Howard Hughes Holdings Inc. Supplemental Information Three Months Ended September 30, 2025 NYSE: HHH .2

2H O W A R D H U G H E S H O L D I N G S 2 Cautionary StatementsCautionary Statements Forward-Looking Statements This presentation includes forward-looking statements. Forward-looking statements give our current expectations relating to our financial condition, results of operations, plans, objectives, future performance, and business. You can identify forward-looking statements by the fact that they do not relate strictly to current or historical facts. These statements may include words such as “anticipate,” "believe," “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “plan,” "project,” “realize,” “should,” “transform,” "will," “would” and other statements of similar expression. Forward-looking statements give our expectations about the future and are not guarantees. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. We caution you not to rely on these forward-looking statements. For a discussion of the risk factors that could have an impact on these forward-looking statements, see our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as filed with the Securities and Exchange Commission (SEC) on February 26, 2025 and our Quarterly Report on Form 10-Q for the nine months ended September 30, 2025, as filed with the SEC on November 10, 2025. The statements made herein speak only as of the date of this presentation, and we do not undertake to update this information except as required by law. Past performance does not guarantee future results. Performance during time periods shown is limited and may not reflect the performance for the full year or future years, or in different economic and market cycles. Non-GAAP Financial Measures Our financial statements have been prepared in accordance with accounting principles generally accepted in the United States (GAAP); however, we use certain non- GAAP performance measures in this presentation, in addition to GAAP measures, as we believe these measures improve the understanding of our operational results and make comparisons of operating results among peer companies more meaningful. Management continually evaluates the usefulness, relevance, limitations, and calculation of our reported non-GAAP performance measures to determine how best to provide relevant information to the public, and thus such reported measures could change. The non-GAAP financial measures used in this presentation are net operating income (NOI), Cash G&A, Adjusted condo gross profit, and Net debt. Non-GAAP financial measures should not be considered independently, or as a substitute, for financial information presented in accordance with GAAP. We define NOI as operating revenues (rental income, tenant recoveries, and other revenue) less operating expenses (real estate taxes, repairs and maintenance, marketing, and other property expenses). NOI excludes straight-line rents and amortization of tenant incentives, net; interest expense, net; ground rent amortization; demolition costs; other income (loss); depreciation and amortization; development-related marketing costs; gain on sale or disposal of real estate and other assets, net; loss on extinguishment of debt; provision for impairment; and equity in earnings from unconsolidated ventures. We believe that NOI is a useful supplemental measure of the performance of our Operating Assets segment because it provides a performance measure that reflects the revenues and expenses directly associated with owning and operating real estate properties. This amount is presented as Operating Assets NOI throughout this document. Total Operating Assets NOI represents NOI as defined above with the addition of our share of NOI from unconsolidated ventures. We use NOI to evaluate our operating performance on a property-by- property basis because NOI allows us to evaluate the impact that property-specific factors such as rental and occupancy rates, tenant mix, and operating costs have on our operating results, gross margins, and investment returns. While NOI is relevant and widely used measures of operating performance of real estate companies, it does not represent cash flows from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating our liquidity or operating performance. NOI does not purport to be indicative of cash available to fund our future cash requirements. Further, our computation of NOI may not be comparable to NOI reported by other real estate companies. We have included in this presentation a reconciliation from our GAAP Operating Assets segment earnings before taxes (EBT) to NOI. Our other non-GAAP measures are defined and reconciled on the applicable supplemental pages. Additional Information Our website address is www.howardhughes.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other publicly filed or furnished documents are available and may be accessed free of charge through the “Investors” section of our website under the "SEC Filings" subsection, as soon as reasonably practicable after those documents are filed with, or furnished to, the SEC. Also available through the Investors section of our website are beneficial ownership reports filed by our directors, officers, and certain shareholders on Forms 3, 4, and 5.

3H O W A R D H U G H E S H O L D I N G S 3 Table of Contents Financial Overview Definitions 4 Company Profile 5 Financial Summary 7 Balance Sheets 9 Statements of Operations 10 Operating Portfolio Performance Same Store Metrics 11 NOI by Region 13 Stabilized Properties 15 Unstabilized Properties 17 Under Construction Properties 18 Other Portfolio Metrics Completed Condominiums 19 Under Construction Condominiums 20 Predevelopment Condominiums 21 Summary of Remaining Development Costs 22 Portfolio Key Metrics 23 MPC Performance 24 MPC Land 25 MPC Land Appreciation 26 Lease Expirations 27 Debt Summary 28 Reconciliations of Non-GAAP Measures 30

4H O W A R D H U G H E S H O L D I N G S 4 Stabilized - Properties in the Operating Assets segment that have reached 90% occupancy or have been in service for 36 months or more, whichever occurs first. If an office, retail, or multifamily property has been in service for more than 36 months but does not exceed 90% occupancy, the asset is considered underperforming. Unstabilized - Properties in the Operating Assets segment that have been in service for less than 36 months and do not exceed 90% occupancy. Under Construction - Projects in the Strategic Developments segment for which construction has commenced as of September 30, 2025, unless otherwise noted. This excludes Master Planned Community (MPC) and condominium development. Net Operating Income (NOI) - We define net operating income (NOI) as operating revenues (rental income, tenant recoveries, and other revenues) less operating expenses (real estate taxes, repairs and maintenance, marketing, and other property expenses). NOI excludes straight-line rents and amortization of tenant incentives, net; interest expense, net; ground rent amortization; demolition costs; other income (loss); depreciation and amortization; development-related marketing costs; gain on sale or disposal of real estate and other assets, net; loss on extinguishment of debt; provision for impairment; and equity in earnings from unconsolidated ventures. We use NOI to evaluate our operating performance on a property-by-property basis because NOI allows us to evaluate the impact that property-specific factor, such as lease structure, lease rates, and tenant bases, have on our operating results, gross margins, and investment returns. We believe that NOI is a useful supplemental measure of the performance of our Operating Assets segment because it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating real estate properties and the impact on operations from trends in rental and occupancy rates and operating costs. This amount is presented as Operating Assets NOI throughout this document. In-Place NOI - We define In-Place NOI as forecasted current year NOI, excluding certain items affecting comparability to Estimated Stabilized NOI, such as non-recurring items and other items not indicative of stabilized operations, for all properties included in the Operating Assets segment as of the end of the current period. Total Operating Assets NOI - This term represents NOI as defined above with the addition of our share of NOI from unconsolidated ventures. Estimated Stabilized NOI - Estimated Stabilized NOI is an asset's potential annual NOI. This measure is initially projected prior to the development of the asset based on market assumptions and is revised over the life of the asset as market conditions evolve. On a quarterly basis, each asset’s In-Place NOI is compared to its Estimated Stabilized NOI in conjunction with forecast data to determine if an adjustment is needed. Adjustments are made when changes to the asset's long-term performance are thought to be more than likely and permanent. Remaining Development Costs - Development costs and related debt held for projects that are under construction or substantially complete and in service in the Operating Assets segment are disclosed on the Summary of Remaining Development Costs slide if the project has more than $1.0 million of estimated costs remaining to be incurred. The total estimated costs and costs paid are prepared on a cash basis to reflect the total anticipated cash requirements for the projects. Projects not yet under construction are not included. Same Store Properties - The Company defines Same Store Properties as consolidated and unconsolidated properties that are acquired or placed in service prior to the beginning of the earliest period presented and owned by the Company through the end of the latest period presented. Same Store Properties exclude properties placed in service, acquired, repositioned, or in development or redevelopment after the beginning of the earliest period presented or disposed of prior to the end of the latest period presented. Accordingly, it takes at least one year and one quarter after a property is acquired or treated as in service for that property to be included in Same Store Properties. Same Store NOI - We calculate Same Store Net Operating Income (Same Store NOI) as Operating Assets NOI applicable to consolidated properties acquired or placed in service prior to the beginning of the earliest period presented and owned by the Company through the end of the latest period presented. Same Store NOI also includes the Company's share of NOI from unconsolidated ventures and the annual distribution from a cost basis investment. Same Store NOI is a non-GAAP financial measure and should not be viewed as an alternative to net income calculated in accordance with GAAP as a measurement of our operating performance. We believe that Same Store NOI is helpful to investors as a supplemental comparative performance measure of the income generated from the same group of properties from one period to the next. Other companies may not define Same Store NOI in the same manner as we do; therefore, our computation of Same Store NOI may not be comparable to that of other companies. Additionally, we do not control investments in unconsolidated properties, and while we consider disclosures of our share of NOI to be useful, they may not accurately depict the legal and economic implications of our investment arrangements. Definitions

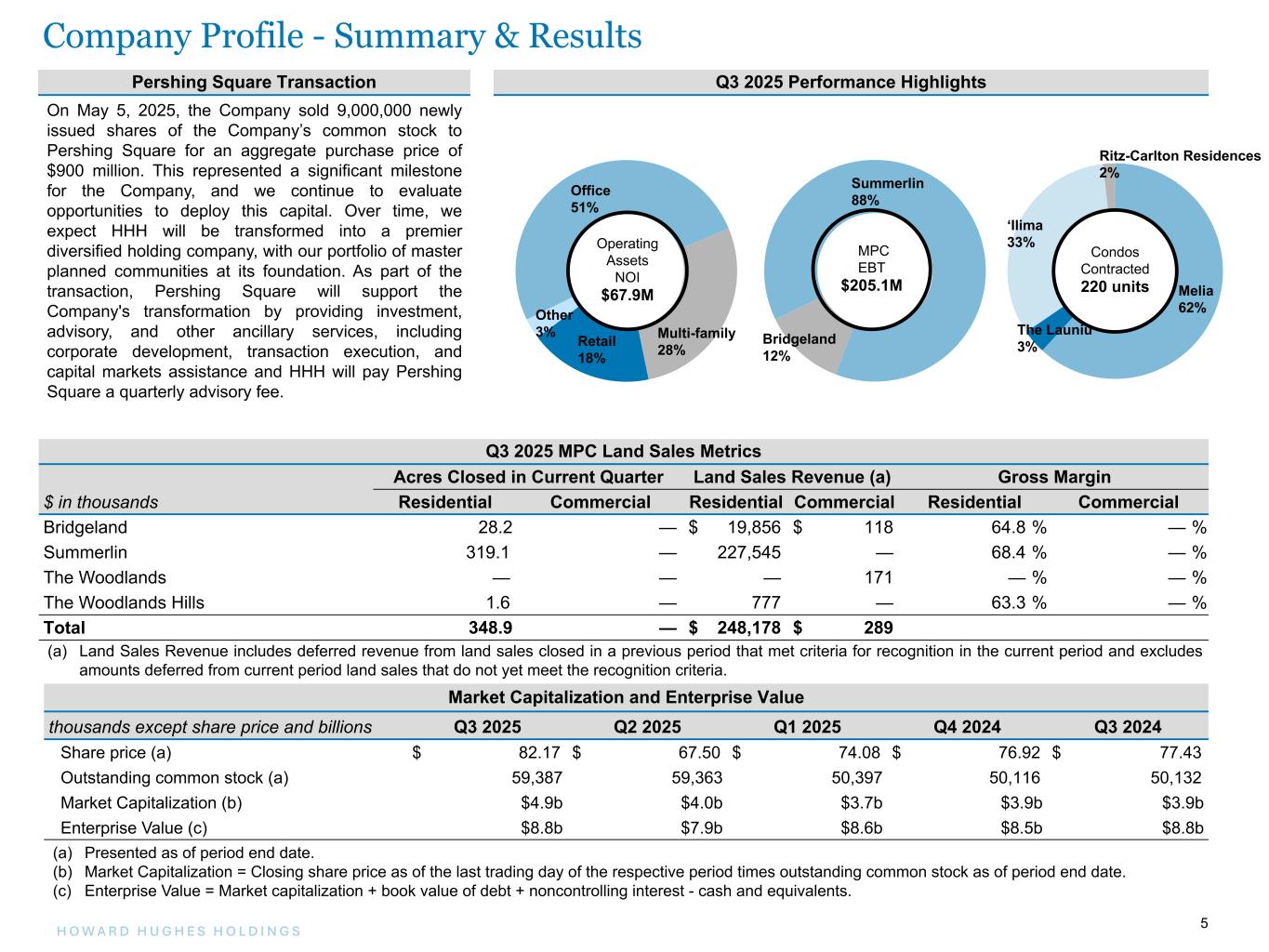

5H O W A R D H U G H E S H O L D I N G S 5 Company Profile - Summary & Results Melia 62% The Launiu 3% ‘Ilima 33% Ritz-Carlton Residences 2% Summerlin 88% Bridgeland 12% MPC EBT $205.1M Condos Contracted 220 units Office 51% Multi-family 28%Retail 18% Other 3% Operating Assets NOI $67.9M Q3 2025 Performance Highlights Q3 2025 MPC Land Sales Metrics Acres Closed in Current Quarter Land Sales Revenue (a) Gross Margin $ in thousands Residential Commercial Residential Commercial Residential Commercial Bridgeland 28.2 — $ 19,856 $ 118 64.8 % — % Summerlin 319.1 — 227,545 — 68.4 % — % The Woodlands — — — 171 — % — % The Woodlands Hills 1.6 — 777 — 63.3 % — % Total 348.9 — $ 248,178 $ 289 (a) Land Sales Revenue includes deferred revenue from land sales closed in a previous period that met criteria for recognition in the current period and excludes amounts deferred from current period land sales that do not yet meet the recognition criteria. Pershing Square Transaction On May 5, 2025, the Company sold 9,000,000 newly issued shares of the Company’s common stock to Pershing Square for an aggregate purchase price of $900 million. This represented a significant milestone for the Company, and we continue to evaluate opportunities to deploy this capital. Over time, we expect HHH will be transformed into a premier diversified holding company, with our portfolio of master planned communities at its foundation. As part of the transaction, Pershing Square will support the Company's transformation by providing investment, advisory, and other ancillary services, including corporate development, transaction execution, and capital markets assistance and HHH will pay Pershing Square a quarterly advisory fee. Market Capitalization and Enterprise Value thousands except share price and billions Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Share price (a) $ 82.17 $ 67.50 $ 74.08 $ 76.92 $ 77.43 Outstanding common stock (a) 59,387 59,363 50,397 50,116 50,132 Market Capitalization (b) $4.9b $4.0b $3.7b $3.9b $3.9b Enterprise Value (c) $8.8b $7.9b $8.6b $8.5b $8.8b (a) Presented as of period end date. (b) Market Capitalization = Closing share price as of the last trading day of the respective period times outstanding common stock as of period end date. (c) Enterprise Value = Market capitalization + book value of debt + noncontrolling interest - cash and equivalents.

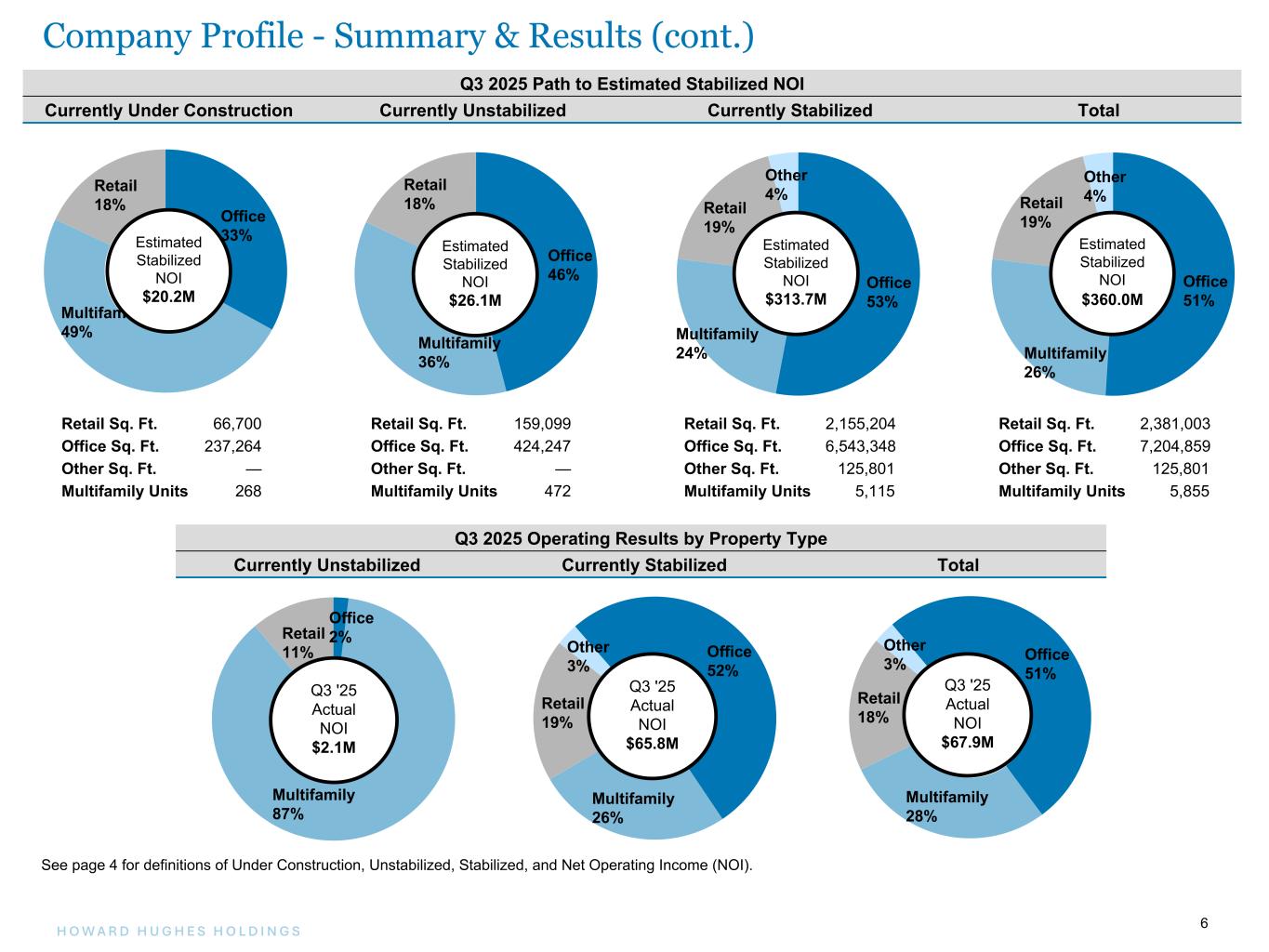

6H O W A R D H U G H E S H O L D I N G S 6 Office 33% Multifamily 49% Retail 18% Office 2% Multifamily 87% Retail 11% Office 51% Multifamily 26% Retail 19% Other 4% Office 53% Multifamily 24% Retail 19% Other 4% Office 46% Multifamily 36% Retail 18% Q3 2025 Path to Estimated Stabilized NOI Currently Under Construction Currently Unstabilized Currently Stabilized Total Estimated Stabilized NOI $26.1M Estimated Stabilized NOI $313.7M Estimated Stabilized NOI $360.0M Office 52% Multifamily 26% Retail 19% Other 3% Office 51% Multifamily 28% Retail 18% Other 3% See page 4 for definitions of Under Construction, Unstabilized, Stabilized, and Net Operating Income (NOI). Q3 '25 Actual NOI $65.8M Q3 '25 Actual NOI $2.1M Q3 '25 Actual NOI $67.9M Estimated Stabilized NOI $20.2M Retail Sq. Ft. 66,700 Retail Sq. Ft. 159,099 Retail Sq. Ft. 2,155,204 Retail Sq. Ft. 2,381,003 Office Sq. Ft. 237,264 Office Sq. Ft. 424,247 Office Sq. Ft. 6,543,348 Office Sq. Ft. 7,204,859 Other Sq. Ft. — Other Sq. Ft. — Other Sq. Ft. 125,801 Other Sq. Ft. 125,801 Multifamily Units 268 Multifamily Units 472 Multifamily Units 5,115 Multifamily Units 5,855 Q3 2025 Operating Results by Property Type Currently Unstabilized Currently Stabilized Total Company Profile - Summary & Results (cont.)

