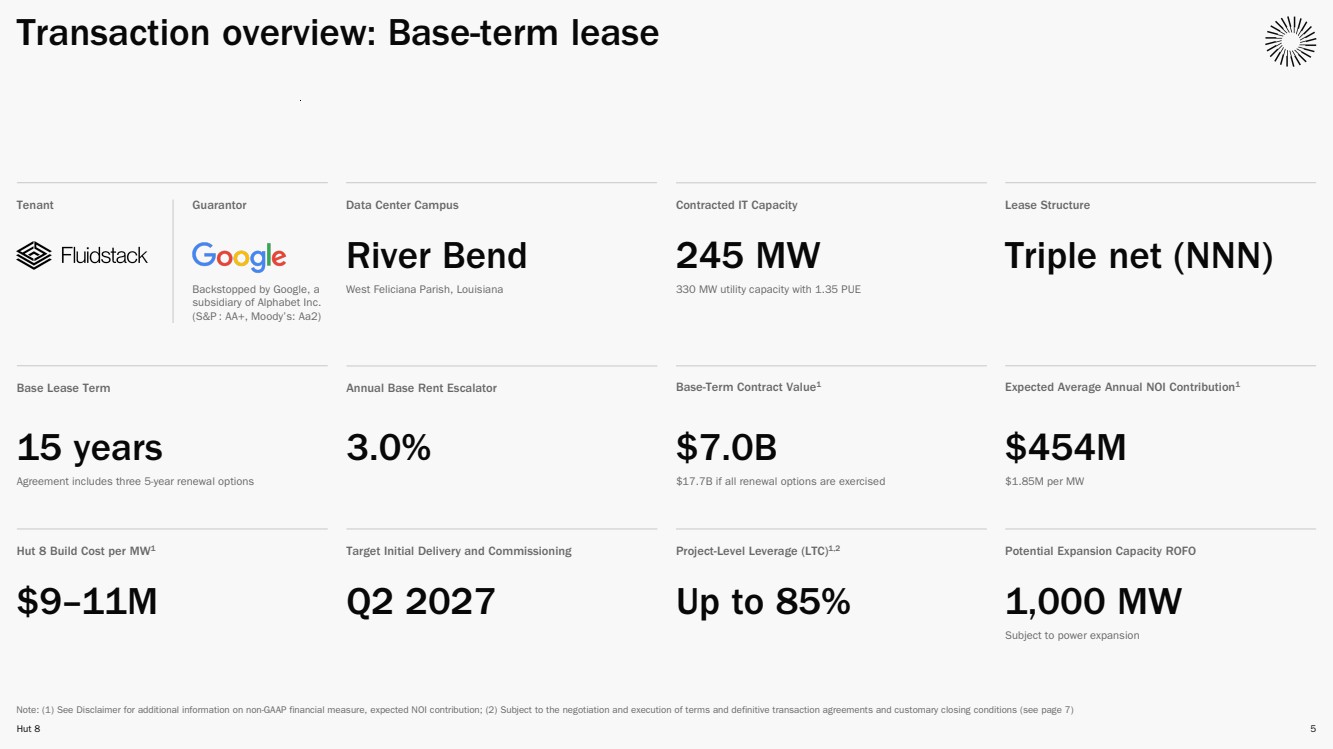

| Hut 8 5 Transaction overview: Base-term lease Note: (1) See Disclaimer for additional information on non-GAAP financial measure, expected NOI contribution; (2) Subject to the negotiation and execution of terms and definitive transaction agreements and customary closing conditions (see page 7) Data Center Campus River Bend West Feliciana Parish, Louisiana Lease Structure Triple net (NNN) Annual Base Rent Escalator 3.0% Base-Term Contract Value1 Expected Average Annual NOI Contribution1 Q2 2027 Target Initial Delivery and Commissioning Project-Level Leverage (LTC)1,2 Up to 85% Tenant Guarantor Base Lease Term 15 years Agreement includes three 5-year renewal options 245 MW 330 MW utility capacity with 1.35 PUE Contracted IT Capacity Hut 8 Build Cost per MW1 Potential Expansion Capacity ROFO Backstopped by Google, a subsidiary of Alphabet Inc. (S&P : AA+, Moody’s: Aa2) $9–11M $454M $1.85M per MW $7.0B $17.7B if all renewal options are exercised 1,000 MW Subject to power expansion |

