Third Quarter Earnings Webinar October 30, 2025 8-K Date: October 30, 2025

Forward-Looking Statements 2 Information in this communication, other than statements of historical facts, may constitute forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements about the benefits of the proposed transaction between NorthWestern and Black Hills, including future financial and operating results (including the anticipated impact of the transaction on NorthWestern’s and Black Hills’ respective earnings), statements related to the expected timing of the completion of the transaction, the plans, objectives, expectations and intentions of either company or of the combined company following the merger, anticipated future results of either company or of the combined company following the merger, the anticipated benefits and strategic and financial rationale of the merger, including estimated rate bases, investment opportunities, cash flows and capital expenditure rates and other statements that are not historical facts. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “targets,” “scheduled,” “plans,” “intends,” “goal,” “anticipates,” “expects,” “believes,” “forecasts,” “outlook,” “estimates,” “potential,” or “continue” or negatives of such terms or other comparable terminology. The forward-looking statements are based on NorthWestern and Black Hills’ current expectations, plans and estimates. NorthWestern and Black Hills believe these assumptions to be reasonable, but there is no assurance that they will prove to be accurate. All forward-looking statements are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of NorthWestern or Black Hills to differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others, (1) the risk of delays in consummating the potential transaction, including as a result of required regulatory and shareholder approvals, which may not be obtained on the expected timeline, or at all, (2) the risk of any event, change or other circumstance that could give rise to the termination of the merger agreement, (3) the risk that required regulatory approvals are subject to conditions not anticipated by NorthWestern and Black Hills, (4) the possibility that any of the anticipated benefits and projected synergies of the potential transaction will not be realized or will not be realized within the expected time period, (5) disruption to the parties’ businesses as a result of the announcement and pendency of the transaction, including potential distraction of management from current plans and operations of NorthWestern or Black Hills and the ability of NorthWestern or Black Hills to retain and hire key personnel, (6) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the transaction, (7) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (8) the outcome of any legal or regulatory proceedings that may be instituted against NorthWestern or Black Hills related to the merger agreement or the transaction, (9) the risks associated with third party contracts containing consent and/or other provisions that may be triggered by the proposed transaction, (10) legislative, regulatory, political, market, economic and other conditions, developments and uncertainties affecting NorthWestern’s and Black Hills’ businesses; (11) the evolving legal, regulatory and tax regimes under which NorthWestern and Black Hills operate; (12) restrictions during the pendency of the proposed transaction that may impact NorthWestern’s or Black Hills’ ability to pursue certain business opportunities or strategic transactions; and (13) unpredictability and severity of catastrophic events, including, but not limited to, extreme weather, natural disasters, acts of terrorism or outbreak of war or hostilities, as well as NorthWestern’s and Black Hills’ response to any of the aforementioned factors. Additional factors which could affect future results of NorthWestern and Black Hills can be found in NorthWestern Energy’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and Black Hills’ Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the SEC and available on the SEC’s website at http://www.sec.gov. NorthWestern and Black Hills disclaim any obligation and do not intend to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by federal securities laws. See Appendix for Additional Merger Related Disclosures.

NorthWestern Energy 3 NorthWestern Energy Group, Inc. dba: NorthWestern Energy Ticker: NWE (Nasdaq) www.northwesternenergy.com Corporate Support Office 3010 West 69th Street Sioux Falls, SD 57108 (605) 978-2900 Director - Corporate Development & Investor Relations Officer Travis Meyer 605-978-2967 travis.meyer@northwestern.com

Recent Highlights ✓ Reported GAAP diluted EPS of $0.62 o Non-GAAP diluted EPS of $0.791 ✓ Affirming 2025 earnings guidance range of $3.53 - $3.652 ✓ Integrated Energy West natural gas assets, customers, and employees ✓ Announced Agreement with Black Hills Corporation for an all-stock Merger of Equals • Filed joint applications for transaction approval with regulatory commissions in Montana, Nebraska, and South Dakota ✓ Filed a tariff waiver request with MPSC for recovery of operating costs associated with the Avista Colstrip interest3 ✓ Submitted 131 MW natural gas generation project in the Southwest Power Pool (SPP) expedited resource adequacy study • Approximately $300 million project not included in current five-year capex plan ✓ Dividend Declared: $0.66 per share payable December 31, 2025 to shareholders of record as of December 15, 2025 1.) See slides “Third Quarter 2025 Non-GAAP Earnings” and “Non-GAAP Financial Measures” that follow. 2.) See “2025 Earnings Bridge” slide that follows for additional details and major assumptions included in guidance. 3) See “Colstrip Transaction Overview” slide that follows for additional details.4 Powerhouse at Hauser Dam on the Missouri River (near Helena, Montana) Missoula, Montana

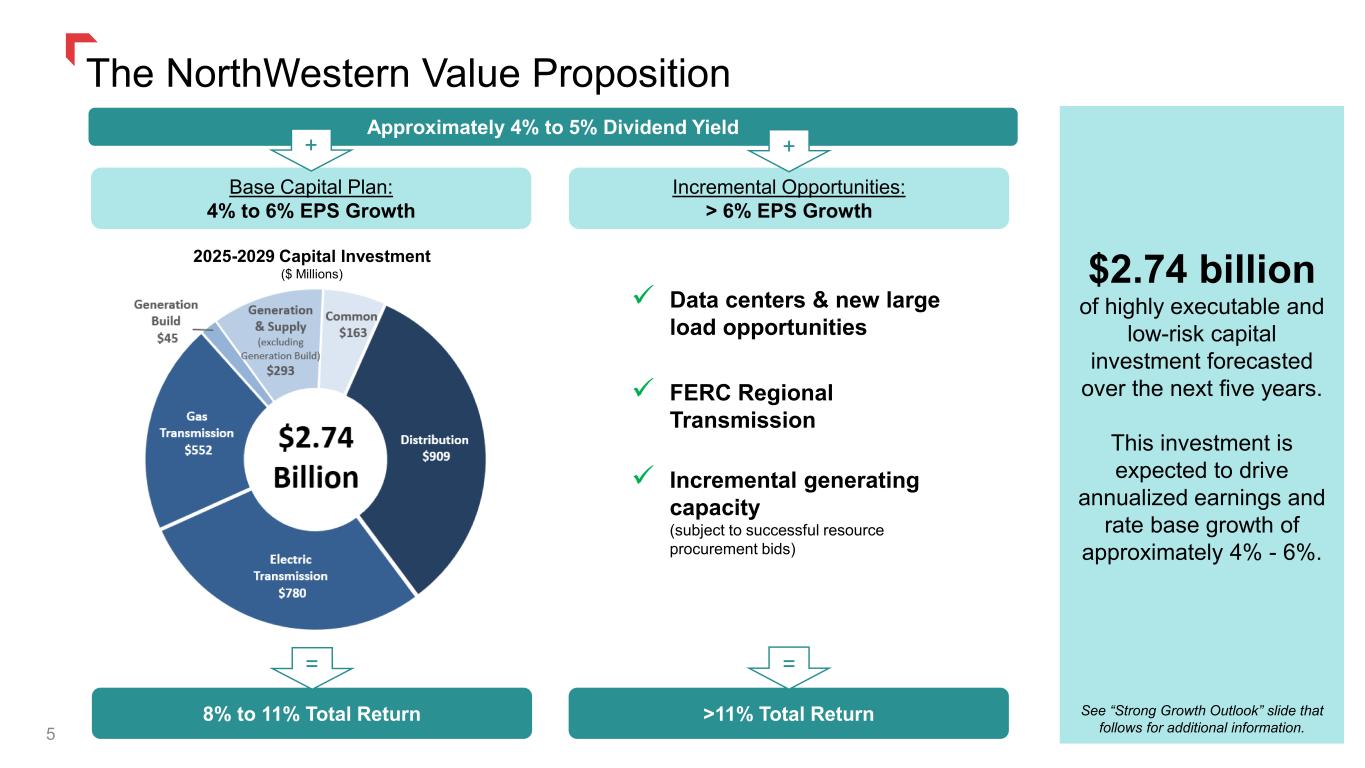

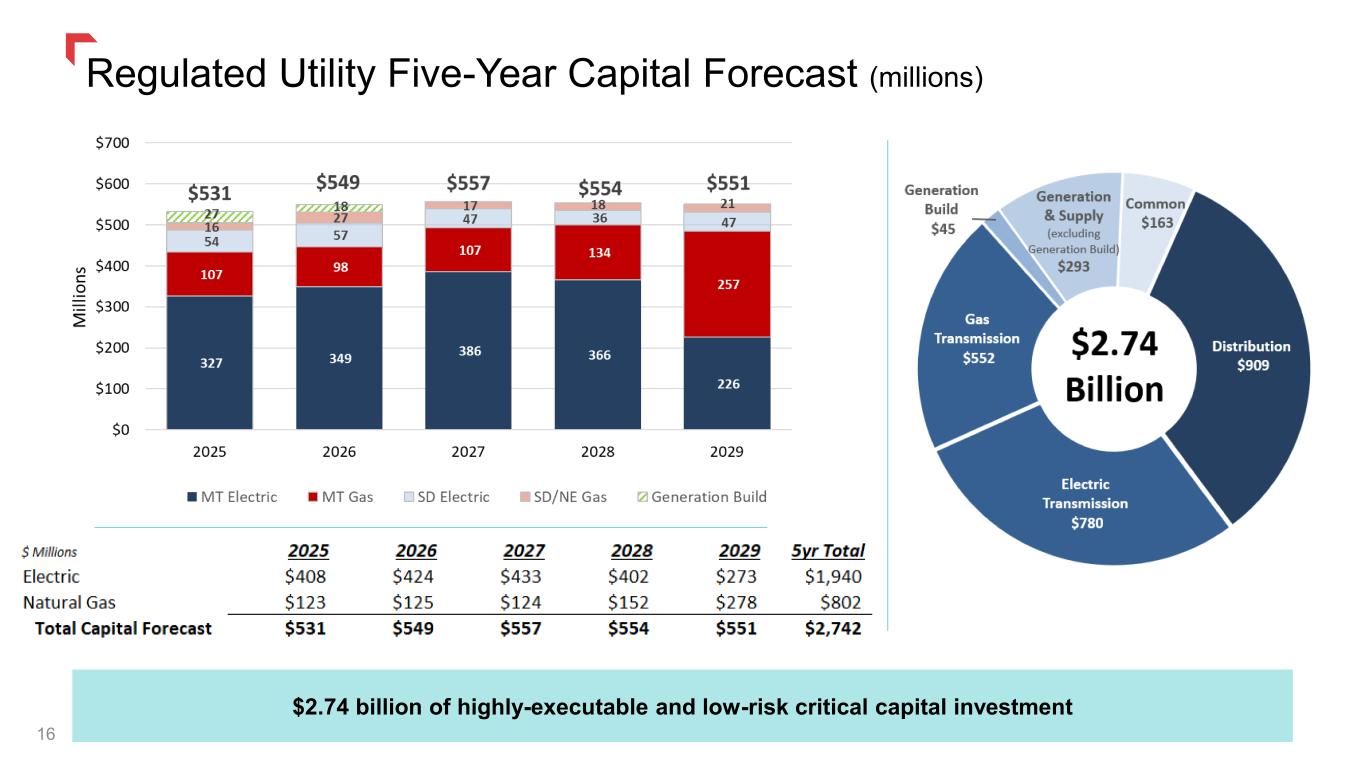

8% to 11% Total Return >11% Total Return Incremental Opportunities: > 6% EPS Growth Approximately 4% to 5% Dividend Yield Base Capital Plan: 4% to 6% EPS Growth ✓ Data centers & new large load opportunities ✓ FERC Regional Transmission ✓ Incremental generating capacity (subject to successful resource procurement bids) $2.74 billion of highly executable and low-risk capital investment forecasted over the next five years. This investment is expected to drive annualized earnings and rate base growth of approximately 4% - 6%. See “Strong Growth Outlook” slide that follows for additional information. + The NorthWestern Value Proposition + 5 = = 2025-2029 Capital Investment ($ Millions)

Thank youThird Quarter Financial Review 6

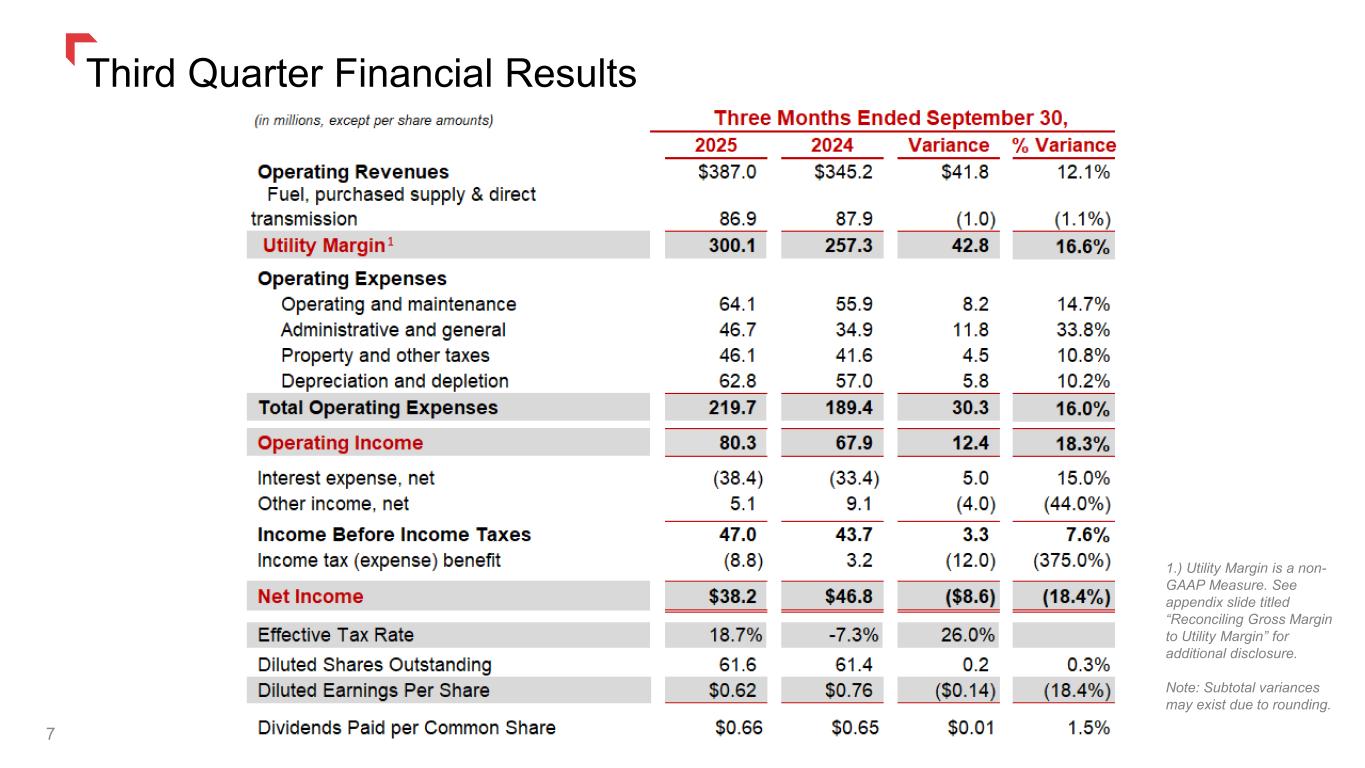

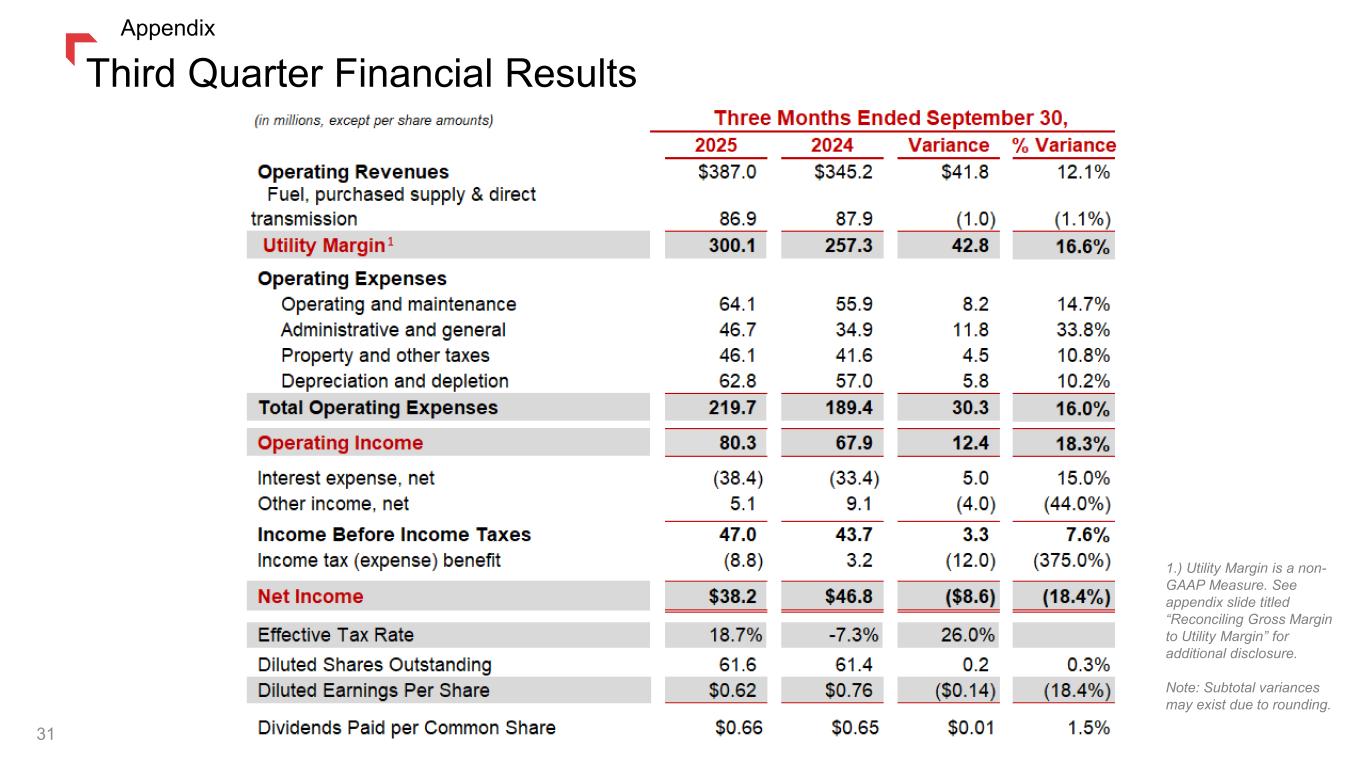

Third Quarter Financial Results 7 1.) Utility Margin is a non- GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. Note: Subtotal variances may exist due to rounding.

