Howard Hughes Holdings Inc. Supplemental Information Three Months Ended March 31, 2025 NYSE: HHH .2

HOWARD HUGHES 2 Cautionary StatementsCautionary Statements Forward-Looking Statements This presentation includes forward-looking statements. Forward-looking statements give our current expectations relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to current or historical facts. These statements may include words such as “anticipate,” "believe," “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “plan,” "project,” “realize,” “should,” “transform,” "will," “would” and other statements of similar expression. Forward-looking statements give our expectations about the future and are not guarantees. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. We caution you not to rely on these forward-looking statements. For a discussion of the risk factors that could have an impact on these forward-looking statements, see our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as filed with the Securities and Exchange Commission (SEC) on February 26, 2025. The statements made herein speak only as of the date of this presentation, and we do not undertake to update this information except as required by law. Past performance does not guarantee future results. Performance during time periods shown is limited and may not reflect the performance for the full year or future years, or in different economic and market cycles. Non-GAAP Financial Measures Our financial statements have been prepared in accordance with accounting principles generally accepted in the United States (GAAP); however, we use certain non- GAAP performance measures in this presentation, in addition to GAAP measures, as we believe these measures improve the understanding of our operational results and make comparisons of operating results among peer companies more meaningful. Management continually evaluates the usefulness, relevance, limitations, and calculation of our reported non-GAAP performance measures to determine how best to provide relevant information to the public, and thus such reported measures could change. The non-GAAP financial measures used in this presentation are net operating income (NOI), Cash G&A, Adjusted condo gross profit, and Net debt. Non-GAAP financial measures should not be considered independently, or as a substitute, for financial information presented in accordance with GAAP. We define NOI as operating revenues (rental income, tenant recoveries, and other revenue) less operating expenses (real estate taxes, repairs and maintenance, marketing, and other property expenses). NOI excludes straight-line rents and amortization of tenant incentives, net; interest expense, net; ground rent amortization; demolition costs; other income (loss); depreciation and amortization; development-related marketing costs; gain on sale or disposal of real estate and other assets, net; loss on extinguishment of debt; provision for impairment; and equity in earnings from unconsolidated ventures. We believe that NOI is a useful supplemental measure of the performance of our Operating Assets segment because it provides a performance measure that reflects the revenues and expenses directly associated with owning and operating real estate properties. This amount is presented as Operating Assets NOI throughout this document. Total Operating Assets NOI represents NOI as defined above with the addition of our share of NOI from unconsolidated ventures. We use NOI to evaluate our operating performance on a property-by- property basis because NOI allows us to evaluate the impact that property-specific factors such as rental and occupancy rates, tenant mix, and operating costs have on our operating results, gross margins, and investment returns. While NOI is relevant and widely used measures of operating performance of real estate companies, it does not represent cash flows from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating our liquidity or operating performance. NOI does not purport to be indicative of cash available to fund our future cash requirements. Further, our computation of NOI may not be comparable to NOI reported by other real estate companies. We have included in this presentation a reconciliation from our GAAP Operating Assets segment earnings before taxes (EBT) to NOI. Our other non-GAAP measures are defined and reconciled on the applicable supplemental pages. Additional Information Our website address is www.howardhughes.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other publicly filed or furnished documents are available and may be accessed free of charge through the “Investors” section of our website under the "SEC Filings" subsection, as soon as reasonably practicable after those documents are filed with, or furnished to, the SEC. Also available through the Investors section of our website are beneficial ownership reports filed by our directors, officers, and certain shareholders on Forms 3, 4, and 5.

3 Table of Contents Table of Contents FINANCIAL OVERVIEW Definitions 4 Company Profile 5 Financial Summary 7 Balance Sheets 9 Statements of Operations 10 OPERATING PORTFOLIO PERFORMANCE Same Store Metrics 11 NOI by Region 13 Stabilized Properties 15 Unstabilized Properties 17 Under Construction Properties 18 OTHER PORTFOLIO METRICS Completed Condominiums 19 Under Construction Condominiums 20 Predevelopment Condominiums 21 Summary of Remaining Development Costs 22 Portfolio Key Metrics 23 MPC Performance 24 MPC Land 25 MPC Land Appreciation 26 Lease Expirations 27 Debt Summary 28 Reconciliations of Non-GAAP Measures 30

HOWARD HUGHES 4 Stabilized - Properties in the Operating Assets segment that have reached 90% occupancy or have been in service for 36 months or more, whichever occurs first. If an office, retail, or multifamily property has been in service for more than 36 months but does not exceed 90% occupancy, the asset is considered underperforming. Unstabilized - Properties in the Operating Assets segment that have been in service for less than 36 months and do not exceed 90% occupancy. Under Construction - Projects in the Strategic Developments segment for which construction has commenced as of March 31, 2025, unless otherwise noted. This excludes Master Planned Community (MPC) and condominium development. Net Operating Income (NOI) - We define net operating income (NOI) as operating revenues (rental income, tenant recoveries, and other revenues) less operating expenses (real estate taxes, repairs and maintenance, marketing, and other property expenses). NOI excludes straight-line rents and amortization of tenant incentives, net; interest expense, net; ground rent amortization; demolition costs; other income (loss); depreciation and amortization; development-related marketing costs; gain on sale or disposal of real estate and other assets, net; loss on extinguishment of debt; provision for impairment; and equity in earnings from unconsolidated ventures. We use NOI to evaluate our operating performance on a property-by-property basis because NOI allows us to evaluate the impact that property-specific factor, such as lease structure, lease rates, and tenant bases, have on our operating results, gross margins, and investment returns. We believe that NOI is a useful supplemental measure of the performance of our Operating Assets segment because it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating real estate properties and the impact on operations from trends in rental and occupancy rates and operating costs. This amount is presented as Operating Assets NOI throughout this document. In-Place NOI - We define In-Place NOI as forecasted current year NOI, excluding certain items affecting comparability to Estimated Stabilized NOI, such as non-recurring items and other items not indicative of stabilized operations, for all properties included in the Operating Assets segment as of the end of the current period. Total Operating Assets NOI - This term represents NOI as defined above with the addition of our share of NOI from unconsolidated ventures. Estimated Stabilized NOI - Estimated Stabilized NOI is an asset's potential annual NOI. This measure is initially projected prior to the development of the asset based on market assumptions and is revised over the life of the asset as market conditions evolve. On a quarterly basis, each asset’s In-Place NOI is compared to its Estimated Stabilized NOI in conjunction with forecast data to determine if an adjustment is needed. Adjustments are made when changes to the asset's long-term performance are thought to be more than likely and permanent. Remaining Development Costs - Development costs and related debt held for projects that are under construction or substantially complete and in service in the Operating Assets segment are disclosed on the Summary of Remaining Development Costs slide if the project has more than $1.0 million of estimated costs remaining to be incurred. The total estimated costs and costs paid are prepared on a cash basis to reflect the total anticipated cash requirements for the projects. Projects not yet under construction are not included. Same Store Properties - The Company defines Same Store Properties as consolidated and unconsolidated properties that are acquired or placed in service prior to the beginning of the earliest period presented and owned by the Company through the end of the latest period presented. Same Store Properties exclude properties placed in service, acquired, repositioned, or in development or redevelopment after the beginning of the earliest period presented or disposed of prior to the end of the latest period presented. Accordingly, it takes at least one year and one quarter after a property is acquired or treated as in service for that property to be included in Same Store Properties. Same Store NOI - We calculate Same Store Net Operating Income (Same Store NOI) as Operating Assets NOI applicable to consolidated properties acquired or placed in service prior to the beginning of the earliest period presented and owned by the Company through the end of the latest period presented. Same Store NOI also includes the Company's share of NOI from unconsolidated ventures and the annual distribution from a cost basis investment. Same Store NOI is a non-GAAP financial measure and should not be viewed as an alternative to net income calculated in accordance with GAAP as a measurement of our operating performance. We believe that Same Store NOI is helpful to investors as a supplemental comparative performance measure of the income generated from the same group of properties from one period to the next. Other companies may not define Same Store NOI in the same manner as we do; therefore, our computation of Same Store NOI may not be comparable to that of other companies. Additionally, we do not control investments in unconsolidated properties, and while we consider disclosures of our share of NOI to be useful, they may not accurately depict the legal and economic implications of our investment arrangements. DefinitionsDefinitions

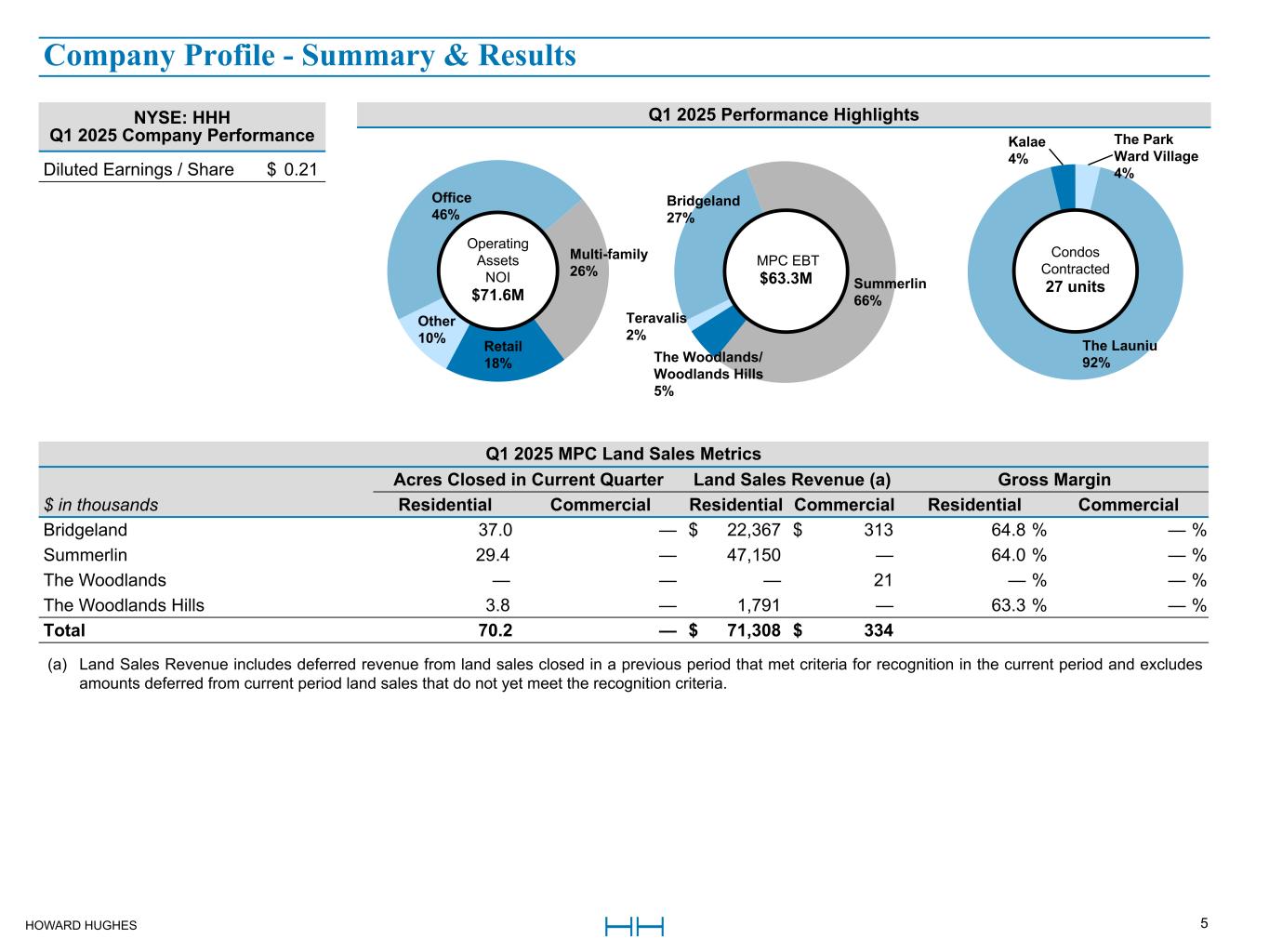

HOWARD HUGHES 5 Company Profile - Summary & Results The Park Ward Village 4% The Launiu 92% Kalae 4% Bridgeland 27% Summerlin 66% The Woodlands/ Woodlands Hills 5% Teravalis 2% MPC EBT $63.3M Condos Contracted 27 units Office 46% Multi-family 26% Retail 18% Other 10% Operating Assets NOI $71.6M Q1 2025 Performance Highlights Q1 2025 MPC Land Sales Metrics Acres Closed in Current Quarter Land Sales Revenue (a) Gross Margin $ in thousands Residential Commercial Residential Commercial Residential Commercial Bridgeland 37.0 — $ 22,367 $ 313 64.8 % — % Summerlin 29.4 — 47,150 — 64.0 % — % The Woodlands — — — 21 — % — % The Woodlands Hills 3.8 — 1,791 — 63.3 % — % Total 70.2 — $ 71,308 $ 334 (a) Land Sales Revenue includes deferred revenue from land sales closed in a previous period that met criteria for recognition in the current period and excludes amounts deferred from current period land sales that do not yet meet the recognition criteria. NYSE: HHH Q1 2025 Company Performance Diluted Earnings / Share $ 0.21

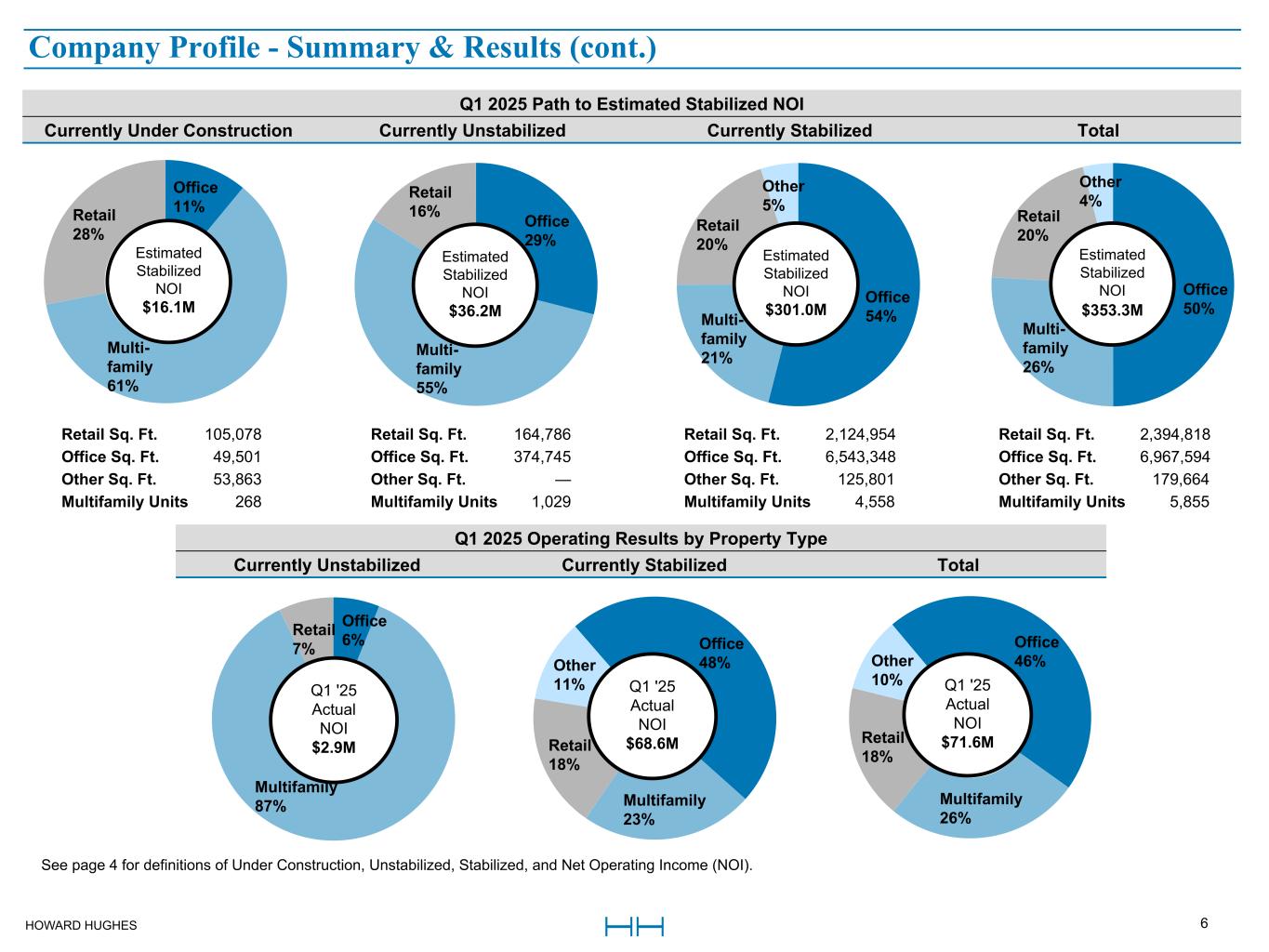

HOWARD HUGHES 6 Office 11% Multi- family 61% Retail 28% Office 6% Multifamily 87% Retail 7% Office 50% Multi- family 26% Retail 20% Other 4% Office 54%Multi- family 21% Retail 20% Other 5% Office 29% Multi- family 55% Retail 16% Q1 2025 Path to Estimated Stabilized NOI Currently Under Construction Currently Unstabilized Currently Stabilized Total Estimated Stabilized NOI $36.2M Estimated Stabilized NOI $301.0M Estimated Stabilized NOI $353.3M Office 48% Multifamily 23% Retail 18% Other 11% Office 46% Multifamily 26% Retail 18% Other 10% See page 4 for definitions of Under Construction, Unstabilized, Stabilized, and Net Operating Income (NOI). Q1 '25 Actual NOI $68.6M Q1 '25 Actual NOI $2.9M Q1 '25 Actual NOI $71.6M Estimated Stabilized NOI $16.1M Retail Sq. Ft. 105,078 Retail Sq. Ft. 164,786 Retail Sq. Ft. 2,124,954 Retail Sq. Ft. 2,394,818 Office Sq. Ft. 49,501 Office Sq. Ft. 374,745 Office Sq. Ft. 6,543,348 Office Sq. Ft. 6,967,594 Other Sq. Ft. 53,863 Other Sq. Ft. — Other Sq. Ft. 125,801 Other Sq. Ft. 179,664 Multifamily Units 268 Multifamily Units 1,029 Multifamily Units 4,558 Multifamily Units 5,855 Q1 2025 Operating Results by Property Type Currently Unstabilized Currently Stabilized Total Company Profile - Summary & Results (cont.)

