.2

_0 1 TM Q3 2025 Earnings Call November 14, 2025 T1 Energy _ Q3 2025 Earnings Call Building America’s Solar Supply Chains Pictured: Nextpower Founder and CEO, Dan Shugar, and T1 CEO and Chairman of the Board, Dan Barcelo at G1_Dallas

_0 2 TM T1 Energy _ Q3 2025 Earnings Call Important Notices Forward Looking Statements This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . All statements, other than statements of present or historical facts included in this presentation, including, without limitation, with respect to T1 Energy Inc.'s ("T1") strategy of developing a U.S. silicon - based solar supply chain, supporting AI power demand, reshoring American PV solar manufacturing and T1’s ability to enhance U.S. energy security through integrated domestic supply chains and AI integration; T1's ability t o b e well - positioned to help customers meet domestic content bonus qualification thresholds; the projected demand for energy to power AI in the U.S. and the role solar power may play in filling the demand; the policy and r egu latory developments, that may impact T1’s operation and financial performance and the solar industry; T1’s ability to build commercial traction with U.S. customers; T1’s ability to deliver to U.S. customers reli abl e, low - cost energy solutions; T1's project financing and development and construction of G2_Austin and related timeline; T1’s financial and operating performance and guidance, including the expectation on productio n a nd sales run rates; T1’s commercial presence and ability to grow its U.S. customer base and enter into at least one offtake agreement before year - end 2025; T1’s ability to repurpose and generate value from European p ortfolio optimization; T1’s ability to meet its production plan and pursue strategic partnerships, and the expected benefits of the agreements with Talon PV LLC, Nextpower and Hemlock/Corning; T1's ability to s our ce non - FEOC international solar cells; the expected benefits to T1 and its customers on the expanded supply agreement with Corning, as well as the expected ability to support a total of nearly 3,000 American jobs bet ween the companies’ U.S. facilities; T1’s capital formation opportunities; the ramp up of production and revenues at G1_Dallas; T1’s ability to maintain 45X eligibility T1’s ability to meet its strategic priorities on 45X eligibility, satisfy de - FEOCing criteria within the given deadlines under the Public Law 119 - 21 (commonly known as the One Big Beautiful Bill Act) as enacted on July 4, 2025 (the “OBBB”), align the Trina relationship with th e OBBB tax credit eligibility criteria; T1’s liquidity profile and monetization of Section 45X PTCs; expand its integrated American supply chain and its cash flow, are forward - looking statements. These forward - looking statements involve significant risks and uncertainties that could cause the actual results to differ mater ially from the expected results. Most of these factors that could impact T1's results are outside T1’s control and are difficult to predict. Additional information about factors that could materially affect T1 is set forth und er the “Risk Factors” section in (i) T1's Annual Report on Form 10 - K for the year ended December 31, 2024 filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 31, 2025, as amended and supplemented by Am endment No. 1 on Form 10 - K/A filed with the SEC on April 30, 2025, (ii) T1’s Quarterly Report on Form 10 - Q for the quarterly period ended March 31, 2025 filed with the SEC on May 15, 2025, as amended and s upplemented by Amendment No. 1 on Form 10 - Q/A filed with the SEC on August 18, 2025, (iii) T1's Quarterly Report on Form 10 - Q for the period ended June 30, 2025, filed with the SEC on August 19, 2025, (iv) T 1’s Post - Effective Amendment No. 1 to the Registration Statement on Form S - 3 filed with the SEC on January 4, 2024, (v) T1’s Registration Statement on Form S - 4 filed with the SEC on September 8, 2023 and subsequent amend ments thereto filed on October 13, 2023, October 19, 2023 and October 31, 2023, and (vi) T1’s Registration Statement on Form S - 3 filed with the SEC on September 23, 2025, each of which are available on the SEC’s website at www.sec.gov. Except as otherwise required by applicable law, T1 disclaims any duty to update any forward - looking statements, all of which are expressly qualified by the statements in this section, to reflec t events or circumstances after the date of this presentation. Should any underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward - looking statements. T1 intends to use its website as a channel of distribution to disclose information which may be of interest or material to in ves tors and to communicate with investors and the public. Such disclosures will be included on T1’s website in the ‘Investor Relations’ section. T1, and its CEO and Chairman of the Board, Daniel Barcelo, also intend to u se certain social media channels, including, but not limited to, X, LinkedIn and Instagram, as means of communicating with the public and investors about T1, its progress, products, and other matters. While not all the i nfo rmation that T1 or Daniel Barcelo post to their respective digital platforms may be deemed to be of a material nature, some information may be. As a result, T1 encourages investors and others interested to review the in formation that it and Daniel Barcelo posts and to monitor such portions of T1’s website and social media channels on a regular basis, in addition to following T1’s press releases, SEC filings, and public conference ca lls and webcasts. The contents of T1’s website and its and Daniel Barcelo’s social media channels shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