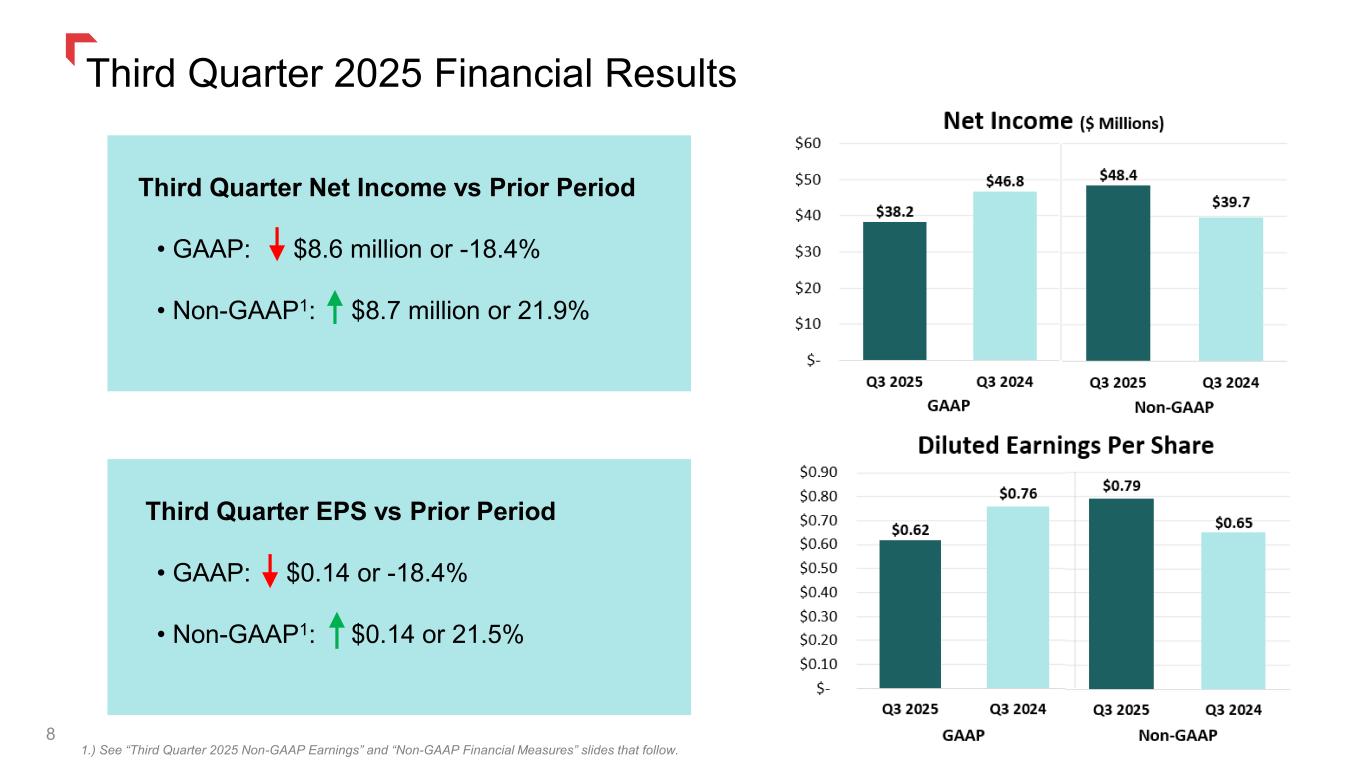

Third Quarter 2025 Financial Results 8 1.) See “Third Quarter 2025 Non-GAAP Earnings” and “Non-GAAP Financial Measures” slides that follow. Third Quarter Net Income vs Prior Period • GAAP: $8.6 million or -18.4% • Non-GAAP1: $8.7 million or 21.9% Third Quarter EPS vs Prior Period • GAAP: $0.14 or -18.4% • Non-GAAP1: $0.14 or 21.5%

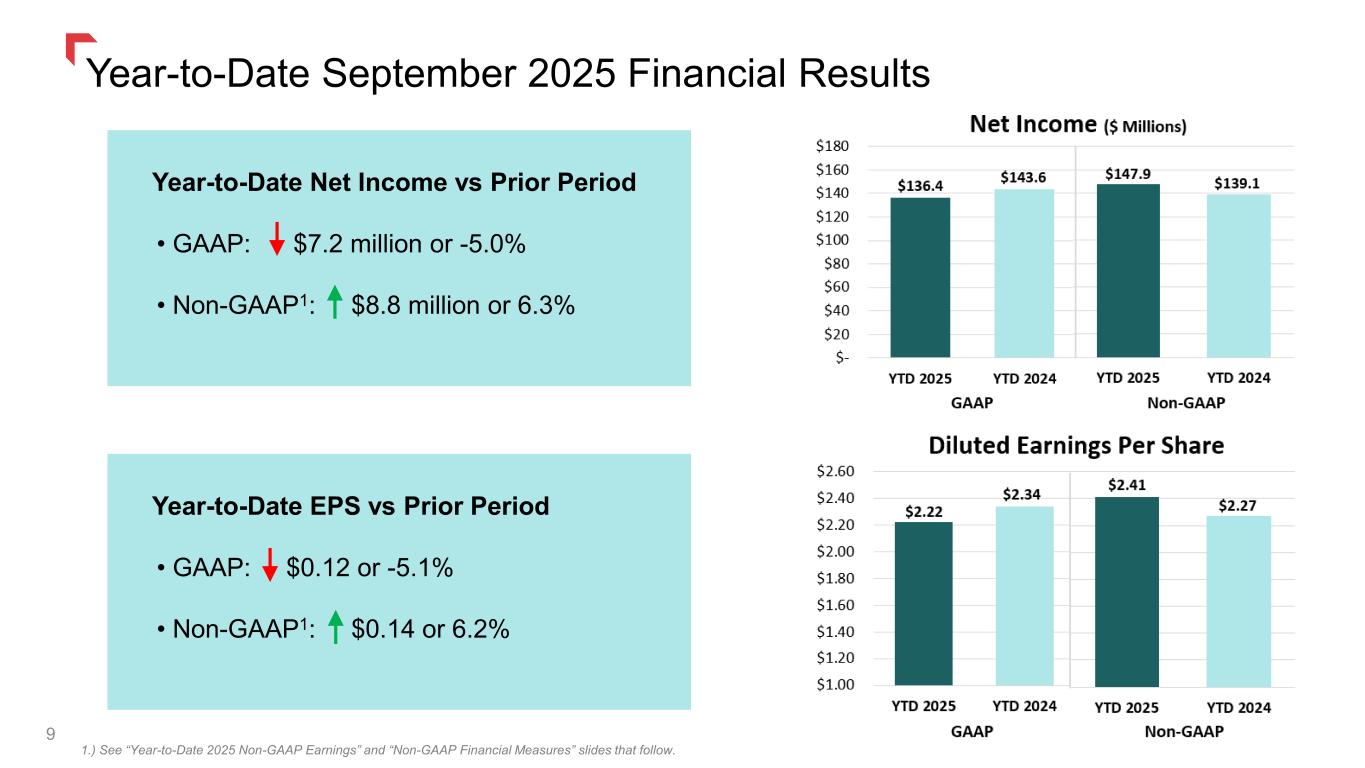

Year-to-Date September 2025 Financial Results 9 1.) See “Year-to-Date 2025 Non-GAAP Earnings” and “Non-GAAP Financial Measures” slides that follow. Year-to-Date Net Income vs Prior Period • GAAP: $7.2 million or -5.0% • Non-GAAP1: $8.8 million or 6.3% Year-to-Date EPS vs Prior Period • GAAP: $0.12 or -5.1% • Non-GAAP1: $0.14 or 6.2%

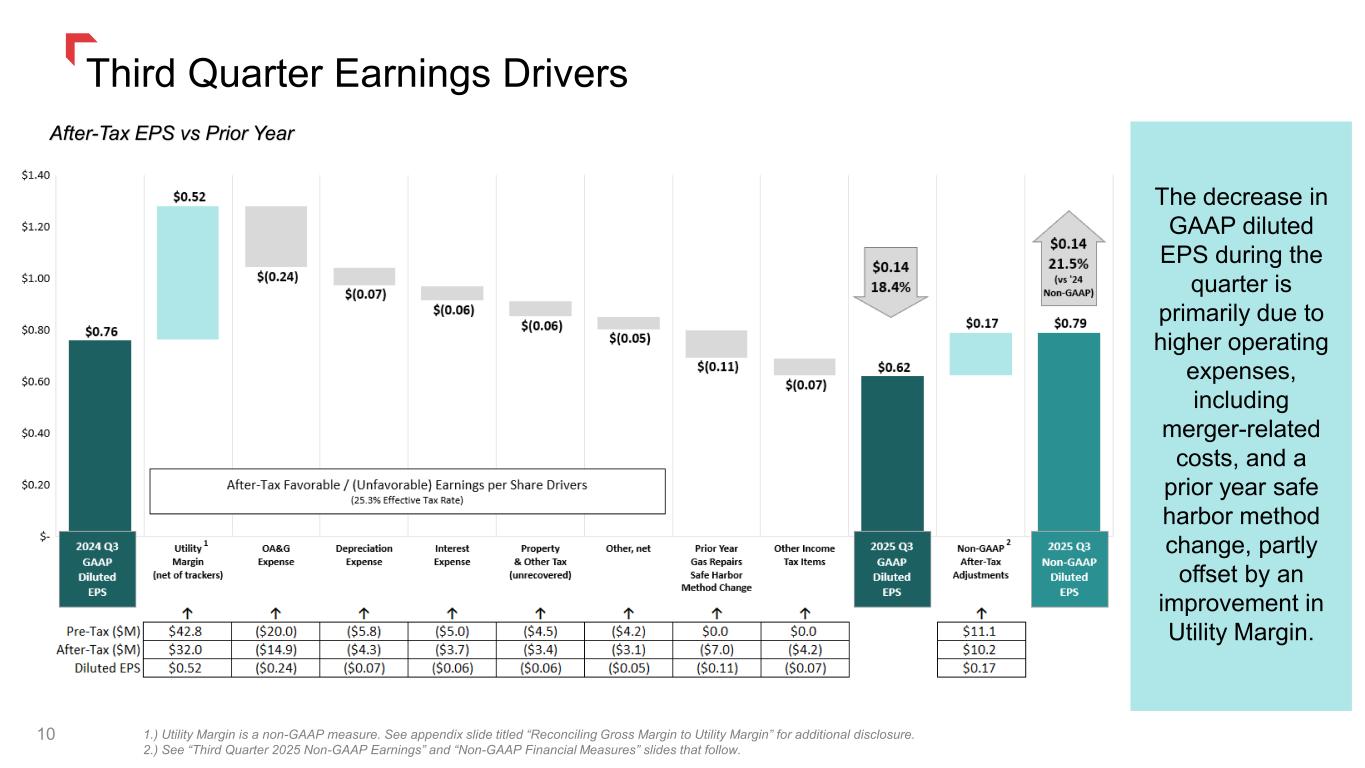

Third Quarter Earnings Drivers 10 The decrease in GAAP diluted EPS during the quarter is primarily due to higher operating expenses, including merger-related costs, and a prior year safe harbor method change, partly offset by an improvement in Utility Margin. After-Tax EPS vs Prior Year 1.) Utility Margin is a non-GAAP measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. 2.) See “Third Quarter 2025 Non-GAAP Earnings” and “Non-GAAP Financial Measures” slides that follow.

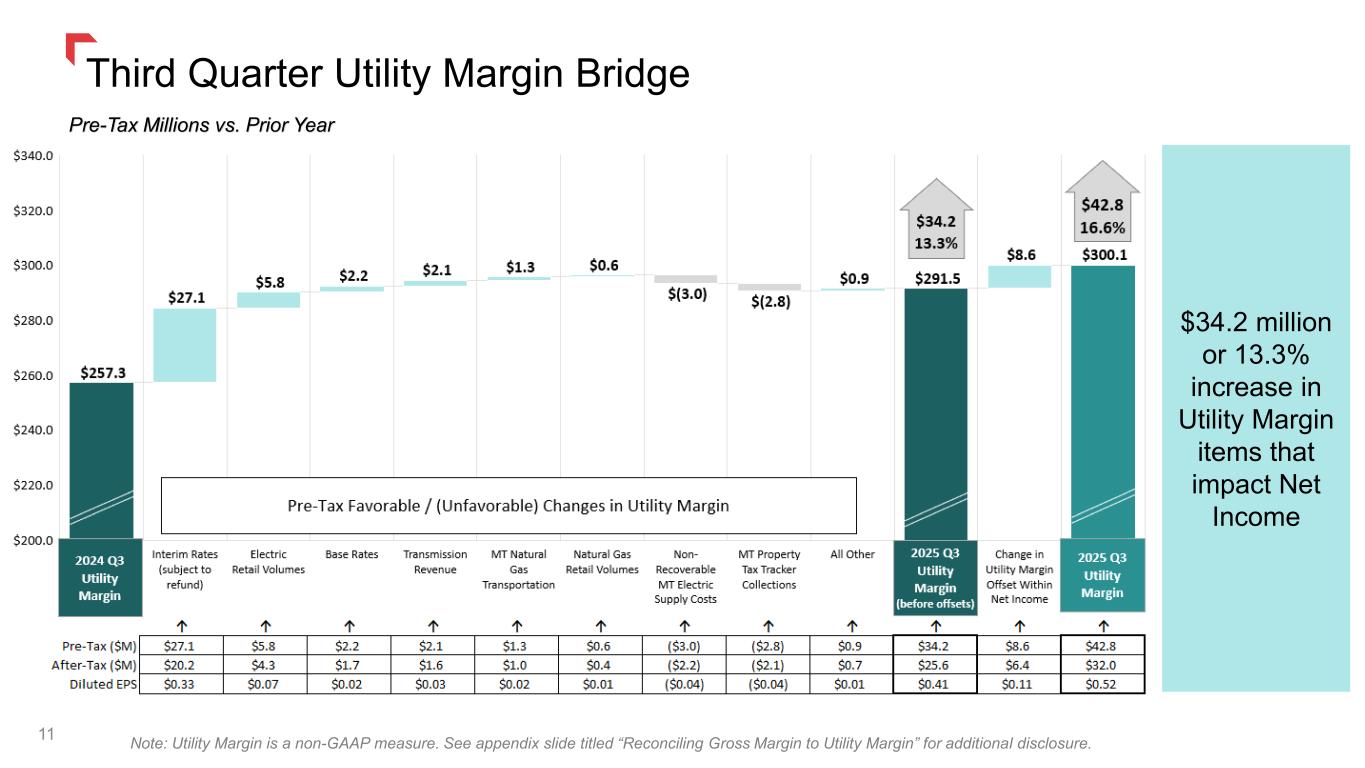

Third Quarter Utility Margin Bridge Pre-Tax Millions vs. Prior Year $34.2 million or 13.3% increase in Utility Margin items that impact Net Income Note: Utility Margin is a non-GAAP measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. 11

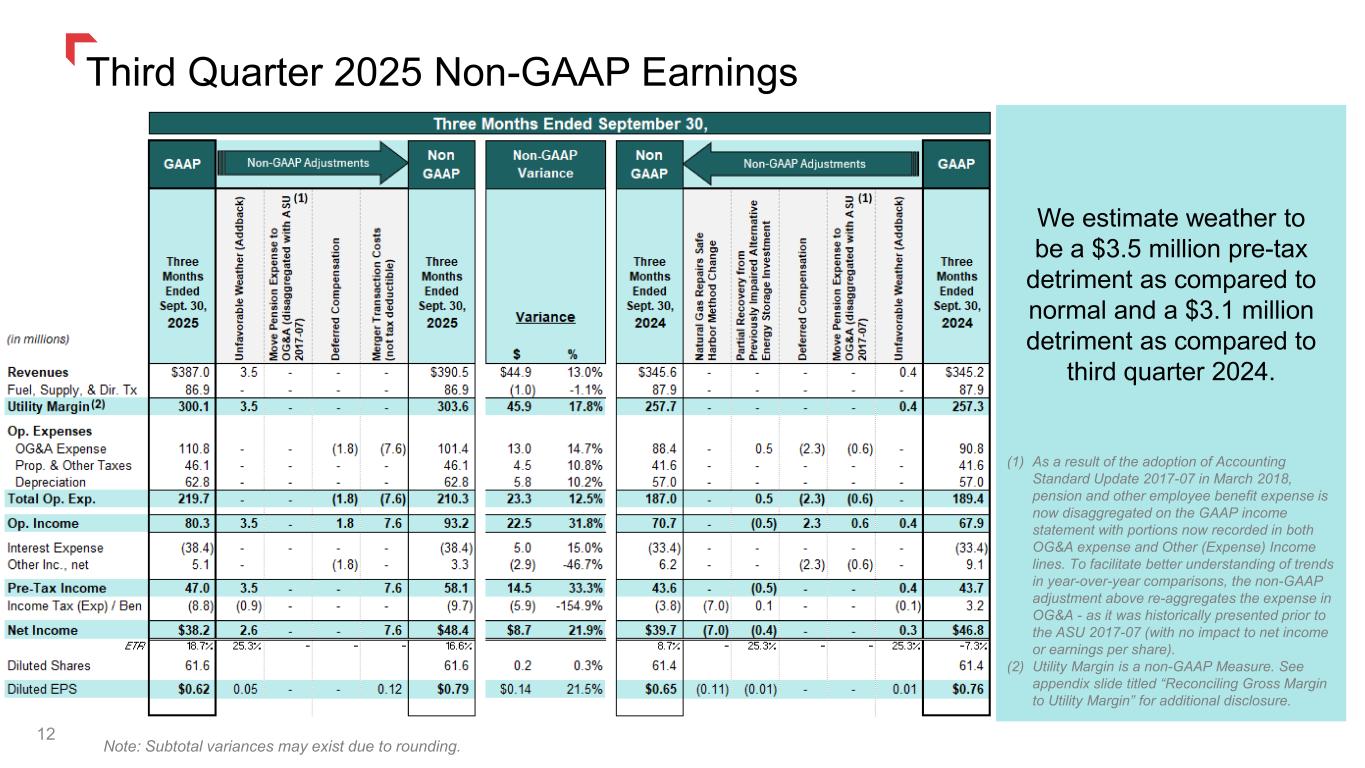

We estimate weather to be a $3.5 million pre-tax detriment as compared to normal and a $3.1 million detriment as compared to third quarter 2024. (1) As a result of the adoption of Accounting Standard Update 2017-07 in March 2018, pension and other employee benefit expense is now disaggregated on the GAAP income statement with portions now recorded in both OG&A expense and Other (Expense) Income lines. To facilitate better understanding of trends in year-over-year comparisons, the non-GAAP adjustment above re-aggregates the expense in OG&A - as it was historically presented prior to the ASU 2017-07 (with no impact to net income or earnings per share). (2) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. Third Quarter 2025 Non-GAAP Earnings 12 Note: Subtotal variances may exist due to rounding.

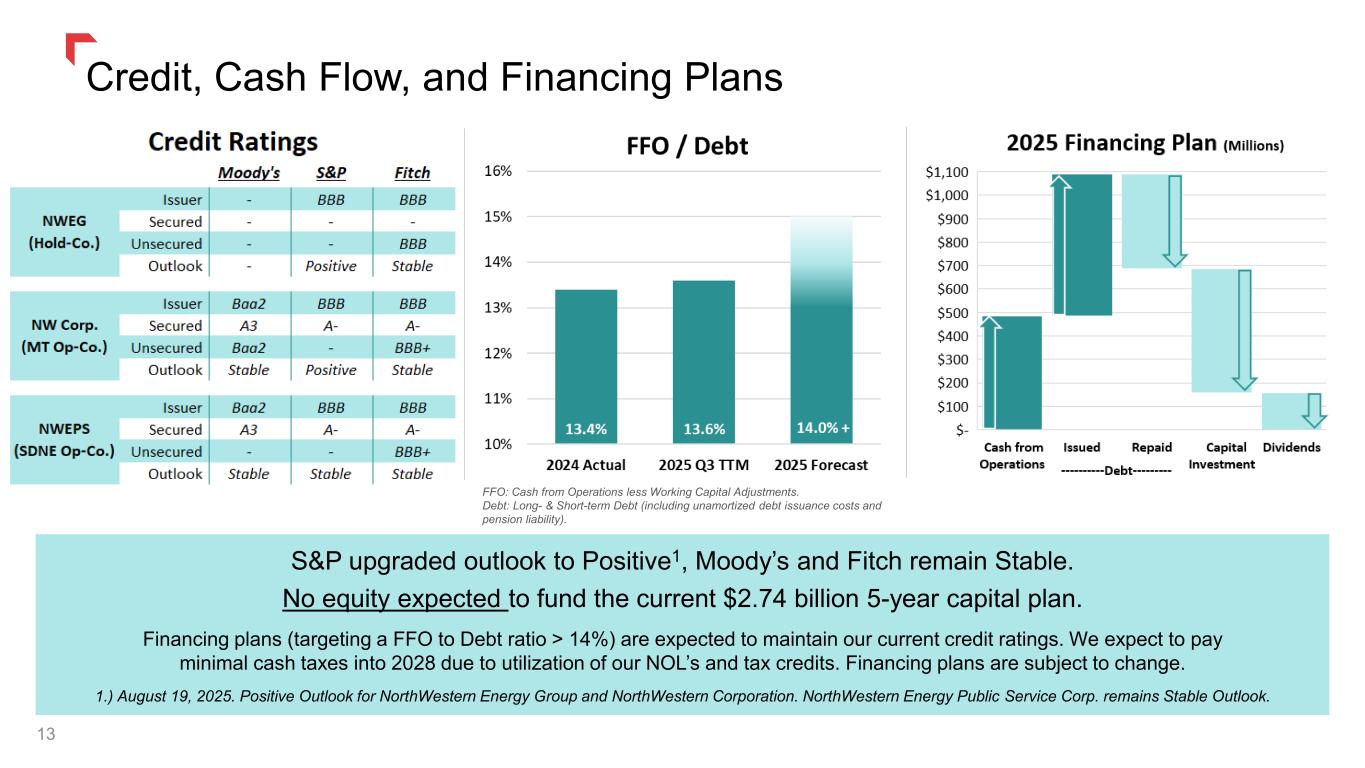

Credit, Cash Flow, and Financing Plans 13 FFO: Cash from Operations less Working Capital Adjustments. Debt: Long- & Short-term Debt (including unamortized debt issuance costs and pension liability). S&P upgraded outlook to Positive1, Moody’s and Fitch remain Stable. No equity expected to fund the current $2.74 billion 5-year capital plan. Financing plans (targeting a FFO to Debt ratio > 14%) are expected to maintain our current credit ratings. We expect to pay minimal cash taxes into 2028 due to utilization of our NOL’s and tax credits. Financing plans are subject to change. 1.) August 19, 2025. Positive Outlook for NorthWestern Energy Group and NorthWestern Corporation. NorthWestern Energy Public Service Corp. remains Stable Outlook.