| Hut 8 6 Transaction overview: Upside economics Note: (1) See Disclaimer for additional information on non-GAAP financial measure, expected NOI contribution Upside potential is driven by embedded renewal options and a ROFO for future expansion phases totaling up to 1,000 MW Base Case Base-Term Lease (15 Years) Upside Case Extended Lease (30 Years) Expansion Case Expansion Capacity ROFO Description 15-year triple-net colocation lease with Fluidstack, backstopped by Google Assumes Fluidstack exercises three embedded 5-year renewal options under the same financial and term structure Right of first offer (ROFO) for up to 1,000 MW of additional IT capacity, subject to power expansion at the site Status Executed Embedded contractual option Embedded contractual option Total Contracted IT Capacity 245 MW 245 MW Up to 1,000 MW Term 15 years 30 years (cumulative) - Expected NOI Contribution1 $6.9B $17.5B (cumulative) - Implied Average Annual Expected NOI1 $454M $580M - |

| Hut 8 7 NYSE: GOOGL | MKT CAP1: $3,724B | S&P: AA+ | MOODY’S: Guarantor, a subsidiary of Alphabet Inc., to deliver a financial backstop that covers the lease payments and related pass-through obligations NYSE: ETR | MKT CAP1: $42B | S&P: BBB+ | MOODY’S: Baa2 Delivers scalable power supply for the site: 330 MW of initial utility capacity supporting 245 MW of IT capacity, with the potential to scale by up to an additional 1,000 MW of IT capacity NYSE: JPM | MKT CAP1: $861B | S&P: A | MOODY’S: A1 Expected to serve as lead left loan underwriter and active loan structurer for project-level financing, expected to provide, together with Goldman Sachs & Co. LLC, up to 85% LTC2 NYSE: VRT | MKT CAP1: $60B | S&P: BB+ | MOODY’S: Ba1 Co-developer of the custom infrastructure solution designed to enable rapid buildout of AI infrastructure; dedicated manufacturing and supply chain network NYSE: GS | MKT CAP1: $278B | S&P: BBB+ | MOODY’S: A2 Expected to serve as a loan underwriter for project-level financing, expected to provide, together with J.P. Morgan, up to 85% LTC2 NYSE: J | MKT CAP1: $16B | S&P: BBB- | MOODY’S: Baa2 Global engineering, procurement, and construction management (EPCM) and program management partner enables disciplined, on-schedule project construction and delivery Project delivery driven by a scalable, institutional-grade execution model A Tier I consortium mitigates critical risk vectors across the project lifecycle Note: (1) As of December 16, 2025; (2) Subject to the negotiation and execution of terms and definitive transaction agreements and customary closing conditions Aa2 |