7H O W A R D H U G H E S H O L D I N G S 7 thousands except percentages Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 YTD Q3 2025 YTD Q3 2024 Debt Summary Total debt payable (a) $ 5,324,080 $ 5,260,184 $ 5,286,877 $ 5,168,437 $ 5,338,119 $ 5,324,080 $ 5,338,119 Fixed-rate debt $ 3,848,684 $ 3,867,214 $ 3,780,580 $ 3,769,529 $ 3,680,904 $ 3,848,684 $ 3,680,904 Weighted avg. rate - fixed 4.77 % 4.78 % 4.72 % 4.71 % 4.68 % 4.77 % 4.68 % Variable-rate debt, excluding condominium financing $ 802,988 $ 806,291 $ 1,068,223 $ 1,067,682 $ 1,078,503 $ 802,988 $ 1,078,503 Weighted avg. rate - variable (b) 7.22 % 7.15 % 6.99 % 6.98 % 7.95 % 7.22 % 7.95 % Condominium debt outstanding at end of period $ 672,408 $ 586,679 $ 438,074 $ 331,226 $ 578,712 $ 672,408 $ 578,712 Weighted avg. rate - condominium financing 8.04 % 8.11 % 8.10 % 8.13 % 9.36 % 8.04 % 9.36 % Leverage ratio (debt to enterprise value) 60.24 % 66.49 % 61.35 % 60.67 % 59.90 % 60.24 % 59.90 % General and Administrative Expenses General and administrative (G&A) (c)(d) $ 28,281 $ 34,552 $ 22,436 $ 22,822 $ 24,862 $ 85,269 $ 68,930 Less: Non-cash stock compensation (2,585) (6,167) (2,751) (2,229) (2,911) (11,503) (6,875) Cash G&A (e) $ 25,696 $ 28,385 $ 19,685 $ 20,593 $ 21,951 $ 73,766 $ 62,055 (a) Represents total mortgages, notes, and loans payable, as stated in our GAAP financial statements as of the respective date, excluding unamortized deferred financing costs. (b) Includes the impact of interest rate derivatives. (c) G&A expense for the second quarter of 2025 includes $9.7 million of severance costs and $3.4 million of non-cash stock compensation related to a strategic reduction in force. (d) G&A expense for the third quarter of 2025 includes the first full quarter of the Pershing Square advisory fees comprised of a $3.8 million base fee and a $3.4 million variable fee. (e) Cash G&A is a non-GAAP financial measure that we believe is useful to our investors and other users of our financial statements as an indicator of overhead efficiency without regard to non-cash expenses associated with stock compensation. However, it should not be used as an alternative to general and administrative expenses in accordance with GAAP. Financial Summary

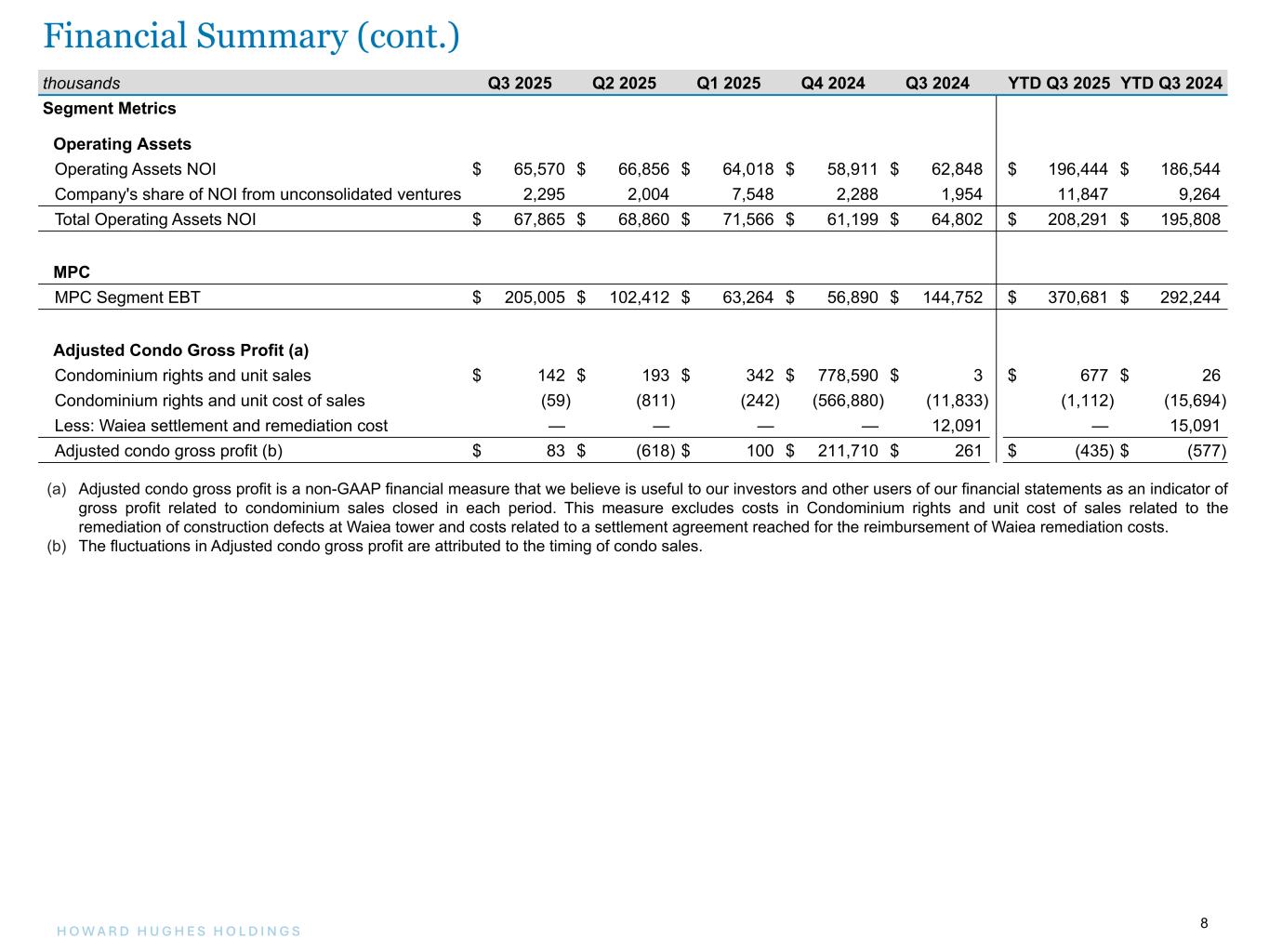

8H O W A R D H U G H E S H O L D I N G S 8 (a) Adjusted condo gross profit is a non-GAAP financial measure that we believe is useful to our investors and other users of our financial statements as an indicator of gross profit related to condominium sales closed in each period. This measure excludes costs in Condominium rights and unit cost of sales related to the remediation of construction defects at Waiea tower and costs related to a settlement agreement reached for the reimbursement of Waiea remediation costs. (b) The fluctuations in Adjusted condo gross profit are attributed to the timing of condo sales. thousands Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 YTD Q3 2025 YTD Q3 2024 Segment Metrics Operating Assets Operating Assets NOI $ 65,570 $ 66,856 $ 64,018 $ 58,911 $ 62,848 $ 196,444 $ 186,544 Company's share of NOI from unconsolidated ventures 2,295 2,004 7,548 2,288 1,954 11,847 9,264 Total Operating Assets NOI $ 67,865 $ 68,860 $ 71,566 $ 61,199 $ 64,802 $ 208,291 $ 195,808 MPC MPC Segment EBT $ 205,005 $ 102,412 $ 63,264 $ 56,890 $ 144,752 $ 370,681 $ 292,244 Adjusted Condo Gross Profit (a) Condominium rights and unit sales $ 142 $ 193 $ 342 $ 778,590 $ 3 $ 677 $ 26 Condominium rights and unit cost of sales (59) (811) (242) (566,880) (11,833) (1,112) (15,694) Less: Waiea settlement and remediation cost — — — — 12,091 — 15,091 Adjusted condo gross profit (b) $ 83 $ (618) $ 100 $ 211,710 $ 261 $ (435) $ (577) Financial Summary (cont.)

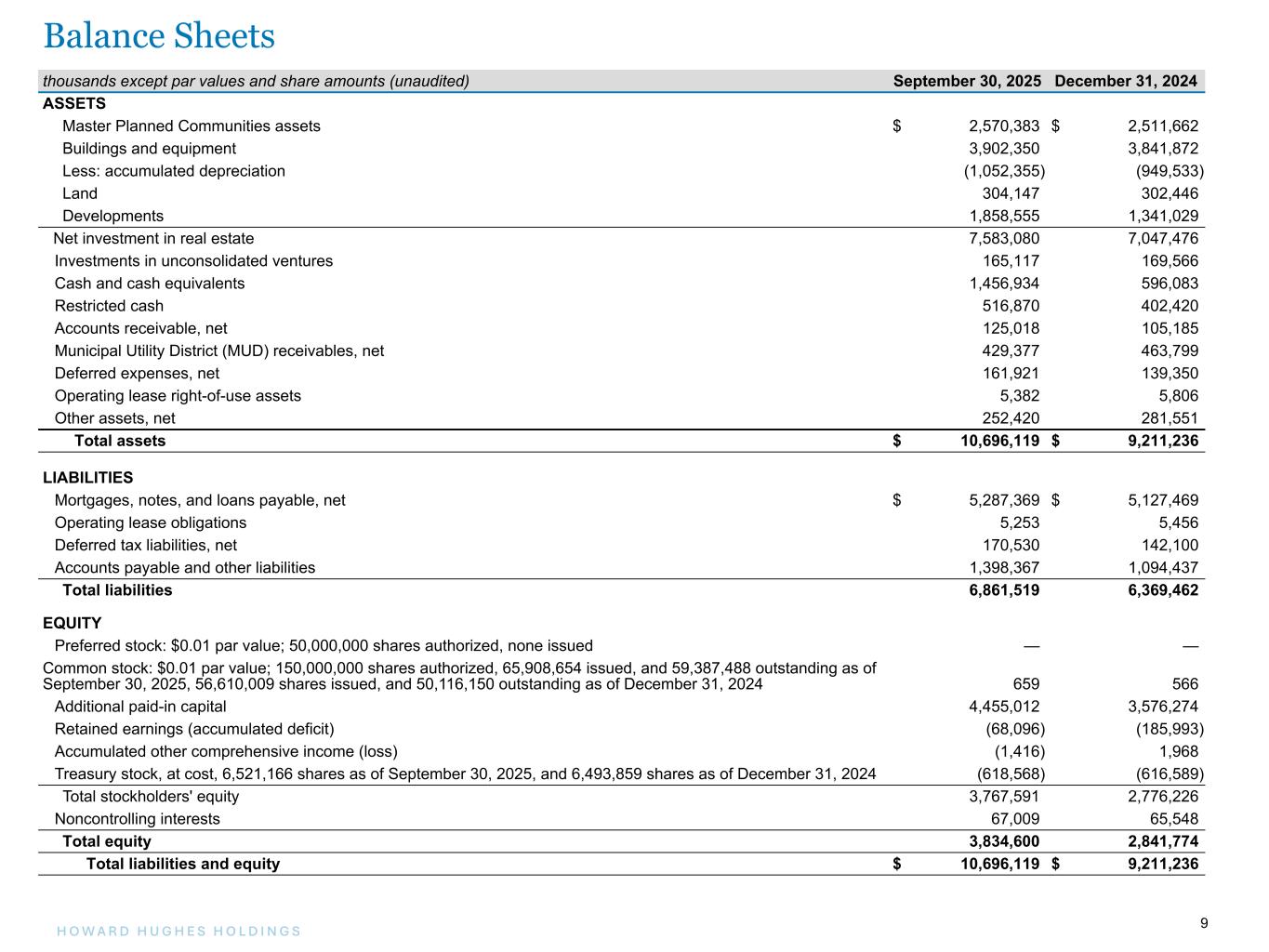

9H O W A R D H U G H E S H O L D I N G S 9 thousands except par values and share amounts (unaudited) September 30, 2025 December 31, 2024 ASSETS Master Planned Communities assets $ 2,570,383 $ 2,511,662 Buildings and equipment 3,902,350 3,841,872 Less: accumulated depreciation (1,052,355) (949,533) Land 304,147 302,446 Developments 1,858,555 1,341,029 Net investment in real estate 7,583,080 7,047,476 Investments in unconsolidated ventures 165,117 169,566 Cash and cash equivalents 1,456,934 596,083 Restricted cash 516,870 402,420 Accounts receivable, net 125,018 105,185 Municipal Utility District (MUD) receivables, net 429,377 463,799 Deferred expenses, net 161,921 139,350 Operating lease right-of-use assets 5,382 5,806 Other assets, net 252,420 281,551 Total assets $ 10,696,119 $ 9,211,236 LIABILITIES Mortgages, notes, and loans payable, net $ 5,287,369 $ 5,127,469 Operating lease obligations 5,253 5,456 Deferred tax liabilities, net 170,530 142,100 Accounts payable and other liabilities 1,398,367 1,094,437 Total liabilities 6,861,519 6,369,462 EQUITY Preferred stock: $0.01 par value; 50,000,000 shares authorized, none issued — — Common stock: $0.01 par value; 150,000,000 shares authorized, 65,908,654 issued, and 59,387,488 outstanding as of September 30, 2025, 56,610,009 shares issued, and 50,116,150 outstanding as of December 31, 2024 659 566 Additional paid-in capital 4,455,012 3,576,274 Retained earnings (accumulated deficit) (68,096) (185,993) Accumulated other comprehensive income (loss) (1,416) 1,968 Treasury stock, at cost, 6,521,166 shares as of September 30, 2025, and 6,493,859 shares as of December 31, 2024 (618,568) (616,589) Total stockholders' equity 3,767,591 2,776,226 Noncontrolling interests 67,009 65,548 Total equity 3,834,600 2,841,774 Total liabilities and equity $ 10,696,119 $ 9,211,236 Balance Sheets

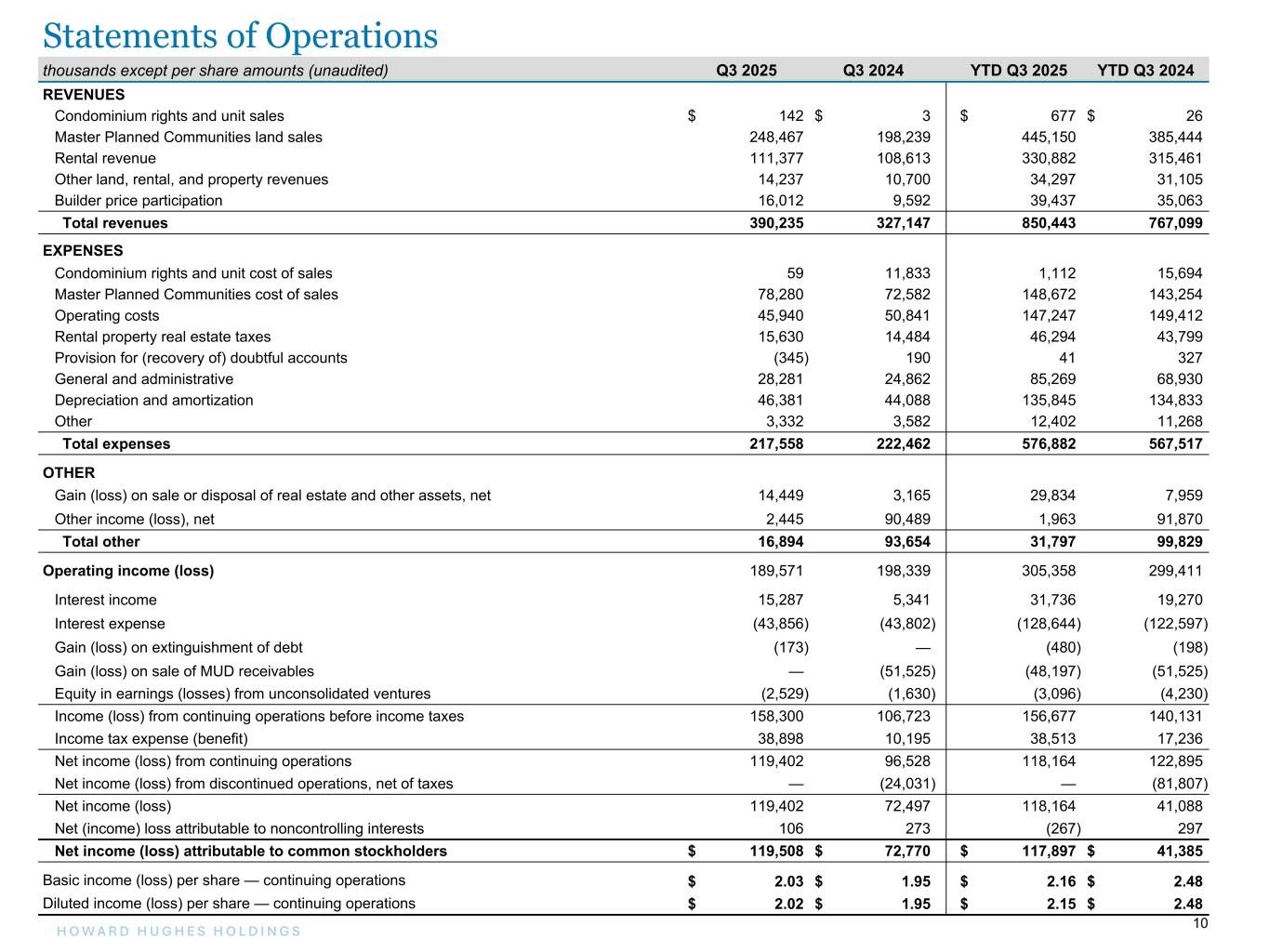

10H O W A R D H U G H E S H O L D I N G S 10 thousands except per share amounts (unaudited) Q3 2025 Q3 2024 YTD Q3 2025 YTD Q3 2024 REVENUES Condominium rights and unit sales $ 142 $ 3 $ 677 $ 26 Master Planned Communities land sales 248,467 198,239 445,150 385,444 Rental revenue 111,377 108,613 330,882 315,461 Other land, rental, and property revenues 14,237 10,700 34,297 31,105 Builder price participation 16,012 9,592 39,437 35,063 Total revenues 390,235 327,147 850,443 767,099 EXPENSES Condominium rights and unit cost of sales 59 11,833 1,112 15,694 Master Planned Communities cost of sales 78,280 72,582 148,672 143,254 Operating costs 45,940 50,841 147,247 149,412 Rental property real estate taxes 15,630 14,484 46,294 43,799 Provision for (recovery of) doubtful accounts (345) 190 41 327 General and administrative 28,281 24,862 85,269 68,930 Depreciation and amortization 46,381 44,088 135,845 134,833 Other 3,332 3,582 12,402 11,268 Total expenses 217,558 222,462 576,882 567,517 OTHER Gain (loss) on sale or disposal of real estate and other assets, net 14,449 3,165 29,834 7,959 Other income (loss), net 2,445 90,489 1,963 91,870 Total other 16,894 93,654 31,797 99,829 Operating income (loss) 189,571 198,339 305,358 299,411 Interest income 15,287 5,341 31,736 19,270 Interest expense (43,856) (43,802) (128,644) (122,597) Gain (loss) on extinguishment of debt (173) — (480) (198) Gain (loss) on sale of MUD receivables — (51,525) (48,197) (51,525) Equity in earnings (losses) from unconsolidated ventures (2,529) (1,630) (3,096) (4,230) Income (loss) from continuing operations before income taxes 158,300 106,723 156,677 140,131 Income tax expense (benefit) 38,898 10,195 38,513 17,236 Net income (loss) from continuing operations 119,402 96,528 118,164 122,895 Net income (loss) from discontinued operations, net of taxes — (24,031) — (81,807) Net income (loss) 119,402 72,497 118,164 41,088 Net (income) loss attributable to noncontrolling interests 106 273 (267) 297 Net income (loss) attributable to common stockholders $ 119,508 $ 72,770 $ 117,897 $ 41,385 Basic income (loss) per share — continuing operations $ 2.03 $ 1.95 $ 2.16 $ 2.48 Diluted income (loss) per share — continuing operations $ 2.02 $ 1.95 $ 2.15 $ 2.48 Statements of Operations

