Please wait

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-23909

Eagle Point Enhanced

Income Trust

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 202

Greenwich, CT 06830

(Address of principal executive offices) (Zip code)

Thomas P. Majewski

c/o Eagle Point Enhanced

Income Trust

600 Steamboat Road, Suite 202

Greenwich, CT 06830

(Name and address of agent

for service)

Copies to

Thomas J. Friedmann

Philip Hinkle

Alexander C. Karampatsos

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, MA 02110

(617) 728-7120

Registrant’s telephone number, including

area code: (203) 340-8500

Date of fiscal year end: September 30

Date of reporting period: March 31, 2025

| Item 1. |

Report to Stockholders |

The Semi-Annual Report to shareholders of Eagle Point Enhanced Income Trust

for the six-months ended March 31, 2025, is filed herewith.

Eagle Point Enhanced Income Trust

Semiannual Report – March 31, 2025

Table

of Contents

Management Discussion of Fund Performance

MAY 30,

2025

Dear Shareholders:

We are pleased to provide you

with the enclosed report of Eagle Point Enhanced Income Trust (“we,” “us,” “our” or the “Fund”)

for the six months ended March 31, 2025.

The Fund is a closed-end management

investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), operates as an interval

fund and is advised by Eagle Point Enhanced Income Management LLC (the “Adviser”). The Fund, organized as a Delaware statutory

trust, offers its common shares of beneficial interest (“Shares”) to investors on a continuous basis at the Fund’s net

asset value (“NAV”) per share plus any applicable sales charges. The Fund’s primary investment objective is to generate

high current income, with a secondary objective to generate capital gains. We seek to achieve these investment objectives by investing

in a broad range of income-oriented assets, including Portfolio Debt Securities,1 Strategic Credit2 investments

and equity and junior debt tranches of collateralized loan obligations, or “CLOs.”

The Fund’s Adviser is an

affiliate of Eagle Point Credit Management LLC (collectively with the Adviser and certain other affiliates, “Eagle Point”).

Eagle Point has significant experience in investing across well-structured income-oriented securities and, as of March 31, 2025,

Eagle Point had over $12 billion of total assets under management.3 The Fund was formed by the Adviser in order to provide

investors with access to institutional credit investment strategies in a continuously offered, SEC-registered and non-traded format.

During the six months ended March 31,

2025, we:

| ● | Constructed the Fund’s investment portfolio to generate attractive risk-adjusted returns. |

| o | As of March 31, 2025, we held 73 unique investments across Strategic Credit, CLOs and Portfolio Debt

Securities. |

| o | The investment portfolio had a weighted average yield of 15.1% and a weighted average interest rate duration

of 1.0 year. |

| o | Nearly all of the Fund’s investments were also held by other Eagle Point managed funds and accounts. |

| ● | Strengthened our balance sheet by issuing $25 million of Series A Preferred Stock due 2029, with

proceeds deployed opportunistically into new assets, which we expect to be accretive to the Fund’s common stock. |

| ● | Maintained a robust investment pipeline through primary originations and secondary market opportunities

and actively deployed over $70 million into new investments. |

| ● | Paid $0.55 per share in cash distributions to shareholders, which represents an annualized distribution

rate of nearly 11% based on the Fund’s September 30, 2024 NAV per share of $10.38. |

Market

Commentary

During the first half of our fiscal

year 2025, we saw risk assets broadly reach new highs before widespread concerns over changes in global trade relationships took hold

and disrupted the markets in March 2025. While real-time economic data remained solid, many investors began pricing in a higher probability

of adverse economic outcomes. The volatility persisted into April but as we write this, the perceived flexibility shown by countries

globally in their stance on tariffs has helped the bond and equity markets gain a relatively firmer footing.

Looking ahead, we are entering

a period of increased uncertainty around global economic outcomes as countries across the world start adjusting to changing trade relationships.

In addition, we don’t think much of the actual impact of the trade uncertainty has flowed through current economic measures, and

we believe May and June could see some surprise economic readings. This should keep risk-premia elevated in the near term and

allow us to source well-underwritten opportunities with attractive returns. As we evaluate fundamental collateral performance across sectors,

while defaults continue to remain historically low, we are cautious around their trajectory and will apply additional default stress tests

in our underwriting.

Our investment portfolio is designed

to have a lower correlation with broader risk markets in such periods of volatility and our portfolio positioning allowed us to capitalize

on it by investing in high quality assets at attractive levels.

The regulatory capital relief

(“RCR”) market remains a focus for us given the diversity and higher quality of assets. We took advantage of the recent volatility

to add some higher return RCR investments in the secondary market, and we expect to continue to partner with banks in the primary market,

given the wider spreads that they are willing to pay to issue through a changing economic environment. In the past six months we invested

in attractive high-income Portfolio Debt Securities which provided additional return through price upside, and we believe this should

remain an accretive source of return for the portfolio going forward too. Additionally, our pipeline of high-quality, well-structured

investments in asset-backed credit remains robust, and we will look to augment the portfolio further by utilizing our expertise in infrastructure

credit.

We believe the Fund is well positioned

to generate attractive risk-adjusted returns, particularly compared to other competing areas of the credit market. In addition, the recent

market volatility should allow us to source attractively priced opportunities that we believe will further enhance fund returns.

*

* * * *

Management remains keenly focused on continuing to

create value for our fellow shareholders. We appreciate the trust and confidence our shareholders have placed in the Fund.

Thomas Majewski

Chairman and Chief Executive Officer

This letter is intended to assist

shareholders in understanding the Fund’s performance for the period ended March 31, 2025. The views and opinions in this letter

were current as of May 30, 2025. Statements other than those of historical facts included herein may constitute forward-looking statements

and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially

from those in the forward-looking statements as a result of a number of factors. The Fund undertakes no duty to update any forward-looking

statement made herein. Information contained on our website is not incorporated by reference into this shareholder letter, and you should

not consider information contained on our website to be part of this shareholder letter or any other report we file with the Securities

and Exchange Commission.

Notes

| 1 | The Adviser defines “Portfolio Debt Securities”

primarily as debt and preferred equity securities or instruments (including debt and preferred securities which are convertible into

common equity) issued by funds and investment vehicles, such as business development companies (“BDCs”), registered closed-end

investment companies, unregistered private funds, real estate investment trusts (“REITs”) and sponsors of such vehicles,

to finance a portion of their underlying investment portfolios. |

| 2 | The Adviser defines “Strategic Credit” investments

as a broad range of credit-related investments that the Adviser believes present attractive risk-adjusted returns under then current

market conditions. Such investments may include, among other credit-related securities and instruments, (i) high yield, investment

grade and distressed corporate bonds, (ii) corporate loans (including, without limitation, senior secured loans, mezzanine loans,

revolving loans, delayed draw loans, distressed loans, and debtor-in-possession (“DIP”) financings), (iii) common stock

and other securities or instruments issued by funds and other investment vehicles, (iv) credit-related exchange-traded funds, (v) credit

default swaps and other credit derivatives, (vi) commodity-related investments, (vii) securities issued by asset-backed and

similar securitization vehicles (including, without limitation, collateralized bond obligations, mortgage-backed securitizations, credit-linked

notes, and small business loan pool certificates), (viii) regulatory capital relief investments (including, without limitation,

significant risk transfer or transactions), (ix) equipment loans/leases, (x) convertible debt (including contingent convertible

securities), preferred equity, warrants, and rights, and (xi) derivative instruments on any of the foregoing. |

| 3 | Assets under management represent gross assets, inclusive of

committed but undrawn capital, managed by Eagle Point and certain of its affiliates. |

Page Intentionally Left Blank

Important Information about this Report and Eagle Point

Enhanced Income Trust

This report is transmitted to

the shareholders of Eagle Point Enhanced Income Trust (“we”, “us”, “our” or the “Fund”)

and is furnished pursuant to certain regulatory requirements. This report and the information and views herein do not constitute investment

advice, or a recommendation or an offer to enter into any transaction with the Fund or any of its affiliates. This report is provided

for informational purposes only, does not constitute an offer to sell securities of the Fund or a solicitation of an offer to purchase

any such securities and is not a prospectus. From time to time, the Fund may have a registration statement relating to one or more of

its securities on file with the US Securities and Exchange Commission (“SEC”). Any registration statement that has not yet

been declared effective by the SEC, and any prospectus relating thereto, is not complete and may be changed. Any securities that are the

subject of such a registration statement may not be sold until the registration statement filed with the SEC is effective.

The information and its contents

are the property of Eagle Point Enhanced Income Management LLC (the “Adviser”) and/or the Fund. Any unauthorized dissemination,

copying or use of this presentation is strictly prohibited and may be in violation of law. This presentation is being provided for informational

purposes only.

Investors should read the Fund’s

prospectus and SEC filings (which are publicly available on the EDGAR Database on the SEC website at www.sec.gov) carefully and consider

their investment goals, time horizons and risk tolerance before investing in the Fund. Investors should consider the Fund’s investment

objectives, risks, charges and expenses carefully before investing in securities of the Fund. There is no guarantee that any of the goals,

targets or objectives described in this report will be achieved.