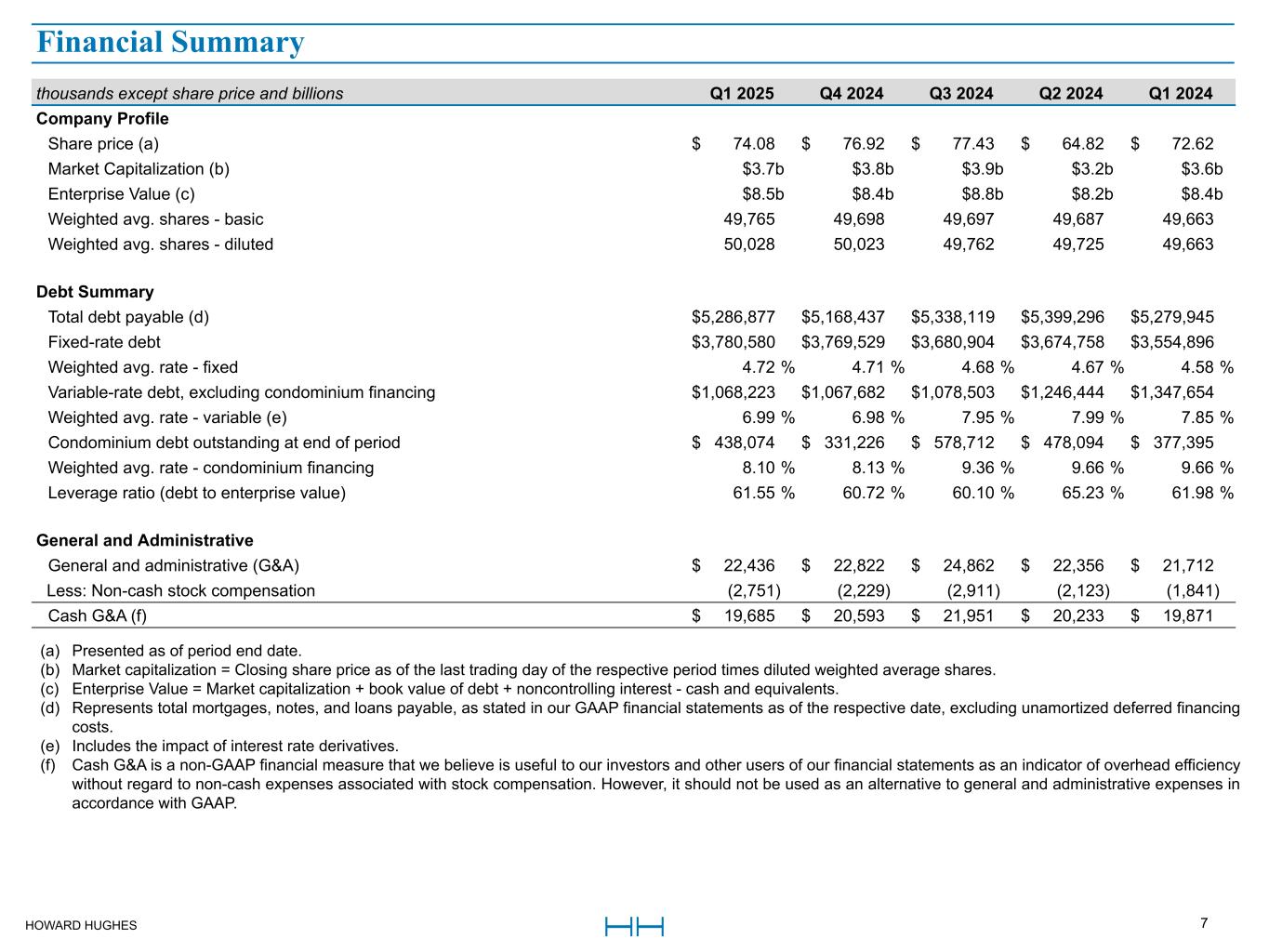

HOWARD HUGHES 7 thousands except share price and billions Q1 2025 Q4 2024 Q3 2024 Q2 2024 Q1 2024 Company Profile Share price (a) $ 74.08 $ 76.92 $ 77.43 $ 64.82 $ 72.62 Market Capitalization (b) $3.7b $3.8b $3.9b $3.2b $3.6b Enterprise Value (c) $8.5b $8.4b $8.8b $8.2b $8.4b Weighted avg. shares - basic 49,765 49,698 49,697 49,687 49,663 Weighted avg. shares - diluted 50,028 50,023 49,762 49,725 49,663 Debt Summary Total debt payable (d) $ 5,286,877 $ 5,168,437 $ 5,338,119 $ 5,399,296 $ 5,279,945 Fixed-rate debt $ 3,780,580 $ 3,769,529 $ 3,680,904 $ 3,674,758 $ 3,554,896 Weighted avg. rate - fixed 4.72 % 4.71 % 4.68 % 4.67 % 4.58 % Variable-rate debt, excluding condominium financing $ 1,068,223 $ 1,067,682 $ 1,078,503 $ 1,246,444 $ 1,347,654 Weighted avg. rate - variable (e) 6.99 % 6.98 % 7.95 % 7.99 % 7.85 % Condominium debt outstanding at end of period $ 438,074 $ 331,226 $ 578,712 $ 478,094 $ 377,395 Weighted avg. rate - condominium financing 8.10 % 8.13 % 9.36 % 9.66 % 9.66 % Leverage ratio (debt to enterprise value) 61.55 % 60.72 % 60.10 % 65.23 % 61.98 % General and Administrative General and administrative (G&A) $ 22,436 $ 22,822 $ 24,862 $ 22,356 $ 21,712 Less: Non-cash stock compensation (2,751) (2,229) (2,911) (2,123) (1,841) Cash G&A (f) $ 19,685 $ 20,593 $ 21,951 $ 20,233 $ 19,871 Financial Summary (a) Presented as of period end date. (b) Market capitalization = Closing share price as of the last trading day of the respective period times diluted weighted average shares. (c) Enterprise Value = Market capitalization + book value of debt + noncontrolling interest - cash and equivalents. (d) Represents total mortgages, notes, and loans payable, as stated in our GAAP financial statements as of the respective date, excluding unamortized deferred financing costs. (e) Includes the impact of interest rate derivatives. (f) Cash G&A is a non-GAAP financial measure that we believe is useful to our investors and other users of our financial statements as an indicator of overhead efficiency without regard to non-cash expenses associated with stock compensation. However, it should not be used as an alternative to general and administrative expenses in accordance with GAAP. Financial Summary

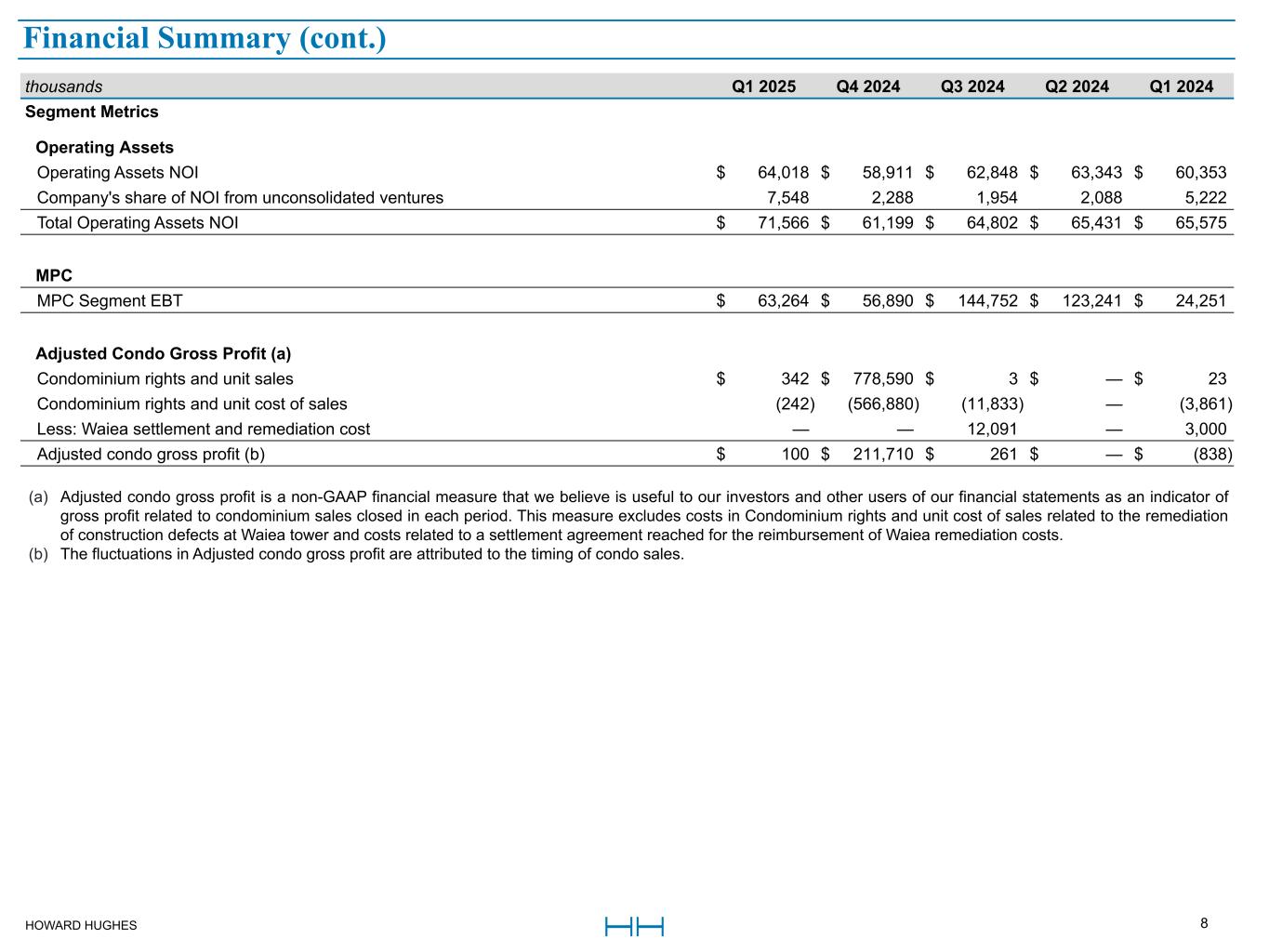

HOWARD HUGHES 8 Financial Summary (a) Adjusted condo gross profit is a non-GAAP financial measure that we believe is useful to our investors and other users of our financial statements as an indicator of gross profit related to condominium sales closed in each period. This measure excludes costs in Condominium rights and unit cost of sales related to the remediation of construction defects at Waiea tower and costs related to a settlement agreement reached for the reimbursement of Waiea remediation costs. (b) The fluctuations in Adjusted condo gross profit are attributed to the timing of condo sales. thousands Q1 2025 Q4 2024 Q3 2024 Q2 2024 Q1 2024 Segment Metrics Operating Assets Operating Assets NOI $ 64,018 $ 58,911 $ 62,848 $ 63,343 $ 60,353 Company's share of NOI from unconsolidated ventures 7,548 2,288 1,954 2,088 5,222 Total Operating Assets NOI $ 71,566 $ 61,199 $ 64,802 $ 65,431 $ 65,575 MPC MPC Segment EBT $ 63,264 $ 56,890 $ 144,752 $ 123,241 $ 24,251 Adjusted Condo Gross Profit (a) Condominium rights and unit sales $ 342 $ 778,590 $ 3 $ — $ 23 Condominium rights and unit cost of sales (242) (566,880) (11,833) — (3,861) Less: Waiea settlement and remediation cost — — 12,091 — 3,000 Adjusted condo gross profit (b) $ 100 $ 211,710 $ 261 $ — $ (838) Financial Summary (cont.)

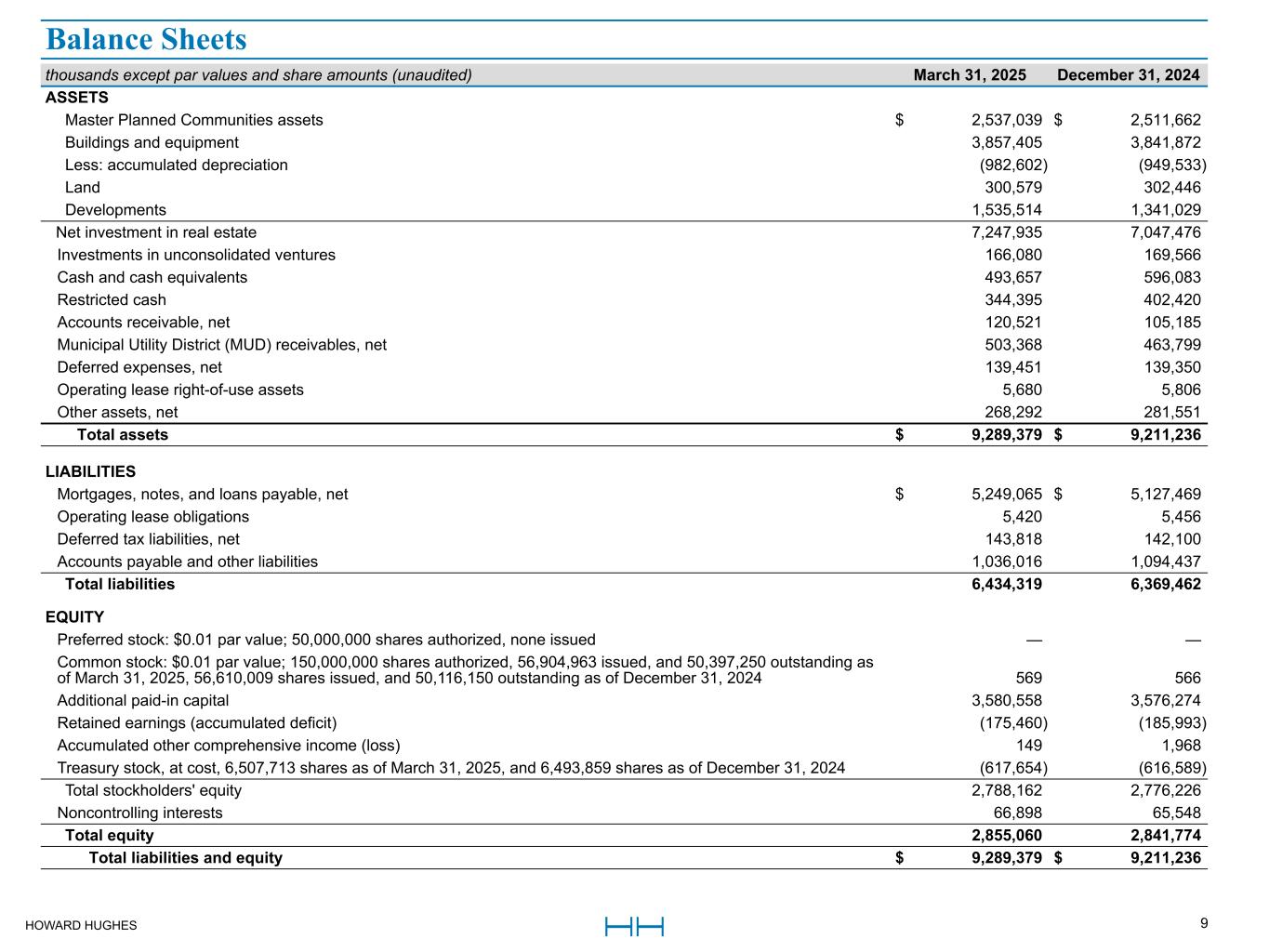

HOWARD HUGHES 9 thousands except par values and share amounts (unaudited) March 31, 2025 December 31, 2024 ASSETS Master Planned Communities assets $ 2,537,039 $ 2,511,662 Buildings and equipment 3,857,405 3,841,872 Less: accumulated depreciation (982,602) (949,533) Land 300,579 302,446 Developments 1,535,514 1,341,029 Net investment in real estate 7,247,935 7,047,476 Investments in unconsolidated ventures 166,080 169,566 Cash and cash equivalents 493,657 596,083 Restricted cash 344,395 402,420 Accounts receivable, net 120,521 105,185 Municipal Utility District (MUD) receivables, net 503,368 463,799 Deferred expenses, net 139,451 139,350 Operating lease right-of-use assets 5,680 5,806 Other assets, net 268,292 281,551 Total assets $ 9,289,379 $ 9,211,236 LIABILITIES Mortgages, notes, and loans payable, net $ 5,249,065 $ 5,127,469 Operating lease obligations 5,420 5,456 Deferred tax liabilities, net 143,818 142,100 Accounts payable and other liabilities 1,036,016 1,094,437 Total liabilities 6,434,319 6,369,462 EQUITY Preferred stock: $0.01 par value; 50,000,000 shares authorized, none issued — — Common stock: $0.01 par value; 150,000,000 shares authorized, 56,904,963 issued, and 50,397,250 outstanding as of March 31, 2025, 56,610,009 shares issued, and 50,116,150 outstanding as of December 31, 2024 569 566 Additional paid-in capital 3,580,558 3,576,274 Retained earnings (accumulated deficit) (175,460) (185,993) Accumulated other comprehensive income (loss) 149 1,968 Treasury stock, at cost, 6,507,713 shares as of March 31, 2025, and 6,493,859 shares as of December 31, 2024 (617,654) (616,589) Total stockholders' equity 2,788,162 2,776,226 Noncontrolling interests 66,898 65,548 Total equity 2,855,060 2,841,774 Total liabilities and equity $ 9,289,379 $ 9,211,236 Balance Sheets

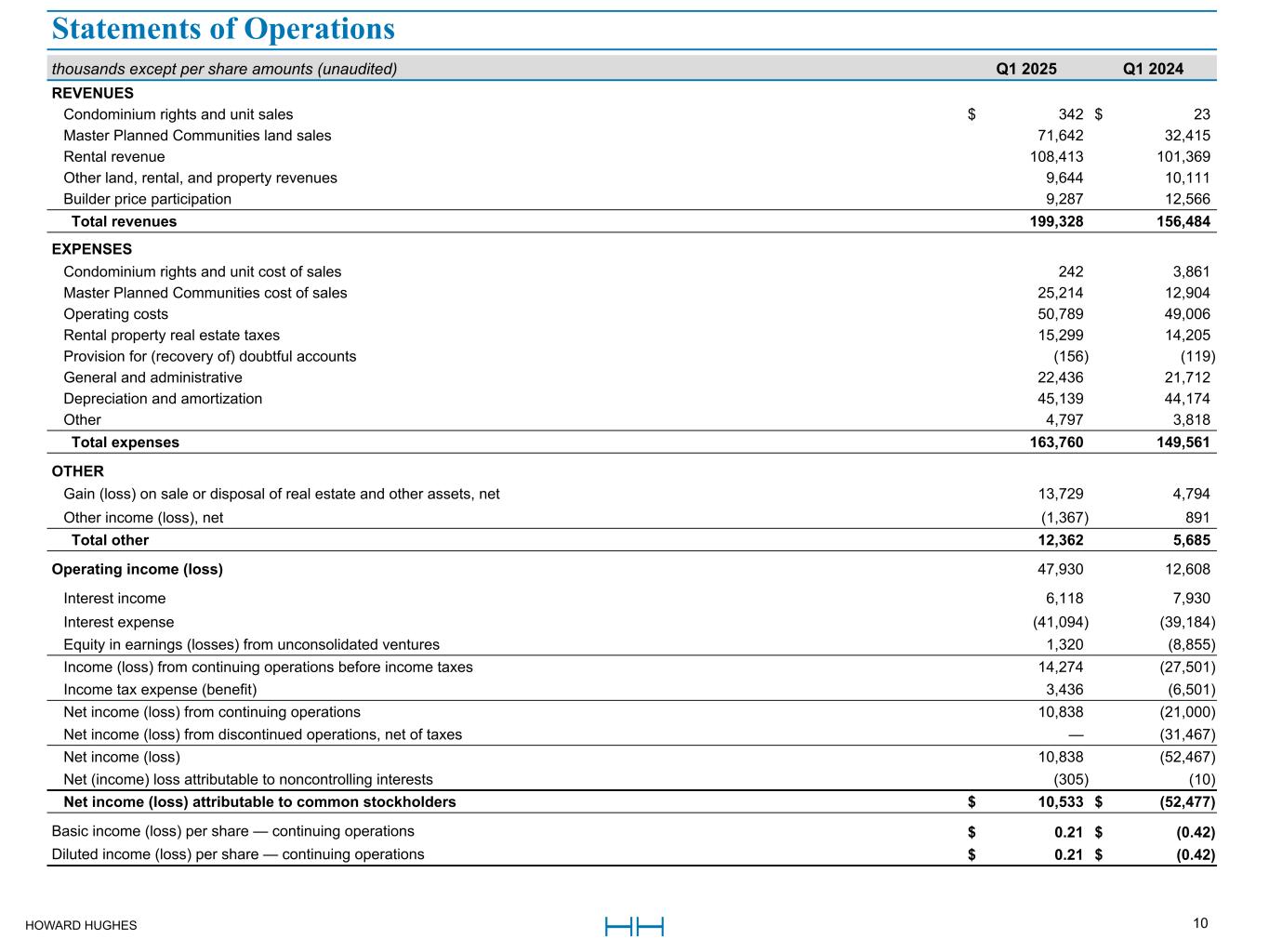

HOWARD HUGHES 10 thousands except per share amounts (unaudited) Q1 2025 Q1 2024 REVENUES Condominium rights and unit sales $ 342 $ 23 Master Planned Communities land sales 71,642 32,415 Rental revenue 108,413 101,369 Other land, rental, and property revenues 9,644 10,111 Builder price participation 9,287 12,566 Total revenues 199,328 156,484 EXPENSES Condominium rights and unit cost of sales 242 3,861 Master Planned Communities cost of sales 25,214 12,904 Operating costs 50,789 49,006 Rental property real estate taxes 15,299 14,205 Provision for (recovery of) doubtful accounts (156) (119) General and administrative 22,436 21,712 Depreciation and amortization 45,139 44,174 Other 4,797 3,818 Total expenses 163,760 149,561 OTHER Gain (loss) on sale or disposal of real estate and other assets, net 13,729 4,794 Other income (loss), net (1,367) 891 Total other 12,362 5,685 Operating income (loss) 47,930 12,608 Interest income 6,118 7,930 Interest expense (41,094) (39,184) Equity in earnings (losses) from unconsolidated ventures 1,320 (8,855) Income (loss) from continuing operations before income taxes 14,274 (27,501) Income tax expense (benefit) 3,436 (6,501) Net income (loss) from continuing operations 10,838 (21,000) Net income (loss) from discontinued operations, net of taxes — (31,467) Net income (loss) 10,838 (52,467) Net (income) loss attributable to noncontrolling interests (305) (10) Net income (loss) attributable to common stockholders $ 10,533 $ (52,477) Basic income (loss) per share — continuing operations $ 0.21 $ (0.42) Diluted income (loss) per share — continuing operations $ 0.21 $ (0.42) Statements of Operations