_0 3 TM Participants and Agenda T1 Energy _ Q3 2025 Earnings Call Daniel Barcelo Chairman of the Board and Chief Executive Officer Evan Calio Chief Financial Officer ▪ T1 investment themes ▪ Business updates ▪ Concluding remarks ▪ 2025 operating and financial guidance unchanged ▪ Financial summary ▪ Proforma T1 capitalization table ▪ G2_Austin overview and update Prepared Remarks Q&A J eff Spittel EVP, Investor Relations and Corporate Development Otto Erster Bergesen SVP, Project Development Jaim e Gualy Chief Operating Officer

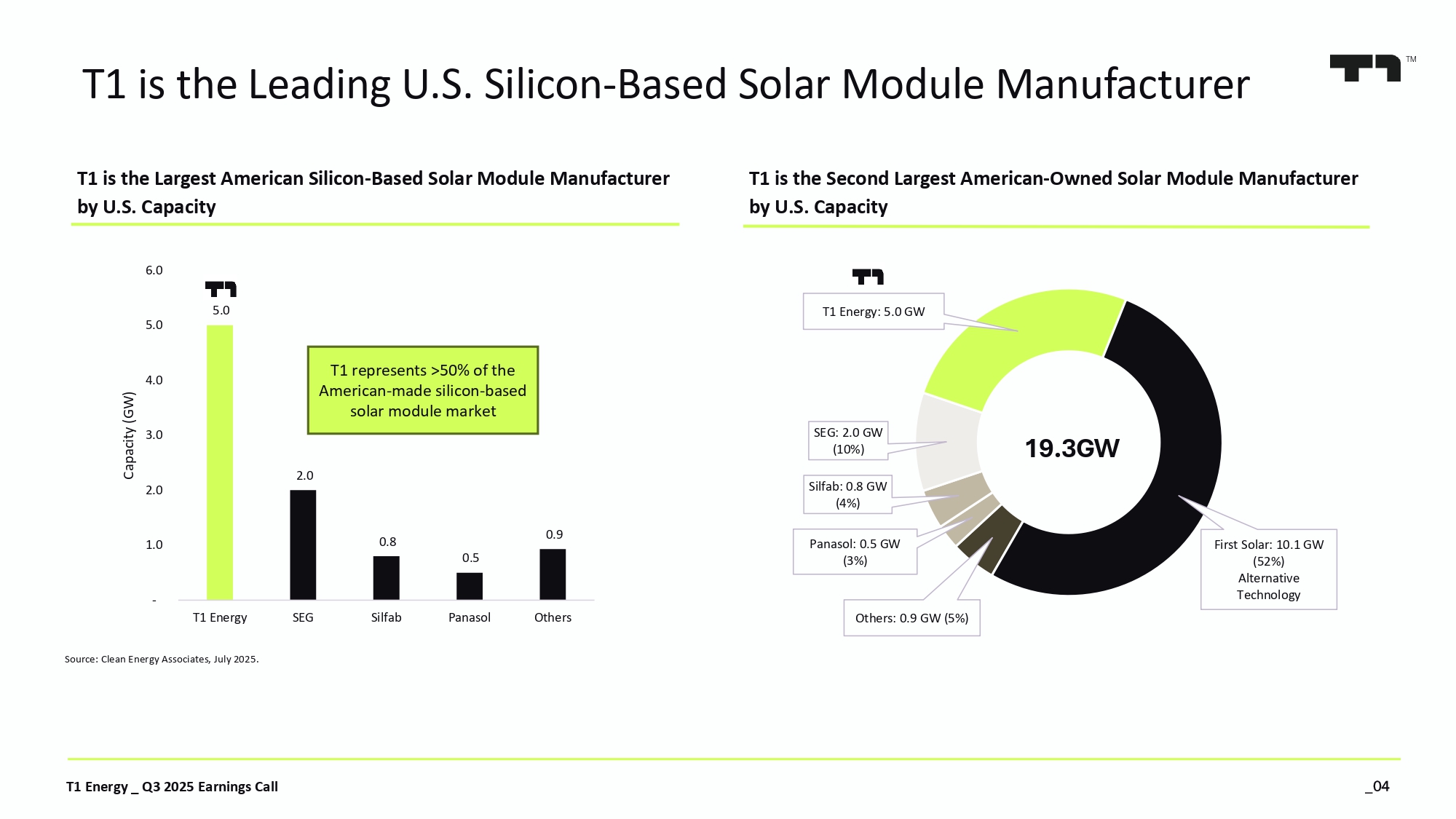

_0 4 TM T1 Energy _ Q3 2025 Earnings Call T1 is the Leading U.S. Silicon - Based Solar Module Manufacturer 5.0 2.0 0.8 0.5 0.9 - 1.0 2.0 3.0 4.0 5.0 6.0 T1 Energy SEG Silfab Panasol Others Capacity (GW) Others : 0.9 GW ( 5% ) Panasol : 0.5 GW ( 3% ) Silfab : 0.8 GW ( 4% ) SEG : 2.0 GW ( 10% ) T1 Energy : 5.0 GW First Solar : 10.1 GW ( 52% ) Alternative Technology T1 is the Largest American Silicon - Based Solar Module Manufacturer by U.S. Capacity T1 is the Second Largest American - Owned Solar Module Manufacturer by U.S. Capacity T1 represents >50% of the American - made silicon - based solar module market 19.3GW Source: Clean Energy Associates, July 2025.