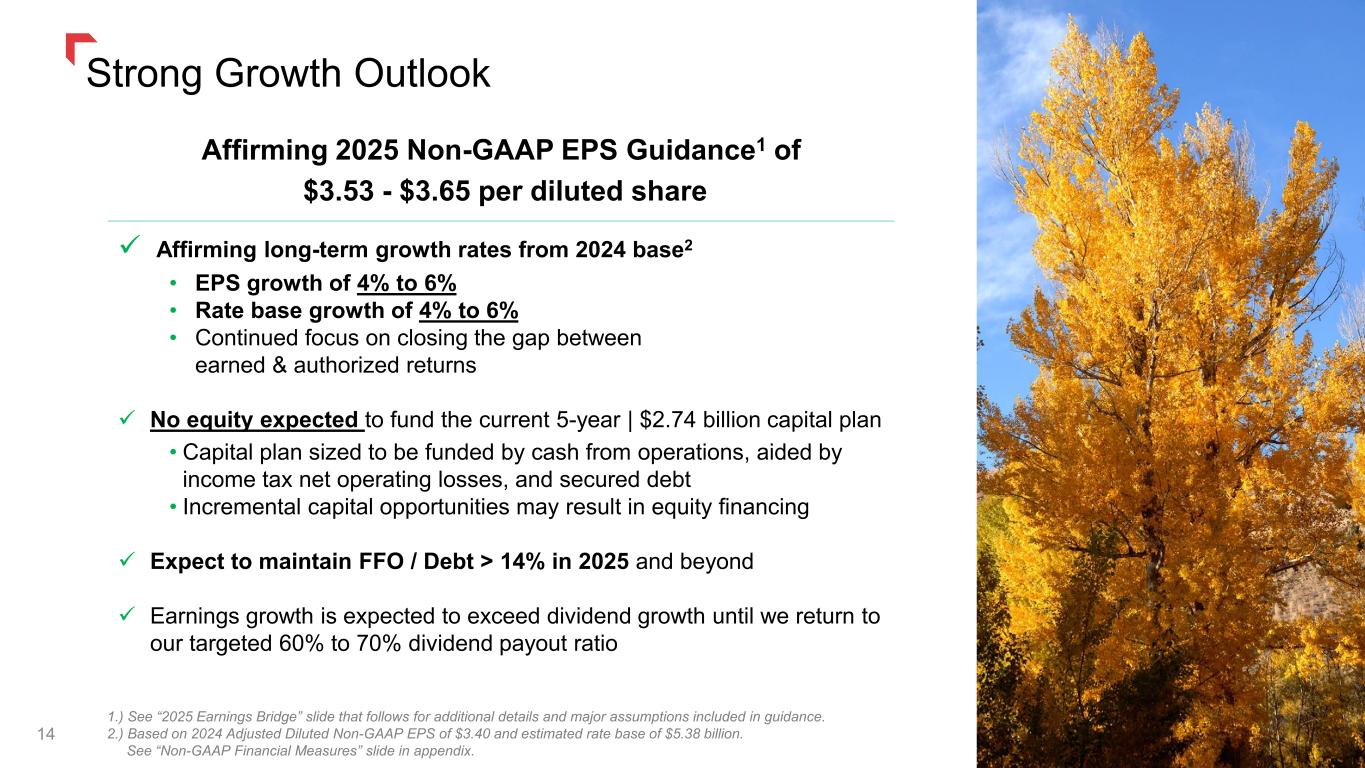

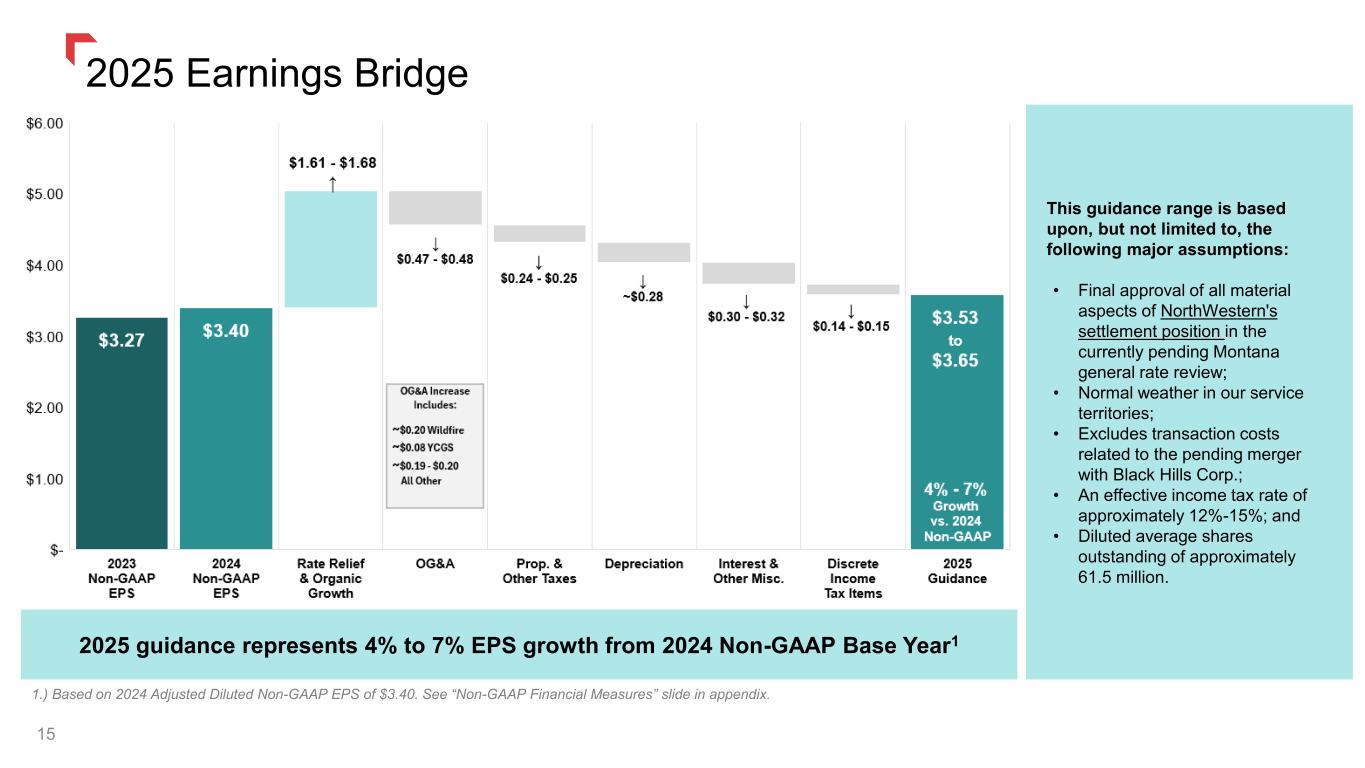

14 Affirming 2025 Non-GAAP EPS Guidance1 of $3.53 - $3.65 per diluted share ✓ Affirming long-term growth rates from 2024 base2 • EPS growth of 4% to 6% • Rate base growth of 4% to 6% • Continued focus on closing the gap between earned & authorized returns ✓ No equity expected to fund the current 5-year | $2.74 billion capital plan • Capital plan sized to be funded by cash from operations, aided by income tax net operating losses, and secured debt • Incremental capital opportunities may result in equity financing ✓ Expect to maintain FFO / Debt > 14% in 2025 and beyond ✓ Earnings growth is expected to exceed dividend growth until we return to our targeted 60% to 70% dividend payout ratio 1.) See “2025 Earnings Bridge” slide that follows for additional details and major assumptions included in guidance. 2.) Based on 2024 Adjusted Diluted Non-GAAP EPS of $3.40 and estimated rate base of $5.38 billion. See “Non-GAAP Financial Measures” slide in appendix. Strong Growth Outlook

15 2025 Earnings Bridge This guidance range is based upon, but not limited to, the following major assumptions: • Final approval of all material aspects of NorthWestern's settlement position in the currently pending Montana general rate review; • Normal weather in our service territories; • Excludes transaction costs related to the pending merger with Black Hills Corp.; • An effective income tax rate of approximately 12%-15%; and • Diluted average shares outstanding of approximately 61.5 million. 2025 guidance represents 4% to 7% EPS growth from 2024 Non-GAAP Base Year1 1.) Based on 2024 Adjusted Diluted Non-GAAP EPS of $3.40. See “Non-GAAP Financial Measures” slide in appendix.

$2.74 billion of highly-executable and low-risk critical capital investment Regulated Utility Five-Year Capital Forecast (millions) 16

Thank youOther Updates 17

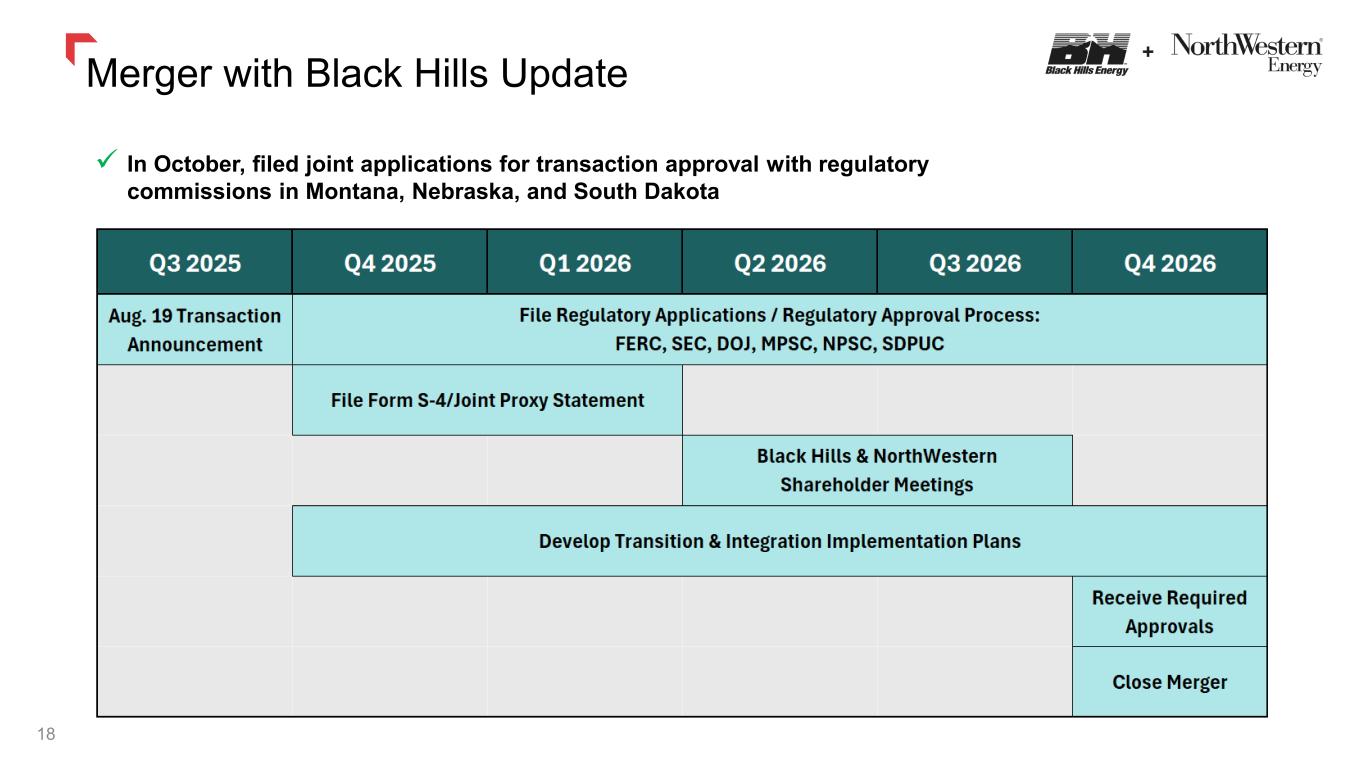

Merger with Black Hills Update 18 ✓ In October, filed joint applications for transaction approval with regulatory commissions in Montana, Nebraska, and South Dakota

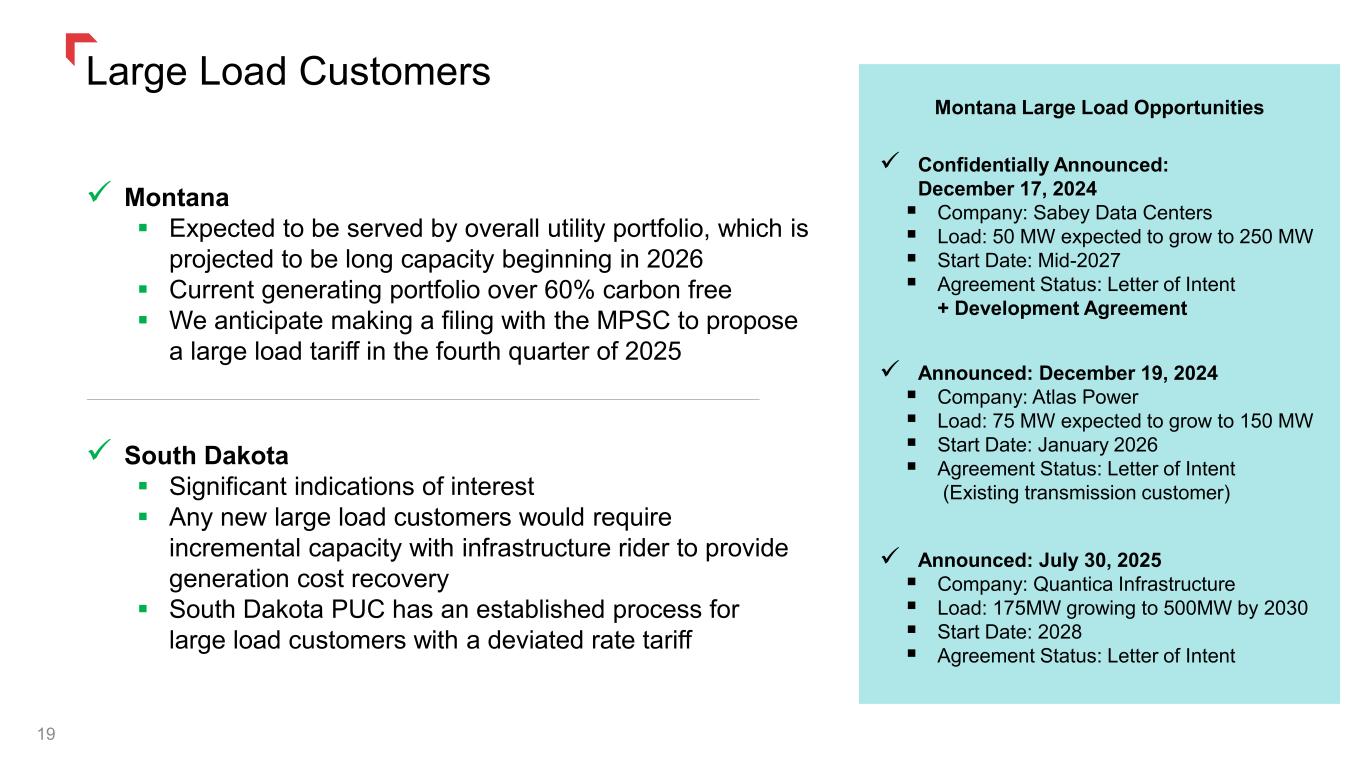

✓ Montana ▪ Expected to be served by overall utility portfolio, which is projected to be long capacity beginning in 2026 ▪ Current generating portfolio over 60% carbon free ▪ We anticipate making a filing with the MPSC to propose a large load tariff in the fourth quarter of 2025 ✓ South Dakota ▪ Significant indications of interest ▪ Any new large load customers would require incremental capacity with infrastructure rider to provide generation cost recovery ▪ South Dakota PUC has an established process for large load customers with a deviated rate tariff 19 Large Load Customers Montana Large Load Opportunities ✓ Confidentially Announced: December 17, 2024 ▪ Company: Sabey Data Centers ▪ Load: 50 MW expected to grow to 250 MW ▪ Start Date: Mid-2027 ▪ Agreement Status: Letter of Intent + Development Agreement ✓ Announced: December 19, 2024 ▪ Company: Atlas Power ▪ Load: 75 MW expected to grow to 150 MW ▪ Start Date: January 2026 ▪ Agreement Status: Letter of Intent (Existing transmission customer) ✓ Announced: July 30, 2025 ▪ Company: Quantica Infrastructure ▪ Load: 175MW growing to 500MW by 2030 ▪ Start Date: 2028 ▪ Agreement Status: Letter of Intent

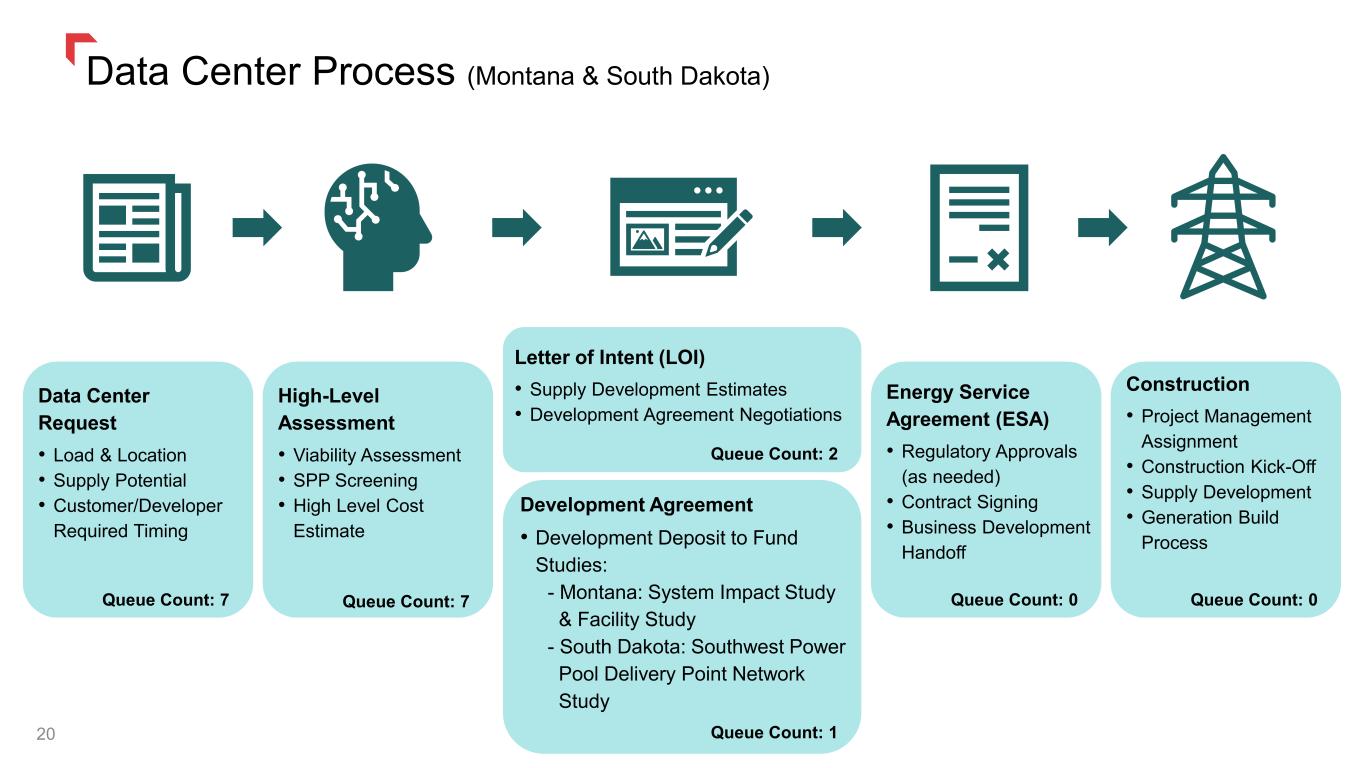

20 Data Center Process (Montana & South Dakota) Data Center Request • Load & Location • Supply Potential • Customer/Developer Required Timing Queue Count: 7 High-Level Assessment • Viability Assessment • SPP Screening • High Level Cost Estimate Queue Count: 7 Energy Service Agreement (ESA) • Regulatory Approvals (as needed) • Contract Signing • Business Development Handoff Queue Count: 0 Construction • Project Management Assignment • Construction Kick-Off • Supply Development • Generation Build Process Queue Count: 0 Letter of Intent (LOI) • Supply Development Estimates • Development Agreement Negotiations Development Agreement • Development Deposit to Fund Studies: - Montana: System Impact Study & Facility Study - South Dakota: Southwest Power Pool Delivery Point Network Study Queue Count: 1 Queue Count: 2

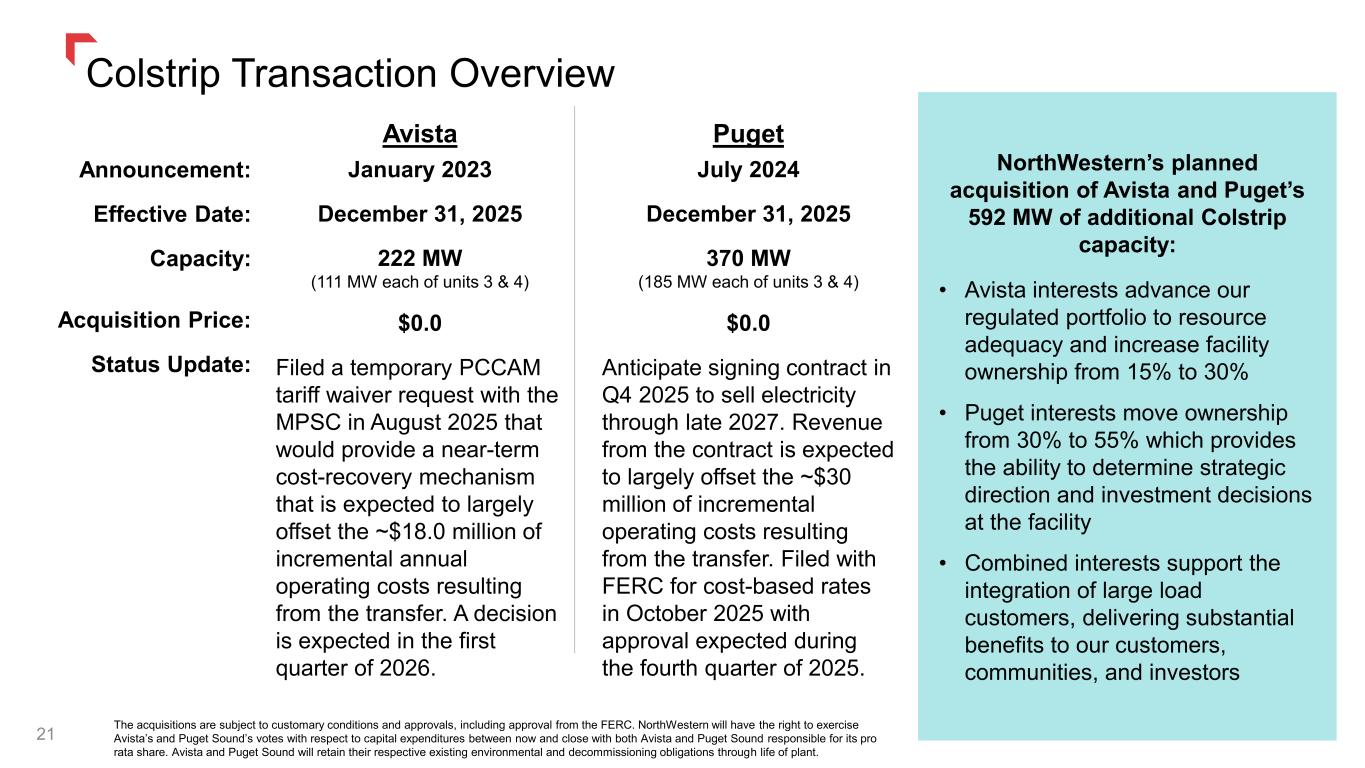

Colstrip Transaction Overview 21 Announcement: Effective Date: Capacity: Acquisition Price: Status Update: Puget July 2024 December 31, 2025 370 MW (185 MW each of units 3 & 4) $0.0 Anticipate signing contract in Q4 2025 to sell electricity through late 2027. Revenue from the contract is expected to largely offset the ~$30 million of incremental operating costs resulting from the transfer. Filed with FERC for cost-based rates in October 2025 with approval expected during the fourth quarter of 2025. Avista January 2023 December 31, 2025 222 MW (111 MW each of units 3 & 4) $0.0 Filed a temporary PCCAM tariff waiver request with the MPSC in August 2025 that would provide a near-term cost-recovery mechanism that is expected to largely offset the ~$18.0 million of incremental annual operating costs resulting from the transfer. A decision is expected in the first quarter of 2026. NorthWestern’s planned acquisition of Avista and Puget’s 592 MW of additional Colstrip capacity: • Avista interests advance our regulated portfolio to resource adequacy and increase facility ownership from 15% to 30% • Puget interests move ownership from 30% to 55% which provides the ability to determine strategic direction and investment decisions at the facility • Combined interests support the integration of large load customers, delivering substantial benefits to our customers, communities, and investors The acquisitions are subject to customary conditions and approvals, including approval from the FERC. NorthWestern will have the right to exercise Avista’s and Puget Sound’s votes with respect to capital expenditures between now and close with both Avista and Puget Sound responsible for its pro rata share. Avista and Puget Sound will retain their respective existing environmental and decommissioning obligations through life of plant.

