UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission File Number: 001-41815

AngloGold Ashanti plc

(Translation of registrant’s name into English)

Third Floor, Hobhouse Court, Suffolk Street

London SW1Y 4HH

United Kingdom

6363 S. Fiddlers Green Circle, Suite 1000

Greenwood Village, CO 80111

United States of America

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F

or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Enclosure: AngloGold Ashanti Earnings Release for the Three Months and Nine Months Ended

30 September 2025

Q3 2025 EARNINGS RELEASE | 2 |  | |||

AngloGold Ashanti posts strong Q3 2025 YoY: • Gold production +17% • Total cash costs* flat in real terms • Adjusted EBITDA* +109% to $1.6bn • Free cash flow* +141% to $920m • Adjusted net cash* of $450m • Q3 interim dividend of $460m, or 91cps • Total dividends declared for 9 months YTD of $927m, or 183.5cps |

London, Denver, Johannesburg, 11 November 2025 –

AngloGold Ashanti plc’s(2) (“AngloGold Ashanti”, “AGA”, the

“Company” or the “Group”) third quarter free cash flow* rose

141% year-on-year to a record $920m as continued cost

discipline helped capture the benefits of a higher gold price.

A quarterly dividend of $460m was declared, taking

dividends declared this year to $927m.

Annual guidance for 2025 was reaffirmed.

Group(1)(2)(3) gold production rose 17% in Q3 2025 compared

to Q3 2024. Strong contributions were made by Obuasi

(Ghana), Geita (Tanzania), Cuiabá (Brazil), Kibali (DRC) and

the addition of Sukari(2) (Egypt) to our portfolio. The average

gold price received per ounce*(6) increased to $3,490/oz in

Q3 2025, from $2,486/oz in Q3 2024.

“This is another record quarter for cash generation and

another healthy dividend declaration,” said CEO Alberto

Calderon. “Cash costs again stayed flat in real terms, which

means we can capture these stronger margins and show

capital discipline by passing the benefit on to shareholders.”

A 40% increase in the average gold price received per

ounce*(6) in Q3 2025 compared to Q3 2024 translated into a

94% rise in cash generated from operations, reflecting

strong price pass-through and cost discipline.

Balance sheet strengthened by earnings and cash

flow

Free cash flow*(5) rose to $920m in Q3 2025, from $381m in

Q3 2024. AngloGold Ashanti has continued to strengthen its

balance sheet, moving from an Adjusted net debt* position

into an Adjusted net cash* position of $450m at 30

September 2025. The Group ended Q3 2025 with liquidity of

$3.9bn, including $2.5bn in cash and cash equivalents.

Adjusted EBITDA* increased 109% year-on-year to $1.6bn

in Q3 2025, from $746m in Q3 2024. Headline earnings(4)

rose to $672m, or $1.32 per share, in Q3 2025, compared to

$236m, or $0.56 per share, in Q3 2024 — an increase of

185% and 136% year-on-year, respectively. Net cash flow

from operations rose 134% to $1.4bn in Q3 2025, from

$606m in Q3 2024, boosting free cash flow* for the quarter.

Dividend demonstrates confidence, strong cash

flow

An interim dividend of 91 US cents per share was declared

for Q3 2025, which includes the minimum quarterly dividend

of $63m or 12.5 US cents, with the balance reflecting the

decision to pay half of free cash flow* generated for the three

months ended 30 September 2025. While AngloGold

Ashanti’s dividend policy commits to this ‘true up’ payment to

50% of free cash flow* annually at year-end, the Board used

its discretion to make the payment at the quarter given the

strength of cash flows and its confidence in the outlook for

the balance of the year.

The Company maintained its strong safety performance, with

a Total Recordable Injury Frequency Rate (“TRIFR”) of 0.96

injuries per million hours worked in Q3 2025, well below

industry benchmarks.

Momentum continued at managed operations(1)

Gold production for the Group(1)(2)(3) increased by 17% year-

on-year to 768,000oz in Q3 2025, up from 657,000oz in Q3

2024. This growth reflects the contribution from Sukari and

improved performances at key assets, including Obuasi

(+30%), Kibali (+21%), Geita (+6%), and Cuiabá (+6%).

Managed operations(1) saw gold production up 16% year-on-

year to 682,000oz in Q3 2025, compared to 586,000oz in Q3

2024. The increase, driven by Sukari’s inclusion and the

continued ramp-up at Obuasi, was partially offset by lower

output from Australia and Siguiri. Non-managed joint

ventures(1), namely Kibali, recorded a year-on-year increase

in gold production to 86,000oz in Q3 2025 from 71,000oz in

Q3 2024 mainly due to higher grades mined.

Production improvements were led by Obuasi, with a

growing contribution from underhand drift-and-fill mining

(“UHDF”) and a 23% year-on-year increase in recovered

grade. Sukari posted another strong result, with the third

consecutive quarterly production increase. Gold production

at Cerro Vanguardia, Iduapriem and Serra Grande remained

largely unchanged year-on-year.

The focus on operational discipline and efficiencies was

evident once again, with total cash costs* flat in real terms,

year-on-year in Q3 2025. The inflation rate experienced

across the business in Q3 2025 was approximately 5%.

Total cash costs* for the Group(1)(2) increased by 5% year-on-

year to $1,225/oz in Q3 2025 from $1,172/oz in Q3 2024 as

the Full Asset Potential programme, operational excellence

and the addition of Sukari to the portfolio partly offset market

driven factors of inflation and higher gold price royalty

payments. All-in sustaining costs* (“AISC”) rose 6% to

$1,720/oz in Q3 2025, from $1,616/oz in Q3 2024.

For managed operations(1), total cash costs* rose 5% year-

on-year to $1,244/oz in Q3 2025 from $1,186/oz in Q3 2024,

while AISC* rose 6% to $1,766/oz in Q3 2025 from $1,665/

oz in Q3 2024. These increases were mainly driven by a

20% increase in sustaining capital expenditure* and

continued inflationary cost pressures of approximately 5%

Q3 2025 EARNINGS RELEASE | 3 |  | |||

| ||||||

2025 I GROUP PERFORMANCE | ||||||

CONTINUED

mainly driven by increases in labour and mining contractor

costs. More than half of this AISC increase came from a $56/

oz average jump in the overall Group royalty charge linked to

the higher gold price.

Total cash costs* for the managed operations(1) increased by

3% year-on-year to $1,233/oz in year-to-date (“YTD”) Sep

2025 from $1,195/oz in YTD Sep 2024, significantly below

the inflation rate of approximately 4% in YTD Sep 2025.

Total capital expenditure for the Group(1)(2) rose in line with

plan to $388m in Q3 2025, up 32% year-on-year from Q3

2024, with sustaining capital expenditure* increasing 24%

year-on-year to $281m. The increase in sustaining capital

expenditure* reflects the first-time inclusion of Sukari ($32m)

and ongoing investment to support asset integrity and long-

term operational resilience, in line with strategic priorities.

Reinvesting in the portfolio

As part of the strategy to further unlock shareholder value,

the Company is reinvesting in the growth of its Mineral

Reserve base and enhancing operational flexibility. Over the

next three years, targeted spending will be directed towards

exploration, Mineral Reserve Development, and the

conversion of Mineral Resource to Mineral Reserve at sites

with high geological potential.

At the tier one Geita Gold Mine in Tanzania, this investment

strategy is already underway, with additional capital

expenditure already approved this year, and ongoing

investment for the next three years is expected to increase

the Mineral Reserve by approximately 60% and to extend

life-of-mine to 10 years or more at current production rates of

about 500,000oz a year.

In addition, a conceptual study showing potential for a 1.0Mt

per annum mill expansion could underpin an increase in

production to about 600,000oz a year for at least a decade.

A detailed feasibility study into this project is now underway,

and is expected to be completed by 2027.

Augusta transaction complete

AngloGold Ashanti has further consolidated the Beatty

District in Nevada and, on 23 October 2025, concluded the

acquisition of Augusta Gold Corp., strengthening its position

in one of the most significant emerging gold districts in the

United States. This transaction enhances the Company’s

ability to develop the region under a unified regional plan.

Reaffirming guidance

Full-year 2025 guidance remains unchanged.

(1)The term “managed operations” refers to subsidiaries managed by

AngloGold Ashanti and included in its consolidated reporting, while the

term “non-managed joint ventures” (i.e., Kibali) refers to equity-accounted

joint ventures that are reported based on AngloGold Ashanti's share of

attributable earnings and are not managed by AngloGold Ashanti.

Managed operations are reported on a consolidated basis. Non-managed

joint ventures are reported on an attributable basis.

(2)On 22 November 2024, the acquisition of Centamin plc (“Centamin”) was

successfully completed. Centamin has been included from the effective

date of the acquisition.

(3)Includes gold concentrate from the Cuiabá mine sold to third parties.

(4)The financial measures “headline earnings (loss)” and “headline earnings

(loss) per share” are not calculated in accordance with IFRS® Accounting

Standards, but in accordance with the Headline Earnings Circular 1/2023,

issued by the South African Institute of Chartered Accountants (SAICA),

at the request of the Johannesburg Stock Exchange Limited (JSE). These

measures are required to be disclosed by the JSE Listings Requirements

and therefore do not constitute Non-GAAP financial measures for

purposes of the rules and regulations of the US Securities and Exchange

Commission (“SEC”) applicable to the use and disclosure of Non-GAAP

financial measures.

(5)To enhance comparability with industry peers, AngloGold Ashanti has

revised its definition of free cash flow*, which is a Non-GAAP financial

measure. Pursuant to its revised definition, free cash flow* is calculated

as operating cash flow less capital expenditure. Operating cash flow is

defined as net cash flow from operating activities, plus repayment of

loans advanced to joint ventures, less dividends paid to non-controlling

interests (i.e., dividends paid to non-controlling interests in Sukari (50%),

Siguiri (15%) and Cerro Vanguardia (7.5%)). Free cash flow* figures for

prior periods (including Q3 2024 and YTD Sep 2024) have been adjusted

to reflect this change in reporting.