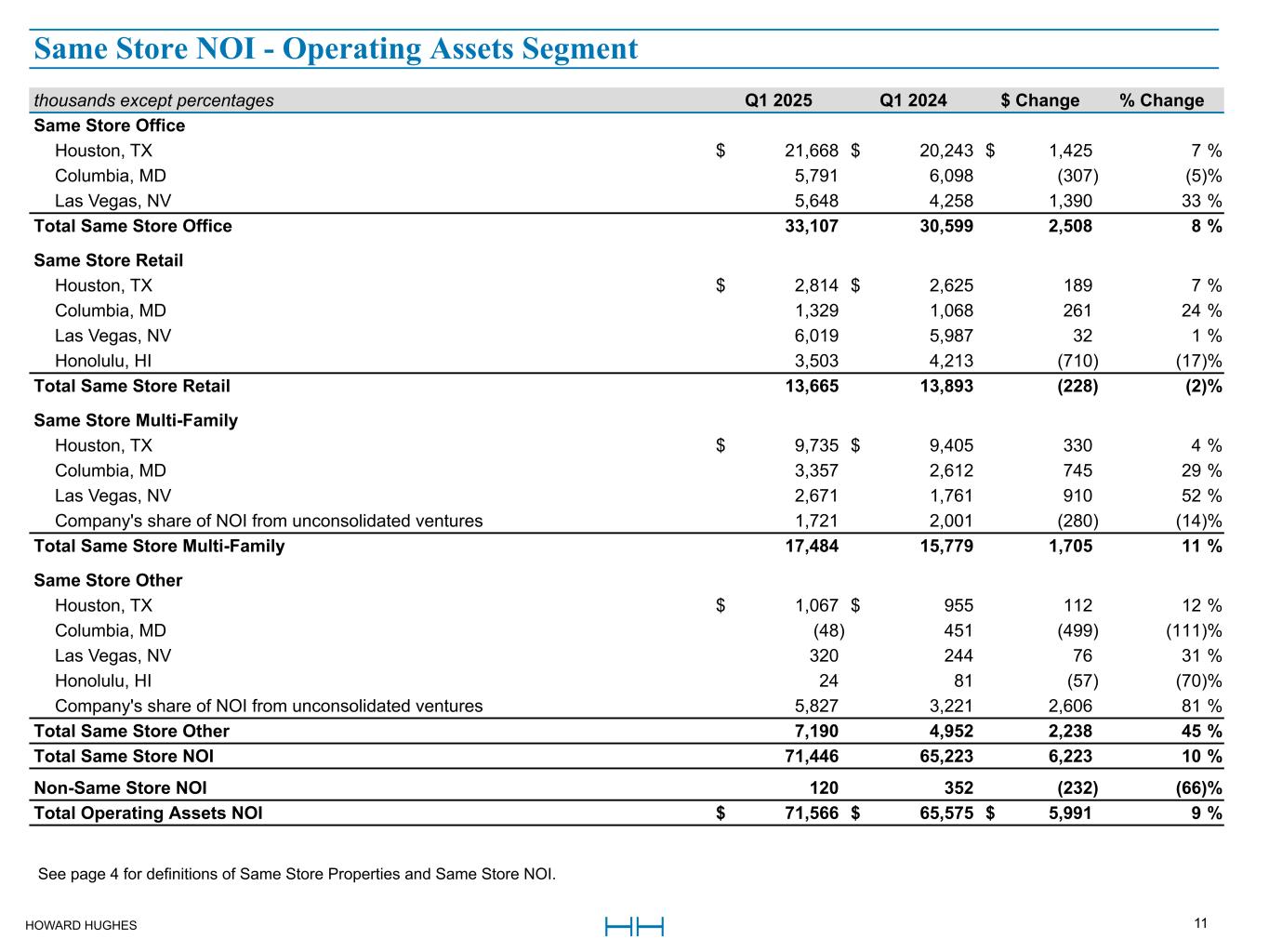

HOWARD HUGHES 11 thousands except percentages Q1 2025 Q1 2024 $ Change % Change Same Store Office Houston, TX $ 21,668 $ 20,243 $ 1,425 7 % Columbia, MD 5,791 6,098 (307) (5) % Las Vegas, NV 5,648 4,258 1,390 33 % Total Same Store Office 33,107 30,599 2,508 8 % Same Store Retail Houston, TX $ 2,814 $ 2,625 189 7 % Columbia, MD 1,329 1,068 261 24 % Las Vegas, NV 6,019 5,987 32 1 % Honolulu, HI 3,503 4,213 (710) (17) % Total Same Store Retail 13,665 13,893 (228) (2) % Same Store Multi-Family Houston, TX $ 9,735 $ 9,405 330 4 % Columbia, MD 3,357 2,612 745 29 % Las Vegas, NV 2,671 1,761 910 52 % Company's share of NOI from unconsolidated ventures 1,721 2,001 (280) (14) % Total Same Store Multi-Family 17,484 15,779 1,705 11 % Same Store Other Houston, TX $ 1,067 $ 955 112 12 % Columbia, MD (48) 451 (499) (111) % Las Vegas, NV 320 244 76 31 % Honolulu, HI 24 81 (57) (70) % Company's share of NOI from unconsolidated ventures 5,827 3,221 2,606 81 % Total Same Store Other 7,190 4,952 2,238 45 % Total Same Store NOI 71,446 65,223 6,223 10 % Non-Same Store NOI 120 352 (232) (66) % Total Operating Assets NOI $ 71,566 $ 65,575 $ 5,991 9 % See page 4 for definitions of Same Store Properties and Same Store NOI. Same Store NOI - Operating Assets Segment

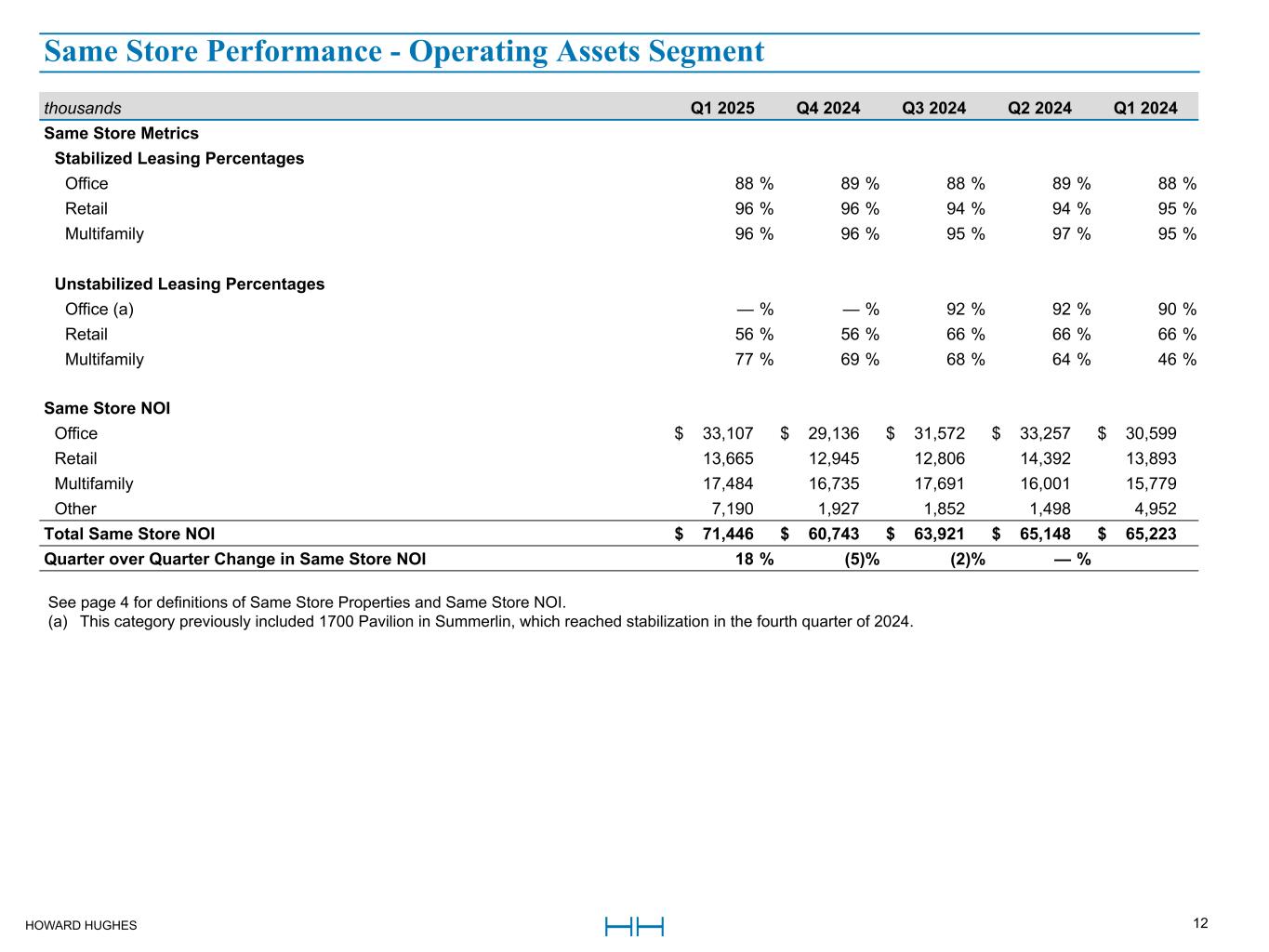

HOWARD HUGHES 12 thousands Q1 2025 Q4 2024 Q3 2024 Q2 2024 Q1 2024 Same Store Metrics Stabilized Leasing Percentages Office 88 % 89 % 88 % 89 % 88 % Retail 96 % 96 % 94 % 94 % 95 % Multifamily 96 % 96 % 95 % 97 % 95 % Unstabilized Leasing Percentages Office (a) — % — % 92 % 92 % 90 % Retail 56 % 56 % 66 % 66 % 66 % Multifamily 77 % 69 % 68 % 64 % 46 % Same Store NOI Office $ 33,107 $ 29,136 $ 31,572 $ 33,257 $ 30,599 Retail 13,665 12,945 12,806 14,392 13,893 Multifamily 17,484 16,735 17,691 16,001 15,779 Other 7,190 1,927 1,852 1,498 4,952 Total Same Store NOI $ 71,446 $ 60,743 $ 63,921 $ 65,148 $ 65,223 Quarter over Quarter Change in Same Store NOI 18 % (5) % (2) % — % See page 4 for definitions of Same Store Properties and Same Store NOI. (a) This category previously included 1700 Pavilion in Summerlin, which reached stabilization in the fourth quarter of 2024. Same Store Performance - Operating Assets Segment

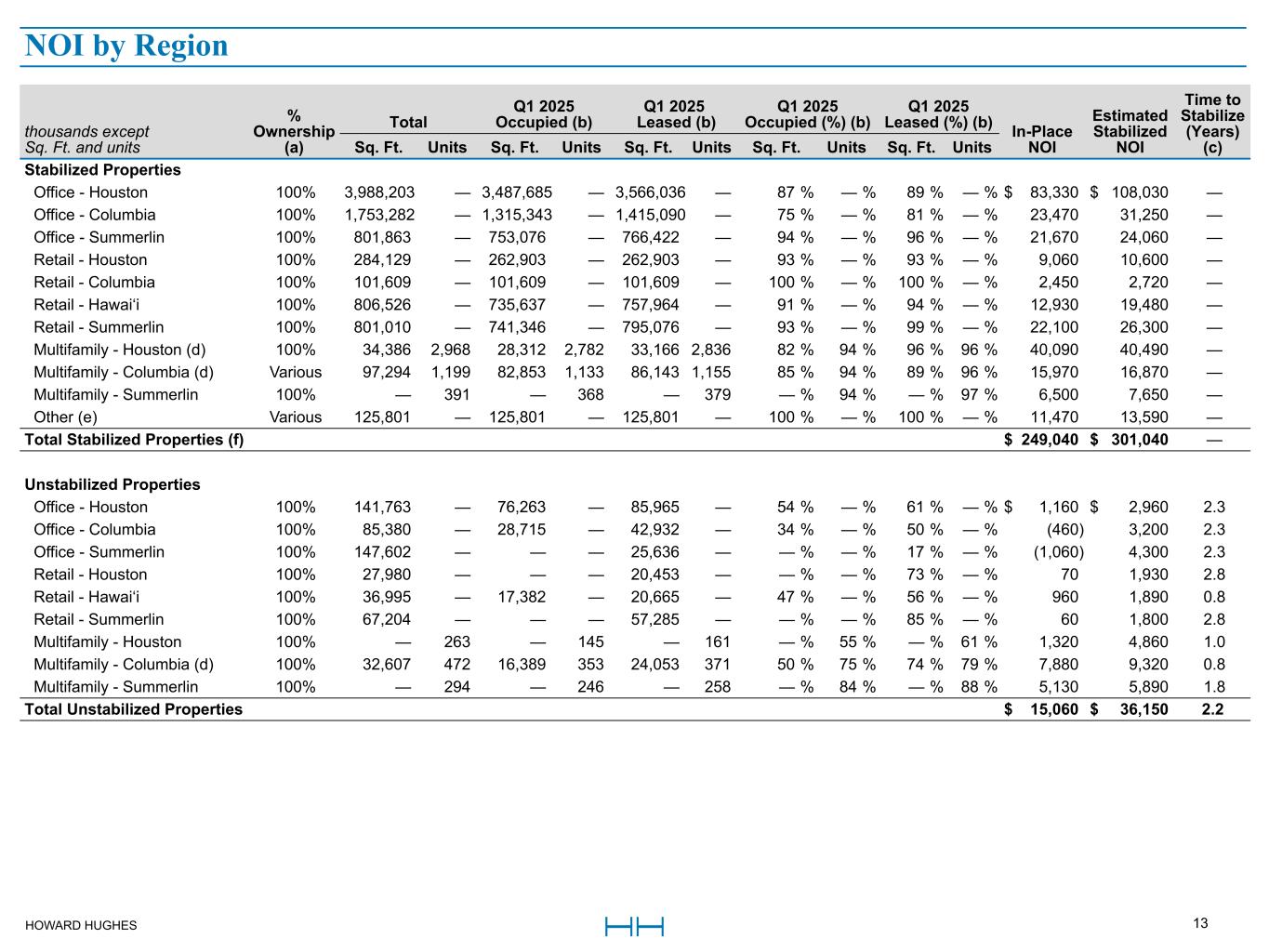

HOWARD HUGHES 13 NOI by Region thousands except Sq. Ft. and units % Ownership (a) Total Q1 2025 Occupied (b) Q1 2025 Leased (b) Q1 2025 Occupied (%) (b) Q1 2025 Leased (%) (b) In-Place NOI Estimated Stabilized NOI Time to Stabilize (Years) (c)Sq. Ft. Units Sq. Ft. Units Sq. Ft. Units Sq. Ft. Units Sq. Ft. Units Stabilized Properties Office - Houston 100% 3,988,203 — 3,487,685 — 3,566,036 — 87 % — % 89 % — % $ 83,330 $ 108,030 — Office - Columbia 100% 1,753,282 — 1,315,343 — 1,415,090 — 75 % — % 81 % — % 23,470 31,250 — Office - Summerlin 100% 801,863 — 753,076 — 766,422 — 94 % — % 96 % — % 21,670 24,060 — Retail - Houston 100% 284,129 — 262,903 — 262,903 — 93 % — % 93 % — % 9,060 10,600 — Retail - Columbia 100% 101,609 — 101,609 — 101,609 — 100 % — % 100 % — % 2,450 2,720 — Retail - Hawai‘i 100% 806,526 — 735,637 — 757,964 — 91 % — % 94 % — % 12,930 19,480 — Retail - Summerlin 100% 801,010 — 741,346 — 795,076 — 93 % — % 99 % — % 22,100 26,300 — Multifamily - Houston (d) 100% 34,386 2,968 28,312 2,782 33,166 2,836 82 % 94 % 96 % 96 % 40,090 40,490 — Multifamily - Columbia (d) Various 97,294 1,199 82,853 1,133 86,143 1,155 85 % 94 % 89 % 96 % 15,970 16,870 — Multifamily - Summerlin 100% — 391 — 368 — 379 — % 94 % — % 97 % 6,500 7,650 — Other (e) Various 125,801 — 125,801 — 125,801 — 100 % — % 100 % — % 11,470 13,590 — Total Stabilized Properties (f) $ 249,040 $ 301,040 — Unstabilized Properties Office - Houston 100% 141,763 — 76,263 — 85,965 — 54 % — % 61 % — % $ 1,160 $ 2,960 2.3 Office - Columbia 100% 85,380 — 28,715 — 42,932 — 34 % — % 50 % — % (460) 3,200 2.3 Office - Summerlin 100% 147,602 — — — 25,636 — — % — % 17 % — % (1,060) 4,300 2.3 Retail - Houston 100% 27,980 — — — 20,453 — — % — % 73 % — % 70 1,930 2.8 Retail - Hawai‘i 100% 36,995 — 17,382 — 20,665 — 47 % — % 56 % — % 960 1,890 0.8 Retail - Summerlin 100% 67,204 — — — 57,285 — — % — % 85 % — % 60 1,800 2.8 Multifamily - Houston 100% — 263 — 145 — 161 — % 55 % — % 61 % 1,320 4,860 1.0 Multifamily - Columbia (d) 100% 32,607 472 16,389 353 24,053 371 50 % 75 % 74 % 79 % 7,880 9,320 0.8 Multifamily - Summerlin 100% — 294 — 246 — 258 — % 84 % — % 88 % 5,130 5,890 1.8 Total Unstabilized Properties $ 15,060 $ 36,150 2.2

HOWARD HUGHES 14 NOI by RegionNOI by Region (cont.) (a) Includes our share of NOI from our unconsolidated ventures. (b) Occupied and Leased metrics are as of March 31, 2025. (c) The estimated stabilization date used in the Time to Stabilize calculation for all unstabilized and under construction assets is set at the maximum stabilization period of 36 months from the in-service or expected in-service date. If an Unstabilized property achieves 90% occupancy prior to this date, it will move to Stabilized. (d) Multifamily square feet represent ground floor retail whereas multifamily units represent residential units for rent. (e) These assets can be found on page 16 of this presentation. (f) For Stabilized Properties, the difference between In-Place NOI and Estimated Stabilized NOI is attributable to a number of factors which may include temporary abatements, timing of lease turnovers, free rent, and other market factors. thousands except Sq. Ft. and units % Ownership (a) Total Q1 2025 Occupied (b) Q1 2025 Leased (b) Q1 2025 Occupied (%) (b) Q1 2025 Leased (%) (b) In-Place NOI Estimated Stabilized NOI Time to Stabilize (Years) (c)Sq. Ft. Units Sq. Ft. Units Sq. Ft. Units Sq. Ft. Units Sq. Ft. Units Under Construction Properties Office - Houston 100 % 49,501 — — — — — — % — % — % — % n/a $ 1,780 3.3 Retail - Houston 100 % 44,178 — — — — — — % — % — % — % n/a 1,650 4.2 Retail - Hawai‘i 100 % 60,900 — — — — — — % — % — % — % n/a 2,800 4.2 Multifamily - Houston 100 % — 268 — — — — — % — % — % — % n/a 9,890 3.8 Other - Houston 100 % 53,863 — — — — — — % — % — % — % n/a n/a n/a Total Under Construction Properties n/a $ 16,120 3.9 Total / Wtd. Avg. for Portfolio $ 264,100 $ 353,310 3.0