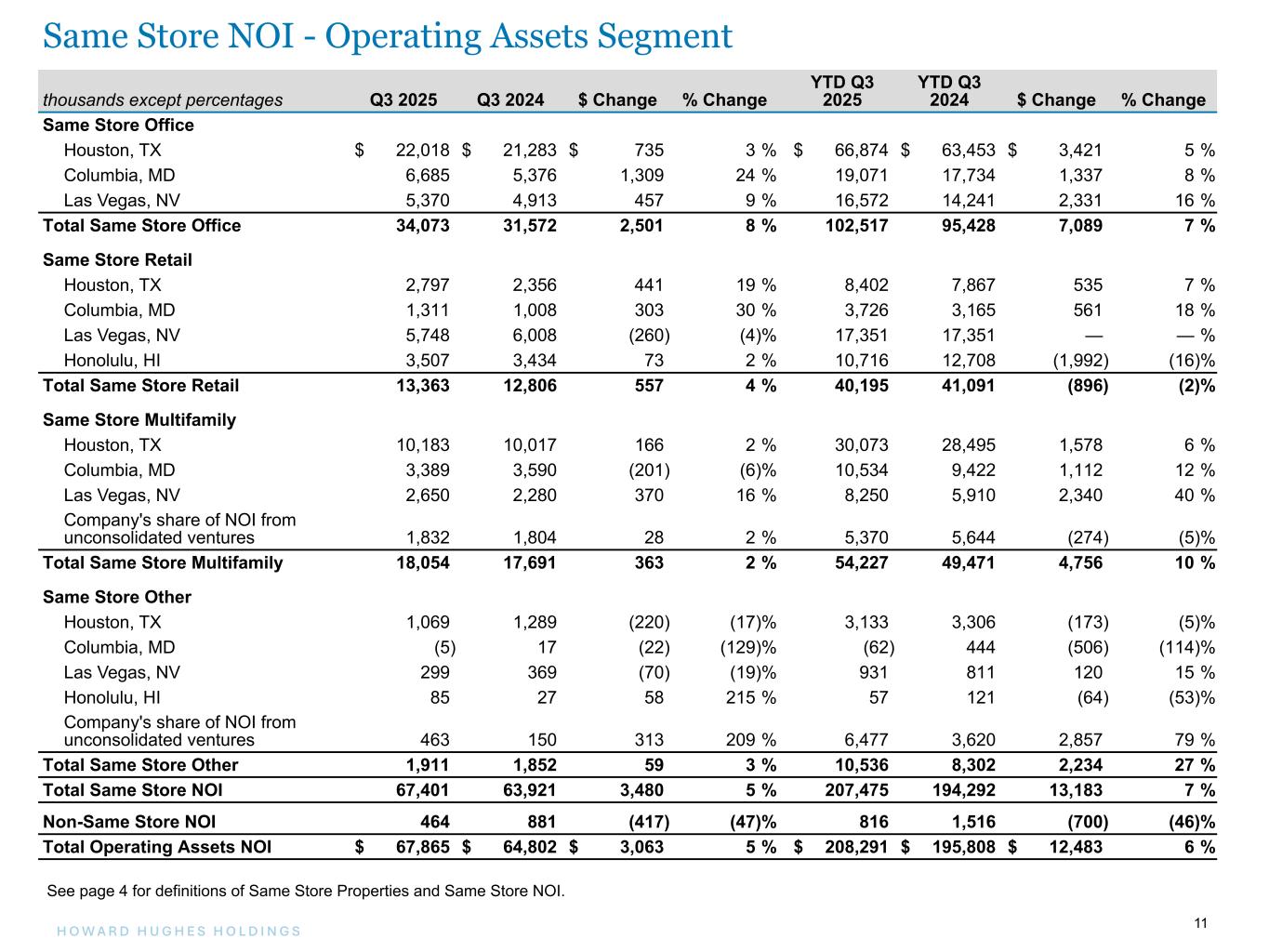

11H O W A R D H U G H E S H O L D I N G S 11 thousands except percentages Q3 2025 Q3 2024 $ Change % Change YTD Q3 2025 YTD Q3 2024 $ Change % Change Same Store Office Houston, TX $ 22,018 $ 21,283 $ 735 3 % $ 66,874 $ 63,453 $ 3,421 5 % Columbia, MD 6,685 5,376 1,309 24 % 19,071 17,734 1,337 8 % Las Vegas, NV 5,370 4,913 457 9 % 16,572 14,241 2,331 16 % Total Same Store Office 34,073 31,572 2,501 8 % 102,517 95,428 7,089 7 % Same Store Retail Houston, TX 2,797 2,356 441 19 % 8,402 7,867 535 7 % Columbia, MD 1,311 1,008 303 30 % 3,726 3,165 561 18 % Las Vegas, NV 5,748 6,008 (260) (4) % 17,351 17,351 — — % Honolulu, HI 3,507 3,434 73 2 % 10,716 12,708 (1,992) (16) % Total Same Store Retail 13,363 12,806 557 4 % 40,195 41,091 (896) (2) % Same Store Multifamily Houston, TX 10,183 10,017 166 2 % 30,073 28,495 1,578 6 % Columbia, MD 3,389 3,590 (201) (6) % 10,534 9,422 1,112 12 % Las Vegas, NV 2,650 2,280 370 16 % 8,250 5,910 2,340 40 % Company's share of NOI from unconsolidated ventures 1,832 1,804 28 2 % 5,370 5,644 (274) (5) % Total Same Store Multifamily 18,054 17,691 363 2 % 54,227 49,471 4,756 10 % Same Store Other Houston, TX 1,069 1,289 (220) (17) % 3,133 3,306 (173) (5) % Columbia, MD (5) 17 (22) (129) % (62) 444 (506) (114) % Las Vegas, NV 299 369 (70) (19) % 931 811 120 15 % Honolulu, HI 85 27 58 215 % 57 121 (64) (53) % Company's share of NOI from unconsolidated ventures 463 150 313 209 % 6,477 3,620 2,857 79 % Total Same Store Other 1,911 1,852 59 3 % 10,536 8,302 2,234 27 % Total Same Store NOI 67,401 63,921 3,480 5 % 207,475 194,292 13,183 7 % Non-Same Store NOI 464 881 (417) (47) % 816 1,516 (700) (46) % Total Operating Assets NOI $ 67,865 $ 64,802 $ 3,063 5 % $ 208,291 $ 195,808 $ 12,483 6 % See page 4 for definitions of Same Store Properties and Same Store NOI. Same Store NOI - Operating Assets Segment

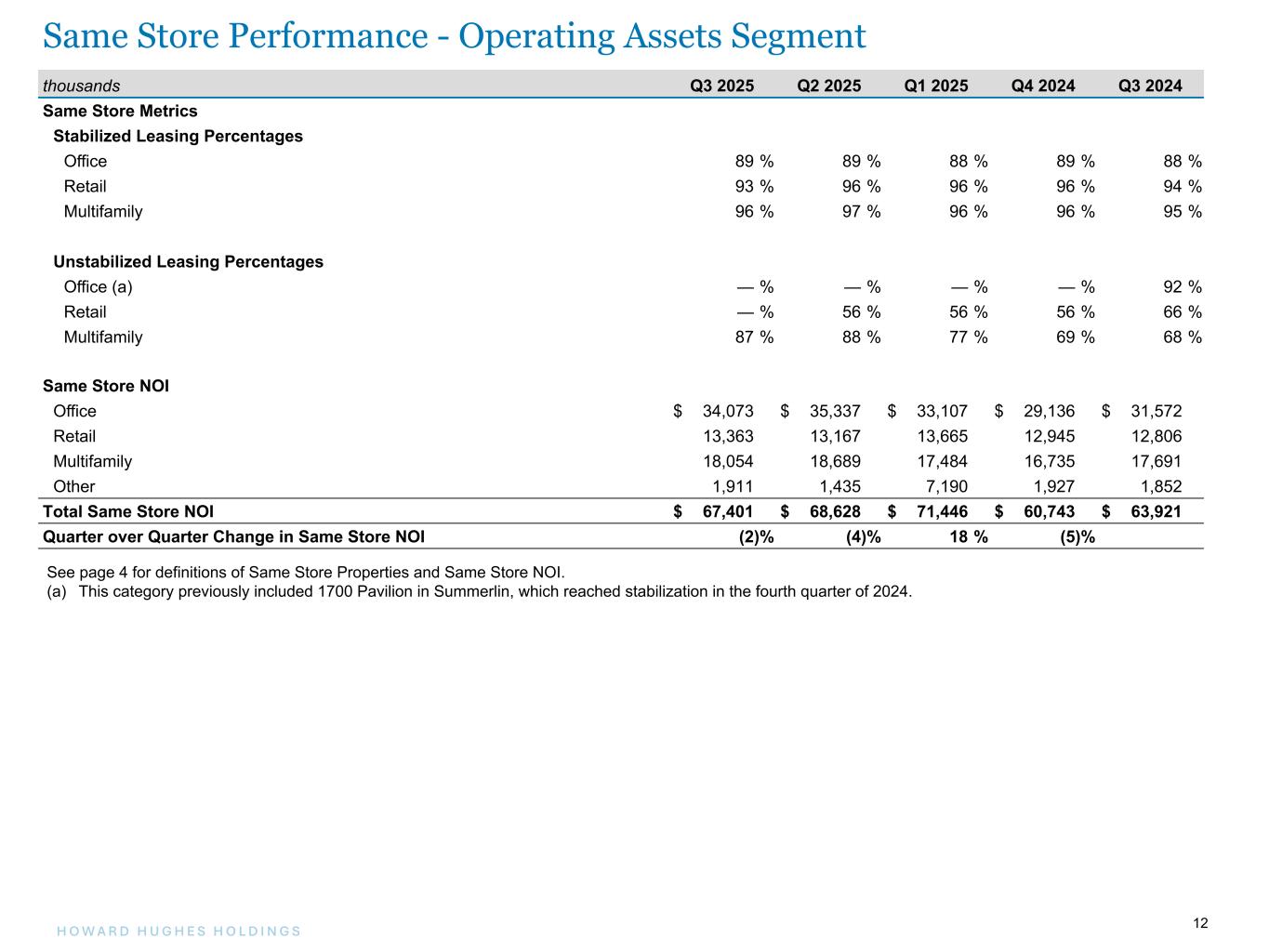

12H O W A R D H U G H E S H O L D I N G S 12 thousands Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Same Store Metrics Stabilized Leasing Percentages Office 89 % 89 % 88 % 89 % 88 % Retail 93 % 96 % 96 % 96 % 94 % Multifamily 96 % 97 % 96 % 96 % 95 % Unstabilized Leasing Percentages Office (a) — % — % — % — % 92 % Retail — % 56 % 56 % 56 % 66 % Multifamily 87 % 88 % 77 % 69 % 68 % Same Store NOI Office $ 34,073 $ 35,337 $ 33,107 $ 29,136 $ 31,572 Retail 13,363 13,167 13,665 12,945 12,806 Multifamily 18,054 18,689 17,484 16,735 17,691 Other 1,911 1,435 7,190 1,927 1,852 Total Same Store NOI $ 67,401 $ 68,628 $ 71,446 $ 60,743 $ 63,921 Quarter over Quarter Change in Same Store NOI (2) % (4) % 18 % (5) % See page 4 for definitions of Same Store Properties and Same Store NOI. (a) This category previously included 1700 Pavilion in Summerlin, which reached stabilization in the fourth quarter of 2024. Same Store Performance - Operating Assets Segment

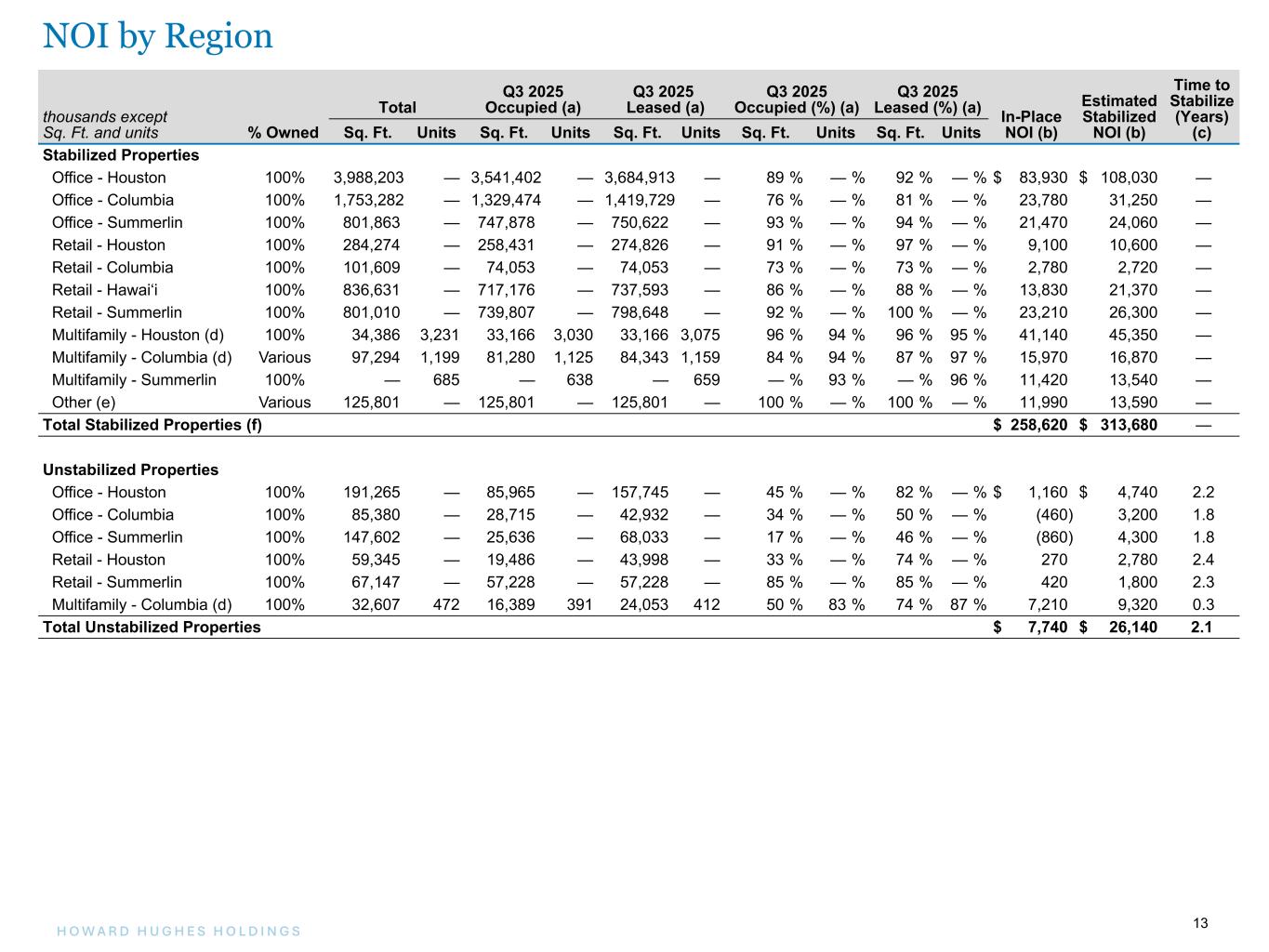

13H O W A R D H U G H E S H O L D I N G S 13 thousands except Sq. Ft. and units % Owned Total Q3 2025 Occupied (a) Q3 2025 Leased (a) Q3 2025 Occupied (%) (a) Q3 2025 Leased (%) (a) In-Place NOI (b) Estimated Stabilized NOI (b) Time to Stabilize (Years) (c)Sq. Ft. Units Sq. Ft. Units Sq. Ft. Units Sq. Ft. Units Sq. Ft. Units Stabilized Properties Office - Houston 100% 3,988,203 — 3,541,402 — 3,684,913 — 89 % — % 92 % — % $ 83,930 $ 108,030 — Office - Columbia 100% 1,753,282 — 1,329,474 — 1,419,729 — 76 % — % 81 % — % 23,780 31,250 — Office - Summerlin 100% 801,863 — 747,878 — 750,622 — 93 % — % 94 % — % 21,470 24,060 — Retail - Houston 100% 284,274 — 258,431 — 274,826 — 91 % — % 97 % — % 9,100 10,600 — Retail - Columbia 100% 101,609 — 74,053 — 74,053 — 73 % — % 73 % — % 2,780 2,720 — Retail - Hawai‘i 100% 836,631 — 717,176 — 737,593 — 86 % — % 88 % — % 13,830 21,370 — Retail - Summerlin 100% 801,010 — 739,807 — 798,648 — 92 % — % 100 % — % 23,210 26,300 — Multifamily - Houston (d) 100% 34,386 3,231 33,166 3,030 33,166 3,075 96 % 94 % 96 % 95 % 41,140 45,350 — Multifamily - Columbia (d) Various 97,294 1,199 81,280 1,125 84,343 1,159 84 % 94 % 87 % 97 % 15,970 16,870 — Multifamily - Summerlin 100% — 685 — 638 — 659 — % 93 % — % 96 % 11,420 13,540 — Other (e) Various 125,801 — 125,801 — 125,801 — 100 % — % 100 % — % 11,990 13,590 — Total Stabilized Properties (f) $ 258,620 $ 313,680 — Unstabilized Properties Office - Houston 100% 191,265 — 85,965 — 157,745 — 45 % — % 82 % — % $ 1,160 $ 4,740 2.2 Office - Columbia 100% 85,380 — 28,715 — 42,932 — 34 % — % 50 % — % (460) 3,200 1.8 Office - Summerlin 100% 147,602 — 25,636 — 68,033 — 17 % — % 46 % — % (860) 4,300 1.8 Retail - Houston 100% 59,345 — 19,486 — 43,998 — 33 % — % 74 % — % 270 2,780 2.4 Retail - Summerlin 100% 67,147 — 57,228 — 57,228 — 85 % — % 85 % — % 420 1,800 2.3 Multifamily - Columbia (d) 100% 32,607 472 16,389 391 24,053 412 50 % 83 % 74 % 87 % 7,210 9,320 0.3 Total Unstabilized Properties $ 7,740 $ 26,140 2.1 NOI by Region

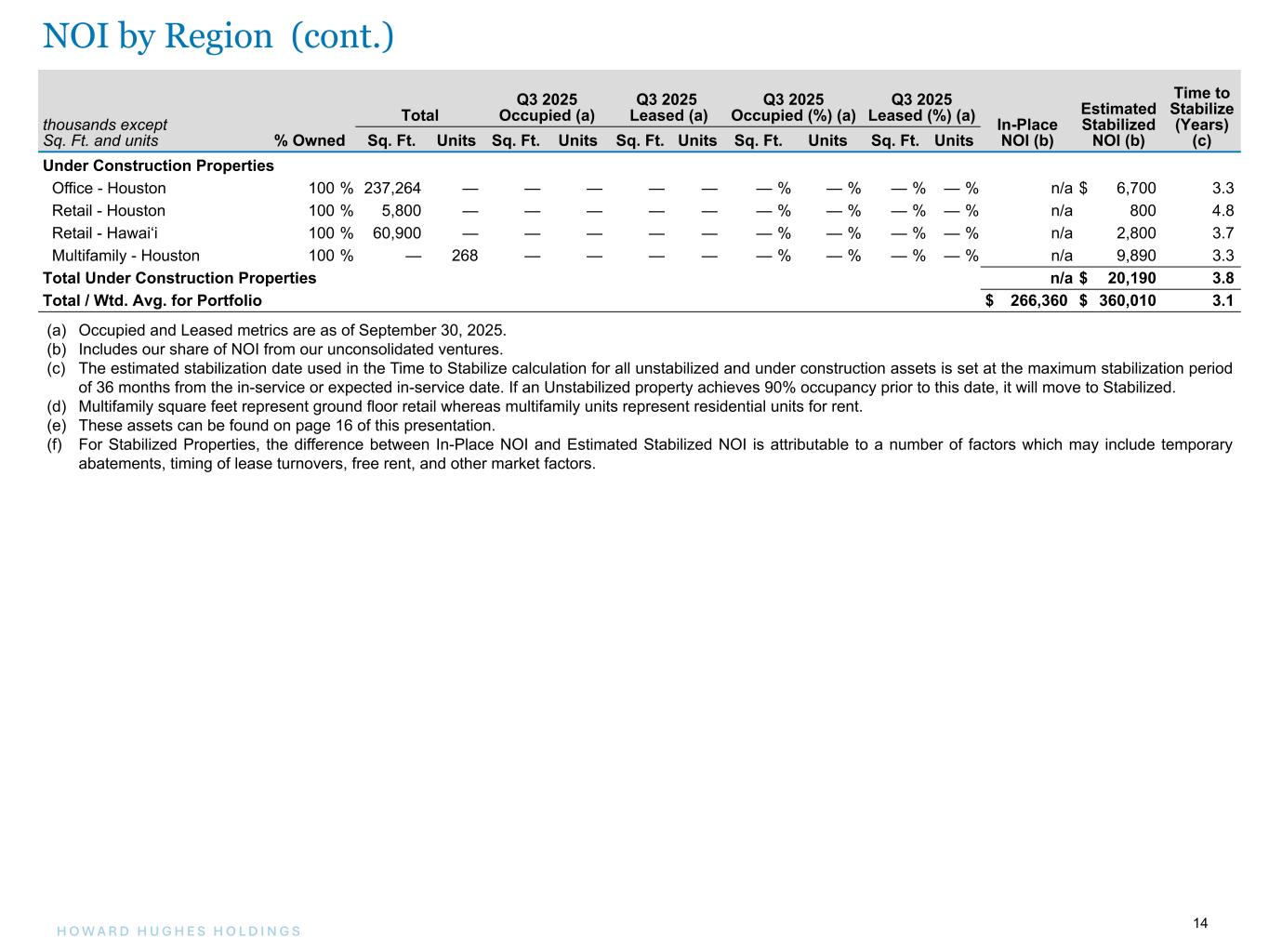

14H O W A R D H U G H E S H O L D I N G S 14 NOI by Region (a) Occupied and Leased metrics are as of September 30, 2025. (b) Includes our share of NOI from our unconsolidated ventures. (c) The estimated stabilization date used in the Time to Stabilize calculation for all unstabilized and under construction assets is set at the maximum stabilization period of 36 months from the in-service or expected in-service date. If an Unstabilized property achieves 90% occupancy prior to this date, it will move to Stabilized. (d) Multifamily square feet represent ground floor retail whereas multifamily units represent residential units for rent. (e) These assets can be found on page 16 of this presentation. (f) For Stabilized Properties, the difference between In-Place NOI and Estimated Stabilized NOI is attributable to a number of factors which may include temporary abatements, timing of lease turnovers, free rent, and other market factors. thousands except Sq. Ft. and units % Owned Total Q3 2025 Occupied (a) Q3 2025 Leased (a) Q3 2025 Occupied (%) (a) Q3 2025 Leased (%) (a) In-Place NOI (b) Estimated Stabilized NOI (b) Time to Stabilize (Years) (c)Sq. Ft. Units Sq. Ft. Units Sq. Ft. Units Sq. Ft. Units Sq. Ft. Units Under Construction Properties Office - Houston 100 % 237,264 — — — — — — % — % — % — % n/a $ 6,700 3.3 Retail - Houston 100 % 5,800 — — — — — — % — % — % — % n/a 800 4.8 Retail - Hawai‘i 100 % 60,900 — — — — — — % — % — % — % n/a 2,800 3.7 Multifamily - Houston 100 % — 268 — — — — — % — % — % — % n/a 9,890 3.3 Total Under Construction Properties n/a $ 20,190 3.8 Total / Wtd. Avg. for Portfolio $ 266,360 $ 360,010 3.1 NOI by Region (cont.)