(6)The average gold price received per ounce* for Q3 2024 and YTD Sep

2024 has been restated to be based on the gold revenue from primary

operating activities. Previously, the gold price received per ounce

calculation included revenue from normal operating activities as well as

hedging activities.

*Refer to “Non-GAAP disclosure” for definitions and reconciliations.

Cerro Vanguardia, Argentina

Q3 2025 EARNINGS RELEASE | 4 |  | |||

| ||||||

2025 I GROUP PERFORMANCE | ||||||

CONTINUED

FINANCIAL RESULTS | Quarter | Quarter | Nine months | Nine months | ||

ended | ended | % | ended | ended | % | |

Sep | Sep | Variance | Sep | Sep | Variance | |

US Dollar million, except as otherwise noted | 2025 | 2024 | 2025 | 2024 | ||

Average gold price received*(1)(2)(6) ($/oz) | 3,490 | 2,486 | 40% | 3,222 | 2,298 | 40% |

Adjusted EBITDA* ($m) | 1,556 | 746 | 109% | 4,119 | 1,863 | 121% |

Headline earnings(4) ($m) | 672 | 236 | 185% | 1,759 | 549 | 220% |

Capital expenditure - Group(1)(2) ($m) | 388 | 295 | 32% | 1,105 | 846 | 31% |

Net cash flow from operating activities ($m) | 1,419 | 606 | 134% | 3,162 | 1,278 | 147% |

Free cash flow* ($m) | 920 | 381 | 141% | 1,858 | 653 | 185% |

Adjusted net debt (cash)* ($m) | (450) | 906 | (150)% | (450) | 906 | (150)% |

FINANCIAL HIGHLIGHTS •Adjusted EBITDA* rose by 109% year-on-year to $1,556m in Q3 2025, compared to $746m in Q3 2024, supported by increased production volumes, effective cost management, and a higher average gold price received per ounce* •Free cash flow* rose by 141% to $920m in Q3 2025, from $381m in Q3 2024 •Headline earnings(4) rose 185% year-on-year to $672m in Q3 2025, from $236m in Q3 2024; headline earnings(4) per share up 136% year-on-year to 132 US cents per share in Q3 2025, from 56 US cents per share in Q3 2024 •Total capital expenditure for the Group(1)(2), which included $59m at Sukari, increased 32% year-on-year to $388m in Q3 2025, from $295m in Q3 2024, including $281m in sustaining capital expenditure* and $107m in non-sustaining capital expenditure*, reflecting Sukari inclusion and reinvestment across the portfolio •Adjusted net debt* moved into a cash position of $450m at 30 September 2025 •Dividend of 91 US cents/share declared for Q3 2025 |

* Refer to “Non-GAAP disclosure” for definitions and reconciliations. | ||||

Q3 2025 EARNINGS RELEASE | 5 |  | |||

| ||||||

2025 I GROUP PERFORMANCE | ||||||

CONTINUED

OPERATING RESULTS | Quarter | Quarter | Nine months | Nine months | ||

ended | ended | % | ended | ended | % | |

Sep | Sep | Variance | Sep | Sep | Variance | |

US Dollar million, except as otherwise noted | 2025 | 2024 | 2025 | 2024 | ||

Gold production - Group(1)(2)(3) (koz) | 768 | 657 | 17% | 2,292 | 1,911 | 20% |

Gold production - Managed operations(1)(2)(3)(koz) | 682 | 586 | 16% | 2,068 | 1,682 | 23% |

Total cash costs* - Group(1)(2) ($/oz) | 1,225 | 1,172 | 5% | 1,224 | 1,163 | 5% |

Total cash costs* - Managed operations(1)(2) ($/oz) | 1,244 | 1,186 | 5% | 1,233 | 1,195 | 3% |

AISC* - Group(1)(2) ($/oz) | 1,720 | 1,616 | 6% | 1,676 | 1,598 | 5% |

AISC* - Managed operations(1)(2) ($/oz) | 1,766 | 1,665 | 6% | 1,706 | 1,660 | 3% |

OPERATIONAL HIGHLIGHTS •TRIFR was 0.96 injuries per million hours worked in Q3 2025, well below industry benchmarks •Gold production for the Group(1)(2)(3) increased by 17% year-on-year in Q3 2025, reaching 768,000oz compared to 657,000oz in Q3 2024 •Strong year-on-year gold production growth in Q3 2025 at Obuasi (+30%), Kibali (+21%), Geita (+6%) and Cuiabá (+6%) •Sukari contributed 135,000oz for Q3 2025, firmly establishing its role as one of the top producers in the portfolio •Obuasi delivered a strong 69,000oz in Q3 2025, a 30% year-on-year increase, as grade improved and production ramped up steadily •Gold production from managed operations(1)(2)(3) rose 16% year-on-year to 682,000oz in Q3 2025, up from 586,000oz in Q3 2024, supported by consistent delivery from Sukari, Obuasi, Geita, Cuiabá, Cerro Vanguardia and Iduapriem •Australia’s production was lower year-on-year in Q3 2025, in line with internal expectations •Total cash costs per ounce* for the Group(1)(2) increased 5% to $1,225/oz in Q3 2025, from $1,172/oz in Q3 2024; AISC per ounce* for the Group(1)(2) rose 6% to $1,720/oz in Q3 2025, from $1,616/oz in Q3 2024 •Total cash costs per ounce* from managed operations(1)(2) increased 5% year-on-year to $1,244/oz in Q3 2025, from $1,186/oz in Q3 2024 •AISC per ounce* from managed operations(1)(2) rose 6% year-on-year to $1,766/oz in Q3 2025, from $1,665/oz in Q3 2024, reflecting sustaining capital expenditure* reinvestment, cost inflation, and higher gold royalty costs •AngloGold Ashanti reaffirmed its full-year 2025 guidance, with gold production, cost and capital spending expected to remain within the guided ranges |

* Refer to “Non-GAAP disclosure” for definitions and reconciliations. | ||||

Q3 2025 EARNINGS RELEASE | 6 |  | |||

| ||||||

GROUP I FINANCIAL AND OPERATING KEY STATISTICS | ||||||

KEY STATISTICS | Quarter | Quarter | Nine months | Nine months | |

ended | ended | ended | ended | ||

Sep | Sep | Sep | Sep | ||

US Dollar million, except as otherwise noted | 2025 | 2024 | 2025 | 2024 | |

Operating review | |||||

Gold | |||||

Produced - Group(1)(2)(3) | - oz (000) | 768 | 657 | 2,292 | 1,911 |

Produced - Managed operations(1)(2)(3) | - oz (000) | 682 | 586 | 2,068 | 1,682 |

Produced - Non-managed joint ventures(1) | - oz (000) | 86 | 71 | 224 | 229 |

Sold - Group(1)(2)(3) | - oz (000) | 764 | 667 | 2,302 | 1,954 |

Sold - Managed operations(1)(2)(3) | - oz (000) | 680 | 590 | 2,083 | 1,724 |

Sold - Non-managed joint ventures(1) | - oz (000) | 84 | 77 | 219 | 230 |

Financial review | |||||

Gold income | - $m | 2,373 | 1,466 | 6,707 | 3,957 |

Cost of sales - Group(1)(2) | - $m | 1,348 | 1,025 | 3,933 | 2,961 |

Cost of sales - Managed operations(1)(2) | - $m | 1,225 | 921 | 3,597 | 2,683 |

Cost of sales - Non-managed joint ventures(1) | - $m | 123 | 104 | 336 | 278 |

Total operating costs | - $m | 894 | 720 | 2,669 | 2,096 |

Gross profit | - $m | 1,192 | 541 | 3,228 | 1,290 |

Average gold price received per ounce* - Group(1)(2)(6) | - $/oz | 3,490 | 2,486 | 3,222 | 2,298 |

Average gold price received per ounce* - Managed operations(1)(2)(6) | - $/oz | 3,488 | 2,484 | 3,220 | 2,296 |

Average gold price received per ounce* - Non-managed joint ventures(1)(6) | - $/oz | 3,502 | 2,502 | 3,240 | 2,313 |

All-in sustaining costs per ounce* - Group(1)(2) | - $/oz | 1,720 | 1,616 | 1,676 | 1,598 |

All-in sustaining costs per ounce* - Managed operations(1)(2) | - $/oz | 1,766 | 1,665 | 1,706 | 1,660 |

All-in sustaining costs per ounce* - Non-managed joint ventures(1) | - $/oz | 1,355 | 1,241 | 1,392 | 1,133 |

Total cash costs per ounce* - Group(1)(2) | - $/oz | 1,225 | 1,172 | 1,224 | 1,163 |

Total cash costs per ounce* - Managed operations(1)(2) | - $/oz | 1,244 | 1,186 | 1,233 | 1,195 |

Total cash costs per ounce* - Non-managed joint ventures(1) | - $/oz | 1,068 | 1,053 | 1,145 | 924 |

Profit before taxation | - $m | 1,057 | 394 | 2,832 | 974 |

Adjusted EBITDA* | - $m | 1,556 | 746 | 4,119 | 1,863 |

Total borrowings | - $m | 2,301 | 2,303 | 2,301 | 2,303 |

Adjusted net debt (cash)* | - $m | (450) | 906 | (450) | 906 |

Profit attributable to equity shareholders | - $m | 669 | 223 | 1,781 | 534 |

- US cents/share | 132 | 53 | 350 | 127 | |

Headline earnings(4) | - $m | 672 | 236 | 1,759 | 549 |

- US cents/share | 132 | 56 | 346 | 130 | |

Net cash inflow from operating activities | - $m | 1,419 | 606 | 3,162 | 1,278 |

Free cash flow*(5) | - $m | 920 | 381 | 1,858 | 653 |

Capital expenditure - Group(1)(2) | - $m | 388 | 295 | 1,105 | 846 |

Capital expenditure - Managed operations(1)(2) | - $m | 342 | 267 | 995 | 757 |

Capital expenditure - Non-managed joint ventures(1) | - $m | 46 | 28 | 110 | 89 |