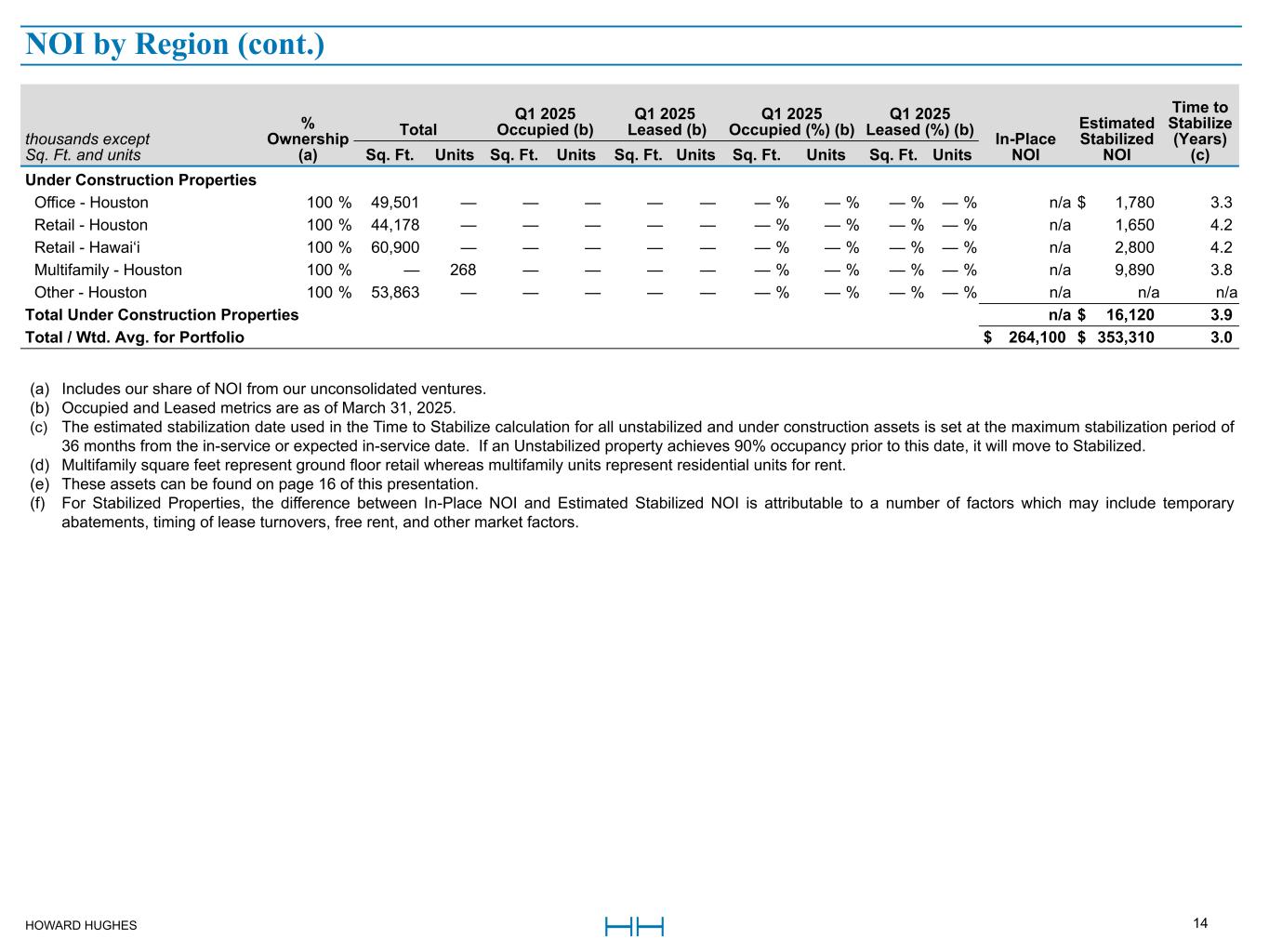

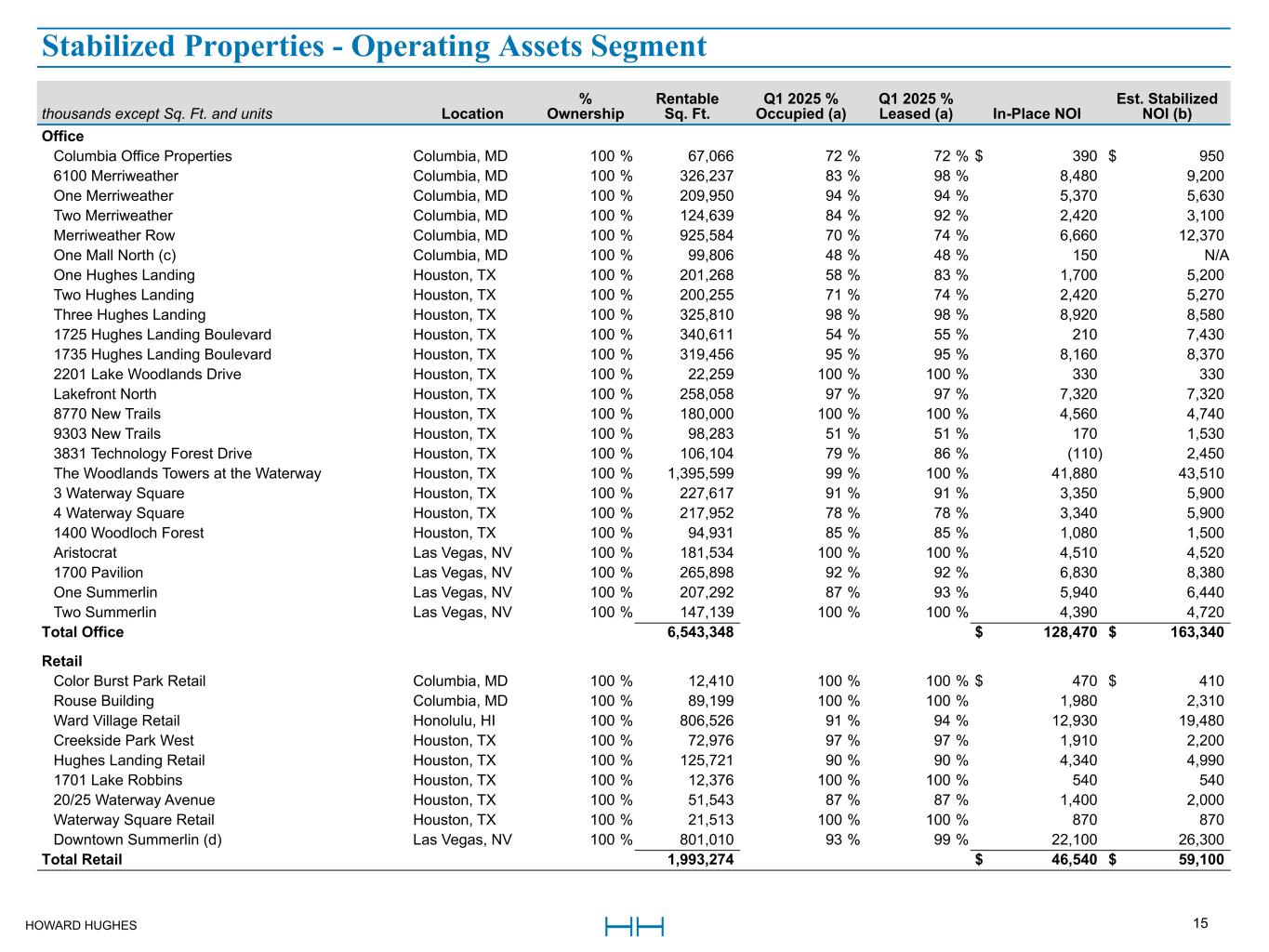

HOWARD HUGHES 15 thousands except Sq. Ft. and units Location % Ownership Rentable Sq. Ft. Q1 2025 % Occupied (a) Q1 2025 % Leased (a) In-Place NOI Est. Stabilized NOI (b) Office Columbia Office Properties Columbia, MD 100 % 67,066 72 % 72 % $ 390 $ 950 6100 Merriweather Columbia, MD 100 % 326,237 83 % 98 % 8,480 9,200 One Merriweather Columbia, MD 100 % 209,950 94 % 94 % 5,370 5,630 Two Merriweather Columbia, MD 100 % 124,639 84 % 92 % 2,420 3,100 Merriweather Row Columbia, MD 100 % 925,584 70 % 74 % 6,660 12,370 One Mall North (c) Columbia, MD 100 % 99,806 48 % 48 % 150 N/A One Hughes Landing Houston, TX 100 % 201,268 58 % 83 % 1,700 5,200 Two Hughes Landing Houston, TX 100 % 200,255 71 % 74 % 2,420 5,270 Three Hughes Landing Houston, TX 100 % 325,810 98 % 98 % 8,920 8,580 1725 Hughes Landing Boulevard Houston, TX 100 % 340,611 54 % 55 % 210 7,430 1735 Hughes Landing Boulevard Houston, TX 100 % 319,456 95 % 95 % 8,160 8,370 2201 Lake Woodlands Drive Houston, TX 100 % 22,259 100 % 100 % 330 330 Lakefront North Houston, TX 100 % 258,058 97 % 97 % 7,320 7,320 8770 New Trails Houston, TX 100 % 180,000 100 % 100 % 4,560 4,740 9303 New Trails Houston, TX 100 % 98,283 51 % 51 % 170 1,530 3831 Technology Forest Drive Houston, TX 100 % 106,104 79 % 86 % (110) 2,450 The Woodlands Towers at the Waterway Houston, TX 100 % 1,395,599 99 % 100 % 41,880 43,510 3 Waterway Square Houston, TX 100 % 227,617 91 % 91 % 3,350 5,900 4 Waterway Square Houston, TX 100 % 217,952 78 % 78 % 3,340 5,900 1400 Woodloch Forest Houston, TX 100 % 94,931 85 % 85 % 1,080 1,500 Aristocrat Las Vegas, NV 100 % 181,534 100 % 100 % 4,510 4,520 1700 Pavilion Las Vegas, NV 100 % 265,898 92 % 92 % 6,830 8,380 One Summerlin Las Vegas, NV 100 % 207,292 87 % 93 % 5,940 6,440 Two Summerlin Las Vegas, NV 100 % 147,139 100 % 100 % 4,390 4,720 Total Office 6,543,348 $ 128,470 $ 163,340 Retail Color Burst Park Retail Columbia, MD 100 % 12,410 100 % 100 % $ 470 $ 410 Rouse Building Columbia, MD 100 % 89,199 100 % 100 % 1,980 2,310 Ward Village Retail Honolulu, HI 100 % 806,526 91 % 94 % 12,930 19,480 Creekside Park West Houston, TX 100 % 72,976 97 % 97 % 1,910 2,200 Hughes Landing Retail Houston, TX 100 % 125,721 90 % 90 % 4,340 4,990 1701 Lake Robbins Houston, TX 100 % 12,376 100 % 100 % 540 540 20/25 Waterway Avenue Houston, TX 100 % 51,543 87 % 87 % 1,400 2,000 Waterway Square Retail Houston, TX 100 % 21,513 100 % 100 % 870 870 Downtown Summerlin (d) Las Vegas, NV 100 % 801,010 93 % 99 % 22,100 26,300 Total Retail 1,993,274 $ 46,540 $ 59,100 Stabilized Properties - Operating Assets Segment

HOWARD HUGHES 16 Q1 2025 % Occupied (a) Q1 2025 % Leased (a) Estimated Stabilized NOI (b)thousands except Sq. Ft. and units Location % Ownership Rentable Sq. Ft. Units Rentable Sq. Ft. Units Rentable Sq. Ft. Units In-Place NOI (b) Multifamily Juniper Columbia, MD 100 % 55,677 382 87 % 95 % 93 % 97 % $ 8,770 $ 9,160 TEN.m.flats Columbia, MD 50 % 28,026 437 96 % 95 % 96 % 97 % 4,080 4,250 The Metropolitan Columbia, MD 50 % 13,591 380 56 % 94 % 56 % 96 % 3,120 3,460 Creekside Park Houston, TX 100 % — 292 n/a 92 % n/a 93 % 2,950 3,000 Creekside Park The Grove Houston, TX 100 % — 360 n/a 95 % n/a 98 % 3,820 4,210 One Lakes Edge Houston, TX 100 % 22,971 390 83 % 94 % 95 % 96 % 7,680 7,680 Two Lakes Edge Houston, TX 100 % 11,415 386 81 % 95 % 100 % 97 % 8,760 8,750 Lakeside Row Houston, TX 100 % — 312 n/a 93 % n/a 94 % 2,910 3,090 Millennium Six Pines Houston, TX 100 % — 314 n/a 94 % n/a 96 % 3,840 3,770 Millennium Waterway Houston, TX 100 % — 393 n/a 93 % n/a 95 % 4,220 3,910 Starling at Bridgeland Houston, TX 100 % — 358 — % 92 % — % 94 % 3,230 3,400 The Lane at Waterway Houston, TX 100 % — 163 n/a 96 % n/a 98 % 2,680 2,680 Constellation Las Vegas, NV 100 % — 124 n/a 95 % n/a 98 % 1,950 2,500 Tanager Las Vegas, NV 100 % — 267 n/a 94 % n/a 96 % 4,550 5,150 Total Multifamily (e) 131,680 4,558 $ 62,560 $ 65,010 Other Houston Ground Leases Houston, TX 100 % n/a n/a n/a n/a n/a n/a $ 2,940 $ 3,160 Hughes Landing Daycare Houston, TX 100 % — n/a — % n/a — % n/a 250 280 Stewart Title of Montgomery County, TX Houston, TX 50 % n/a n/a n/a n/a n/a n/a 40 1,600 The Woodlands Warehouse Houston, TX 100 % 125,801 n/a 100 % n/a 100 % n/a 1,440 1,520 Woodlands Sarofim Houston, TX 20 % n/a n/a n/a n/a n/a n/a 220 250 Kewalo Basin Harbor Honolulu, HI 100 % n/a n/a n/a n/a n/a n/a 1,780 1,900 Hockey Ground Lease Las Vegas, NV 100 % n/a n/a n/a n/a n/a n/a 610 610 Summerlin Hospital Medical Center Las Vegas, NV 5 % n/a n/a n/a n/a n/a n/a 5,600 5,600 Other Assets Various 100 % n/a n/a n/a n/a n/a n/a (1,410) (1,330) Total Other 125,801 — $ 11,470 $ 13,590 Total Stabilized $ 249,040 $ 301,040 (a) Occupied and Leased percentages are as of March 31, 2025. (b) For Stabilized Properties, the difference between In-Place NOI and Estimated Stabilized NOI is attributable to a number of factors which may include temporary abatements, timing of lease turnovers, free rent, and other market factors. (c) One Mall North will be decommissioned in 2025 and moved to Strategic Developments for redevelopment in 2026. (d) Downtown Summerlin rentable sq. ft. excludes 381,767 sq. ft. of anchor space and 39,700 sq. ft. of office space. (e) Multifamily square feet represent ground floor retail whereas multifamily units represent residential units for rent. Stabilized Properties - Operating Assets Segment (cont.)