An investment in the Fund is not

appropriate for all investors. The investment program of the Fund is speculative, entails substantial risk and includes investment techniques

not employed by traditional mutual funds. An investment in the Fund is not intended to be a complete investment program. Past performance

is not indicative of, or a guarantee of, future performance. The performance and certain other portfolio information quoted herein represents

information as of March 31, 2025. Nothing herein should be relied upon as a representation of the future performance or portfolio

holdings of the Fund. Investment return and principal value of an investment will fluctuate, and shares, when sold, may be worth more

or less than their original cost. The Fund’s performance is subject to change since the end of the period noted in this report and

may be lower or higher than the performance data shown herein.

Liquidity will be provided by

the Fund only through limited repurchase offers described below. An investment in the Fund is suitable only for investors

who can bear the risks associated with the limited liquidity of the Fund’s shares and should be viewed as a long-term investment.

The Fund’s shares will not be publicly traded and an investor should not expect to be able to sell shares regardless of how the

Fund performs.

Neither the Adviser nor the Fund

provides legal, accounting or tax advice. Any statement regarding such matters is explanatory and may not be relied upon as definitive

advice. Investors should consult with their legal, accounting and tax advisors regarding any potential investment. The information presented

herein is as of the dates noted herein and is derived from financial and other information of the Fund, and, in certain cases, from third-party

sources and reports (including reports of third-party custodians, collateralized loan obligation (collateral managers and trustees) that

have not been independently verified by the Fund. As noted herein, certain of this information is estimated and unaudited, and therefore

subject to change. We do not represent that such information is accurate or complete, and it should not be relied upon as such.

Forward-Looking Statements

This report may contain “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical

facts included in this report may constitute forward-looking statements and are not guarantees of future performance or results and involve

a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of

a number of factors, including those described in the Fund’s filings with the SEC. The Fund undertakes no duty to update any forward-looking

statement made herein. All forward-looking statements speak only as of the date of this report

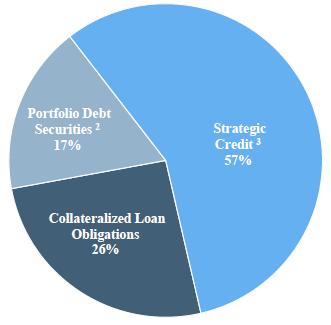

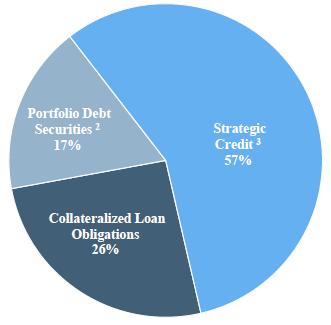

Summary of Certain Unaudited Portfolio Characteristics

The summary of portfolio characteristics

reflected below is as of March 31, 2025:

Portfolio

Breakdown1

Top

5 Investments1

| INVESTMENT | |

DESCRIPTION | |

INVESTMENT STRATEGY | |

FAIR

VALUE (IN

MILLIONS) | | |

%

OF NET

ASSETS | |

| Gregory SPV S.r.l | |

Credit Linked Note | |

Strategic Credit | |

$ | 4.2 | | |

| 7.29 | % |

| Cork Harmony Consumer Loans DAC | |

Mezzanine Loan, Delayed Draw | |

Portfolio Debt Securities | |

$ | 3.7 | | |

| 6.41 | % |

| US Bank NA 2025-SUP1 | |

Credit Linked Note - Class R | |

Strategic Credit | |

$ | 2.9 | | |

| 4.95 | % |

| Opal SPV LLC | |

Senior Secured Term Loan, DD | |

Strategic Credit | |

$ | 2.8 | | |

| 4.93 | % |

| Setanta Finance DAC | |

Class B Note | |

Strategic Credit | |

$ | 2.7 | | |

| 4.68 | % |

| TOTAL | |

| |

| |

$ | 16.3 | | |

| 28.26 | % |

Notes

| 1 | The summary of portfolio investments shown is based on the estimated

fair value of the underlying positions as of March 31, 2025. |

| 2 | See note 1 on page 5. |

| 3 | See note 2 on page 5. |

Consolidated Financial Statements for the Six Months

Ended

March 31, 2025 (Unaudited)

Eagle Point Enhanced Income Trust &

Subsidiaries

Consolidated Statement of Assets and Liabilities

As of March 31, 2025

(expressed in U.S. dollars)

(Unaudited)

| ASSETS | |

| | |

| Investments, at fair value (cost $93,482,229) (1) | |

$ | 91,287,366 | |

| Cash and cash equivalents (inclusive of restricted cash of $1,650,000) | |

| 4,329,555 | |

| Unrealized appreciation on forward currency contracts | |

| 62,234 | |

| Interest receivable | |

| 2,003,155 | |

| Deferred offering costs attributed to common shares | |

| 245,483 | |

| Prepaid expenses | |

| 54,592 | |

| Excise tax refund receivable | |

| 3,964 | |

| Due from investor | |

| 1,347 | |

| Total Assets | |

| 97,987,696 | |

| | |

| | |

| LIABILITIES | |

| | |

| Series A Term Preferred Shares due 2029, less unamortized deferred issuance costs of $614,699 (25,000 shares outstanding (Note 10)) | |

| 24,385,301 | |

| Borrowings under credit facility, less unamortized deferred financing costs of $180,736 (Note 9) | |

| 13,819,264 | |

| Unrealized depreciation on forward currency contracts | |

| 664,528 | |

| Interest expense payable | |

| 341,739 | |

| Professional fees payable | |

| 328,869 | |

| Management fees payable | |

| 326,490 | |

| Incentive fees payable | |

| 122,927 | |

| Administration fees payable | |

| 107,282 | |

| Transfer agent fees payable | |

| 22,950 | |

| Trustees' fees payable | |

| 21,276 | |

| Other expenses payable | |

| 22,807 | |

| Total Liabilities | |

| 40,163,433 | |

| | |

| | |

| COMMITMENTS AND CONTINGENCIES (Note 7) | |

| | |

| | |

| | |

| NET ASSETS applicable to common shares, unlimited shares authorized, 5,913,207 shares issued and outstanding | |

$ | 57,824,263 | |

| | |

| | |

| NET ASSETS consist of: | |

| | |

| Paid-in capital | |

$ | 59,351,952 | |

| Aggregate distributable earnings (losses) | |

| (1,527,689 | ) |

| Total Net Assets | |

$ | 57,824,263 | |

| | |

| | |

| Shares issued and outstanding | |

| 5,913,207 | |

| | |

| | |

| Net asset value per share | |

$ | 9.78 | |

(1) Includes $2,031,926 of affiliated investments at fair value (cost $2,032,192). See Note 5 "Related Party Transactions" for further discussion.

See accompanying notes to the consolidated

financial statements

Eagle

Point Enhanced Income Trust & Subsidiaries

Consolidated

Schedule of Investments

As

of March 31, 2025

(expressed

in U.S. dollars)

(Unaudited)

| Issuer ⁽¹⁾ | |

Investment Description | |

Acquisition

Date ⁽²⁾ | |

Principal

Amount /

Shares | | |

Cost | | |

Fair Value ⁽³⁾ | | |

% of Net

Assets |

| Investments at Fair Value ⁽⁴⁾ ⁽¹⁷⁾ | |

| |

| |

| | | |

| | | |

| | | |

|

| Asset Backed Securities ⁽⁵⁾ | |

| |

| |

| | | |

| | | |

| | | |

|

| Structured Finance | |

| |

| |

| | | |

| | | |

| | | |

|

| France | |

| |

| |

| | | |

| | | |

| | | |

|

| FCT Noria 2023 | |

Class G Note, 15.05% (1M EURIBOR + 12.50%, due 10/24/2040) ⁽⁷⁾ ⁽⁸⁾ ⁽⁹⁾ | |

10/01/2023 | |

$ | 1,694,381 | | |

$ | 1,796,377 | | |

$ | 1,805,578 | | |

3.12% |

| Germany | |

| |

| |

| | | |

| | | |

| | | |

|

| Cork Harmony Consumer Loans DAC | |

Mezzanine Loan, DD, 9.00% (1M EURIBOR + 9.00%, due 07/15/2027) ⁽⁷⁾ ⁽⁸⁾ ⁽⁹⁾ ⁽¹⁰⁾ | |

10/01/2023 | |

| 3,428,571 | | |

| 3,707,007 | | |

| 3,707,341 | | |

6.41% |

| Spain | |

| |

| |

| | | |

| | | |

| | | |

|

| Autonoria Spain 2023 FT | |

Class G Note, 13.05% (1M EURIBOR + 10.50%, due 09/30/2041) ⁽⁷⁾ ⁽⁸⁾ ⁽⁹⁾ | |

10/01/2023 | |

| 738,168 | | |

| 780,429 | | |

| 802,606 | | |

1.39% |

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| Carvana Auto Receivables Trust 2024-P4 | |