(1) The term “managed operations” refers to subsidiaries managed by AngloGold Ashanti and included in its consolidated reporting, while the term “non-managed joint ventures” (i.e., Kibali) refers to equity-accounted joint ventures that are reported based on AngloGold Ashanti’s share of attributable earnings and are not managed by AngloGold Ashanti. Managed operations are reported on a consolidated basis. Non-managed joint ventures are reported on an attributable basis. | |||||

(2) On 22 November 2024, the acquisition of Centamin was successfully completed. Centamin has been included from the effective date of the acquisition. | |||||

(3) Includes gold concentrate from the Cuiabá mine sold to third parties. | |||||

(4) The financial measures “headline earnings (loss)” and “headline earnings (loss) per share” are not calculated in accordance with IFRS® Accounting Standards, but in accordance with the Headline Earnings Circular 1/2023, issued by the South African Institute of Chartered Accountants (SAICA), at the request of the Johannesburg Stock Exchange Limited (JSE). These measures are required to be disclosed by the JSE Listings Requirements and therefore do not constitute Non-GAAP financial measures for purposes of the rules and regulations of the US Securities and Exchange Commission (“SEC”) applicable to the use and disclosure of Non-GAAP financial measures. | |||||

(5) To enhance comparability with industry peers, AngloGold Ashanti has revised its definition of free cash flow*, which is a Non-GAAP financial measure. Pursuant to its revised definition, free cash flow* is calculated as operating cash flow less capital expenditure. Operating cash flow is defined as net cash flow from operating activities, plus repayment of loans advanced to joint ventures, less dividends paid to non-controlling interests (i.e., dividends paid to non-controlling interests in Sukari (50%), Siguiri (15%) and Cerro Vanguardia (7.5%)). Free cash flow* figures for prior periods (including Q3 2024 and YTD Sep 2024) have been adjusted to reflect this change in reporting. | |||||

(6) The average gold price received per ounce* for Q3 2024 and YTD Sep 2024 has been restated to be based on the gold revenue from primary operating activities. Previously, the gold price received per ounce calculation included revenue from normal operating activities as well as hedging activities. | |||||

* Refer to “Non-GAAP disclosure” for definitions and reconciliations. | |||||

$ represents US Dollar, unless otherwise stated. | |||||

Rounding of figures may result in computational discrepancies. | |||||

Q3 2025 EARNINGS RELEASE | 7 |  | |||

| ||||||

GROUP I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTERLY REVIEW

Gold production

Group gold production for Q3 2025 totalled 768,000oz, a

17% increase from 657,000oz in Q3 2024. This strong year-

on-year growth was the result of another full-quarter

contribution from Sukari, combined with solid performances

across a number of operations.

In Q3 2025, the Group delivered notable year-on-year gold

production increases at several operations, including Obuasi

(+16koz), Kibali (+15koz), Geita (+7koz) and Cuiabá

(+4koz). The Group experienced lower production at Siguiri

(-32koz), impacted by a 42 day plant stoppage during which

the mine continued normal operations (the plant has

resumed operations in the meantime and gold production at

Siguiri is still expected to grow significantly during Q4 2025);

at Sunrise Dam (-21koz), mainly due to lower underground

mined tonnes and grade from a revised mine plan, together

with lower stope and equipment availability; and at Tropicana

(-14koz), mainly due to a higher proportion of lower grade

stockpile ore processed. Gold production at Cerro

Vanguardia (+1koz), Iduapriem (+1koz), and Serra Grande

(-1koz) remained largely unchanged year-on-year.

Obuasi delivered a particularly strong performance in Q3

2025, with a growing contribution from UHDF, higher

underground grades, improved plant recovery from a new

flash cell, and no low-grade low-recovery surface material

treated in Q3 2025 compared to Q3 2024. Tonnes treated

also increased, overcoming the ventilation and equipment

constraints experienced in Q3 2024.

Kibali’s gold production increased by 21% in Q3 2025,

benefiting from improved plant feed grades compared to Q3

2024, partly offset by lower tonnes treated due to a mill

shutdown and loader shortages.

Group gold production for year-to-date (“YTD”) Sep 2025

totalled 2,292,000oz, a 20% increase from 1,911,000oz in

YTD Sep 2024. This strong year-on-year growth was driven

by the addition of Sukari into the portfolio, and sustained

production improvements across several key assets.

Costs

Total cash costs per ounce* for the Group increased by 5%

year-on-year to $1,225/oz in Q3 2025, compared to $1,172/

oz in Q3 2024. The increase was primarily driven by an

estimated 5% rise in inflation, reflecting consumer price

index (“CPI”) movements in the jurisdictions where the

Group operates, and higher royalty costs linked to the

stronger average gold price received per ounce* during Q3

2025. These impacts were partially offset by a favourable

foreign currency exchange environment against the US

dollar, which resulted in a 2% cost benefit.

Managed operations recorded a 5% year-on-year increase in

total cash costs per ounce*, rising from $1,186/oz in Q3

2024 to $1,244/oz in Q3 2025. In addition to the impacts of

inflation mainly due to increases in labour and mining

contractor costs, and higher gold royalties, the increase

reflects lower gold production at Siguiri, Sunrise Dam and

Tropicana, as well as higher operating costs at Obuasi.

These pressures were partially offset by the addition of

Sukari to the portfolio, and stronger production performances

at Obuasi, Geita and Cuiabá.

Total cash costs per ounce* at the Group’s non-managed

joint ventures marginally increased by 1% year-on-year to

$1,068/oz in Q3 2025, compared to $1,053/oz in Q3 2024.

The increase was primarily driven by higher royalties and

higher operating costs, partially offset by a stronger

production performance in Q3 2025.

All-in sustaining costs per ounce* (“AISC”) for the Group

increased by 6% year-on-year to $1,720/oz in Q3 2025,

compared to $1,616/oz in Q3 2024. At the managed

operations, AISC per ounce* increased by 6% to $1,766/oz

in Q3 2025, up from $1,665/oz in Q3 2024, reflecting higher

total cash costs per ounce* and increased sustaining capital

expenditure*. AISC per ounce* at the non-managed joint

ventures increased by 9% to $1,355/oz in Q3 2025, from

$1,241/oz in Q3 2024, primarily due to year-on-year increase

in sustaining capital expenditure* at Kibali.

Total cash costs per ounce* for the Group increased by 5%

year-on-year to $1,224/oz for YTD Sep 2025, compared to

$1,163/ oz in YTD Sep 2024. Consistent with the quarterly

trend, this increase was primarily driven by an estimated 4%

rise in inflation driven by higher labour and mining contractor

costs, and higher royalty costs associated with the stronger

average gold price received per ounce*. These impacts were

partially offset by a favourable cumulative foreign currency

exchange rate against the US dollar, which resulted in a 3%

cost benefit.

Managed operations reported a 3% year-on-year increase in

total cash costs per ounce*, increased from $1,195/oz in

YTD Sep 2024 to $1,233/oz in YTD Sep 2025. This increase

was primarily driven by inflationary pressures mainly due to

higher labour and mining contractor costs, and higher gold

royalty costs, including operational challenges at Iduapriem,

Sunrise Dam and Serra Grande. These impacts were

partially offset by the inclusion of Sukari into the portfolio and

strong operational performances at Geita and Obuasi.

Total cash costs per ounce* at non-managed joint ventures

increased by 24% year-on-year to $1,145/oz for YTD Sep

2025, up from $924/oz in YTD Sep 2024, primarily due to

higher royalties, higher labour and mining contractor costs

and higher open-pit volume-related operating costs.

AISC per ounce* for the Group increased by 5% year-on-

year to $1,676/oz in YTD Sep 2025, from $1,598/oz in YTD

Sep 2024. For managed operations, AISC per ounce*

increased by 3% to $1,706/oz for YTD Sep 2025, up from

$1,660/oz in YTD Sep 2024, reflecting the impact of higher

total cash costs per ounce*, partially offset by the positive

impact of Sukari’s inclusion in the portfolio. AISC per ounce*

at non-managed joint ventures increased by 23% to $1,392/

oz for YTD Sep 2025, compared to $1,133/oz for YTD Sep

2024, primarily due to a year-on-year increase in operating

costs.

Adjusted EBITDA*

Adjusted earnings before interest, tax, depreciation and

amortisation* (“Adjusted EBITDA*”) for Q3 2025 increased to

$1,556m, up from $746m in Q3 2024. This strong year-on-

year growth was underpinned by a favourable operating and

market environment, including a higher average gold price

received per ounce*, increased gold sales volumes, no

losses on non-hedge derivatives and other commodity

contracts, and higher equity earnings from associates and

non-managed joint ventures. These gains were partially

offset by higher total operating costs—driven by increased

royalty expenses, the first-time inclusion of Sukari, higher

costs related to legacy tailings storage facilities (“TSFs”) and

governmental fiscal claims, higher corporate costs, higher

legal fees and other provisions, and higher indirect taxes.

Q3 2025 EARNINGS RELEASE | 8 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTERLY REVIEW CONTINUED

Adjusted EBITDA* for YTD Sep 2025 increased to $4,119m,

compared to $1,863m in YTD Sep 2024. This strong year-

on-year growth was driven by a combination of favourable

operational and market conditions, including a higher

average gold price received per ounce*, increased gold

sales volumes, no losses on non-hedge derivatives and

other commodity contracts, favourable inventory

movements, lower legal fees, and higher equity earnings

from associates and non-managed joint ventures. These

positive factors were partially offset by higher total operating

costs, reflecting increased royalty expenses, the initial

inclusion of Sukari, higher costs associated with legacy

TSFs and governmental fiscal claims, higher corporate

costs, higher restructuring costs and other provisions, higher

costs relating to mining contractor rate adjustments, and

higher indirect taxes.