Conclusion Pure Electric & Gas Utility Solid Utility Foundation Best Practices Corporate Governance Attractive Future Growth Prospects Strong Earnings & Cash Flows 22 The pending merger with Black Hills Corporation will combine the strengths of both companies, resulting in an organization with greater scale, financial stability, and operational expertise and is designed to create a stronger, more resilient energy company focused on delivering safe, reliable, and affordable energy solutions to customers.

Thank youAppendix: 23

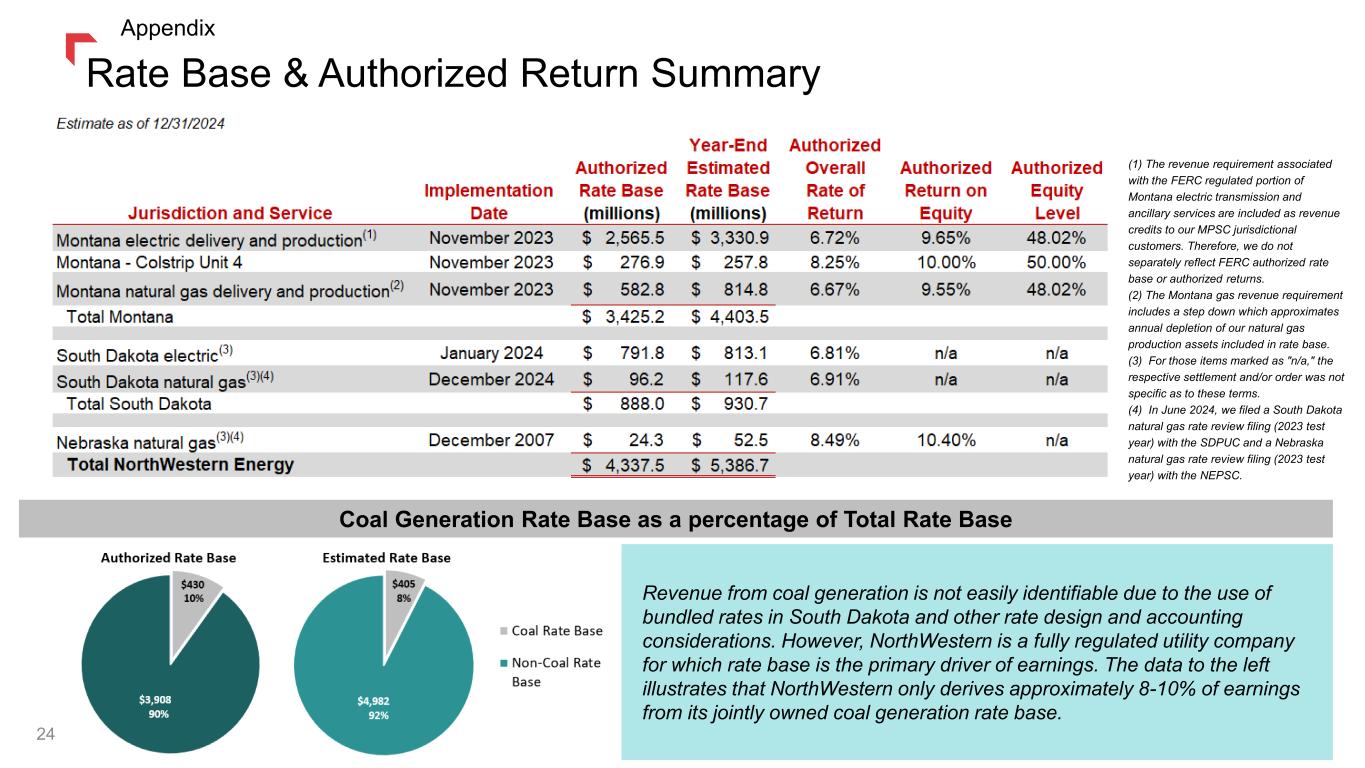

(1) The revenue requirement associated with the FERC regulated portion of Montana electric transmission and ancillary services are included as revenue credits to our MPSC jurisdictional customers. Therefore, we do not separately reflect FERC authorized rate base or authorized returns. (2) The Montana gas revenue requirement includes a step down which approximates annual depletion of our natural gas production assets included in rate base. (3) For those items marked as "n/a," the respective settlement and/or order was not specific as to these terms. (4) In June 2024, we filed a South Dakota natural gas rate review filing (2023 test year) with the SDPUC and a Nebraska natural gas rate review filing (2023 test year) with the NEPSC. Coal Generation Rate Base as a percentage of Total Rate Base Revenue from coal generation is not easily identifiable due to the use of bundled rates in South Dakota and other rate design and accounting considerations. However, NorthWestern is a fully regulated utility company for which rate base is the primary driver of earnings. The data to the left illustrates that NorthWestern only derives approximately 8-10% of earnings from its jointly owned coal generation rate base. Rate Base & Authorized Return Summary Appendix 24

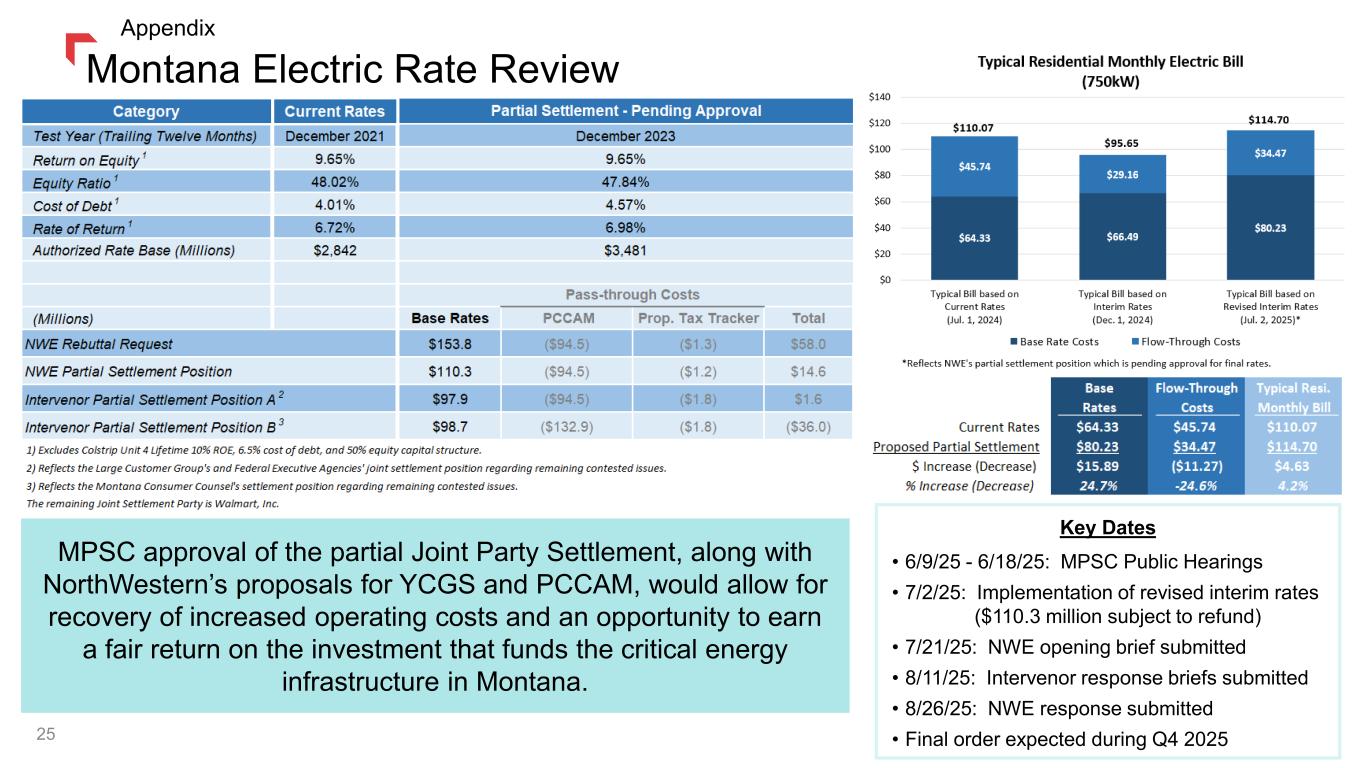

25 Montana Electric Rate Review MPSC approval of the partial Joint Party Settlement, along with NorthWestern’s proposals for YCGS and PCCAM, would allow for recovery of increased operating costs and an opportunity to earn a fair return on the investment that funds the critical energy infrastructure in Montana. Key Dates • 6/9/25 - 6/18/25: MPSC Public Hearings • 7/2/25: Implementation of revised interim rates ($110.3 million subject to refund) • 7/21/25: NWE opening brief submitted • 8/11/25: Intervenor response briefs submitted • 8/26/25: NWE response submitted • Final order expected during Q4 2025 Appendix

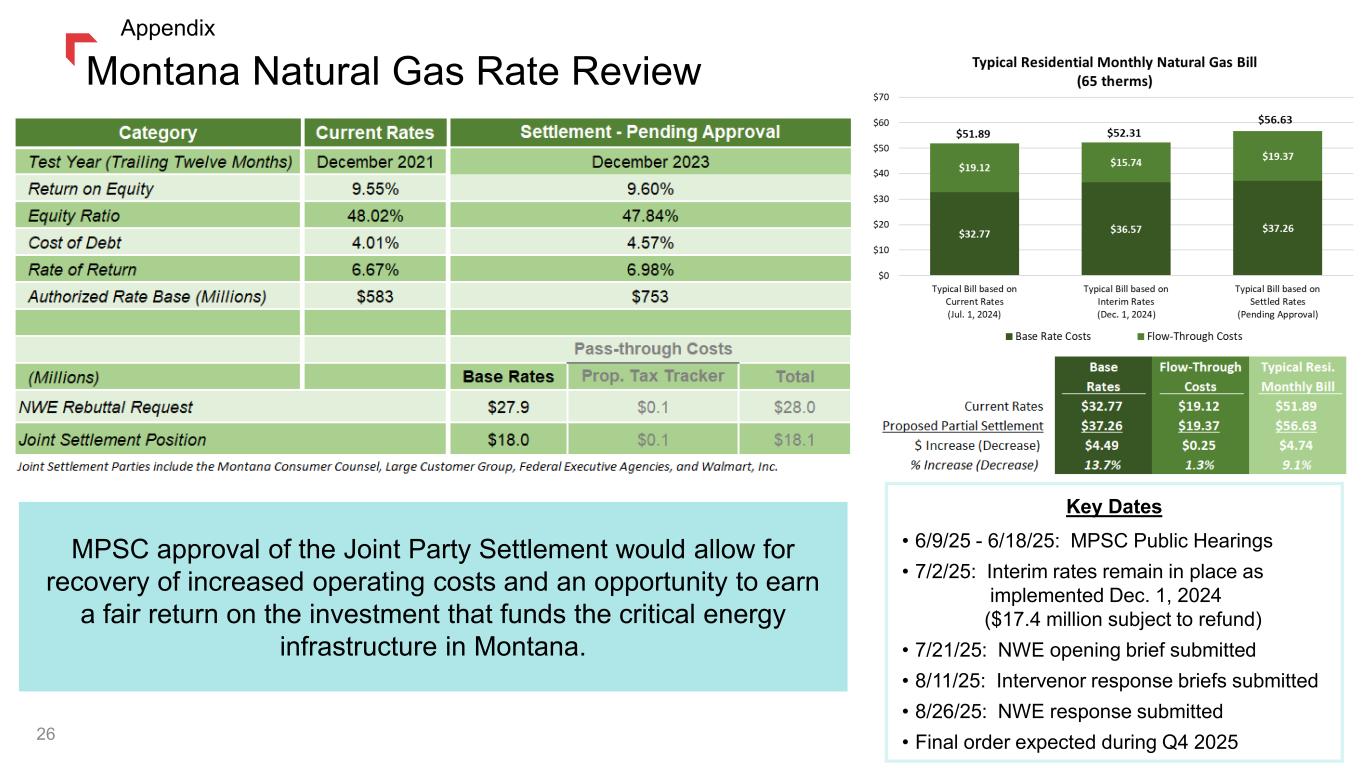

Key Dates • 6/9/25 - 6/18/25: MPSC Public Hearings • 7/2/25: Interim rates remain in place as implemented Dec. 1, 2024 ($17.4 million subject to refund) • 7/21/25: NWE opening brief submitted • 8/11/25: Intervenor response briefs submitted • 8/26/25: NWE response submitted • Final order expected during Q4 2025 MPSC approval of the Joint Party Settlement would allow for recovery of increased operating costs and an opportunity to earn a fair return on the investment that funds the critical energy infrastructure in Montana. 26 Montana Natural Gas Rate Review Appendix

27 Montana Wildfire Bill No Strict Liability: • Confirms strict liability cannot be applied to utility operations related to wildfire Legal Protections for Providers: • Negligence standard based on Montana specific circumstances • Rebuttable presumption utility acted reasonably if it substantially followed a MPSC approved wildfire mitigation plan (burden of proof rests on plaintiffs) • 3-year statute of limitations from date of damage Damages: • Economic: Property damage (market value or restoration) and fire control costs • Noneconomic: Only if bodily injury or death occurs • Punitive: Only with clear & convincing evidence of gross negligence or intent NorthWestern’s 2025 Wildfire Mitigation Plan was filed in August and is expected to be updated every three years going forward. HB 490 was passed by the Montana Legislature with broad bipartisan support in both the House (90-0) and Senate (40-8) and has been signed into law. The new law clarifies and limits wildfire-related risks, protecting our customers, communities and investors. Appendix

28 Transmission Bill Allows Certificate of Public Convenience & Necessity (CPCN) for electric transmission to be issued by the Montana Public Service Commission (MPSC) • Greater confidence of fair and equitable return Bill allows greater confidence for investors providing the critical capital necessary for the continued modernization of the energy grid • Approvals MPSC shall determine within 300 days of application if transmission projects (greater than 69 kV) are in public interest and may grant or deny a CPCN • Cost clarity post CPCN Within 90 days of application, the MPSC shall issue an order responding to a utilities request for advanced approval of prudent cost recovery SB 301 was also passed by the Montana Legislature with unanimous bipartisan support and signed into law. Appendix

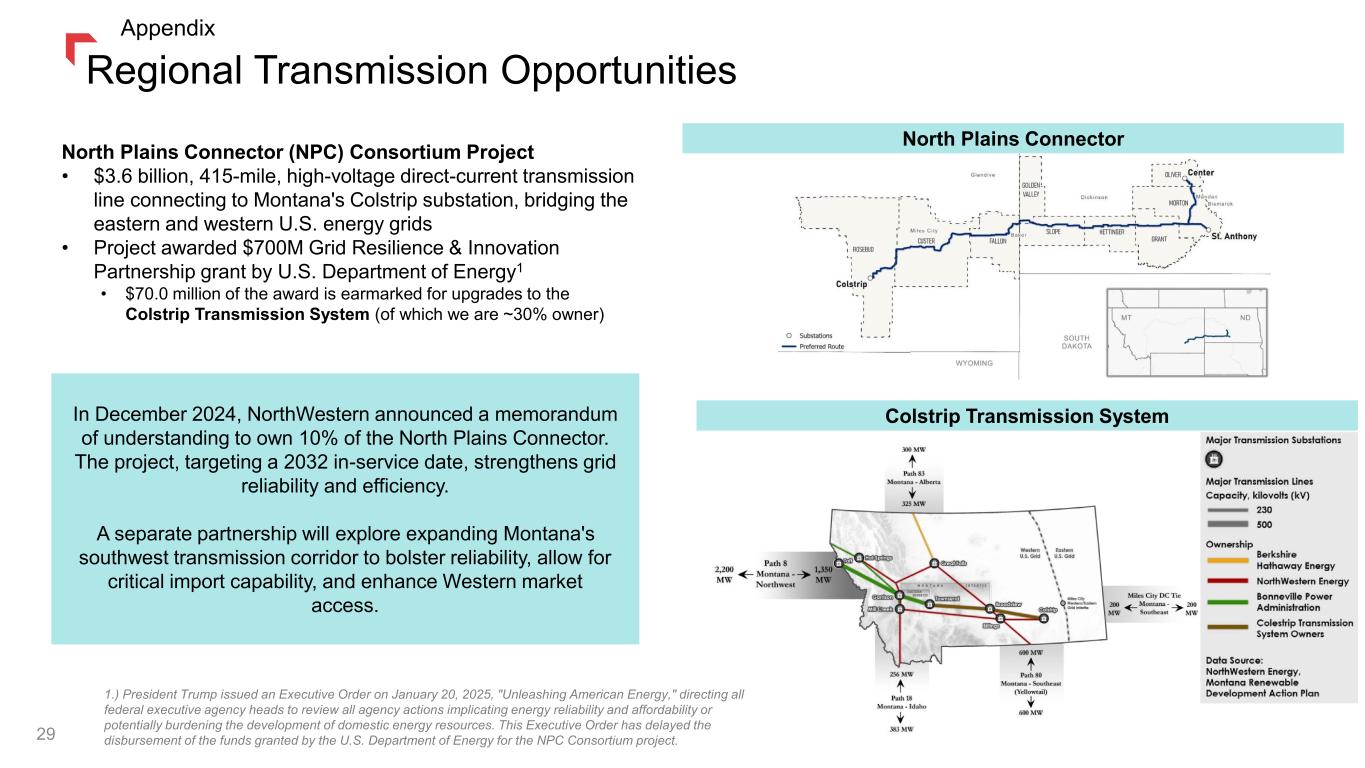

29 Regional Transmission Opportunities Colstrip Transmission System North Plains Connector (NPC) Consortium Project • $3.6 billion, 415-mile, high-voltage direct-current transmission line connecting to Montana's Colstrip substation, bridging the eastern and western U.S. energy grids • Project awarded $700M Grid Resilience & Innovation Partnership grant by U.S. Department of Energy1 • $70.0 million of the award is earmarked for upgrades to the Colstrip Transmission System (of which we are ~30% owner) North Plains Connector In December 2024, NorthWestern announced a memorandum of understanding to own 10% of the North Plains Connector. The project, targeting a 2032 in-service date, strengthens grid reliability and efficiency. A separate partnership will explore expanding Montana's southwest transmission corridor to bolster reliability, allow for critical import capability, and enhance Western market access. 1.) President Trump issued an Executive Order on January 20, 2025, "Unleashing American Energy," directing all federal executive agency heads to review all agency actions implicating energy reliability and affordability or potentially burdening the development of domestic energy resources. This Executive Order has delayed the disbursement of the funds granted by the U.S. Department of Energy for the NPC Consortium project. Appendix

Thank youThird Quarter Appendix 30

Third Quarter Financial Results 31 1.) Utility Margin is a non- GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. Note: Subtotal variances may exist due to rounding. Appendix