Class R Note, 16.30% (N/A, due 12/10/2032) ⁽⁸⁾ ⁽¹¹⁾ | |

12/10/2024 | |

| 2,937 | | |

| 1,425,355 | | |

| 1,380,287 | | |

2.39% |

| Carvana Auto Receivables Trust 2025-N1 | |

Class EX5 Note, 17.40% (N/A, due 08/10/2032) ⁽⁸⁾ ⁽¹¹⁾ | |

02/11/2025 | |

| 3,571 | | |

| 1,246,957 | | |

| 1,229,507 | | |

2.13% |

| Island Finance Trust 2025-I | |

Class C Note, 10.00% (due 03/19/2035)⁽⁶⁾ ⁽⁸⁾ | |

01/22/2025 | |

| 2,250,000 | | |

| 2,105,684 | | |

| 2,267,550 | | |

3.92% |

| Oportun Funding LLC | |

Class E Note, 10.00% (due 02/08/2033)⁽⁶⁾ ⁽⁸⁾ | |

01/10/2025 | |

| 1,750,000 | | |

| 1,703,673 | | |

| 1,748,075 | | |

3.02% |

| VCP RRL ABS IV LLC | |

Class C Note, 11.72% (3M SOFR + 7.40%, due 04/20/2035) ⁽⁸⁾ ⁽⁹⁾ | |

02/04/2025 | |

| 2,500,000 | | |

| 2,500,000 | | |

| 2,493,500 | | |

4.31% |

| Total United States | |

| |

| |

| | | |

| 8,981,669 | | |

| 9,118,919 | | |

15.77% |

| Total Asset Backed Securities | |

| |

| |

| | | |

| 15,265,482 | | |

| 15,434,444 | | |

26.69% |

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Collateralized Fund Obligation Equity ⁽⁵⁾ ⁽¹¹⁾ | |

| |

| |

| | | |

| | | |

| | | |

|

| Structured Finance | |

| |

| |

| | | |

| | | |

| | | |

|

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| ALP CFO 2024, L.P. | |

Subordinated Loan, DD (effective yield 38.50%, maturity 10/15/2036)⁽⁸⁾ | |

10/21/2024 | |

| 2,036,000 | | |

| 2,036,000 | | |

| 1,823,316 | | |

3.15% |

| Glendower Capital Secondaries CFO, LLC | |

Subordinated Loan, DD (effective yield 44.85%, due 07/13/2038)⁽⁸⁾ | |

10/01/2023 | |

| 415,896 | | |

| 434,406 | | |

| 530,067 | | |

0.92% |

| Total Collateralized Fund Obligation Equity | |

| |

| |

| | | |

| 2,470,406 | | |

| 2,353,383 | | |

4.07% |

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Collateralized Loan Obligation Debt ⁽⁵⁾ | |

| |

| |

| | | |

| | | |

| | | |

|

| Structured Finance | |

| |

| |

| | | |

| | | |

| | | |

|

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| KKR CLO 16 Ltd. | |

Secured Note - Class D-R2, 11.66% (3M SOFR + 7.37%, due 10/20/2034)⁽⁹⁾ | |

10/01/2023 | |

| 1,200,000 | | |

| 1,114,397 | | |

| 1,184,400 | | |

2.05% |

| Total Collateralized Loan Obligation Debt | |

| |

| |

| | | |

| 1,114,397 | | |

| 1,184,400 | | |

2.05% |

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Collateralized Loan Obligation Equity ⁽⁵⁾ ⁽¹¹⁾ | |