Earnings

Basic earnings (profit attributable to equity shareholders) for

Q3 2025 were $669m, or 132 US cents per share, compared

to $223m, or 53 US cents per share, in Q3 2024. The strong

year-on-year increase was largely driven by a higher

average gold price received per ounce*, increased gold

sales volumes, no losses on non-hedge derivatives and

other commodity contracts, higher finance income, lower

foreign exchange and fair value adjustments and higher

equity earnings from associates and non-managed joint

ventures. Q3 2025 also benefited from lower asset

derecognitions, lower care and maintenance costs and

higher profits on disposal of assets than Q3 2024.

These positive contributions were partially offset by higher

total operating costs, including increased royalty expenses

and costs associated with the initial inclusion of Sukari,

along with higher asset amortisation, elevated costs related

to legacy TSFs and governmental fiscal claims, higher

corporate and finance costs, higher legal fees and other

provisions, higher indirect taxes, an asset impairment in Q3

2025, and a higher tax charge.

Basic earnings (profit attributable to equity shareholders) for

YTD Sep 2025 were $1,781m, or 350 US cents per share,

compared to $534m, or 127 US cents per share, in YTD Sep

2024. This strong year-on-year growth was primarily driven

by a higher average gold price received per ounce*,

increased gold sales volumes, and no losses on non-hedge

derivatives and other commodity contracts. Additional

contributions came from favourable inventory movements,

lower legal fees, lower care and maintenance costs, higher

equity earnings from associates and non-managed joint

ventures, lower asset derecognitions and an impairment

reversal at Serra Grande which was not present in YTD Sep

2024.

These positive impacts were partially offset by higher total

operating costs, including increased royalty expenses and

the first-time inclusion of Sukari, alongside higher

amortisation of assets, elevated costs related to legacy TSFs

and governmental fiscal claims, higher costs relating to

mining contractor rate adjustments, higher corporate and

finance costs, higher foreign exchange and fair value

adjustments, higher indirect taxes, restructuring costs and

other provisions, lower finance income, and loss on disposal

of the Doropo and ABC projects in Côte d’Ivoire, and a

higher tax charge.

Headline earnings‡ for Q3 2025 were $672m, or 132 US

cents per share, compared to $236m, or 56 US cents per

share in Q3 2024. The increase in headline earnings‡

reflects the same key drivers that supported the rise in basic

earnings during Q3 2025. In addition, headline earnings‡

excludes impairment reversals/impairments, asset

derecognitions and losses (profits) on disposal of assets and

taxes thereon.

Headline earnings‡ for YTD Sep 2025 were $1,759m, or 346

US cents per share, compared to $549m, or 130 US cents

per share, for YTD Sep 2024. The increase in headline

earnings‡ reflects the same key drivers that supported the

rise in basic earnings during YTD Sep 2025.

‡The financial measures “headline earnings (loss)” and “headline

earnings (loss) per share” are not calculated in accordance with

IFRS® Accounting Standards, but in accordance with the

Headline Earnings Circular 1/2023, issued by the South African

Institute of Chartered Accountants (SAICA), at the request of the

Johannesburg Stock Exchange Limited (JSE). These measures

are required to be disclosed by the JSE Listings Requirements

and therefore do not constitute Non-GAAP financial measures

for purposes of the rules and regulations of the SEC applicable

to the use and disclosure of Non-GAAP financial measures.

Cash flow

Net cash inflow from operating activities reached $1,419m in

Q3 2025, representing a 134% year-on-year increase from

$606m in Q3 2024. This strong performance was

underpinned by a higher average gold price received per

ounce*, increased gold sales volumes from managed

operations, and higher dividends received from joint

ventures. These gains were partially offset by higher total

operating costs and increased tax payments.

After accounting for capital expenditure, loan repayments

from Kibali, and dividends paid to non-controlling

shareholders, the Company generated a free cash inflow* of

$920m in Q3 2025, compared to $381m in Q3 2024.

Net cash inflow from operating activities was $3,162m for

YTD Sep 2025, a 147% increase year-on-year from $1,278m

for YTD Sep 2024. This strong performance was primarily

driven by a higher average gold price received per ounce*,

increased gold sales volumes from managed operations,

and higher dividends received from joint ventures. These

benefits were partially offset by higher total operating costs

and increased tax payments.

After accounting for capital expenditure, loan repayments

from Kibali, dividends paid to non-controlling shareholders,

and landholder duties of $37m paid in May 2025 in respect

of the corporate restructuring, the Company generated a free

cash inflow* of $1,858m in YTD Sep 2025, compared to

$653m in YTD Sep 2024.

To enhance comparability with industry peers, AngloGold

Ashanti revised its definition of free cash flow*, which is a

Non-GAAP financial measure. Pursuant to its revised

definition, free cash flow* is calculated as operating cash

flow less capital expenditure. Operating cash flow is defined

as net cash flow from operating activities, plus repayment of

loans advanced to joint ventures, less dividends paid to non-

controlling interests (i.e., dividends paid to non-controlling

interests in Sukari (50%), Siguiri (15%) and Cerro

Vanguardia (7.5%)). Free cash flow* figures for prior periods

(including Q3 2024 and YTD Sep 2024) have been adjusted

to reflect this change in reporting.

The dividend policy targets a 50% payout of annual free

cash flow*, subject to maintaining an Adjusted net debt* to

Adjusted EBITDA* ratio of 1.0 times. The dividend policy

Q3 2025 EARNINGS RELEASE | 9 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTERLY REVIEW CONTINUED

also introduced a base dividend of $0.50 per share per

annum, payable in quarterly instalments of $0.125 per share.

The interim dividend for Q3 2025, is 91 US cents per share.

During Q3 2025, AngloGold Ashanti received $37m in

dividends from the Kibali joint venture, compared to $49m in

loan repayments and $8m in dividends in Q3 2024. The

Company’s attributable share of outstanding cash balances

awaiting repatriation from the Democratic Republic of the

Congo (“DRC”) was $119m at 30 September 2025, up from

$25m at 30 June 2025.

Free cash flow* during Q3 2025 was impacted by ongoing

movements in value-added tax (“VAT”) recoveries at Geita

and Kibali, as well as foreign exchange controls and export

duty-related restrictions at Cerro Vanguardia (“CVSA”):

•In Tanzania, the net overdue recoverable VAT input credit

balance (after discounting provisions) increased by $17m

during Q3 2025 to $186m at 30 September 2025, up

from $169m at 30 June 2025. This increase reflects

foreign exchange gains of $14m, new claims submitted

during the period of $22m, and a decrease in the

discounting provision of $12m, partially offset by the

application of $31m in verified VAT claims against

corporate tax liabilities. AngloGold Ashanti expects to

continue offsetting eligible VAT claims against corporate

taxes as part of its recovery strategy.

•In the DRC, the Company’s attributable share of the net

recoverable VAT balance (including fuel duties and after

discounting provisions) increased by $14m during

Q3 2025 to $90m at 30 September 2025, up from $76m

at 30 June 2025. This increase was driven by $7m in

new claims submitted and $12m in revaluation

adjustments, partially offset by $5m increase in the

discounting provision.

•In Argentina, CVSA’s cash balance decreased by $62m#

during Q3 2025 to $109m# at 30 September 2025 from

$171m# at 30 June 2025. The cash remains available for

CVSA’s operational and exploration requirements.

During Q2, 2025, CVSA approved its 2024 local financial

statements and declared dividends attributable to the

2024 financial year to AngloGold Ashanti’s offshore

($251m#) and onshore ($28m#) investment holding

companies. During Q3 2025, CVSA paid offshore

dividends of $140m to AngloGold Ashanti by utilising a

currency swap mechanism to secure the required US

dollars. CVSA expects to continue with monthly dividend

payments, subject to cash availability, in order to satisfy

the remaining amount of declared dividends.

#US dollar equivalent and at prevailing exchange rates.

Geita, Tanzania

Q3 2025 EARNINGS RELEASE | 10 |  | |||

| ||||||

GROUP I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTERLY REVIEW CONTINUED

FREE CASH FLOW* | Quarter | Quarter | Nine months | Nine months |

ended | ended | ended | ended | |

Sep | Sep | Sep | Sep | |

US Dollar million, except as otherwise noted | 2025 | 2024 | 2025 | 2024 |

Net cash flow from operating activities (1) | 1,419 | 606 | 3,162 | 1,278 |

Repayment of loans advanced to joint ventures | — | 49 | 77 | 139 |

Dividends paid to non-controlling interests | (157) | (7) | (386) | (7) |

Operating cash flow | 1,262 | 648 | 2,853 | 1,410 |

Capital expenditure on tangible and intangible assets | (342) | (267) | (995) | (757) |

Free cash flow* | 920 | 381 | 1,858 | 653 |

(1) Includes landholder duties of $37m paid in May 2025.

* Refer to “Non-GAAP disclosure” for definitions and reconciliations.

Rounding of figures may result in computational discrepancies.

Balance sheet and liquidity

During Q3 2025, Adjusted net debt* moved into a cash

position, despite the payment of $562m in dividends during

Q3 2025. Adjusted net cash* at 30 September 2025 was

$450m, compared to Adjusted net debt* of $906m at 30

September 2024.

At 30 September 2025, the balance sheet remained robust,

supported by significant available liquidity. This included the

undrawn $1.4bn multi-currency revolving credit facility

(“RCF”). AngloGold Ashanti held approximately $2.5bn in

cash and cash equivalents (net of bank overdraft) at 30

September 2025, bringing Group liquidity to approximately

$3.9bn at 30 September 2025.

Capital expenditure

During Q3 2025, sustaining capital expenditure* of the

Group increased by 24% year-on-year to $281m, compared

to $227m in Q3 2024. Sustaining capital expenditure* at

managed operations rose by 20% year-on-year to $255m in

Q3 2025, up from $212m in Q3 2024. This increase was

primarily driven by the inclusion of Sukari’s sustaining capital

expenditure* of $32m in the portfolio and a $12m increase at

Sunrise Dam mainly due to the concentrated leach project.

At non-managed joint ventures, sustaining capital

expenditure* increased by 73% year-on-year to $26m in Q3

2025, from $15m in Q3 2024, mainly reflecting higher

expenditure on underground equipment and increased

Mineral Reserve development costs at Kibali, aligned with

increased underground development metres.