_0 5 TM T1 Energy _ Q3 2025 Earnings Call T1 Investment Themes T1 is building a U.S. silicon - based solar supply chain aligned with emerging macro trends ▪ AI and data center development underpin projections for soaring U.S. electricity demand growth ▪ U.S. data centers are expected to consume more than 600 TWh of electricity by 2030, approximately the amount of electricity generated by the entire U.S. coal fleet last year 1 ▪ The digital infrastructure supporting AI is growing dramatically more complex and electricity intensive, placing stress on aging U.S. power assets ▪ By 2027, AI server racks are expected to require 50x more power than cloud equivalents from 2020 2 Supporting AI Power Demand Reshoring Advanced Manufacturing Enhancing U.S. Energy Security ▪ T1 is focused on bringing back American PV solar manufacturing based on domestic content and leading - edge technologies ▪ T1 expects to be well - positioned to help customers meet domestic content bonus qualification thresholds ▪ T1’s current and planned investments at G1_Dallas and G2_Austin are expected to support ~3,000 American jobs ▪ Expanding strategic partnership network with Hemlock/Corning, Nextpower, and Talon PV to establish a U.S. PV solar supply chain ▪ Establishing the power infrastructure to support AI aligns with U.S. strategic and economic interests ▪ T1 is developing an integrated U.S. polysilicon - based solar supply chain to provide America with reliable, low - cost energy ▪ Domestic polysilicon solar supply chain has potential to strengthen semiconductor production through shared materials and manufacturing processes 1. IEA, EIA, McKinsey & Co. 2. Goldman Sachs: Powering the AI Era