| Hut 8 8 SITE & LAND CONTROL UTILITY POWER INFRASTRUCTURE SITE POWER INFRASTRUCTURE FIBER & NETWORK CONNECTIVITY Large, controlled land position with secured water access enables significant expansion Power-dense utility region with generation and transmission infrastructure capable of supporting gigawatt-scale load Near-term power availability enables initial lease with a structured path up to 1.3 GW of utility capacity Resilient, low-latency national fiber connectivity suitable for mission-critical HPC workloads Location West Feliciana Parish, LA RTO/ISO Midcontinent Independent System Operator (MISO) Initial Utility Capacity 330 MW available July 1, 2026 Campus Access Up to five diverse campus entrances Owned Acreage 627 acres; potential expansion to 2,988 acres 35 acres added to parcel in Q4 2025 Local Power ~3.7 GW across four nearby generation facilities Expansion Utility Capacity Potential to scale to up to 1,000 MW Performance & Latency 10–70 ms RTD (Round-Trip Delay) Water Riparian rights; adjacent to Mississippi River Transmission Entergy Louisiana Transmission Infrastructure Upgraded line capacity of ~1,045 MVA Geographic Reach Connection to East and West Coast hubs River Bend data center campus overview Strategically located site with the potential to support more than 1 GW of utility capacity for HPC computing infrastructure WIP== PHASE 1 OWNED (592 ACRES) PHASE 2 OWNED (35 ACRES) PHASE 3 UNDER OPTION (2,361 ACRES) 230 kV 500 kV 69 kV T-LINE TAP RIVER BEND NUCLEAR 1,035.9 MW BIG CAJUN II 1,902.9 MW VENTRESS SOLAR 300 MW BIG CAJUN I 492.8 MW RIVER BEND RIVER BEND SWITCHYARD & SUBSTATION LOS ANGELES SAN FRANCISCO SACRAMENTO RENO SAN JOSE FRESNO SALT LAKE CITY DENVER AMARILLO FORTH WORTH DALLAS JACKSON PENSACOLA TALLAHASSEE JACKSONVILLE SAVANNAH CHARLESTON WILMINGTON RICHMOND ATLANTA NASHVILLE LOUISVILLE INDIANAPOLIS CHICAGO RIVER BEND CLEVELAND PITTSBURGH IAD |

| Hut 8 9 Rigorous, Power-First Site Origination and Development Deep, Proactive Stakeholder Engagement Patient, Disciplined Commercialization Innovation-Driven, Institutional-Grade Execution We applied a systematic approach to identify the potential of the Louisiana market, later validated by Meta’s investment, and secured a prime site through deep grid and generation analysis We engaged proactively with the Governor’s Office, Louisiana Economic Development (LED), and West Feliciana Parish to align incentives and advance community and economic impact We maintained financial discipline to secure a counterparty and transaction that optimizes long-term economics and shareholder value creation We co-developed an industrialized critical infrastructure platform engineered for rapid, capital-efficient delivery Working with Entergy Louisiana, we assumed key interconnection and development functions typically managed by the utility to materially accelerate originally quoted power delivery We continued to build our partnership with Entergy Louisiana to secure scalable, long-term capacity for the campus, demonstrating our ability to operate at a utility level We secured a long-term lease with a high-quality tenant, validating our ability to deliver mission-critical infrastructure at scale to blue-chip counterparties We structured a scalable, institutional-grade execution model that integrates Tier I counterparties across the project lifecycle to address key execution risks River Bend exemplifies Hut 8’s power-first development model Our approach is designed to unlock long-term value through power-first, innovation-driven execution |

| Hut 8 10 DIMENSION RIVER BEND TRANSACTION EXPECTED IMPACT COUNTERPARTIES Tenant Profile Fluidstack High-quality tenant at the forefront of AI research & development Lease Structure Triple net (NNN) Superior return profile relative to modified-gross structures Lease Term & Renewal 15 years + three 5-year renewal options Long-duration lease with committed payments Pricing Structure Fixed base rent with 3% annual escalator Inflation protection and predictable long-term yield Counterparty Financial Support Financial backstop Secure, predictable cash flows supported by creditworthy backing Equity-Linked Consideration No equity or warrants issued No equity dilution required to secure transaction N/A Project-level Leverage Up to 85% LTC1 non-recourse financing High LTC reduces equity requirements and enhances capital efficiency Cost of Debt SOFR + 2251 basis points Efficient cost of capital consistent with investment-grade offtake Development Contract Model Design-build guaranteed maximum price EPCM contract Insight into predictable development economics Scalability & Expansion ROFO for up to 1,000 MW of additional IT capacity Scalable growth with reduced execution risk River Bend reflects a focus on patient, disciplined commercialization Holistic, multi-dimensional framework for structuring high-value transactions and mitigating execution risk Note: (1) Subject to the negotiation and execution of definitive transaction agreements and customary closing conditions |

