JANUARY 28, 2026 Capital markets day NYC

DISCLAIMER CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS Certain statements in this presentation (the “Presentation”) of Birkenstock Holding plc (together with all of its subsidiaries, the “Company,” “Birkenstock,” “we,” “our,” “ours,” or “us”) may constitute “forward-looking” statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Such forward-looking statements relate to our current expectations and views of future events, including our current expectations and views with respect to, among other things, our operations and financial performance. In particular, such forward-looking statements include statements relating to our 2026 fiscal year outlook. Forward-looking statements include all statements that do not relate to matters of historical fact. In some cases, you can identify these forward-looking statements by the use of words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” “aim,” “anticipate,” “assume,”, “continue,” “could,”, “expect,” “forecast,” “guidance,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would” or similar words or phrases, or the negatives of those words or phrases. The forward-looking statements contained in this Presentation are based on the Company’s current expectations and are not guarantees of future performance. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Our actual results could differ materially from those expected in our forward-looking statements for many reasons, including: our dependence on the image and reputation of the BIRKENSTOCK brand; the intense competition we face from both established companies and newer entrants into the market; our ability to execute our DTC growth strategy and risks associated with our e-commerce platforms; our ability to adapt to changes in consumer preferences and attract new customers; our ability to attract and retain customers, and the effectiveness and efficiency of our marketing efforts; risks related to merchandise returns; harm to our brand and market share due to counterfeit products; our ability to successfully operate and expand retail stores, and our dependence on favorable lease terms, brand awareness and the ability to hire adequate staff to successfully operate such retail stores; economic conditions impacting consumer spending, such as inflation, tariffs and other trade policy actions, the deterioration of consumer sentiment, a deterioration of the macroeconomic situation generally, and our ability to react to any of them; the relative illiquidity of our real property investments and our ability to sell properties on reasonable terms in response to changing economic, financial and investment conditions; risks related to our non-footwear products; failure to realize expected returns from our investments in our businesses and operations; our ability to adequately manage our acquisitions, investments or other strategic initiatives; our ability to manage our operations at our current size or manage future growth effectively; currency exchange rate fluctuations; risks related to global or regional health events; our dependence on third parties for our sales and distribution channels, as well as deterioration or termination of relationships with major wholesale partners; risks related to the conversion of wholesale distribution markets to owned and operated markets and risks related to productivity or efficiency initiatives; operational challenges related to the distribution of our products; seasonality, weather conditions and climate change; adverse events influencing the sustainability of our supply chain or our relationships with major suppliers, or increases in raw materials or labor costs; our ability to effectively manage inventory; unforeseen business interruptions and other operational problems at our production facilities, as well as disruptions to our shipping and delivery arrangements; fluctuations in product costs and availability due to fuel price uncertainty; failure to attract, hire, train and retain key employees and deterioration of relationships with employees, employee representative bodies and stakeholders; our dependence on the services and reputation of our Chief Executive Officer; adequate protection, maintenance and enforcement of our trademarks and other intellectual property rights; regulations governing the use and processing of personal data, as well as disruption and security breaches affecting information technology systems; payment-related risks related to the use of credit cards and debit cards; the reliance of our operations, products, systems and services on complex IT systems; risks related to international markets; risks related to litigation, compliance and regulatory matters, including corporate responsibility and ESG matters; risks related to climate change and regulatory responses to it; inadequate insurance coverage, or increased insurance costs; compliance with existing laws and regulations or changes in such laws and regulations; tax-related risks; risks related to our amount of indebtedness, its restrictive covenants and our ability to repay our debt; control by our Principal Shareholder whose interests may conflict with ours or yours in the future; material weaknesses identified in our internal control over financial reporting and our ability to remediate such material weaknesses; our status as a foreign private issuer and as a “controlled company” within the meaning of the NYSE rules; natural disasters, public health crises, political crises, civil unrest and other catastrophic events beyond control and the factors described in the sections titled “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors” in our Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission on December 18, 2025, as updated, from time to time, by our reports on Form 6-K that update, supplement or supersede such information. Any forward-looking statement made by us in this Presentation speaks only as of the date of this Presentation and is expressly qualified in its entirety by the cautionary statements included in this Presentation. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law. NON-IFRS FINANCIAL INFORMATION This Presentation includes “non-IFRS measures” that are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). Specifically, we make use of the non-IFRS financial measures adjusted earnings per share (EPS) (basic/diluted), adjusted EBITDA, adjusted EBITDA margin, adjusted gross profit, adjusted gross profit margin, adjusted net profit, adjusted general administrative expenses, net debt, net leverage, average selling price, and metrics on a constant currency basis, which are not recognized measures under IFRS and should not be considered as alternatives to net profit (loss) or revenue as a measure of financial performance or any other performance measure derived in accordance with IFRS. We discuss non-IFRS financial measures in this Presentation because they are a basis upon which our management assesses our performance, and we believe they reflect underlying trends and are indicators of our business. Additionally, we believe that such non-IFRS financial measures and similar measures are widely used by securities analysts, investors and other interested parties as a means of evaluating a company’s performance. Our non-IFRS financial measures may not be comparable to similarly titled measures used by other companies. Our non-IFRS financial measures have limitations as analytical tools, as they do not reflect all the amounts associated with our results of operations as determined in accordance with IFRS. Our non-IFRS financial measures should not be considered in isolation, nor should they be regarded as a substitute for, or superior to, measures calculated and presented in accordance with IFRS. A reconciliation is provided in the Appendix to this Presentation for each non-IFRS financial measure in this Presentation to the most directly comparable financial measure stated in accordance with IFRS. A reconciliation is not provided for any forward-looking non-IFRS financial measures as such a reconciliation is not available without unreasonable efforts. Average selling price (“ASP”) is calculated by dividing our total revenue from sales of footwear pairs by the number of footwear pairs sold. Prior to fiscal 2024, ASP was calculated by dividing our total revenue by our total number of units of all products sold. The difference between these two methods is immaterial. Our management uses group ASP in managing and monitoring the performance of the business. We believe presenting a directional change in ASP provides useful information to investors as it helps facilitate an enhanced understanding of our operating results and enables them to make more meaningful period-to-period comparisons, particularly because a change in ASP is typically one of several principal drivers of our revenue development between periods. However, in channels and segments, ASP can vary significantly based on various factors and circumstances, and, therefore, management believes that quantifying ASP or the directional change thereof at segment or channel level would provide a level of granularity not considered helpful and potentially misleading. In addition, we also present ASP growth on a constant currency basis. We define constant currency ASP as ASP excluding the effect of foreign exchange rate movements and use constant currency ASP to determine constant currency ASP growth on a comparative basis. Constant currency ASP is calculated by translating the current period foreign currency ASP using the prior period exchange rate. Constant currency ASP growth is calculated by determining the increase in current period ASP as compared to the prior period ASP, where current period foreign currency ASP is translated using prior period exchange rates. We believe that presenting ASP growth on a constant currency basis offers valuable insight to both management and investors by isolating the Company’s operational performance from foreign exchange rate fluctuations, which are beyond the Company’s control. 2

CAPITAL MARKETS DAY SCHEDULE 3 9:00 – 9:10 Welcome & Introductions Megan Kulick, Director IR 9:10 – 9:30 Opening Remarks Oliver Reichert, CEO 9:30 – 10:00 Q1 Review & 3-Year Outlook Ivica Krolo, CFO 10:00 – 10:15 Opening Q&A 10:15 – 10:30 Coffee Break 10:30 – 11:30 Segment Overview David Kahan, President Americas Nico Bouyakhf, President EMEA Klaus Baumann, CSO, President APAC 11:30 – 12:00 Product Markus Baum, CPO 12:00 – 12:45 Lunch Break / Tour Product Display 12:45 – 1:00 Video Tour of Manufacturing 1:00 – 1:30 Supply Chain Jakub Nachtigall, VP Operational Excellence 1:30 – 2:30 Final Q&A

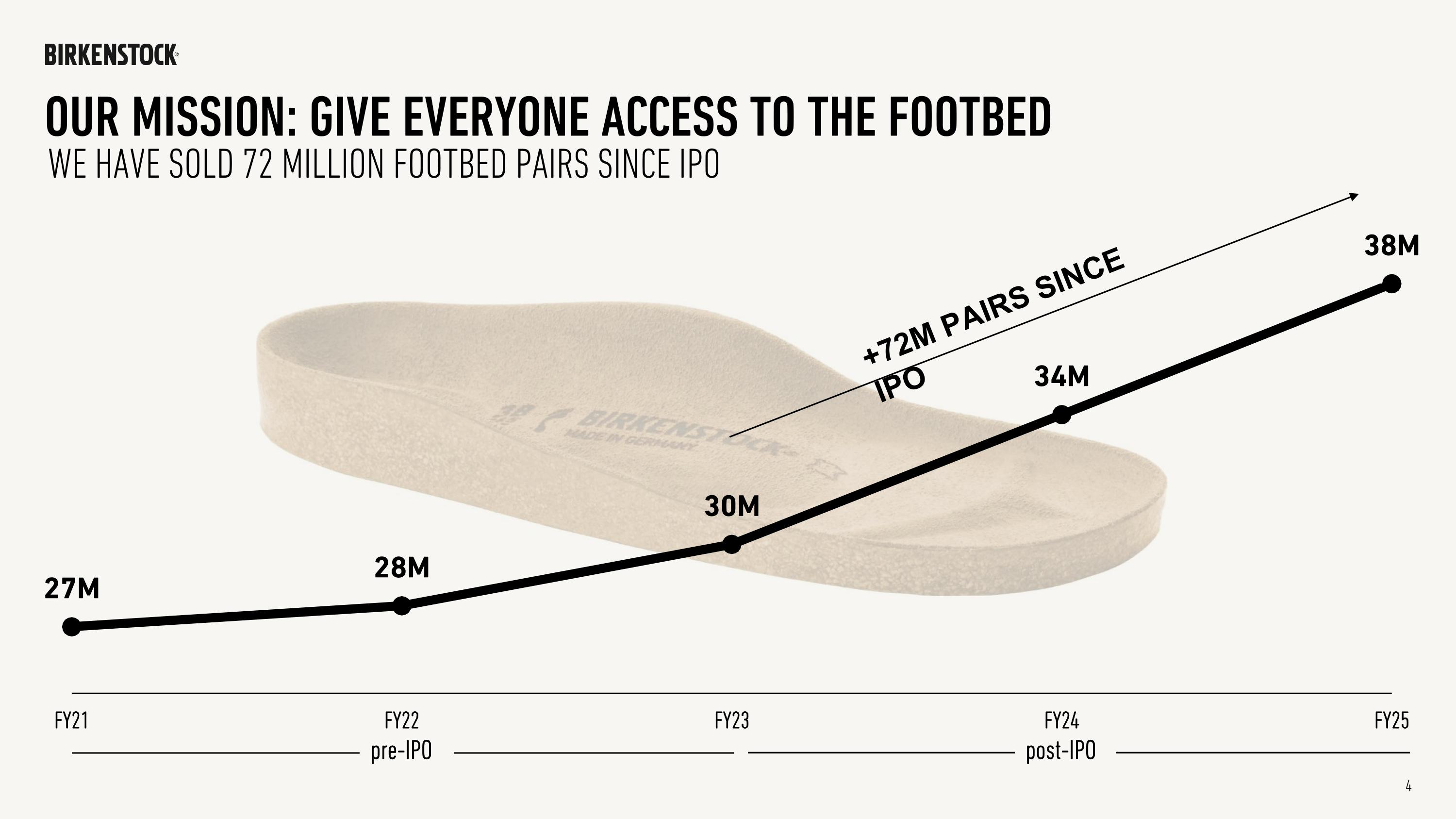

27M FY21 28M FY22 30M FY23 34M FY24 38M FY25 post-IPO OUR Mission: GIVE EVERYONE access to the footbed WE HAVE SOLD 72 MILLION FOOTBED PAIRS SINCE IPO pre-IPO 4 +72M PAIRS SINCE IPO

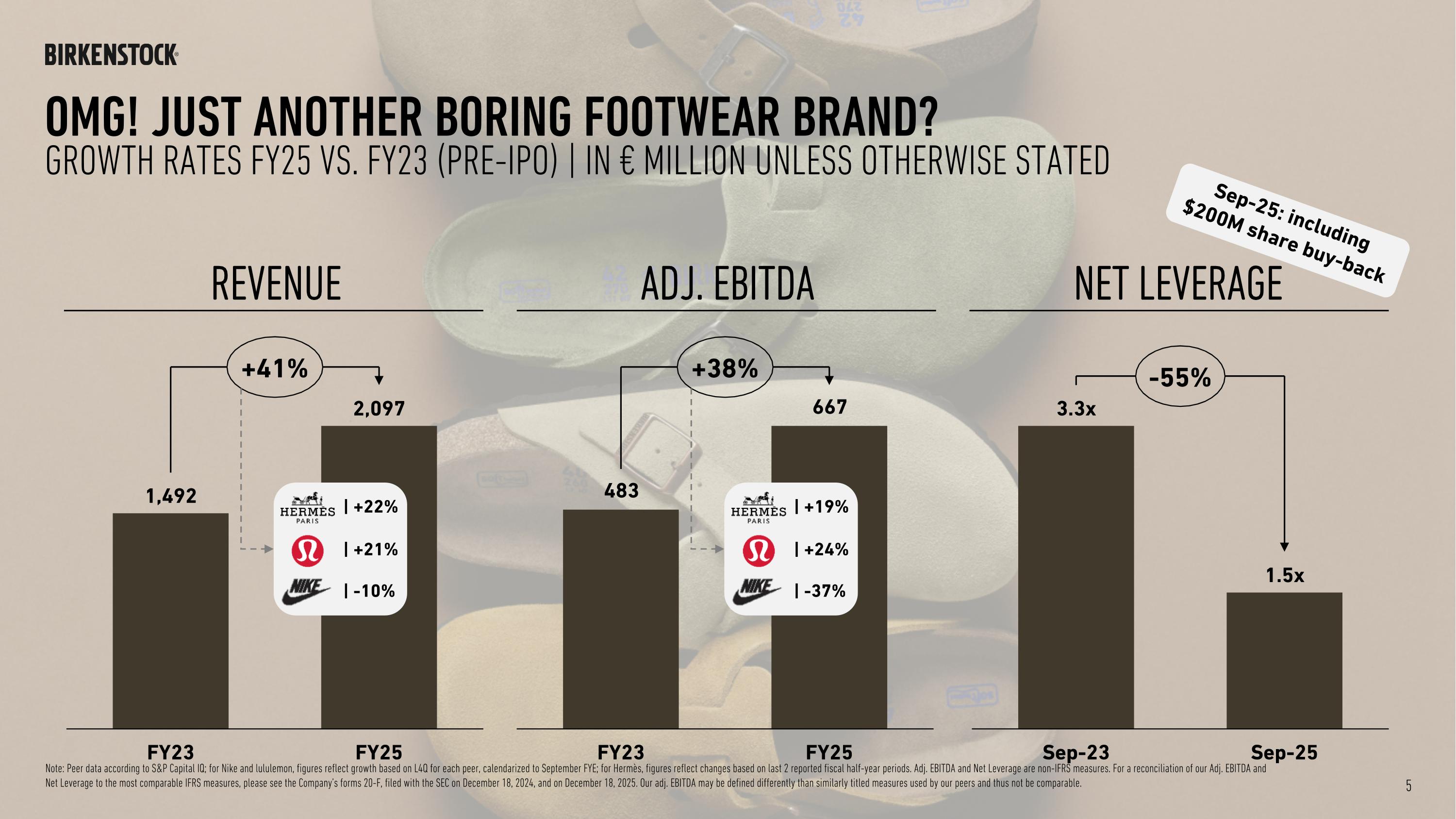

OMG! JUST ANOTHER BORING FOOTWEAR BRAND? Note: Peer data according to S&P Capital IQ; for Nike and lululemon, figures reflect growth based on L4Q for each peer, calendarized to September FYE; for Hermès, figures reflect changes based on last 2 reported fiscal half-year periods. Adj. EBITDA and Net Leverage are non-IFRS measures. For a reconciliation of our Adj. EBITDA and Net Leverage to the most comparable IFRS measures, please see the Company’s forms 20-F, filed with the SEC on December 18, 2024, and on December 18, 2025. Our adj. EBITDA may be defined differently than similarly titled measures used by our peers and thus not be comparable. Growth rates FY25 vs. FY23 (pre-IPO) | IN € MILLION UNLESS OTHERWISE STATED REVENUE ADJ. EBITDA NET LEVERAGE FY23 FY25 1,492 2,097 +41% FY23 FY25 +38% Sep-23 Sep-25 3.3x 1.5x -55% | -10% | +22% | +21% | -37% | +24% | +19% 5 Sep-25: including $200M share buy-back

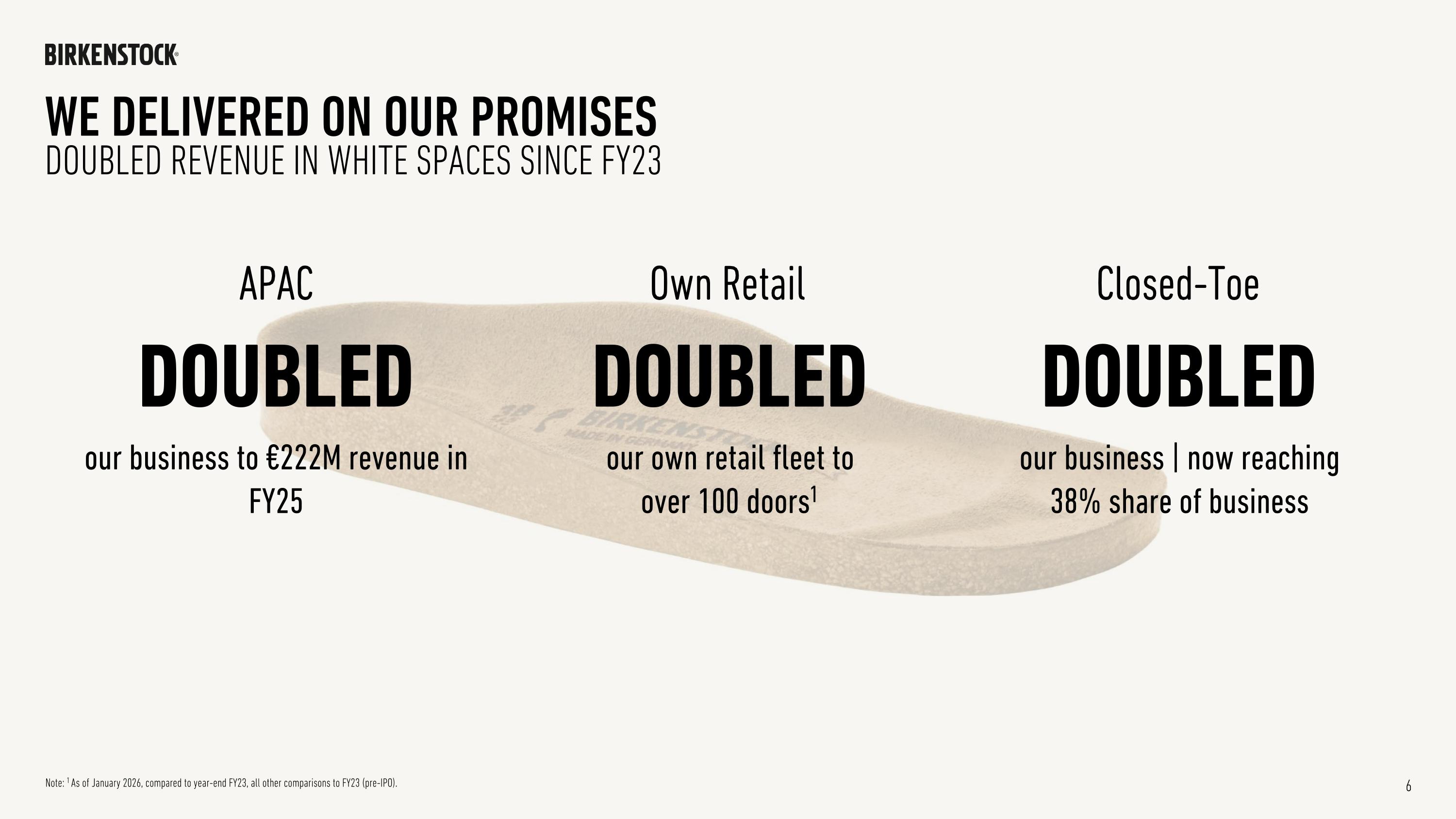

WE DELIVERED ON OUR PROMISES DOUBLED REVENUE IN WHITE SPACES SINCE FY23 Note: 1 As of January 2026, compared to year-end FY23, all other comparisons to FY23 (pre-IPO). APAC DOUBLED our business to €222M revenue in FY25 Own Retail DOUBLED our own retail fleet to over 100 doors1 Closed-Toe DOUBLED our business | now reaching 38% share of business 6