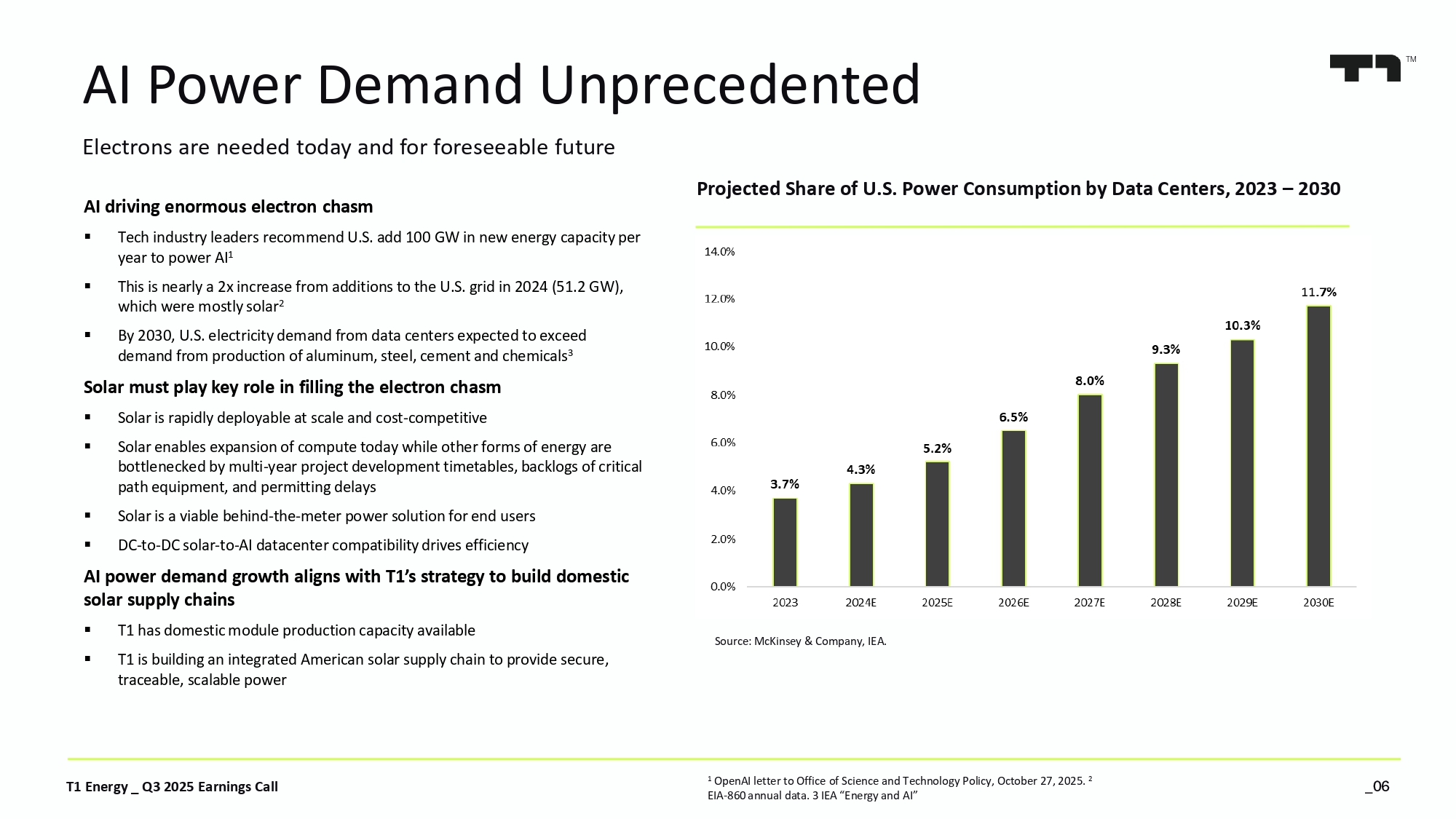

_0 6 TM T1 Energy _ Q3 2025 Earnings Call AI Power Demand Unprecedented Electrons are needed today and for foreseeable future AI driving enormous electron chasm ▪ Tech industry leaders recommend U.S. add 100 GW in new energy capacity per year to power AI 1 ▪ This is nearly a 2x increase from additions to the U.S. grid in 2024 (51.2 GW), which were mostly solar 2 ▪ By 2030, U.S. electricity demand from data centers expected to exceed demand from production of aluminum, steel, cement and chemicals 3 Solar must play key role in filling the electron chasm ▪ Solar is rapidly deployable at scale and cost - competitive ▪ Solar enables expansion of compute today while other forms of energy are bottlenecked by multi - year project development timetables, backlogs of critical path equipment, and permitting delays ▪ Solar is a viable behind - the - meter power solution for end users ▪ DC - to - DC solar - to - AI datacenter compatibility drives efficiency AI power demand growth aligns with T1’s strategy to build domestic solar supply chains ▪ T1 has domestic module production capacity available ▪ T1 is building an integrated American solar supply chain to provide secure, traceable, scalable power 1 OpenAI letter to Office of Science and Technology Policy, October 27, 2025. 2 EIA - 860 annual data. 3 IEA “Energy and AI” Projected Share of U.S. Power Consumption by Data Centers, 2023 – 2030 Source: McKinsey & Company, IEA.

_0 7 TM T1 Energy _ Q3 2025 Earnings Call Business Update T1 is building the foundation of America’s polysilicon solar supply chain Capital formation progress unlocks initial G2_Austin development ▪ Registered direct equity and convertible preferred proceeds to trigger Q4 2025 start of Phase 1 construction at G2 ▪ T1 is advancing debt and junior capital formation processes and commercial discussions to fund remaining portion of estimated $4 00 - $425 million Phase 1 capex Building T1’s domestic supply chain through expanding U.S. strategic partner network ▪ T1 has made a strategic investment in Talon PV LLC to complement G2_Austin U.S. solar cell fab ▪ Signed framework agreement with Nextpower for supply of American made steel frames ▪ Expanded supply agreement with Hemlock/Corning for U.S. polysilicon/wafers Positioning T1 to benefit from policy environment ▪ T1 is executing key workstreams to ensure eligibility for Section 45X tax credits in 2026 and beyond ▪ Strategic focus on advanced American manufacturing and building critical domestic energy supply chains aligns with policy bac kdr op Ramping at G1_Austin in Q4 2025 ▪ Expect to achieve highest year - to - date production and sales run rates at G1_Austin in fourth quarter ▪ Underpins unchanged 2025 EBITDA guidance of $25 - $50 million Advancing European Portfolio Optimization ▪ T1 is executing plan to generate value from meaningful legacy investments in facilities and infrastructure in the Nordic regi on

_0 8 TM T1 Energy _ Q3 2025 Earnings Call G2_Austin Update Detailed design and partner selection complete; T1 moving forward with the 2.1 GW first phase of its planned U.S. solar cell fab G2_Austin Virtual Design Renderings Measure Twice … ▪ G2_Austin iterates on proven designs of Trina’s 5 GW Huai’an and 1 GW Indonesia solar cell fabs ▪ Working with experienced combination of Yates (General Contractor) and SSOE (Engineering) ▪ Selection of Laplace Renewable Energy Technology for production line equipment brings in partner that has deployed >400 GW of equipment for TOPCon fabs globally and has deep R&D experience ▪ G2 design is approaching 60% completion milestone in Q4 2026 … Cut Once ▪ As disclosed previously, T1 is pursuing two phase development of state - of - the - art solar cell fab G2_Austin with the first 2.1 GW phase scheduled to begin construction in Q4 2025 & first production by year - end 2026 ▪ Estimated Phase 1 capital expenditure of $400 - $425 million ▪ Phase 2 expected 3.2 GW of capacity; capacity flexible and can be configured for additional Phase 3 to match demand Capital Formation Update ▪ October offerings raised $122 million of gross proceeds expected to trigger start of construction ▪ Engaged with potential debt investors, T1’s G1_Dallas lenders on traditional project financing ▪ Evaluating additional debt capital markets solutions to accelerate financing