| Hut 8 11 Clearing and rough grading of data center footprint Delivery of Entergy 230 kV breakers Construction of Entergy permanent access road Delivery of T-line poles Critical sitework at River Bend is underway Construction of switchyard Preparation for installation of transmission line conductors Grading and preparation for substation construction Onsite coordination with Entergy in preparation for data center buildout |

| Hut 8 Development Platform |

| Hut 8 13 Description Commercialized capacity Sites where Hut 8 has executed a definitive offtake agreement and commenced construction activities Sites where Hut 8 is actively investing in development and commercialization by executing definitive land and/or power agreements, advancing site design and infrastructure buildout, and engaging with prospective customers Sites where Hut 8 has secured a clear path to ownership through either: (1) an exclusivity agreement that prevents the sale of designated power and/or land capacity to another party or (2) a tendered interconnection agreement, confirming a viable path to securing power and infrastructure for deployment Sites identified for large-load use cases. At this stage, Hut 8 assesses site potential by engaging with utilities, landowners, and other stakeholders to evaluate critical factors, including power availability, infrastructure readiness, fiber connectivity, and overall commercial viability Hut 8’s development platform consists of Energy Capacity Under Management and Development Pipeline capacity Hut 8’s development platform spans nearly 10 GW Includes 1,020 MW1 of Energy Capacity Under Management and a Development Pipeline of 8,500 MW2 Note: (1) Includes 310 MW of power generation assets Hut 8 expects to sell to TransAlta in early Q1 2026, subject to customary closing conditions including regulatory approval; (2) Excludes 1,000 MW of potential expansion capacity at River Bend, for which Fluidstack holds a ROFO under the River Bend lease Energy Capacity Under Management Energy Capacity Under Construction Energy Capacity Under Development Energy Capacity Under Exclusivity Energy Capacity Under Diligence Development Platform 1,020 MW1 330 MW 1,230 MW 1,255 MW2 5,685 MW 9,520 MW DEVELOPMENT PIPELINE In conjunction with the River Bend transaction, Hut 8 has introduced a new category to its development framework: Energy Capacity Under Construction. The River Bend transaction advances 330 MW of utility capacity from River Bend from Energy Capacity Under Development to Energy Capacity Under Construction Hut 8 Development Platform as of December 17, 2025 |

| Hut 8 14 Following the River Bend transaction, Hut 8 continues to advance 1,230 MW of remaining Capacity Under Development across three sites Site 01 River Bend 330 MW Louisiana (MISO) Site 02 1,000 MW Texas (ERCOT) Site 03 180 MW Texas (ERCOT) Site 04 50 MW Illinois (PJM) Site 04 50 MW Site 03 180 MW Site 01. River Bend 330 MW Alpha 50 MW Vega 205 MW King Mountain 280 MW Salt Creek 63 MW Site 02 1,000 MW Drumheller1 42 MW Medicine Hat 67 MW Vancouver II 0.5 MW Vancouver I 0.3 MW Vaughan 0.6 MW Kelowna 1.1 MW Mississauga 0.9 MW Iroquois Falls2 120 MW Kingston2 120 MW North Bay2 35 MW Kapuskasing2 35 MW The River Bend transaction advances 330 MW from development to construction Note: As of December 17, 2025; (1) Site currently shut down; (2) One of four sites comprising the 310 MW portfolio of power generation assets Hut 8 expects to sell to TransAlta in early Q1 2026, subject to customary closing conditions including regulatory approval |