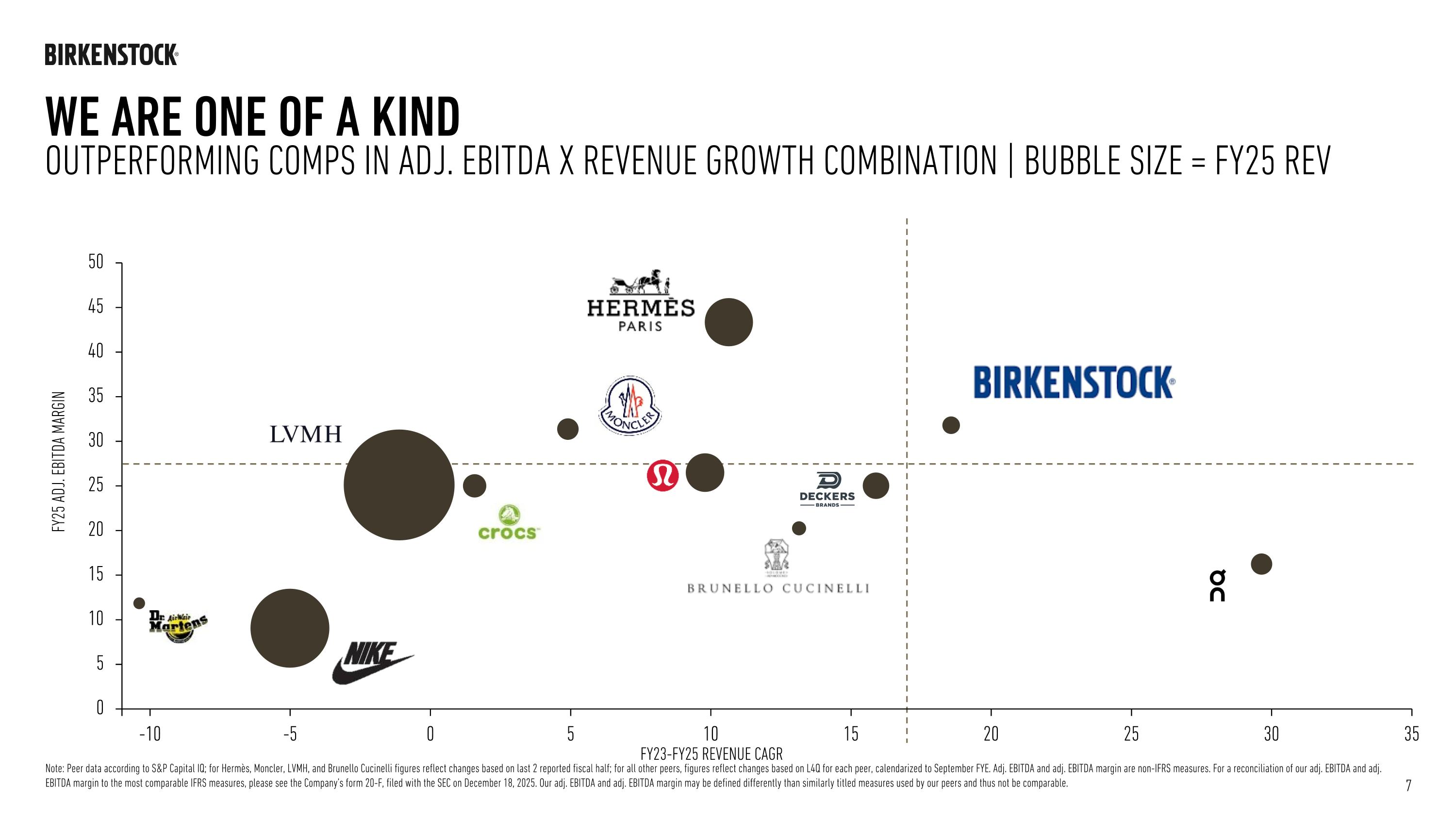

-10 -5 0 5 10 15 20 25 30 35 OUTPERFORMING COMPS IN Adj. EBITDA x REVENUE GROWTH COMBINATION | BUBBLE SIZE = FY25 REV We are one of a KIND FY23-FY25 Revenue CAGR FY25 Adj. EBITDA Margin Note: Peer data according to S&P Capital IQ; for Hermès, Moncler, LVMH, and Brunello Cucinelli figures reflect changes based on last 2 reported fiscal half; for all other peers, figures reflect changes based on L4Q for each peer, calendarized to September FYE. Adj. EBITDA and adj. EBITDA margin are non-IFRS measures. For a reconciliation of our adj. EBITDA and adj. EBITDA margin to the most comparable IFRS measures, please see the Company’s form 20-F, filed with the SEC on December 18, 2025. Our adj. EBITDA and adj. EBITDA margin may be defined differently than similarly titled measures used by our peers and thus not be comparable. 7

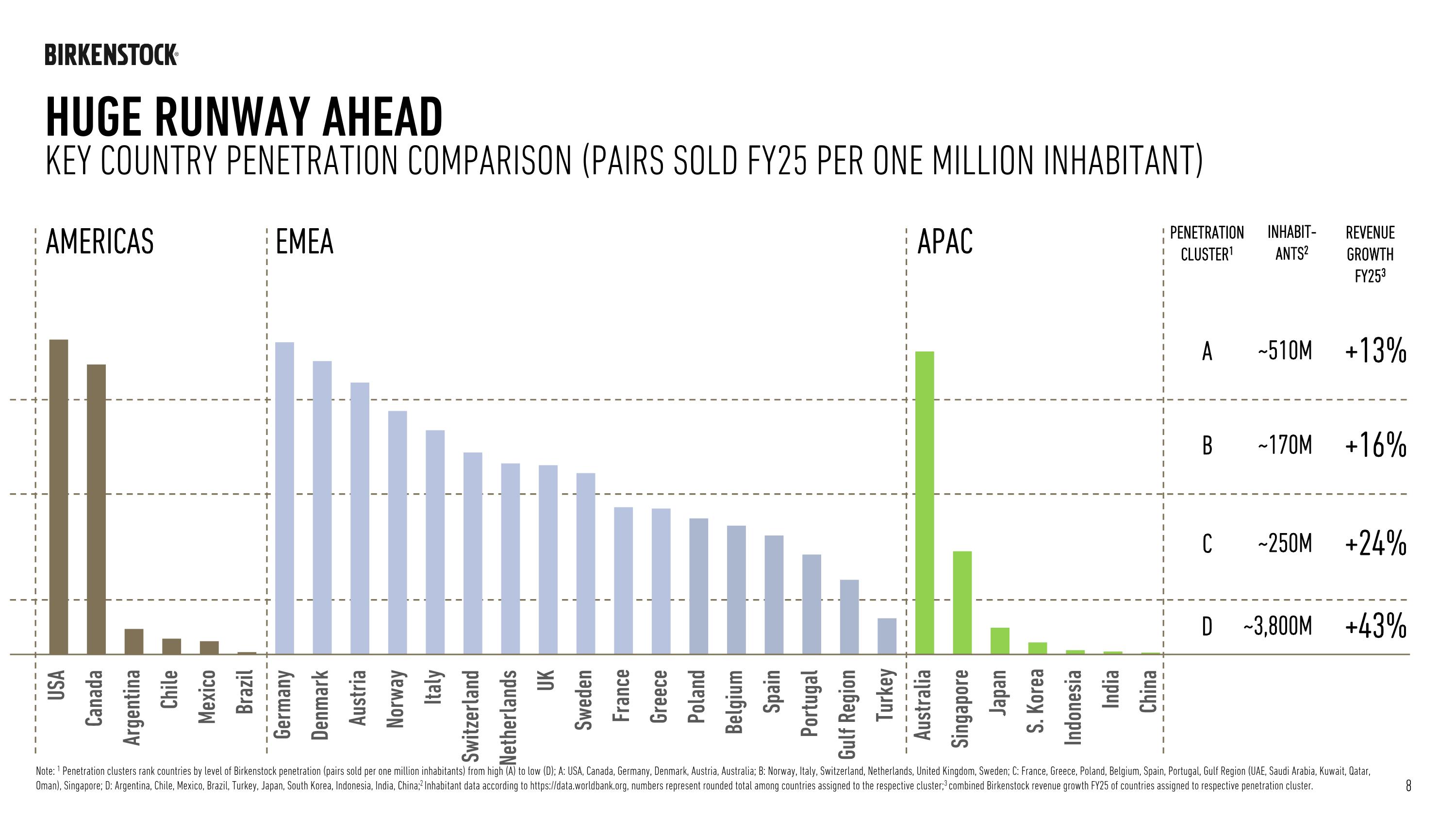

+16% Inhabit-ants2 Penetration Cluster1 Revenue growth FY253 ~510M A +13% ~170M B ~250M C +24% ~3,800M D +43% Note: 1 Penetration clusters rank countries by level of Birkenstock penetration (pairs sold per one million inhabitants) from high (A) to low (D); A: USA, Canada, Germany, Denmark, Austria, Australia; B: Norway, Italy, Switzerland, Netherlands, United Kingdom, Sweden; C: France, Greece, Poland, Belgium, Spain, Portugal, Gulf Region (UAE, Saudi Arabia, Kuwait, Qatar, Oman), Singapore; D: Argentina, Chile, Mexico, Brazil, Turkey, Japan, South Korea, Indonesia, India, China; 2 Inhabitant data according to https://data.worldbank.org, numbers represent rounded total among countries assigned to the respective cluster; 3 combined Birkenstock revenue growth FY25 of countries assigned to respective penetration cluster. HUGE RUNWAY AHEAD Key Country Penetration comparison (Pairs sold FY25 per ONE million Inhabitant) AMERICAS EMEA APAC 8

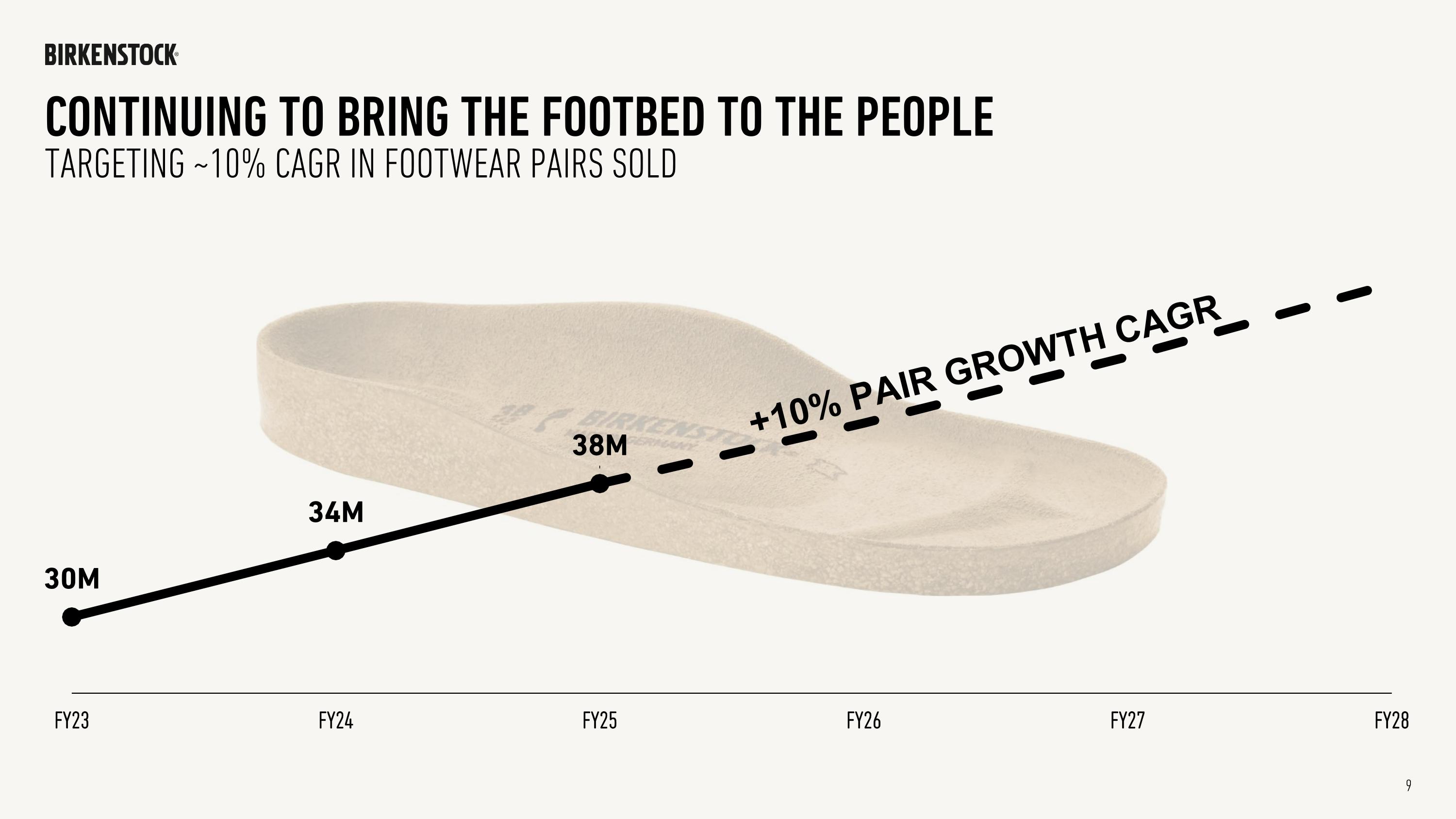

30M FY23 34M FY24 38M FY25 FY26 FY27 FY28 ContinuING to bring THE FOOTBED TO THE PEOPLE TARGETING ~10% CAGR IN FOOTWEAR PAIRS SOLD +10% PAIR GROWTH CAGR 9

PRELIMINARY RESULTS Q1 FY26

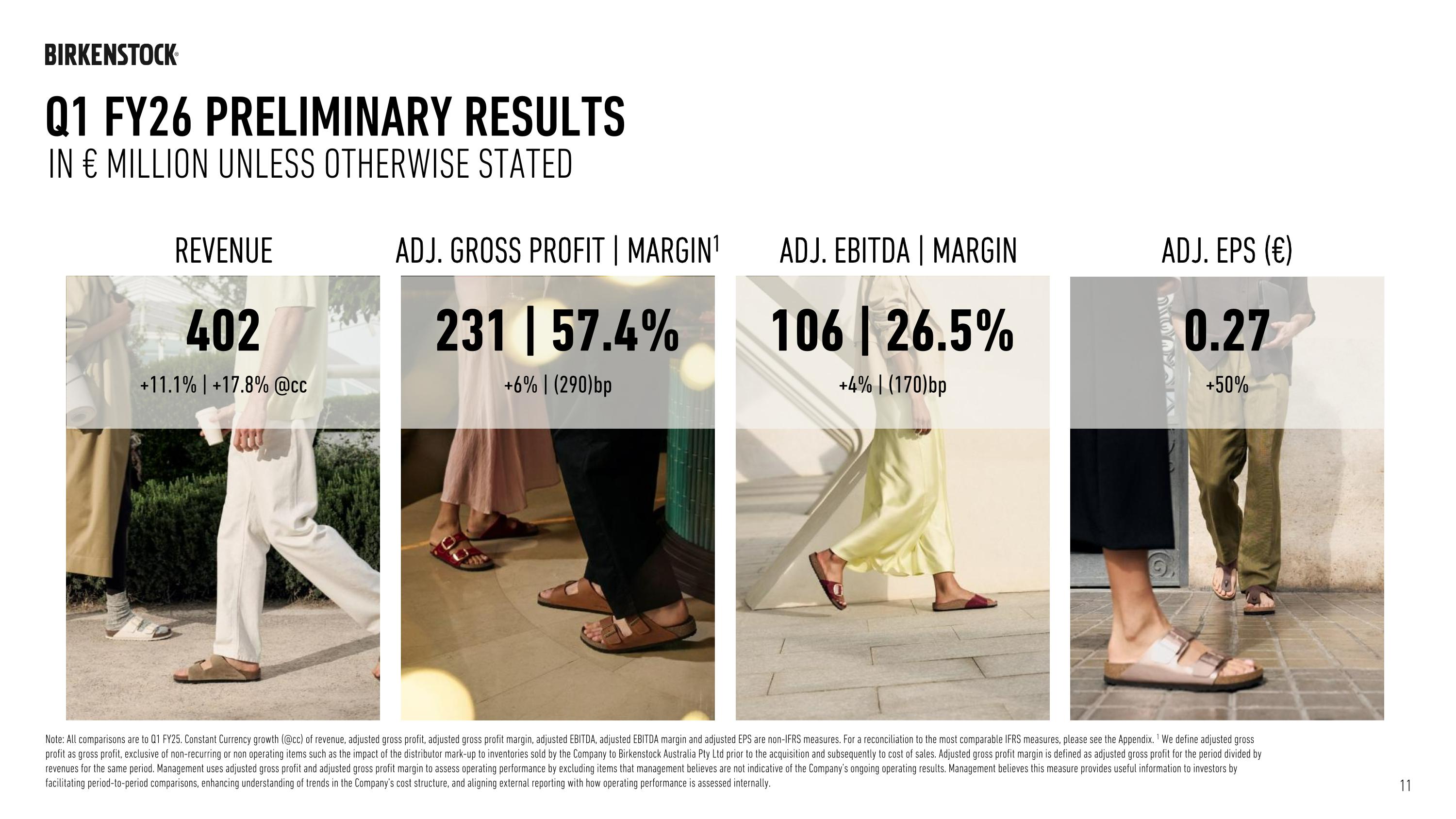

IN € MILLION UNLESS OTHERWISE STATED REVENUE ADJ. EPS (€) ADJ. GROSS PROFIT | MARGIN1 ADJ. EBITDA | MARGIN 231 | 57.4% +6% | (290)bp 402 +11.1% | +17.8% @cc 106 | 26.5% +4% | (170)bp 0.27 +50% Note: All comparisons are to Q1 FY25. Constant Currency growth (@cc) of revenue, adjusted gross profit, adjusted gross profit margin, adjusted EBITDA, adjusted EBITDA margin and adjusted EPS are non-IFRS measures. For a reconciliation to the most comparable IFRS measures, please see the Appendix. 1 We define adjusted gross profit as gross profit, exclusive of non-recurring or non operating items such as the impact of the distributor mark-up to inventories sold by the Company to Birkenstock Australia Pty Ltd prior to the acquisition and subsequently to cost of sales. Adjusted gross profit margin is defined as adjusted gross profit for the period divided by revenues for the same period. Management uses adjusted gross profit and adjusted gross profit margin to assess operating performance by excluding items that management believes are not indicative of the Company’s ongoing operating results. Management believes this measure provides useful information to investors by facilitating period-to-period comparisons, enhancing understanding of trends in the Company’s cost structure, and aligning external reporting with how operating performance is assessed internally. Q1 FY26 Preliminary Results 11