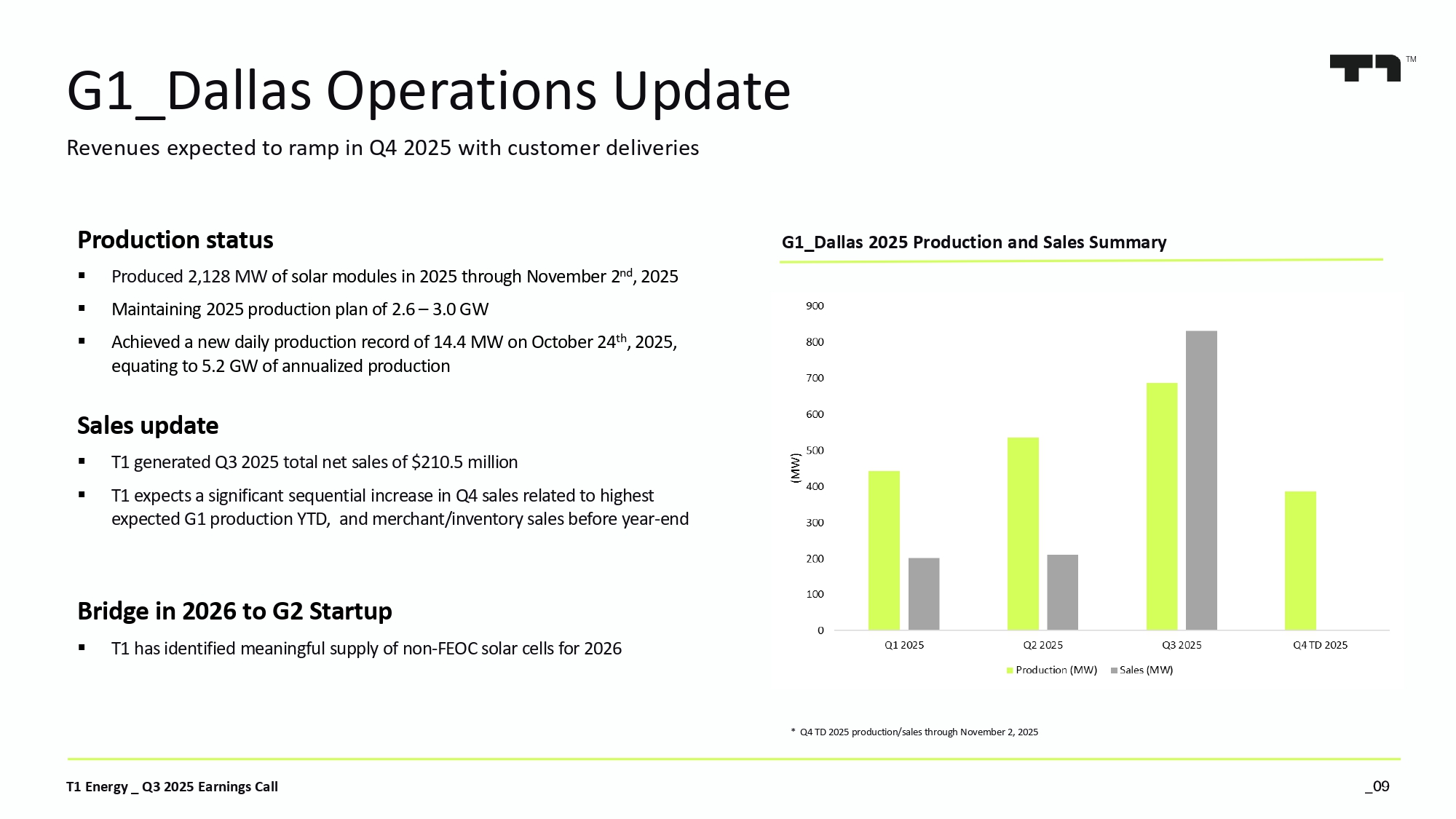

_0 9 TM T1 Energy _ Q3 2025 Earnings Call G1_Dallas Operations Update Revenues expected to ramp in Q4 2025 with customer deliveries Production status ▪ Produced 2,128 MW of solar modules in 2025 through November 2 nd , 2025 ▪ Maintaining 2025 production plan of 2.6 – 3.0 GW ▪ Achieved a new daily production record of 14.4 MW on October 24 th , 2025, equating to 5.2 GW of annualized production Sales update ▪ T1 generated Q3 2025 total net sales of $210.5 million ▪ T1 expects a significant sequential increase in Q4 sales related to highest expected G1 production YTD, and merchant/inventory sales before year - end Bridge in 2026 to G2 Startup ▪ T1 has identified meaningful supply of non - FEOC solar cells for 2026 * Q4 TD 2025 production/sales through November 2, 2025 G1_Dallas 2025 Production and Sales Summary