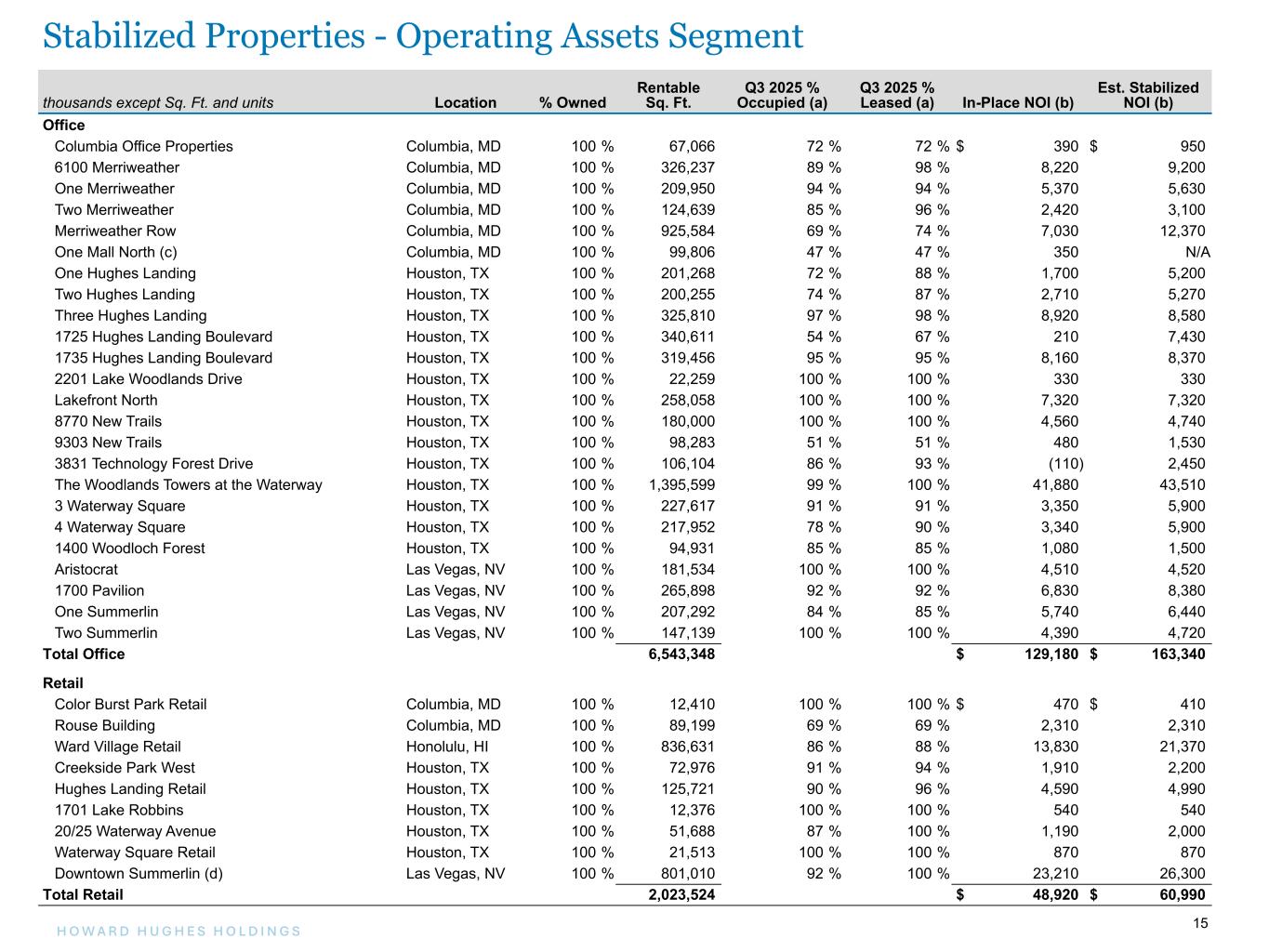

15H O W A R D H U G H E S H O L D I N G S 15 thousands except Sq. Ft. and units Location % Owned Rentable Sq. Ft. Q3 2025 % Occupied (a) Q3 2025 % Leased (a) In-Place NOI (b) Est. Stabilized NOI (b) Office Columbia Office Properties Columbia, MD 100 % 67,066 72 % 72 % $ 390 $ 950 6100 Merriweather Columbia, MD 100 % 326,237 89 % 98 % 8,220 9,200 One Merriweather Columbia, MD 100 % 209,950 94 % 94 % 5,370 5,630 Two Merriweather Columbia, MD 100 % 124,639 85 % 96 % 2,420 3,100 Merriweather Row Columbia, MD 100 % 925,584 69 % 74 % 7,030 12,370 One Mall North (c) Columbia, MD 100 % 99,806 47 % 47 % 350 N/A One Hughes Landing Houston, TX 100 % 201,268 72 % 88 % 1,700 5,200 Two Hughes Landing Houston, TX 100 % 200,255 74 % 87 % 2,710 5,270 Three Hughes Landing Houston, TX 100 % 325,810 97 % 98 % 8,920 8,580 1725 Hughes Landing Boulevard Houston, TX 100 % 340,611 54 % 67 % 210 7,430 1735 Hughes Landing Boulevard Houston, TX 100 % 319,456 95 % 95 % 8,160 8,370 2201 Lake Woodlands Drive Houston, TX 100 % 22,259 100 % 100 % 330 330 Lakefront North Houston, TX 100 % 258,058 100 % 100 % 7,320 7,320 8770 New Trails Houston, TX 100 % 180,000 100 % 100 % 4,560 4,740 9303 New Trails Houston, TX 100 % 98,283 51 % 51 % 480 1,530 3831 Technology Forest Drive Houston, TX 100 % 106,104 86 % 93 % (110) 2,450 The Woodlands Towers at the Waterway Houston, TX 100 % 1,395,599 99 % 100 % 41,880 43,510 3 Waterway Square Houston, TX 100 % 227,617 91 % 91 % 3,350 5,900 4 Waterway Square Houston, TX 100 % 217,952 78 % 90 % 3,340 5,900 1400 Woodloch Forest Houston, TX 100 % 94,931 85 % 85 % 1,080 1,500 Aristocrat Las Vegas, NV 100 % 181,534 100 % 100 % 4,510 4,520 1700 Pavilion Las Vegas, NV 100 % 265,898 92 % 92 % 6,830 8,380 One Summerlin Las Vegas, NV 100 % 207,292 84 % 85 % 5,740 6,440 Two Summerlin Las Vegas, NV 100 % 147,139 100 % 100 % 4,390 4,720 Total Office 6,543,348 $ 129,180 $ 163,340 Retail Color Burst Park Retail Columbia, MD 100 % 12,410 100 % 100 % $ 470 $ 410 Rouse Building Columbia, MD 100 % 89,199 69 % 69 % 2,310 2,310 Ward Village Retail Honolulu, HI 100 % 836,631 86 % 88 % 13,830 21,370 Creekside Park West Houston, TX 100 % 72,976 91 % 94 % 1,910 2,200 Hughes Landing Retail Houston, TX 100 % 125,721 90 % 96 % 4,590 4,990 1701 Lake Robbins Houston, TX 100 % 12,376 100 % 100 % 540 540 20/25 Waterway Avenue Houston, TX 100 % 51,688 87 % 100 % 1,190 2,000 Waterway Square Retail Houston, TX 100 % 21,513 100 % 100 % 870 870 Downtown Summerlin (d) Las Vegas, NV 100 % 801,010 92 % 100 % 23,210 26,300 Total Retail 2,023,524 $ 48,920 $ 60,990 Stabilized Properties - Operating Assets Segment

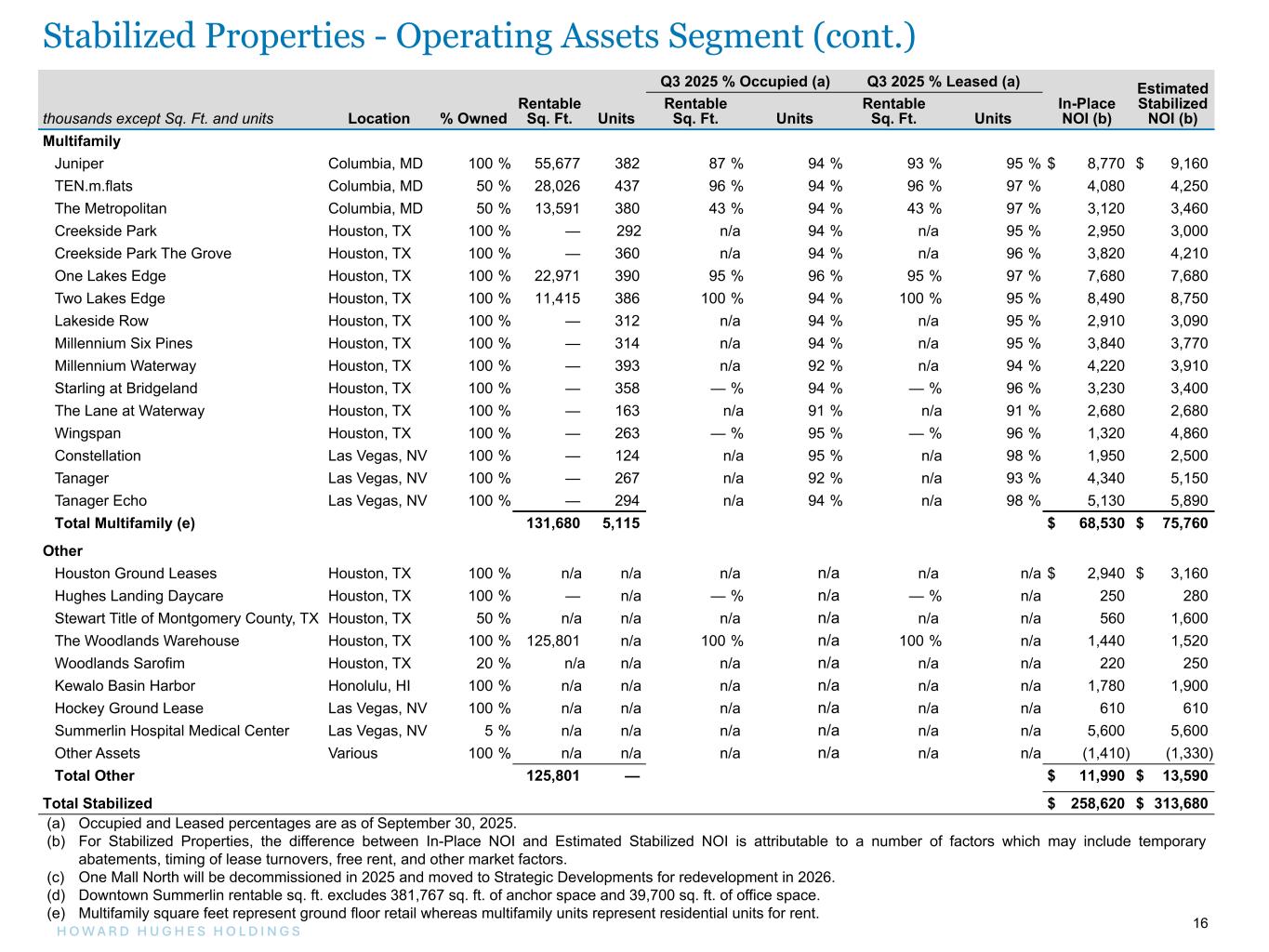

16H O W A R D H U G H E S H O L D I N G S 16 Q3 2025 % Occupied (a) Q3 2025 % Leased (a) Estimated Stabilized NOI (b)thousands except Sq. Ft. and units Location % Owned Rentable Sq. Ft. Units Rentable Sq. Ft. Units Rentable Sq. Ft. Units In-Place NOI (b) Multifamily Juniper Columbia, MD 100 % 55,677 382 87 % 94 % 93 % 95 % $ 8,770 $ 9,160 TEN.m.flats Columbia, MD 50 % 28,026 437 96 % 94 % 96 % 97 % 4,080 4,250 The Metropolitan Columbia, MD 50 % 13,591 380 43 % 94 % 43 % 97 % 3,120 3,460 Creekside Park Houston, TX 100 % — 292 n/a 94 % n/a 95 % 2,950 3,000 Creekside Park The Grove Houston, TX 100 % — 360 n/a 94 % n/a 96 % 3,820 4,210 One Lakes Edge Houston, TX 100 % 22,971 390 95 % 96 % 95 % 97 % 7,680 7,680 Two Lakes Edge Houston, TX 100 % 11,415 386 100 % 94 % 100 % 95 % 8,490 8,750 Lakeside Row Houston, TX 100 % — 312 n/a 94 % n/a 95 % 2,910 3,090 Millennium Six Pines Houston, TX 100 % — 314 n/a 94 % n/a 95 % 3,840 3,770 Millennium Waterway Houston, TX 100 % — 393 n/a 92 % n/a 94 % 4,220 3,910 Starling at Bridgeland Houston, TX 100 % — 358 — % 94 % — % 96 % 3,230 3,400 The Lane at Waterway Houston, TX 100 % — 163 n/a 91 % n/a 91 % 2,680 2,680 Wingspan Houston, TX 100 % — 263 — % 95 % — % 96 % 1,320 4,860 Constellation Las Vegas, NV 100 % — 124 n/a 95 % n/a 98 % 1,950 2,500 Tanager Las Vegas, NV 100 % — 267 n/a 92 % n/a 93 % 4,340 5,150 Tanager Echo Las Vegas, NV 100 % — 294 n/a 94 % n/a 98 % 5,130 5,890 Total Multifamily (e) 131,680 5,115 $ 68,530 $ 75,760 Other Houston Ground Leases Houston, TX 100 % n/a n/a n/a n/a n/a n/a $ 2,940 $ 3,160 Hughes Landing Daycare Houston, TX 100 % — n/a — % n/a — % n/a 250 280 Stewart Title of Montgomery County, TX Houston, TX 50 % n/a n/a n/a n/a n/a n/a 560 1,600 The Woodlands Warehouse Houston, TX 100 % 125,801 n/a 100 % n/a 100 % n/a 1,440 1,520 Woodlands Sarofim Houston, TX 20 % n/a n/a n/a n/a n/a n/a 220 250 Kewalo Basin Harbor Honolulu, HI 100 % n/a n/a n/a n/a n/a n/a 1,780 1,900 Hockey Ground Lease Las Vegas, NV 100 % n/a n/a n/a n/a n/a n/a 610 610 Summerlin Hospital Medical Center Las Vegas, NV 5 % n/a n/a n/a n/a n/a n/a 5,600 5,600 Other Assets Various 100 % n/a n/a n/a n/a n/a n/a (1,410) (1,330) Total Other 125,801 — $ 11,990 $ 13,590 Total Stabilized $ 258,620 $ 313,680 (a) Occupied and Leased percentages are as of September 30, 2025. (b) For Stabilized Properties, the difference between In-Place NOI and Estimated Stabilized NOI is attributable to a number of factors which may include temporary abatements, timing of lease turnovers, free rent, and other market factors. (c) One Mall North will be decommissioned in 2025 and moved to Strategic Developments for redevelopment in 2026. (d) Downtown Summerlin rentable sq. ft. excludes 381,767 sq. ft. of anchor space and 39,700 sq. ft. of office space. (e) Multifamily square feet represent ground floor retail whereas multifamily units represent residential units for rent. Stabilized Properties - Operating Assets Segment (cont.)