| |

| |

| | | |

| | | |

| | | |

|

| Structured Finance | |

| |

| |

| | | |

| | | |

| | | |

|

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| AMMC CLO 28, Limited | |

Subordinated Note (effective yield 17.61%, maturity 07/20/2037)⁽⁸⁾ | |

01/28/2025 | |

| 2,800,000 | | |

| 2,241,575 | | |

| 2,094,893 | | |

3.62% |

| Ares LXV CLO Ltd. | |

Subordinated Note (effective yield 17.27%, maturity 07/25/2034)⁽⁸⁾ | |

04/16/2024 | |

| 1,075,000 | | |

| 704,984 | | |

| 602,820 | | |

1.04% |

| Ares LXIX CLO Ltd. | |

Income Note (effective yield 21.66%, maturity 04/15/2037)⁽⁸⁾ ⁽¹³⁾ | |

01/31/2024 | |

| 2,625,000 | | |

| 1,670,699 | | |

| 1,680,076 | | |

2.91% |

| Carlyle US CLO 2021-10 Ltd. | |

Subordinated Note (effective yield 9.79%, maturity 10/20/2034)⁽⁸⁾ | |

12/04/2024 | |

| 4,958,815 | | |

| 2,710,259 | | |

| 2,118,787 | | |

3.66% |

| Carlyle US CLO 2022-2, Ltd. | |

Subordinated Note (effective yield 11.39%, maturity 04/20/2035)⁽⁸⁾ | |

01/03/2025 | |

| 2,791,000 | | |

| 1,826,414 | | |

| 1,430,734 | | |

2.47% |

| CIFC Funding 2017-V Ltd | |

Subordinated Note (effective yield 13.53%, maturity 07/17/2037)⁽⁸⁾ | |

10/30/2024 | |

| 1,000,000 | | |

| 470,231 | | |

| 387,744 | | |

0.67% |

| Clover CLO 2019-1 Ltd. | |

Subordinated Note (effective yield 18.82%, maturity 04/18/2035)⁽⁸⁾ | |

02/15/2024 | |

| 1,075,000 | | |

| 742,421 | | |

| 684,192 | | |

1.18% |

| Dryden 90 CLO, Ltd. | |

Subordinated Note (effective yield 5.47%, maturity 02/20/2035)⁽⁸⁾ | |

04/09/2024 | |

| 1,500,000 | | |

| 828,806 | | |

| 490,146 | | |

0.85% |

| Generate CLO 3 Ltd. | |

Subordinated Note (effective yield 7.24%, maturity 10/20/2036)⁽⁸⁾ | |

04/23/2024 | |

| 1,824,000 | | |

| 1,013,644 | | |

| 715,731 | | |

1.24% |

| KKR CLO 37 Ltd. | |

Subordinated Note (effective yield 14.06%, maturity 01/20/2035)⁽⁸⁾ | |

04/16/2024 | |

| 2,126,000 | | |

| 1,316,084 | | |

| 1,113,898 | | |

1.93% |

| Morgan Stanley Eaton Vance CLO 2023-19, Ltd. | |

Subordinated Note (effective yield 12.29%, maturity 07/20/2036)⁽⁸⁾ | |

02/21/2024 | |

| 2,100,000 | | |

| 1,240,122 | | |

| 1,399,720 | | |

2.42% |

| Octagon Investment Partners 49, Ltd. | |

Subordinated Note (effective yield 14.04%, maturity 04/15/2037)⁽⁸⁾ | |

03/25/2024 | |

| 1,300,000 | | |

| 676,298 | | |

| 475,242 | | |

0.82% |

| Wind River 2022-1 CLO Ltd. | |

Subordinated Note (effective yield 7.46%, maturity 07/20/2035)⁽⁸⁾ | |

10/01/2023 | |

| 2,250,000 | | |

| 1,395,229 | | |

| 631,680 | | |

1.09% |

| Total United States | |

| |

| |

| | | |

| 16,836,766 | | |

| 13,825,663 | | |

23.90% |

| European Union - Various | |

| |

| |

| | | |

| | | |

| | | |

|

| Aqueduct European CLO 5-2020 DAC | |

Class M-2 Note (effective yield 13.25%, maturity 04/20/2034)⁽⁷⁾ ⁽⁸⁾ | |

12/27/2024 | |

| 973,000 | | |

| 752,297 | | |

| 717,407 | | |

1.24% |

| Aqueduct European CLO 5-2020 DAC | |

Class M-1 Note (effective yield 13.81%, maturity 04/20/2034)⁽⁷⁾ ⁽⁸⁾ ⁽¹³⁾ | |

12/27/2024 | |

| 962,000 | | |

| 783,861 | | |

| 747,241 | | |

1.29% |

| Aurium CLO XIII DAC | |

Subordinated Note (effective yield 18.18%, maturity 04/15/2038)⁽⁷⁾ ⁽⁸⁾ | |

01/30/2025 | |

| 905,000 | | |

| 895,004 | | |

| 927,521 | | |

1.60% |

| Avoca CLO XXXI DAC | |

Subordinated Note (effective yield 13.43%, maturity 07/15/2038)⁽⁷⁾ ⁽⁸⁾ | |

02/12/2025 | |

| 820,000 | | |

| 765,893 | | |

| 758,641 | | |

1.31% |

| Blackrock European CLO XV DAC | |

Subordinated Note (effective yield 15.68%, maturity 01/28/2038)⁽⁷⁾ ⁽⁸⁾ | |

11/29/2024 | |

| 810,000 | | |

| 813,167 | | |

| 784,614 | | |

1.36% |

| Henley CLO XI DAC | |

Subordinated Note (effective yield 13.53%, maturity 04/25/2039)⁽⁷⁾ ⁽⁸⁾ | |

02/10/2025 | |

| 430,000 | | |

| 443,180 | | |

| 464,152 | | |

0.80% |

| OCP Euro CLO 2022-6 DAC | |

Subordinated Note (effective yield 13.87%, maturity 01/20/2033)⁽⁷⁾ ⁽⁸⁾ | |

04/23/2024 | |

| 625,000 | | |

| 523,418 | | |

| 581,284 | | |

1.01% |

| Sculptor European CLO XII DAC | |

Subordinated Note (effective yield 18.85%, maturity 01/15/2038)⁽⁷⁾ ⁽⁸⁾ | |

11/27/2024 | |

| 1,395,000 | | |

| 1,179,106 | | |

| 1,178,231 | | |

2.04% |

| Total European Union - Various | |

| |

| |

| | | |

| 6,155,926 | | |

| 6,159,091 | | |

10.65% |

| Total Collateralized Loan Obligation Equity | |

| |

| |

| | | |

| 22,992,692 | | |

| 19,984,754 | | |

34.55% |

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Common Stock ⁽⁵⁾ | |

| |

| |

| | | |

| | | |

| | | |

|

| Financial Services | |

| |

| |

| | | |

| | | |

| | | |

|

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| Delta Financial Holdings LLC | |

Common Units⁽⁸⁾ ⁽¹²⁾ ⁽¹⁶⁾ | |

10/01/2023 | |

| 0 | | |

| 115 | | |

| 115 | | |

0.00% |

| Delta Leasing SPV III, LLC | |

Common Equity⁽⁸⁾ ⁽¹²⁾ ⁽¹⁶⁾ | |

10/01/2023 | |

| 4 | | |

| 2 | | |

| 2 | | |

0.00% |

| Opal SPV LLC | |

Common Units ⁽⁸⁾ ⁽¹²⁾ | |

02/25/2025 | |

| 603 | | |

| 446,241 | | |

| 446,241 | | |

0.77% |

| Total Common Stock | |

| |

| |

| | | |

| 446,358 | | |

| 446,358 | | |

0.77% |

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Limited Partnership Interest ⁽⁵⁾ | |

| |

| |

| | | |

| | | |

| | | |

|

| Financial Services | |

| |

| |

| | | |

| | | |

| | | |

|

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| ASPF Oceanus Co-Invest (Cayman), L.P. | |

Partnership Interest (effective yield 13.96%, due 01/05/2029)⁽⁸⁾ ⁽¹⁰⁾ ⁽¹¹⁾ | |

01/30/2024 | |

| 158,684 | | |

| 52,605 | | |

| 153,582 | | |

0.27% |

| Healthcare | |

| |

| |

| | | |

| | | |

| | | |

|

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| Frazier Healthcare Credit SPV II, L.P. | |

Partnership Interest⁽⁸⁾ | |

11/25/2024 | |

| 1,865,625 | | |

| 1,865,625 | | |

| 1,865,625 | | |

3.23% |

| Total Limited Partnership Interest | |

| |

| |

| | | |

| 1,918,230 | | |

| 2,019,207 | | |

3.50% |

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Loan Accumulation Facilities ⁽¹⁴⁾ ⁽⁵⁾ | |

| |

| |

| | | |

| | | |

| | | |

|

| Structured Finance | |

| |

| |

| | | |

| | | |

| | | |

|

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| Steamboat XLVIII Ltd. | |

Loan Accumulation Facility⁽⁸⁾ | |

04/08/2024 | |

| 2,303,500 | | |

| 2,303,500 | | |

| 2,321,081 | | |

4.01% |

| Total Loan Accumulation Facilities | |

| |

| |

| | | |

| 2,303,500 | | |

| 2,321,081 | | |

4.01% |

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Loans and Notes | |

| |

| |

| | | |

| | | |

| | | |

|

| Structured Finance | |

| |

| |

| | | |

| | | |

| | | |

|

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| Glendower Capital Secondaries CFO, LLC | |

Collateralized Fund Obligation, Senior Secured Class B Loan, DD, 11.50% (due 07/13/2038) ⁽⁵⁾ ⁽⁶⁾ ⁽⁸⁾ | |

10/01/2023 | |

$ | 398,429 | | |

$ | 397,796 | | |

$ | 409,942 | | |

0.71% |

| Glendower Capital Secondaries CFO, LLC | |

Collateralized Fund Obligation, Senior Secured Class C Loan, DD, 14.50% (due 07/13/2038) ⁽⁵⁾ ⁽⁶⁾ ⁽⁸⁾ | |

10/01/2023 | |

| 182,440 | | |

| 182,077 | | |

| 189,687 | | |

0.33% |

| Total Structured Finance | |

| |

| |

| | | |

| 579,873 | | |

| 599,629 | | |

1.04% |

See accompanying notes

to the consolidated financial statements

Eagle

Point Enhanced Income Trust & Subsidiaries

Consolidated

Schedule of Investments

As

of March 31, 2025

(expressed

in U.S. dollars)

(Unaudited)

| Issuer ⁽¹⁾ | |

Investment Description | |

Acquisition

Date ⁽²⁾ | |

Principal

Amount /

Shares | | |

Cost | | |

Fair Value ⁽³⁾ | | |

% of Net

Assets |

| Loans and Notes (continued) | |

| |

| |

| | | |

| | | |

| | | |

|

| Financial Services | |

| |

| |

| | | |

| | | |

| | | |

|

| Singapore | |

| |

| |

| | | |

| | | |

| | | |

|

| FinAccel Pte Ltd | |

Senior Secured Class C Note, 15.00% (due 06/30/2026) ⁽⁵⁾ ⁽⁶⁾ ⁽⁸⁾ | |

10/01/2023 | |

| 2,982,670 | | |

| 1,521,078 | | |

| 1,518,179 | | |

2.63% |

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| BSD Capital Inc. | |

Floating Rate Note, 6.94% (3M SOFR + 2.66%, due 10/31/2027) ⁽⁵⁾ ⁽⁸⁾ ⁽⁹⁾ | |

01/16/2025 | |

| 1,341,000 | | |

| 1,126,931 | | |

| 1,201,536 | | |

2.08% |

| Dawson Rated Fund 6-R2 LP | |

Senior Secured Term Loan, DD, 13.48% (US CMT + 9.15%, due 12/15/2034) ⁽⁵⁾ ⁽⁸⁾ ⁽⁹⁾ ⁽¹⁰⁾ | |

11/20/2024 | |

| 1,580,614 | | |

| 1,580,614 | | |

| 1,578,625 | | |

2.73% |

| Delta Leasing SPV III, LLC | |

Senior Secured Note, DD, 13.00% (due 07/18/2030) ⁽⁵⁾ ⁽⁶⁾ ⁽⁸⁾ ⁽¹⁰⁾ ⁽¹⁵⁾ ⁽¹⁶⁾ | |

10/01/2023 | |

| 1,981,216 | | |

| 1,981,475 | | |

| 1,981,216 | | |

3.43% |

| Opal SPV LLC | |

Senior Secured Term Loan, DD, 14.00% (due 02/04/2030) ⁽⁵⁾ ⁽⁶⁾ ⁽⁸⁾ ⁽¹⁰⁾ | |

02/14/2025 | |

| 3,296,457 | | |

| 2,853,465 | | |

| 2,849,787 | | |

4.93% |

| Ready Capital Corp | |

Senior Unsecured Note, 9.00% (due 12/15/2029)⁽⁶⁾ | |

12/03/2024 | |

| 15,795 | | |

| 394,838 | | |

| 374,499 | | |

0.65% |

| Ready Term Holdings, LLC | |

Senior Secured Term Loan, DD , 9.79% (3M SOFR + 5.50%, due 04/12/2029) ⁽⁵⁾ ⁽⁸⁾ ⁽⁹⁾ | |

04/10/2024 | |

| 2,250,000 | | |

| 2,202,334 | | |

| 2,219,850 | | |

3.84% |

| Total United States | |

| |

| |

| | | |

| 10,139,657 | | |

| 10,205,513 | | |

17.66% |

| Total Financial Services | |

| |

| |

| | | |

| 11,660,735 | | |

| 11,723,692 | | |

20.29% |

| Manufacturing | |

| |

| |

| | | |

| | | |

| | | |

|

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| Footprint International Holdco Inc | |

Senior Secured Term Loan, DD, 14.75% (Prime + 7.25%, due 03/01/2027) ⁽⁵⁾ ⁽⁸⁾ ⁽⁹⁾ | |

10/01/2023 | |

| 763,697 | | |

| 771,029 | | |

| 749,187 | | |

1.30% |

| Footprint International Holdco Inc | |

Senior Secured Term Loan C, DD, 14.75% (Prime + 7.25%, due 03/01/2027) ⁽⁵⁾ ⁽⁸⁾ ⁽⁹⁾ | |