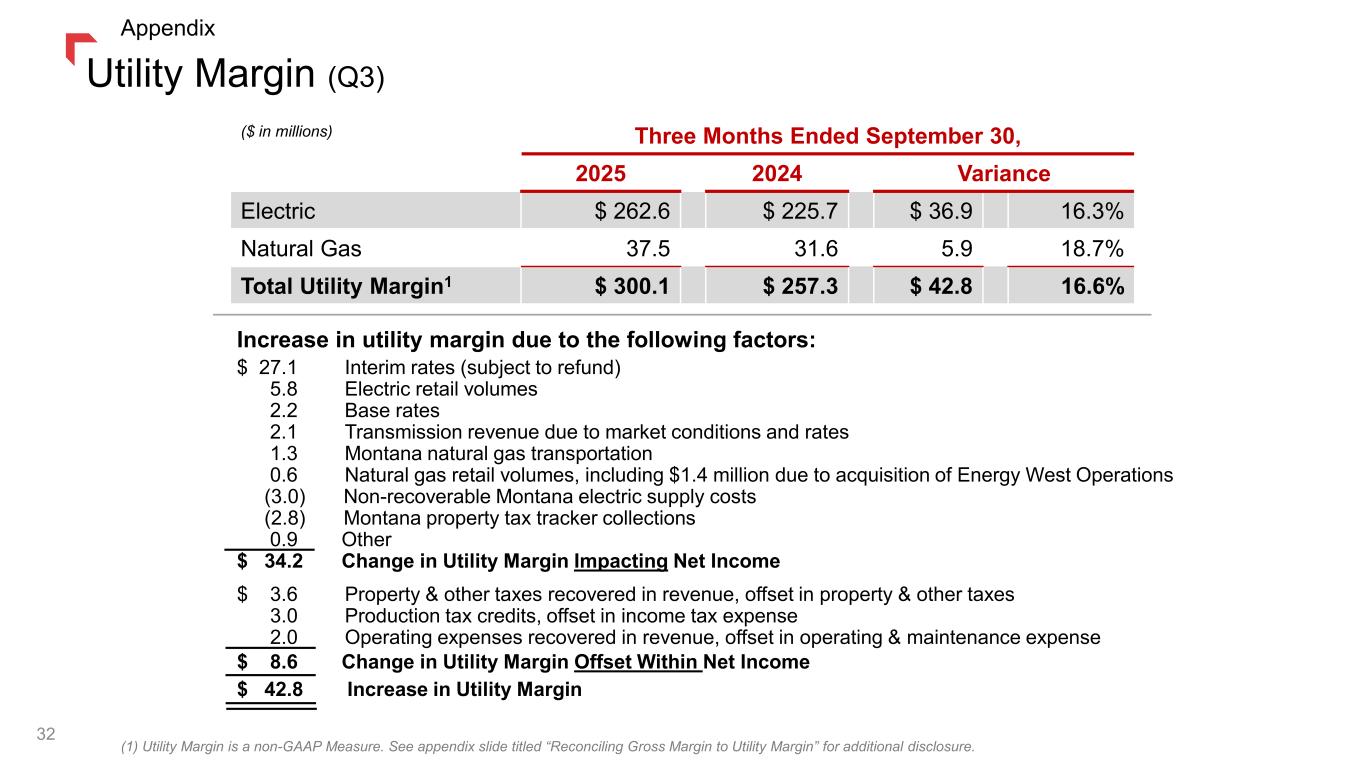

Utility Margin (Q3) ($ in millions) Three Months Ended September 30, 2025 2024 Variance Electric $ 262.6 $ 225.7 $ 36.9 16.3% Natural Gas 37.5 31.6 5.9 18.7% Total Utility Margin1 $ 300.1 $ 257.3 $ 42.8 16.6% (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. Increase in utility margin due to the following factors: $ 27.1 Interim rates (subject to refund) 5.8 Electric retail volumes 2.2 Base rates 2.1 Transmission revenue due to market conditions and rates 1.3 Montana natural gas transportation 0.6 Natural gas retail volumes, including $1.4 million due to acquisition of Energy West Operations (3.0) Non-recoverable Montana electric supply costs (2.8) Montana property tax tracker collections 0.9 Other $ 34.2 Change in Utility Margin Impacting Net Income $ 3.6 Property & other taxes recovered in revenue, offset in property & other taxes 3.0 Production tax credits, offset in income tax expense 2.0 Operating expenses recovered in revenue, offset in operating & maintenance expense $ 8.6 Change in Utility Margin Offset Within Net Income $ 42.8 Increase in Utility Margin 32 Appendix

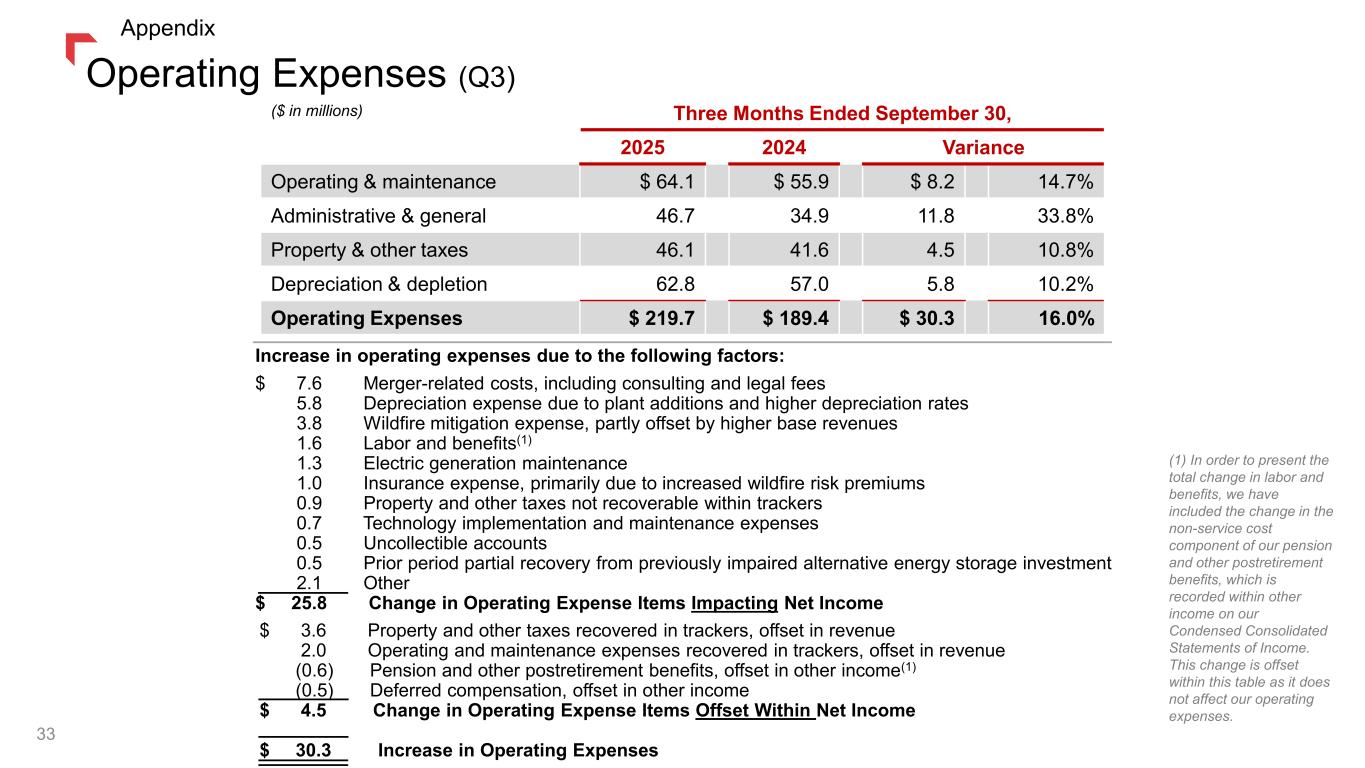

Operating Expenses (Q3) Increase in operating expenses due to the following factors: $ 7.6 Merger-related costs, including consulting and legal fees 5.8 Depreciation expense due to plant additions and higher depreciation rates 3.8 Wildfire mitigation expense, partly offset by higher base revenues 1.6 Labor and benefits(1) 1.3 Electric generation maintenance 1.0 Insurance expense, primarily due to increased wildfire risk premiums 0.9 Property and other taxes not recoverable within trackers 0.7 Technology implementation and maintenance expenses 0.5 Uncollectible accounts 0.5 Prior period partial recovery from previously impaired alternative energy storage investment 2.1 Other $ 25.8 Change in Operating Expense Items Impacting Net Income ($ in millions) Three Months Ended September 30, 2025 2024 Variance Operating & maintenance $ 64.1 $ 55.9 $ 8.2 14.7% Administrative & general 46.7 34.9 11.8 33.8% Property & other taxes 46.1 41.6 4.5 10.8% Depreciation & depletion 62.8 57.0 5.8 10.2% Operating Expenses $ 219.7 $ 189.4 $ 30.3 16.0% $ 3.6 Property and other taxes recovered in trackers, offset in revenue 2.0 Operating and maintenance expenses recovered in trackers, offset in revenue (0.6) Pension and other postretirement benefits, offset in other income(1) (0.5) Deferred compensation, offset in other income $ 4.5 Change in Operating Expense Items Offset Within Net Income $ 30.3 Increase in Operating Expenses (1) In order to present the total change in labor and benefits, we have included the change in the non-service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses. 33 Appendix

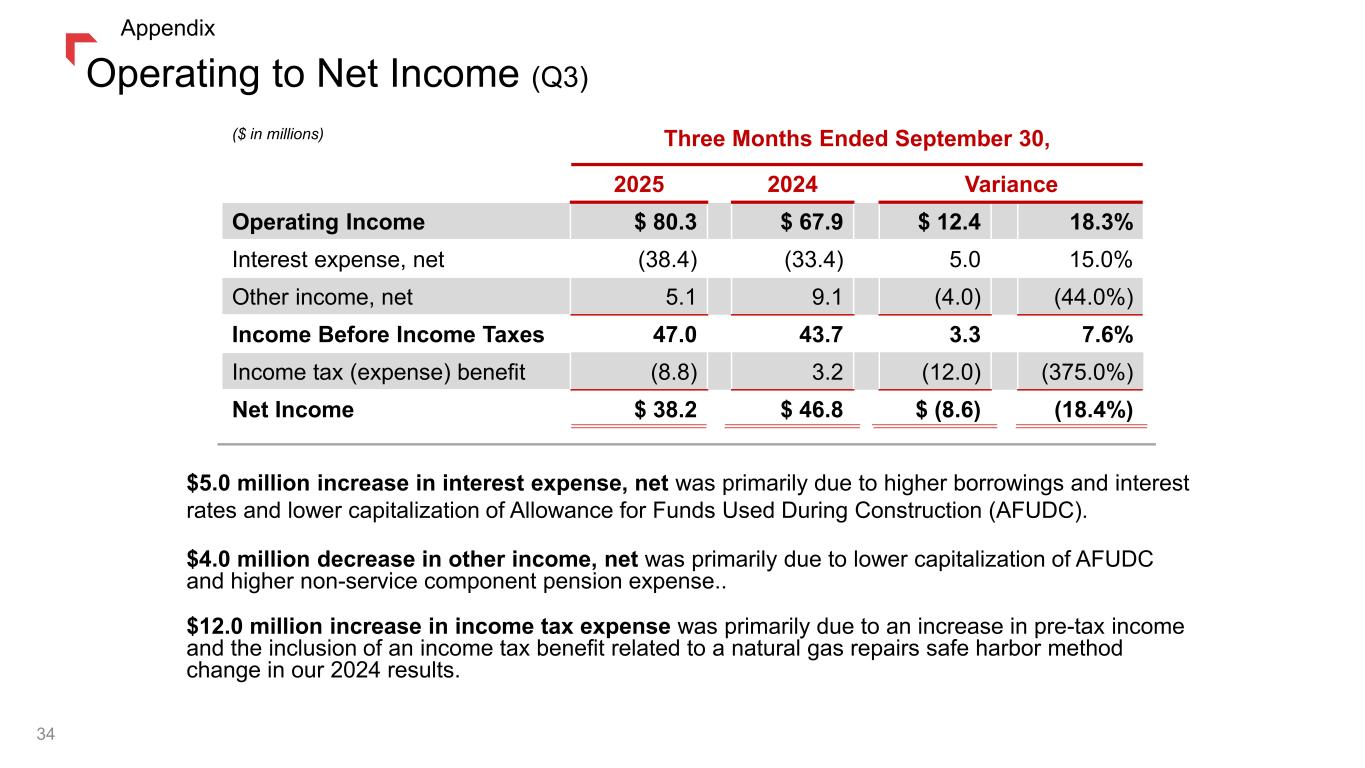

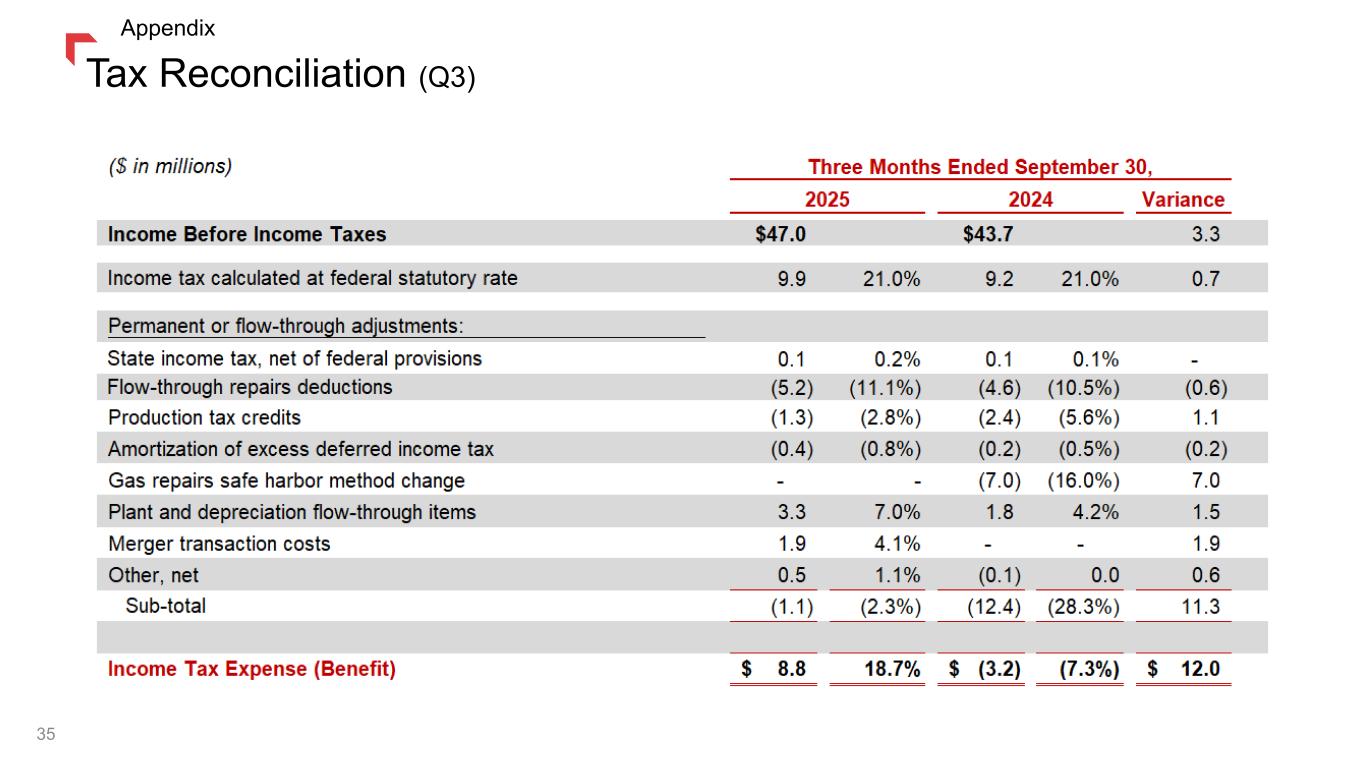

Operating to Net Income (Q3) ($ in millions) Three Months Ended September 30, 2025 2024 Variance Operating Income $ 80.3 $ 67.9 $ 12.4 18.3% Interest expense, net (38.4) (33.4) 5.0 15.0% Other income, net 5.1 9.1 (4.0) (44.0%) Income Before Income Taxes 47.0 43.7 3.3 7.6% Income tax (expense) benefit (8.8) 3.2 (12.0) (375.0%) Net Income $ 38.2 $ 46.8 $ (8.6) (18.4%) $5.0 million increase in interest expense, net was primarily due to higher borrowings and interest rates and lower capitalization of Allowance for Funds Used During Construction (AFUDC). $4.0 million decrease in other income, net was primarily due to lower capitalization of AFUDC and higher non-service component pension expense.. $12.0 million increase in income tax expense was primarily due to an increase in pre-tax income and the inclusion of an income tax benefit related to a natural gas repairs safe harbor method change in our 2024 results. 34 Appendix

Tax Reconciliation (Q3) 35 Appendix

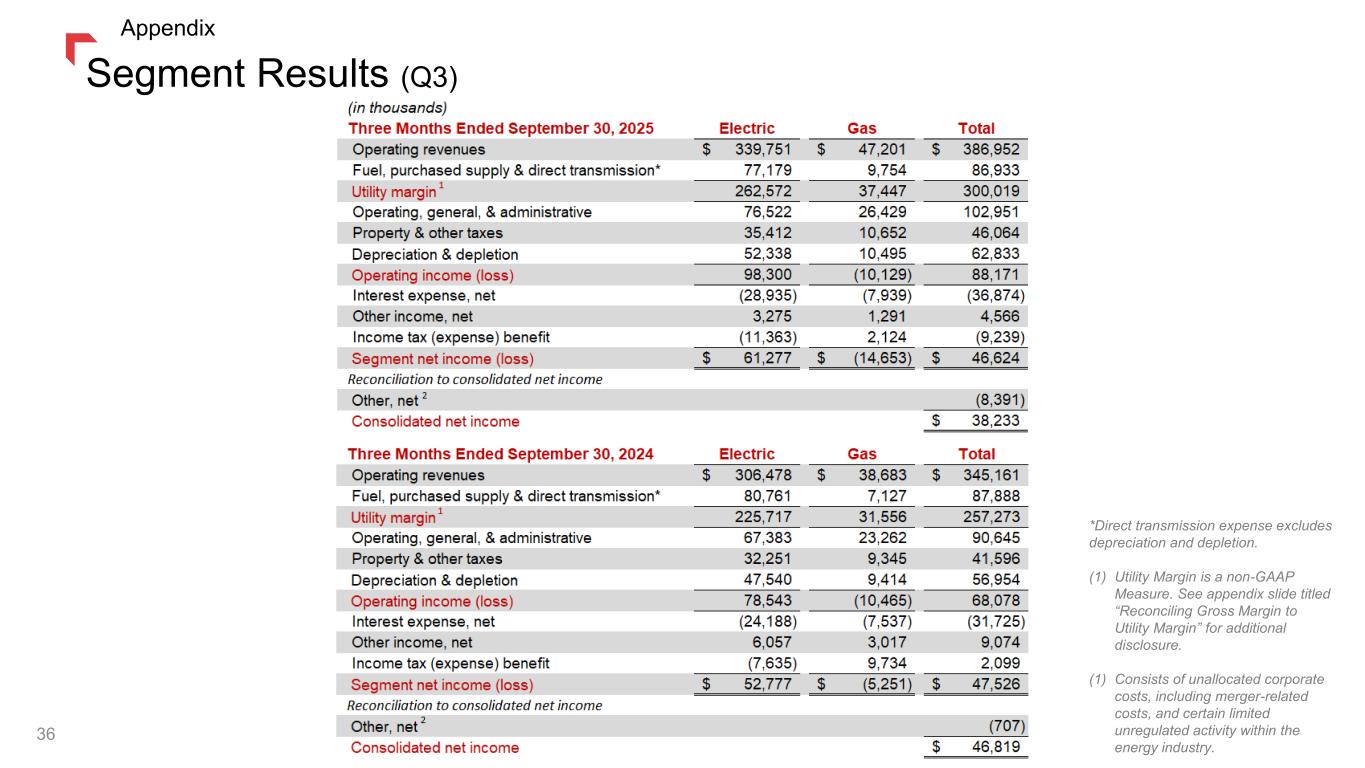

Segment Results (Q3) 36 Appendix *Direct transmission expense excludes depreciation and depletion. (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. (1) Consists of unallocated corporate costs, including merger-related costs, and certain limited unregulated activity within the energy industry.