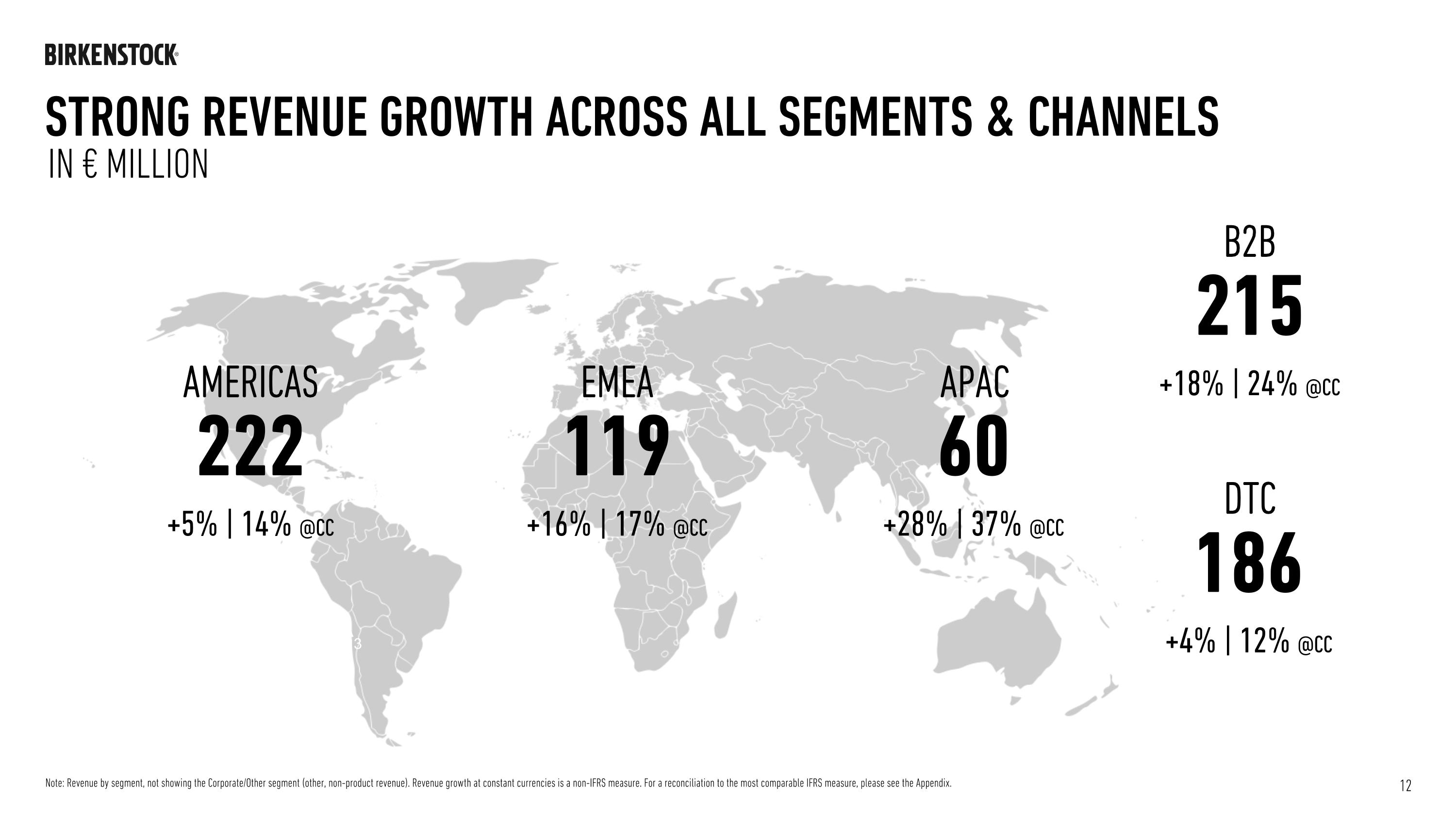

Adj. EBITDA MARGIN3 IN € MILLION 222 +5% | 14% @cc AMERICAS 119 +16% | 17% @cc EMEA 60 +28% | 37% @cc APAC 215 +18% | 24% @cc B2B 186 +4% | 12% @cc DTC Strong REVENUE growth across all segments & Channels Note: Revenue by segment, not showing the Corporate/Other segment (other, non-product revenue). Revenue growth at constant currencies is a non-IFRS measure. For a reconciliation to the most comparable IFRS measure, please see the Appendix. 12

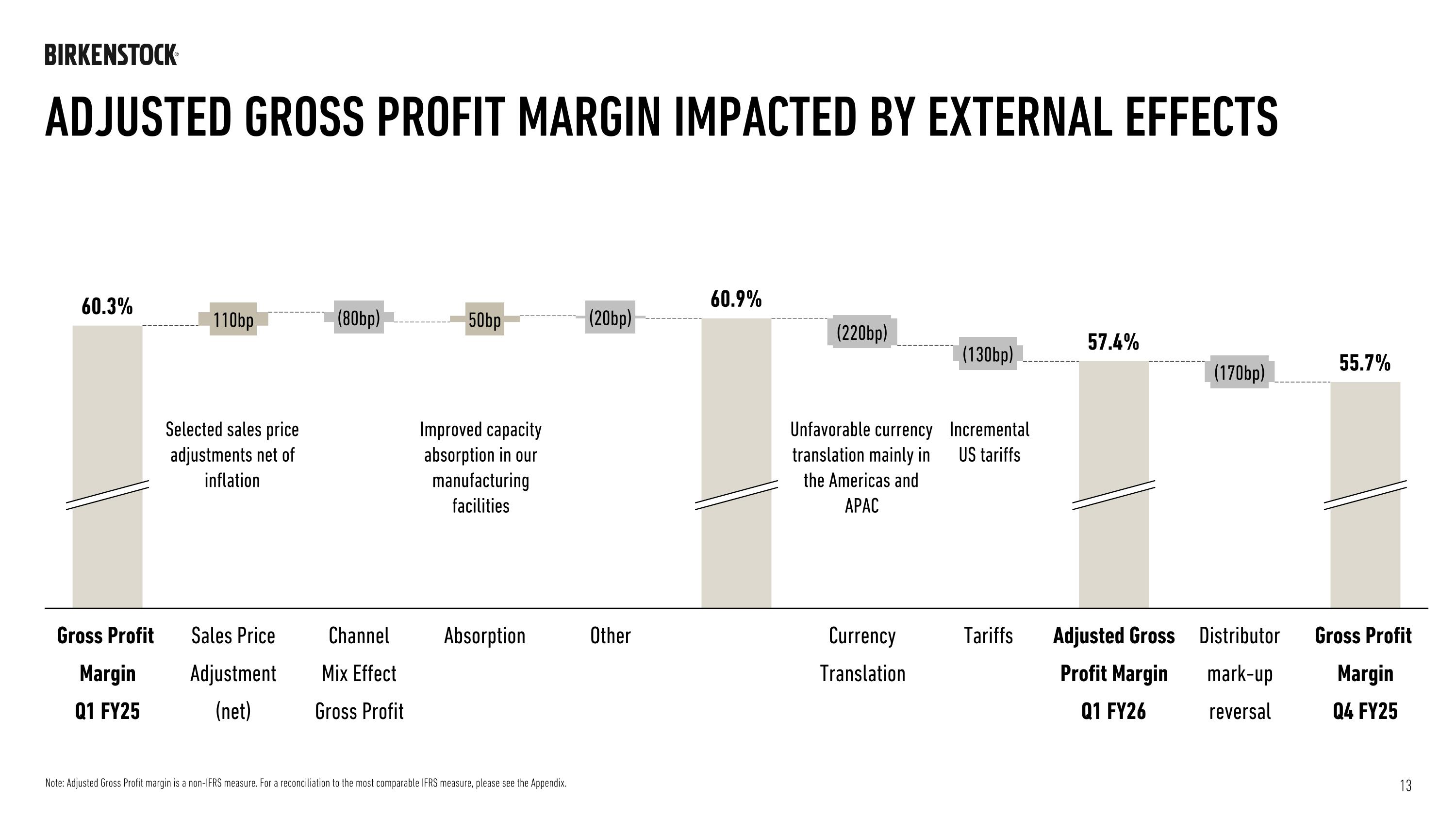

Adjusted Gross PROFIT MARGIN IMPACTED BY EXTERNAL EFFECTS 13 Note: Adjusted Gross Profit margin is a non-IFRS measure. For a reconciliation to the most comparable IFRS measure, please see the Appendix. Gross Profit

Margin

Q1 FY25 110bp Sales Price

Adjustment (net) (80bp) Channel Mix Effect

Gross Profit Absorption (20bp) Other (220bp) Currency

Translation (130bp) Adjusted Gross Profit Margin

Q1 FY26 60.3% 60.9% 57.4% 55.7% Tariffs Gross Profit

Margin

Q4 FY25 50bp Distributor

mark-up reversal (170bp) Selected sales price adjustments net of inflation Improved capacity absorption in our manufacturing facilities Incremental US tariffs Unfavorable currency translation mainly in the Americas and APAC

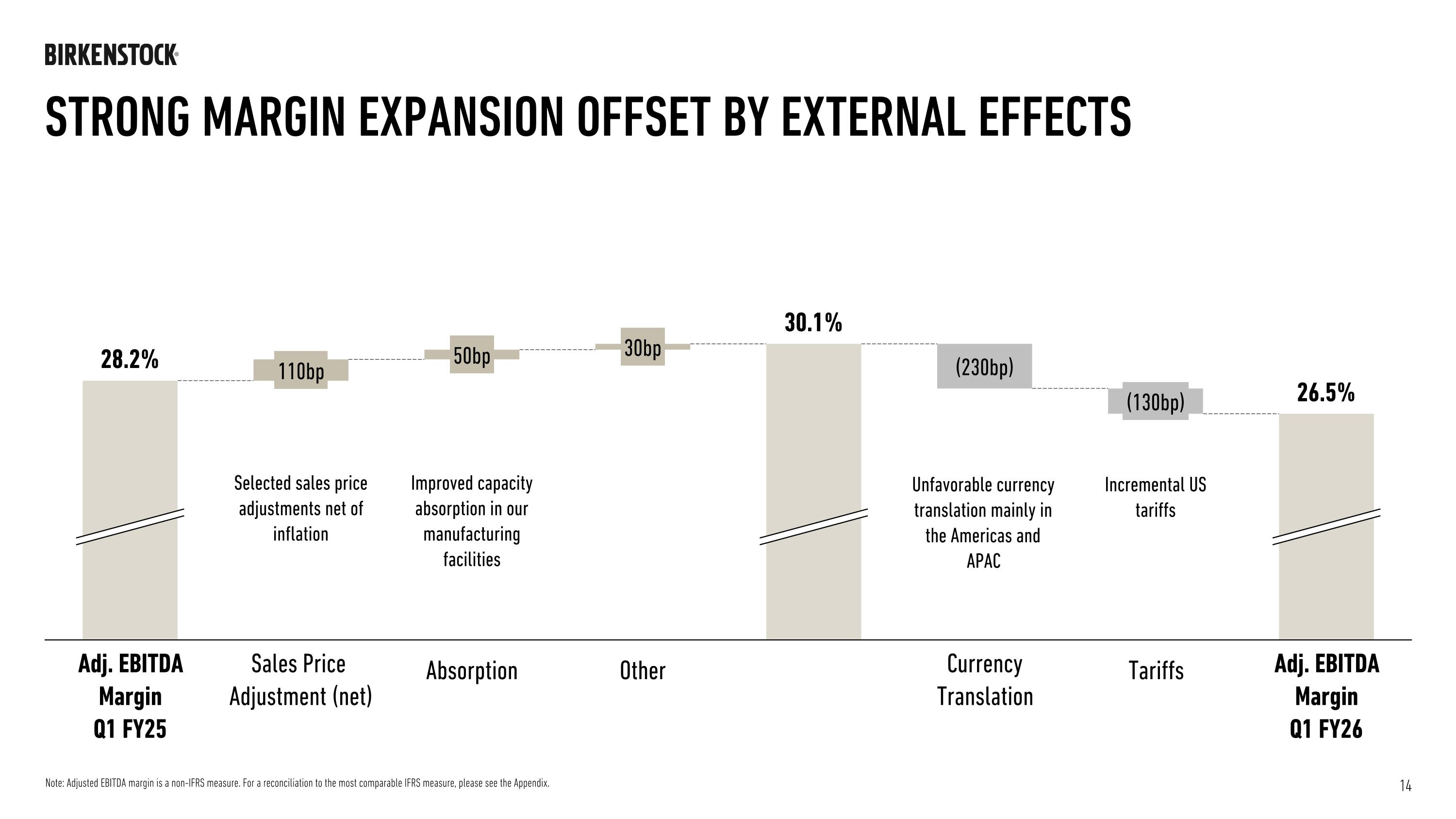

STRONG MARGIN EXPANSION OFFSET BY EXTERNAL EFFECTS Adj. EBITDA Margin

Q1 FY25 110bp Sales Price

Adjustment (net) 50bp Absorption 30bp Other (230bp) Currency

Translation (130bp) Tariffs Adj. EBITDA Margin

Q1 FY26 28.2% 30.1% 26.5% Unfavorable currency translation mainly in the Americas and APAC Selected sales price adjustments net of inflation Incremental US tariffs Improved capacity absorption in our manufacturing facilities 14 Note: Adjusted EBITDA margin is a non-IFRS measure. For a reconciliation to the most comparable IFRS measure, please see the Appendix.

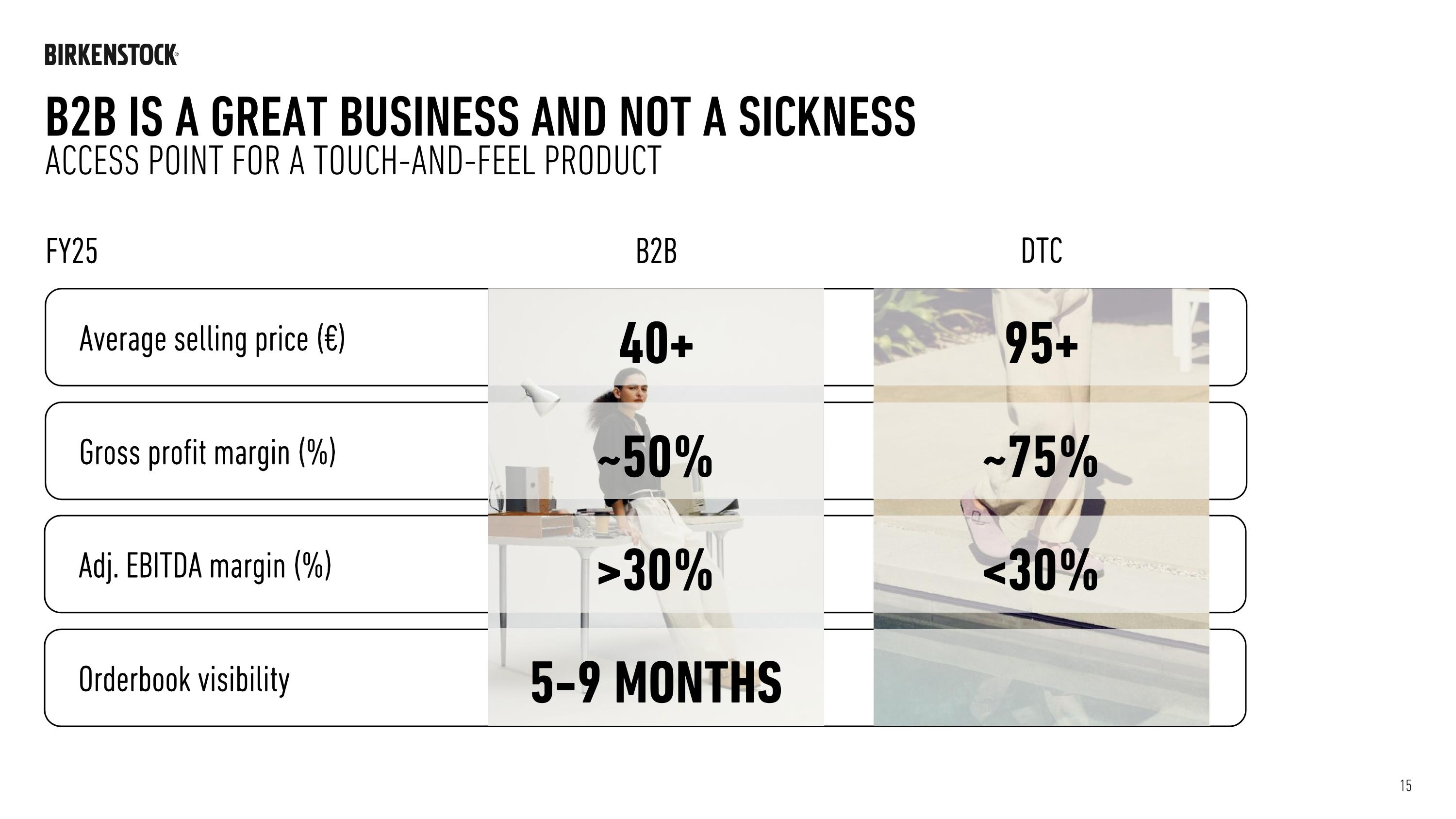

B2b is a great business and NOT A SICKNESS ACCESS POINT FOR A TOUCH-AND-FEEL PRODUCT Average selling price (€) B2B DTC 40+ Gross profit margin (%) Adj. EBITDA margin (%) Orderbook visibility 95+ ~50% ~75% >30% <30% 5-9 Months FY25 15

OUTLOOK FY26-FY28

2028T 2026E Revenue growth2 Adj. GROSS PROFIT MARGIN4 ADJ. EBITDA MARGIN +13-15% @cc €2.30 – 2.35BN3 | +10-12% +13-15% @cc ~57-58% 57.0-57.5% Incl tariff and FX headwind of 200bps 30.0-30.5% Incl tariff and FX headwind of 200bps 30%+ FY26-FY28 outlook: Double-digit revenue and eps growth1 ADJ. Eps GROWTH €1.90-2.05 Incl tariff and FX headwind of €0.15-0.20 ~200BPS Faster than revenue growth Note: See cautionary statement regarding forward-looking statements included elsewhere in this Presentation. Constant Currency growth (@cc) of revenue, adjusted gross profit margin, adjusted EBITDA margin and adjusted EPS are non-IFRS measures. For a reconciliation of historical non-IFRS measures to the most comparable IFRS measure, please see the Appendix and the Company’s form 20-F, filed with the SEC on December 18, 2025. 1 This outlook is based on the following assumptions: A EUR/USD exchange rate of 1.17 (rate as of December 18, 2025 when 2026 guidance was established); no further escalation in US tariff rate; and share buybacks of ~USD 200 million per year; 2 FY26e-FY28t CAGR at constant currencies. 3 based on EUR/USD exchange rate of 1.17. 4 We define adjusted gross profit as gross profit, exclusive of non-recurring or non operating items such as the impact of the distributor mark-up to inventories sold by the Company to Birkenstock Australia Pty Ltd prior to the acquisition and subsequently to cost of sales. Adjusted gross profit margin is defined as adjusted gross profit for the period divided by revenues for the same period. Management uses adjusted gross profit and adjusted gross profit margin to assess operating performance by excluding items that management believes are not indicative of the Company’s ongoing operating results. Management believes this measure provides useful information to investors by facilitating period-to-period comparisons, enhancing understanding of trends in the Company’s cost structure, and aligning external reporting with how operating performance is assessed internally. 17