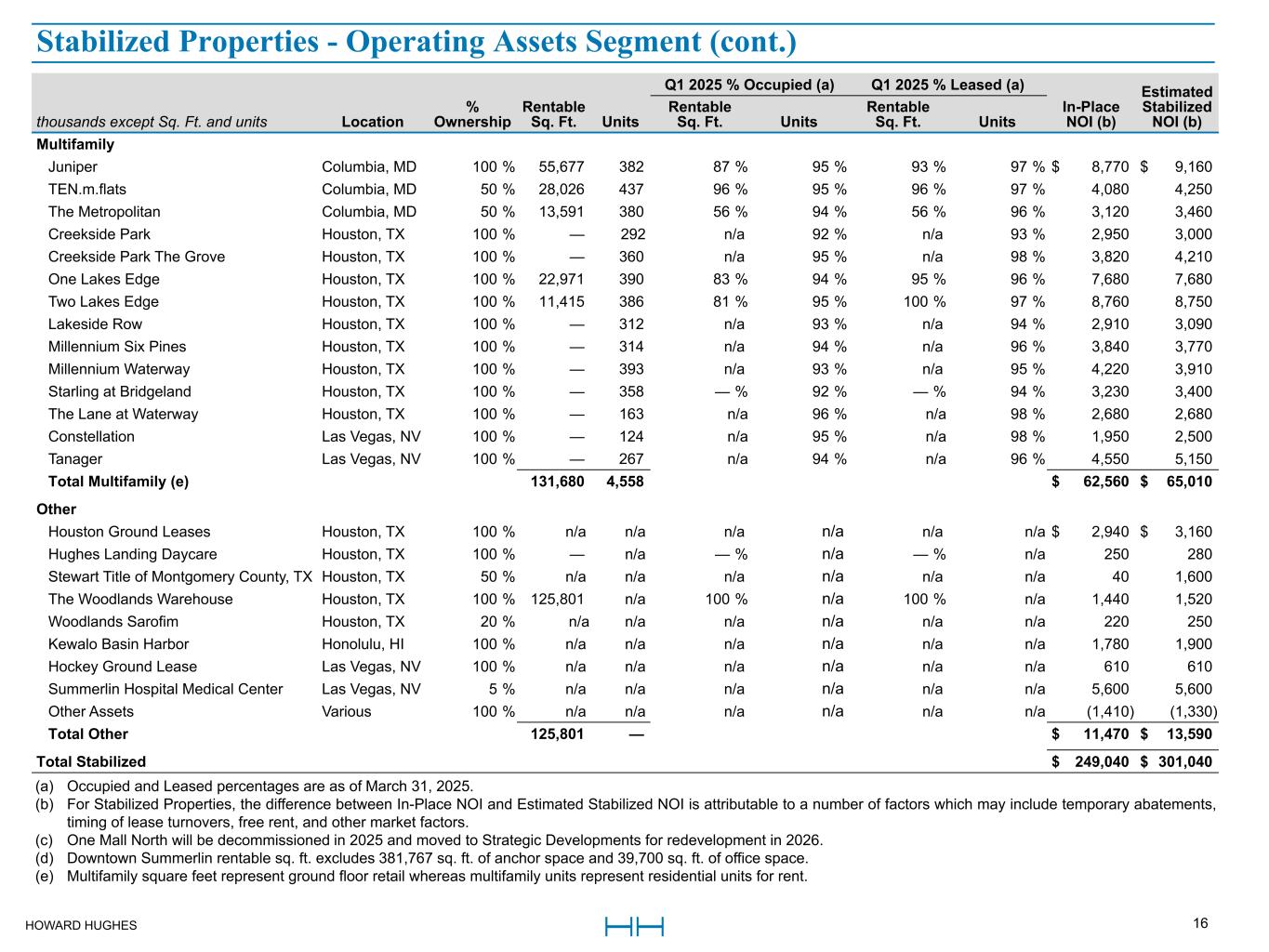

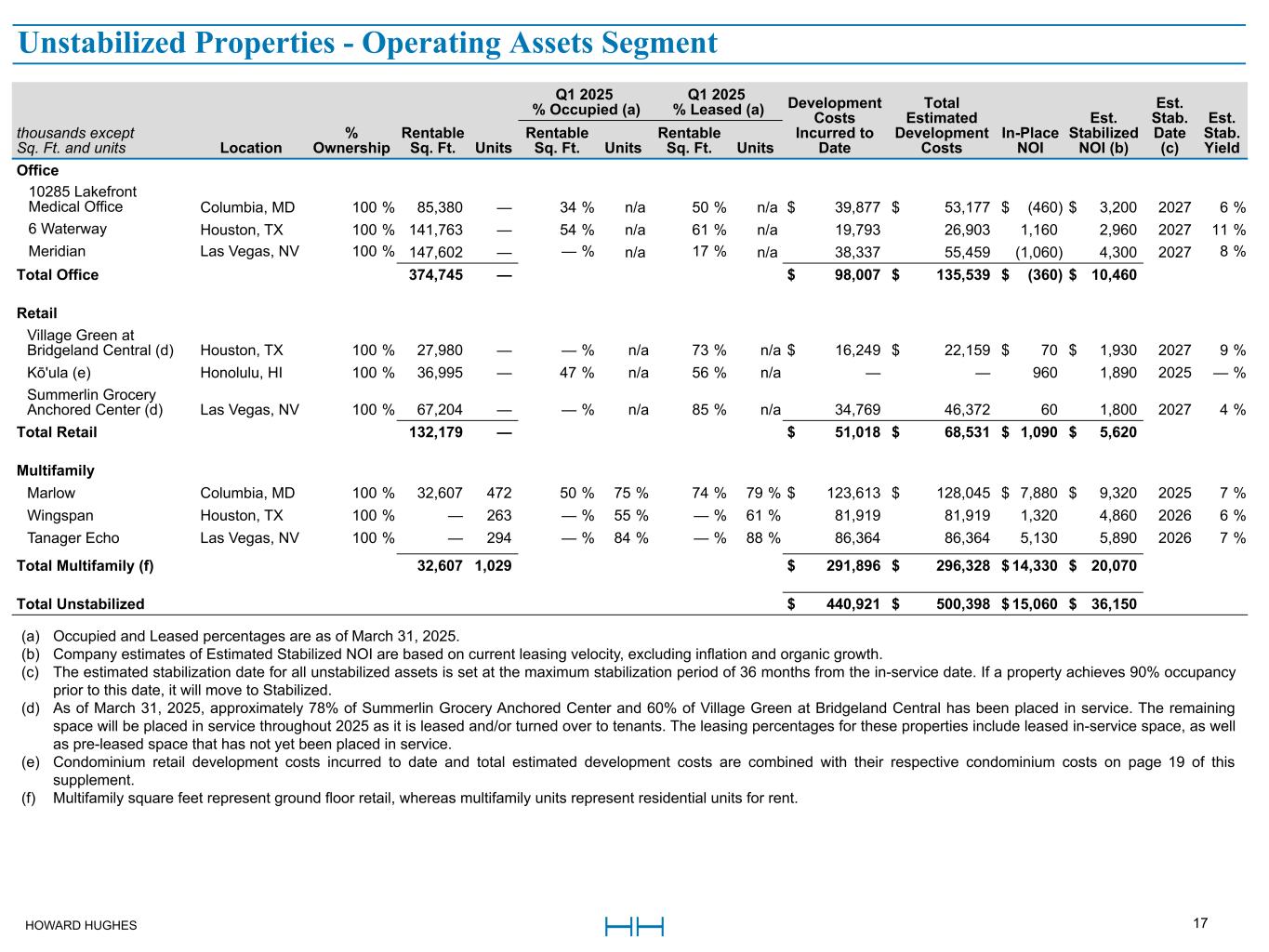

HOWARD HUGHES 17 Q1 2025 % Occupied (a) Q1 2025 % Leased (a) Development Costs Incurred to Date Total Estimated Development Costs In-Place NOI Est. Stabilized NOI (b) Est. Stab. Date (c) Est. Stab. Yield thousands except Sq. Ft. and units Location % Ownership Rentable Sq. Ft. Units Rentable Sq. Ft. Units Rentable Sq. Ft. Units Office 10285 Lakefront Medical Office Columbia, MD 100 % 85,380 — 34 % n/a 50 % n/a $ 39,877 $ 53,177 $ (460) $ 3,200 2027 6 % 6 Waterway Houston, TX 100 % 141,763 — 54 % n/a 61 % n/a 19,793 26,903 1,160 2,960 2027 11 % Meridian Las Vegas, NV 100 % 147,602 — — % n/a 17 % n/a 38,337 55,459 (1,060) 4,300 2027 8 % Total Office 374,745 — $ 98,007 $ 135,539 $ (360) $ 10,460 Retail Village Green at Bridgeland Central (d) Houston, TX 100 % 27,980 — — % n/a 73 % n/a $ 16,249 $ 22,159 $ 70 $ 1,930 2027 9 % Kō'ula (e) Honolulu, HI 100 % 36,995 — 47 % n/a 56 % n/a — — 960 1,890 2025 — % Summerlin Grocery Anchored Center (d) Las Vegas, NV 100 % 67,204 — — % n/a 85 % n/a 34,769 46,372 60 1,800 2027 4 % Total Retail 132,179 — $ 51,018 $ 68,531 $ 1,090 $ 5,620 Multifamily Marlow Columbia, MD 100 % 32,607 472 50 % 75 % 74 % 79 % $ 123,613 $ 128,045 $ 7,880 $ 9,320 2025 7 % Wingspan Houston, TX 100 % — 263 — % 55 % — % 61 % 81,919 81,919 1,320 4,860 2026 6 % Tanager Echo Las Vegas, NV 100 % — 294 — % 84 % — % 88 % 86,364 86,364 5,130 5,890 2026 7 % Total Multifamily (f) 32,607 1,029 $ 291,896 $ 296,328 $ 14,330 $ 20,070 Total Unstabilized $ 440,921 $ 500,398 $ 15,060 $ 36,150 (a) Occupied and Leased percentages are as of March 31, 2025. (b) Company estimates of Estimated Stabilized NOI are based on current leasing velocity, excluding inflation and organic growth. (c) The estimated stabilization date for all unstabilized assets is set at the maximum stabilization period of 36 months from the in-service date. If a property achieves 90% occupancy prior to this date, it will move to Stabilized. (d) As of March 31, 2025, approximately 78% of Summerlin Grocery Anchored Center and 60% of Village Green at Bridgeland Central has been placed in service. The remaining space will be placed in service throughout 2025 as it is leased and/or turned over to tenants. The leasing percentages for these properties include leased in-service space, as well as pre-leased space that has not yet been placed in service. (e) Condominium retail development costs incurred to date and total estimated development costs are combined with their respective condominium costs on page 19 of this supplement. (f) Multifamily square feet represent ground floor retail, whereas multifamily units represent residential units for rent. Unstabilized Properties - Operating Assets Segment

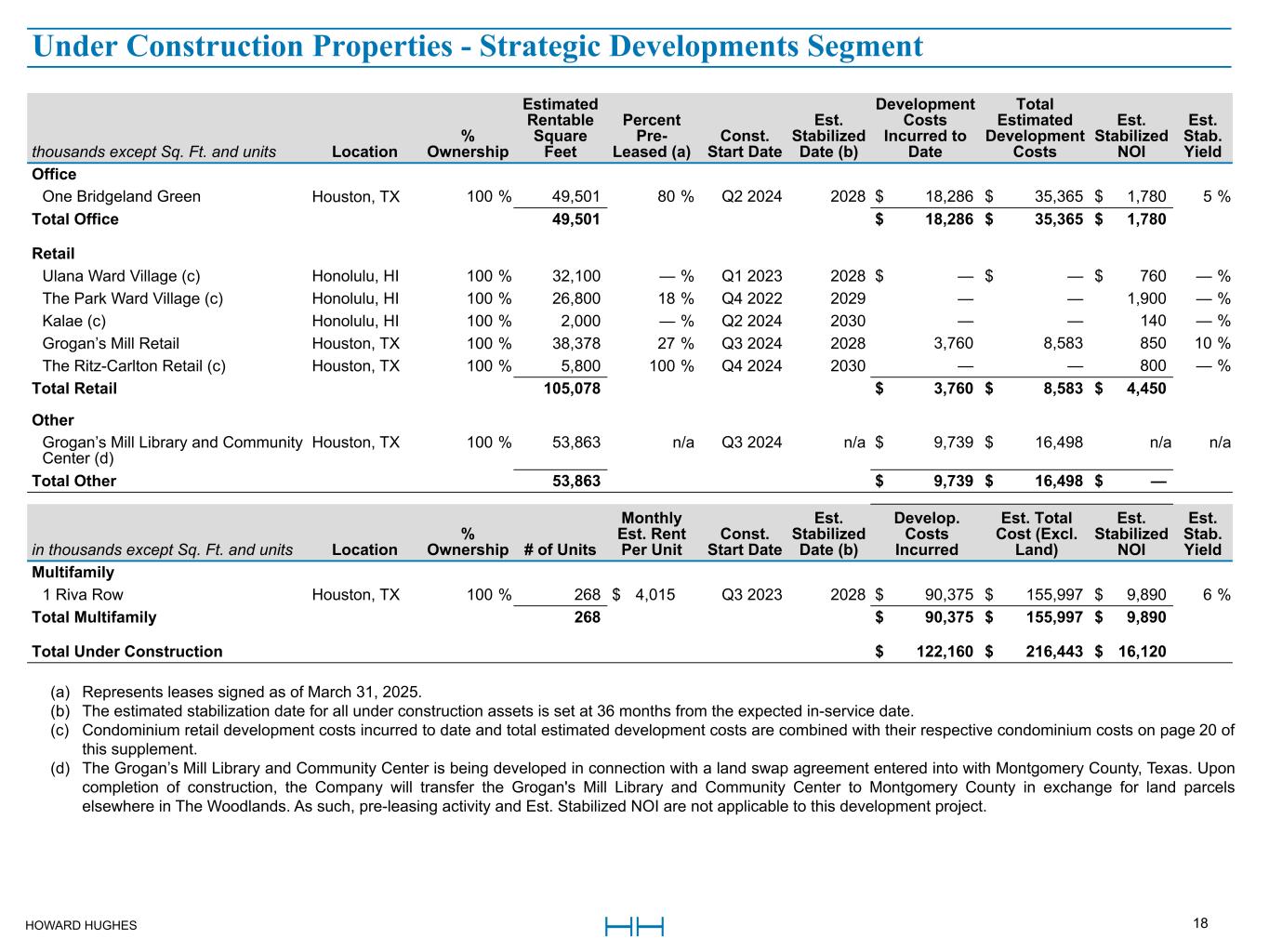

HOWARD HUGHES 18 Under Construction Properties thousands except Sq. Ft. and units Location % Ownership Estimated Rentable Square Feet Percent Pre- Leased (a) Const. Start Date Est. Stabilized Date (b) Development Costs Incurred to Date Total Estimated Development Costs Est. Stabilized NOI Est. Stab. Yield Office One Bridgeland Green Houston, TX 100 % 49,501 80 % Q2 2024 2028 $ 18,286 $ 35,365 $ 1,780 5 % Total Office 49,501 $ 18,286 $ 35,365 $ 1,780 Retail Ulana Ward Village (c) Honolulu, HI 100 % 32,100 — % Q1 2023 2028 $ — $ — $ 760 — % The Park Ward Village (c) Honolulu, HI 100 % 26,800 18 % Q4 2022 2029 — — 1,900 — % Kalae (c) Honolulu, HI 100 % 2,000 — % Q2 2024 2030 — — 140 — % Grogan’s Mill Retail Houston, TX 100 % 38,378 27 % Q3 2024 2028 3,760 8,583 850 10 % The Ritz-Carlton Retail (c) Houston, TX 100 % 5,800 100 % Q4 2024 2030 — — 800 — % Total Retail 105,078 $ 3,760 $ 8,583 $ 4,450 Other Grogan’s Mill Library and Community Center (d) Houston, TX 100 % 53,863 n/a Q3 2024 n/a $ 9,739 $ 16,498 n/a n/a Total Other 53,863 $ 9,739 $ 16,498 $ — in thousands except Sq. Ft. and units Location % Ownership # of Units Monthly Est. Rent Per Unit Const. Start Date Est. Stabilized Date (b) Develop. Costs Incurred Est. Total Cost (Excl. Land) Est. Stabilized NOI Est. Stab. Yield Multifamily 1 Riva Row Houston, TX 100 % 268 $ 4,015 Q3 2023 2028 $ 90,375 $ 155,997 $ 9,890 6 % Total Multifamily 268 $ 90,375 $ 155,997 $ 9,890 Total Under Construction $ 122,160 $ 216,443 $ 16,120 (a) Represents leases signed as of March 31, 2025. (b) The estimated stabilization date for all under construction assets is set at 36 months from the expected in-service date. (c) Condominium retail development costs incurred to date and total estimated development costs are combined with their respective condominium costs on page 20 of this supplement. (d) The Grogan’s Mill Library and Community Center is being developed in connection with a land swap agreement entered into with Montgomery County, Texas. Upon completion of construction, the Company will transfer the Grogan's Mill Library and Community Center to Montgomery County in exchange for land parcels elsewhere in The Woodlands. As such, pre-leasing activity and Est. Stabilized NOI are not applicable to this development project. Under Construction Properties - Strategic Developments Segment

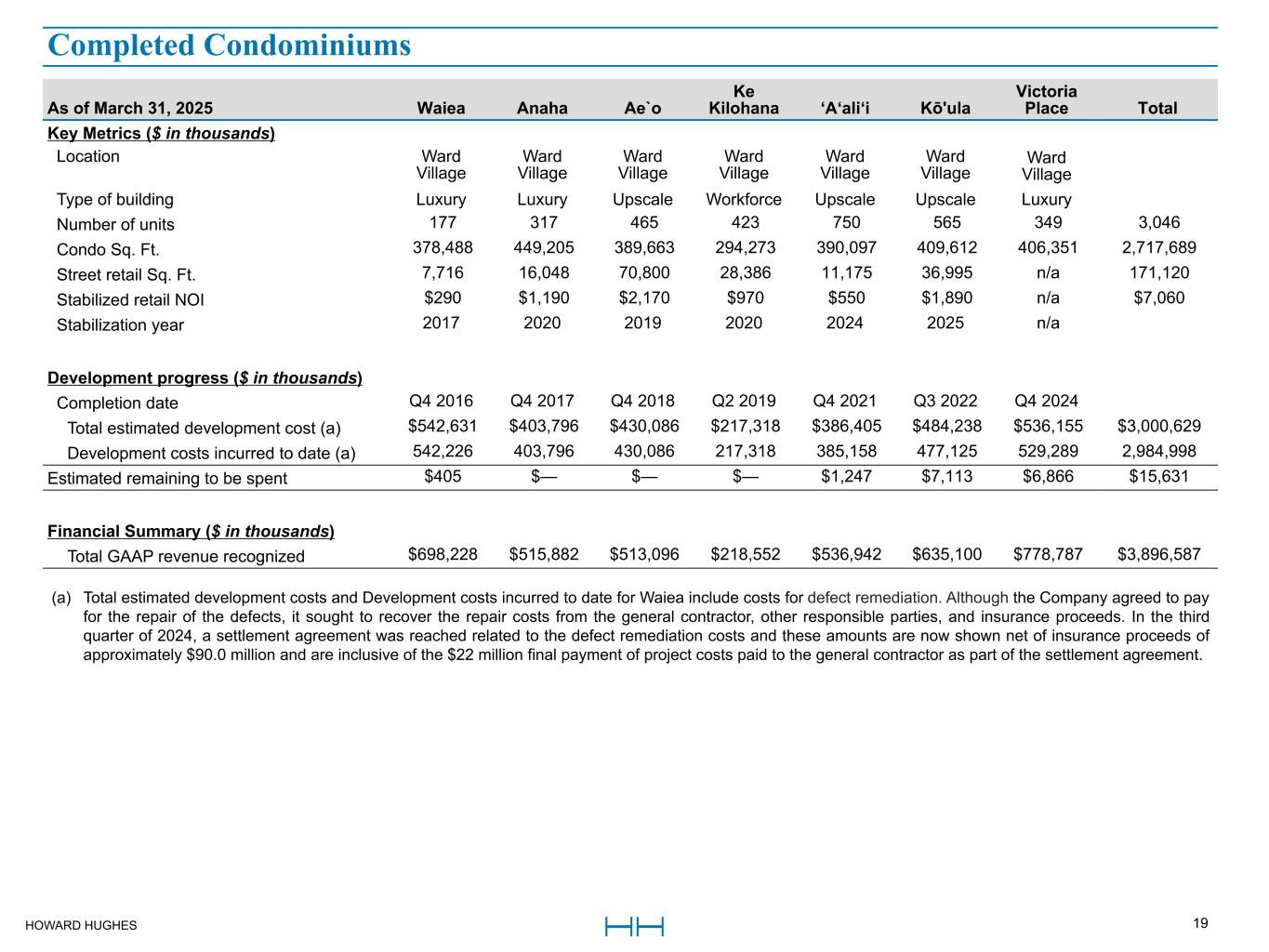

HOWARD HUGHES 19 As of March 31, 2025 Waiea Anaha Ae`o Ke Kilohana ‘A‘ali‘i Kō'ula Victoria Place Total Key Metrics ($ in thousands) Location Ward Village Ward Village Ward Village Ward Village Ward Village Ward Village Ward Village Type of building Luxury Luxury Upscale Workforce Upscale Upscale Luxury Number of units 177 317 465 423 750 565 349 3,046 Condo Sq. Ft. 378,488 449,205 389,663 294,273 390,097 409,612 406,351 2,717,689 Street retail Sq. Ft. 7,716 16,048 70,800 28,386 11,175 36,995 n/a 171,120 Stabilized retail NOI $290 $1,190 $2,170 $970 $550 $1,890 n/a $7,060 Stabilization year 2017 2020 2019 2020 2024 2025 n/a Development progress ($ in thousands) Completion date Q4 2016 Q4 2017 Q4 2018 Q2 2019 Q4 2021 Q3 2022 Q4 2024 Total estimated development cost (a) $542,631 $403,796 $430,086 $217,318 $386,405 $484,238 $536,155 $3,000,629 Development costs incurred to date (a) 542,226 403,796 430,086 217,318 385,158 477,125 529,289 2,984,998 Estimated remaining to be spent $405 $— $— $— $1,247 $7,113 $6,866 $15,631 Financial Summary ($ in thousands) Total GAAP revenue recognized $698,228 $515,882 $513,096 $218,552 $536,942 $635,100 $778,787 $3,896,587 Completed Condominiums (a) Total estimated development costs and Development costs incurred to date for Waiea include costs for defect remediation. Although the Company agreed to pay for the repair of the defects, it sought to recover the repair costs from the general contractor, other responsible parties, and insurance proceeds. In the third quarter of 2024, a settlement agreement was reached related to the defect remediation costs and these amounts are now shown net of insurance proceeds of approximately $90.0 million and are inclusive of the $22 million final payment of project costs paid to the general contractor as part of the settlement agreement.

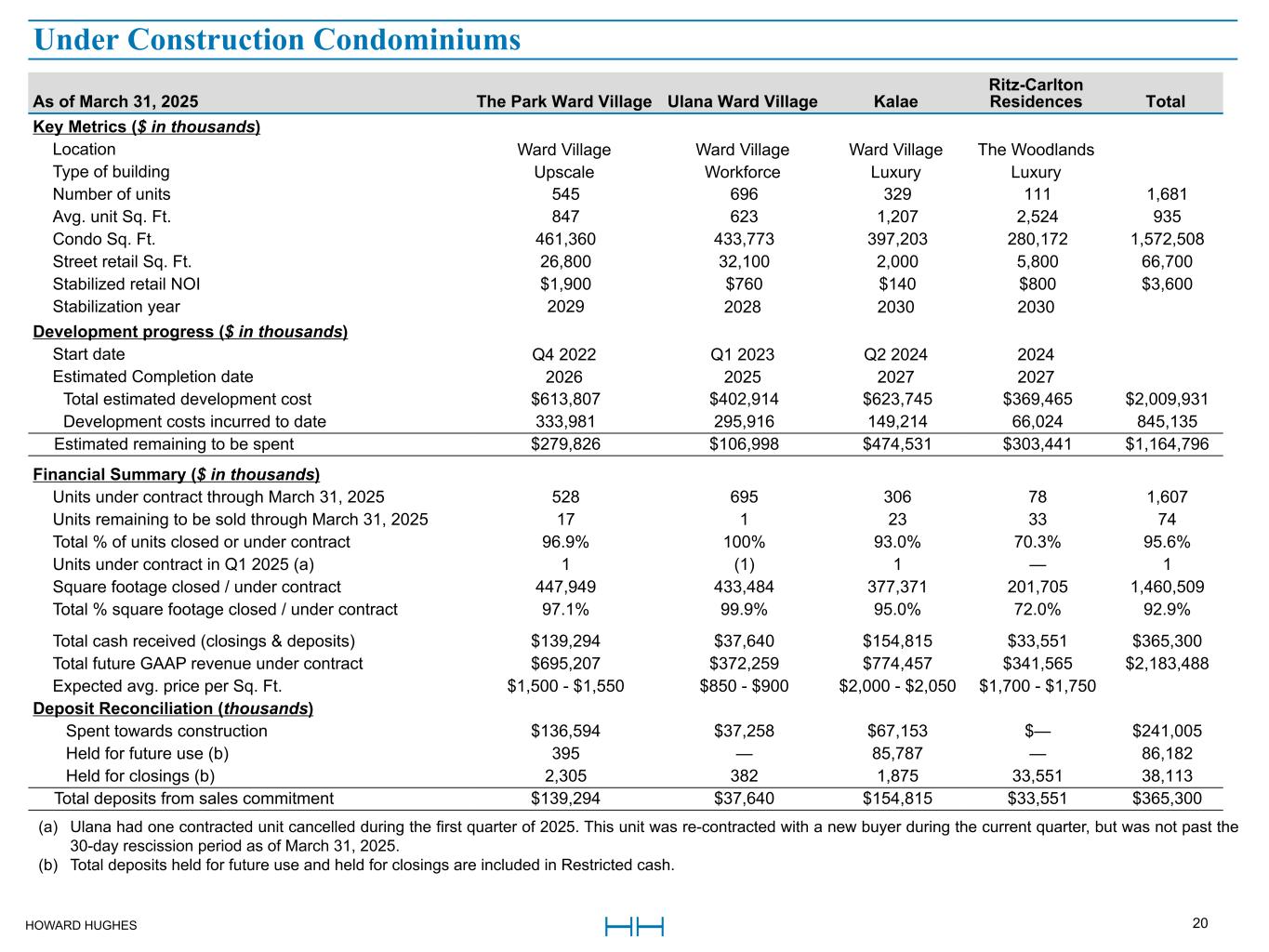

HOWARD HUGHES 20 As of March 31, 2025 The Park Ward Village Ulana Ward Village Kalae Ritz-Carlton Residences Total Key Metrics ($ in thousands) Location Ward Village Ward Village Ward Village The Woodlands Type of building Upscale Workforce Luxury Luxury Number of units 545 696 329 111 1,681 Avg. unit Sq. Ft. 847 623 1,207 2,524 935 Condo Sq. Ft. 461,360 433,773 397,203 280,172 1,572,508 Street retail Sq. Ft. 26,800 32,100 2,000 5,800 66,700 Stabilized retail NOI $1,900 $760 $140 $800 $3,600 Stabilization year 2029 2028 2030 2030 Development progress ($ in thousands) Start date Q4 2022 Q1 2023 Q2 2024 2024 Estimated Completion date 2026 2025 2027 2027 Total estimated development cost $613,807 $402,914 $623,745 $369,465 $2,009,931 Development costs incurred to date 333,981 295,916 149,214 66,024 845,135 Estimated remaining to be spent $279,826 $106,998 $474,531 $303,441 $1,164,796 Financial Summary ($ in thousands) Units under contract through March 31, 2025 528 695 306 78 1,607 Units remaining to be sold through March 31, 2025 17 1 23 33 74 Total % of units closed or under contract 96.9% 100% 93.0% 70.3% 95.6% Units under contract in Q1 2025 (a) 1 (1) 1 — 1 Square footage closed / under contract 447,949 433,484 377,371 201,705 1,460,509 Total % square footage closed / under contract 97.1% 99.9% 95.0% 72.0% 92.9% Total cash received (closings & deposits) $139,294 $37,640 $154,815 $33,551 $365,300 Total future GAAP revenue under contract $695,207 $372,259 $774,457 $341,565 $2,183,488 Expected avg. price per Sq. Ft. $1,500 - $1,550 $850 - $900 $2,000 - $2,050 $1,700 - $1,750 Deposit Reconciliation (thousands) Spent towards construction $136,594 $37,258 $67,153 $— $241,005 Held for future use (b) 395 — 85,787 — 86,182 Held for closings (b) 2,305 382 1,875 33,551 38,113 Total deposits from sales commitment $139,294 $37,640 $154,815 $33,551 $365,300 (a) Ulana had one contracted unit cancelled during the first quarter of 2025. This unit was re-contracted with a new buyer during the current quarter, but was not past the 30-day rescission period as of March 31, 2025. (b) Total deposits held for future use and held for closings are included in Restricted cash. Under Construction Condominiums