Non-sustaining capital expenditure* for the Group was

$107m in Q3 2025, a 57% increase year-on-year from $68m

in Q3 2024. At managed operations, non-sustaining capital

expenditure* rose by 58% year-on-year to $87m, from $55m

in Q3 2024, largely due to the addition of Sukari’s non-

sustaining capital expenditure* of $27m to the portfolio, a

$11m increase in the Havana growth capital expenditure at

Tropicana and investment in growth at Cuiabá to ramp up

production. This increase was partially offset by reduced

growth capital expenditure at Obuasi, following the

completion of Phase 3 of the Obuasi redevelopment project

in Q4 2024. Non-managed joint ventures recorded a 54%

year-on-year increase in non-sustaining capital expenditure*

to $20m in Q3 2025, from $13m in Q3 2024, mainly driven

by higher expenditure at Kibali on waste stripping for the

Pamao deposition project, as well as expenditure on

buttressing the TSF.

During YTD Sep 2025, sustaining capital expenditure* of the

Group increased by 22% year-on-year to $791m, compared

to $647m in YTD Sep 2024. Sustaining capital expenditure*

at managed operations rose by 24% year-on-year to $741m

in YTD Sep 2025, up from $598m in YTD Sep 2024. This

increase was primarily driven by the inclusion of Sukari’s

sustaining capital expenditure* of $101m in the portfolio, a

$38m increase at Geita reflecting the acquisition of a new

mining fleet and increased investment in Mineral Reserve

development, and a $20m increase at Sunrise Dam mainly

due to the concentrated leach project. This increase was

partially offset by lower expenditure at Siguiri following

elevated activity in Sep YTD 2024 related to waste mining,

TSF life extension and recovery work on a carbon-in-leach

(“CIL”) tank failure, and reduced expenditure at Iduapriem

mainly due to lower stripping costs. At non-managed joint

ventures, sustaining capital expenditure* at Kibali increased

marginally by 2% year-on-year to $50m in YTD Sep 2025,

from $49m in YTD Sep 2024.

Non-sustaining capital expenditure* for the Group was

$314m in YTD Sep 2025, a 58% increase year-on-year from

$199m in YTD Sep 2024. At managed operations, non-

sustaining capital expenditure* rose by 60% year-on-year to

$254m, from $159m in YTD Sep 2024, primarily driven by

the addition of Sukari’s non-sustaining capital expenditure*

of $83m to the portfolio, investment in growth at Cuiabá to

ramp up production and increased expenditure on the

Beposo TSF at Iduapriem. These increases were partially

offset by lower non-sustaining capital expenditure* at Obuasi

following the successful completion of Phase 3 of the Obuasi

redevelopment project in Q4 2024. Non-managed joint

ventures recorded a 50% year-on-year increase in non-

sustaining capital expenditure* to $60m in YTD Sep 2025,

from $40m in YTD Sep 2024. The increase was primarily

driven by higher investment at Kibali, including waste

stripping for the Pamao deposition project and continued

progress on buttressing the TSF.

* Refer to “Non-GAAP disclosure” for definitions and reconciliations.

Q3 2025 EARNINGS RELEASE | 11 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER IN REVIEW

Regional view

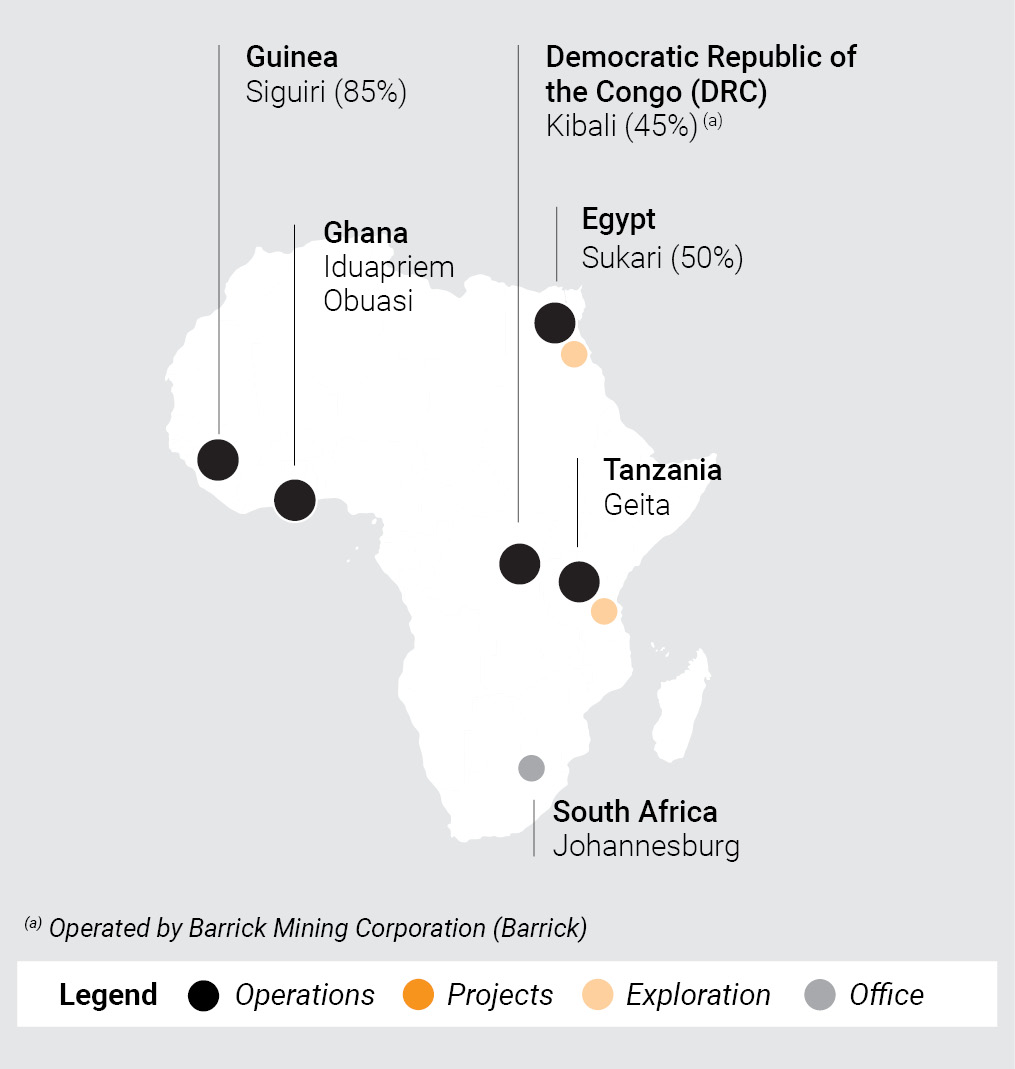

Africa region

In the Africa region, managed operations (including Sukari)

produced 428,000oz at a total cash cost* of $1,154/oz in Q3

2025, compared to 301,000oz at a total cash cost* of

$1,179/oz in Q3 2024. In the Africa region, non-managed

joint ventures produced (on an attributable basis) 86,000oz

at a total cash cost* of $1,068/oz in Q3 2025, compared to

71,000oz at a total cash cost* of $1,053/oz in Q3 2024.

Managed operations (including Sukari) produced

1,307,000oz at a total cash cost* of $1,144/oz in YTD Sep

2025, compared to 894,000oz at a total cash cost* of

$1,206/oz in YTD Sep 2024.

In the Africa region, non-managed joint ventures produced

(on an attributable basis) 224,000oz at a total cash cost* of

$1,145/oz in YTD Sep 2025, compared to 229,000oz at a

total cash cost* of $924/oz in YTD Sep 2024.

In Ghana, at Iduapriem, gold production was 60,000oz at a

total cash cost* of $1,321/oz for Q3 2025, compared to

59,000oz at a total cash cost* of $1,191/oz during Q3 2024.

Gold production marginally increased by 2% year-on-year in

Q3 2025 compared to Q3 2024, due primarily to increased

tonnes treated, with reduced engineering downtime leading

to higher effective plant operating hours. The supply of

higher grade ore from Block 7/8 Cut 1 also contributed to

improved production. Total cash costs per ounce* increased

by 11% year-on-year in Q3 2025 compared to Q3 2024,

largely reflecting increases in production taxes, royalties

linked to a higher gold price, and an increase in

maintenance-related expenditures, partially offset by a lower

drawdown of metal inventories compared to Q3 2024.

Gold production was 149,000oz at a total cash cost* of

$1,480/oz for YTD Sep 2025, compared to 187,000oz at a

total cash cost* of $1,021/oz during YTD Sep 2024. Gold

production decreased by 20% year-on-year in YTD Sep

2025 compared to YTD Sep 2024, mainly due to an

unplanned seventeen-day plant shutdown in Q1 2025 to

investigate and repair a tear in the lining of the Beposo TSF,

as well as a reduction in overall grade resulting from the

depletion of the higher-grade Cut 2B pit in 2024 and

increased operational downtime due to power supply

interruptions. Total cash costs per ounce* increased by 45%

year-on-year in YTD Sep 2025 compared to YTD Sep 2024,

mainly driven by lower production - including an estimated

shortfall of approximately 12,000oz due to the plant

stoppage in Q1 2025 - and the processing of lower-grade

ore. Additionally, operating costs increased due to higher

expenditure on mining contractors, consultants and

maintenance costs.

Iduapriem, Ghana

Q3 2025 EARNINGS RELEASE | 12 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER IN REVIEW CONTINUED

At Obuasi, gold production was 69,000oz at a total cash

cost* of $1,331/oz for Q3 2025, compared to 53,000oz at a

total cash cost* of $1,153/oz during Q3 2024. Gold

production increased by 30% year-on-year in Q3 2025

compared to Q3 2024, mainly due to a growing contribution

from UHDF delivering improved underground ore tonnes and

grades to the plant, with Q3 2024 impacted by ventilation

constraints and low equipment availability. Plant recoveries

improved by 2% year-on-year, supported by the installation

of a second flash cell and processing of higher-grade

material. Total cash costs per ounce* increased by 15%

year-on-year in Q3 2025 compared to Q3 2024, mainly due

to higher operating costs associated with year-on-year

increases in labour costs related to bonuses and once-off

payment to bargaining unit employees, increases in mining

contractor costs related to mining volume and updated rates,

and elevated consultant and maintenance expenditure.