Targeting €1 billion of incremental revenue in the next 3 years Note: 1 Targeted incremental annual revenue in FY28 vs. FY25, assuming the mid-point of the 13-15% guidance and a foreign exchange rate of EUR/IUSD 1.17; Constant Currency growth (@cc) of revenue is a non-IFRS measure. For a reconciliation to the most comparable IFRS measure, please see the Company’s form 20-F, filed with the SEC on December 18, 2025. EMEA AMERICAS +€1 BILLION1 [+13-15% @cc] APAC double-digit Growth DOUBLING THE BUSINESS double-digit GROWTH 18

AMERICAS Picture

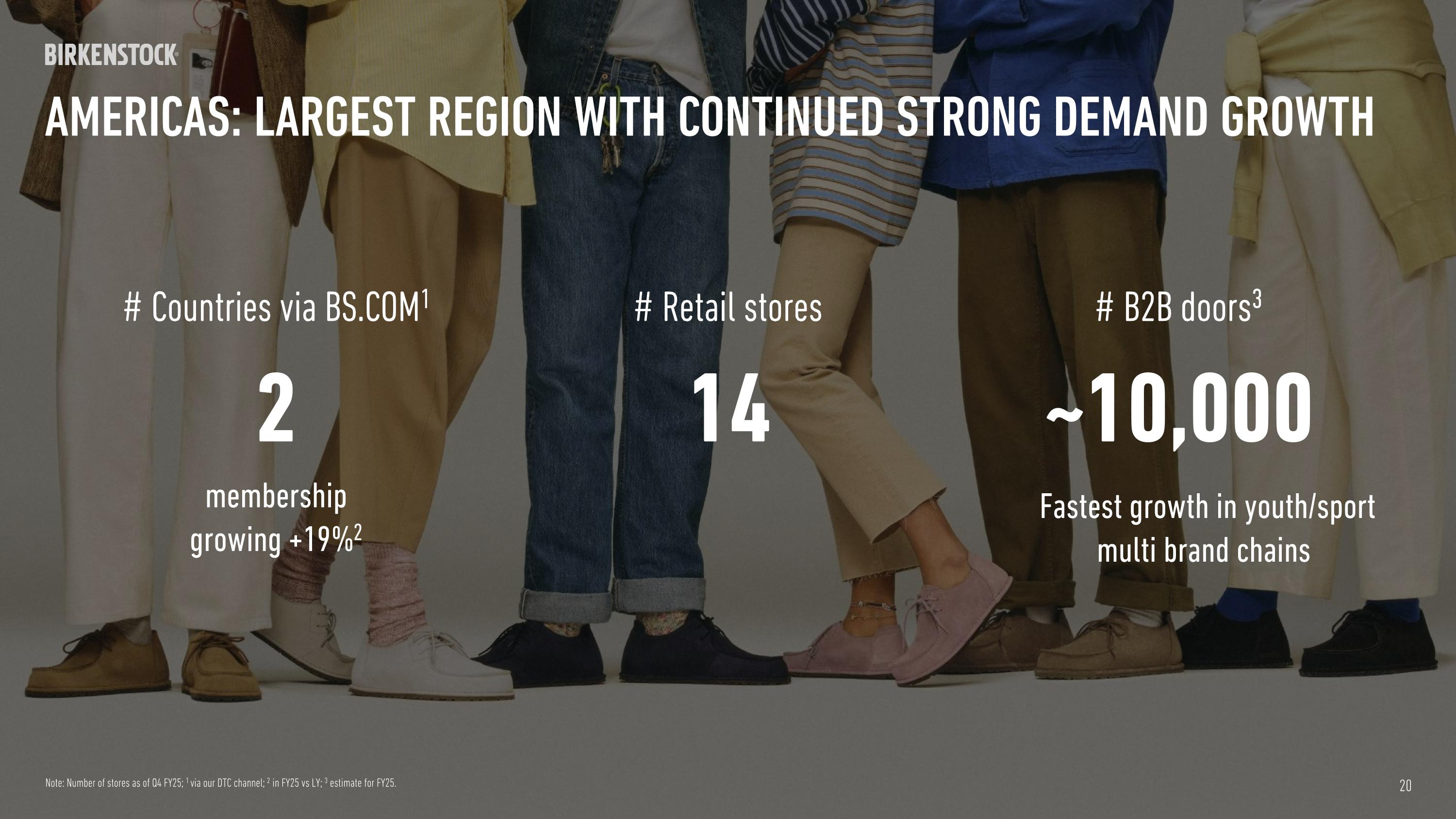

AMERICAS: Largest region with continued strong demand growth Note: Number of stores as of Q4 FY25; 1 via our DTC channel; 2 in FY25 vs LY; 3 estimate for FY25. # Countries via BS.COM1 2 membership growing +19%2 # Retail stores 14 # B2B doors3 ~10,000 Fastest growth in youth/sport multi brand chains 20

AMERICAS CONTRIBUTING 10%+ CAGR OVER NEXT 3 YEARS Emerging youth Fastest growing demographic adding lifetime value B2b continues to lead DTC driven by new retail 21 Note: Targeted growth FY28 vs. FY25.

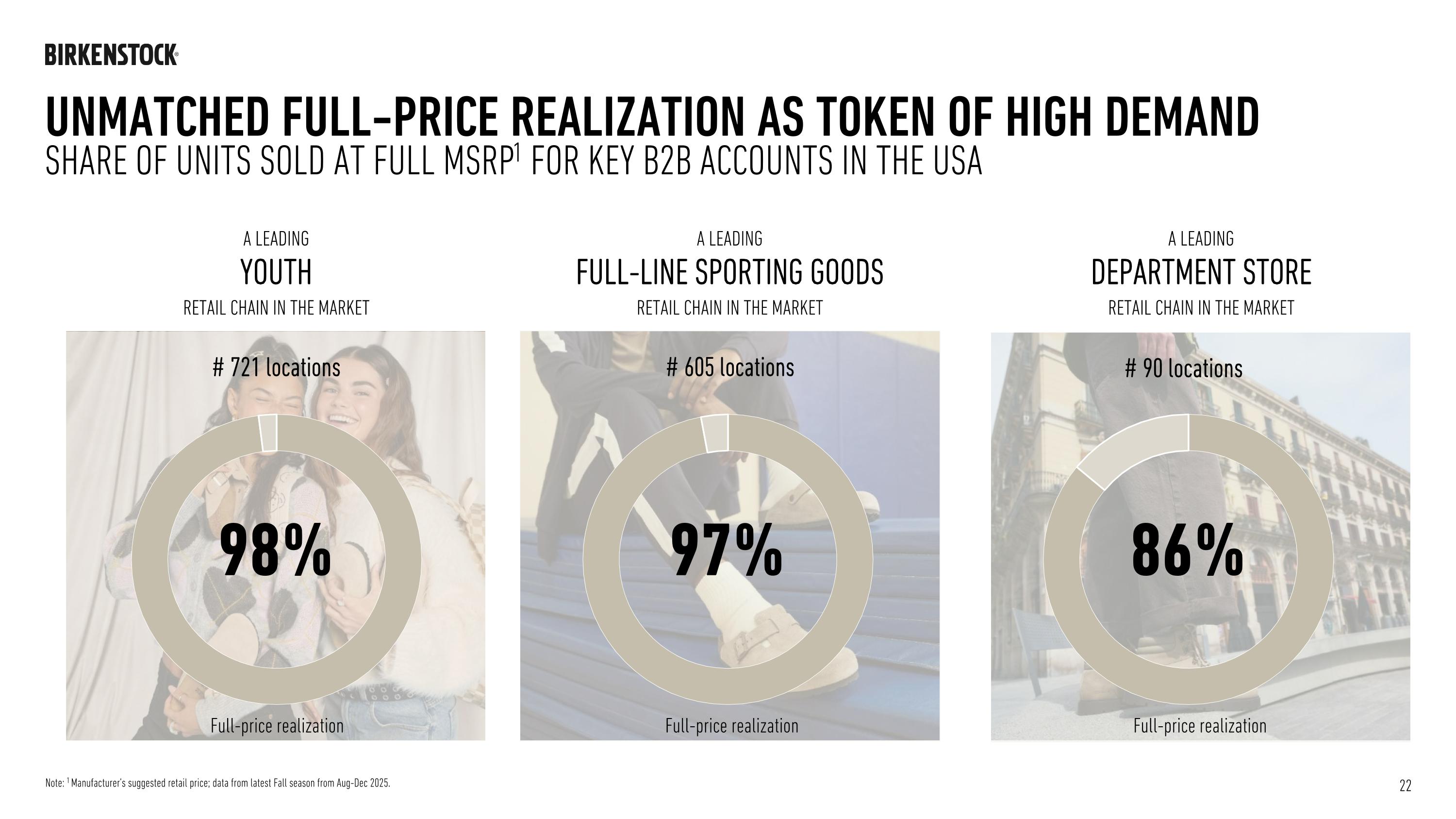

unmatched full-price realization as token of HIGH demand Share of units sold at full MSRP1 for key B2B accounts in the USA A LEADING YOUTH RETAIL CHAIN IN THE MARKET Note: 1 Manufacturer’s suggested retail price; data from latest Fall season from Aug-Dec 2025. # 605 locations 97% A LEADING FULL-LINE SPORTING GOODS RETAIL CHAIN IN THE MARKET A LEADING DEPARTMENT STORE RETAIL CHAIN IN THE MARKET # 721 locations 98% # 90 locations 86% 22 Full-price realization Full-price realization Full-price realization

attackING white spaces and Increase PRESENCE AT existing doors WHITE SPACE ATTACK ACCELERATION IN CURRENT B2B FOOTPRINT ~600 DOORS +90% FROM EXISTING DOORS 23 GROWTH PRIORITIES IN B2B Note: Targets by end of FY28.

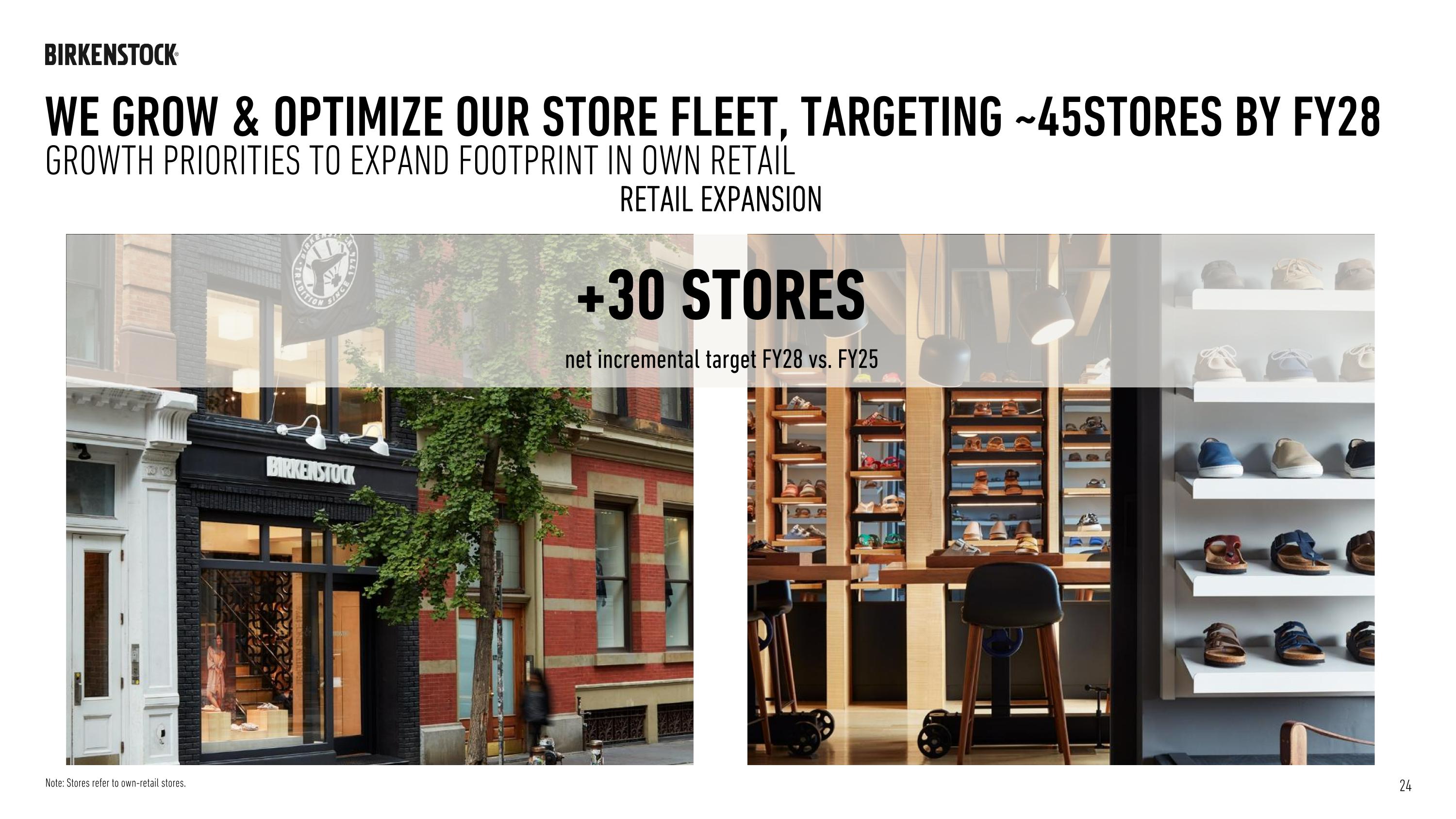

We GROW & OPTIMIZE our STORE fleet, TARGETING ~45 stores by FY28 RETAIL EXPANSION +30 STORES net incremental target FY28 vs. FY25 24 Note: Stores refer to own-retail stores. Growth priorities to expand footprint in own Retail

Membership Loyalty EVENTS CUSTOMER FOCUS ENGAGE & CONVERT SEAMLESS EXPERIENCE Emerging YOUTH SOCIAL COMMERCE website replatform & AI ENABLED TOOLS ACTING AS A DTC BRAND PROVIDING THE MOST OPTIMAL OWN-CHANNEL EXPERIENCE | CREATING BRAND ADVOCACY AND FANDOM 4 Focus areas TO DRIVE DYNAMIC GROWTH IN DIGITAL / DTC CRITICAL Growth priorities in Digital OWNed BRAND COMMERCE & COMMUNICATION CONNECT WHERE THEY ARE 25

EMEA Picture

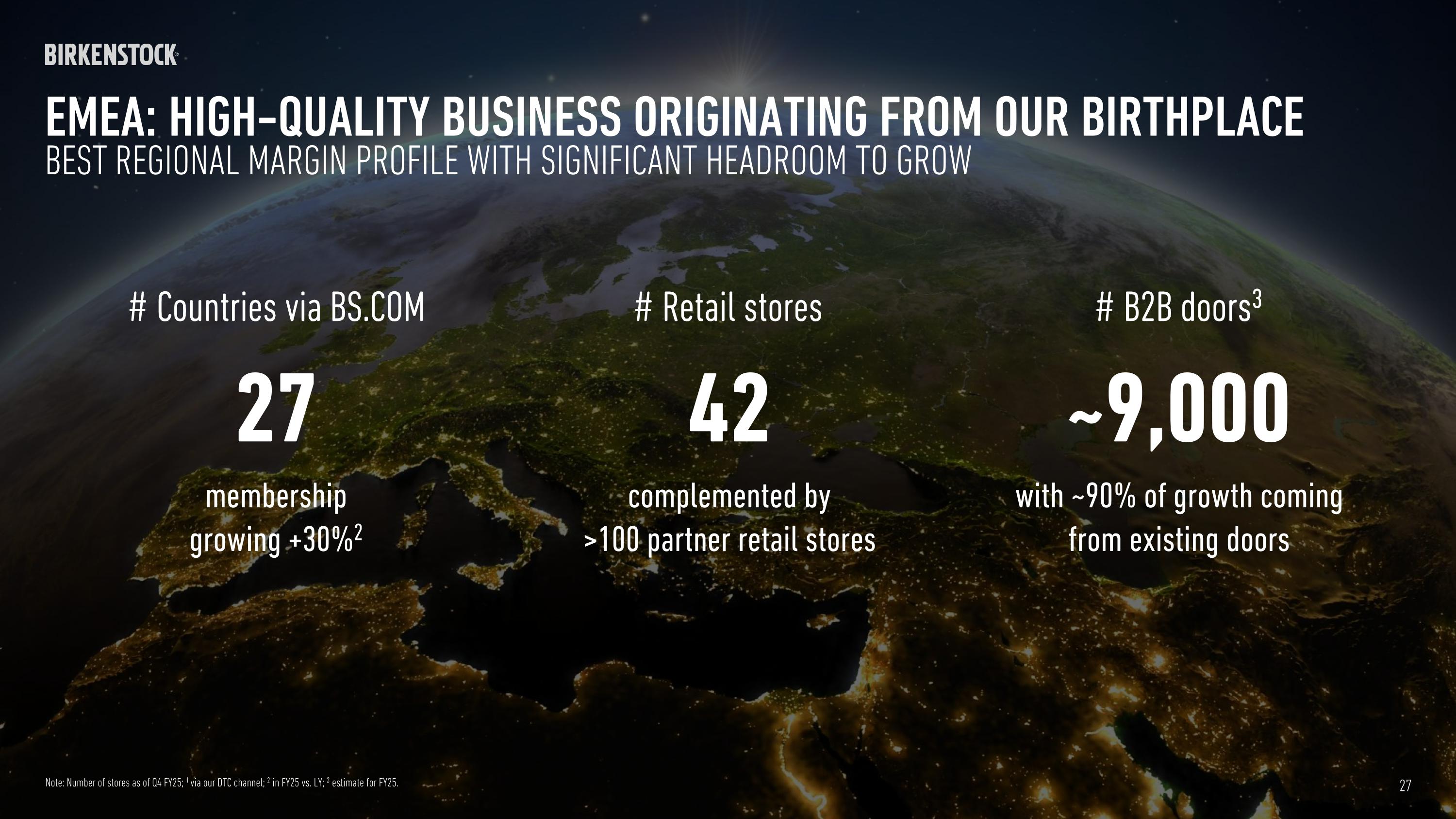

EMEA: High-Quality Business OriginatING from our Birthplace # Countries via BS.COM 27 membership growing +30%2 # Retail stores # B2B doors3 ~9,000 with ~90% of growth coming from existing doors Best regional Margin Profile with significant headroom to grow 27 Note: Number of stores as of Q4 FY25; 1 via our DTC channel; 2 in FY25 vs. LY; 3 estimate for FY25. 42 complemented by >100 partner retail stores

EMEA DELIVERINg DD GROWTH WITH HIGHEST regional PROFITABILITY Broad based engineered growth x1.5+ closed-toe to outpace open-toe demand exceeding supply DTC ACCELERATION deeper direct consumer engagement higher profit per pair HIGHER PENETRATION underpenetrated markets new audiences 28 Note: Targets by end of FY28.