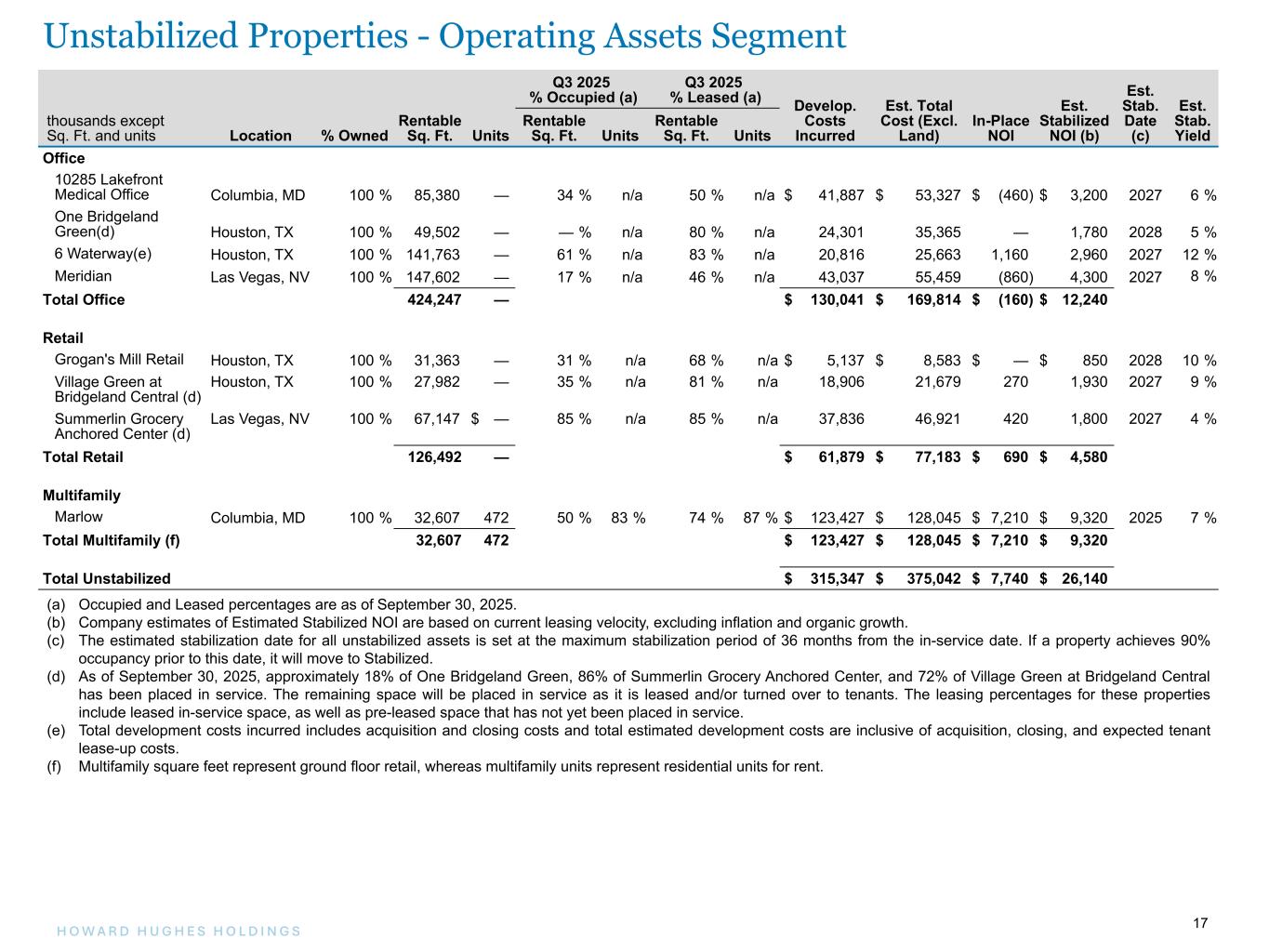

17H O W A R D H U G H E S H O L D I N G S 17 Q3 2025 % Occupied (a) Q3 2025 % Leased (a) Develop. Costs Incurred Est. Total Cost (Excl. Land) In-Place NOI Est. Stabilized NOI (b) Est. Stab. Date (c) Est. Stab. Yield thousands except Sq. Ft. and units Location % Owned Rentable Sq. Ft. Units Rentable Sq. Ft. Units Rentable Sq. Ft. Units Office 10285 Lakefront Medical Office Columbia, MD 100 % 85,380 — 34 % n/a 50 % n/a $ 41,887 $ 53,327 $ (460) $ 3,200 2027 6 % One Bridgeland Green(d) Houston, TX 100 % 49,502 — — % n/a 80 % n/a 24,301 35,365 — 1,780 2028 5 % 6 Waterway(e) Houston, TX 100 % 141,763 — 61 % n/a 83 % n/a 20,816 25,663 1,160 2,960 2027 12 % Meridian Las Vegas, NV 100 % 147,602 — 17 % n/a 46 % n/a 43,037 55,459 (860) 4,300 2027 8 % Total Office 424,247 — $ 130,041 $ 169,814 $ (160) $ 12,240 Retail Grogan's Mill Retail Houston, TX 100 % 31,363 — 31 % n/a 68 % n/a $ 5,137 $ 8,583 $ — $ 850 2028 10 % Village Green at Bridgeland Central (d) Houston, TX 100 % 27,982 — 35 % n/a 81 % n/a 18,906 21,679 270 1,930 2027 9 % Summerlin Grocery Anchored Center (d) Las Vegas, NV 100 % 67,147 $ — 85 % n/a 85 % n/a 37,836 46,921 420 1,800 2027 4 % Total Retail 126,492 — $ 61,879 $ 77,183 $ 690 $ 4,580 Multifamily Marlow Columbia, MD 100 % 32,607 472 50 % 83 % 74 % 87 % $ 123,427 $ 128,045 $ 7,210 $ 9,320 2025 7 % Total Multifamily (f) 32,607 472 $ 123,427 $ 128,045 $ 7,210 $ 9,320 Total Unstabilized $ 315,347 $ 375,042 $ 7,740 $ 26,140 (a) Occupied and Leased percentages are as of September 30, 2025. (b) Company estimates of Estimated Stabilized NOI are based on current leasing velocity, excluding inflation and organic growth. (c) The estimated stabilization date for all unstabilized assets is set at the maximum stabilization period of 36 months from the in-service date. If a property achieves 90% occupancy prior to this date, it will move to Stabilized. (d) As of September 30, 2025, approximately 18% of One Bridgeland Green, 86% of Summerlin Grocery Anchored Center, and 72% of Village Green at Bridgeland Central has been placed in service. The remaining space will be placed in service as it is leased and/or turned over to tenants. The leasing percentages for these properties include leased in-service space, as well as pre-leased space that has not yet been placed in service. (e) Total development costs incurred includes acquisition and closing costs and total estimated development costs are inclusive of acquisition, closing, and expected tenant lease-up costs. (f) Multifamily square feet represent ground floor retail, whereas multifamily units represent residential units for rent. Unstabilized Properties - Operating Assets Segment

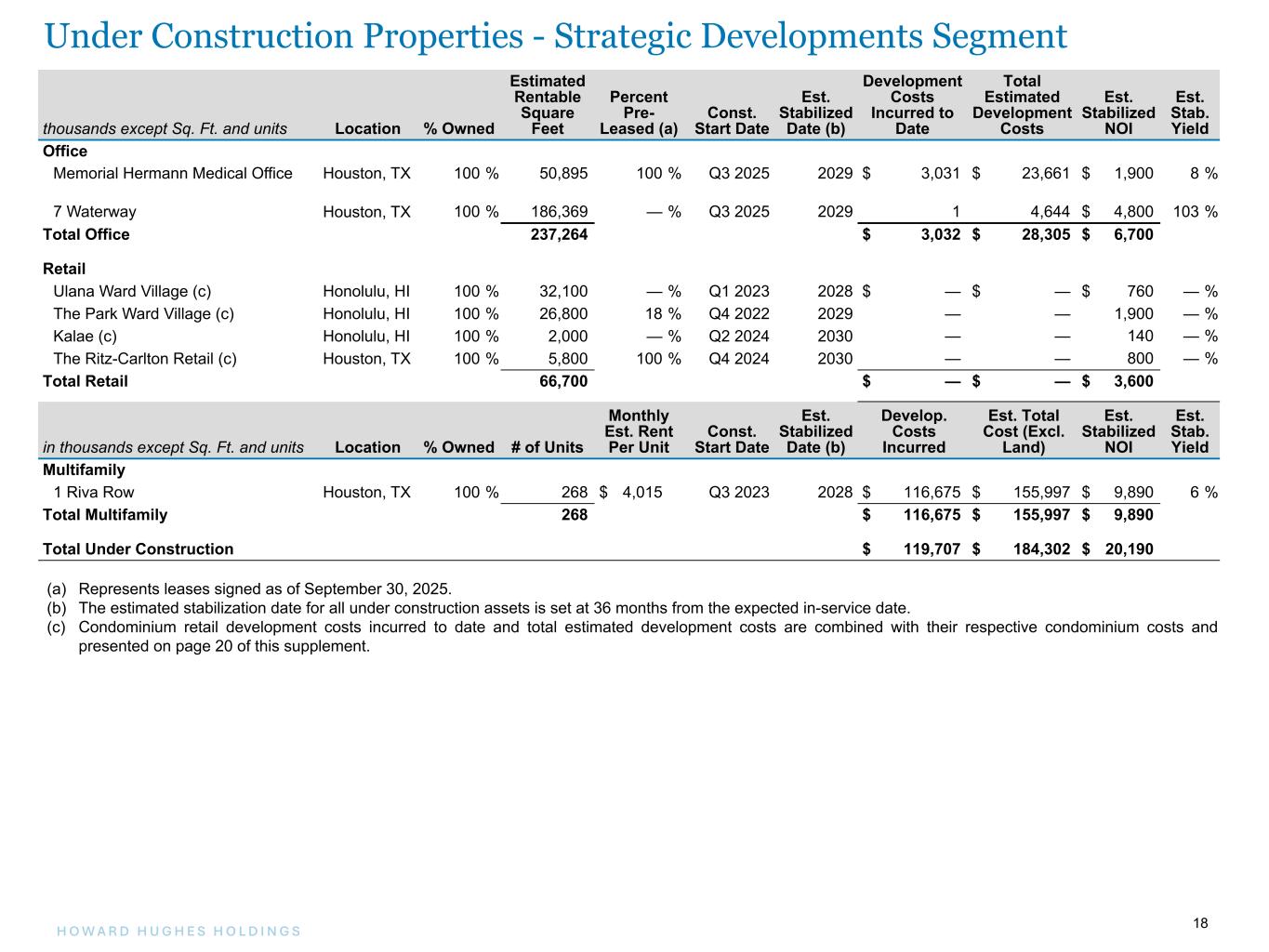

18H O W A R D H U G H E S H O L D I N G S 18 Under Construction Properties thousands except Sq. Ft. and units Location % Owned Estimated Rentable Square Feet Percent Pre- Leased (a) Const. Start Date Est. Stabilized Date (b) Development Costs Incurred to Date Total Estimated Development Costs Est. Stabilized NOI Est. Stab. Yield Office Memorial Hermann Medical Office Houston, TX 100 % 50,895 100 % Q3 2025 2029 $ 3,031 $ 23,661 $ 1,900 8 % 7 Waterway Houston, TX 100 % 186,369 — % Q3 2025 2029 1 4,644 $ 4,800 103 % Total Office 237,264 $ 3,032 $ 28,305 $ 6,700 Retail Ulana Ward Village (c) Honolulu, HI 100 % 32,100 — % Q1 2023 2028 $ — $ — $ 760 — % The Park Ward Village (c) Honolulu, HI 100 % 26,800 18 % Q4 2022 2029 — — 1,900 — % Kalae (c) Honolulu, HI 100 % 2,000 — % Q2 2024 2030 — — 140 — % The Ritz-Carlton Retail (c) Houston, TX 100 % 5,800 100 % Q4 2024 2030 — — 800 — % Total Retail 66,700 $ — $ — $ 3,600 in thousands except Sq. Ft. and units Location % Owned # of Units Monthly Est. Rent Per Unit Const. Start Date Est. Stabilized Date (b) Develop. Costs Incurred Est. Total Cost (Excl. Land) Est. Stabilized NOI Est. Stab. Yield Multifamily 1 Riva Row Houston, TX 100 % 268 $ 4,015 Q3 2023 2028 $ 116,675 $ 155,997 $ 9,890 6 % Total Multifamily 268 $ 116,675 $ 155,997 $ 9,890 Total Under Construction $ 119,707 $ 184,302 $ 20,190 (a) Represents leases signed as of September 30, 2025. (b) The estimated stabilization date for all under construction assets is set at 36 months from the expected in-service date. (c) Condominium retail development costs incurred to date and total estimated development costs are combined with their respective condominium costs and presented on page 20 of this supplement. Under Construction Properties - Strategic Developments Segment

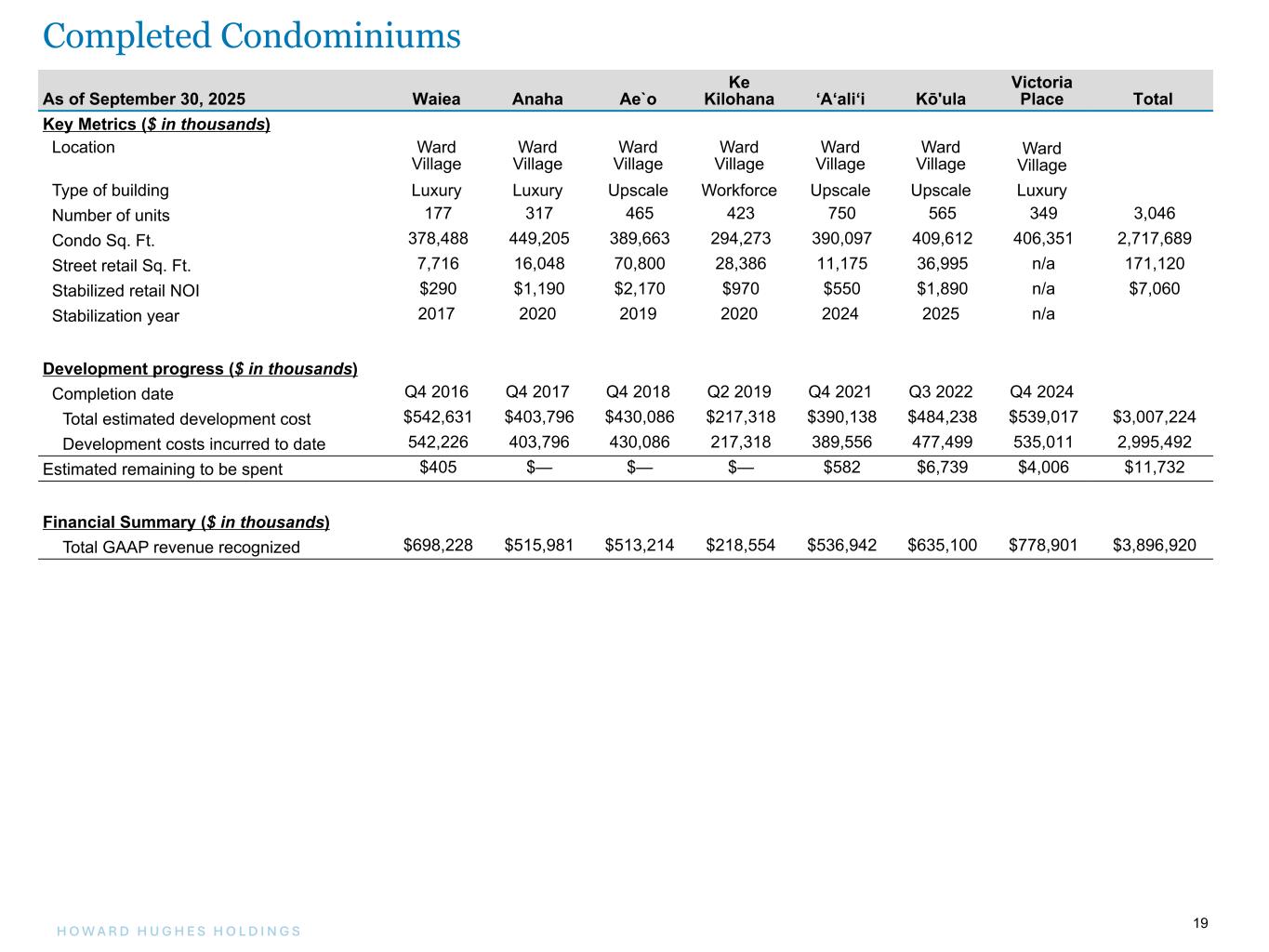

19H O W A R D H U G H E S H O L D I N G S 19 As of September 30, 2025 Waiea Anaha Ae`o Ke Kilohana ‘A‘ali‘i Kō'ula Victoria Place Total Key Metrics ($ in thousands) Location Ward Village Ward Village Ward Village Ward Village Ward Village Ward Village Ward Village Type of building Luxury Luxury Upscale Workforce Upscale Upscale Luxury Number of units 177 317 465 423 750 565 349 3,046 Condo Sq. Ft. 378,488 449,205 389,663 294,273 390,097 409,612 406,351 2,717,689 Street retail Sq. Ft. 7,716 16,048 70,800 28,386 11,175 36,995 n/a 171,120 Stabilized retail NOI $290 $1,190 $2,170 $970 $550 $1,890 n/a $7,060 Stabilization year 2017 2020 2019 2020 2024 2025 n/a Development progress ($ in thousands) Completion date Q4 2016 Q4 2017 Q4 2018 Q2 2019 Q4 2021 Q3 2022 Q4 2024 Total estimated development cost $542,631 $403,796 $430,086 $217,318 $390,138 $484,238 $539,017 $3,007,224 Development costs incurred to date 542,226 403,796 430,086 217,318 389,556 477,499 535,011 2,995,492 Estimated remaining to be spent $405 $— $— $— $582 $6,739 $4,006 $11,732 Financial Summary ($ in thousands) Total GAAP revenue recognized $698,228 $515,981 $513,214 $218,554 $536,942 $635,100 $778,901 $3,896,920 Completed Condominiums

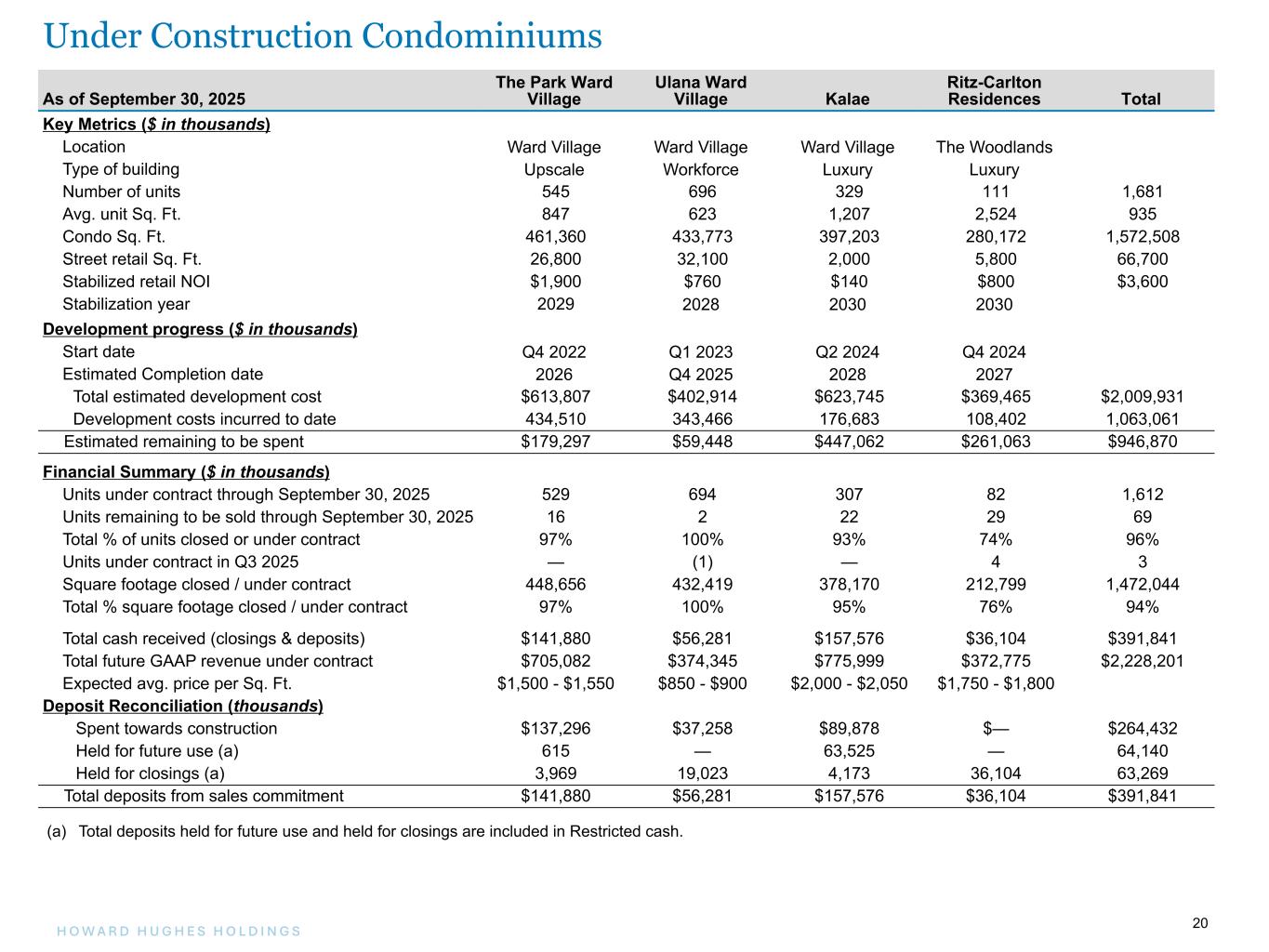

20H O W A R D H U G H E S H O L D I N G S 20 As of September 30, 2025 The Park Ward Village Ulana Ward Village Kalae Ritz-Carlton Residences Total Key Metrics ($ in thousands) Location Ward Village Ward Village Ward Village The Woodlands Type of building Upscale Workforce Luxury Luxury Number of units 545 696 329 111 1,681 Avg. unit Sq. Ft. 847 623 1,207 2,524 935 Condo Sq. Ft. 461,360 433,773 397,203 280,172 1,572,508 Street retail Sq. Ft. 26,800 32,100 2,000 5,800 66,700 Stabilized retail NOI $1,900 $760 $140 $800 $3,600 Stabilization year 2029 2028 2030 2030 Development progress ($ in thousands) Start date Q4 2022 Q1 2023 Q2 2024 Q4 2024 Estimated Completion date 2026 Q4 2025 2028 2027 Total estimated development cost $613,807 $402,914 $623,745 $369,465 $2,009,931 Development costs incurred to date 434,510 343,466 176,683 108,402 1,063,061 Estimated remaining to be spent $179,297 $59,448 $447,062 $261,063 $946,870 Financial Summary ($ in thousands) Units under contract through September 30, 2025 529 694 307 82 1,612 Units remaining to be sold through September 30, 2025 16 2 22 29 69 Total % of units closed or under contract 97% 100% 93% 74% 96% Units under contract in Q3 2025 — (1) — 4 3 Square footage closed / under contract 448,656 432,419 378,170 212,799 1,472,044 Total % square footage closed / under contract 97% 100% 95% 76% 94% Total cash received (closings & deposits) $141,880 $56,281 $157,576 $36,104 $391,841 Total future GAAP revenue under contract $705,082 $374,345 $775,999 $372,775 $2,228,201 Expected avg. price per Sq. Ft. $1,500 - $1,550 $850 - $900 $2,000 - $2,050 $1,750 - $1,800 Deposit Reconciliation (thousands) Spent towards construction $137,296 $37,258 $89,878 $— $264,432 Held for future use (a) 615 — 63,525 — 64,140 Held for closings (a) 3,969 19,023 4,173 36,104 63,269 Total deposits from sales commitment $141,880 $56,281 $157,576 $36,104 $391,841 (a) Total deposits held for future use and held for closings are included in Restricted cash. Under Construction Condominiums