Gold production was 194,000oz at a total cash cost* of

$1,306/oz for YTD Sep 2025, compared to 161,000oz at a

total cash cost* of $1,231/oz during YTD Sep 2024. Gold

production increased by 20% year-on-year in YTD Sep 2025

compared to YTD Sep 2024. This strong performance was

primarily due to UHDF delivering improved underground

mine health, and no Kokoteasua tailings processed during

YTD Sep 2025 — whereas surface sources accounted for

13% of the feed in YTD Sep 2024. Total underground tonnes

milled increased by 16% year-on-year to 976kt and the

average head grade improved significantly by 17%, rising to

7.09g/t in YTD Sep 2025 from 6.05g/t in YTD Sep 2024.

Total cash costs per ounce* increased by 6% year-on-year in

YTD Sep 2025 compared to YTD Sep 2024, mainly due to

higher labour costs associated with increases in labour

complement, once-off payment to bargaining unit

employees, bonuses linked to stronger production

performance, contractor costs associated with increased

tonnes mined and updated rates, along with elevated

consultant and maintenance costs.

In Guinea, at Siguiri, gold production was 39,000oz at a

total cash cost* of $2,331/oz for Q3 2025, compared to

71,000oz at a total cash cost* of $1,500/oz in Q3 2024. Gold

production decreased by 45% year-on-year in Q3 2025

compared to Q3 2024, mainly due to the suspension of

processing at the plant during Q3 2025 to address seepage

on a section of the south wall of the TSF following rainfall of

more than 110mm in a single day during the wet season.

Processing resumed at the plant at the end of Q3 2025,

while a project to buttress the perimeter of the TSF

continues to make good progress. Mining had continued

throughout the suspension and the Company expects to be

able to process the mined ore in the next few months. Gold

production is still expected to increase year-on-year by

approximately 8% during 2025 compared to 2024.

Total cash costs per ounce* increased by 55% year-on-year

in Q3 2025 compared to Q3 2024, mainly due to lower

production as a result of the plant stoppage, and volume-

related increases in mining costs, partially offset by a build-

up in metal inventories.

Gold production was 204,000oz at a total cash cost* of

$1,735/oz for YTD Sep 2025, compared to 199,000oz at a

total cash cost* of $1,687/oz in YTD Sep 2024. Gold

production increased by 3% in YTD Sep 2025 compared to

YTD Sep 2024, mainly due to a 7% improvement in

recovery, achieved by excluding deleterious Bidini ore from

the blend and optimising carbon management. This increase

was partly offset by a 5% decrease in tonnes treated, due to

the plant stoppage in Q3 2025 to address TSF concerns.

Total cash costs per ounce* increased by 3% year-on-year in

YTD Sep 2025 compared to YTD Sep 2024, largely

reflecting an increase in gold royalty expenses associated

with the higher gold price, partially offset by the higher

production base year-on-year, and a build-up of metal

inventories.

Obuasi, Ghana

Q3 2025 EARNINGS RELEASE | 13 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER IN REVIEW CONTINUED

In Tanzania, at Geita, gold production was 125,000oz at a

total cash cost* of $1,010/oz for Q3 2025, compared to

118,000oz at a total cash cost* of $995/oz in Q3 2024. Gold

production increased by 6% year-on-year in Q3 2025

compared to Q3 2024, mainly due to a 10% higher

recovered grade resulting from improved mined grade from

Nyamulilima, partly offset by reduced underground mined

grade due to low availability of high grade stopes and a 4%

decline in ore tonnes treated resulting from a planned mill

shutdown. Total cash costs per ounce* marginally increased

by 2% year-on-year in Q3 2025 compared to Q3 2024,

mainly due to the year-on-year increase in production, and

metal inventory build-up. This benefit was partly offset by

higher gold refining and royalty charges associated with the

stronger gold price, along with increased backfilling,

maintenance and stores costs.

Gold production was 379,000oz at a total cash cost* of $993/

oz for YTD Sep 2025, compared to 347,000oz at a total cash

cost* of $1,020/oz in YTD Sep 2024. Gold production

increased by 9% year-on-year in YTD Sep 2025 compared

to YTD Sep 2024, mainly due to improved recovered grades,

supported by a 10% uplift in the mine call factor, partially

offset by a 6% decline in ore tonnes treated, due to lower

plant throughput rates and mill utilisation. Total cash costs

per ounce* decreased by 3% year-on-year in YTD Sep 2025

compared to YTD Sep 2024, mainly reflecting the benefit of

increased production volumes and a build-up of metal

inventories. This decrease was partly offset by higher direct

operating costs, including higher labour associated with

benefit adjustments and production bonuses, higher

contractor and consultant expenditure, higher stores costs,

and additional maintenance expenditure on the plant and

mining fleet.

In Egypt, at Sukari, a third consecutive quarterly production

increase was delivered, with gold production for Q3 2025 of

135,000oz (Q3 2024 132,000oz) at a total cash cost* of

$793/oz. Sukari was acquired by the Company on

22 November 2024. Float feed tonnes increased in Q3 2025

by 48kt, driven by higher plant throughput rates and

increased mill availability, partly offset by a decline in heap

leach production.

The mine performed in line with plan with gold production for

YTD Sep 2025 of 381,000oz (YTD Sep 2024 356,000oz) at

a total cash cost* of $765/oz. Gold production increased by

7% year-on-year in YTD Sep 2025 compared to YTD Sep

2024 mainly due to significantly higher mill grades, driven by

higher mined grades from both open pit and underground.

In the DRC, at Kibali, gold production (on an attributable

basis) was 86,000oz at a total cash cost* of $1,068/oz for Q3

2025, compared to 71,000oz at a total cash cost* of $1,053/

oz in Q3 2024. Gold production increased by 21% year-on-

year in Q3 2025 compared to Q3 2024, mainly due to a

greater proportion of higher grade ore fed from stockpiles.

Tonnes treated in Q3 2025 were 3% below Q3 2024 mainly

due to a shutdown overrun on Mill 1 and 2, as well as a

shortfall in underground tonnes due to loader availability

issues. Total cash costs per ounce* marginally increased by

1% year-on-year in Q3 2025 compared to Q3 2024, mainly

due to higher operating costs associated with volume-related

open-pit mining costs and higher gold royalties, partially

offset by higher gold production.

Gold production (on an attributable basis) was 224,000oz at

a total cash cost* of $1,145/oz for YTD Sep 2025, compared

to 229,000oz at a total cash cost* of $924/oz in YTD Sep

2024. Gold production marginally decreased by 2% year-on-

year in YTD Sep 2025 compared to YTD Sep 2024, mainly

due to operational challenges resulting in reduced

underground ore available for treatment. Total cash costs per

ounce* increased by 24% year-on-year in YTD Sep 2025

compared to YTD Sep 2024, mainly due to lower production

and higher operating costs from volume-related increases in

open-pit mining costs, and higher royalties driven by a

stronger gold price.

Geita, Tanzania

Q3 2025 EARNINGS RELEASE | 14 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER IN REVIEW CONTINUED

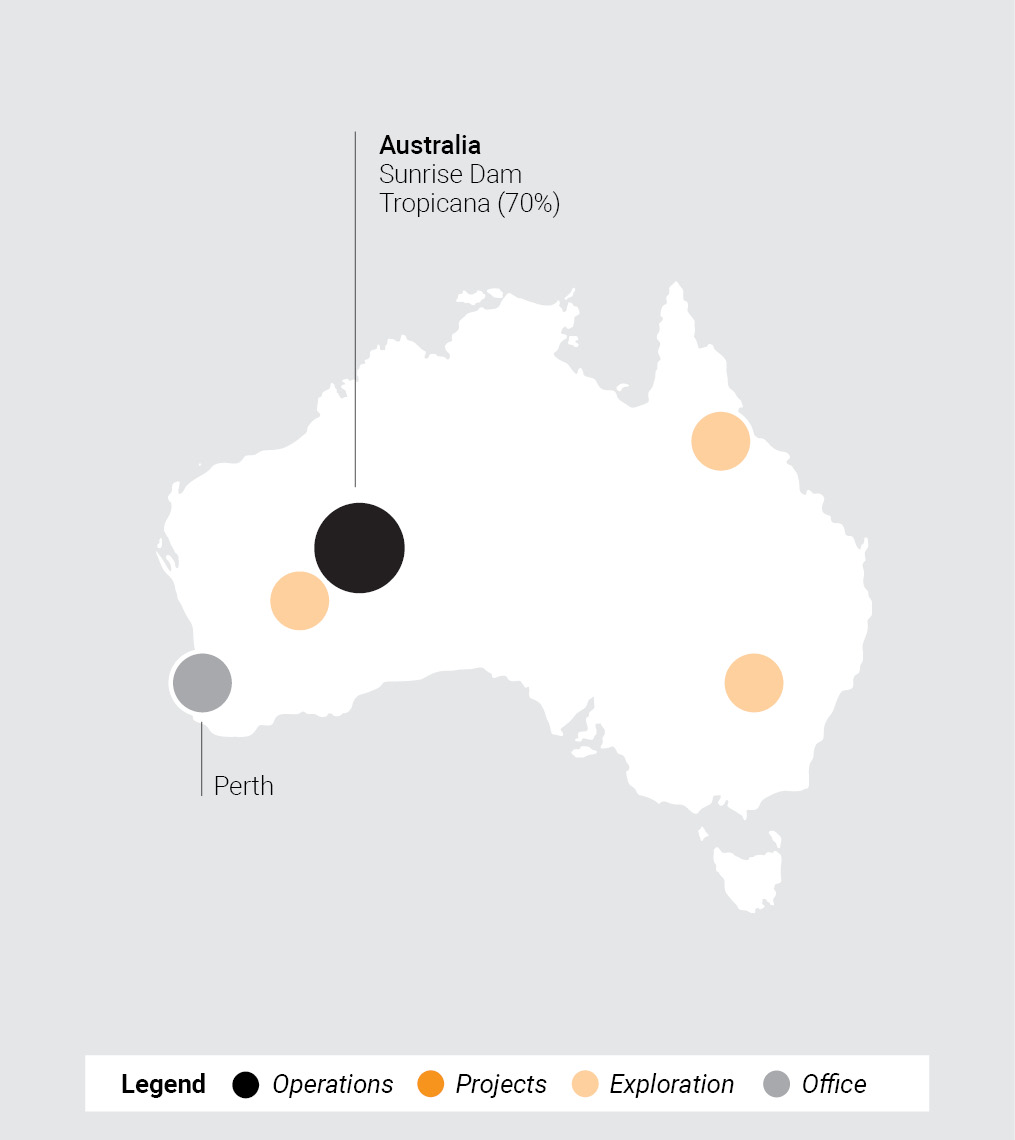

Australia region

In the Australia region, gold production (on an attributable

basis) was 125,000oz at a total cash cost* of $1,638/oz in

Q3 2025, compared to 160,000oz at a total cash cost* of

$1,245/oz in Q3 2024. The region’s performance was

broadly in line with expectations.