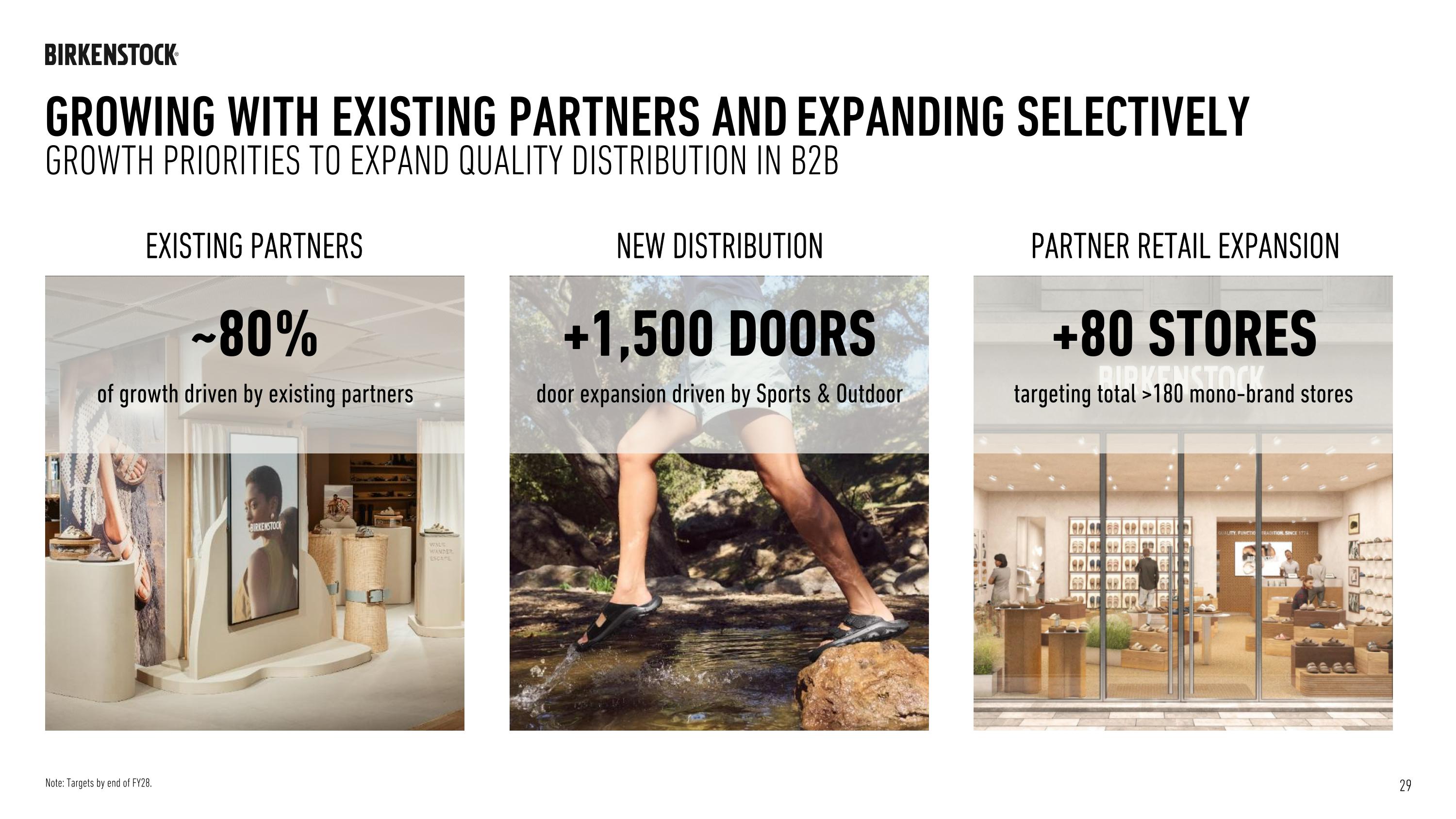

growing WITH existing partners AND Expanding SELECTIVELY Growth priorities to expand quality distribution in B2B NEW DISTRIBUTION EXISTING PARTNERS ~80% of growth driven by existing partners +1,500 doors door expansion driven by Sports & Outdoor PARTNER RETAIL EXPANSION +80 STORES targeting total >180 mono-brand stores Note: Targets by end of FY28. 29

Doubling our STORE fleet, TARGETING ~80 stores Growth priorities to expand footprint in own Retail RETAIL EXPANSION LIKE-FOR-LIKE OPTIMIZATION +40 Stores net incremental target FY28 vs. FY25 +MSD% LFL growth target p.a. Note: Targets by end of FY28; MSD = “mid-single digits”; LFL = like-for-like stores. 30

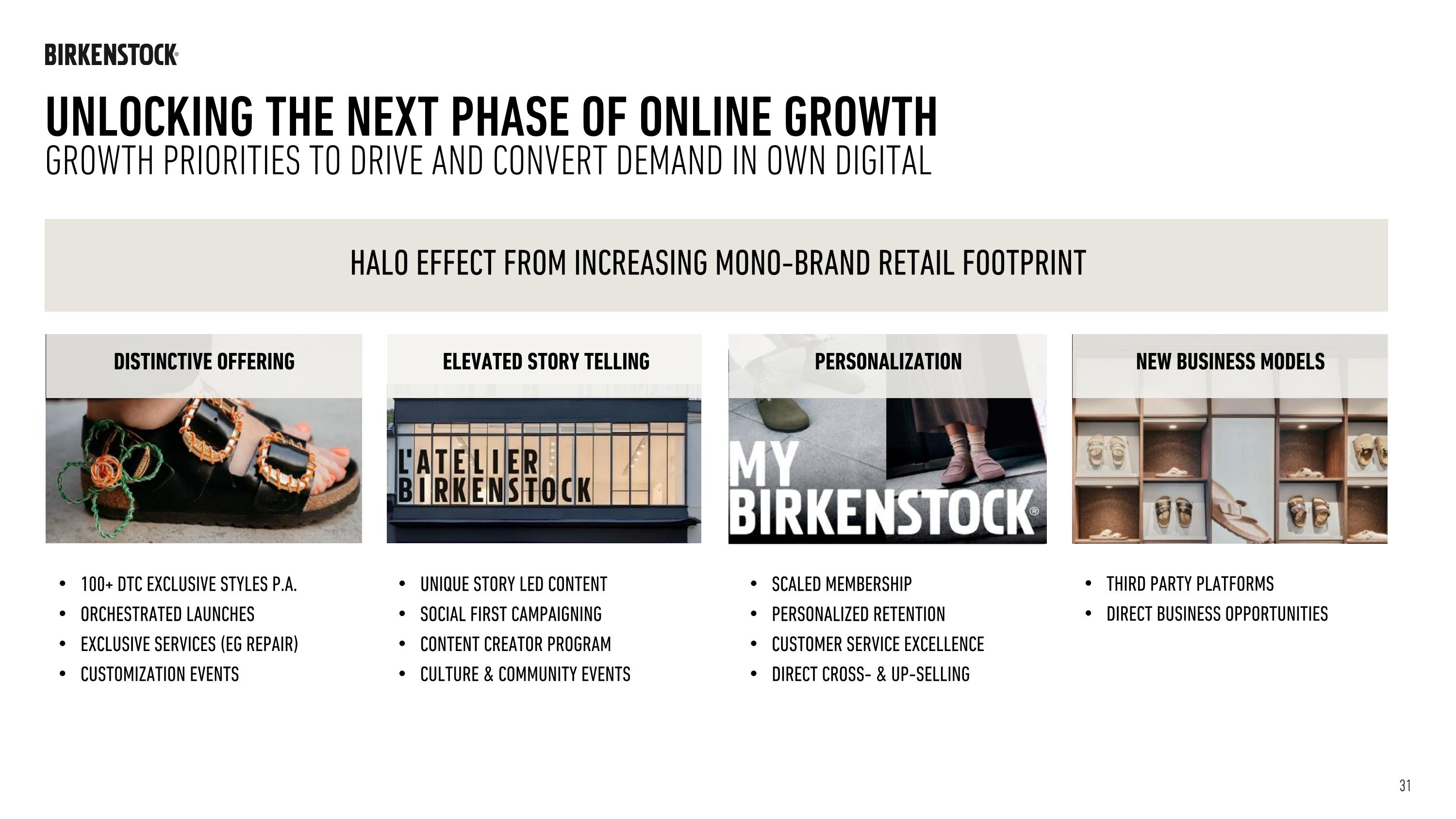

Unlocking the Next Phase of Online Growth Growth priorities to drive and Convert Demand in Own Digital unique Story led Content Social First campaigning Content Creator Program Culture & COMMUNITY Events Personalization Scaled membership Personalized Retention CUSTOMER SERVICE EXCELLENCE Direct Cross- & Up-selling New Business Models THIRD PARTY PLATFORMS DIRECT Business Opportunities HALO EFFECT FROM Increasing MONO-BRAND Retail Footprint Distinctive Offering 100+ DTC Exclusive styles p.a. Orchestrated Launches Exclusive Services (EG Repair) Customization events Elevated Story Telling 31

FURTHER EXPANDING OUR high-quality business IN EMEA DELIVERING SUBSTANTIAL INCREMENTAL GROWTH MATERIAL GROWTH OPPORTUNITIES AHEAD HIGH DEGREE OF DISTRIBUTION DISCIPLINE BEST MARGIN PROFILE 32

APAC

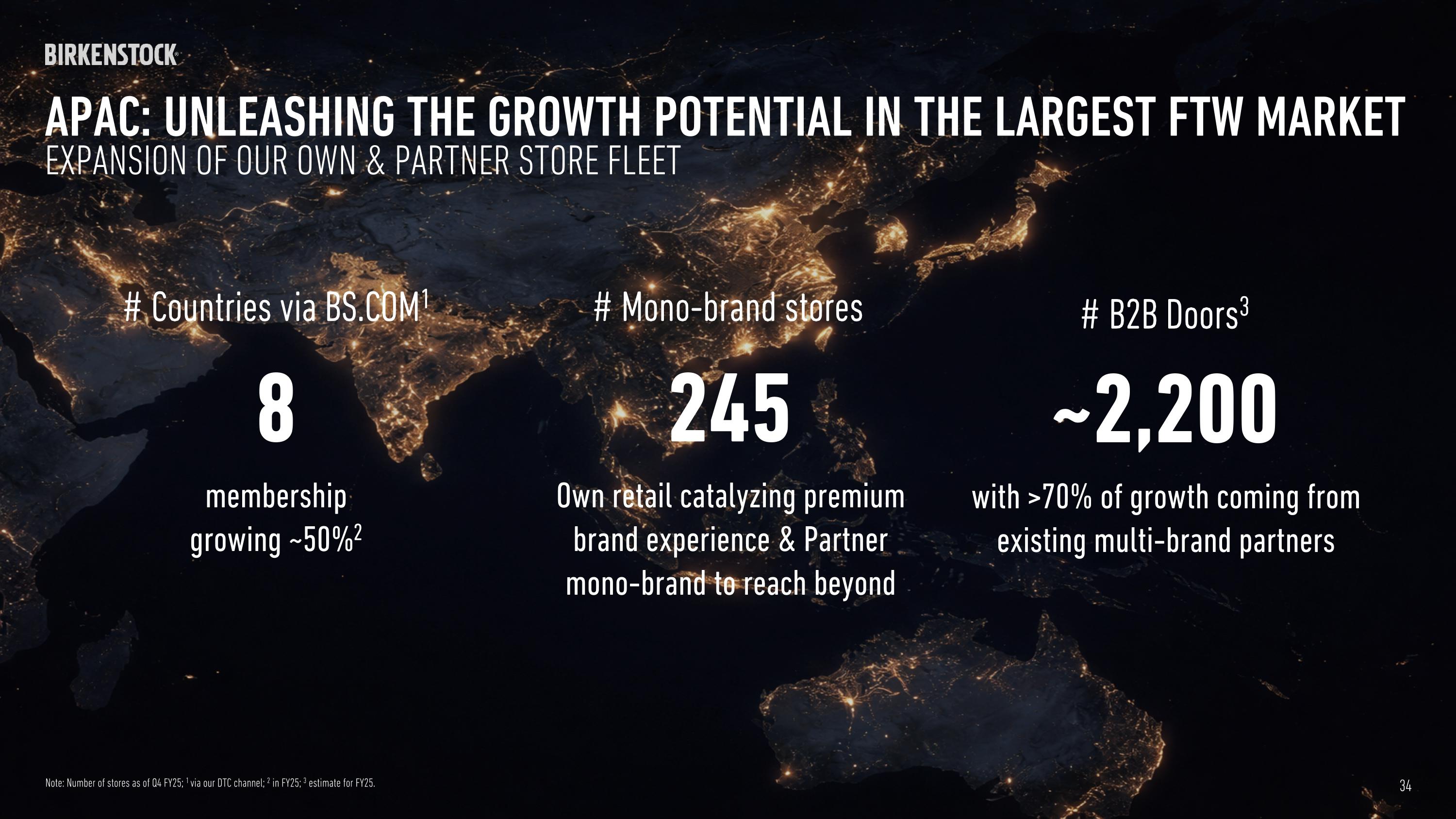

APAC: unleashing the growth potential IN THE LARGEST FTW MARKET # Countries via BS.COM1 8 membership growing ~50%2 # Mono-brand stores 245 Own retail catalyzing premium brand experience & Partner mono-brand to reach beyond expansion OF our own & partner store fleet # B2B Doors3 ~2,200 with >70% of growth coming from existing multi-brand partners 34 Note: Number of stores as of Q4 FY25; 1 via our DTC channel; 2 in FY25; 3 estimate for FY25.

APAC: DOUBLING THE BUSINESS BY FY28 DISCIPLINED GROWTH AND PROFITABILTY shoes And clogs becoming a year-around business DTC driven growth deepen direct consumer engagement & raise brand awareness 35

UNLocking THE growth potential in APAC Connect through community 3-Pillar omnichannel expansion Product Acceleration 3-Pillar omnichannel expansion 3-Pillar omnichannel expansion Engagement 36 CONNECT PURPOSE EXPERIENCE OWN RETAIL PARTNER RETAIL DIGITAL SHOES CLOGS 1774/SMU

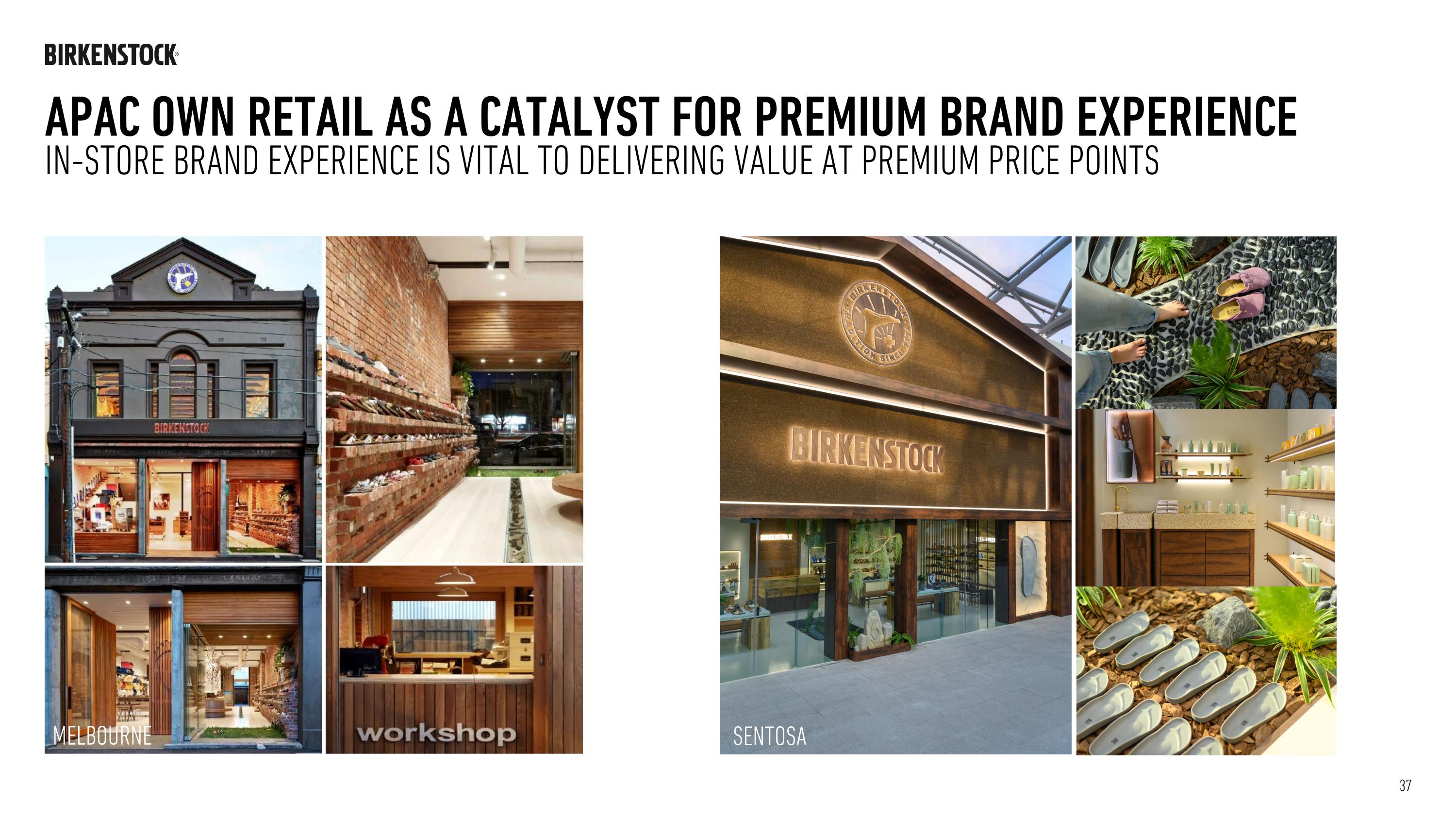

In-Store Brand Experience Is Vital to Delivering Value at Premium Price Points APAC Own Retail as A Catalyst for Premium Brand experience 37 melbourne SENTOSA

GROWING & OPTIMIZING premium retail to over 400 STORES by FY28 Growth priorities in offline expansion through owned and partner retail OWN RETAIL EXPANSION LFL OPTIMIZATION PARTNER RETAIL EXPANSION +70 stores net incremental target FY28 vs. FY25 +DD% LFL growth target +100 partner store target FY28 vs. FY25 38 Note: Targets by end of FY28; LFL = “like-for-like stores”; DD = “double-digits”.

DELIVERING Qualitative, Value DRIVEN growth in digital 3 Pillars OF Sustainable GrowtH Creating demand through CONSISTENT high-value content Exclusivity & Channel Segmentation CONTENT-LED STRATEGY MERCHANDISE STRATEGY MEMBERSHIP & SERVICES 39 Membership Value & Brand Asset Equity

PRODUCT

purpose driven iconic product - Rooted in our rich archive Key franchise overview (the BIG 5) Arizona (1973) Vision give all people access to an anatomically correct footbed. purpose empower all people to walk the way nature intended Core invention We are in the FOOTBED business 41 Boston (1973) Gizeh (1983) Mayari (2009) Madrid (1963)

We have extended consumer reach and price architecture of Arizona Franchise Arizona Franchise – selected executions across price points [RRP1 €] 42 EVA 55€ Birkoflor 90€ Suede Leather 120€ Injected rivets 150€ Shearling 150€ Big Buckle 160€ Droplet buckle 200€ 1774 500€ Note: 1RRP = Recommended Retail Price.