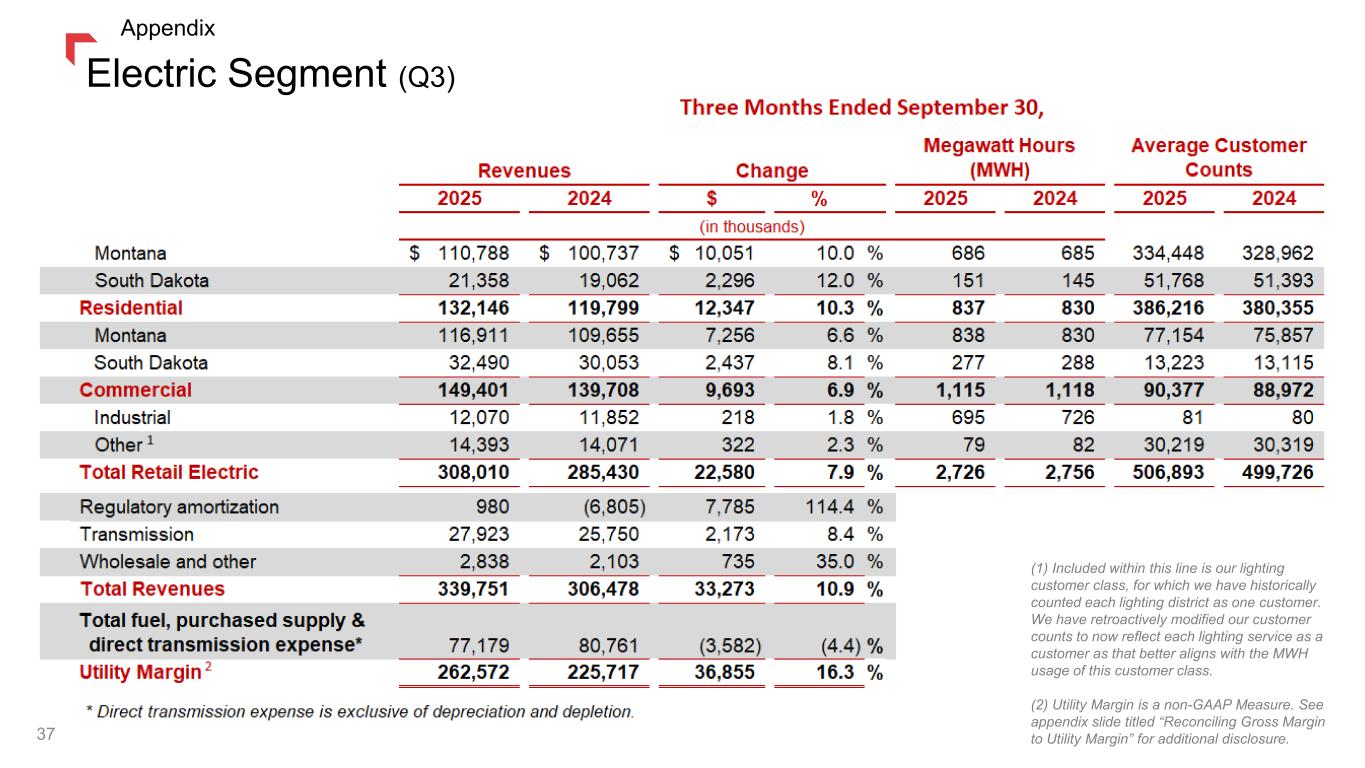

Electric Segment (Q3) (1) Included within this line is our lighting customer class, for which we have historically counted each lighting district as one customer. We have retroactively modified our customer counts to now reflect each lighting service as a customer as that better aligns with the MWH usage of this customer class. (2) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. 37 Appendix

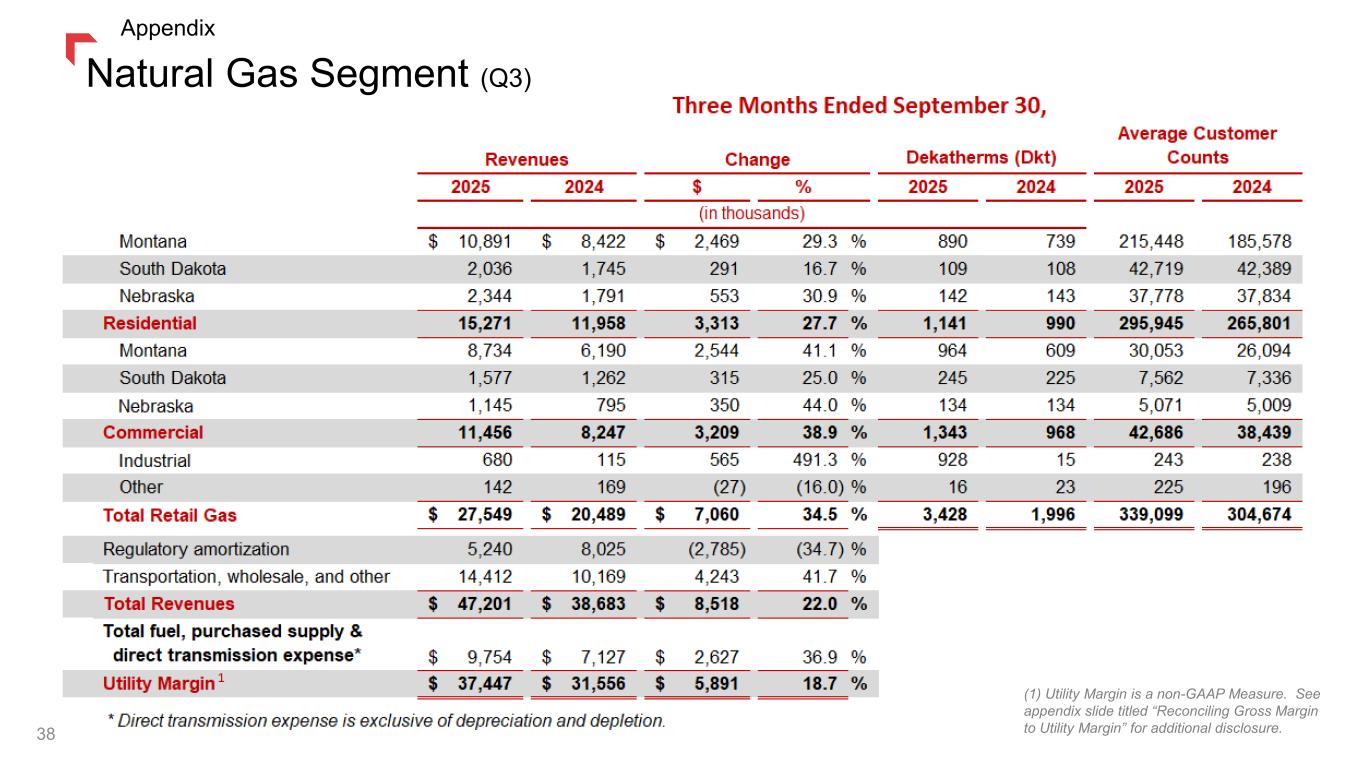

Natural Gas Segment (Q3) 38 Appendix (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure.

Thank you2025 Year-to-Date Appendix 39

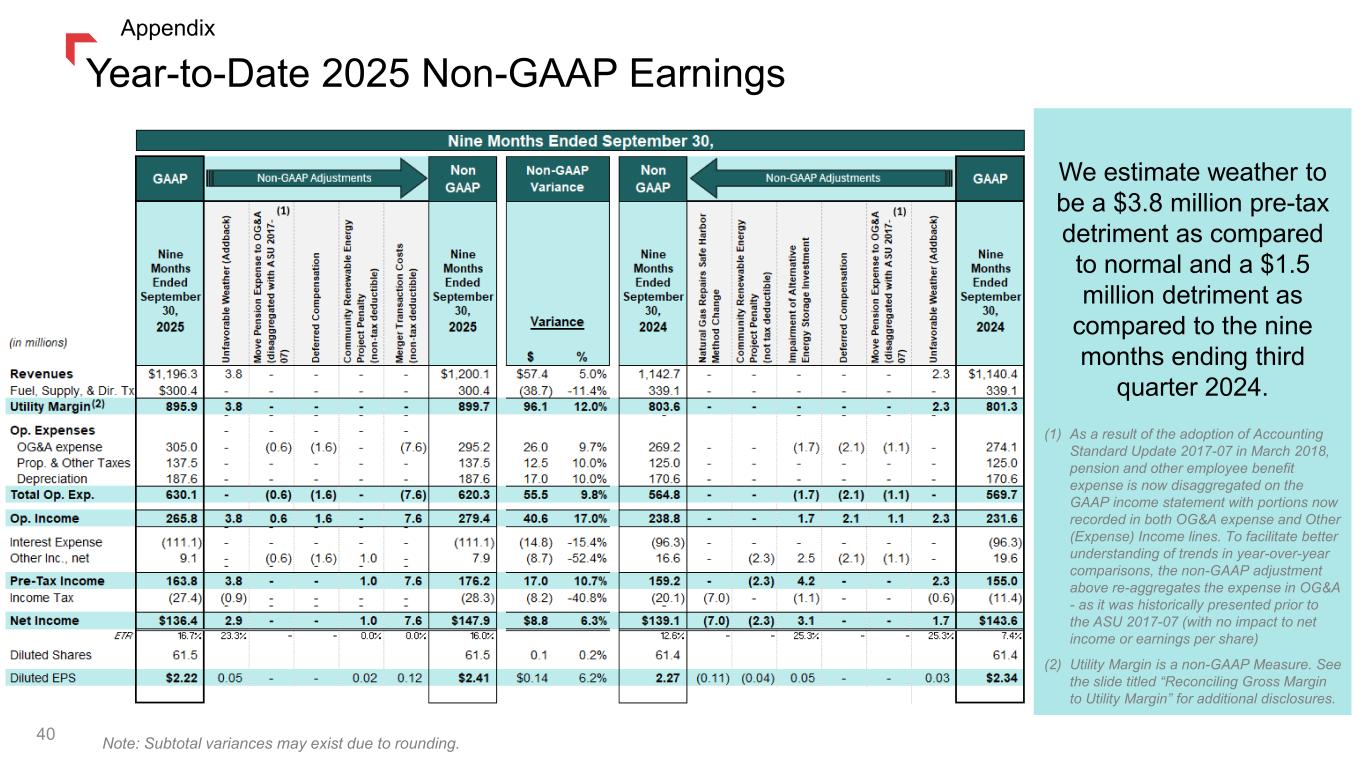

We estimate weather to be a $3.8 million pre-tax detriment as compared to normal and a $1.5 million detriment as compared to the nine months ending third quarter 2024. (1) As a result of the adoption of Accounting Standard Update 2017-07 in March 2018, pension and other employee benefit expense is now disaggregated on the GAAP income statement with portions now recorded in both OG&A expense and Other (Expense) Income lines. To facilitate better understanding of trends in year-over-year comparisons, the non-GAAP adjustment above re-aggregates the expense in OG&A - as it was historically presented prior to the ASU 2017-07 (with no impact to net income or earnings per share) (2) Utility Margin is a non-GAAP Measure. See the slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosures. Year-to-Date 2025 Non-GAAP Earnings 40 Note: Subtotal variances may exist due to rounding. Appendix

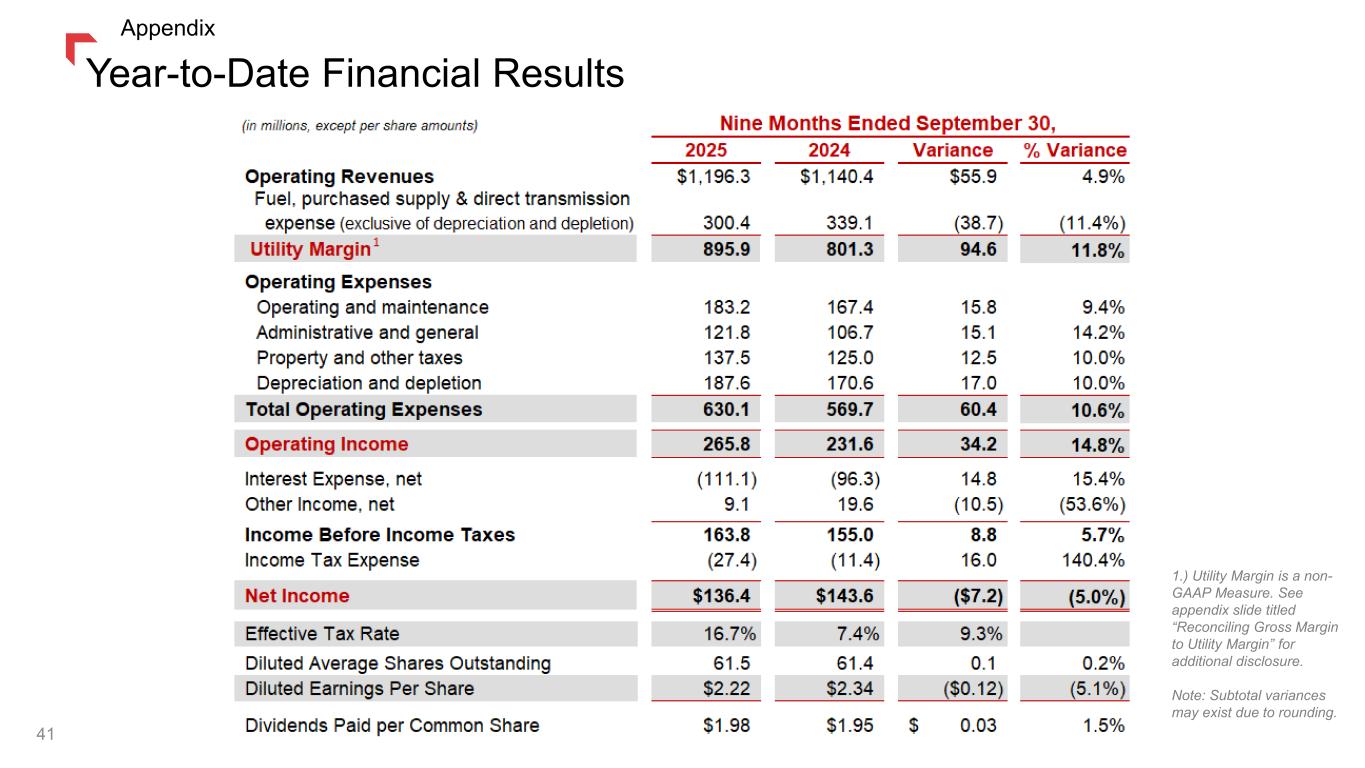

Year-to-Date Financial Results 41 1.) Utility Margin is a non- GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. Note: Subtotal variances may exist due to rounding. Appendix

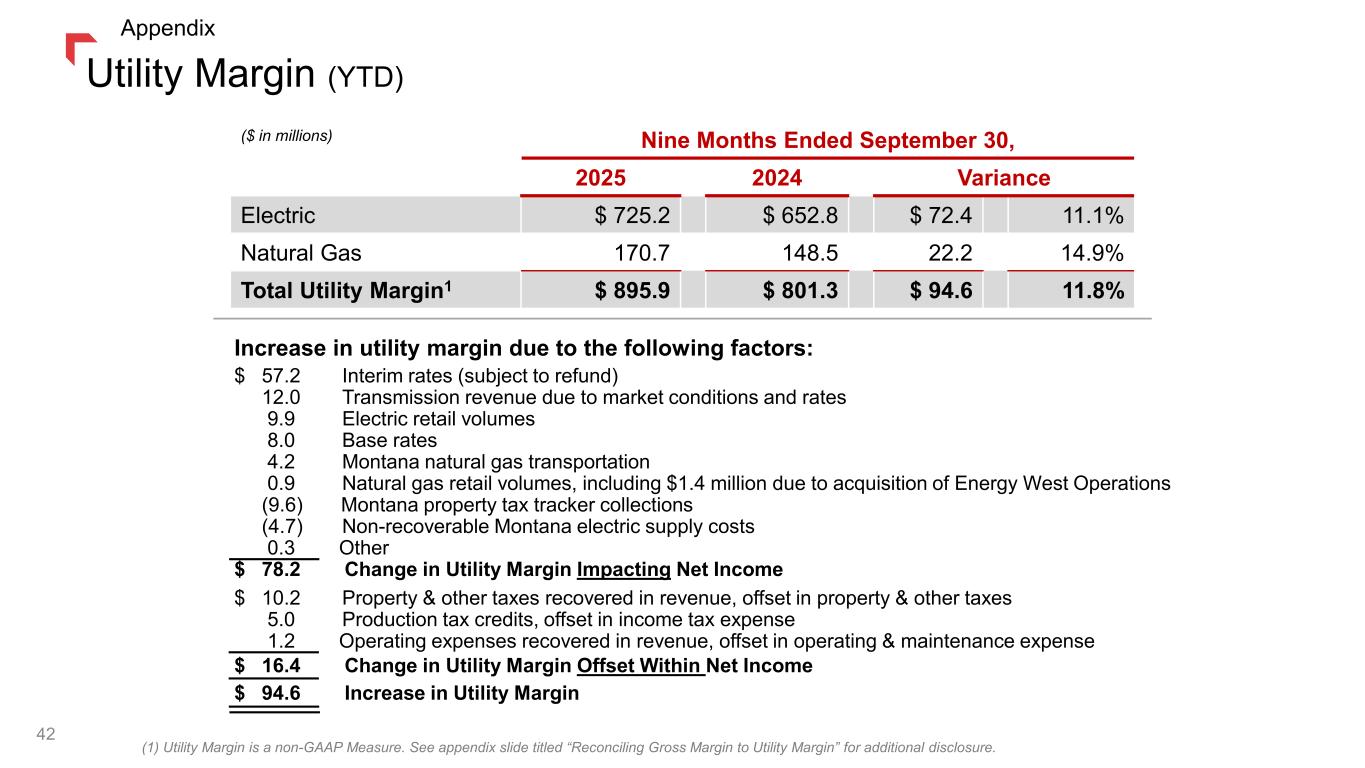

Utility Margin (YTD) ($ in millions) Nine Months Ended September 30, 2025 2024 Variance Electric $ 725.2 $ 652.8 $ 72.4 11.1% Natural Gas 170.7 148.5 22.2 14.9% Total Utility Margin1 $ 895.9 $ 801.3 $ 94.6 11.8% (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. Increase in utility margin due to the following factors: $ 57.2 Interim rates (subject to refund) 12.0 Transmission revenue due to market conditions and rates 9.9 Electric retail volumes 8.0 Base rates 4.2 Montana natural gas transportation 0.9 Natural gas retail volumes, including $1.4 million due to acquisition of Energy West Operations (9.6) Montana property tax tracker collections (4.7) Non-recoverable Montana electric supply costs 0.3 Other $ 78.2 Change in Utility Margin Impacting Net Income $ 10.2 Property & other taxes recovered in revenue, offset in property & other taxes 5.0 Production tax credits, offset in income tax expense 1.2 Operating expenses recovered in revenue, offset in operating & maintenance expense $ 16.4 Change in Utility Margin Offset Within Net Income $ 94.6 Increase in Utility Margin 42 Appendix

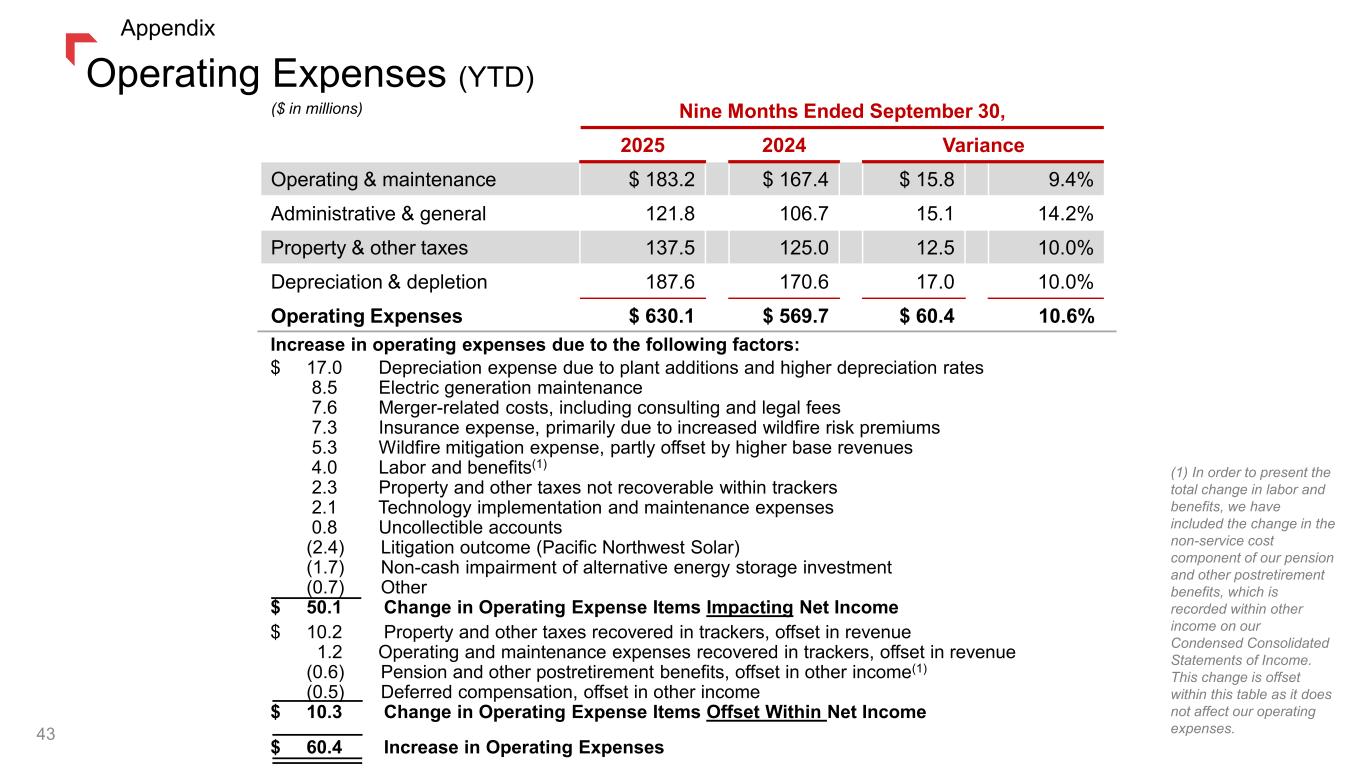

Operating Expenses (YTD) Increase in operating expenses due to the following factors: $ 17.0 Depreciation expense due to plant additions and higher depreciation rates 8.5 Electric generation maintenance 7.6 Merger-related costs, including consulting and legal fees 7.3 Insurance expense, primarily due to increased wildfire risk premiums 5.3 Wildfire mitigation expense, partly offset by higher base revenues 4.0 Labor and benefits(1) 2.3 Property and other taxes not recoverable within trackers 2.1 Technology implementation and maintenance expenses 0.8 Uncollectible accounts (2.4) Litigation outcome (Pacific Northwest Solar) (1.7) Non-cash impairment of alternative energy storage investment (0.7) Other $ 50.1 Change in Operating Expense Items Impacting Net Income ($ in millions) Nine Months Ended September 30, 2025 2024 Variance Operating & maintenance $ 183.2 $ 167.4 $ 15.8 9.4% Administrative & general 121.8 106.7 15.1 14.2% Property & other taxes 137.5 125.0 12.5 10.0% Depreciation & depletion 187.6 170.6 17.0 10.0% Operating Expenses $ 630.1 $ 569.7 $ 60.4 10.6% $ 10.2 Property and other taxes recovered in trackers, offset in revenue 1.2 Operating and maintenance expenses recovered in trackers, offset in revenue (0.6) Pension and other postretirement benefits, offset in other income(1) (0.5) Deferred compensation, offset in other income $ 10.3 Change in Operating Expense Items Offset Within Net Income $ 60.4 Increase in Operating Expenses 43 Appendix (1) In order to present the total change in labor and benefits, we have included the change in the non-service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses.