Gold production (on an attributable basis) was 386,000oz at

a total cash cost* of $1,564/oz in YTD Sep 2025, compared

to 406,000oz at a total cash cost* of $1,335/oz in YTD Sep

2024.

At Sunrise Dam, gold production was 52,000oz at a total

cash cost* of $1,844/oz for Q3 2025, compared to 73,000oz

at a total cash cost* of $1,132/oz in Q3 2024. Gold

production decreased by 29% year-on-year in Q3 2025

compared to Q3 2024, mainly due to lower underground

tonnes mined and grade, which was impacted by lower

loader and stope availability, partially offset by improved

recoveries driven by increased circuit residence time and

reduced solution losses. Total cash costs per ounce*

increased by 63% year-on-year in Q3 2025 compared to Q3

2024, largely reflecting the impact of lower production, a

drawdown of metal inventories and volume-related increases

in open-pit mining costs.

Gold production was 174,000oz at a total cash cost* of

$1,646/oz for YTD Sep 2025, compared to 193,000oz at a

total cash cost* of $1,321/oz in YTD Sep 2024. Gold

production decreased by 10% year-on-year in YTD Sep

2025 compared to YTD Sep 2024, mainly due to reduced

underground mined tonnes and grade resulting from lower

loader and stope availability, partially offset by an

improvement in plant recoveries. Total cash costs per ounce*

increased by 25% year-on-year in YTD Sep 2025 compared

to YTD Sep 2024, mainly due to the lower production base,

gold-in-process inventory movements linked to timing of gold

pours, and additional crushing, reagents and maintenance

expenditure incurred at the plant.

At Tropicana, gold production (on an attributable basis) was

73,000oz at a total cash cost* of $1,364/oz in Q3 2025,

compared to 87,000oz at a total cash cost* of $1,243/oz in

Q3 2024. Gold production decreased by 16% year-on-year

in Q3 2025 compared to Q3 2024, mainly due to a greater

proportion of the lower-grade stockpile ore processed,

partially offset by higher open-pit grade. Total cash costs per

ounce* increased by 10% year-on-year in Q3 2025

compared to Q3 2024, mainly driven by the lower production

base, inflationary pressures driven primarily by increases in

mining contractor costs, and higher gold royalties.

Gold production (on an attributable basis) was 212,000oz at

a total cash cost* of $1,372/oz in YTD Sep 2025, compared

to 213,000oz at a total cash cost* of $1,230/oz in YTD Sep

2024. Gold production largely remained in line year-on-year

for YTD Sep 2025 compared to YTD Sep 2024, with lower

recovered grade, primarily driven by a greater proportion of

lower-grade stockpile ore processed, partially offset by an

increase in tonnes treated. Total cash costs per ounce*

increased by 12% year-on-year for YTD Sep 2025 compared

to YTD Sep 2024, primarily driven by volume-related

increases in underground costs, increase in maintenance

expenditure, elevated gold royalties, and a lower level of

open-pit capitalisation compared to YTD Sep 2024.

Sunrise Dam, Australia

Q3 2025 EARNINGS RELEASE | 15 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER IN REVIEW CONTINUED

Americas region

In the Americas region, gold production was 129,000oz at

a total cash cost* of $1,192/oz in Q3 2025, compared to

125,000oz at a total cash cost* of $1,127/oz in Q3 2024.

Gold production was 375,000oz at a total cash cost* of

$1,201/oz in YTD Sep 2025, compared to 382,000oz at a

total cash cost* of $1,024/oz in YTD Sep 2024.

In Brazil, at Cuiabá (AGA Mineração), gold production was

71,000oz at a total cash cost* of $983/oz for Q3 2025,

compared to 67,000oz at a total cash cost* of $896/oz in Q3

2024. Following the successful restart of the Queiroz plant in

September 2024, gold production is now recorded upon

refining and pouring at the plant, rather than at the shipment

of gold concentrate. Gold production increased by 6% year-

on-year in Q3 2025 compared to Q3 2024, mainly due to

higher ore tonnes mined, partially offset by a decrease in

plant recoveries related to the shift to bar production. Total

cash costs per ounce* increased by 10% year-on-year for

Q3 2025 compared to Q3 2024, mainly due to the restart of

the Queiroz plant, which had previously been under care and

maintenance. This increase was partially offset by higher

gold production and increased by-product revenue.

Gold production was 196,000oz at a total cash cost* of $944/

oz for YTD Sep 2025, compared to 196,000oz at a total cash

cost* of $883/oz in YTD Sep 2024. Gold production

remained unchanged year-on-year in YTD Sep 2025

compared to YTD Sep 2024, with an improvement in ore

head grade and plant throughput offset by a 4% decline in

plant recoveries.

Total cash costs per ounce* increased by 7% year-on-year

for YTD Sep 2025 compared to YTD Sep 2024, mainly

reflecting higher operating costs associated with the

successful restart of the Queiroz plant. This increase was

partially mitigated by increased by-product revenue and a

weaker Brazilian real relative to the US dollar.

At Serra Grande, gold production was 15,000oz at a total

cash cost* of $2,253/oz for Q3 2025, compared to 16,000oz

at a total cash cost* of $1,801/oz in Q3 2024. Gold

production decreased by 6% year-on-year in Q3 2025

compared to Q3 2024, mainly due to lower tonnes treated as

a result of no open-pit mining in Q3 2025. Total cash costs

per ounce* increased by 25% year-on-year in Q3 2025

compared to Q3 2024, mainly driven by lower production

and higher operating costs. The team continues to focus on

enhancing operational efficiency to support improved cost

performance.

Gold production was 42,000oz at a total cash cost* of

$2,184/oz for YTD Sep 2025, compared to 57,000oz at a

total cash cost* of $1,439/oz in YTD Sep 2024. Gold

production decreased by 26% year-on-year in YTD Sep

2025 compared to YTD Sep 2024, mainly due to lower

recovered grades and reduced ore volumes treated,

impacted by a reduction in stope recovery resulting from

operational and geotechnical constraints. Total cash costs

per ounce* increased by 52% year-on-year for YTD Sep

2025 compared to YTD Sep 2024, largely reflecting the

impact of lower production. This increase was partially offset

by the weakening of the Brazilian real against the US dollar,

which helped mitigate some cost pressures.

The proposed sale of Serra Grande is expected to be

completed during Q4 2025.

In Argentina, at Cerro Vanguardia, gold production was

43,000oz at a total cash cost* of $1,139/oz during Q3 2025,

compared to 42,000oz at a total cash cost* of $1,224/oz in

Q3 2024. Gold production marginally increased by 2% year-

on-year in Q3 2025 compared to Q3 2024, mainly driven by

an increase in tonnes treated, with higher tonnes placed on

the heap leach pad, partially offset by a decrease in

recovered grade. Total cash costs per ounce* decreased by

7% year-on-year in Q3 2025 compared to Q3 2024, mainly

due to a year-on-year increase in by-product revenue driven

by higher volumes sold and a stronger silver price, partially

offset by higher gold royalties resulting from a higher gold

price.

Gold production was 137,000oz at a total cash cost* of

$1,253/oz during YTD Sep 2025, compared to 129,000oz at

a total cash cost* of $1,044/oz in YTD Sep 2024. Gold

production increased by 6% year-on-year in YTD Sep 2025

compared to YTD Sep 2024, mainly due to higher recovered

grades and an increase in ore tonnes treated, supporting

stronger operational performance. Total cash costs per

ounce* increased by 20% year-on-year in YTD Sep 2025

compared to YTD Sep 2024, primarily due to higher in-

country inflation and higher royalty costs associated with the

increased gold price. These increases were partially offset

by a weaker Argentinean peso against the US dollar, higher

by-product revenue and higher gold production, which

helped mitigate overall cost increases.

Q3 2025 EARNINGS RELEASE | 16 |  | |||

| ||||||

REGIONS I FINANCIAL AND OPERATING RESULTS | ||||||

QUARTER IN REVIEW CONTINUED

Corporate update

Issued share capital

As at 10 November 2025, the total issued ordinary share

capital of the Company consisted of 504,887,435 ordinary

shares of $1.00 each. Each AngloGold Ashanti ordinary

share carries one voting right. The Company does not hold

any of its ordinary shares in treasury.

This figure may be used by AngloGold Ashanti shareholders

to determine whether they are required to notify their

interest, or a change to their interest, in the Company under

its Articles of Association or to comply with any other

applicable laws and regulations.