ContinUously building ASP through product mix management Arizona Franchise – examples of detailed product differentiation and uptrading [RRP1 €] 43 EVA “Classic” 55€ EVA Big Buckle 65€ Suede Full Exquisite 180€ Suede leather 120€ Rivets Full Exquisite 230€ Injected rivets 150€ Big Buckle Raffia 250€ Big Buckle 160€ Note: 1RRP = Recommended Retail Price.

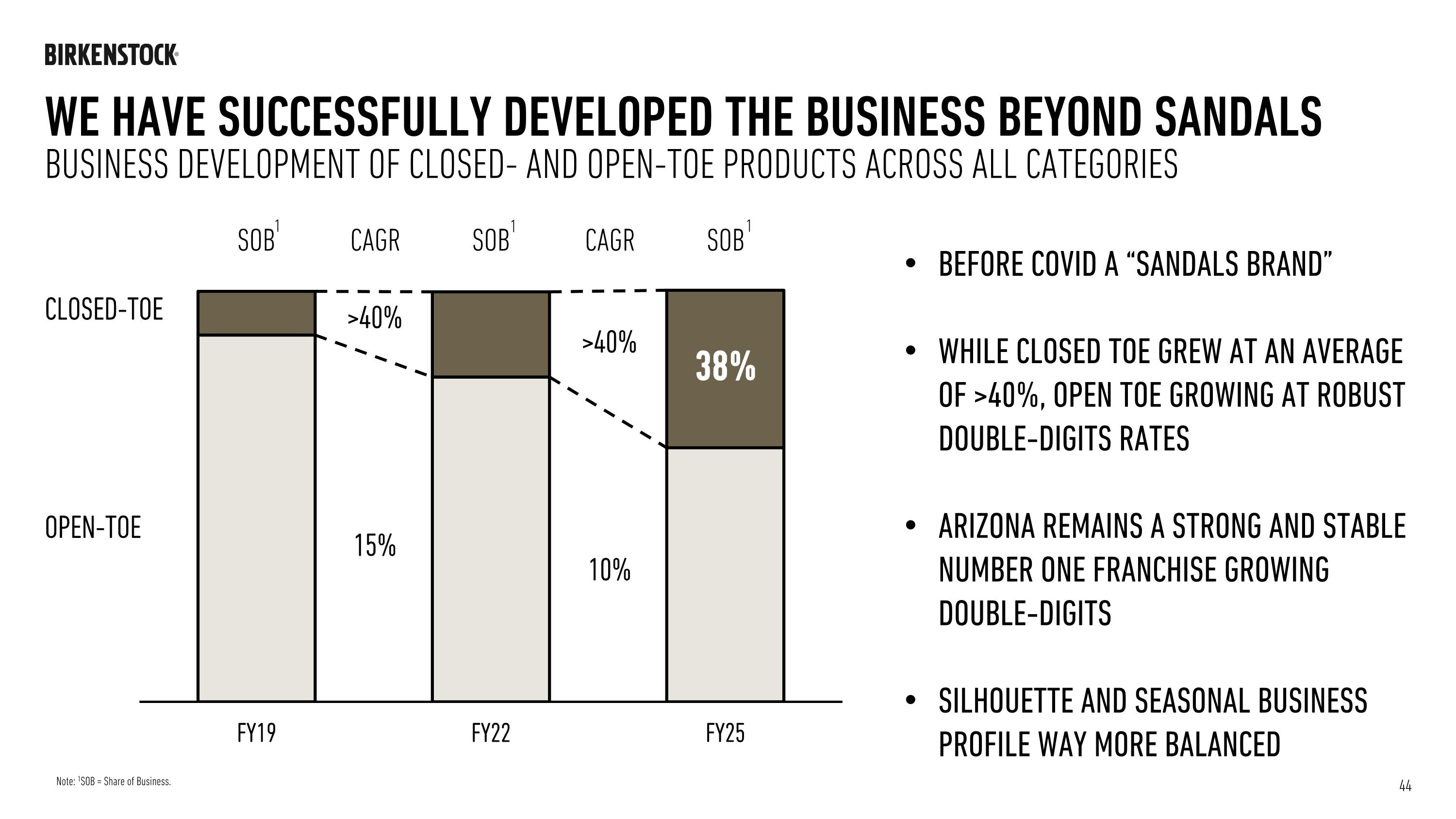

We have successfully developed the business beyond sandals Business development of closed- and open-toe products across all categories Closed-toe Open-toe SOB SOB SOB CAGR CAGR >40% >40% 15% 10% Before COVID a “sandals brand” While closed toe grew at an average of >40%, open toe growing at robust double-digits rates Arizona remains a strong and stable number one franchise growing double-digits Silhouette and seasonal business profile way more balanced 44 Note: 1SOB = Share of Business. 1 1 1

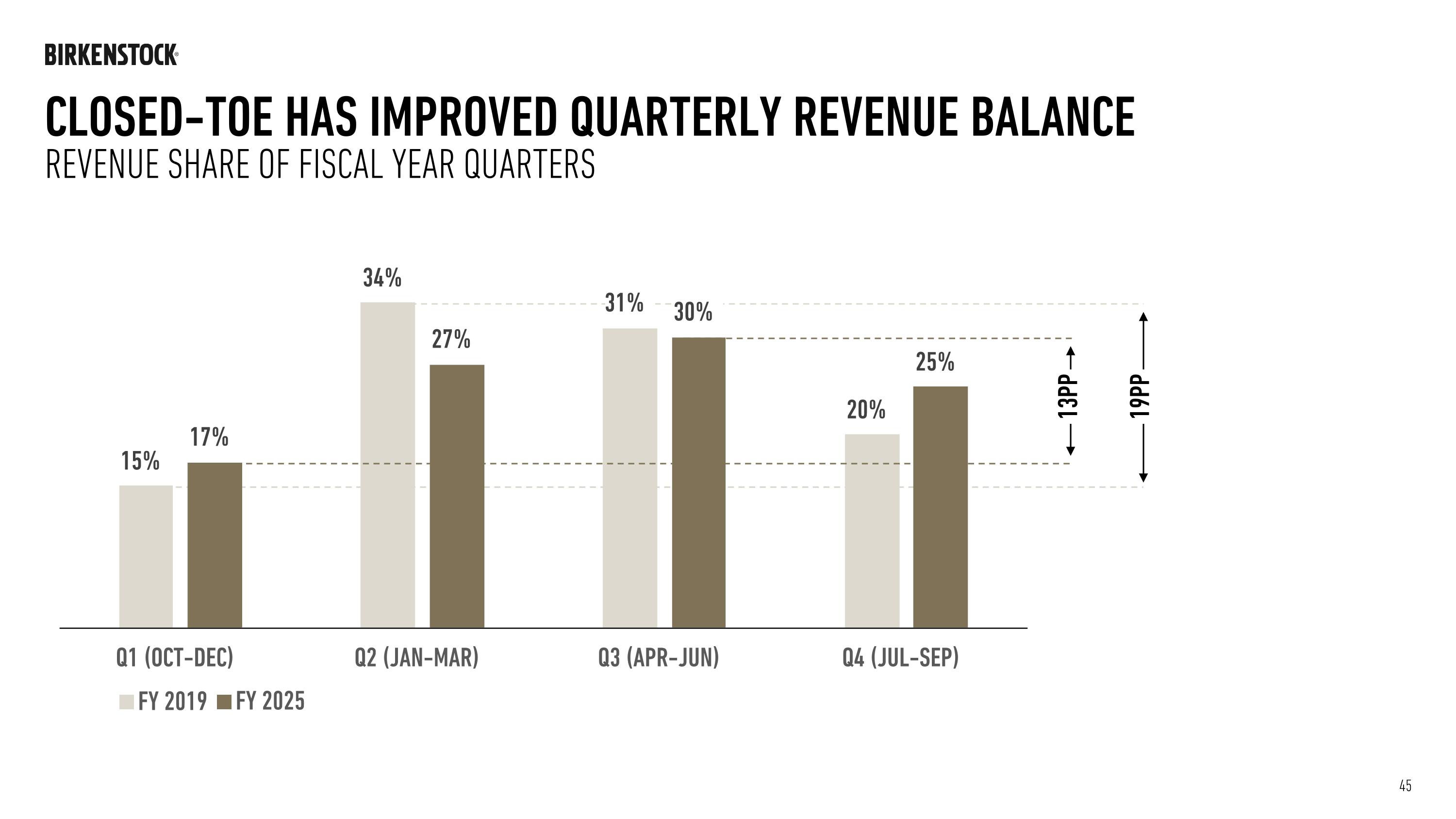

Closed-Toe has improved quarterly revenue balance Revenue share of Fiscal year Quarters 19pp 45 15% 34% 20% 31% 13pp 17% 27% 30% 25% Q1 (OCT-DEC) Q2 (JAN-MAR) Q3 (APR-JUN) Q4 (JUL-SEP) FY 2019 FY 2025

We own THE sandal category! 46

Now We also own the clogs category! 47 Happy birthday Boston Since 1976

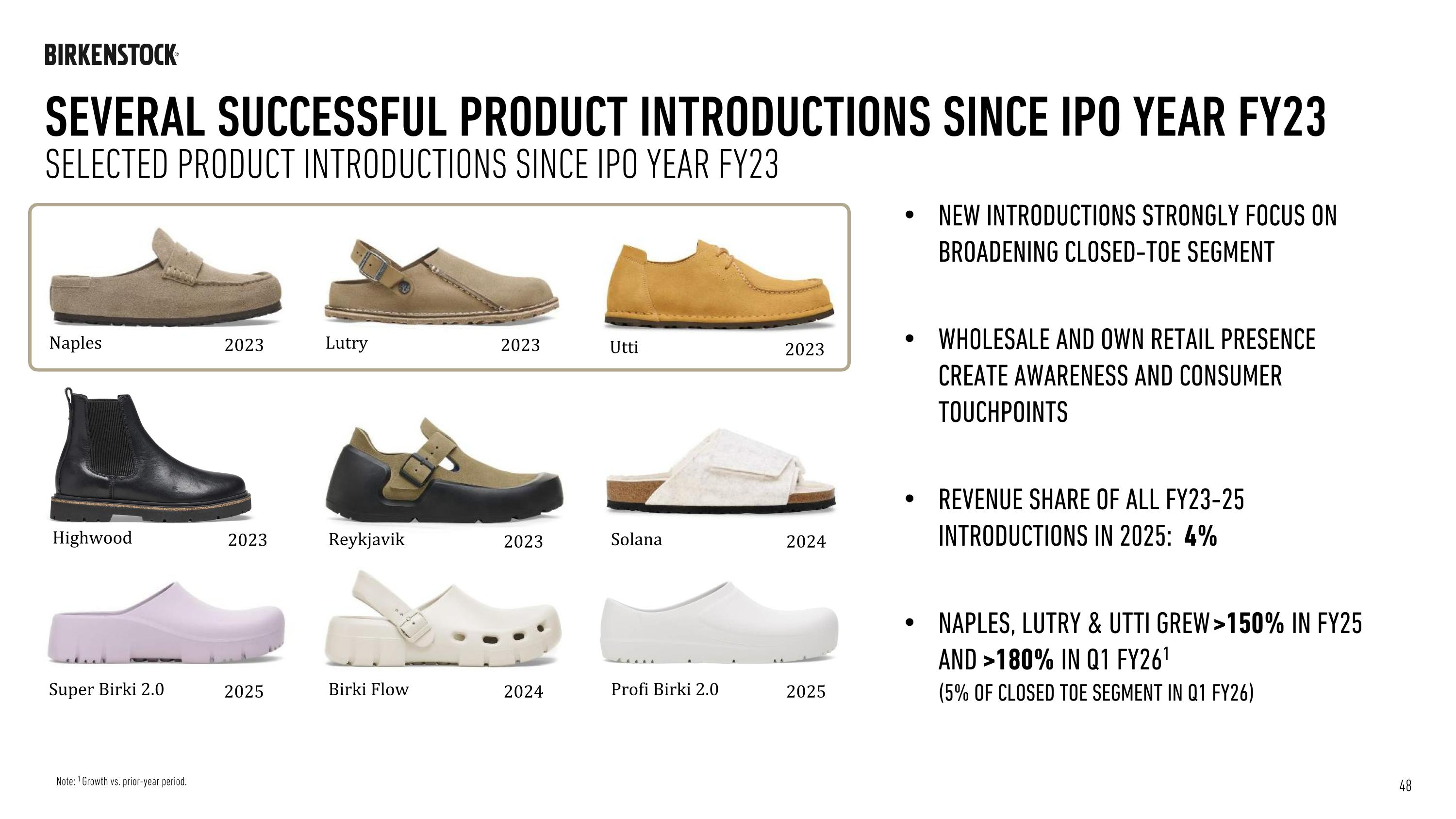

New introductions Strongly Focus on broadening closed-toe segment wholesale and own retail presence create awareness and consumer touchpoints Revenue Share of all FY23-25 introductions in 2025: 4% Naples, Lutry & Utti grew >150% in FY25 and >180% in Q1 FY261 (5% of Closed Toe segment in Q1 FY26) Highwood 2023 Several successful product introductions since IPO year FY23 Selected product introductions since IPO year FY23 Naples 2023 Lutry 2023 Utti 2023 Reykjavik 2023 Solana 2024 Super Birki 2.0 2025 Birki Flow 2024 Profi Birki 2.0 2025 48 Note: 1 Growth vs. prior-year period.

Three major ways of innovation | from function to culture Pillars of product innovation SEASONAL Classic I EVA I shoes Converting regional needs & trends into brand relevant business Archive I color I material I pattern Premium Brand Appeal I attracting influential consumer “triBes” Cultural relevance 1774 archive I material I construction Strengthening orthopedic I functional DNA new constructions and methods Pure function Orthopedics I Professional I Outdoor 49

Certified Professional products strengthen brand DNA Product innovation examples I pure function 50 Melbourne Pro Melbourne “every Day”

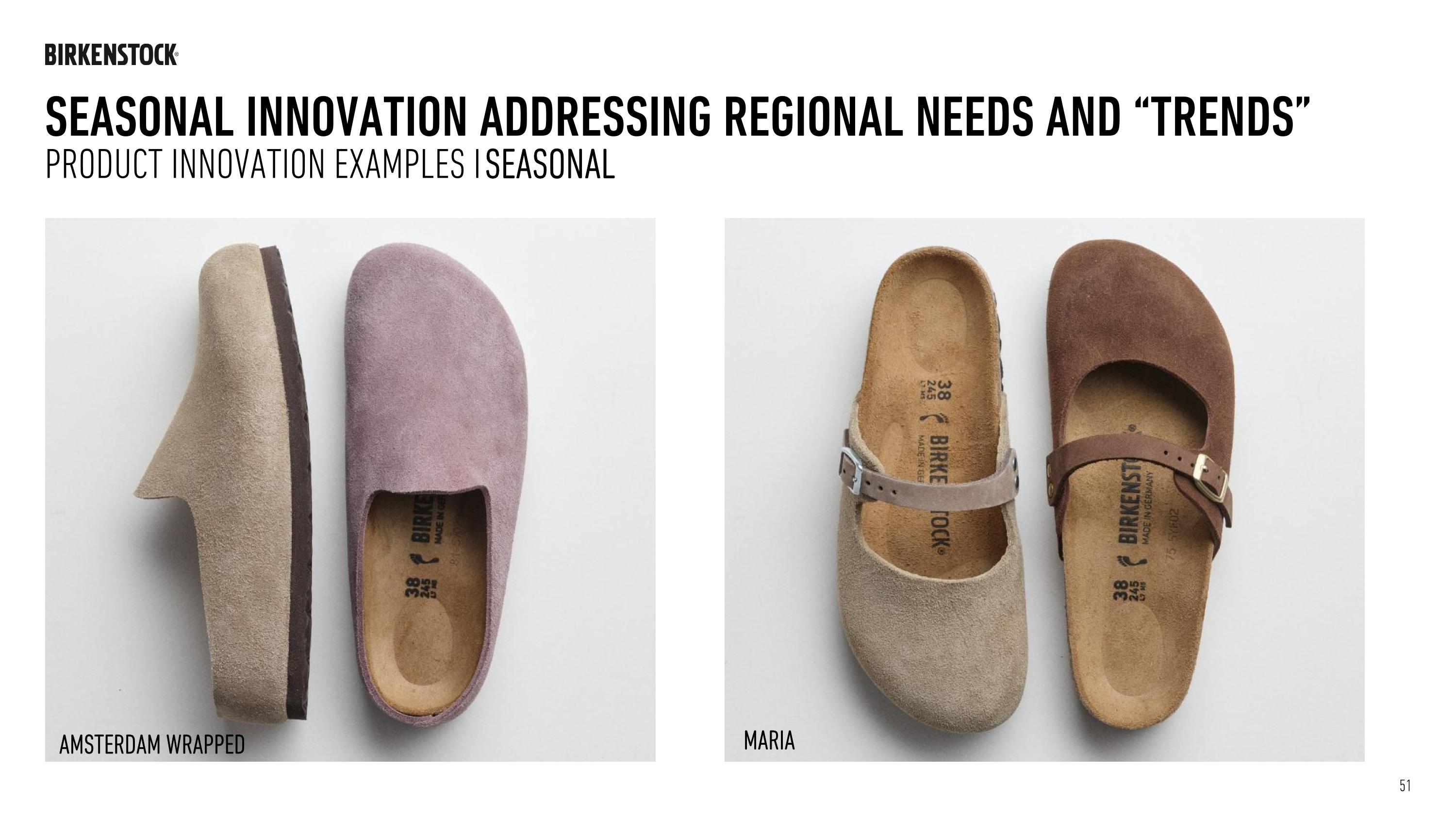

Seasonal innovation addressing regional needs and “trends” Product innovation examples I SEASONAL 51 Amsterdam wrapped Maria

52 1774: spearheading inspiration driven innovation Product innovation examples I cultural relevance 1774 Birkenstock X Danielle Frankel

53 1774: spearheading inspiration driven innovation Product innovation examples I cultural relevance 1774 Birkenstock X Danielle Frankel 53

54 1774: spearheading inspiration driven innovation Product innovation examples I cultural relevance 1774 Birkenstock ensemble 1774 Thibo Denis 54

SUPPLY CHAIN

Note: 1 Targeted CAGR FY25-FY28. Supply chain to support our growth 10% UNIT GROWTH CAGR1 15% PRODUCTION HOUR GROWTH CAGR1 Supply chain targets 56