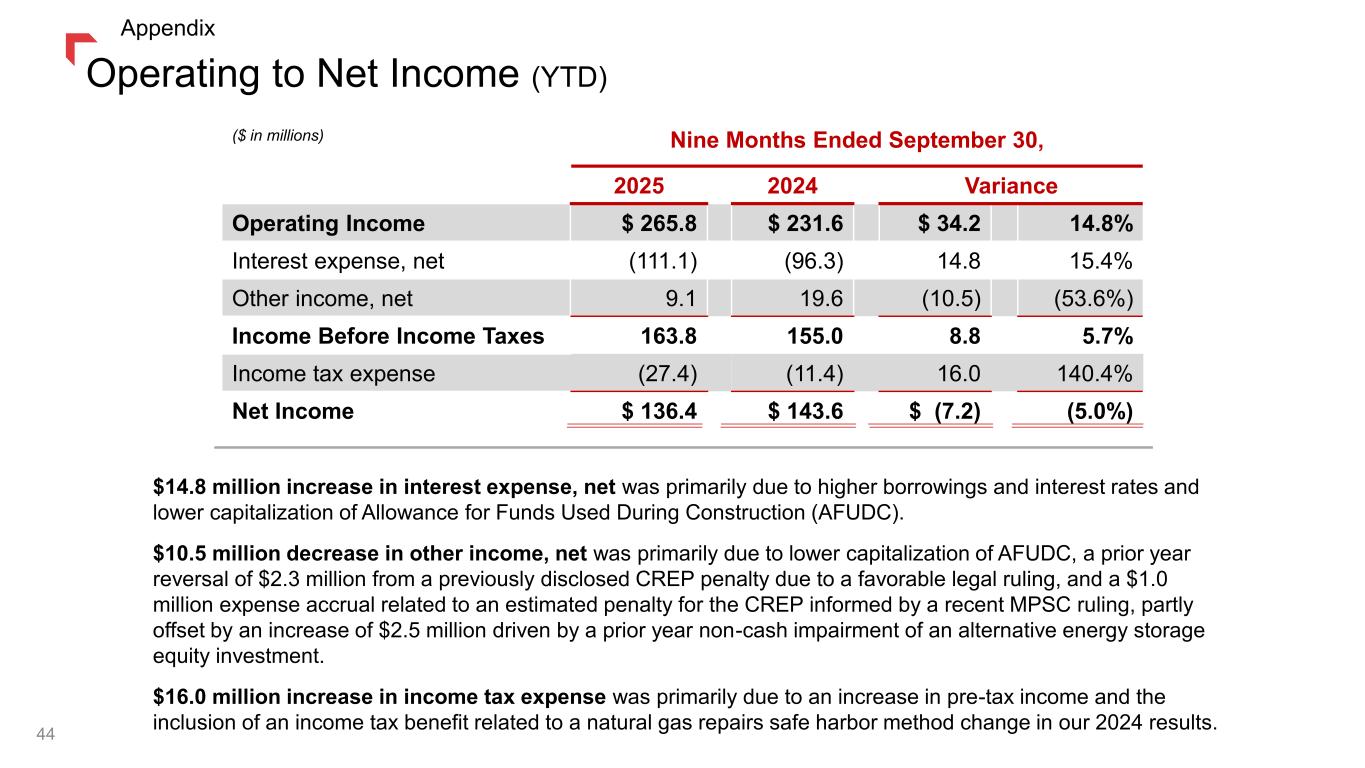

Operating to Net Income (YTD) ($ in millions) Nine Months Ended September 30, 2025 2024 Variance Operating Income $ 265.8 $ 231.6 $ 34.2 14.8% Interest expense, net (111.1) (96.3) 14.8 15.4% Other income, net 9.1 19.6 (10.5) (53.6%) Income Before Income Taxes 163.8 155.0 8.8 5.7% Income tax expense (27.4) (11.4) 16.0 140.4% Net Income $ 136.4 $ 143.6 $ (7.2) (5.0%) $14.8 million increase in interest expense, net was primarily due to higher borrowings and interest rates and lower capitalization of Allowance for Funds Used During Construction (AFUDC). $10.5 million decrease in other income, net was primarily due to lower capitalization of AFUDC, a prior year reversal of $2.3 million from a previously disclosed CREP penalty due to a favorable legal ruling, and a $1.0 million expense accrual related to an estimated penalty for the CREP informed by a recent MPSC ruling, partly offset by an increase of $2.5 million driven by a prior year non-cash impairment of an alternative energy storage equity investment. $16.0 million increase in income tax expense was primarily due to an increase in pre-tax income and the inclusion of an income tax benefit related to a natural gas repairs safe harbor method change in our 2024 results. 44 Appendix

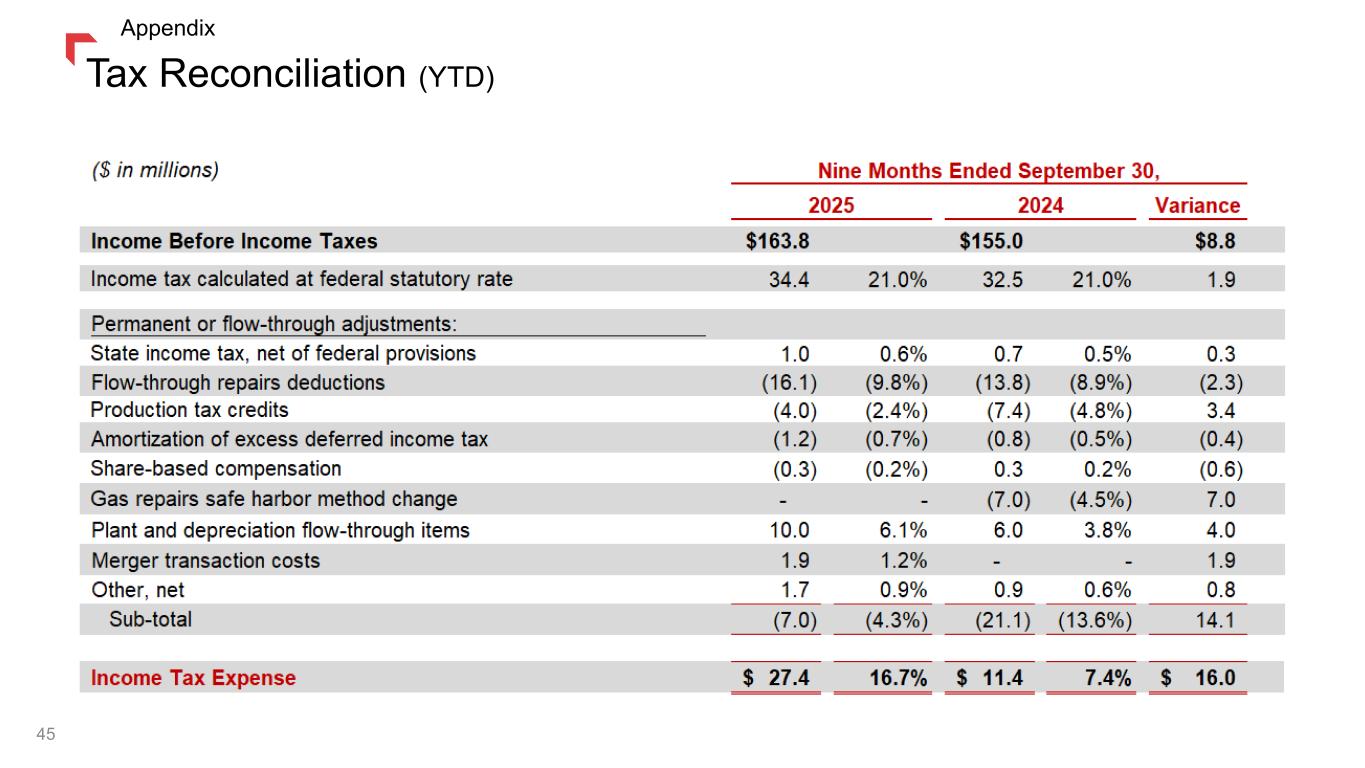

Tax Reconciliation (YTD) 45 Appendix

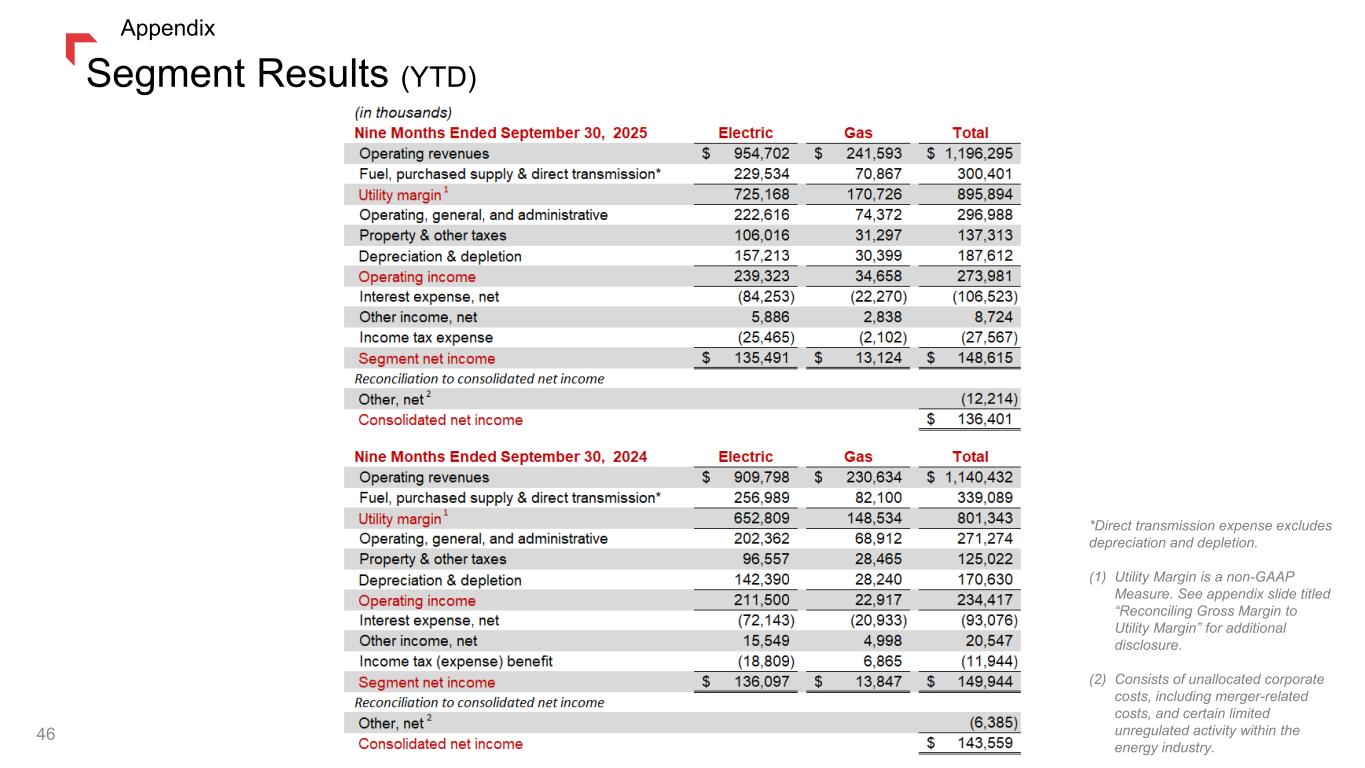

Segment Results (YTD) 46 Appendix *Direct transmission expense excludes depreciation and depletion. (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. (2) Consists of unallocated corporate costs, including merger-related costs, and certain limited unregulated activity within the energy industry.

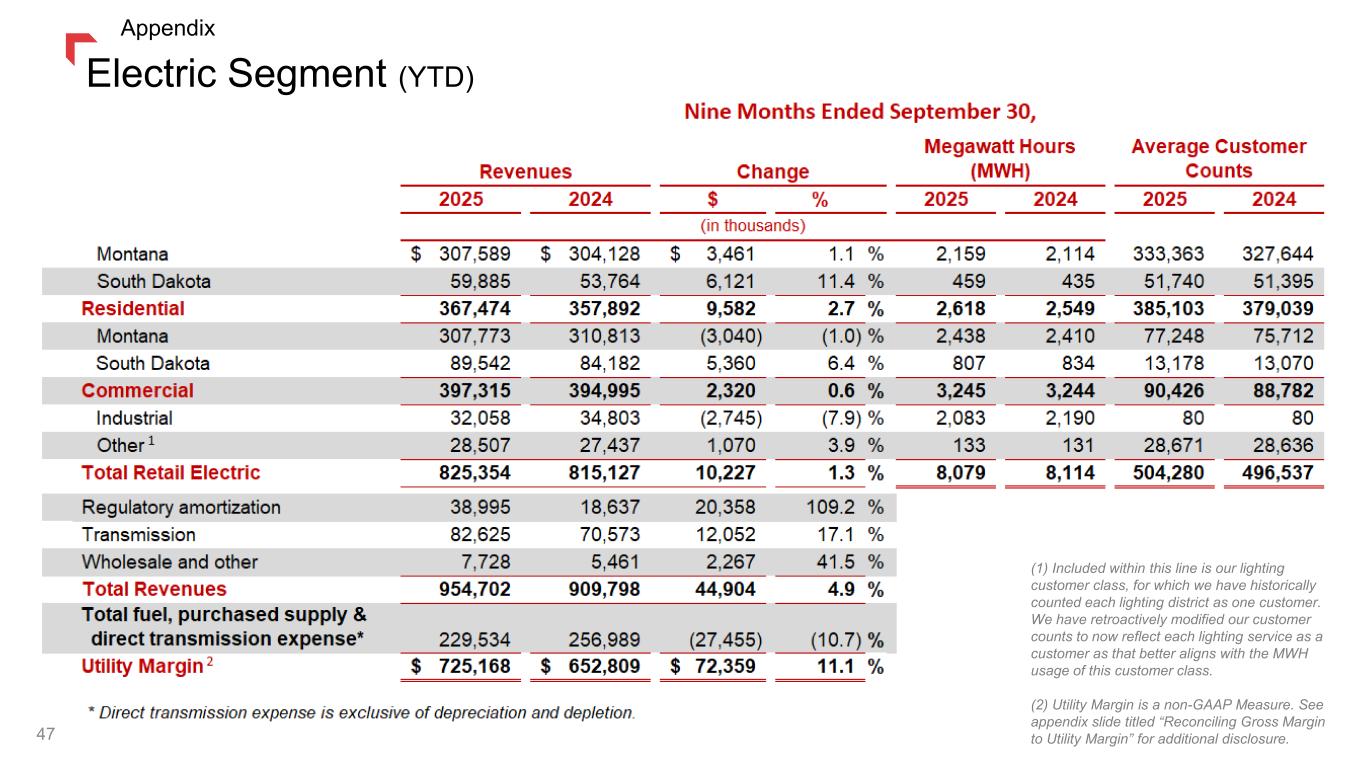

Electric Segment (YTD) (1) Included within this line is our lighting customer class, for which we have historically counted each lighting district as one customer. We have retroactively modified our customer counts to now reflect each lighting service as a customer as that better aligns with the MWH usage of this customer class. (2) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure. 47 Appendix

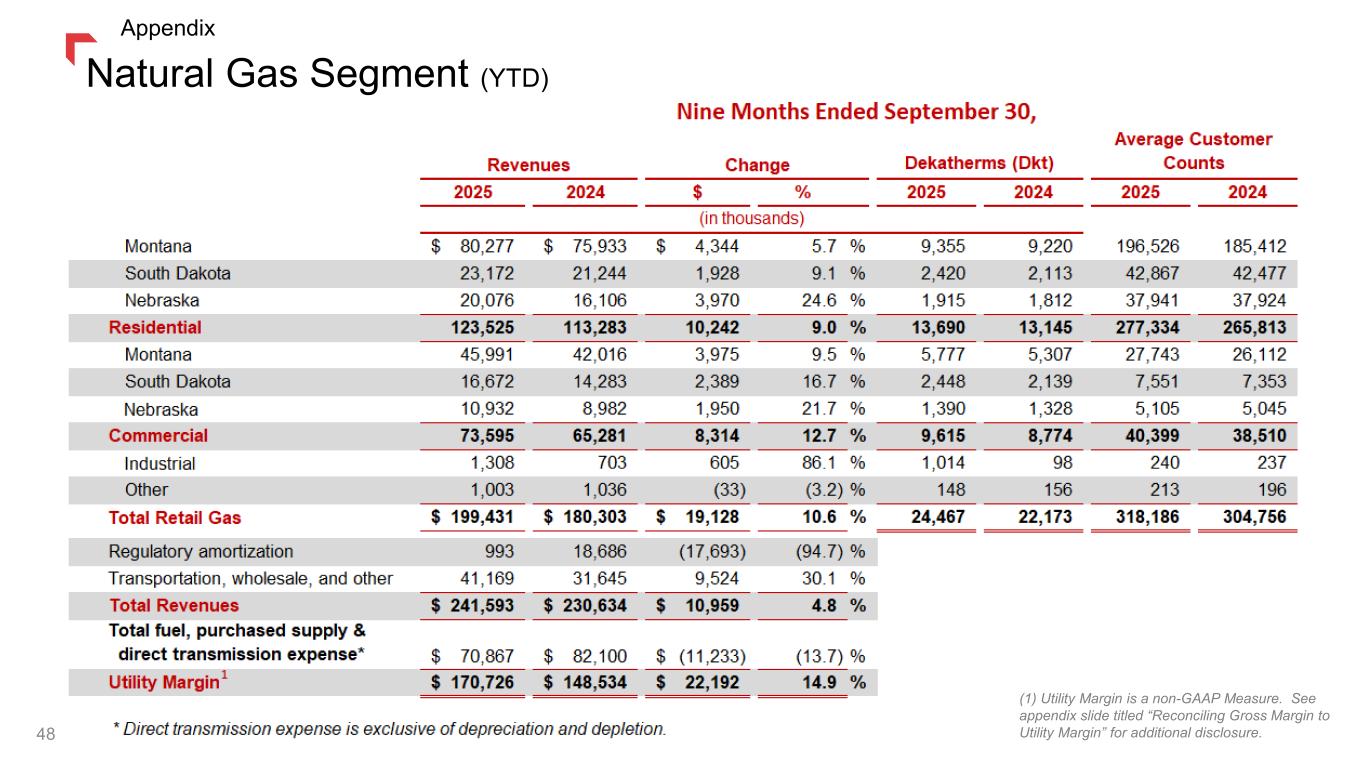

Natural Gas Segment (YTD) 48 Appendix (1) Utility Margin is a non-GAAP Measure. See appendix slide titled “Reconciling Gross Margin to Utility Margin” for additional disclosure.