Proposed sale of the Serra Grande mine

On 2 June 2025, the Company announced that it had agreed

to sell Mineração Serra Grande S.A., which owns the

Company’s Serra Grande mine (“MSG”) in the state of

Goiás, Brazil, to Aura Minerals Inc. for the following

consideration:

•A cash consideration of $76m on closing subject to

certain working capital adjustments at the closing date;

and

•Deferred consideration payments equivalent to a 3% net

smelter returns participation over the current Mineral

Resource of MSG inclusive of the Mineral Reserve,

payable quarterly in cash.

The proposed sale, which is expected to close by the end of

2025, is subject to the fulfilment of certain customary closing

conditions.

Acquisition of Augusta Gold Corp.

On 23 October 2025, AngloGold Ashanti completed its

acquisition of Augusta Gold Corp. (“Augusta Gold”). The

transaction had previously been approved by the Augusta

Gold shareholders at a special meeting held on 20 October

2025. Following completion of the acquisition, the Augusta

Gold shares were delisted from the Toronto Stock Exchange

(TSX) and ceased to be quoted on the OTCQB.

Quebradona

On 20 June 2025, the Colombian Ministry of Environment

and Sustainable Development issued Resolution No. 855 of

2025, declaring a temporary renewable natural resources

reserve zone over multiple municipalities in the southwest of

the Department of Antioquia, including the area in which the

Quebradona project is located.

Resolution No. 855 restricts mining activities for three years

(extendable for a further two years) while authorities conduct

technical studies regarding the conservation value of the

area and subsequently determine whether to convert the

area to a permanent protected area or to withdraw the

temporary designation. No new environmental permits or

environmental licences may be issued as long as Resolution

No. 855 is in force.

On 17 October 2025, the Company submitted a conciliation

request which is a mandatory prerequisite for filing a lawsuit

seeking the annulment of Resolution No. 855 by the

administrative courts.

Change to Board of Directors

Effective 27 October 2025, Mr. Marcus Randolph joined

AngloGold Ashanti’s board of directors as an independent

non-executive director. Mr. Randolph serves as a member of

the Compensation and Human Resources Committee and

the Social, Ethics and Sustainability Committee.

Exploration update

For detailed disclosure on the exploration work done for the

three months ended 30 September 2025, see the

Exploration Update document on the Company’s website at

www.anglogoldashanti.com on both brownfield and

greenfield exploration programmes.

Serra Grande, Brazil

Q3 2025 EARNINGS RELEASE | 17 |  | |||

| ||||||

GROUP I FINANCIAL RESULTS | ||||||

REVISION NOTE

Revision to selected line items in prior period consolidated statements of financial position

The Company’s management has identified prior period errors relating to the classification of deferred and current taxation assets

and liabilities in the Company’s consolidated statements of financial position as at 31 December 2023, as at 30 September 2024

and as at 31 December 2024. Selected line items for those consolidated statements of financial position have been revised to

correct those errors, as presented in the tables that follow. Management has determined that these errors are not material.

As at 31 December 2024 | |||

US Dollar million | Previously Reported | Adjustments Unaudited | Revised Unaudited |

ASSETS | |||

Non-current assets | |||

Deferred taxation | 12 | 73 | 85 |

Total assets | 13,157 | 73 | 13,230 |

EQUITY AND LIABILITIES | |||

Non-current liabilities | |||

Deferred taxation | 519 | (17) | 502 |

Current liabilities | |||

Taxation | 187 | 90 | 277 |

Total liabilities | 4,644 | 73 | 4,717 |

As at 30 September 2024 | |||

US Dollar million | Previously Reported | Adjustments Unaudited | Revised Unaudited |

ASSETS | |||

Non-current assets | |||

Deferred taxation | 14 | 59 | 73 |

Total assets | 8,801 | 59 | 8,860 |

EQUITY AND LIABILITIES | |||

Non-current liabilities | |||

Deferred taxation | 464 | (27) | 437 |

Current liabilities | |||

Taxation | 171 | 86 | 257 |

Total liabilities | 4,629 | 59 | 4,688 |

As at 31 December 2023 | |||

US Dollar million | Previously Reported | Adjustments Unaudited | Revised Unaudited |

ASSETS | |||

Non-current assets | |||

Deferred taxation | 50 | 82 | 132 |

Total assets | 8,175 | 82 | 8,257 |

EQUITY AND LIABILITIES | |||

Current liabilities | |||

Taxation | 64 | 82 | 146 |

Total liabilities | 4,435 | 82 | 4,517 |

The revised amounts shown herein are preliminary, unaudited and have not been reviewed by PricewaterhouseCoopers Inc.,

the Company’s independent registered public accounting firm, and may be subject to change as the Company and

PricewaterhouseCoopers Inc. complete their procedures.

Controls and procedures

Management is also in the process of evaluating the nature and magnitude of the deficiency or deficiencies in the Company’s

internal control over financial reporting (“ICFR”) that led to these errors. The evaluation and remedial steps with regard to the

relevant deficiency or deficiencies will be considered as part of management’s assessment of the effectiveness of ICFR as of

31 December 2025 as will be disclosed in the Company’s annual report on Form 20-F for the financial year ending

31 December 2025.

Q3 2025 EARNINGS RELEASE | 18 |  | |||

| ||||||

GROUP I FINANCIAL RESULTS | ||||||

INCOME STATEMENT

GROUP INCOME STATEMENT | Quarter | Quarter | Nine months | Nine months |

ended | ended | ended | ended | |

Sep | Sep | Sep | Sep | |

2025 | 2024 | 2025 | 2024 | |

US Dollar millions, except as otherwise noted | Unaudited | Unaudited | Unaudited | Unaudited |

Revenue from product sales | 2,417 | 1,491 | 6,825 | 4,043 |

Cost of sales | (1,225) | (921) | (3,597) | (2,683) |

(Loss) gain on non-hedge derivatives and other commodity contracts | — | (29) | — | (70) |

Gross profit | 1,192 | 541 | 3,228 | 1,290 |

Corporate administration, marketing and related expenses | (32) | (20) | (93) | (86) |

Exploration and evaluation costs | (72) | (72) | (177) | (177) |

(Impairment) reversal of impairment, (derecognition of assets) and profit (loss) on disposal (1) | (3) | (13) | 22 | (14) |

Other expenses | (62) | (46) | (186) | (118) |

Finance income | 43 | 33 | 114 | 122 |

Foreign exchange and fair value adjustments | (12) | (21) | (57) | (46) |

Finance costs and unwinding of obligations | (81) | (42) | (166) | (126) |

Share of associates and joint ventures’ profit | 84 | 34 | 147 | 129 |

Profit before taxation | 1,057 | 394 | 2,832 | 974 |

Taxation | (242) | (160) | (669) | (419) |

Profit for the period | 815 | 234 | 2,163 | 555 |

Attributable to: | ||||

Equity shareholders | 669 | 223 | 1,781 | 534 |

Non-controlling interests | 146 | 11 | 382 | 21 |

815 | 234 | 2,163 | 555 | |

Basic earnings per ordinary share (US cents) (2) | 132 | 53 | 350 | 127 |

Diluted earnings per ordinary share (US cents) (3) | 131 | 53 | 350 | 127 |

(1) (Impairment) reversal of impairment, (derecognition of assets) and profit (loss) on disposal line item for the nine months ended 30 September 2025 includes a reversal of impairment for Mineração Serra Grande mine (MSG) of $74m (gross of taxation), partially offset by a loss on disposal of $47m relating to the sale of the Doropo and Archean-Birimian Contact (ABC) projects. | ||||

(2) Calculated on the basic weighted average number of ordinary shares. | ||||

(3) Calculated on the diluted weighted average number of ordinary shares. | ||||

Q3 2025 EARNINGS RELEASE | 19 |  | |||

| ||||||

GROUP I FINANCIAL RESULTS | ||||||

STATEMENT OF FINANCIAL POSITION

GROUP STATEMENT OF FINANCIAL POSITION | As at | As at | As at | |

Sep | Sep | Dec | ||

2025 | 2024 | 2024 | ||

US Dollar millions, except as otherwise noted | Unaudited | Unaudited Revised | Unaudited Revised | |

ASSETS | ||||

Non-current assets | ||||

Tangible assets | 8,456 | 4,724 | 8,512 | |

Right of use assets | 156 | 143 | 123 | |

Intangible assets | 105 | 109 | 98 | |

Investments in associates and joint ventures | 664 | 689 | 530 | |

Other investments | 13 | 48 | 54 | |

Loan receivable | 141 | 289 | 203 | |

Inventories | 170 | 20 | 158 | |

Trade, other receivables and other assets (1) (2) | 304 | 189 | 213 | |

Contingent considerations (2) | 68 | 34 | 30 | |

Reimbursive right for post-retirement benefits | 58 | 62 | 49 | |

Deferred taxation | 115 | 73 | 85 | |

Cash restricted for use | 43 | 34 | 41 | |

10,293 | 6,414 | 10,096 | ||

Current assets | ||||

Loan receivable | 269 | 105 | 260 | |

Inventories | 1,058 | 832 | 1,055 | |

Trade, other receivables and other assets (2) (3) | 404 | 253 | 356 | |

Contingent considerations (2) | 12 | 5 | 18 | |

Taxation | 7 | — | — | |

Cash restricted for use | 24 | 19 | 20 | |

Cash and cash equivalents | 2,546 | 1,232 | 1,425 | |

Assets held for sale (4) | 223 | — | — | |

4,543 | 2,446 | 3,134 | ||

Total assets | 14,836 | 8,860 | 13,230 | |

EQUITY AND LIABILITIES | ||||

Share capital and premium | 552 | 438 | 526 | |

Accumulated losses and other reserves | 7,138 | 3,689 | 6,103 | |

Shareholders’ equity | 7,690 | 4,127 | 6,629 | |

Non-controlling interests | 1,864 | 45 | 1,884 | |

Total equity | 9,554 | 4,172 | 8,513 | |

Non-current liabilities | ||||

Borrowings | 2,025 | 1,939 | 1,901 | |

Lease liabilities | 126 | 84 | 65 | |

Environmental rehabilitation and other provisions (5) | 751 | 650 | 656 | |