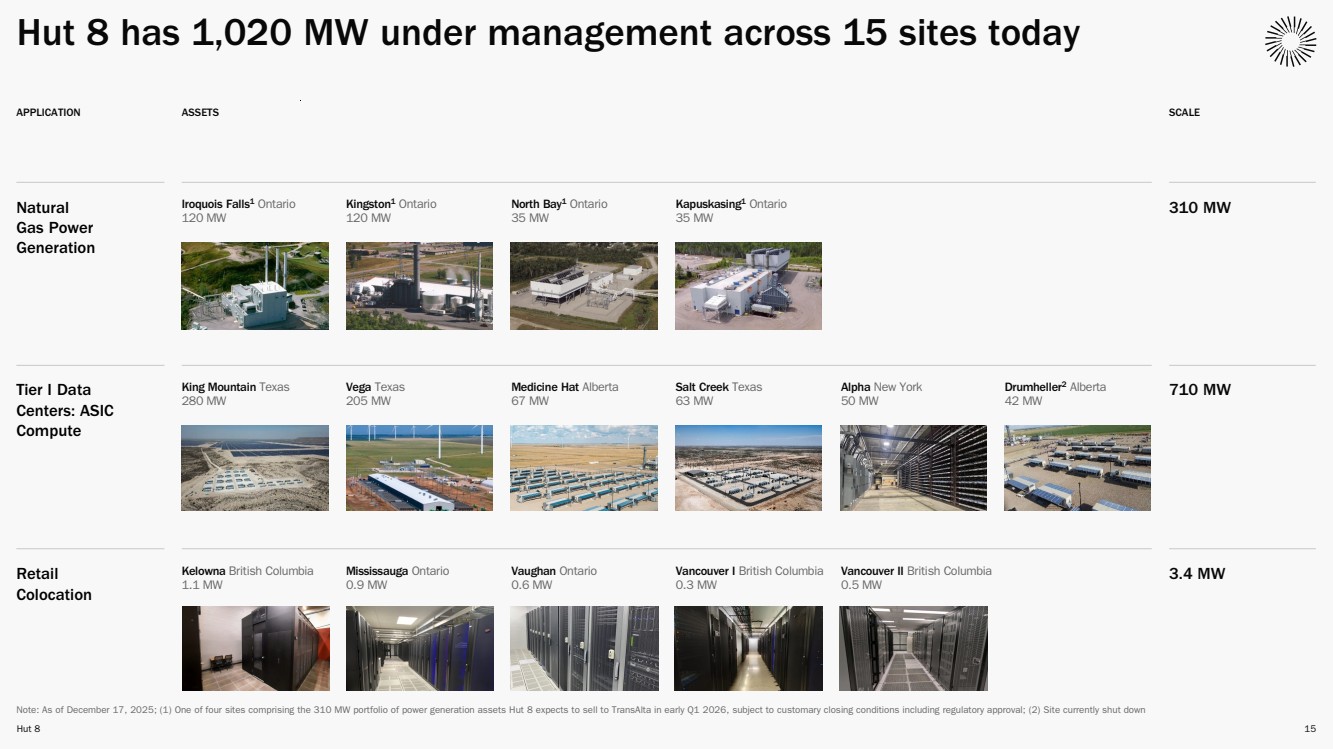

| Hut 8 15 Hut 8 has 1,020 MW under management across 15 sites today APPLICATION ASSETS SCALE Natural Gas Power Generation Iroquois Falls1 Ontario 120 MW Kingston1 Ontario 120 MW North Bay1 Ontario 35 MW Kapuskasing1 Ontario 35 MW 310 MW Tier I Data Centers: ASIC Compute King Mountain Texas 280 MW Vega Texas 205 MW Medicine Hat Alberta 67 MW Salt Creek Texas 63 MW Alpha New York 50 MW Drumheller2 Alberta 42 MW 710 MW Retail Colocation Kelowna British Columbia 1.1 MW Mississauga Ontario 0.9 MW Vaughan Ontario 0.6 MW Vancouver I British Columbia 0.3 MW Vancouver II British Columbia 0.5 MW 3.4 MW Note: As of December 17, 2025; (1) One of four sites comprising the 310 MW portfolio of power generation assets Hut 8 expects to sell to TransAlta in early Q1 2026, subject to customary closing conditions including regulatory approval; (2) Site currently shut down |

| Investor Relations Public Relations ir@hut8.com media@hut8.com |