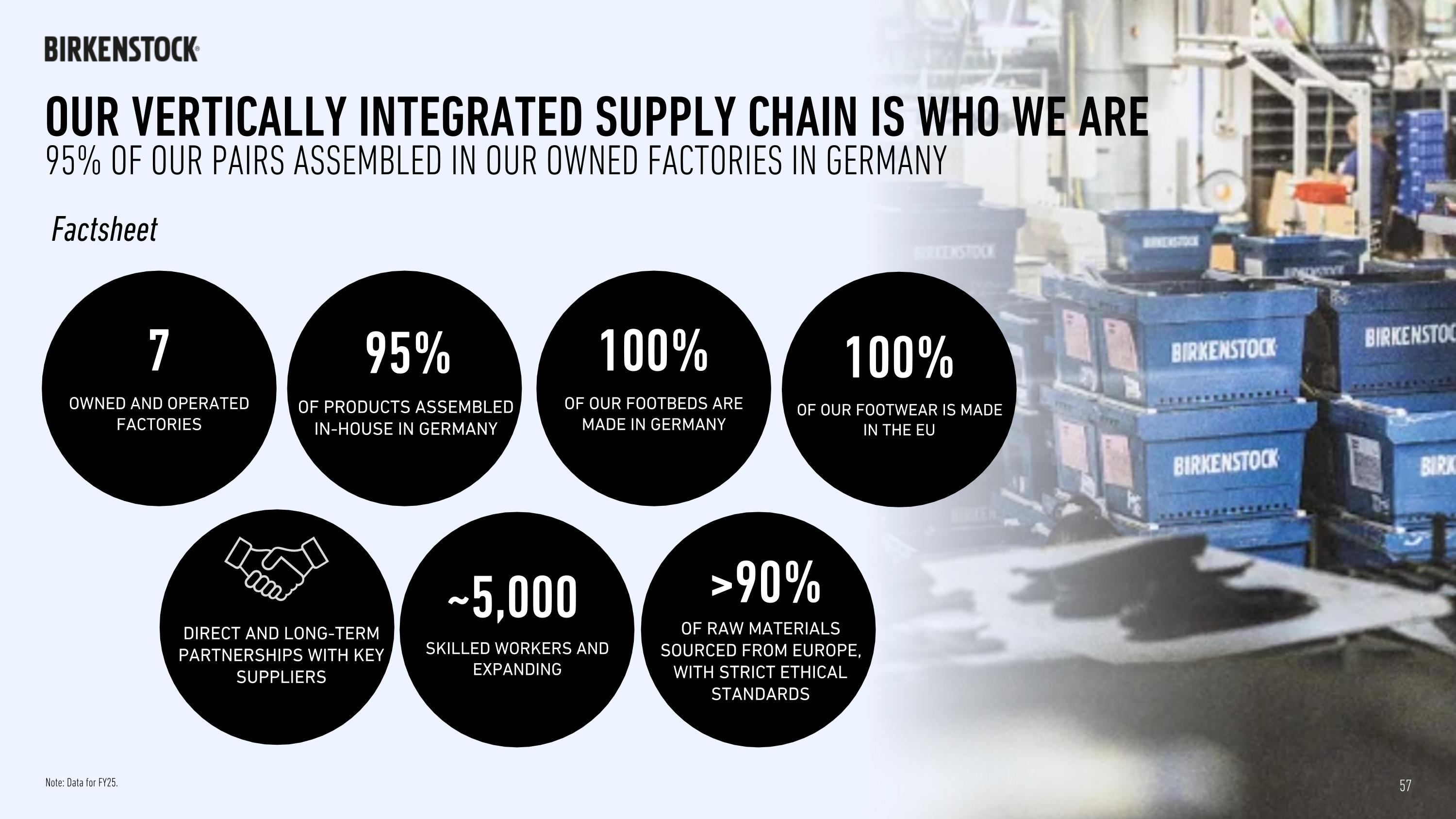

OF RAW MATERIALS SOURCED FROM EUROPE, WITH STRICT ETHICAL STANDARDS 100% OF OUR FOOTBEDS ARE MADE IN GERMANY 100% OF OUR FOOTWEAR IS MADE IN THE EU ~5,000 SKILLED WORKERS AND EXPANDING Note: Data for FY25. OF PRODUCTS ASSEMBLED IN-HOUSE IN GERMANY 95% our Vertically integrated supply chain is who we are 95% of our pairs assembled in our owned factories in germany >90% DIRECT AND LONG-TERM PARTNERSHIPS WITH KEY SUPPLIERS 57 7 OWNED AND OPERATED FACTORIES Factsheet

OUR SUPPLY CHAIN is an asset providing value to shareholders Control over our product, agility, resilience, margin generation and capital deployment Control over IP and quality end-to-end Agility to react to shifts in demand Resilience to supply chain risks Direct partnerships with our suppliers 58 Strong, predictable & improving margin Opportunity to deploy FCF with short paybacks

B2B allows us to efficiently organize our supply chain High plannability of our business and room to react to changes in demand >70% of all units contracted with 5-9 month visibility 85% of all units carryover allowing for preproduction and production balancing ~5% of all units seasonal and not contracted 59 Note: Data for FY25; Rounded to the nearest 5%-multiple. Larger orders with lower complexity & cost for our logistics

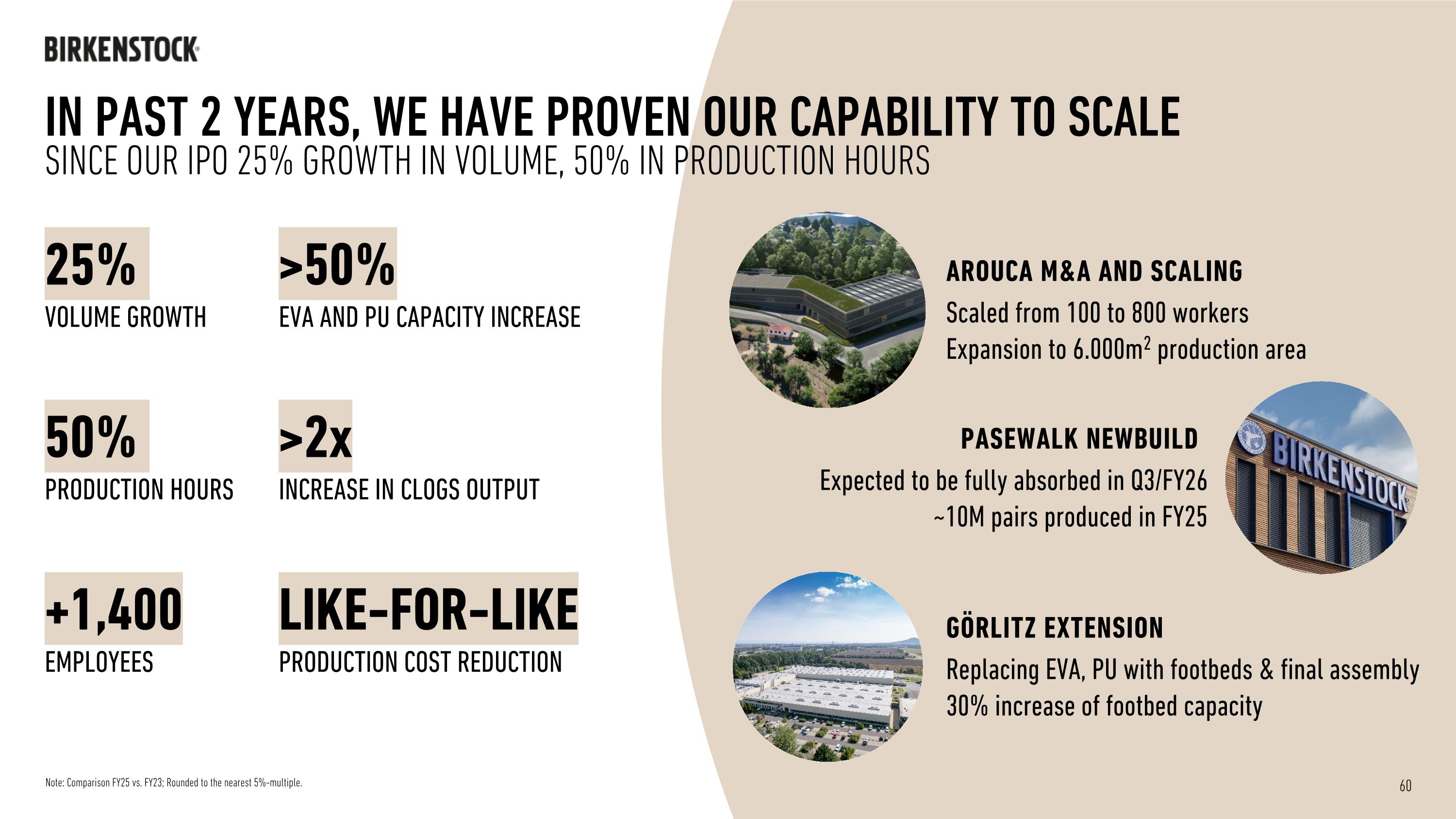

In past 2 years, WE HAVE PROVEN our capability to scale 25% VOLUME GROWTH Arouca M&A and scaling Scaled from 100 to 800 workers Expansion to 6.000m2 production area Pasewalk newbuild Expected to be fully absorbed in Q3/FY26 ~10M pairs produced in FY25 Görlitz extension Replacing EVA, PU with footbeds & final assembly 30% increase of footbed capacity Note: Comparison FY25 vs. FY23; Rounded to the nearest 5%-multiple. SINCE OUR IPO 25% growth in VOLUME, 50% in production hours 50% PRODUCTION HOURS +1,400 EMPLOYEES >50% EVA AND PU CAPACITY INCREASE >2x INCREASE IN CLOGS OUTPUT LIKE-FOR-LIKE PRODUCTION COST REDUCTION 60

New expansion plan is designed for speed & flexibility Extensions of existing facilities Brownfield acquisitions …deliver on growth of units and production hours …have a highly positive business case, CAPEX investment reduced by brownfield acquisitions …be designed for speed with faster go-lives/ramp-ups of brownfields/expansions …focus on leather and cork-latex, but be designed for flexibility between product groups New expansion plan to… 61

three large expansion projects underway… Go live Fy27 Go live FY26 Go live Fy27 Görlitz extension Footbeds | sandals | clogs Project preparation ~1 year from purchase to production go-live Wittichenau brownfield 1st PHASE: Footbeds | sandals | clogs In construction 2-years from purchase of the land to go-live Arouca extension Leather components In construction Filling of existing halls ensures speed up process We plan to be agile looking for additional opportunities to add to our factory footprint Beyond Pasewalk extension Brownfield opportunities Exploring 62

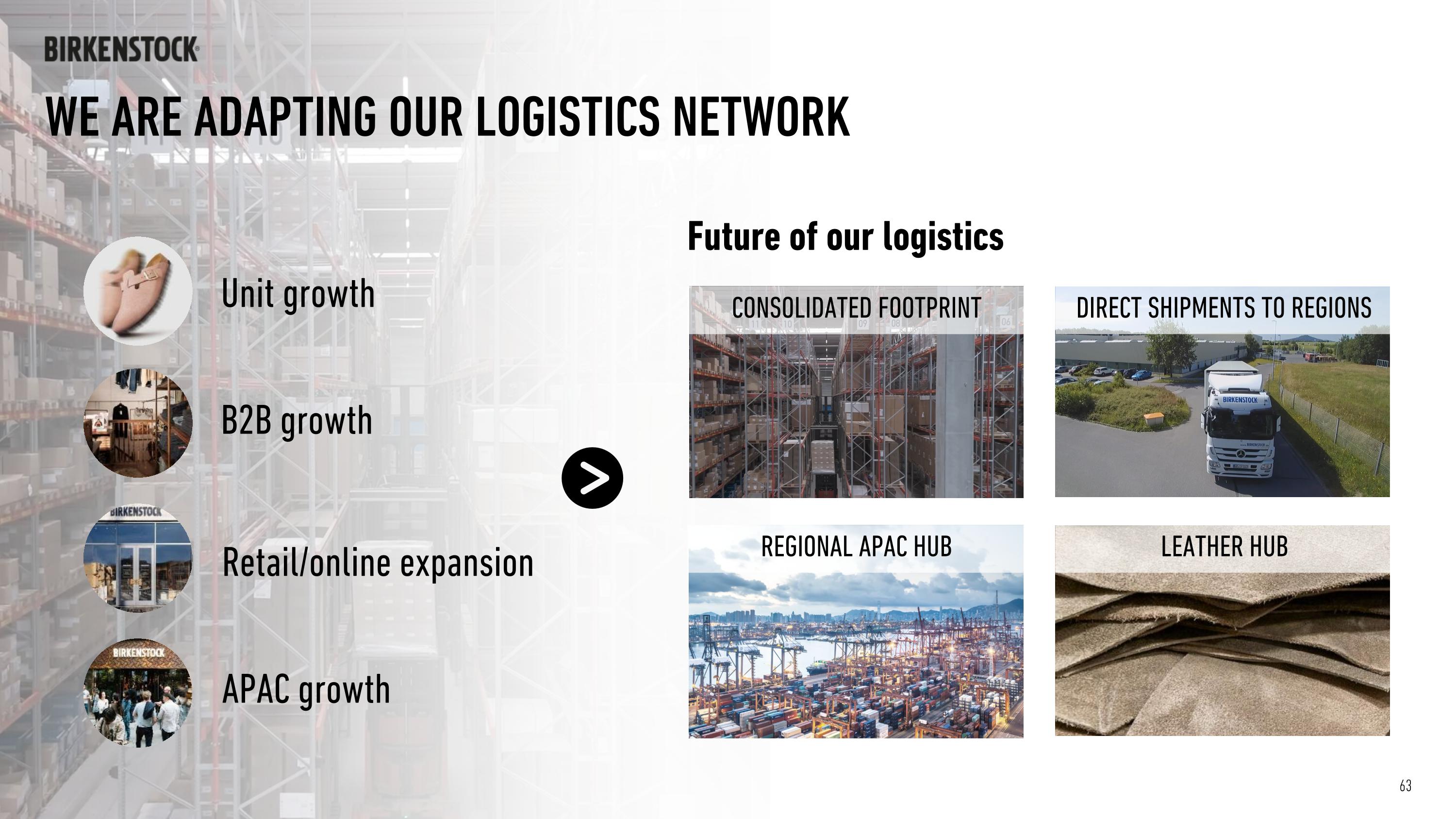

We are adapting Our logistics network Unit growth Retail/online expansion APAC growth Future of our logistics B2B growth CONSOLIDATED FOOTPRINT DIRECT SHIPMENTS TO REGIONS LEATHER HUB REGIONAL APAC HUB 63

APPENDIX

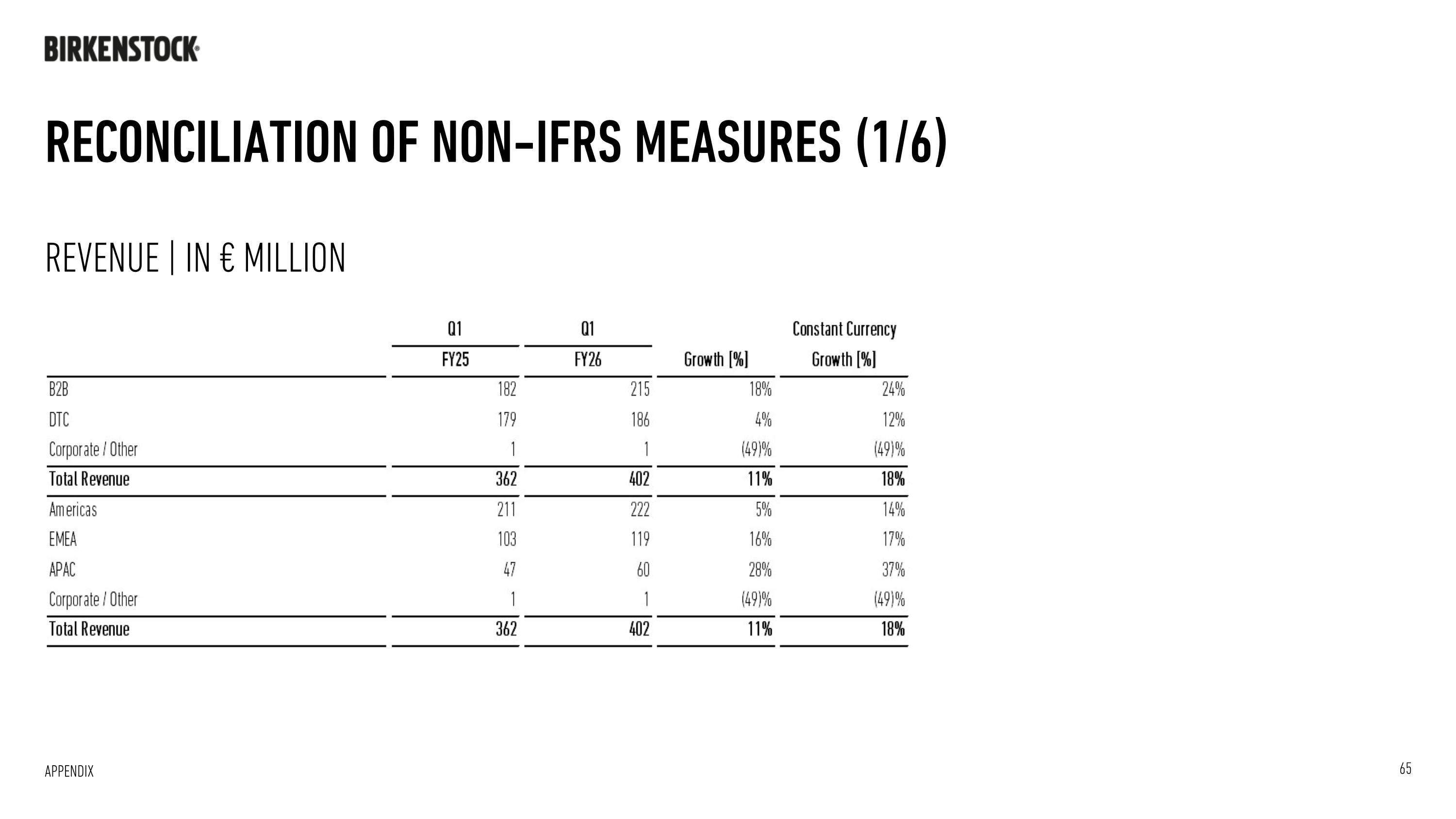

Reconciliation of non-ifrs measures (1/6) Appendix REVENUE | in € million

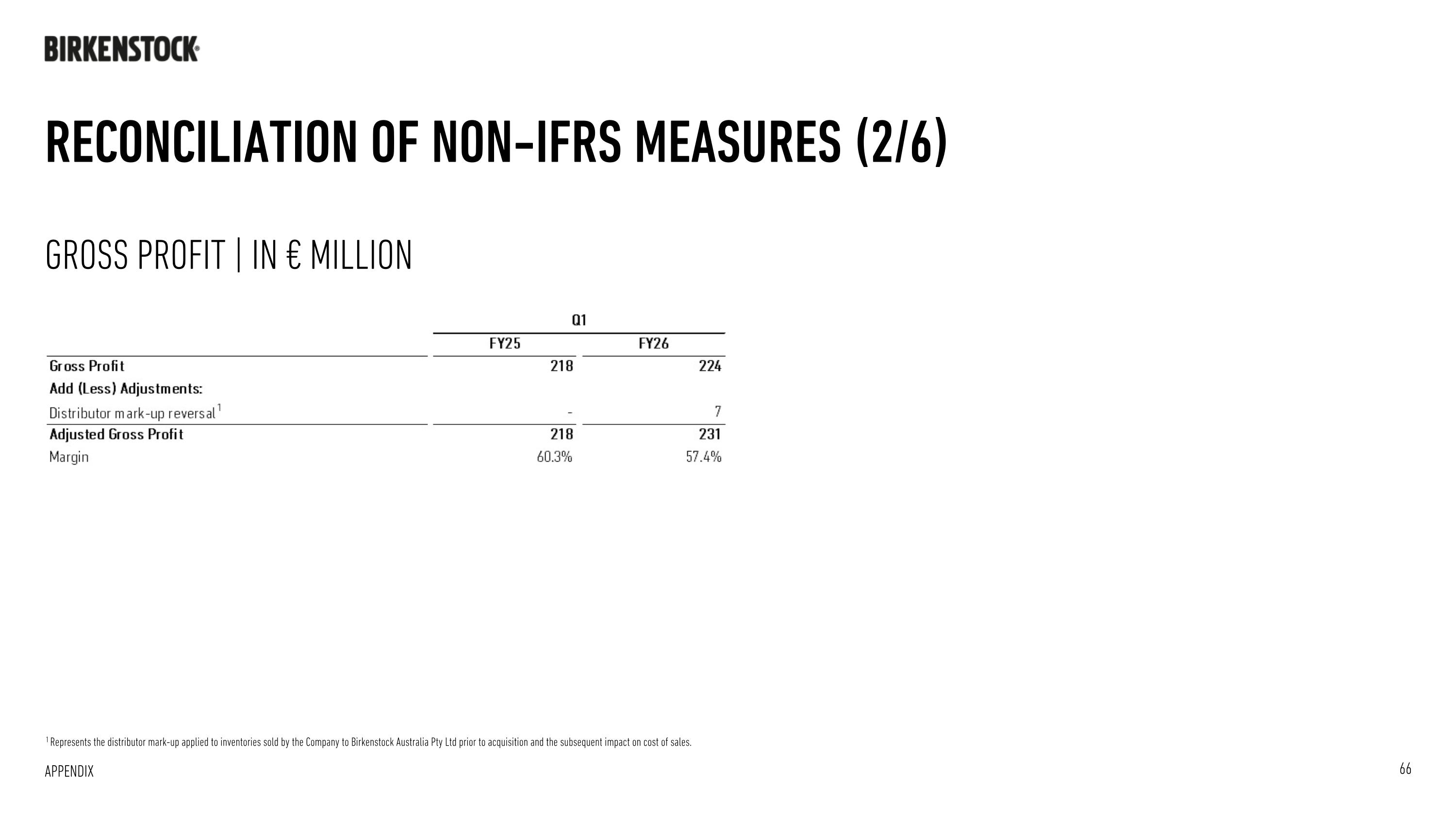

Reconciliation of non-ifrs measures (2/6) Appendix GROSS PROFIT | in € million 1 Represents the distributor mark-up applied to inventories sold by the Company to Birkenstock Australia Pty Ltd prior to acquisition and the subsequent impact on cost of sales.