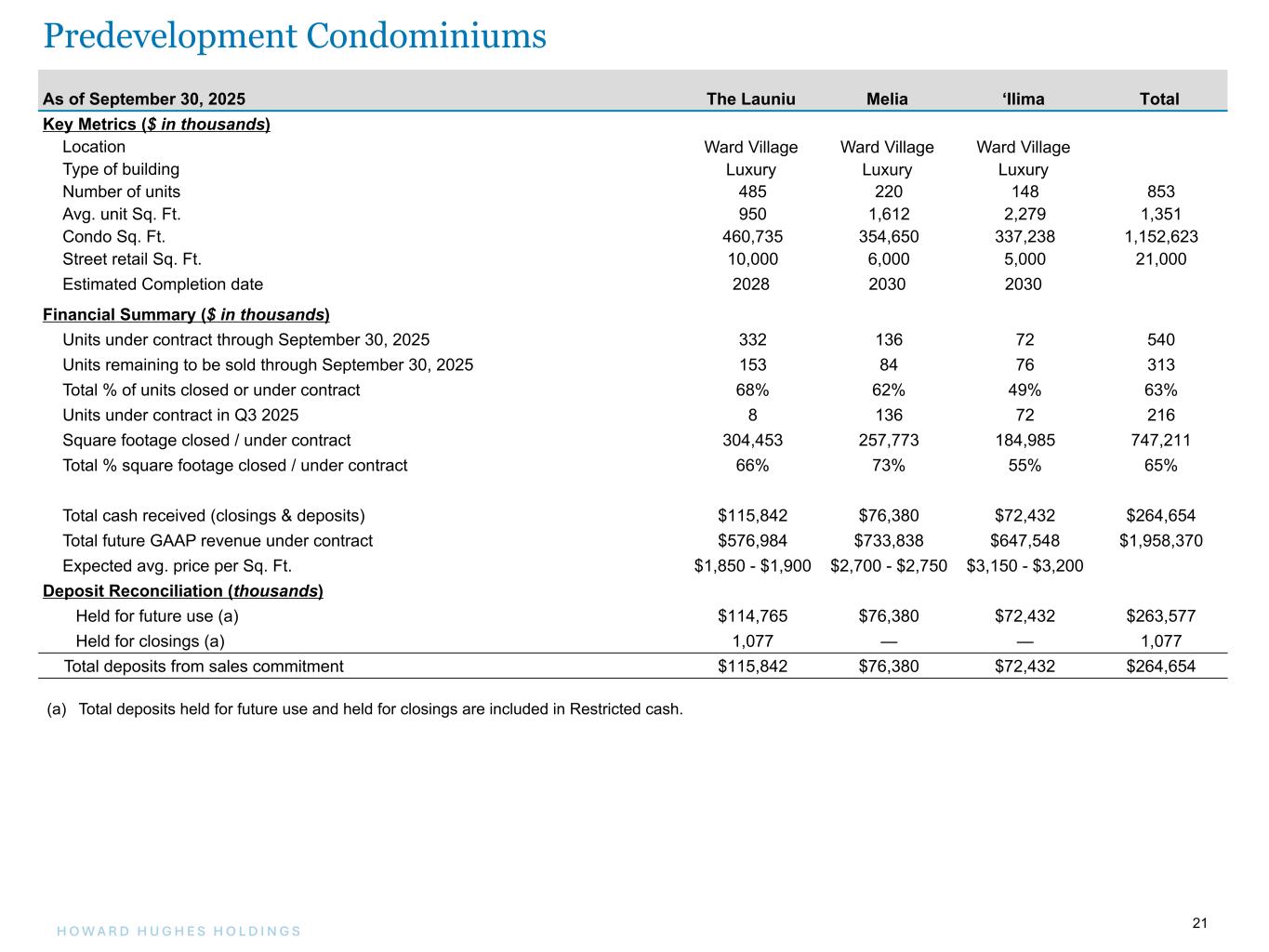

21H O W A R D H U G H E S H O L D I N G S 21 As of September 30, 2025 The Launiu Melia ‘Ilima Total Key Metrics ($ in thousands) Location Ward Village Ward Village Ward Village Type of building Luxury Luxury Luxury Number of units 485 220 148 853 Avg. unit Sq. Ft. 950 1,612 2,279 1,351 Condo Sq. Ft. 460,735 354,650 337,238 1,152,623 Street retail Sq. Ft. 10,000 6,000 5,000 21,000 Estimated Completion date 2028 2030 2030 Financial Summary ($ in thousands) Units under contract through September 30, 2025 332 136 72 540 Units remaining to be sold through September 30, 2025 153 84 76 313 Total % of units closed or under contract 68% 62% 49% 63% Units under contract in Q3 2025 8 136 72 216 Square footage closed / under contract 304,453 257,773 184,985 747,211 Total % square footage closed / under contract 66% 73% 55% 65% Total cash received (closings & deposits) $115,842 $76,380 $72,432 $264,654 Total future GAAP revenue under contract $576,984 $733,838 $647,548 $1,958,370 Expected avg. price per Sq. Ft. $1,850 - $1,900 $2,700 - $2,750 $3,150 - $3,200 Deposit Reconciliation (thousands) Held for future use (a) $114,765 $76,380 $72,432 $263,577 Held for closings (a) 1,077 — — 1,077 Total deposits from sales commitment $115,842 $76,380 $72,432 $264,654 (a) Total deposits held for future use and held for closings are included in Restricted cash. Predevelopment Condominiums

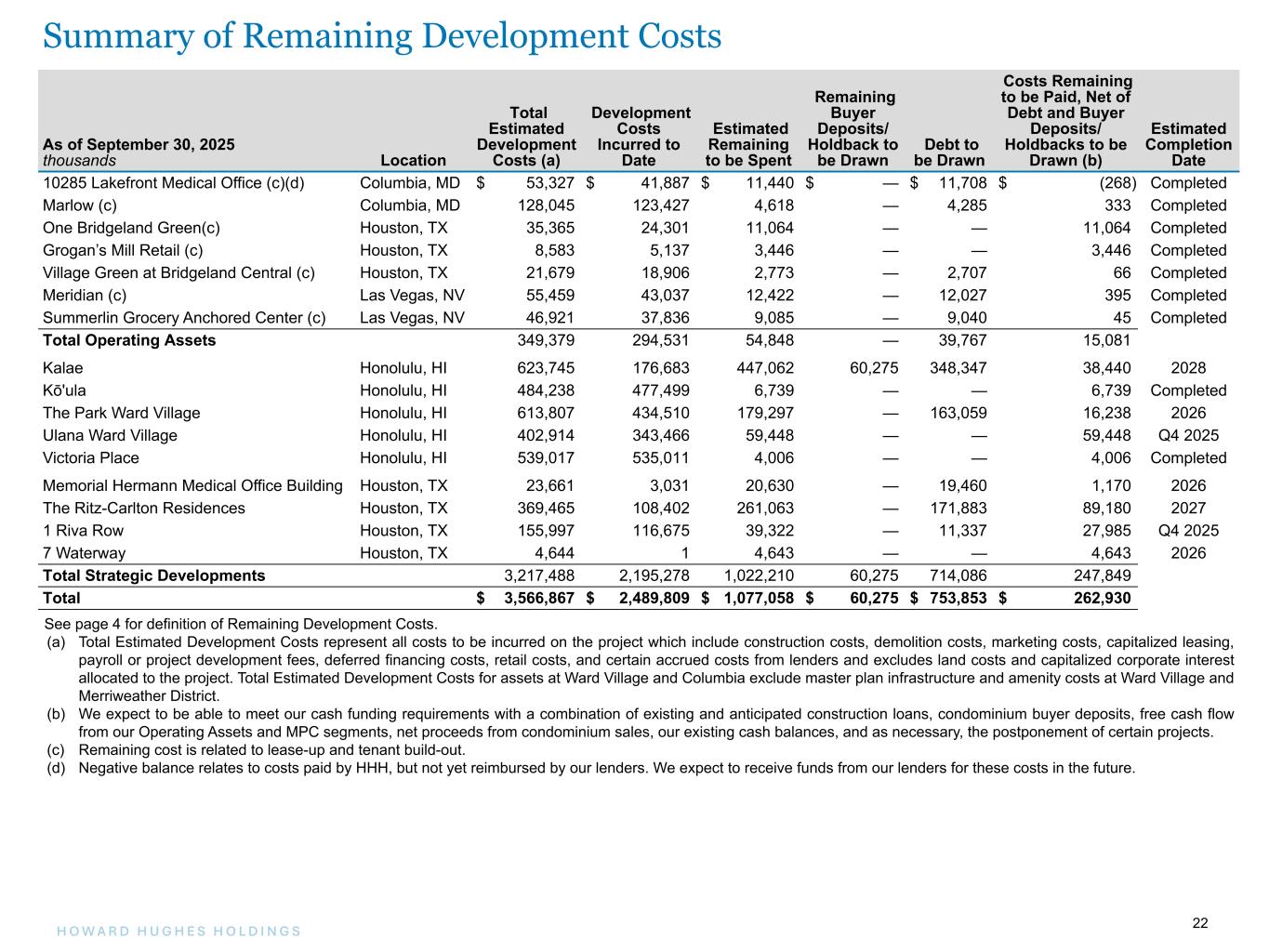

22H O W A R D H U G H E S H O L D I N G S 22 As of September 30, 2025 thousands Location Total Estimated Development Costs (a) Development Costs Incurred to Date Estimated Remaining to be Spent Remaining Buyer Deposits/ Holdback to be Drawn Debt to be Drawn Costs Remaining to be Paid, Net of Debt and Buyer Deposits/ Holdbacks to be Drawn (b) Estimated Completion Date 10285 Lakefront Medical Office (c)(d) Columbia, MD $ 53,327 $ 41,887 $ 11,440 $ — $ 11,708 $ (268) Completed Marlow (c) Columbia, MD 128,045 123,427 4,618 — 4,285 333 Completed One Bridgeland Green(c) Houston, TX 35,365 24,301 11,064 — — 11,064 Completed Grogan’s Mill Retail (c) Houston, TX 8,583 5,137 3,446 — — 3,446 Completed Village Green at Bridgeland Central (c) Houston, TX 21,679 18,906 2,773 — 2,707 66 Completed Meridian (c) Las Vegas, NV 55,459 43,037 12,422 — 12,027 395 Completed Summerlin Grocery Anchored Center (c) Las Vegas, NV 46,921 37,836 9,085 — 9,040 45 Completed Total Operating Assets 349,379 294,531 54,848 — 39,767 15,081 Kalae Honolulu, HI 623,745 176,683 447,062 60,275 348,347 38,440 2028 Kō'ula Honolulu, HI 484,238 477,499 6,739 — — 6,739 Completed The Park Ward Village Honolulu, HI 613,807 434,510 179,297 — 163,059 16,238 2026 Ulana Ward Village Honolulu, HI 402,914 343,466 59,448 — — 59,448 Q4 2025 Victoria Place Honolulu, HI 539,017 535,011 4,006 — — 4,006 Completed Memorial Hermann Medical Office Building Houston, TX 23,661 3,031 20,630 — 19,460 1,170 2026 The Ritz-Carlton Residences Houston, TX 369,465 108,402 261,063 — 171,883 89,180 2027 1 Riva Row Houston, TX 155,997 116,675 39,322 — 11,337 27,985 Q4 2025 7 Waterway Houston, TX 4,644 1 4,643 — — 4,643 2026 Total Strategic Developments 3,217,488 2,195,278 1,022,210 60,275 714,086 247,849 Total $ 3,566,867 $ 2,489,809 $ 1,077,058 $ 60,275 $ 753,853 $ 262,930 See page 4 for definition of Remaining Development Costs. (a) Total Estimated Development Costs represent all costs to be incurred on the project which include construction costs, demolition costs, marketing costs, capitalized leasing, payroll or project development fees, deferred financing costs, retail costs, and certain accrued costs from lenders and excludes land costs and capitalized corporate interest allocated to the project. Total Estimated Development Costs for assets at Ward Village and Columbia exclude master plan infrastructure and amenity costs at Ward Village and Merriweather District. (b) We expect to be able to meet our cash funding requirements with a combination of existing and anticipated construction loans, condominium buyer deposits, free cash flow from our Operating Assets and MPC segments, net proceeds from condominium sales, our existing cash balances, and as necessary, the postponement of certain projects. (c) Remaining cost is related to lease-up and tenant build-out. (d) Negative balance relates to costs paid by HHH, but not yet reimbursed by our lenders. We expect to receive funds from our lenders for these costs in the future. Summary of Remaining Development Costs

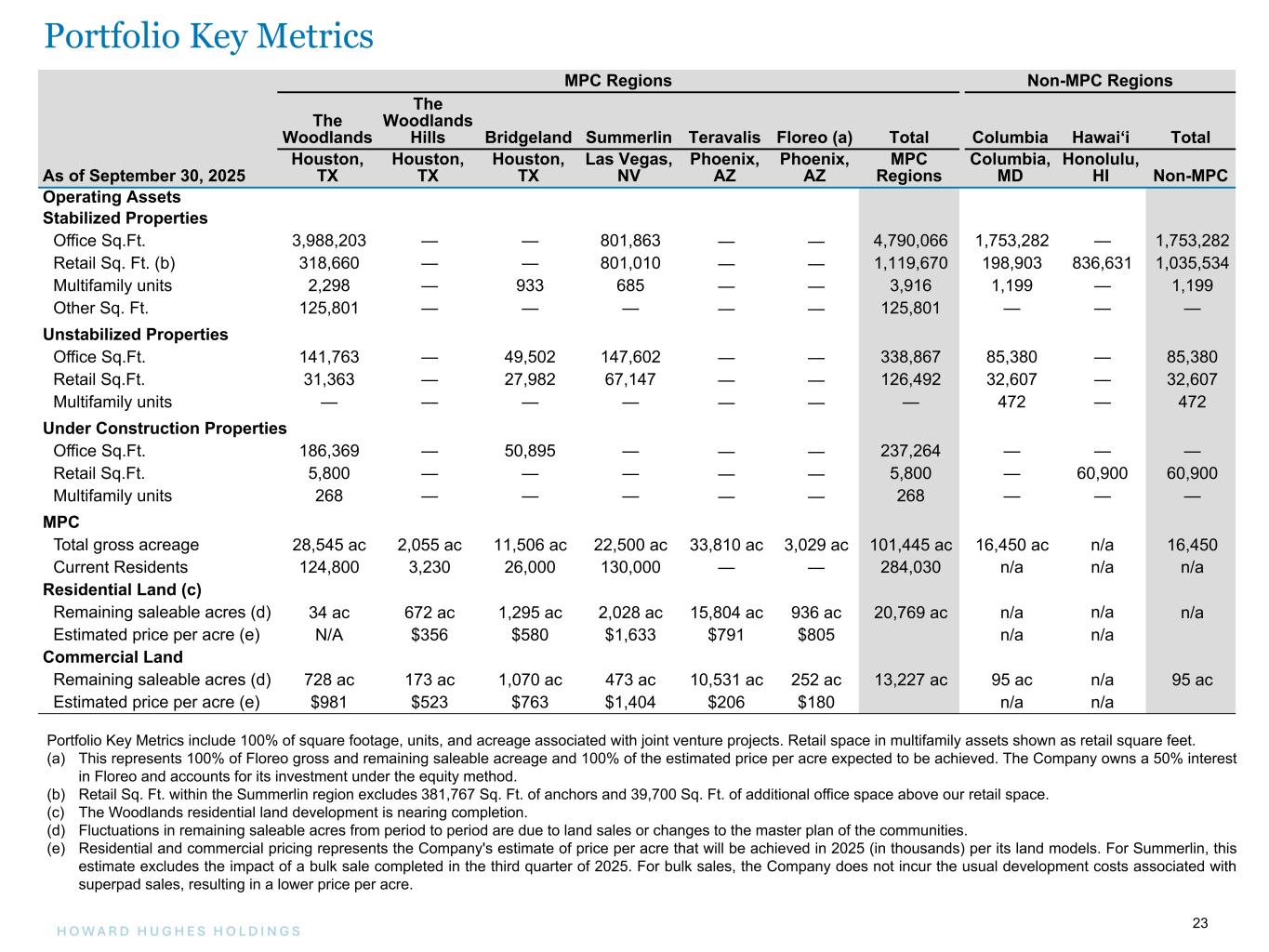

23H O W A R D H U G H E S H O L D I N G S 23 MPC Regions Non-MPC Regions The Woodlands The Woodlands Hills Bridgeland Summerlin Teravalis Floreo (a) Total Columbia Hawai‘i Total As of September 30, 2025 Houston, TX Houston, TX Houston, TX Las Vegas, NV Phoenix, AZ Phoenix, AZ MPC Regions Columbia, MD Honolulu, HI Non-MPC Operating Assets Stabilized Properties Office Sq.Ft. 3,988,203 — — 801,863 — — 4,790,066 1,753,282 — 1,753,282 Retail Sq. Ft. (b) 318,660 — — 801,010 — — 1,119,670 198,903 836,631 1,035,534 Multifamily units 2,298 — 933 685 — — 3,916 1,199 — 1,199 Other Sq. Ft. 125,801 — — — — — 125,801 — — — Unstabilized Properties Office Sq.Ft. 141,763 — 49,502 147,602 — — 338,867 85,380 — 85,380 Retail Sq.Ft. 31,363 — 27,982 67,147 — — 126,492 32,607 — 32,607 Multifamily units — — — — — — — 472 — 472 Under Construction Properties Office Sq.Ft. 186,369 — 50,895 — — — 237,264 — — — Retail Sq.Ft. 5,800 — — — — — 5,800 — 60,900 60,900 Multifamily units 268 — — — — — 268 — — — MPC Total gross acreage 28,545 ac 2,055 ac 11,506 ac 22,500 ac 33,810 ac 3,029 ac 101,445 ac 16,450 ac n/a 16,450 Current Residents 124,800 3,230 26,000 130,000 — — 284,030 n/a n/a n/a Residential Land (c) Remaining saleable acres (d) 34 ac 672 ac 1,295 ac 2,028 ac 15,804 ac 936 ac 20,769 ac n/a n/a n/a Estimated price per acre (e) N/A $356 $580 $1,633 $791 $805 n/a n/a Commercial Land Remaining saleable acres (d) 728 ac 173 ac 1,070 ac 473 ac 10,531 ac 252 ac 13,227 ac 95 ac n/a 95 ac Estimated price per acre (e) $981 $523 $763 $1,404 $206 $180 n/a n/a Portfolio Key Metrics Portfolio Key Metrics include 100% of square footage, units, and acreage associated with joint venture projects. Retail space in multifamily assets shown as retail square feet. (a) This represents 100% of Floreo gross and remaining saleable acreage and 100% of the estimated price per acre expected to be achieved. The Company owns a 50% interest in Floreo and accounts for its investment under the equity method. (b) Retail Sq. Ft. within the Summerlin region excludes 381,767 Sq. Ft. of anchors and 39,700 Sq. Ft. of additional office space above our retail space. (c) The Woodlands residential land development is nearing completion. (d) Fluctuations in remaining saleable acres from period to period are due to land sales or changes to the master plan of the communities. (e) Residential and commercial pricing represents the Company's estimate of price per acre that will be achieved in 2025 (in thousands) per its land models. For Summerlin, this estimate excludes the impact of a bulk sale completed in the third quarter of 2025. For bulk sales, the Company does not incur the usual development costs associated with superpad sales, resulting in a lower price per acre. Portfolio Key Metrics