10/01/2023 | |

| 839,528 | | |

| 840,096 | | |

| 823,577 | | |

1.42% |

| Total Manufacturing | |

| |

| |

| | | |

| 1,611,125 | | |

| 1,572,764 | | |

2.72% |

| Total Loans and Notes | |

| |

| |

| | | |

| 13,851,733 | | |

| 13,896,085 | | |

24.05% |

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Preferred Stock | |

| |

| |

| | | |

| | | |

| | | |

|

| Financial Services | |

| |

| |

| | | |

| | | |

| | | |

|

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| Arbor Realty Trust Inc | |

Preferred Shares, 6.25% (perpetual) ⁽⁶⁾ | |

04/10/2024 | |

| 26,390 | | |

| 496,159 | | |

| 553,662 | | |

0.96% |

| Carlyle Credit Income Fund | |

Preferred Shares, 7.50% (due 01/31/2030) ⁽⁶⁾ ⁽⁸⁾ | |

01/29/2025 | |

| 1,540 | | |

| 1,432,200 | | |

| 1,432,200 | | |

2.48% |

| Delta Financial Holdings LLC | |

Preferred Units ⁽⁵⁾ ⁽⁸⁾ ⁽¹²⁾ ⁽¹⁶⁾ | |

10/01/2023 | |

| 51 | | |

| 50,600 | | |

| 50,593 | | |

0.09% |

| Granite Point Mortgage Trust Inc | |

Preferred Shares, 7.00% (perpetual) ⁽⁶⁾ | |

04/09/2024 | |

| 11,742 | | |

| 200,902 | | |

| 201,493 | | |

0.35% |

| Total Preferred Stock | |

| |

| |

| | | |

| 2,179,861 | | |

| 2,237,948 | | |

3.88% |

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Regulatory Capital Relief Securities ⁽⁵⁾ | |

| |

| |

| | | |

| | | |

| | | |

|

| Banking | |

| |

| |

| | | |

| | | |

| | | |

|

| Europe - Various | |

| |

| |

| | | |

| | | |

| | | |

|

| Banco Santander S.A. | |

Credit Linked Note, 11.53% (3M EURIBOR + 9.00%, due 06/20/2030) ⁽⁷⁾ ⁽⁸⁾ ⁽⁹⁾ | |

03/08/2024 | |

| 600,000 | | |

| 656,190 | | |

| 660,283 | | |

1.14% |

| Pomona Finance Limited | |

Credit Linked Note, 18.22% (ESTR + 15.00%, due 09/29/2033) ⁽⁷⁾ ⁽⁸⁾ ⁽⁹⁾ | |

10/01/2023 | |

| 1,814,832 | | |

| 1,918,731 | | |

| 1,953,119 | | |

3.38% |

| Total Europe - Various | |

| |

| |

| | | |

| 2,574,921 | | |

| 2,613,402 | | |

4.52% |

| France | |

| |

| |

| | | |

| | | |

| | | |

|

| BNP Paribas | |

Credit Linked Note, 10.77% (3M EURIBOR + 8.00%, due 09/26/2031) ⁽⁷⁾ ⁽⁸⁾ ⁽⁹⁾ | |

09/18/2024 | |

| 1,490,603 | | |

| 1,655,545 | | |

| 1,613,494 | | |

2.79% |

| BNP Paribas | |

Credit Linked Note, 12.29% (3M EURIBOR + 9.50%, due 10/12/2032) ⁽⁷⁾ ⁽⁸⁾ ⁽⁹⁾ | |

10/01/2023 | |

| 1,252,216 | | |

| 1,323,905 | | |

| 1,380,476 | | |

2.39% |

| FCT Junon 2023 | |

Class AR Note, 10.10% (3M EURIBOR + 7.60%, due 05/09/2033) ⁽⁷⁾ ⁽⁸⁾ ⁽⁹⁾ | |

03/10/2025 | |

| 2,500,000 | | |

| 2,708,119 | | |

| 2,703,258 | | |

4.67% |

| Total France | |

| |

| |

| | | |

| 5,687,569 | | |

| 5,697,228 | | |

9.85% |

| Ireland | |

| |

| |

| | | |

| | | |

| | | |

|

| Setanta Finance DAC | |

Class B Note, 10.75% (3M EURIBOR + 7.75%, due 01/28/2033) ⁽⁷⁾ ⁽⁸⁾ ⁽⁹⁾ | |

11/08/2024 | |

| 2,500,000 | | |

| 2,679,758 | | |

| 2,705,685 | | |

4.68% |

| Italy | |

| |

| |

| | | |

| | | |

| | | |

|

| Gregory SPV S.r.l | |

Credit Linked Note, 10.12% (3M EURIBOR + 7.75%, due 09/30/2045) ⁽⁷⁾ ⁽⁸⁾ ⁽⁹⁾ | |

03/24/2025 | |

| 3,900,000 | | |

| 4,212,800 | | |

| 4,217,082 | | |

7.29% |

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| BNP Paribas | |

Credit Linked Note, 12.64% (CD SOFR + 8.00%, due 04/12/2031) ⁽⁸⁾ ⁽⁹⁾ | |

03/15/2024 | |

| 1,264,010 | | |

| 1,264,010 | | |

| 1,264,036 | | |

2.19% |

| Granville USD Ltd | |

Class E2 Note, 14.20% (CD SOFR + 9.75%, due 07/31/2031) ⁽⁸⁾ ⁽⁹⁾ | |

10/01/2023 | |

| 1,700,000 | | |

| 1,701,715 | | |

| 1,753,406 | | |

3.03% |

| LOFT 2022-1 | |

Class C Note, 23.43% (CD SOFR + 19.00%, due 02/28/2032) ⁽⁸⁾ ⁽⁹⁾ | |

10/01/2023 | |

| 2,119,694 | | |

| 2,054,204 | | |

| 2,379,876 | | |

4.12% |

| Manitoulin USD Ltd. | |

Class E Note, 14.70% (CD SOFR + 10.25%, due 11/01/2028) ⁽⁸⁾ ⁽⁹⁾ | |

10/16/2023 | |

| 2,235,046 | | |

| 2,235,046 | | |

| 2,126,267 | | |

3.68% |

| Santander Bank Auto CLN Series 2024-B | |

Credit Linked Note - Class G, 12.23% (due 01/18/2033)⁽⁶⁾ ⁽⁸⁾ | |

12/10/2024 | |

| 1,343,750 | | |

| 1,343,750 | | |

| 1,345,420 | | |

2.33% |

| Standard Chartered 1 | |

Class B Note, 15.35% (CD SOFR + 10.75%, due 04/19/2033) ⁽⁸⁾ ⁽⁹⁾ | |

04/05/2024 | |

| 780,000 | | |

| 780,000 | | |

| 780,054 | | |

1.35% |

| Standard Chartered 9 | |

Class A Note, 9.68% (CD SOFR + 5.25%, due 11/28/2029) ⁽⁸⁾ ⁽⁹⁾ | |

10/01/2023 | |

| 1,380,000 | | |

| 1,380,000 | | |

| 1,399,009 | | |

2.42% |

| Standard Chartered 9 | |

Class B Note, 14.03% (CD SOFR + 9.60%, due 11/28/2029) ⁽⁸⁾ ⁽⁹⁾ | |

10/01/2023 | |

| 870,000 | | |

| 870,000 | | |

| 881,745 | | |

1.52% |

| TRAFIN 2023-1 | |

Credit Linked Note, 14.61% (CD SOFR + 10.00%, due 06/01/2029) ⁽⁸⁾ ⁽⁹⁾ | |

11/27/2023 | |

| 1,125,000 | | |

| 1,125,000 | | |

| 1,164,087 | | |

2.01% |

| US Bank NA 2025-SUP1 | |

Credit Linked Note - Class R, 11.85% (CD SOFR + 7.50%, due 02/25/2032) ⁽⁸⁾ ⁽⁹⁾ | |