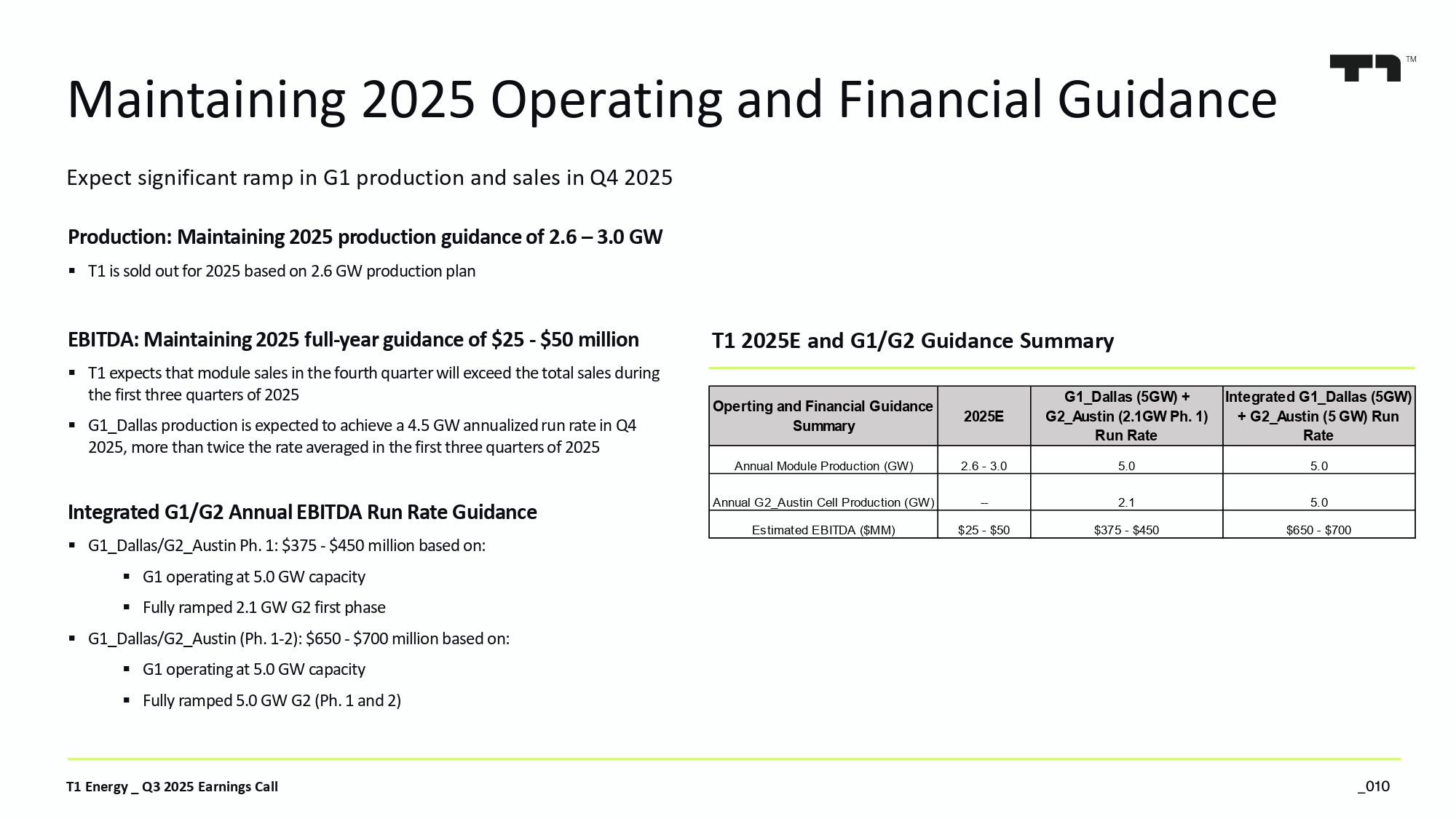

_0 10 TM T1 Energy _ Q3 2025 Earnings Call Expect significant ramp in G1 production and sales in Q4 2025 Maintaining 2025 Operating and Financial Guidance Production: Maintaining 2025 production guidance of 2.6 – 3.0 GW ▪ T1 is sold out for 2025 based on 2.6 GW production plan EBITDA: Maintaining 2025 full - year guidance of $25 - $50 million ▪ T1 expects that module sales in the fourth quarter will exceed the total sales during the first three quarters of 2025 ▪ G1_Dallas production is expected to achieve a 4.5 GW annualized run rate in Q4 2025, more than twice the rate averaged in the first three quarters of 2025 Integrated G1/G2 Annual EBITDA Run Rate Guidance ▪ G1_Dallas/G2_Austin Ph. 1: $375 - $450 million based on: ▪ G1 operating at 5.0 GW capacity ▪ Fully ramped 2.1 GW G2 first phase ▪ G1_Dallas/G2_Austin (Ph. 1 - 2): $650 - $700 million based on: ▪ G1 operating at 5.0 GW capacity ▪ Fully ramped 5.0 GW G2 (Ph. 1 and 2) T1 2025E and G1/G2 Guidance Summary Operting and Financial Guidance Summary 2025E G1_Dallas (5GW) + G2_Austin (2.1GW Ph. 1) Run Rate Integrated G1_Dallas (5GW) + G2_Austin (5 GW) Run Rate Annual Module Production (GW) 2.6 - 3.0 5.0 5.0 Annual G2_Austin Cell Production (GW) -- 2.1 5.0 Estimated EBITDA ($MM) $25 - $50 $375 - $450 $650 - $700