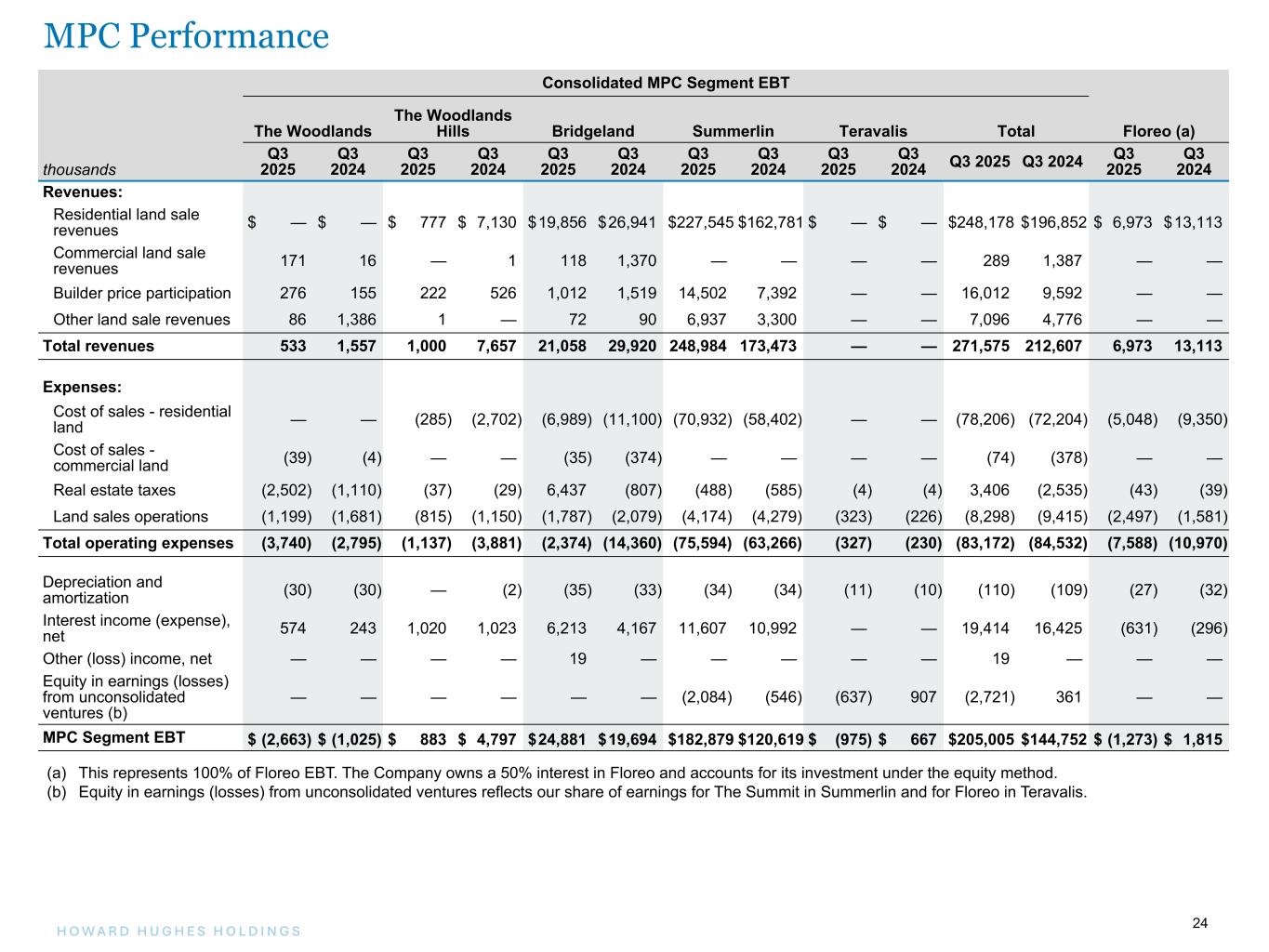

24H O W A R D H U G H E S H O L D I N G S 24 Master Planned Community Land Consolidated MPC Segment EBT The Woodlands The Woodlands Hills Bridgeland Summerlin Teravalis Total Floreo (a) thousands Q3 2025 Q3 2024 Q3 2025 Q3 2024 Q3 2025 Q3 2024 Q3 2025 Q3 2024 Q3 2025 Q3 2024 Q3 2025 Q3 2024 Q3 2025 Q3 2024 Revenues: Residential land sale revenues $ — $ — $ 777 $ 7,130 $ 19,856 $ 26,941 $ 227,545 $ 162,781 $ — $ — $ 248,178 $ 196,852 $ 6,973 $ 13,113 Commercial land sale revenues 171 16 — 1 118 1,370 — — — — 289 1,387 — — Builder price participation 276 155 222 526 1,012 1,519 14,502 7,392 — — 16,012 9,592 — — Other land sale revenues 86 1,386 1 — 72 90 6,937 3,300 — — 7,096 4,776 — — Total revenues 533 1,557 1,000 7,657 21,058 29,920 248,984 173,473 — — 271,575 212,607 6,973 13,113 Expenses: Cost of sales - residential land — — (285) (2,702) (6,989) (11,100) (70,932) (58,402) — — (78,206) (72,204) (5,048) (9,350) Cost of sales - commercial land (39) (4) — — (35) (374) — — — — (74) (378) — — Real estate taxes (2,502) (1,110) (37) (29) 6,437 (807) (488) (585) (4) (4) 3,406 (2,535) (43) (39) Land sales operations (1,199) (1,681) (815) (1,150) (1,787) (2,079) (4,174) (4,279) (323) (226) (8,298) (9,415) (2,497) (1,581) Total operating expenses (3,740) (2,795) (1,137) (3,881) (2,374) (14,360) (75,594) (63,266) (327) (230) (83,172) (84,532) (7,588) (10,970) Depreciation and amortization (30) (30) — (2) (35) (33) (34) (34) (11) (10) (110) (109) (27) (32) Interest income (expense), net 574 243 1,020 1,023 6,213 4,167 11,607 10,992 — — 19,414 16,425 (631) (296) Other (loss) income, net — — — — 19 — — — — — 19 — — — Equity in earnings (losses) from unconsolidated ventures (b) — — — — — — (2,084) (546) (637) 907 (2,721) 361 — — MPC Segment EBT $ (2,663) $ (1,025) $ 883 $ 4,797 $ 24,881 $ 19,694 $ 182,879 $ 120,619 $ (975) $ 667 $ 205,005 $ 144,752 $ (1,273) $ 1,815 (a) This represents 100% of Floreo EBT. The Company owns a 50% interest in Floreo and accounts for its investment under the equity method. (b) Equity in earnings (losses) from unconsolidated ventures reflects our share of earnings for The Summit in Summerlin and for Floreo in Teravalis. MPC Performance

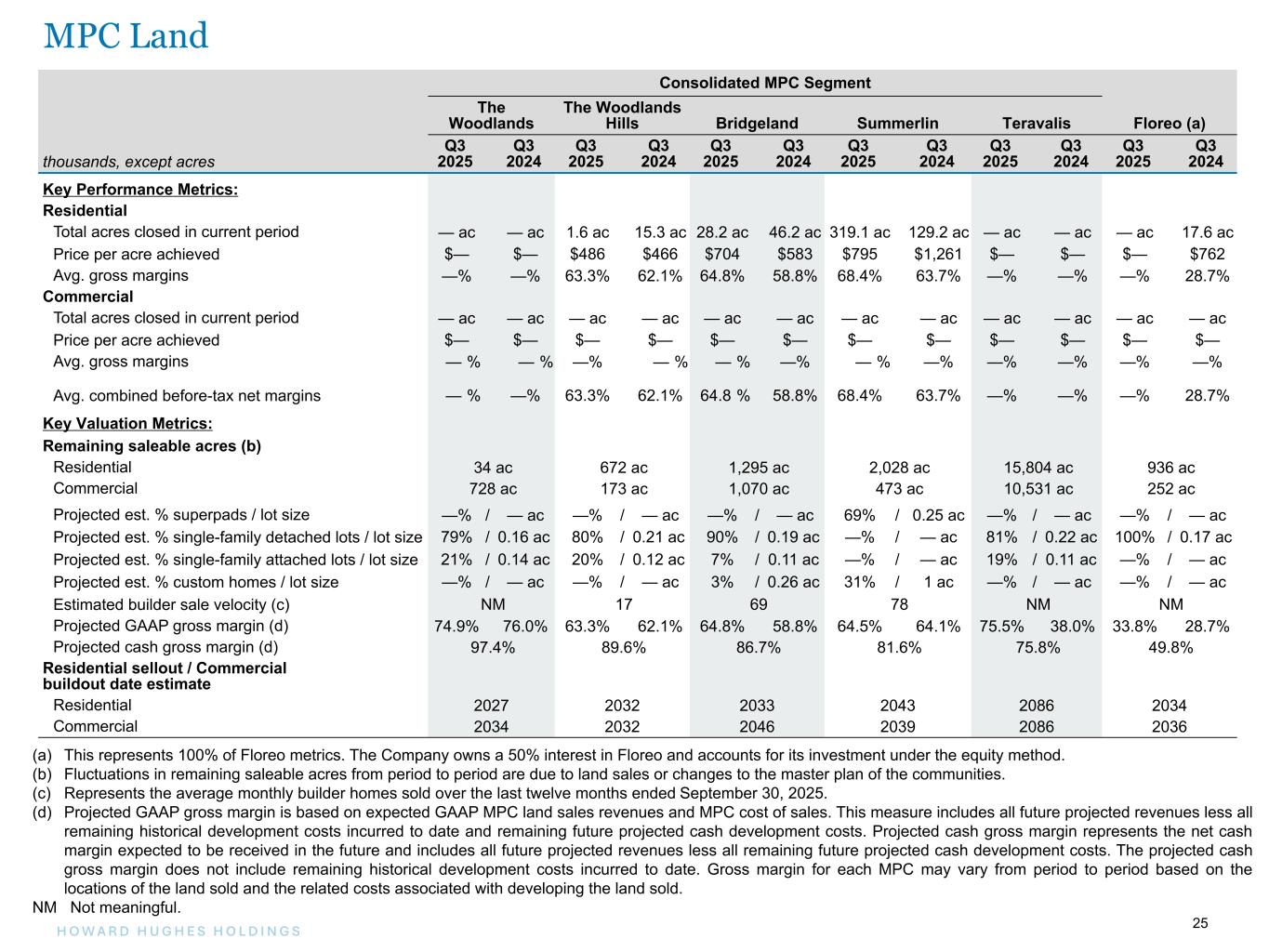

25H O W A R D H U G H E S H O L D I N G S 25 Master Planned Community Land Consolidated MPC Segment The Woodlands The Woodlands Hills Bridgeland Summerlin Teravalis Floreo (a) thousands, except acres Q3 2025 Q3 2024 Q3 2025 Q3 2024 Q3 2025 Q3 2024 Q3 2025 Q3 2024 Q3 2025 Q3 2024 Q3 2025 Q3 2024 Key Performance Metrics: Residential Total acres closed in current period — ac — ac 1.6 ac 15.3 ac 28.2 ac 46.2 ac 319.1 ac 129.2 ac — ac — ac — ac 17.6 ac Price per acre achieved $— $— $486 $466 $704 $583 $795 $1,261 $— $— $— $762 Avg. gross margins —% —% 63.3% 62.1% 64.8% 58.8% 68.4% 63.7% —% —% —% 28.7% Commercial Total acres closed in current period — ac — ac — ac — ac — ac — ac — ac — ac — ac — ac — ac — ac Price per acre achieved $— $— $— $— $— $— $— $— $— $— $— $— Avg. gross margins — % — % —% — % — % —% — % —% —% —% —% —% Avg. combined before-tax net margins — % —% 63.3% 62.1% 64.8 % 58.8% 68.4% 63.7% —% —% —% 28.7% Key Valuation Metrics: Remaining saleable acres (b) Residential 34 ac 672 ac 1,295 ac 2,028 ac 15,804 ac 936 ac Commercial 728 ac 173 ac 1,070 ac 473 ac 10,531 ac 252 ac Projected est. % superpads / lot size —% / — ac —% / — ac —% / — ac 69% / 0.25 ac —% / — ac —% / — ac Projected est. % single-family detached lots / lot size 79% / 0.16 ac 80% / 0.21 ac 90% / 0.19 ac —% / — ac 81% / 0.22 ac 100% / 0.17 ac Projected est. % single-family attached lots / lot size 21% / 0.14 ac 20% / 0.12 ac 7% / 0.11 ac —% / — ac 19% / 0.11 ac —% / — ac Projected est. % custom homes / lot size —% / — ac —% / — ac 3% / 0.26 ac 31% / 1 ac —% / — ac —% / — ac Estimated builder sale velocity (c) NM 17 69 78 NM NM Projected GAAP gross margin (d) 74.9% 76.0% 63.3% 62.1% 64.8% 58.8% 64.5% 64.1% 75.5% 38.0% 33.8% 28.7% Projected cash gross margin (d) 97.4% 89.6% 86.7% 81.6% 75.8% 49.8% Residential sellout / Commercial buildout date estimate Residential 2027 2032 2033 2043 2086 2034 Commercial 2034 2032 2046 2039 2086 2036 (a) This represents 100% of Floreo metrics. The Company owns a 50% interest in Floreo and accounts for its investment under the equity method. (b) Fluctuations in remaining saleable acres from period to period are due to land sales or changes to the master plan of the communities. (c) Represents the average monthly builder homes sold over the last twelve months ended September 30, 2025. (d) Projected GAAP gross margin is based on expected GAAP MPC land sales revenues and MPC cost of sales. This measure includes all future projected revenues less all remaining historical development costs incurred to date and remaining future projected cash development costs. Projected cash gross margin represents the net cash margin expected to be received in the future and includes all future projected revenues less all remaining future projected cash development costs. The projected cash gross margin does not include remaining historical development costs incurred to date. Gross margin for each MPC may vary from period to period based on the locations of the land sold and the related costs associated with developing the land sold. NM Not meaningful. MPC Land

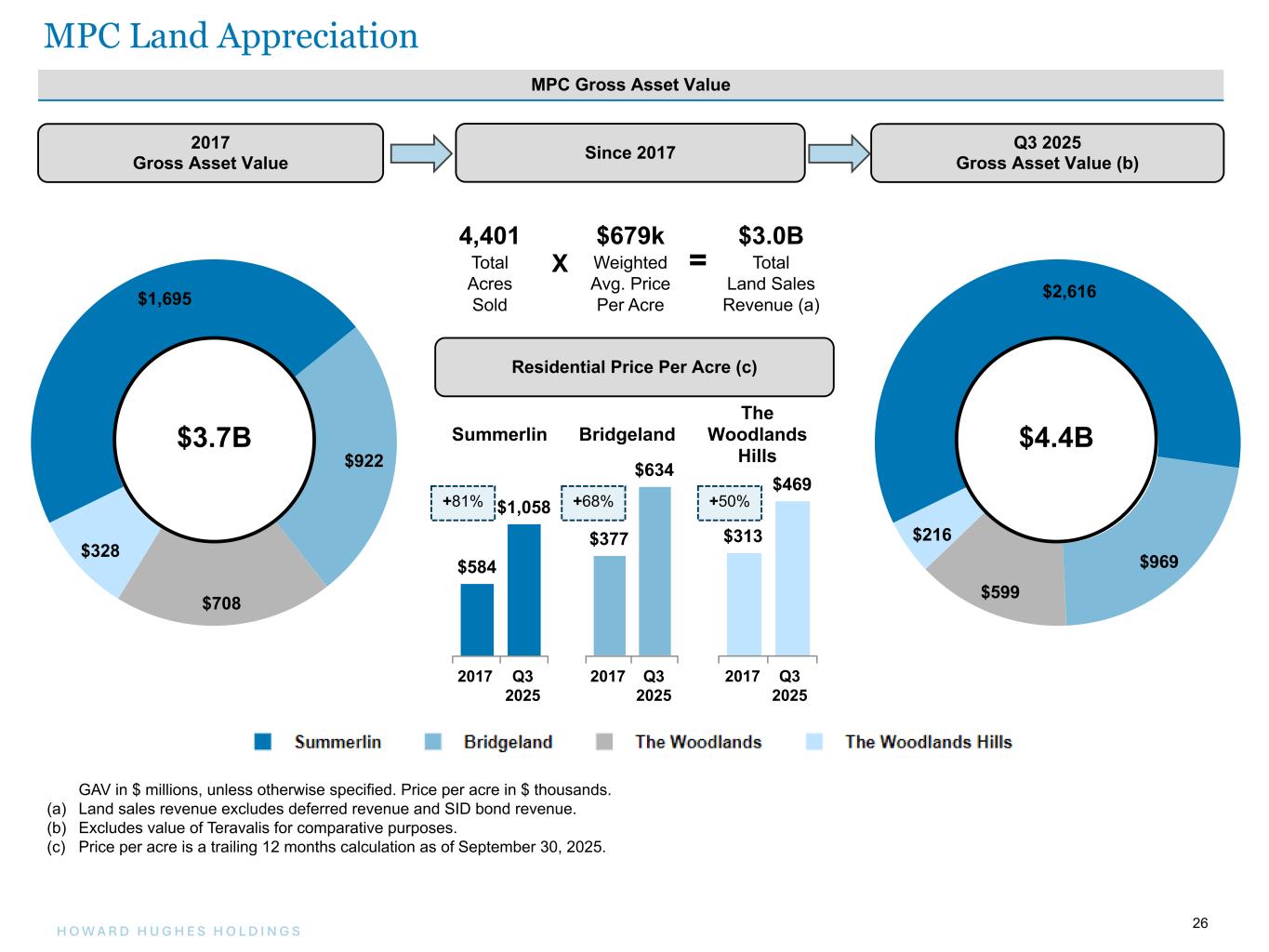

26H O W A R D H U G H E S H O L D I N G S 26 GAV in $ millions, unless otherwise specified. Price per acre in $ thousands. (a) Land sales revenue excludes deferred revenue and SID bond revenue. (b) Excludes value of Teravalis for comparative purposes. (c) Price per acre is a trailing 12 months calculation as of September 30, 2025. MPC Gross Asset Value $1,695 $922 $708 $328 4,401 Total Acres Sold $679k Weighted Avg. Price Per Acre $3.0B Total Land Sales Revenue (a) X = $584 $1,058 2017 Q3 2025 $377 $634 2017 Q3 2025 $313 $469 2017 Q3 2025 +81% +68% +50% $2,616 $969 $599 $216 2017 Gross Asset Value Since 2017 Q3 2025 Gross Asset Value (b) Residential Price Per Acre (c) Summerlin Bridgeland The Woodlands Hills $4.4B$3.7B MPC Land Appreciation

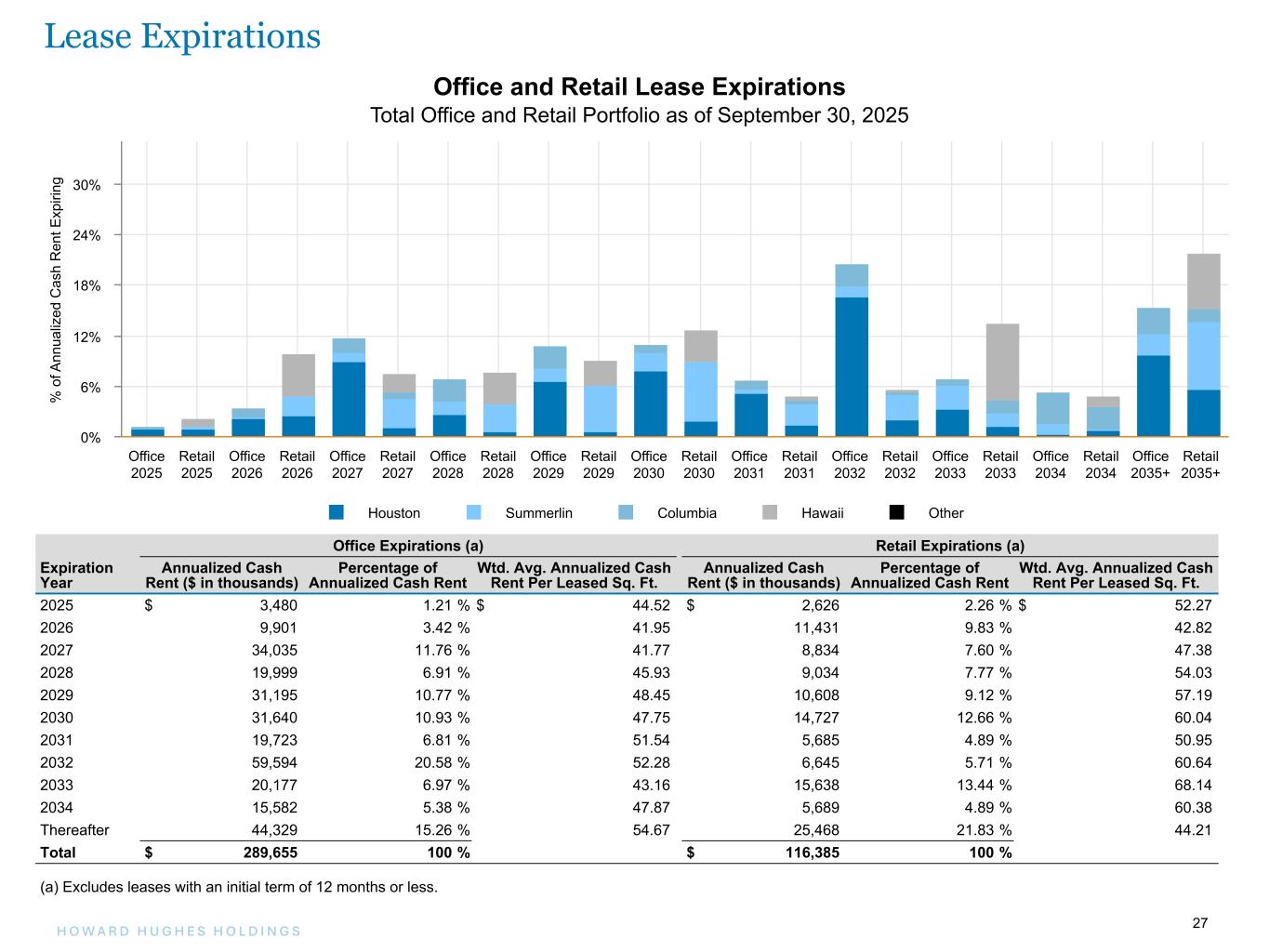

27H O W A R D H U G H E S H O L D I N G S 27 Office Expirations (a) Retail Expirations (a) Expiration Year Annualized Cash Rent ($ in thousands) Percentage of Annualized Cash Rent Wtd. Avg. Annualized Cash Rent Per Leased Sq. Ft. Annualized Cash Rent ($ in thousands) Percentage of Annualized Cash Rent Wtd. Avg. Annualized Cash Rent Per Leased Sq. Ft. 2025 $ 3,480 1.21 % $ 44.52 $ 2,626 2.26 % $ 52.27 2026 9,901 3.42 % 41.95 11,431 9.83 % 42.82 2027 34,035 11.76 % 41.77 8,834 7.60 % 47.38 2028 19,999 6.91 % 45.93 9,034 7.77 % 54.03 2029 31,195 10.77 % 48.45 10,608 9.12 % 57.19 2030 31,640 10.93 % 47.75 14,727 12.66 % 60.04 2031 19,723 6.81 % 51.54 5,685 4.89 % 50.95 2032 59,594 20.58 % 52.28 6,645 5.71 % 60.64 2033 20,177 6.97 % 43.16 15,638 13.44 % 68.14 2034 15,582 5.38 % 47.87 5,689 4.89 % 60.38 Thereafter 44,329 15.26 % 54.67 25,468 21.83 % 44.21 Total $ 289,655 100 % $ 116,385 100 % (a) Excludes leases with an initial term of 12 months or less. Office and Retail Lease Expirations Total Office and Retail Portfolio as of September 30, 2025 % o f A nn ua liz ed C as h R en t E xp iri ng Houston Summerlin Columbia Hawaii Other Office 2025 Retail 2025 Office 2026 Retail 2026 Office 2027 Retail 2027 Office 2028 Retail 2028 Office 2029 Retail 2029 Office 2030 Retail 2030 Office 2031 Retail 2031 Office 2032 Retail 2032 Office 2033 Retail 2033 Office 2034 Retail 2034 Office 2035+ Retail 2035+ 0% 6% 12% 18% 24% 30% Lease Expirations