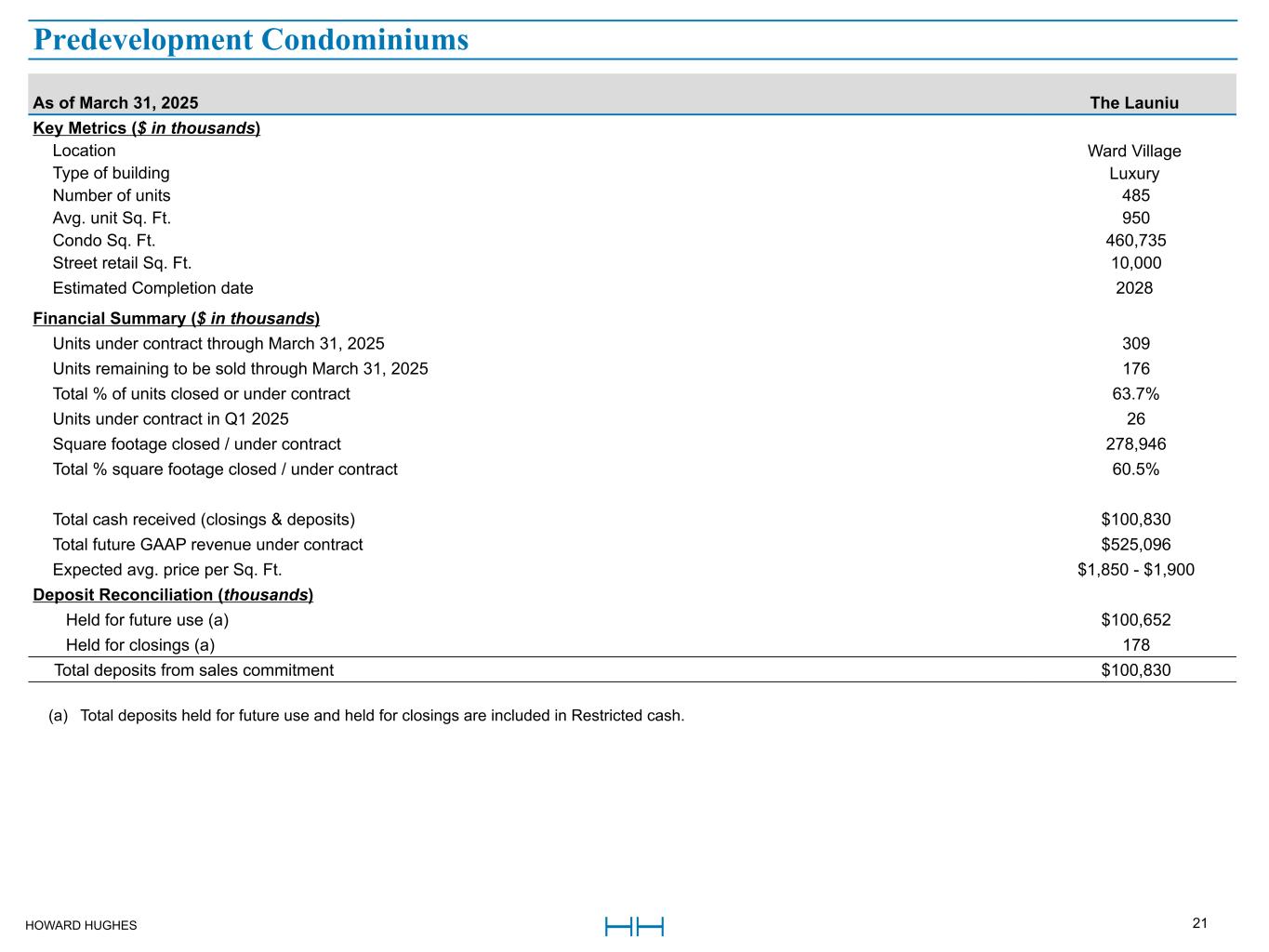

HOWARD HUGHES 21 As of March 31, 2025 The Launiu Key Metrics ($ in thousands) Location Ward Village Type of building Luxury Number of units 485 Avg. unit Sq. Ft. 950 Condo Sq. Ft. 460,735 Street retail Sq. Ft. 10,000 Estimated Completion date 2028 Financial Summary ($ in thousands) Units under contract through March 31, 2025 309 Units remaining to be sold through March 31, 2025 176 Total % of units closed or under contract 63.7% Units under contract in Q1 2025 26 Square footage closed / under contract 278,946 Total % square footage closed / under contract 60.5% Total cash received (closings & deposits) $100,830 Total future GAAP revenue under contract $525,096 Expected avg. price per Sq. Ft. $1,850 - $1,900 Deposit Reconciliation (thousands) Held for future use (a) $100,652 Held for closings (a) 178 Total deposits from sales commitment $100,830 (a) Total deposits held for future use and held for closings are included in Restricted cash. Predevelopment Condominiums

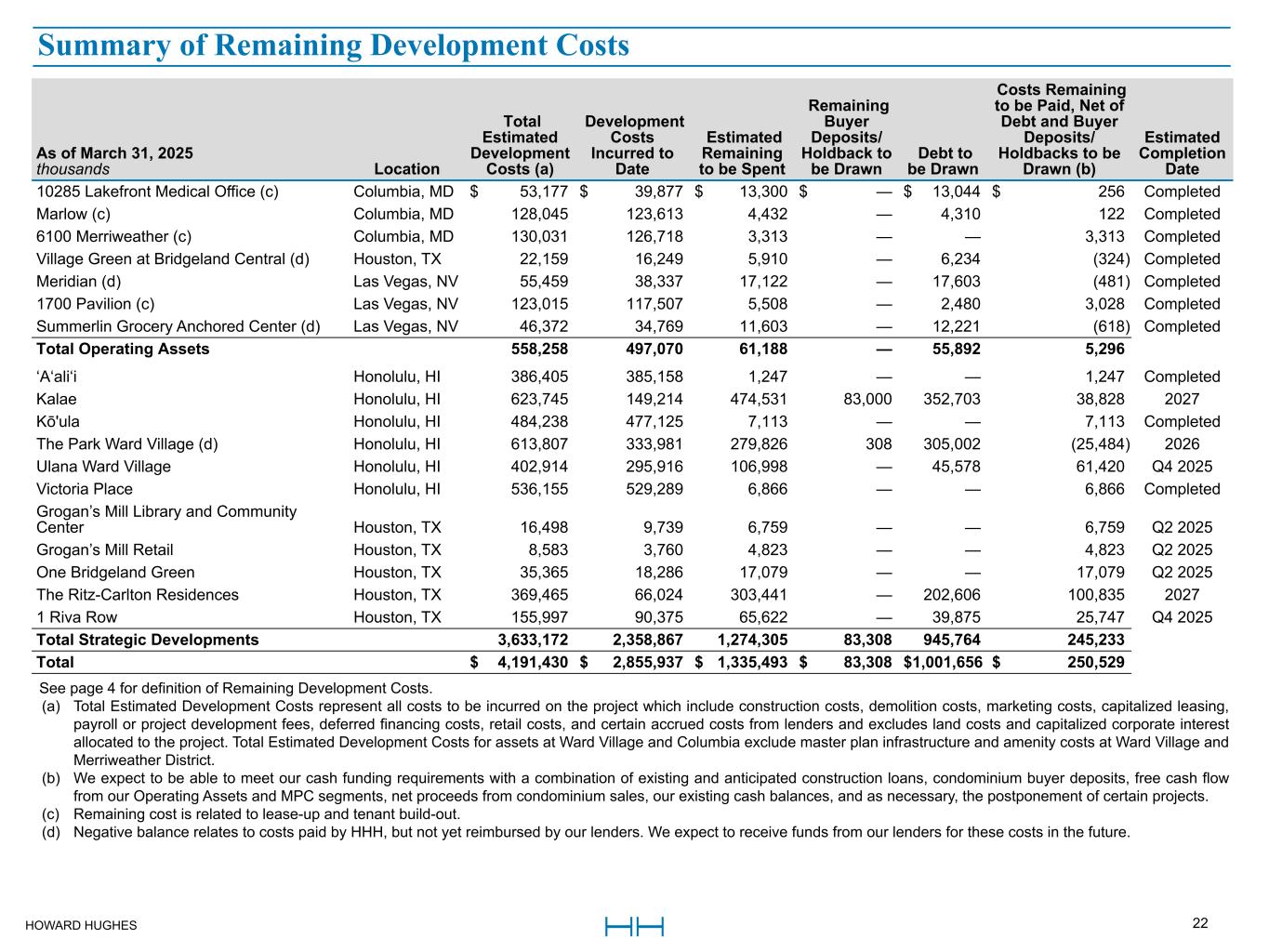

HOWARD HUGHES 22 As of March 31, 2025 thousands Location Total Estimated Development Costs (a) Development Costs Incurred to Date Estimated Remaining to be Spent Remaining Buyer Deposits/ Holdback to be Drawn Debt to be Drawn Costs Remaining to be Paid, Net of Debt and Buyer Deposits/ Holdbacks to be Drawn (b) Estimated Completion Date 10285 Lakefront Medical Office (c) Columbia, MD $ 53,177 $ 39,877 $ 13,300 $ — $ 13,044 $ 256 Completed Marlow (c) Columbia, MD 128,045 123,613 4,432 — 4,310 122 Completed 6100 Merriweather (c) Columbia, MD 130,031 126,718 3,313 — — 3,313 Completed Village Green at Bridgeland Central (d) Houston, TX 22,159 16,249 5,910 — 6,234 (324) Completed Meridian (d) Las Vegas, NV 55,459 38,337 17,122 — 17,603 (481) Completed 1700 Pavilion (c) Las Vegas, NV 123,015 117,507 5,508 — 2,480 3,028 Completed Summerlin Grocery Anchored Center (d) Las Vegas, NV 46,372 34,769 11,603 — 12,221 (618) Completed Total Operating Assets 558,258 497,070 61,188 — 55,892 5,296 ‘A‘ali‘i Honolulu, HI 386,405 385,158 1,247 — — 1,247 Completed Kalae Honolulu, HI 623,745 149,214 474,531 83,000 352,703 38,828 2027 Kō'ula Honolulu, HI 484,238 477,125 7,113 — — 7,113 Completed The Park Ward Village (d) Honolulu, HI 613,807 333,981 279,826 308 305,002 (25,484) 2026 Ulana Ward Village Honolulu, HI 402,914 295,916 106,998 — 45,578 61,420 Q4 2025 Victoria Place Honolulu, HI 536,155 529,289 6,866 — — 6,866 Completed Grogan’s Mill Library and Community Center Houston, TX 16,498 9,739 6,759 — — 6,759 Q2 2025 Grogan’s Mill Retail Houston, TX 8,583 3,760 4,823 — — 4,823 Q2 2025 One Bridgeland Green Houston, TX 35,365 18,286 17,079 — — 17,079 Q2 2025 The Ritz-Carlton Residences Houston, TX 369,465 66,024 303,441 — 202,606 100,835 2027 1 Riva Row Houston, TX 155,997 90,375 65,622 — 39,875 25,747 Q4 2025 Total Strategic Developments 3,633,172 2,358,867 1,274,305 83,308 945,764 245,233 Total $ 4,191,430 $ 2,855,937 $ 1,335,493 $ 83,308 $ 1,001,656 $ 250,529 See page 4 for definition of Remaining Development Costs. (a) Total Estimated Development Costs represent all costs to be incurred on the project which include construction costs, demolition costs, marketing costs, capitalized leasing, payroll or project development fees, deferred financing costs, retail costs, and certain accrued costs from lenders and excludes land costs and capitalized corporate interest allocated to the project. Total Estimated Development Costs for assets at Ward Village and Columbia exclude master plan infrastructure and amenity costs at Ward Village and Merriweather District. (b) We expect to be able to meet our cash funding requirements with a combination of existing and anticipated construction loans, condominium buyer deposits, free cash flow from our Operating Assets and MPC segments, net proceeds from condominium sales, our existing cash balances, and as necessary, the postponement of certain projects. (c) Remaining cost is related to lease-up and tenant build-out. (d) Negative balance relates to costs paid by HHH, but not yet reimbursed by our lenders. We expect to receive funds from our lenders for these costs in the future. Summary of Remaining Development Costs

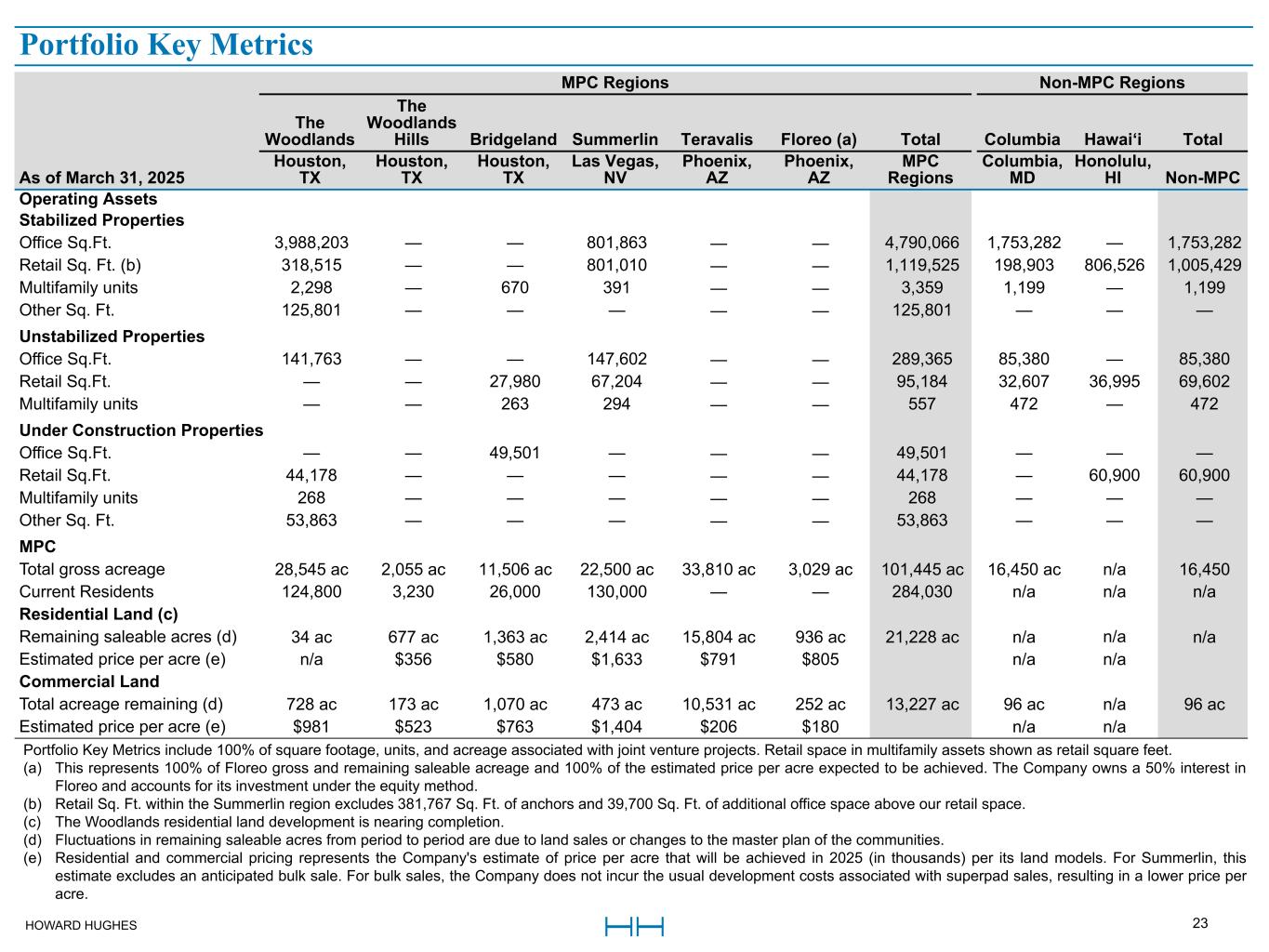

HOWARD HUGHES 23 MPC Regions Non-MPC Regions The Woodlands The Woodlands Hills Bridgeland Summerlin Teravalis Floreo (a) Total Columbia Hawai‘i Total As of March 31, 2025 Houston, TX Houston, TX Houston, TX Las Vegas, NV Phoenix, AZ Phoenix, AZ MPC Regions Columbia, MD Honolulu, HI Non-MPC Operating Assets Stabilized Properties Office Sq.Ft. 3,988,203 — — 801,863 — — 4,790,066 1,753,282 — 1,753,282 Retail Sq. Ft. (b) 318,515 — — 801,010 — — 1,119,525 198,903 806,526 1,005,429 Multifamily units 2,298 — 670 391 — — 3,359 1,199 — 1,199 Other Sq. Ft. 125,801 — — — — — 125,801 — — — Unstabilized Properties Office Sq.Ft. 141,763 — — 147,602 — — 289,365 85,380 — 85,380 Retail Sq.Ft. — — 27,980 67,204 — — 95,184 32,607 36,995 69,602 Multifamily units — — 263 294 — — 557 472 — 472 Under Construction Properties Office Sq.Ft. — — 49,501 — — — 49,501 — — — Retail Sq.Ft. 44,178 — — — — — 44,178 — 60,900 60,900 Multifamily units 268 — — — — — 268 — — — Other Sq. Ft. 53,863 — — — — — 53,863 — — — MPC Total gross acreage 28,545 ac 2,055 ac 11,506 ac 22,500 ac 33,810 ac 3,029 ac 101,445 ac 16,450 ac n/a 16,450 Current Residents 124,800 3,230 26,000 130,000 — — 284,030 n/a n/a n/a Residential Land (c) Remaining saleable acres (d) 34 ac 677 ac 1,363 ac 2,414 ac 15,804 ac 936 ac 21,228 ac n/a n/a n/a Estimated price per acre (e) n/a $356 $580 $1,633 $791 $805 n/a n/a Commercial Land Total acreage remaining (d) 728 ac 173 ac 1,070 ac 473 ac 10,531 ac 252 ac 13,227 ac 96 ac n/a 96 ac Estimated price per acre (e) $981 $523 $763 $1,404 $206 $180 n/a n/a Portfolio Key Metrics Portfolio Key Metrics include 100% of square footage, units, and acreage associated with joint venture projects. Retail space in multifamily assets shown as retail square feet. (a) This represents 100% of Floreo gross and remaining saleable acreage and 100% of the estimated price per acre expected to be achieved. The Company owns a 50% interest in Floreo and accounts for its investment under the equity method. (b) Retail Sq. Ft. within the Summerlin region excludes 381,767 Sq. Ft. of anchors and 39,700 Sq. Ft. of additional office space above our retail space. (c) The Woodlands residential land development is nearing completion. (d) Fluctuations in remaining saleable acres from period to period are due to land sales or changes to the master plan of the communities. (e) Residential and commercial pricing represents the Company's estimate of price per acre that will be achieved in 2025 (in thousands) per its land models. For Summerlin, this estimate excludes an anticipated bulk sale. For bulk sales, the Company does not incur the usual development costs associated with superpad sales, resulting in a lower price per acre. Portfolio Key Metrics