03/06/2025 | |

| 2,860,000 | | |

| 2,860,000 | | |

| 2,860,000 | | |

4.95% |

| Total United States | |

| |

| |

| | | |

| 15,613,725 | | |

| 15,953,900 | | |

27.60% |

| Total Regulatory Capital Relief Securities | |

| |

| |

| | | |

| 30,768,773 | | |

| 31,187,297 | | |

53.94% |

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Warrants ⁽⁵⁾ | |

| |

| |

| | | |

| | | |

| | | |

|

| Manufacturing | |

| |

| |

| | | |

| | | |

| | | |

|

| United States | |

| |

| |

| | | |

| | | |

| | | |

|

| Footprint International Holdco Inc | |

Warrants (expiration 02/18/2032) ⁽⁸⁾ ⁽¹²⁾ | |

10/01/2023 | |

| 4,009 | | |

| 3,789 | | |

| 160 | | |

0.00% |

| Financial Services | |

| |

| |

| | | |

| | | |

| | | |

|

| Singapore | |

| |

| |

| | | |

| | | |

| | | |

|

| FinAccel Pte Ltd | |

C Note PIK Warrants (expiration 06/30/2030) ⁽⁸⁾ ⁽¹²⁾ | |

10/01/2023 | |

| 3,375 | | |

| 131,571 | | |

| 164,886 | | |

0.29% |

| FinAccel Pte Ltd | |

C Note Warrants (expiration 03/12/2029) ⁽⁸⁾ ⁽¹²⁾ | |

10/01/2023 | |

| 1,874 | | |

| 35,437 | | |

| 57,363 | | |

0.10% |

| Total Singapore | |

| |

| |

| | | |

| 167,008 | | |

| 222,249 | | |

0.39% |

| Total Warrants | |

| |

| |

| | | |

| 170,797 | | |

| 222,409 | | |

0.39% |

| | |

| |

| |

| | | |

| | | |

| | | |

|

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Total investments at fair value as of March 31, 2025 | |

| |

| | | |

$ | 93,482,229 | | |

$ | 91,287,366 | | |

157.90% |

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Net assets above (below) fair value of investments | |

| |

| | | |

| | | |

| (33,463,103 | ) | |

|

| | |

| |

| |

| | | |

| | | |

| | | |

|

| Net assets as of March 31, 2025 | |

| |

| | | |

| | | |

$ | 57,824,263 | | |

|

See accompanying notes

to the consolidated financial statements

Eagle Point

Enhanced Income Trust & Subsidiaries

Consolidated

Schedule of Investments

As of March 31,

2025

(expressed

in U.S. dollars)

(Unaudited)

| |

|

Footnotes to the Consolidated Schedule

of Investments: |

| (1) |

|

Unless otherwise noted, the Trust is not affiliated with,

nor does it "control" (as such term is defined in the Investment Company Act of 1940 (the "1940 Act")), any of

the issuers listed. In general, under the 1940 Act, the Trust would be presumed to "control" an issuer if it owned 25%

or more of its voting securities. |

| (2) |

|

Acquisition date represents the initial date of purchase

or the date the investment was acquired by the Trust. |

| (3) |

|

Fair value is determined by the Adviser in accordance with

written valuation policies and procedures, subject to oversight by the Trust’s Board of Trustees, in accordance with Rule 2a-5

under the 1940 Act. |

| (4) |

|

Country represents the principal country of risk where the

investment has exposure. |

| (5) |

|

Securities exempt from registration under the Securities

Act of 1933, and are deemed to be “restricted securities”. As of March 31, 2025, the aggregate fair value of these

securities is $88.7 million, or 153.4% of the Fund’s net assets. |

| (6) |

|

Fixed rate investment. |

| (7) |

|

Investment principal amount is denominated in EUR. |

| (8) |

|

Classified as Level III investment.

|

| (9) |

|

Variable rate investment. Interest rate shown

reflects the rate in effect at the reporting date. Investment description includes the reference rate and spread. |

| (10) |

|

This investment has an unfunded commitment

as of March 31, 2025. |

| (11) |

|

Collateralized Loan Obligation ("CLO") Equity,

Collateralized Fund Obligation Equity and certain other investments are entitled to recurring distributions which are

generally equal to the remaining cash flow of payments made by underlying assets less contractual payments to debt holders and fund

expenses. The effective yield is estimated based on the current projection of the amount and timing of these recurring distributions

in addition to the estimated amount of terminal principal payment. The effective yield and investment cost may ultimately not be

realized. |

| (12) |

|

The following investment is not an income producing security. |

| (13) |

|

Fair value includes the Trust's interest in fee rebates on

CLO subordinated and income notes. |

| (14) |

|

Loan accumulation facilities are financing structures intended

to aggregate loans that may be used to form the basis of a CLO vehicle. |

| (15) |

|

As of March 31, 2025, the investment includes interest

income capitalized as additional investment principal, referred to as "PIK" interest. The PIK interest rate

represents the interest rate at payment date when PIK interest is received. |

| (16) |

|

The following investment is an affiliated investment as defined

under the 1940 Act, which represents investments in which the Trust owns 5% or more of the outstanding voting securities under common

ownership or control. See Note 5 "Related Party Transactions" for further discussion. |

| (17) |

|

Pursuant to the terms of the credit facility agreement, a

security interest in favor of the lender has been granted with respect to all investments. See Note 9 "Revolving Credit Facility"

for further discussion. |

| |

|

|

| Reference Key: |

| CD |

Compounded Daily |

| DD |

Delayed Draw |

| ESTR |

Euro Short Term Rate |

| EUR |

Euro |

| EURIBOR |

Euro London Interbank Offered Rate |

| Prime |

Prime Lending Rate |

| SOFR |

Secured Overnight Financing Rate |

| US CMT |

US Constant Maturity Treasury Yield |

See accompanying notes

to the consolidated financial statements

Eagle Point

Enhanced Income Trust & Subsidiaries

Consolidated

Schedule of Investments

As of March 31,

2025

(expressed

in U.S. dollars)

(Unaudited)

Forward Currency Contracts, at Fair Value(1)

| Currency Purchased | |

Currency Sold | |

Counterparty | |

Acquisition Date | |

Settlement Date | |

Fair Value | |

| | |

| |

| |

| |

| |

| |

| Unrealized appreciation on forward currency contracts | |

| |

| |

| |

| USD | |

2,741,926 | |

EUR | |

2,500,000 | |

Barclays Bank PLC | |

3/11/2025 | |

4/30/2025 | |

$ | 34,601 | |

| USD | |

4,243,748 | |

EUR | |

3,900,000 | |

Barclays Bank PLC | |

3/20/2025 | |

4/30/2025 | |

| 20,321 | |

| EUR | |

167,781 | |

USD | |

175,089 | |

Barclays Bank PLC | |

2/27/2025 | |

4/30/2025 | |

| 6,607 | |

| USD | |

912,516 | |

EUR | |

841,986 | |

Barclays Bank PLC | |

3/25/2025 | |

4/30/2025 | |

| 705 | |

| Total unrealized appreciation on forward currency contracts | |

| |

| |

$ | 62,234 | |

| | |

| |

| |

| |

| |

| |

| |

| | |

| Unrealized depreciation on forward currency contracts | |

| |

| |

| | |

| USD | |

18,823,894 | |

EUR | |

17,968,006 | |

Barclays Bank PLC | |

1/29/2025 | |

4/30/2025 | |

$ | (634,198 | ) |

| USD | |

769,794 | |

EUR | |

737,180 | |

Barclays Bank PLC | |

2/12/2025 | |

4/30/2025 | |

| (28,520 | ) |

| USD | |

430,388 | |

EUR | |

399,100 | |

Barclays Bank PLC | |

3/26/2025 | |

4/30/2025 | |

| (1,810 | ) |

| Total unrealized depreciation on forward currency contracts | |

| |

| |

$ | (664,528 | ) |

(1) See

Note 4 "Derivative Contracts" for further discussion relating to forward currency contracts held by the Fund.

See accompanying notes

to the consolidated financial statements

Eagle Point

Enhanced Income Trust & Subsidiaries

Consolidated

Statement of Operations

For the

six months ended March 31, 2025

(expressed

in U.S. dollars)

(Unaudited)

| INVESTMENT INCOME | |

| | |

| Interest income (1) | |

$ | 4,790,205 | |

| Dividend income | |

| 251,408 | |

| Other income | |

| 20,493 | |

| Total Investment Income | |

| 5,062,106 | |

| | |

| | |

| EXPENSES | |

| | |

| Interest expense | |

| 1,118,089 | |

| Management Fees | |

| 607,395 | |

| Incentive Fees | |

| 300,020 | |

| Administration fees | |

| 269,898 | |

| Professional fees | |

| 262,160 | |

| Amortization of deferred offering costs attributed to common shares | |

| 251,624 | |

| Transfer agent fees | |

| 57,539 | |

| Organizational expenses | |

| 52,591 | |

| Trustees' fees | |

| 42,576 | |

| Other expenses | |

| 75,632 | |

| Total Expenses | |

| 3,037,524 | |

| | |

| | |

| NET INVESTMENT INCOME | |

| 2,024,582 | |

| | |

| | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | |

| | |

| Net realized gain (loss) on: | |

| | |

| Investments, foreign currency and cash equivalents | |

| (209,826 | ) |

| Forward currency contracts | |

| 688,562 | |

| Net unrealized appreciation (depreciation) on: | |

| | |

| Investments, foreign currency and cash equivalents (1) | |

| (2,650,947 | ) |

| Forward currency contracts | |

| (187,729 | ) |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | |

| (2,359,940 | ) |

| | |

| | |

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | |

$ | (335,358 | ) |

| (1) | Interest income and net unrealized

appreciation (depreciation) on investments, foreign currency and cash equivalents include balances attributed to affiliated investments

of $127,047 and $14, respectively. See Note 5 "Related Party Transactions" for further discussion. |

See accompanying notes

to the consolidated financial statements

Eagle Point

Enhanced Income Trust & Subsidiaries

Consolidated

Statements of Changes in Net Assets

(expressed

in U.S. dollars, except share amounts)