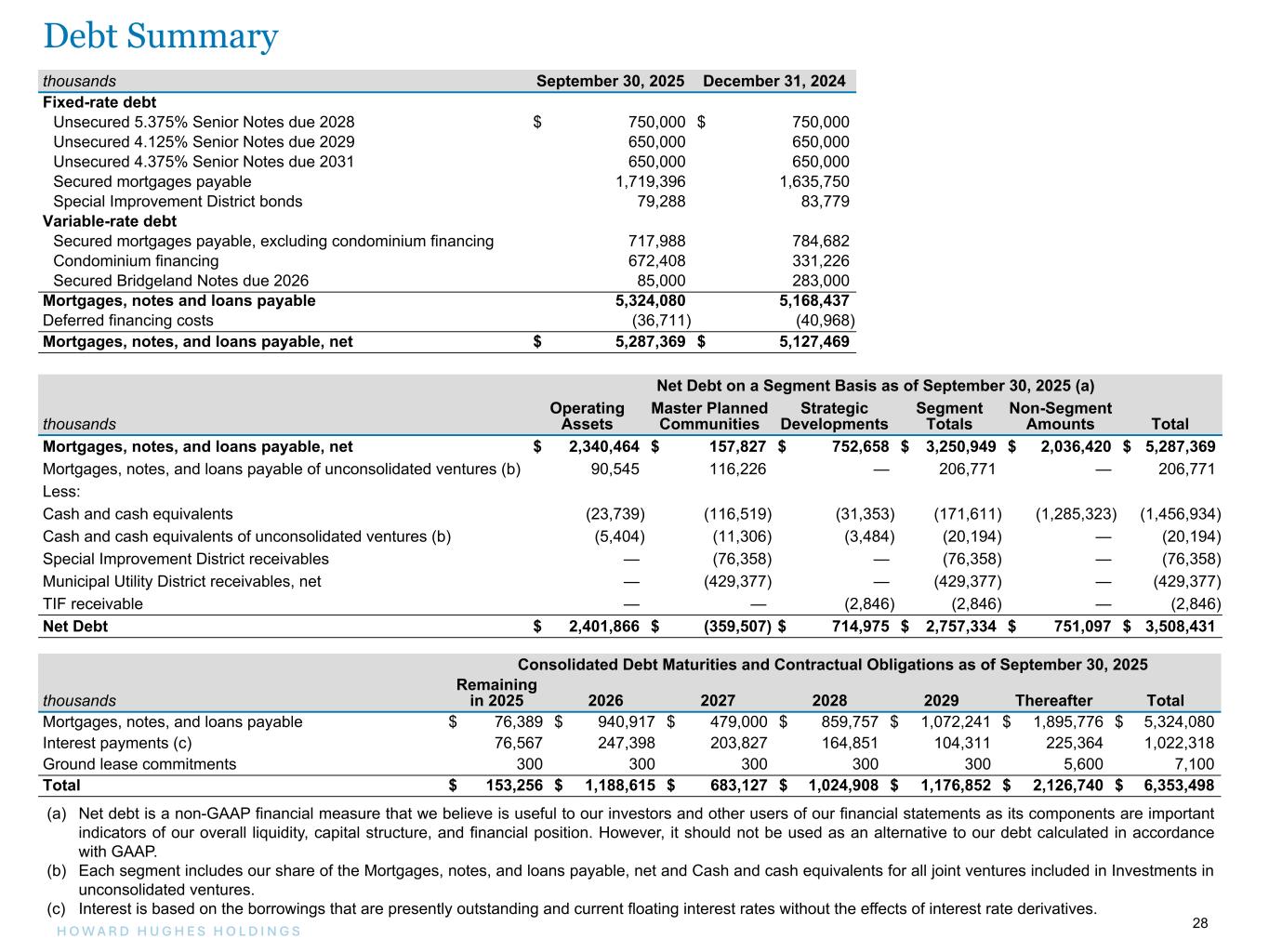

28H O W A R D H U G H E S H O L D I N G S 28 thousands September 30, 2025 December 31, 2024 Fixed-rate debt Unsecured 5.375% Senior Notes due 2028 $ 750,000 $ 750,000 Unsecured 4.125% Senior Notes due 2029 650,000 650,000 Unsecured 4.375% Senior Notes due 2031 650,000 650,000 Secured mortgages payable 1,719,396 1,635,750 Special Improvement District bonds 79,288 83,779 Variable-rate debt Secured mortgages payable, excluding condominium financing 717,988 784,682 Condominium financing 672,408 331,226 Secured Bridgeland Notes due 2026 85,000 283,000 Mortgages, notes and loans payable 5,324,080 5,168,437 Deferred financing costs (36,711) (40,968) Mortgages, notes, and loans payable, net $ 5,287,369 $ 5,127,469 Net Debt on a Segment Basis as of September 30, 2025 (a) thousands Operating Assets Master Planned Communities Strategic Developments Segment Totals Non-Segment Amounts Total Mortgages, notes, and loans payable, net $ 2,340,464 $ 157,827 $ 752,658 $ 3,250,949 $ 2,036,420 $ 5,287,369 Mortgages, notes, and loans payable of unconsolidated ventures (b) 90,545 116,226 — 206,771 — 206,771 Less: Cash and cash equivalents (23,739) (116,519) (31,353) (171,611) (1,285,323) (1,456,934) Cash and cash equivalents of unconsolidated ventures (b) (5,404) (11,306) (3,484) (20,194) — (20,194) Special Improvement District receivables — (76,358) — (76,358) — (76,358) Municipal Utility District receivables, net — (429,377) — (429,377) — (429,377) TIF receivable — — (2,846) (2,846) — (2,846) Net Debt $ 2,401,866 $ (359,507) $ 714,975 $ 2,757,334 $ 751,097 $ 3,508,431 Consolidated Debt Maturities and Contractual Obligations as of September 30, 2025 thousands Remaining in 2025 2026 2027 2028 2029 Thereafter Total Mortgages, notes, and loans payable $ 76,389 $ 940,917 $ 479,000 $ 859,757 $ 1,072,241 $ 1,895,776 $ 5,324,080 Interest payments (c) 76,567 247,398 203,827 164,851 104,311 225,364 1,022,318 Ground lease commitments 300 300 300 300 300 5,600 7,100 Total $ 153,256 $ 1,188,615 $ 683,127 $ 1,024,908 $ 1,176,852 $ 2,126,740 $ 6,353,498 (a) Net debt is a non-GAAP financial measure that we believe is useful to our investors and other users of our financial statements as its components are important indicators of our overall liquidity, capital structure, and financial position. However, it should not be used as an alternative to our debt calculated in accordance with GAAP. (b) Each segment includes our share of the Mortgages, notes, and loans payable, net and Cash and cash equivalents for all joint ventures included in Investments in unconsolidated ventures. (c) Interest is based on the borrowings that are presently outstanding and current floating interest rates without the effects of interest rate derivatives. Debt Summary

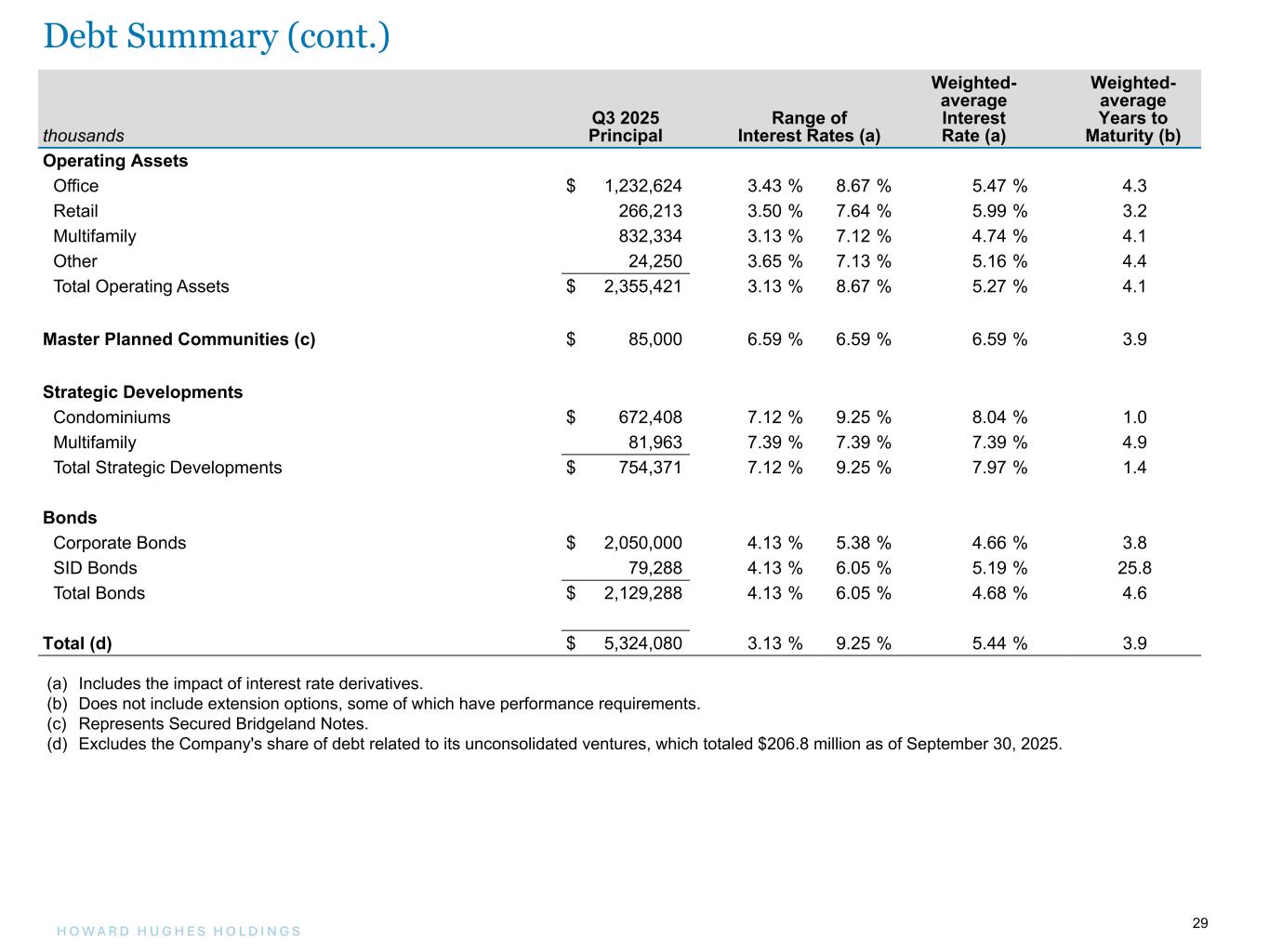

29H O W A R D H U G H E S H O L D I N G S 29 (a) Includes the impact of interest rate derivatives. (b) Does not include extension options, some of which have performance requirements. (c) Represents Secured Bridgeland Notes. (d) Excludes the Company's share of debt related to its unconsolidated ventures, which totaled $206.8 million as of September 30, 2025. thousands Q3 2025 Principal Range of Interest Rates (a) Weighted- average Interest Rate (a) Weighted- average Years to Maturity (b) Operating Assets Office $ 1,232,624 3.43 % 8.67 % 5.47 % 4.3 Retail 266,213 3.50 % 7.64 % 5.99 % 3.2 Multifamily 832,334 3.13 % 7.12 % 4.74 % 4.1 Other 24,250 3.65 % 7.13 % 5.16 % 4.4 Total Operating Assets $ 2,355,421 3.13 % 8.67 % 5.27 % 4.1 Master Planned Communities (c) $ 85,000 6.59 % 6.59 % 6.59 % 3.9 Strategic Developments Condominiums $ 672,408 7.12 % 9.25 % 8.04 % 1.0 Multifamily 81,963 7.39 % 7.39 % 7.39 % 4.9 Total Strategic Developments $ 754,371 7.12 % 9.25 % 7.97 % 1.4 Bonds Corporate Bonds $ 2,050,000 4.13 % 5.38 % 4.66 % 3.8 SID Bonds 79,288 4.13 % 6.05 % 5.19 % 25.8 Total Bonds $ 2,129,288 4.13 % 6.05 % 4.68 % 4.6 Total (d) $ 5,324,080 3.13 % 9.25 % 5.44 % 3.9 Debt Summary (cont.)

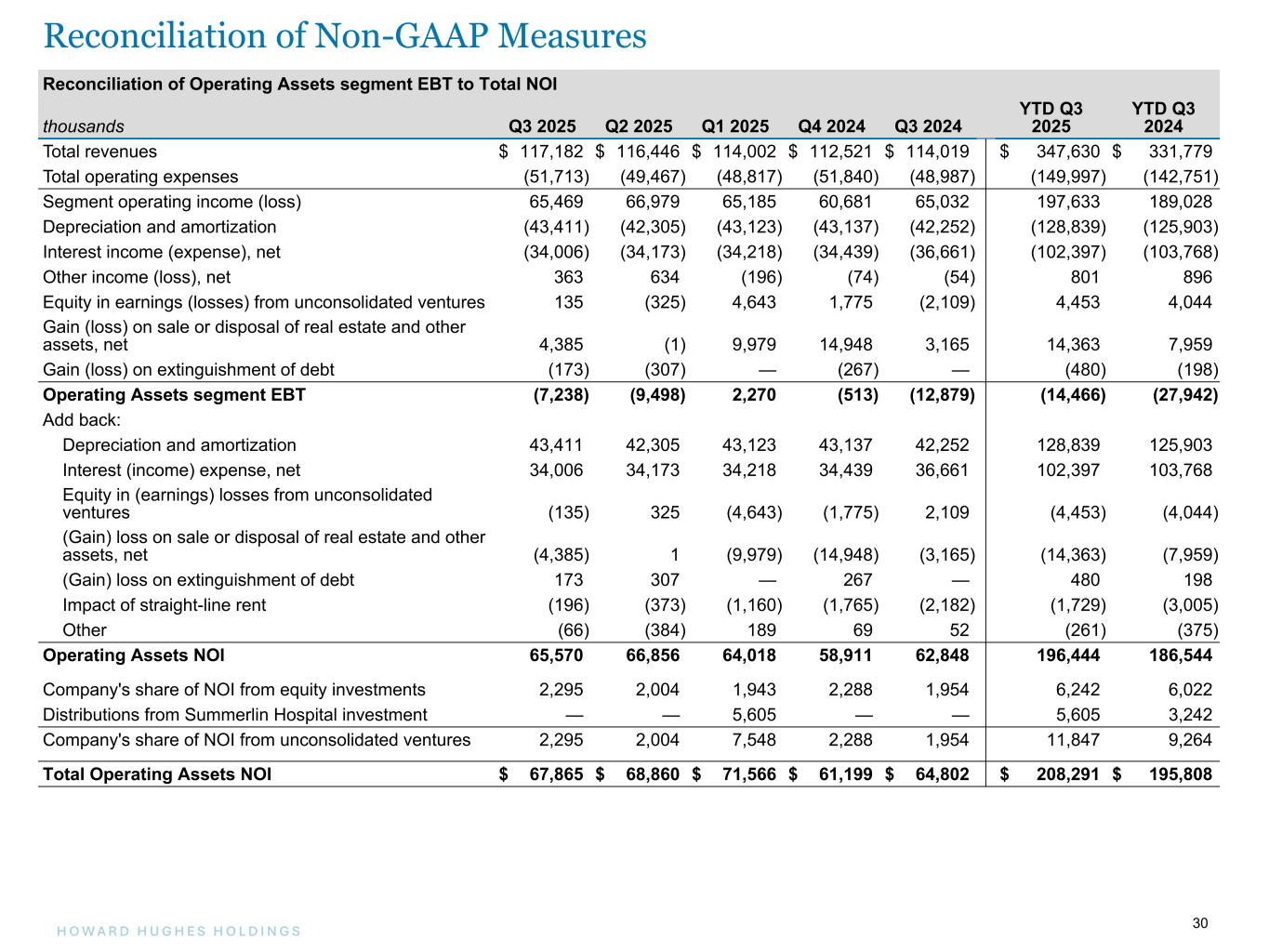

30H O W A R D H U G H E S H O L D I N G S 30 Reconciliation of Operating Assets segment EBT to Total NOI thousands Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 YTD Q3 2025 YTD Q3 2024 Total revenues $ 117,182 $ 116,446 $ 114,002 $ 112,521 $ 114,019 $ 347,630 $ 331,779 Total operating expenses (51,713) (49,467) (48,817) (51,840) (48,987) (149,997) (142,751) Segment operating income (loss) 65,469 66,979 65,185 60,681 65,032 197,633 189,028 Depreciation and amortization (43,411) (42,305) (43,123) (43,137) (42,252) (128,839) (125,903) Interest income (expense), net (34,006) (34,173) (34,218) (34,439) (36,661) (102,397) (103,768) Other income (loss), net 363 634 (196) (74) (54) 801 896 Equity in earnings (losses) from unconsolidated ventures 135 (325) 4,643 1,775 (2,109) 4,453 4,044 Gain (loss) on sale or disposal of real estate and other assets, net 4,385 (1) 9,979 14,948 3,165 14,363 7,959 Gain (loss) on extinguishment of debt (173) (307) — (267) — (480) (198) Operating Assets segment EBT (7,238) (9,498) 2,270 (513) (12,879) (14,466) (27,942) Add back: Depreciation and amortization 43,411 42,305 43,123 43,137 42,252 128,839 125,903 Interest (income) expense, net 34,006 34,173 34,218 34,439 36,661 102,397 103,768 Equity in (earnings) losses from unconsolidated ventures (135) 325 (4,643) (1,775) 2,109 (4,453) (4,044) (Gain) loss on sale or disposal of real estate and other assets, net (4,385) 1 (9,979) (14,948) (3,165) (14,363) (7,959) (Gain) loss on extinguishment of debt 173 307 — 267 — 480 198 Impact of straight-line rent (196) (373) (1,160) (1,765) (2,182) (1,729) (3,005) Other (66) (384) 189 69 52 (261) (375) Operating Assets NOI 65,570 66,856 64,018 58,911 62,848 196,444 186,544 Company's share of NOI from equity investments 2,295 2,004 1,943 2,288 1,954 6,242 6,022 Distributions from Summerlin Hospital investment — — 5,605 — — 5,605 3,242 Company's share of NOI from unconsolidated ventures 2,295 2,004 7,548 2,288 1,954 11,847 9,264 Total Operating Assets NOI $ 67,865 $ 68,860 $ 71,566 $ 61,199 $ 64,802 $ 208,291 $ 195,808 Reconciliation of Non-GAAP Measures