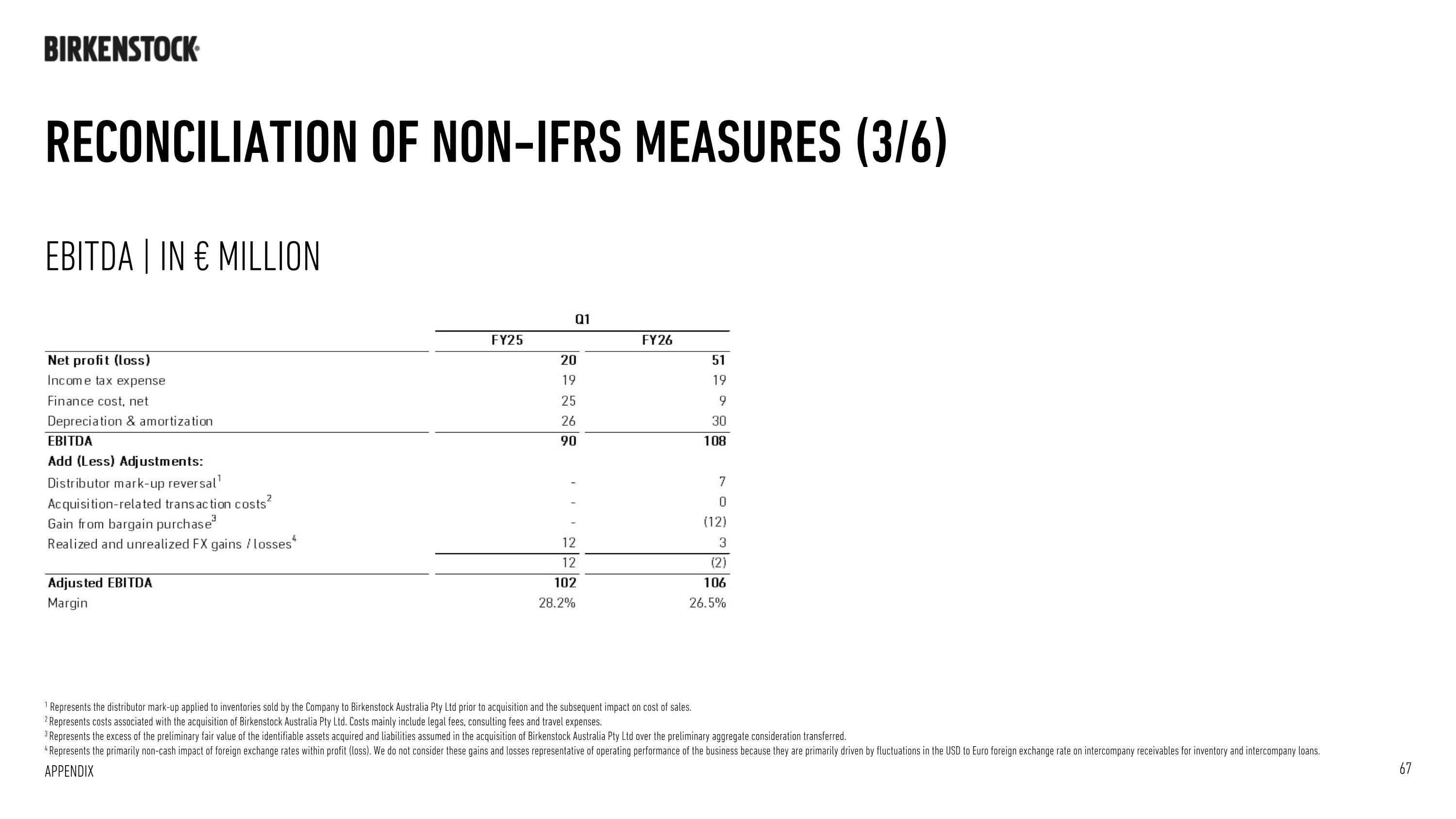

Reconciliation of non-ifrs measures (3/6) Appendix EBITDA | in € million 1 Represents the distributor mark-up applied to inventories sold by the Company to Birkenstock Australia Pty Ltd prior to acquisition and the subsequent impact on cost of sales. 2 Represents costs associated with the acquisition of Birkenstock Australia Pty Ltd. Costs mainly include legal fees, consulting fees and travel expenses. 3 Represents the excess of the preliminary fair value of the identifiable assets acquired and liabilities assumed in the acquisition of Birkenstock Australia Pty Ltd over the preliminary aggregate consideration transferred. 4 Represents the primarily non-cash impact of foreign exchange rates within profit (loss). We do not consider these gains and losses representative of operating performance of the business because they are primarily driven by fluctuations in the USD to Euro foreign exchange rate on intercompany receivables for inventory and intercompany loans.

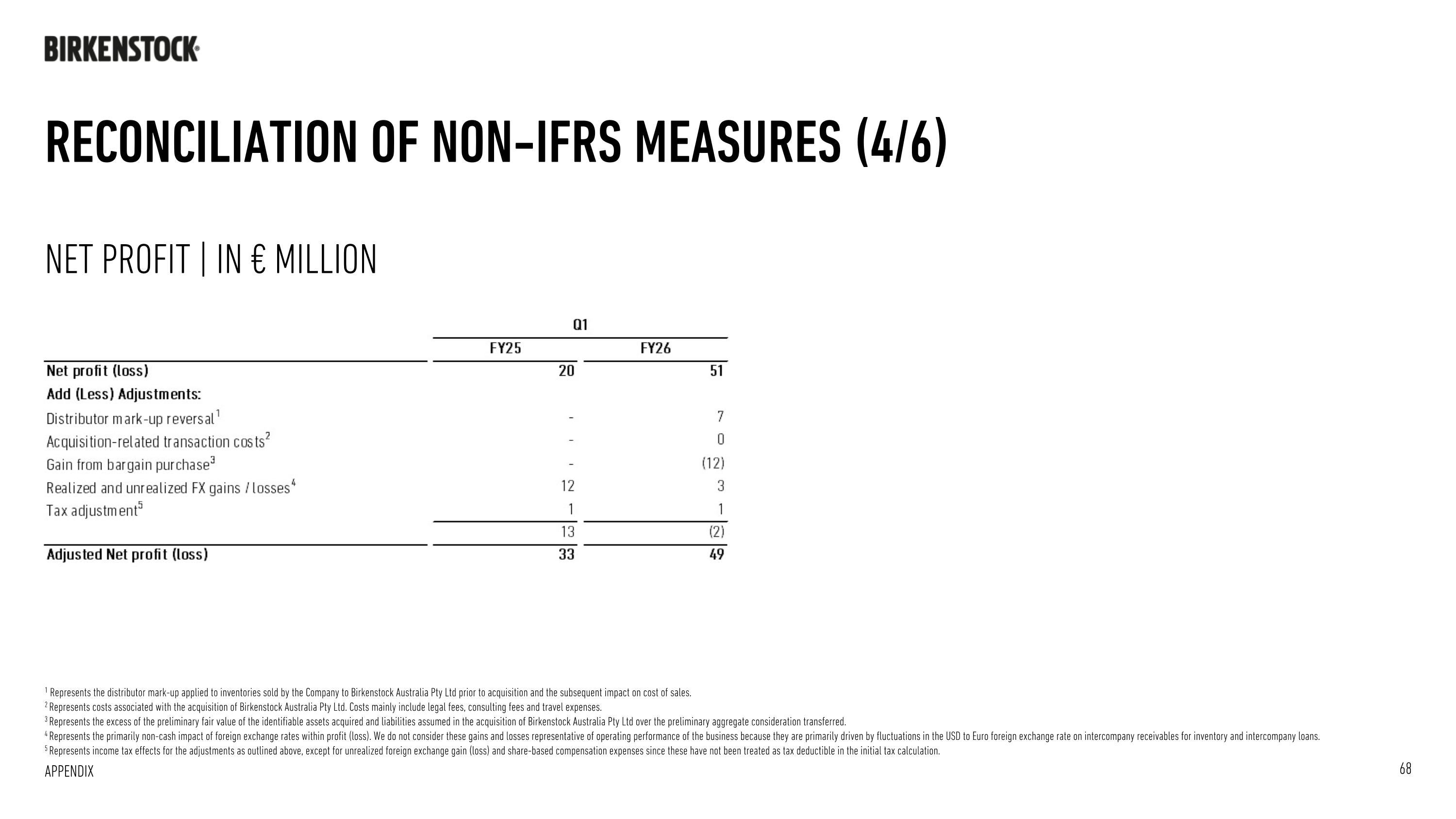

Reconciliation of non-ifrs measures (4/6) Appendix Net profit | in € million 1 Represents the distributor mark-up applied to inventories sold by the Company to Birkenstock Australia Pty Ltd prior to acquisition and the subsequent impact on cost of sales. 2 Represents costs associated with the acquisition of Birkenstock Australia Pty Ltd. Costs mainly include legal fees, consulting fees and travel expenses. 3 Represents the excess of the preliminary fair value of the identifiable assets acquired and liabilities assumed in the acquisition of Birkenstock Australia Pty Ltd over the preliminary aggregate consideration transferred. 4 Represents the primarily non-cash impact of foreign exchange rates within profit (loss). We do not consider these gains and losses representative of operating performance of the business because they are primarily driven by fluctuations in the USD to Euro foreign exchange rate on intercompany receivables for inventory and intercompany loans. 5 Represents income tax effects for the adjustments as outlined above, except for unrealized foreign exchange gain (loss) and share-based compensation expenses since these have not been treated as tax deductible in the initial tax calculation.

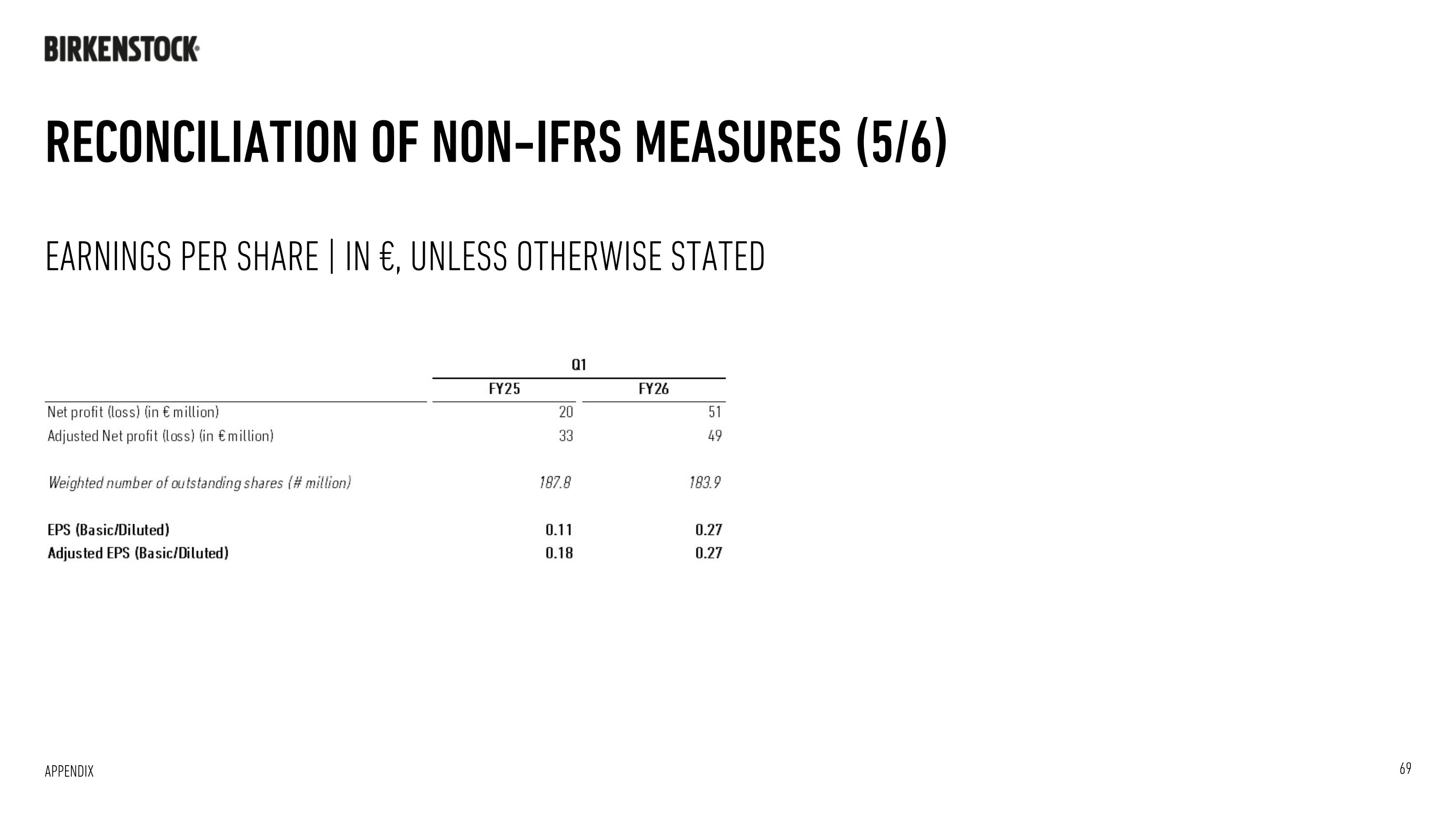

Reconciliation of non-ifrs measures (5/6) Appendix Earnings per share | in €, unless Otherwise stated

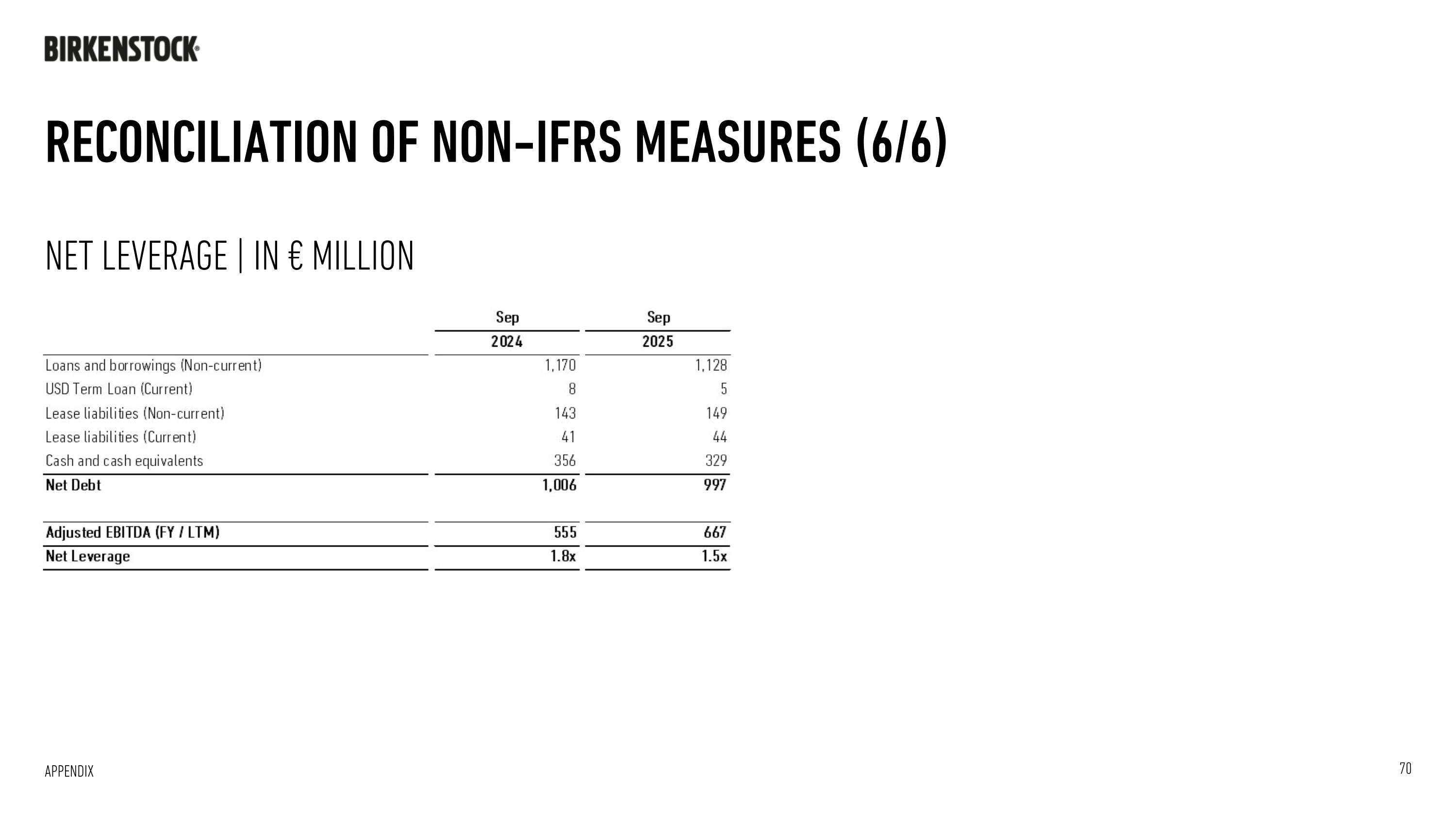

Reconciliation of non-ifrs measures (6/6) Appendix Net Leverage | in € MILLION