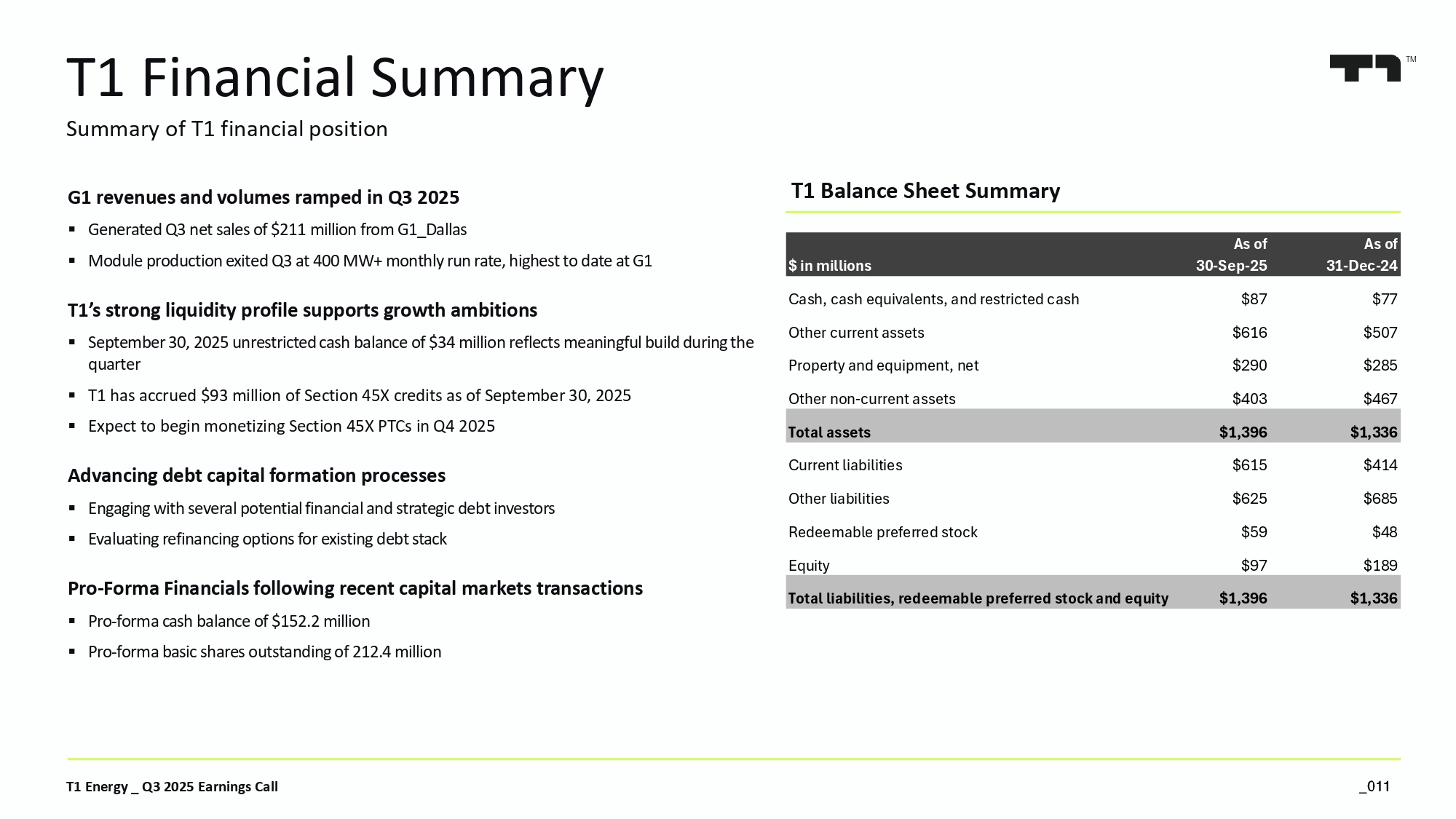

_0 11 TM T1 Energy _ Q3 2025 Earnings Call Summary of T1 financial position T1 Financial Summary G1 revenues and volumes ramped in Q3 2025 ▪ Generated Q3 net sales of $211 million from G1_Dallas ▪ Module production exited Q3 at 400 MW+ monthly run rate, highest to date at G1 T1’s strong liquidity profile supports growth ambitions ▪ September 30, 2025 unrestricted cash balance of $34 million reflects meaningful build during the quarter ▪ T1 has accrued $93 million of Section 45X credits as of September 30, 2025 ▪ Expect to begin monetizing Section 45X PTCs in Q4 2025 Advancing debt capital formation processes ▪ Engaging with several potential financial and strategic debt investors ▪ Evaluating refinancing options for existing debt stack Pro - Forma Financials following recent capital markets transactions ▪ Pro - forma cash balance of $152.2 million ▪ Pro - forma basic shares outstanding of 212.4 million T1 Balance Sheet Summary As of As of $ in millions 30-Sep-25 31-Dec-24 Cash, cash equivalents, and restricted cash $87 $77 Other current assets $616 $507 Property and equipment, net $290 $285 Other non-current assets $403 $467 Total assets $1,396 $1,336 Current liabilities $615 $414 Other liabilities $625 $685 Redeemable preferred stock $59 $48 Equity $97 $189 Total liabilities, redeemable preferred stock and equity$1,396 $1,336