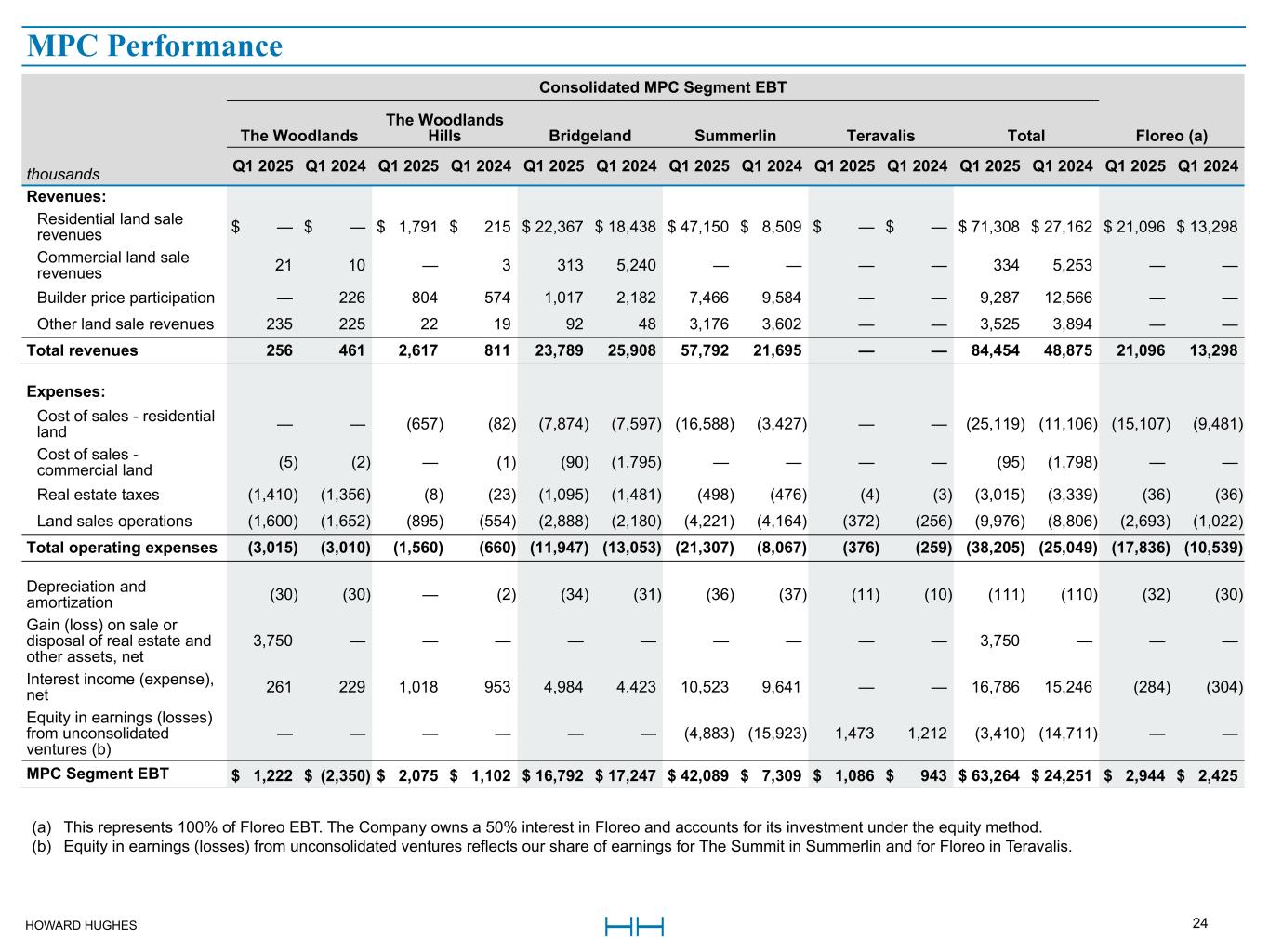

HOWARD HUGHES 24 Master Planned Community Land Consolidated MPC Segment EBT The Woodlands The Woodlands Hills Bridgeland Summerlin Teravalis Total Floreo (a) thousands Q1 2025 Q1 2024 Q1 2025 Q1 2024 Q1 2025 Q1 2024 Q1 2025 Q1 2024 Q1 2025 Q1 2024 Q1 2025 Q1 2024 Q1 2025 Q1 2024 Revenues: Residential land sale revenues $ — $ — $ 1,791 $ 215 $ 22,367 $ 18,438 $ 47,150 $ 8,509 $ — $ — $ 71,308 $ 27,162 $ 21,096 $ 13,298 Commercial land sale revenues 21 10 — 3 313 5,240 — — — — 334 5,253 — — Builder price participation — 226 804 574 1,017 2,182 7,466 9,584 — — 9,287 12,566 — — Other land sale revenues 235 225 22 19 92 48 3,176 3,602 — — 3,525 3,894 — — Total revenues 256 461 2,617 811 23,789 25,908 57,792 21,695 — — 84,454 48,875 21,096 13,298 Expenses: Cost of sales - residential land — — (657) (82) (7,874) (7,597) (16,588) (3,427) — — (25,119) (11,106) (15,107) (9,481) Cost of sales - commercial land (5) (2) — (1) (90) (1,795) — — — — (95) (1,798) — — Real estate taxes (1,410) (1,356) (8) (23) (1,095) (1,481) (498) (476) (4) (3) (3,015) (3,339) (36) (36) Land sales operations (1,600) (1,652) (895) (554) (2,888) (2,180) (4,221) (4,164) (372) (256) (9,976) (8,806) (2,693) (1,022) Total operating expenses (3,015) (3,010) (1,560) (660) (11,947) (13,053) (21,307) (8,067) (376) (259) (38,205) (25,049) (17,836) (10,539) Depreciation and amortization (30) (30) — (2) (34) (31) (36) (37) (11) (10) (111) (110) (32) (30) Gain (loss) on sale or disposal of real estate and other assets, net 3,750 — — — — — — — — — 3,750 — — — Interest income (expense), net 261 229 1,018 953 4,984 4,423 10,523 9,641 — — 16,786 15,246 (284) (304) Equity in earnings (losses) from unconsolidated ventures (b) — — — — — — (4,883) (15,923) 1,473 1,212 (3,410) (14,711) — — MPC Segment EBT $ 1,222 $ (2,350) $ 2,075 $ 1,102 $ 16,792 $ 17,247 $ 42,089 $ 7,309 $ 1,086 $ 943 $ 63,264 $ 24,251 $ 2,944 $ 2,425 (a) This represents 100% of Floreo EBT. The Company owns a 50% interest in Floreo and accounts for its investment under the equity method. (b) Equity in earnings (losses) from unconsolidated ventures reflects our share of earnings for The Summit in Summerlin and for Floreo in Teravalis. MPC Performance

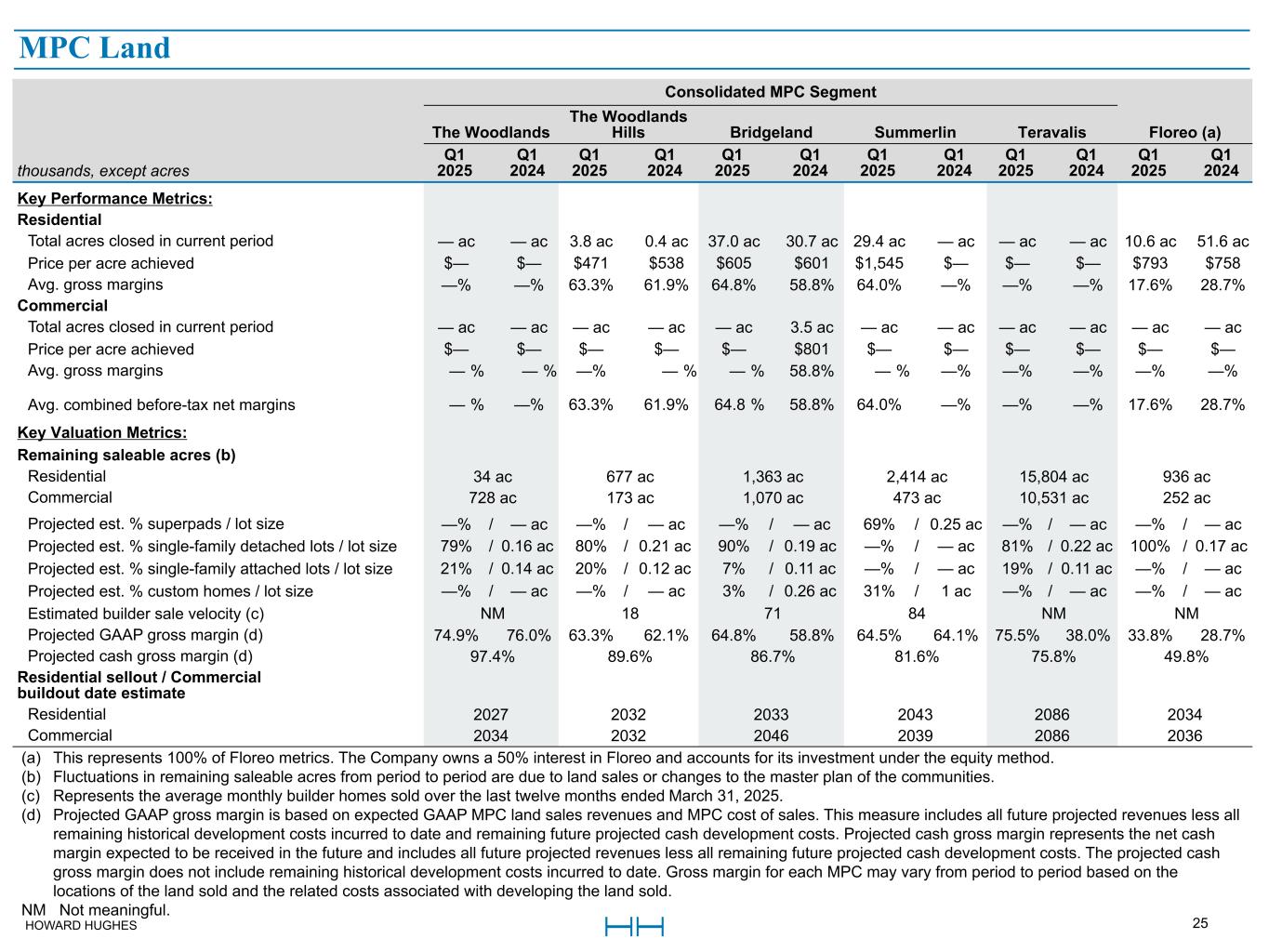

HOWARD HUGHES 25 Master Planned Community Land Consolidated MPC Segment The Woodlands The Woodlands Hills Bridgeland Summerlin Teravalis Floreo (a) thousands, except acres Q1 2025 Q1 2024 Q1 2025 Q1 2024 Q1 2025 Q1 2024 Q1 2025 Q1 2024 Q1 2025 Q1 2024 Q1 2025 Q1 2024 Key Performance Metrics: Residential Total acres closed in current period — ac — ac 3.8 ac 0.4 ac 37.0 ac 30.7 ac 29.4 ac — ac — ac — ac 10.6 ac 51.6 ac Price per acre achieved $— $— $471 $538 $605 $601 $1,545 $— $— $— $793 $758 Avg. gross margins —% —% 63.3% 61.9% 64.8% 58.8% 64.0% —% —% —% 17.6% 28.7% Commercial Total acres closed in current period — ac — ac — ac — ac — ac 3.5 ac — ac — ac — ac — ac — ac — ac Price per acre achieved $— $— $— $— $— $801 $— $— $— $— $— $— Avg. gross margins — % — % —% — % — % 58.8% — % —% —% —% —% —% Avg. combined before-tax net margins — % —% 63.3% 61.9% 64.8 % 58.8% 64.0% —% —% —% 17.6% 28.7% Key Valuation Metrics: Remaining saleable acres (b) Residential 34 ac 677 ac 1,363 ac 2,414 ac 15,804 ac 936 ac Commercial 728 ac 173 ac 1,070 ac 473 ac 10,531 ac 252 ac Projected est. % superpads / lot size —% / — ac —% / — ac —% / — ac 69% / 0.25 ac —% / — ac —% / — ac Projected est. % single-family detached lots / lot size 79% / 0.16 ac 80% / 0.21 ac 90% / 0.19 ac —% / — ac 81% / 0.22 ac 100% / 0.17 ac Projected est. % single-family attached lots / lot size 21% / 0.14 ac 20% / 0.12 ac 7% / 0.11 ac —% / — ac 19% / 0.11 ac —% / — ac Projected est. % custom homes / lot size —% / — ac —% / — ac 3% / 0.26 ac 31% / 1 ac —% / — ac —% / — ac Estimated builder sale velocity (c) NM 18 71 84 NM NM Projected GAAP gross margin (d) 74.9% 76.0% 63.3% 62.1% 64.8% 58.8% 64.5% 64.1% 75.5% 38.0% 33.8% 28.7% Projected cash gross margin (d) 97.4% 89.6% 86.7% 81.6% 75.8% 49.8% Residential sellout / Commercial buildout date estimate Residential 2027 2032 2033 2043 2086 2034 Commercial 2034 2032 2046 2039 2086 2036 (a) This represents 100% of Floreo metrics. The Company owns a 50% interest in Floreo and accounts for its investment under the equity method. (b) Fluctuations in remaining saleable acres from period to period are due to land sales or changes to the master plan of the communities. (c) Represents the average monthly builder homes sold over the last twelve months ended March 31, 2025. (d) Projected GAAP gross margin is based on expected GAAP MPC land sales revenues and MPC cost of sales. This measure includes all future projected revenues less all remaining historical development costs incurred to date and remaining future projected cash development costs. Projected cash gross margin represents the net cash margin expected to be received in the future and includes all future projected revenues less all remaining future projected cash development costs. The projected cash gross margin does not include remaining historical development costs incurred to date. Gross margin for each MPC may vary from period to period based on the locations of the land sold and the related costs associated with developing the land sold. NM Not meaningful. MPC Land

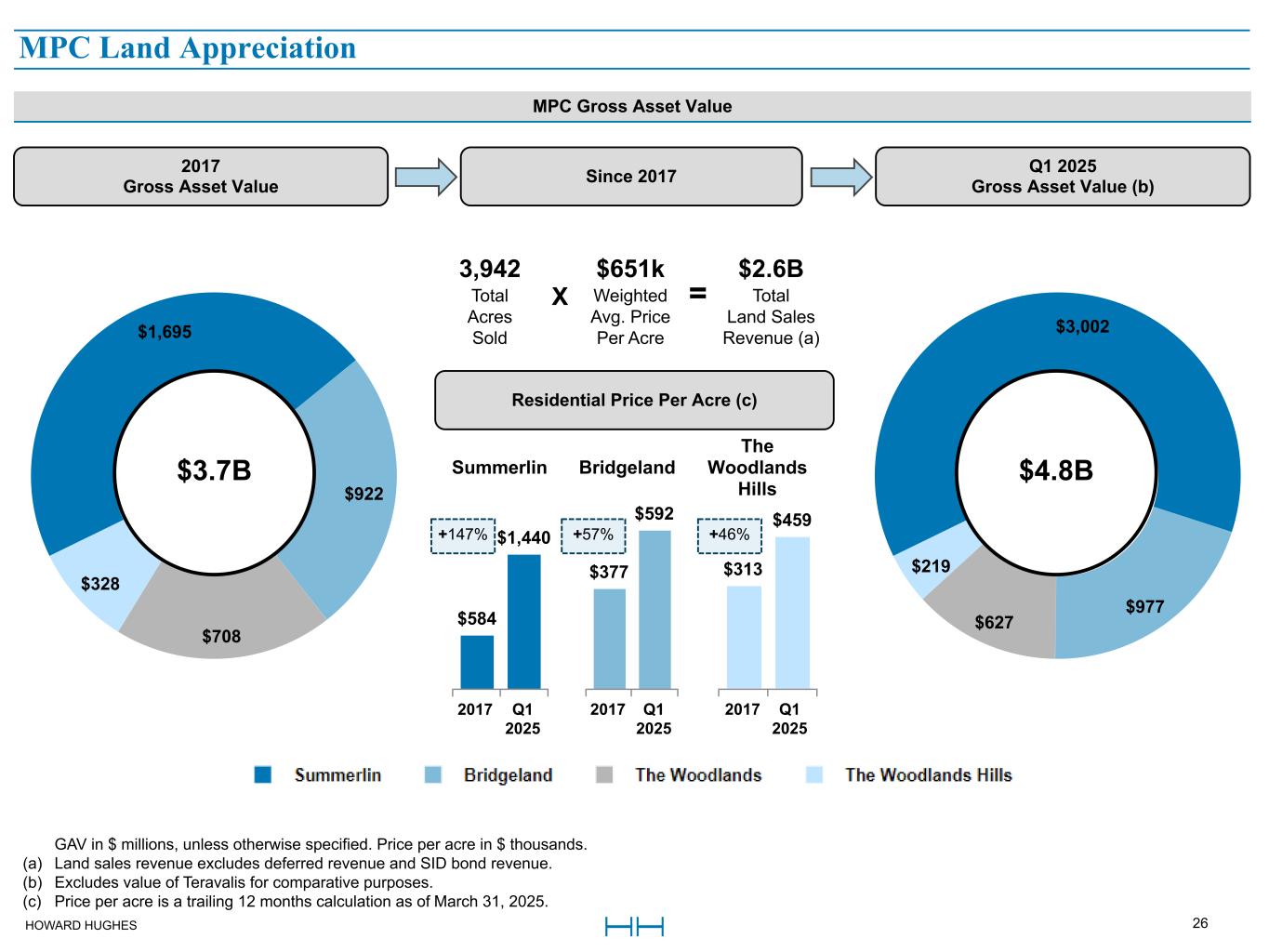

HOWARD HUGHES 26 Master Planned Community Land GAV in $ millions, unless otherwise specified. Price per acre in $ thousands. (a) Land sales revenue excludes deferred revenue and SID bond revenue. (b) Excludes value of Teravalis for comparative purposes. (c) Price per acre is a trailing 12 months calculation as of March 31, 2025. MPC Land Appreciation MPC Gross Asset Value $1,695 $922 $708 $328 3,942 Total Acres Sold $651k Weighted Avg. Price Per Acre $2.6B Total Land Sales Revenue (a) X = $584 $1,440 2017 Q1 2025 $377 $592 2017 Q1 2025 $313 $459 2017 Q1 2025 +147% +57% +46% $3,002 $977 $627 $219 2017 Gross Asset Value Since 2017 Q1 2025 Gross Asset Value (b) Residential Price Per Acre (c) Summerlin Bridgeland The Woodlands Hills $4.8B$3.7B

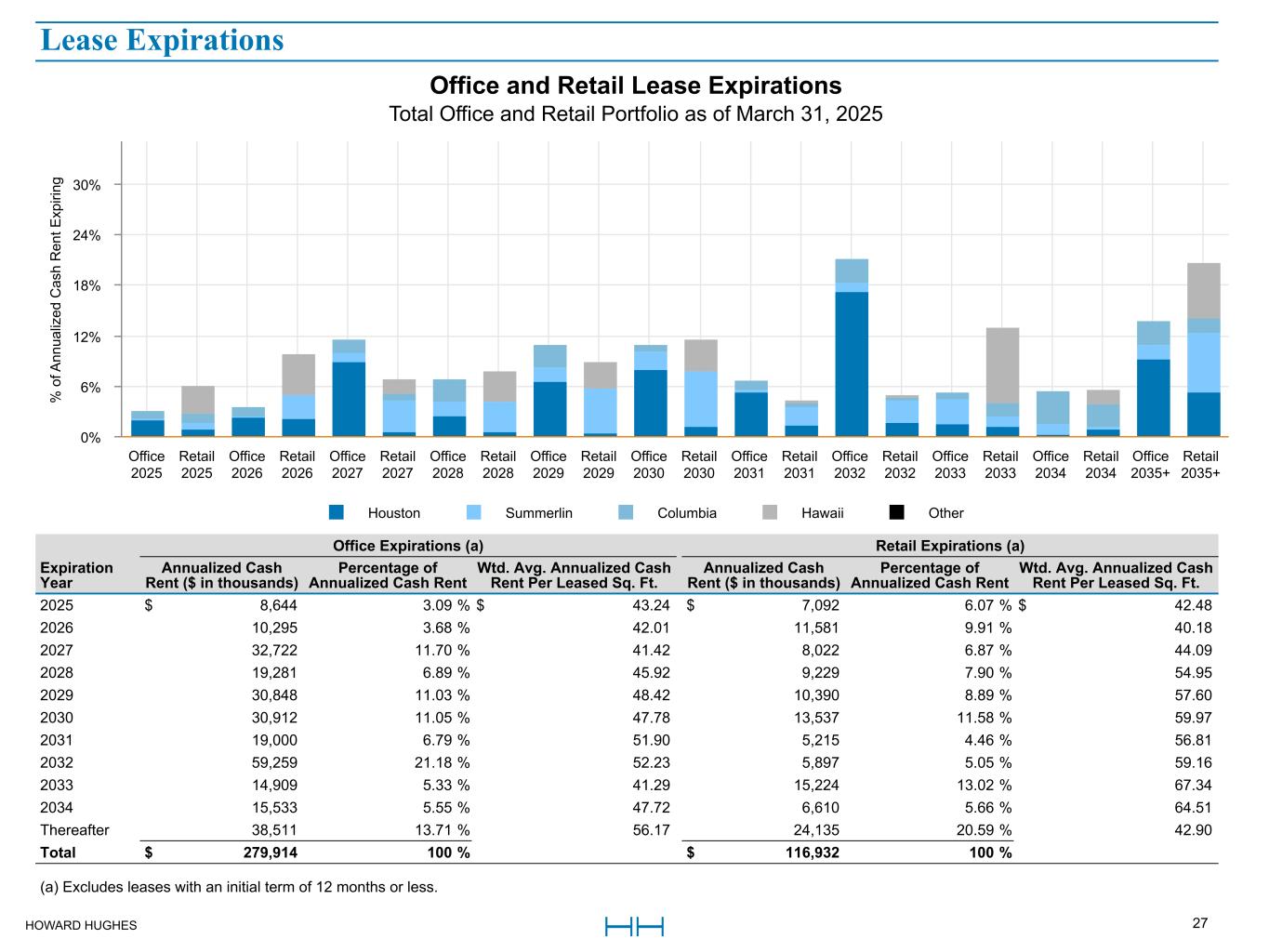

HOWARD HUGHES 27 Office Expirations (a) Retail Expirations (a) Expiration Year Annualized Cash Rent ($ in thousands) Percentage of Annualized Cash Rent Wtd. Avg. Annualized Cash Rent Per Leased Sq. Ft. Annualized Cash Rent ($ in thousands) Percentage of Annualized Cash Rent Wtd. Avg. Annualized Cash Rent Per Leased Sq. Ft. 2025 $ 8,644 3.09 % $ 43.24 $ 7,092 6.07 % $ 42.48 2026 10,295 3.68 % 42.01 11,581 9.91 % 40.18 2027 32,722 11.70 % 41.42 8,022 6.87 % 44.09 2028 19,281 6.89 % 45.92 9,229 7.90 % 54.95 2029 30,848 11.03 % 48.42 10,390 8.89 % 57.60 2030 30,912 11.05 % 47.78 13,537 11.58 % 59.97 2031 19,000 6.79 % 51.90 5,215 4.46 % 56.81 2032 59,259 21.18 % 52.23 5,897 5.05 % 59.16 2033 14,909 5.33 % 41.29 15,224 13.02 % 67.34 2034 15,533 5.55 % 47.72 6,610 5.66 % 64.51 Thereafter 38,511 13.71 % 56.17 24,135 20.59 % 42.90 Total $ 279,914 100 % $ 116,932 100 % (a) Excludes leases with an initial term of 12 months or less. Office and Retail Lease Expirations Total Office and Retail Portfolio as of March 31, 2025 % o f A nn ua liz ed C as h R en t E xp iri ng Houston Summerlin Columbia Hawaii Other Office 2025 Retail 2025 Office 2026 Retail 2026 Office 2027 Retail 2027 Office 2028 Retail 2028 Office 2029 Retail 2029 Office 2030 Retail 2030 Office 2031 Retail 2031 Office 2032 Retail 2032 Office 2033 Retail 2033 Office 2034 Retail 2034 Office 2035+ Retail 2035+ 0% 6% 12% 18% 24% 30% Lease Expirations