(Unaudited)

| | |

For the | | |

For the period from | |

| | |

six months ended | | |

October 14, 2023 through | |

| | |

March 31, 2025 | | |

September 30, 2024 | |

| Net Increase (decrease) in net assets resulting from operations: | |

| | | |

| | |

| Net investment income | |

$ | 2,024,582 | | |

$ | 6,424,554 | |

| Net realized gain (loss) on: | |

| | | |

| | |

| Investments, foreign currency and cash equivalents | |

| (209,826 | ) | |

| 500,428 | |

| Forward currency contracts | |

| 688,562 | | |

| (303,701 | ) |

| Net unrealized appreciation (depreciation) on: | |

| | | |

| | |

| Investments, foreign currency and cash equivalents | |

| (2,650,947 | ) | |

| 597,451 | |

| Forward currency contracts | |

| (187,729 | ) | |

| (414,647 | ) |

| Total net increase (decrease) in net assets resulting from operations | |

| (335,358 | ) | |

| 6,804,085 | |

| | |

| | | |

| | |

| Distributions to shareholders: | |

| | | |

| | |

| Total earnings distributed | |

| (3,126,215 | ) | |

| (4,977,766 | ) |

| Total distributions to shareholders | |

| (3,126,215 | ) | |

| (4,977,766 | ) |

| | |

| | | |

| | |

| Capital share transactions: | |

| | | |

| | |

| Proceeds from shares sold | |

| 4,194,158 | | |

| 2,600,000 | |

| Reinvestment of distributions pursuant to the Fund's distribution reinvestment plan | |

| 227,439 | | |

| 2,161,837 | |

| Total capital share transactions: | |

| 4,421,597 | | |

| 4,761,837 | |

| | |

| | | |

| | |

| Total increase (decrease) in net assets | |

| 960,024 | | |

| 6,588,156 | |

| Net assets at beginning of period | |

| 56,864,239 | | |

| 50,276,083 | |

| Net assets at end of period | |

$ | 57,824,263 | | |

$ | 56,864,239 | |

| | |

| | | |

| | |

| Capital share activity: | |

| | | |

| | |

| Shares sold | |

| 410,886 | | |

| 251,208 | |

| Shares sold pursuant to the Fund's distribution reinvestment plan | |

| 23,338 | | |

| 210,924 | |

| Total increase (decrease) in capital share activity | |

| 434,224 | | |

| 462,132 | |

See accompanying notes

to the consolidated financial statements

Eagle Point

Enhanced Income Trust & Subsidiaries

Consolidated

Statement of Cash Flows

For the

six months ended March 31, 2025

(expressed

in U.S. dollars)

(Unaudited)

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | |

| Net increase (decrease) in net assets resulting from operations | |

$ | (335,358 | ) |

| Adjustments to reconcile net increase (decrease) in net assets

resulting from operations to net cash provided by (used in) operating activities: | |

| | |

| Purchases of investments, net of payable of securities purchased | |

| (89,276,531 | ) |

| Proceeds from sales of investments and repayments of principal, net of receivable for securities sold (1) | |

| 50,676,856 | |

| Payment-in-kind interest | |

| (114,364 | ) |

| Amortization of deferred offering costs attributed to common shares | |

| 251,624 | |

| Amortization of deferred financing costs | |

| 64,625 | |

| Amortization of deferred issuance costs | |

| 77,430 | |

| Amortization (accretion) of premiums or discounts on debt securities | |

| (33,346 | ) |

| Net realized gain (loss) on: | |

| | |

| Investments, foreign currency and cash equivalents | |

| 209,826 | |

| Forward currency contracts | |

| (688,562 | ) |

| Net unrealized appreciation (depreciation) on: | |

| | |

| Investments, foreign currency and cash equivalents | |

| 2,650,947 | |

| Forward currency contracts | |

| 187,729 | |

| Changes in assets and liabilities: | |

| | |

| Interest receivable | |

| (632,310 | ) |

| Prepaid expenses | |

| (31,127 | ) |

| Interest expense payable | |

| 291,879 | |

| Professional fees payable | |

| 28,973 | |

| Management fees payable | |

| 326,490 | |

| Incentive fees payable | |

| 122,927 | |

| Administration fees payable | |

| 83,354 | |

| Transfer agent fees payable | |

| (85,016 | ) |

| Trustees' fees payable | |

| (63,924 | ) |

| Other expenses payable | |

| (1,719 | ) |

| Net cash provided by (used in) operating activities | |

| (36,289,597 | ) |

| | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | |

| Borrowings under credit facility | |

| 19,000,000 | |

| Repayments under credit facility | |

| (10,000,000 | ) |

| Proceeds from issuance of Series A Term Preferred Shares due 2029 | |

| 25,000,000 | |

| Issuance costs, paid and deferred | |

| (692,129 | ) |

| Due from investor | |

| (1,347 | ) |

| Distributions to shareholders | |

| (3,646,717 | ) |

| Proceeds from shares sold, net of comissions | |

| 4,194,158 | |

| Reinvestment of distributions | |

| 227,439 | |

| Offering costs, paid and deferred | |

| (78,004 | ) |

| Net cash provided by (used in) financing activities | |

| 34,003,400 | |

| | |

| | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | |

| (2,286,197 | ) |

| | |

| | |

| EFFECT OF FOREIGN EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | |

| 589,512 | |

| | |

| | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD | |

| 6,026,240 | |

| | |

| | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD | |

$ | 4,329,555 | |

| | |

| | |

| Supplemental disclosure of cash flow from operating activities: | |

| | |

| Cash paid for interest expense | |

$ | 684,154 | |

(1) Proceeds

from sales or maturity of investments includes $765,757 of recurring cash flows treated as return of principal.

See accompanying notes

to the consolidated financial statements

Eagle Point Enhanced Income Trust &

Subsidiaries

Notes to Consolidated Financial

Statements

March 31, 2025

(Unaudited)

Eagle Point Enhanced

Income Trust (the “Fund”) was formed as a Delaware statutory trust on August 7, 2023. The Fund is managed by Eagle Point

Enhanced Income Management LLC (the “Adviser”) and is subject to the supervision of the Fund’s Board of Trustees (the

“Board”). The Adviser is registered as an investment adviser with the U.S. Securities and Exchange Commission (the “SEC”)

under the Investment Advisers Act of 1940.

On October 1, 2023,

the Fund commenced operations and issued 5,016,852 shares of beneficial interest (“Shares”) to Eagle Point Enhanced Income

Investor LLC through a reorganization, in exchange for acquired investments and other assets and liabilities from Eagle Point Enhanced

Income Investor LLC. Subsequently, on October 13, 2023, the Fund registered as a non-diversified, closed end management investment

company under the Investment Company Act of 1940, as amended (the “1940 Act”) to offer its shares on a continuous basis. The

Fund intends to operate so as to qualify to be taxed as a regulated investment company (“RIC”) under Subchapter M of the Internal

Revenue Code of 1986, as amended (the “Code”), for federal income tax purposes.

The Fund’s primary

investment objective is to generate high current income, with a secondary objective to generate capital gains.

As of March 31,

2025, the Fund had three wholly-owned subsidiaries: Eagle Point Enhanced Income Investor Sub (Cayman) Ltd., a Cayman Islands exempted

company, Eagle Point Enhanced Income Investor Sub (US) LLC, a Delaware limited liability company, and Eagle Point Enhanced Income Trust

Sub II Cayman LLC, a Cayman Islands limited liability company. The subsidiaries have been organized to hold certain of the Fund’s

investments for legal, regulatory and tax purposes. As of March 31, 2025, Eagle Point Enhanced Income Investor Sub (Cayman) Ltd.,

Eagle Point Enhanced Income Investor Sub (US) LLC and Eagle Point Enhanced Income Trust Sub II Cayman LLC represented 88.2%, 4.9% and

5.8% of the Fund’s net assets, respectively.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Accounting

The consolidated financial

statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”). The Fund is

an investment company and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting

Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 Financial Services – Investment

Companies. Items included in the consolidated financial statements are measured and presented in U.S. dollars.

Use of Estimates

The preparation of financial

statements in conformity with U.S. GAAP requires management to make estimates and assumptions, which affect the reported amounts included

in the consolidated financial statements and accompanying notes as of the reporting date. Actual results may differ from those estimates.

Operating Segments

The Fund has a single

reportable segment with investment objectives described in Note 1 “Organization”. The chief operating decision maker (“CODM”)

of the Fund is comprised of the Chief Executive Officer and the Chief Financial Officer. Key financial information in the form of the

Fund’s portfolio composition, total return, changes in net assets and expense ratios which are used by the CODM to assess the Fund’s

performance and to make operational decisions for the Fund’s single segment, is consistent with the presentation within the Fund’s

consolidated financial statements. Segment assets are reflected on the accompanying Consolidated Statement of Assets and Liabilities as

“total assets” and significant segment expenses are listed on the Consolidated Statement of Operations.

Eagle Point Enhanced Income Trust &

Subsidiaries

Notes to Consolidated Financial

Statements

March 31, 2025

(Unaudited)

Valuation of Investments

The most significant

estimate inherent in the preparation of the consolidated financial statements is the valuation of investments.