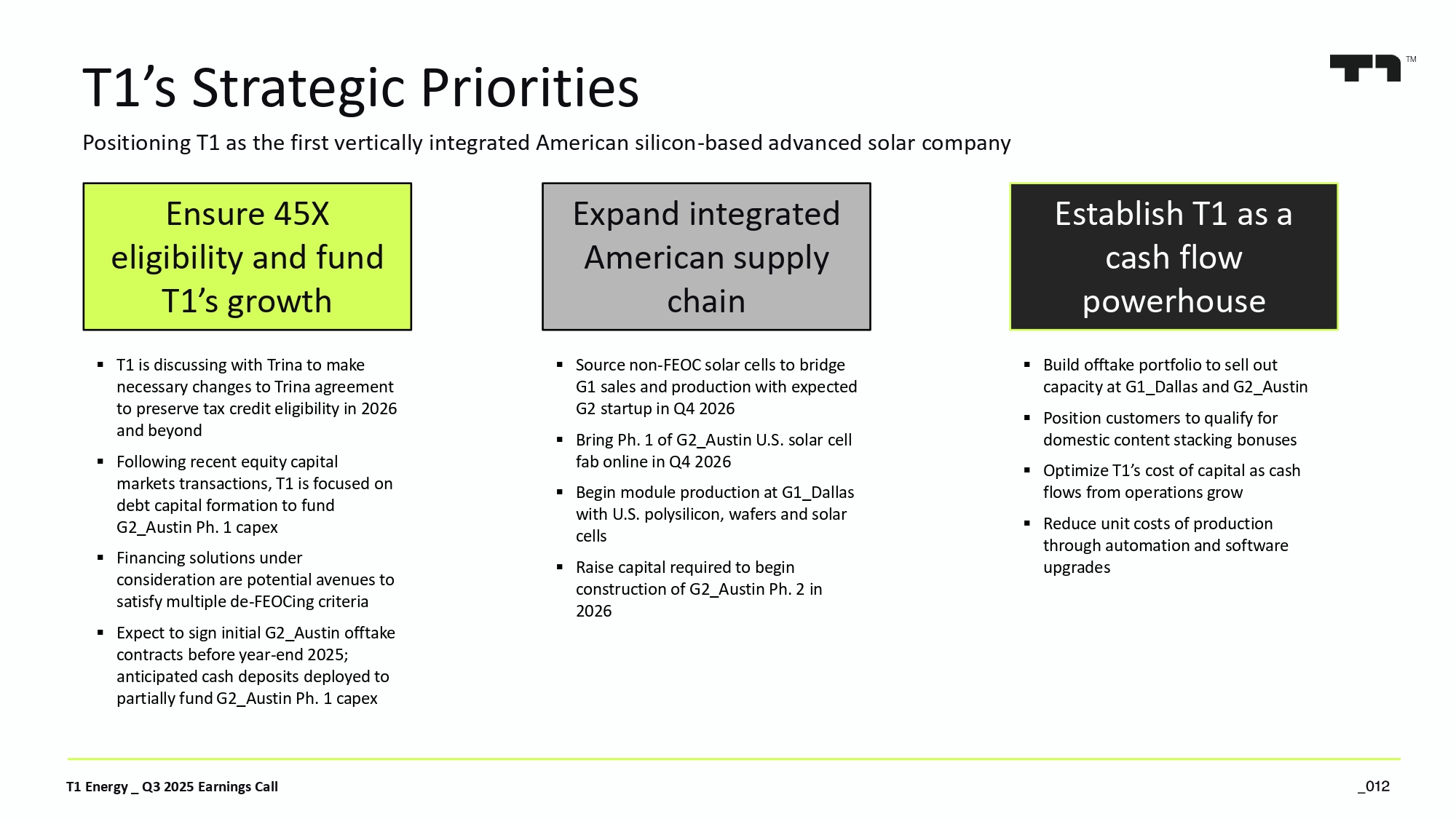

_0 12 TM T1 Energy _ Q3 2025 Earnings Call T1’s Strategic Priorities Positioning T1 as the first vertically integrated American silicon - based advanced solar company ▪ T1 is discussing with Trina to make necessary changes to Trina agreement to preserve tax credit eligibility in 2026 and beyond ▪ Following recent equity capital markets transactions, T1 is focused on debt capital formation to fund G2_Austin Ph. 1 capex ▪ Financing solutions under consideration are potential avenues to satisfy multiple de - FEOCing criteria ▪ Expect to sign initial G2_Austin offtake contracts before year - end 2025; anticipated cash deposits deployed to partially fund G2_Austin Ph. 1 capex Ensure 45X eligibility and fund T1’s growth Expand integrated American supply chain Establish T1 as a cash flow powerhouse ▪ Source non - FEOC solar cells to bridge G1 sales and production with expected G2 startup in Q4 2026 ▪ Bring Ph. 1 of G2_Austin U.S. solar cell fab online in Q4 2026 ▪ Begin module production at G1_Dallas with U.S. polysilicon, wafers and solar cells ▪ Raise capital required to begin construction of G2_Austin Ph. 2 in 2026 ▪ Build offtake portfolio to sell out capacity at G1_Dallas and G2_Austin ▪ Position customers to qualify for domestic content stacking bonuses ▪ Optimize T1’s cost of capital as cash flows from operations grow ▪ Reduce unit costs of production through automation and software upgrades