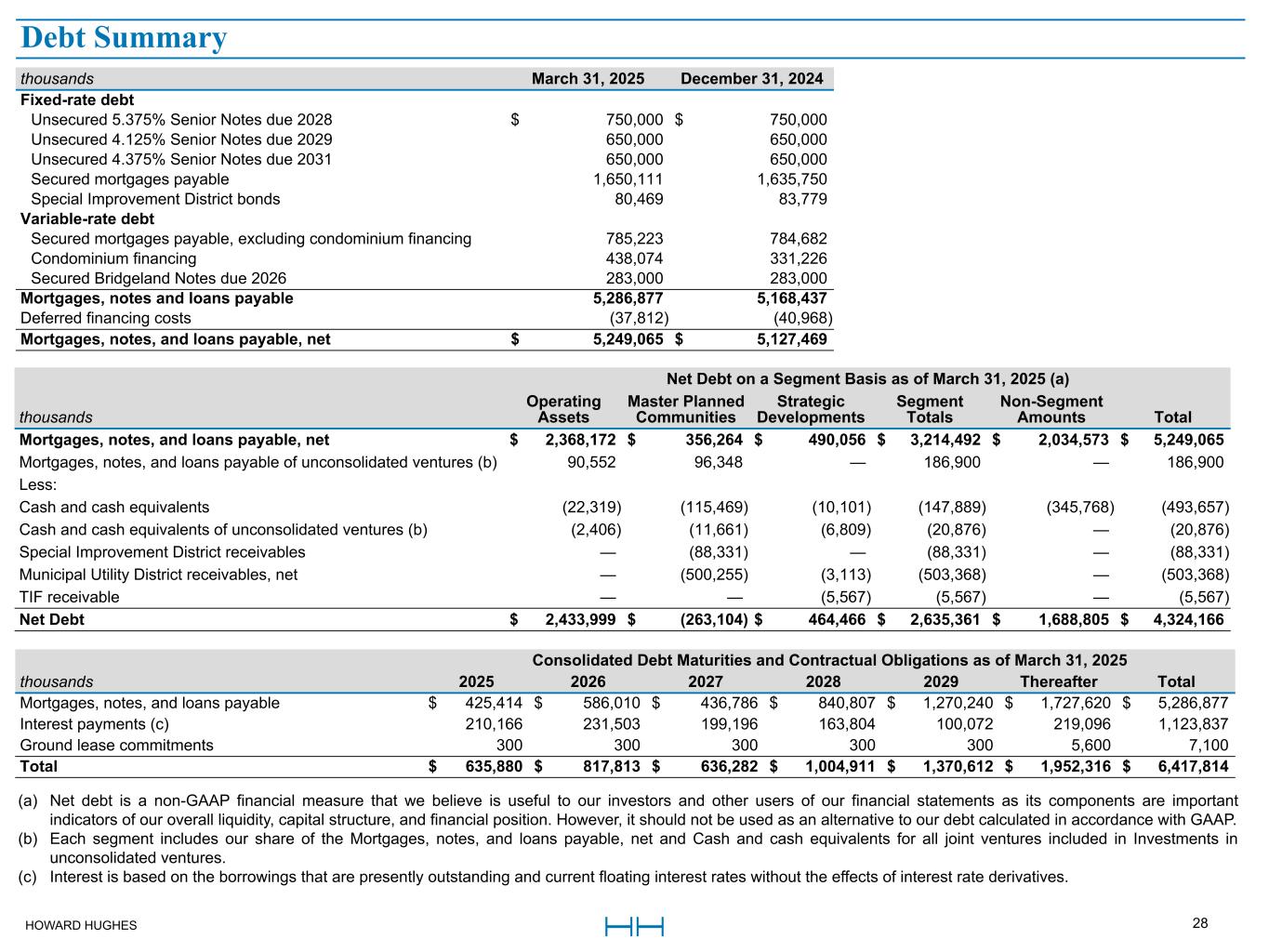

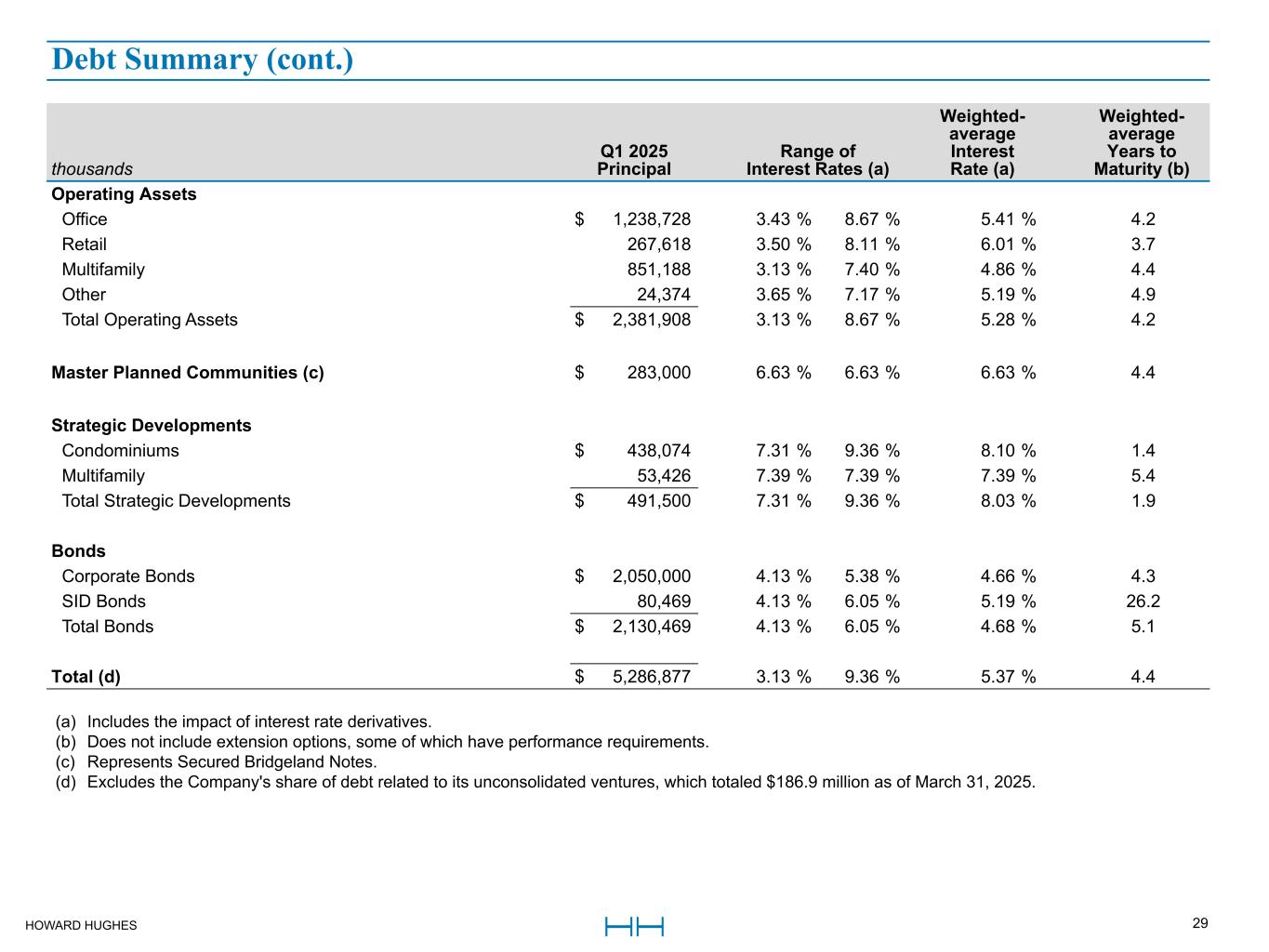

HOWARD HUGHES 28 thousands March 31, 2025 December 31, 2024 Fixed-rate debt Unsecured 5.375% Senior Notes due 2028 $ 750,000 $ 750,000 Unsecured 4.125% Senior Notes due 2029 650,000 650,000 Unsecured 4.375% Senior Notes due 2031 650,000 650,000 Secured mortgages payable 1,650,111 1,635,750 Special Improvement District bonds 80,469 83,779 Variable-rate debt Secured mortgages payable, excluding condominium financing 785,223 784,682 Condominium financing 438,074 331,226 Secured Bridgeland Notes due 2026 283,000 283,000 Mortgages, notes and loans payable 5,286,877 5,168,437 Deferred financing costs (37,812) (40,968) Mortgages, notes, and loans payable, net $ 5,249,065 $ 5,127,469 Net Debt on a Segment Basis as of March 31, 2025 (a) thousands Operating Assets Master Planned Communities Strategic Developments Segment Totals Non-Segment Amounts Total Mortgages, notes, and loans payable, net $ 2,368,172 $ 356,264 $ 490,056 $ 3,214,492 $ 2,034,573 $ 5,249,065 Mortgages, notes, and loans payable of unconsolidated ventures (b) 90,552 96,348 — 186,900 — 186,900 Less: Cash and cash equivalents (22,319) (115,469) (10,101) (147,889) (345,768) (493,657) Cash and cash equivalents of unconsolidated ventures (b) (2,406) (11,661) (6,809) (20,876) — (20,876) Special Improvement District receivables — (88,331) — (88,331) — (88,331) Municipal Utility District receivables, net — (500,255) (3,113) (503,368) — (503,368) TIF receivable — — (5,567) (5,567) — (5,567) Net Debt $ 2,433,999 $ (263,104) $ 464,466 $ 2,635,361 $ 1,688,805 $ 4,324,166 Consolidated Debt Maturities and Contractual Obligations as of March 31, 2025 thousands 2025 2026 2027 2028 2029 Thereafter Total Mortgages, notes, and loans payable $ 425,414 $ 586,010 $ 436,786 $ 840,807 $ 1,270,240 $ 1,727,620 $ 5,286,877 Interest payments (c) 210,166 231,503 199,196 163,804 100,072 219,096 1,123,837 Ground lease commitments 300 300 300 300 300 5,600 7,100 Total $ 635,880 $ 817,813 $ 636,282 $ 1,004,911 $ 1,370,612 $ 1,952,316 $ 6,417,814 Debt Summary (a) Net debt is a non-GAAP financial measure that we believe is useful to our investors and other users of our financial statements as its components are important indicators of our overall liquidity, capital structure, and financial position. However, it should not be used as an alternative to our debt calculated in accordance with GAAP. (b) Each segment includes our share of the Mortgages, notes, and loans payable, net and Cash and cash equivalents for all joint ventures included in Investments in unconsolidated ventures. (c) Interest is based on the borrowings that are presently outstanding and current floating interest rates without the effects of interest rate derivatives. Debt Summary

HOWARD HUGHES 29 (a) Includes the impact of interest rate derivatives. (b) Does not include extension options, some of which have performance requirements. (c) Represents Secured Bridgeland Notes. (d) Excludes the Company's share of debt related to its unconsolidated ventures, which totaled $186.9 million as of March 31, 2025. thousands Q1 2025 Principal Range of Interest Rates (a) Weighted- average Interest Rate (a) Weighted- average Years to Maturity (b) Operating Assets Office $ 1,238,728 3.43 % 8.67 % 5.41 % 4.2 Retail 267,618 3.50 % 8.11 % 6.01 % 3.7 Multifamily 851,188 3.13 % 7.40 % 4.86 % 4.4 Other 24,374 3.65 % 7.17 % 5.19 % 4.9 Total Operating Assets $ 2,381,908 3.13 % 8.67 % 5.28 % 4.2 Master Planned Communities (c) $ 283,000 6.63 % 6.63 % 6.63 % 4.4 Strategic Developments Condominiums $ 438,074 7.31 % 9.36 % 8.10 % 1.4 Multifamily 53,426 7.39 % 7.39 % 7.39 % 5.4 Total Strategic Developments $ 491,500 7.31 % 9.36 % 8.03 % 1.9 Bonds Corporate Bonds $ 2,050,000 4.13 % 5.38 % 4.66 % 4.3 SID Bonds 80,469 4.13 % 6.05 % 5.19 % 26.2 Total Bonds $ 2,130,469 4.13 % 6.05 % 4.68 % 5.1 Total (d) $ 5,286,877 3.13 % 9.36 % 5.37 % 4.4 Debt Summary (cont.)

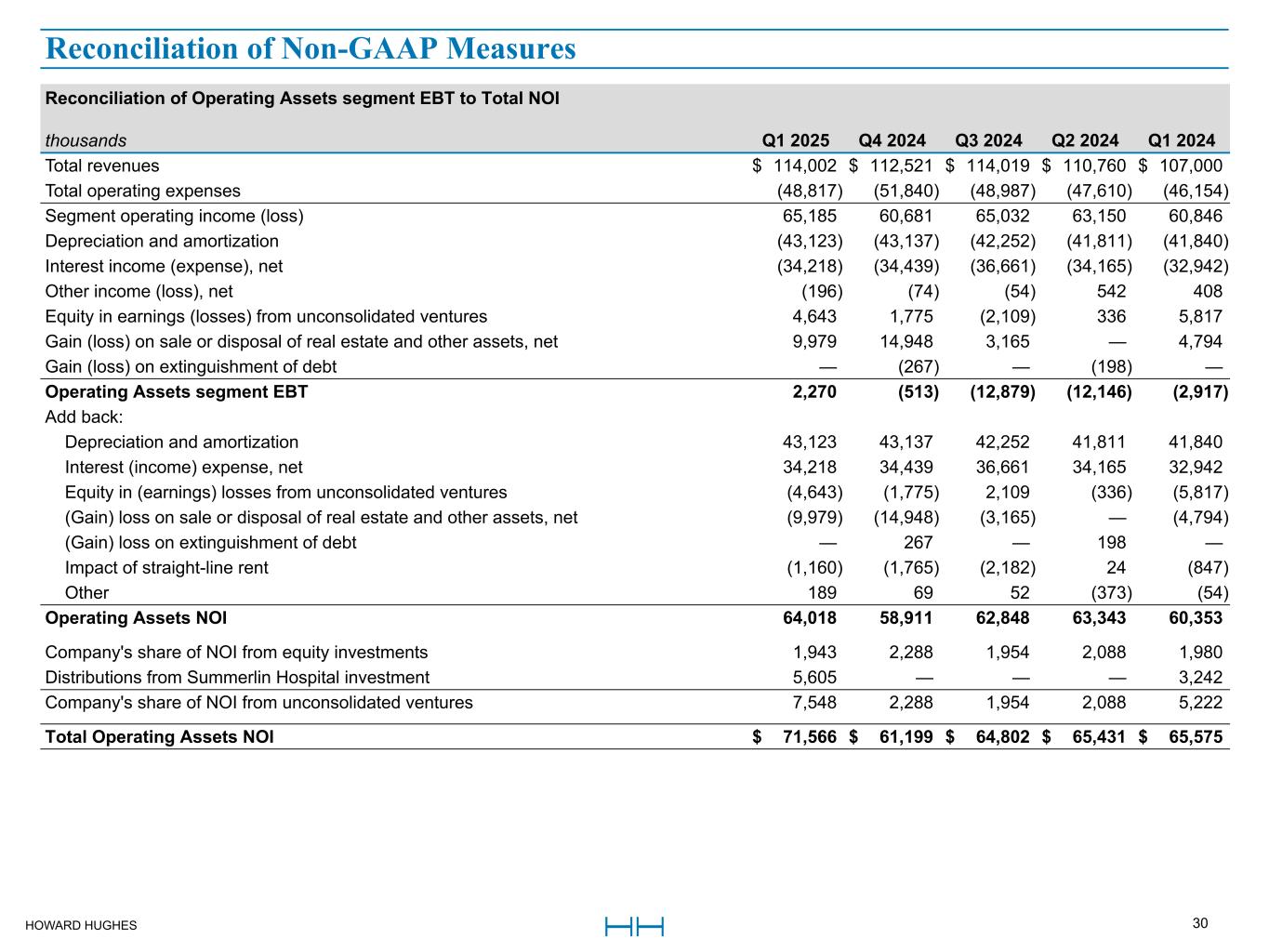

HOWARD HUGHES 30 Reconciliation of Operating Assets segment EBT to Total NOI thousands Q1 2025 Q4 2024 Q3 2024 Q2 2024 Q1 2024 Total revenues $ 114,002 $ 112,521 $ 114,019 $ 110,760 $ 107,000 Total operating expenses (48,817) (51,840) (48,987) (47,610) (46,154) Segment operating income (loss) 65,185 60,681 65,032 63,150 60,846 Depreciation and amortization (43,123) (43,137) (42,252) (41,811) (41,840) Interest income (expense), net (34,218) (34,439) (36,661) (34,165) (32,942) Other income (loss), net (196) (74) (54) 542 408 Equity in earnings (losses) from unconsolidated ventures 4,643 1,775 (2,109) 336 5,817 Gain (loss) on sale or disposal of real estate and other assets, net 9,979 14,948 3,165 — 4,794 Gain (loss) on extinguishment of debt — (267) — (198) — Operating Assets segment EBT 2,270 (513) (12,879) (12,146) (2,917) Add back: Depreciation and amortization 43,123 43,137 42,252 41,811 41,840 Interest (income) expense, net 34,218 34,439 36,661 34,165 32,942 Equity in (earnings) losses from unconsolidated ventures (4,643) (1,775) 2,109 (336) (5,817) (Gain) loss on sale or disposal of real estate and other assets, net (9,979) (14,948) (3,165) — (4,794) (Gain) loss on extinguishment of debt — 267 — 198 — Impact of straight-line rent (1,160) (1,765) (2,182) 24 (847) Other 189 69 52 (373) (54) Operating Assets NOI 64,018 58,911 62,848 63,343 60,353 Company's share of NOI from equity investments 1,943 2,288 1,954 2,088 1,980 Distributions from Summerlin Hospital investment 5,605 — — — 3,242 Company's share of NOI from unconsolidated ventures 7,548 2,288 1,954 2,088 5,222 Total Operating Assets NOI $ 71,566 $ 61,199 $ 64,802 $ 65,431 $ 65,575 Reconciliation of Non-GAAP Measures