The Fund accounts for

its investments in accordance with U.S. GAAP, and fair values its investment portfolio in accordance with the provisions of the FASB ASC

Topic 820, Fair Value Measurements and Disclosures, which defines fair value, establishes a framework for measuring fair value

and requires enhanced disclosures about fair value measurements. Investments are reflected in the consolidated financial statements at

fair value. Fair value is the estimated amount that would be received to sell an asset, or paid to transfer a liability, in an orderly

transaction between market participants at the measurement date (i.e., the exit price).

Pursuant to Rule 2a-5

under the 1940 Act adopted by the SEC in December 2020 (“Rule 2a-5”), the Board has elected to designate the Adviser

as “valuation designee” to perform fair value determinations, subject to Board oversight and certain other conditions. In

the absence of readily available market quotations, as defined by Rule 2a-5, the Adviser determines the fair value of the Fund’s

investments in accordance with its written valuation policy approved by the Board. There is no single method for determining fair value

in good faith. As a result, determining fair value requires judgment be applied to the specific facts and circumstances of each portfolio

investment while employing a consistently applied valuation process for the types of investments held by the Fund. Due to the uncertainty

of valuation, this estimate may differ significantly from the value that would have been used had a ready market for the investments existed,

and the differences could be material.

The Adviser determines

fair value based on assumptions that market participants would use in pricing an asset or liability in an orderly transaction at the measurement

date. When considering market participant assumptions in fair value measurements, the following fair value hierarchy prioritizes and ranks

the level of market price observability used in measuring investments:

| ● | Level I – Unadjusted quoted prices in active markets for identical assets or liabilities

that the Fund is able to access as of the reporting date. |

| ● | Level II – Inputs, other than quoted prices included in Level I, that are observable either

directly or indirectly as of the reporting date. These inputs may include (a) quoted prices for similar assets in active markets,

(b) quoted prices for identical or similar assets in markets that are not active, (c) inputs other than quoted prices that are

observable for the asset, or (d) inputs derived principally from or corroborated by observable market data by correlation or other

means. |

| ● | Level III – Pricing inputs are unobservable for the investment and little, if any, active

market exists as of the reporting date. Fair value inputs require significant judgment or estimation from the Adviser. |

In certain cases, inputs

used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the determination of which category

within the fair value hierarchy is appropriate for any given investment is based on the lowest level of input significant to that fair

value measurement. The assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment

and consideration of factors specific to the investment.

Market price observability

is impacted by a number of factors, including the type of investment, the characteristics specific to the investment and the state of

the marketplace (including the existence and transparency of transactions between market participants). Investments with readily available

actively quoted prices, or for which fair value can be measured from actively quoted prices in an orderly market, will generally have

a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Investments for which

observable, quoted prices in active markets do not exist are reported at fair value based on Level III inputs. The amount determined to

be fair value may incorporate the Adviser’s own assumptions (including assumptions the Adviser believes market participants would

use in valuing investments and assumptions relating to appropriate risk adjustments for nonperformance and lack of marketability), as

provided

Eagle Point Enhanced Income Trust &

Subsidiaries

Notes to Consolidated Financial

Statements

March 31, 2025

(Unaudited)

for in the Adviser’s valuation policy.

An estimate of fair

value is made for each investment at least monthly taking into account information available as of the reporting date.

See Note 3 “Investments”

for further discussion relating to the Fund’s investments.

Forward Currency

Contracts

The Fund may enter

into forward currency contracts to manage the Fund’s exposure to foreign currencies in which some of the Fund’s

investments are denominated. A forward currency contract is an agreement between the Fund and a counterparty to buy and sell a

currency at an agreed-upon exchange rate and on an agreed-upon future date. Forward currency contracts are recorded at fair value

and the change in fair value is reported as unrealized appreciation (depreciation) on forward currency contracts on the Consolidated

Statement of Assets and Liabilities. The Fund records a realized gain or (loss) on the settlement of a forward currency contract

with such realized gains or (losses) reported on the Consolidated Statement of Operations. Cash amounts pledged for forward currency

contracts are considered restricted.

Investment Income

Recognition

Interest income from

debt securities is recorded using the accrual basis of accounting to the extent such amounts are expected to be collected. Dividend income

from investments in equity securities is recorded on the ex-dividend date. Amortization of premium or accretion of discount is recognized

using the effective interest method.

In certain circumstances,

all or a portion of interest income from a given investment may be paid in the form of additional investment principal, often referred

to as payment-in-kind (“PIK”) interest. PIK interest is included in interest income and interest receivable through the payment

date. The PIK interest rate represents the coupon rate at payment date when PIK interest is received. On the payment date, all or a portion

of interest receivable is capitalized as additional principal in the investment generating the PIK interest or in a related investment.

To the extent the Fund does not believe it will be able to collect PIK interest, the investment will be placed on non-accrual status,

and previously recorded PIK interest income will be reversed. For the six months ended March 31, 2025, the Fund recorded $71,720

in PIK interest income, which is included in the Consolidated Statement of Operations.

Collateralized Fund

Obligations (“CFO”) equity, Collateralized Loan Obligation (“CLO”) equity and certain other investments recognize

investment income on an accrual basis applying an effective interest methodology based upon an effective yield to maturity utilizing projected

cash flows, in accordance with ASC Topic 325-40, Beneficial Interests in Securitized Financial Assets. Under the effective interest

method, any difference between cash distributed and the amount calculated pursuant to the effective interest method is recorded as an

adjustment to the cost basis of the investment. It is the Adviser’s policy to update the effective yield for each CLO equity position

held within the Fund’s portfolio at the initiation of each investment and each subsequent quarter thereafter. It is the Adviser’s

policy to review the effective yield for each CFO equity and certain other investment positions at each measurement date and update periodically

based on the facts and circumstances known to the Adviser.

Other Income

Other income includes

the Fund’s share of income under the terms of fee rebate agreements and commitment fee income relating to securities with a delayed

draw or revolving credit feature.

Interest Expense

Interest expense includes

the Fund’s distributions associated with the Fund’s Series A Term Preferred Shares due 2029 (the “Preferred Shares”)

and interest amounts due under the Revolving Credit Facility (as defined in Note 9 “Revolving Credit Facility”) in relation

to outstanding borrowings, unused commitment fees and amortization of deferred financing and issuance costs associated with borrowings.

Eagle Point Enhanced Income Trust &

Subsidiaries

Notes to Consolidated Financial

Statements

March 31, 2025

(Unaudited)

The following table

summarizes the components of interest expense for the six months ended March 31, 2025:

| | |

Preferred

Shares | | |

Revolving

Credit

Facility | | |

Total | |

| Distributions declared and

paid | |

$ | 563,966 | | |

$ | - | | |

$ | 563,966 | |

| Distributions accrued and unpaid | |

| 278,067 | | |

| - | | |

| 278,067 | |

| Interest expense on revolving credit facility | |

| - | | |

| 134,001 | | |

| 134,001 | |

| Amortization of deferred

financing and issuance costs | |

| 77,430 | | |

| 64,625 | | |

| 142,055 | |

| Total interest

expense | |

$ | 919,463 | | |

$ | 198,626 | | |

$ | 1,118,089 | |

Please refer to Note

9 “Revolving Credit Facility” and Note 10 “Mandatorily Redeemable Preferred Shares” for further discussion relating

to the interest expense due under the Revolving Credit Facility and the Preferred Shares, respectively.

Deferred

Financing and Issuance Costs

Deferred financing and

issuance costs consist of fees and expenses incurred in connection with the Revolving Credit Facility and the issuance of Preferred Shares.

The deferred financing and issuance costs are capitalized at the time of payment and amortized over the respective terms of the Preferred

Shares and Revolving Credit Facility on a straight-line basis, which approximates the effective interest method. Amortization of deferred

financing and issuance costs is recorded as an interest expense on the Revolving Credit Facility and the Preferred Shares, respectively,

on the Consolidated Statement of Operations.

Securities Transactions

The Fund records the

purchase and sale of securities on the trade date. Realized gains and losses on investments sold are recorded on the basis of the specific

identification method.

Cash and Cash Equivalents

The Fund defines cash

and cash equivalents as cash and short-term, highly liquid investments with original maturities of three months or less from the date

of purchase. The Fund maintains its cash in bank accounts, which, at times, may exceed federal insured limits. The Adviser monitors the

performance of the financial institution where the accounts are held in order to manage any risk associated with such accounts.

Prepaid Expenses

Prepaid expenses consist

primarily of insurance premiums and state registration fees. Insurance premiums are amortized over the term of the current policy. State

registration fees are amortized over twelve months from the time of payment.

Restricted Cash

Restricted cash is subject

to a legal or contractual restriction by third parties as well as a restriction as to withdrawal or use, including restrictions that require

the funds to be used for a specified purpose and restrictions that limit the purpose for which the funds can be used. The Fund considers

cash collateral posted with counterparties for foreign currency contracts to be restricted cash. As of March 31, 2025, the Fund held