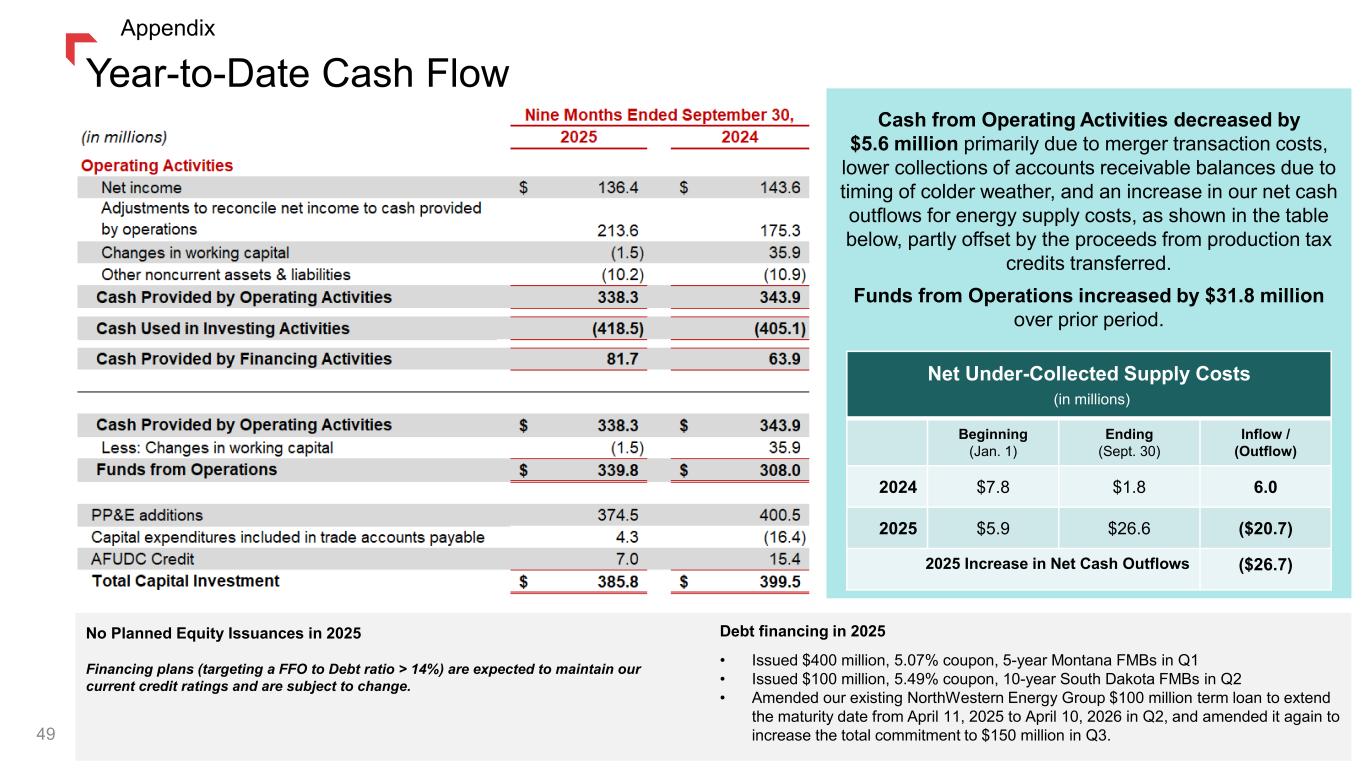

Cash from Operating Activities decreased by $5.6 million primarily due to merger transaction costs, lower collections of accounts receivable balances due to timing of colder weather, and an increase in our net cash outflows for energy supply costs, as shown in the table below, partly offset by the proceeds from production tax credits transferred. Funds from Operations increased by $31.8 million over prior period. Net Under-Collected Supply Costs (in millions) Beginning (Jan. 1) Ending (Sept. 30) Inflow / (Outflow) 2024 $7.8 $1.8 6.0 2025 $5.9 $26.6 ($20.7) 2025 Increase in Net Cash Outflows ($26.7) Year-to-Date Cash Flow 49 No Planned Equity Issuances in 2025 Financing plans (targeting a FFO to Debt ratio > 14%) are expected to maintain our current credit ratings and are subject to change. Debt financing in 2025 • Issued $400 million, 5.07% coupon, 5-year Montana FMBs in Q1 • Issued $100 million, 5.49% coupon, 10-year South Dakota FMBs in Q2 • Amended our existing NorthWestern Energy Group $100 million term loan to extend the maturity date from April 11, 2025 to April 10, 2026 in Q2, and amended it again to increase the total commitment to $150 million in Q3. Appendix

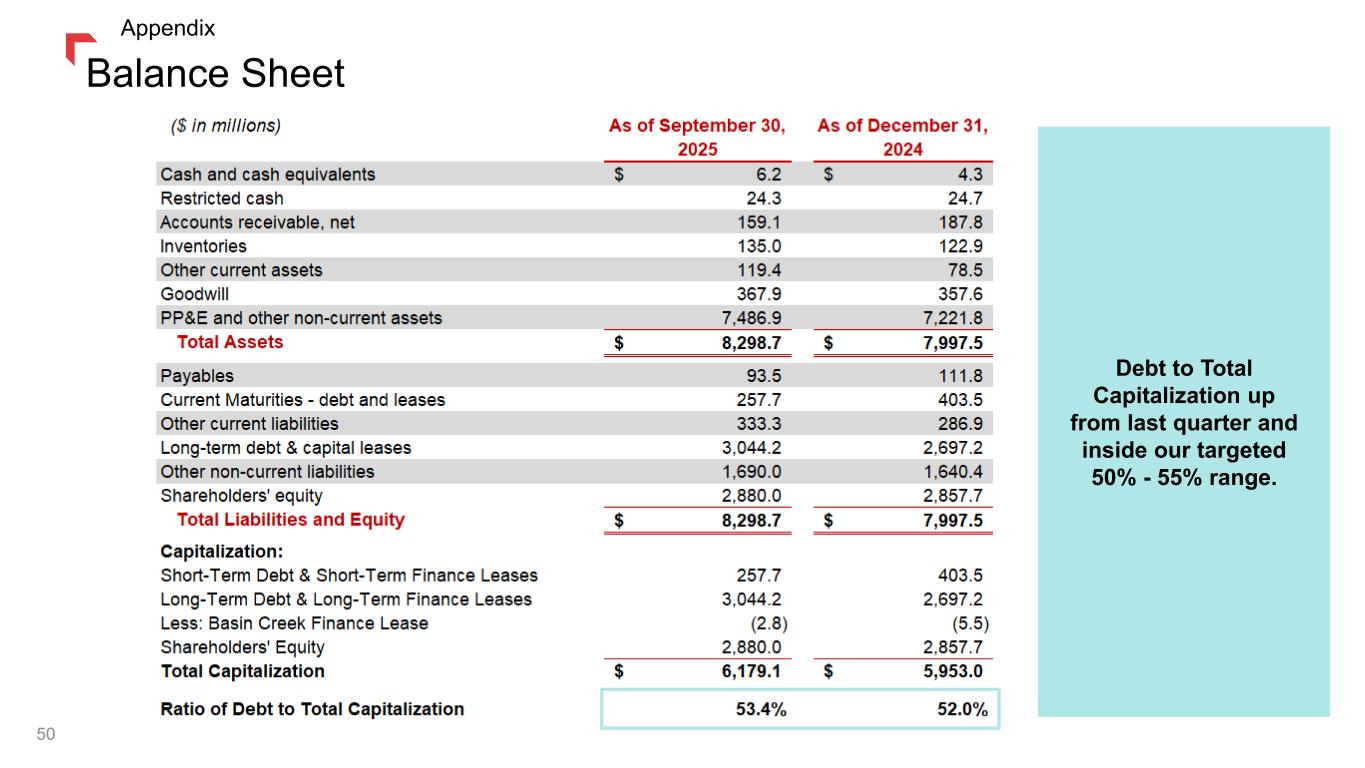

Balance Sheet 50 Appendix Debt to Total Capitalization up from last quarter and inside our targeted 50% - 55% range.

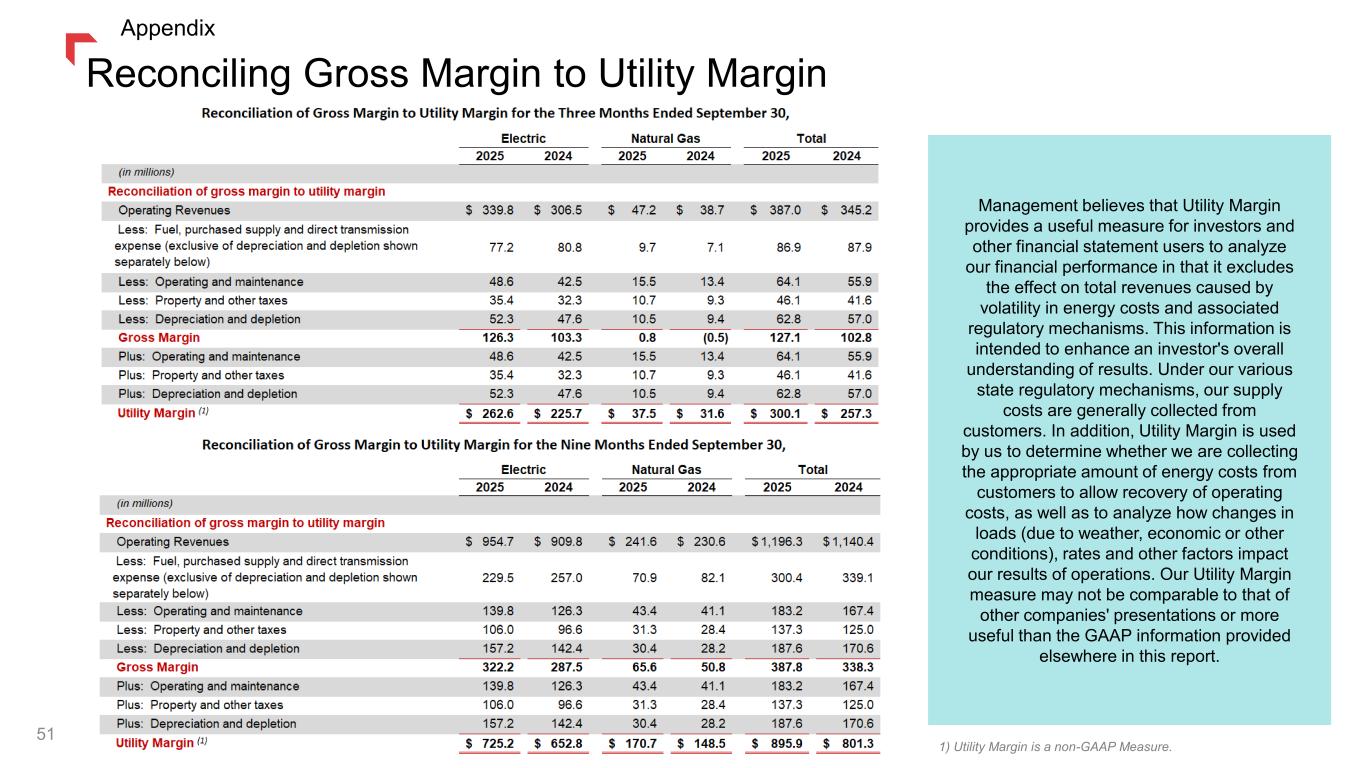

Reconciling Gross Margin to Utility Margin Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report. 1) Utility Margin is a non-GAAP Measure. 51 Appendix

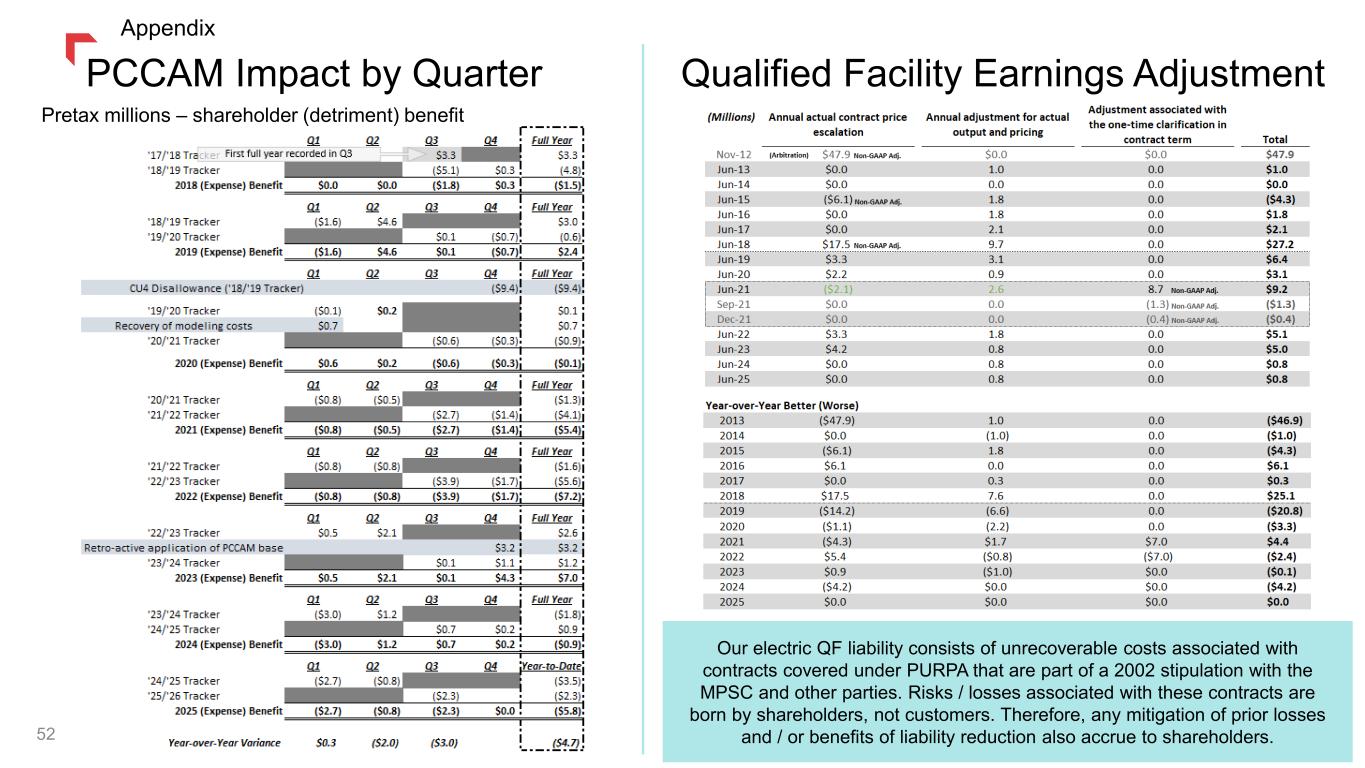

PCCAM Impact by Quarter Qualified Facility Earnings Adjustment Our electric QF liability consists of unrecoverable costs associated with contracts covered under PURPA that are part of a 2002 stipulation with the MPSC and other parties. Risks / losses associated with these contracts are born by shareholders, not customers. Therefore, any mitigation of prior losses and / or benefits of liability reduction also accrue to shareholders.52 Appendix Pretax millions – shareholder (detriment) benefit

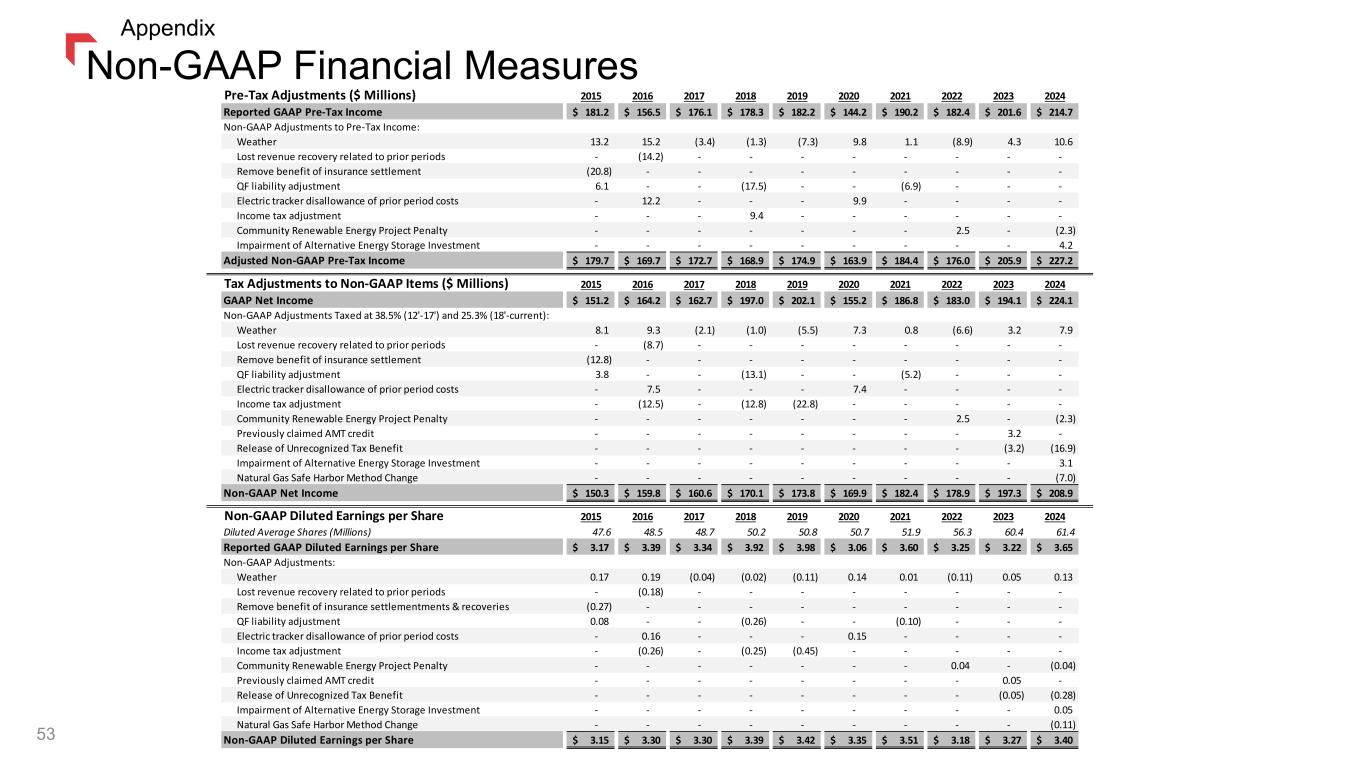

Non-GAAP Financial Measures 53 Appendix Pre-Tax Adjustments ($ Millions) 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Reported GAAP Pre-Tax Income 181.2$ 156.5$ 176.1$ 178.3$ 182.2$ 144.2$ 190.2$ 182.4$ 201.6$ 214.7$ Non-GAAP Adjustments to Pre-Tax Income: Weather 13.2 15.2 (3.4) (1.3) (7.3) 9.8 1.1 (8.9) 4.3 10.6 Lost revenue recovery related to prior periods - (14.2) - - - - - - - - Remove benefit of insurance settlement (20.8) - - - - - - - - - QF liability adjustment 6.1 - - (17.5) - - (6.9) - - - Electric tracker disallowance of prior period costs - 12.2 - - - 9.9 - - - - Income tax adjustment - - - 9.4 - - - - - - Community Renewable Energy Project Penalty - - - - - - - 2.5 - (2.3) Impairment of Alternative Energy Storage Investment - - - - - - - - - 4.2 Adjusted Non-GAAP Pre-Tax Income 179.7$ 169.7$ 172.7$ 168.9$ 174.9$ 163.9$ 184.4$ 176.0$ 205.9$ 227.2$ Tax Adjustments to Non-GAAP Items ($ Millions) 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 GAAP Net Income 151.2$ 164.2$ 162.7$ 197.0$ 202.1$ 155.2$ 186.8$ 183.0$ 194.1$ 224.1$ Non-GAAP Adjustments Taxed at 38.5% (12'-17') and 25.3% (18'-current): Weather 8.1 9.3 (2.1) (1.0) (5.5) 7.3 0.8 (6.6) 3.2 7.9 Lost revenue recovery related to prior periods - (8.7) - - - - - - - - Remove benefit of insurance settlement (12.8) - - - - - - - - - QF liability adjustment 3.8 - - (13.1) - - (5.2) - - - Electric tracker disallowance of prior period costs - 7.5 - - - 7.4 - - - - Income tax adjustment - (12.5) - (12.8) (22.8) - - - - - Community Renewable Energy Project Penalty - - - - - - - 2.5 - (2.3) Previously claimed AMT credit - - - - - - - - 3.2 - Release of Unrecognized Tax Benefit - - - - - - - - (3.2) (16.9) Impairment of Alternative Energy Storage Investment - - - - - - - - - 3.1 Natural Gas Safe Harbor Method Change - - - - - - - - - (7.0) Non-GAAP Net Income 150.3$ 159.8$ 160.6$ 170.1$ 173.8$ 169.9$ 182.4$ 178.9$ 197.3$ 208.9$ Non-GAAP Diluted Earnings per Share 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Diluted Average Shares (Millions) 47.6 48.5 48.7 50.2 50.8 50.7 51.9 56.3 60.4 61.4 Reported GAAP Diluted Earnings per Share 3.17$ 3.39$ 3.34$ 3.92$ 3.98$ 3.06$ 3.60$ 3.25$ 3.22$ 3.65$ Non-GAAP Adjustments: Weather 0.17 0.19 (0.04) (0.02) (0.11) 0.14 0.01 (0.11) 0.05 0.13 Lost revenue recovery related to prior periods - (0.18) - - - - - - - - Remove benefit of insurance settlementments & recoveries (0.27) - - - - - - - - - QF liability adjustment 0.08 - - (0.26) - - (0.10) - - - Electric tracker disallowance of prior period costs - 0.16 - - - 0.15 - - - - Income tax adjustment - (0.26) - (0.25) (0.45) - - - - - Community Renewable Energy Project Penalty - - - - - - - 0.04 - (0.04) Previously claimed AMT credit - - - - - - - - 0.05 - Release of Unrecognized Tax Benefit - - - - - - - - (0.05) (0.28) Impairment of Alternative Energy Storage Investment - - - - - - - - - 0.05 Natural Gas Safe Harbor Method Change - - - - - - - - - (0.11) Non-GAAP Diluted Earnings per Share 3.15$ 3.30$ 3.30$ 3.39$ 3.42$ 3.35$ 3.51$ 3.18$ 3.27$ 3.40$

Non-GAAP Financial Measures This presentation includes financial information prepared in accordance with GAAP, as well as other financial measures, such as Utility Margin, Adjusted Non-GAAP pretax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. We define Utility Margin as Operating Revenues less fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion) as presented in our Consolidated Statements of Income. This measure differs from the GAAP definition of Gross Margin due to the exclusion of Operating and maintenance, Property and other taxes, and Depreciation and depletion expenses, which are presented separately in our Consolidated Statements of Income. A reconciliation of Utility Margin to Gross Margin, the most directly comparable GAAP measure, is included in this presentation. Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report. Management also believes the presentation of Adjusted Non-GAAP pre-tax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS is more representative of normal earnings than GAAP pre-tax income, net income and EPS due to the exclusion (or inclusion) of certain impacts that are not reflective of ongoing earnings. The presentation of these non-GAAP measures is intended to supplement investors' understanding of our financial performance and not to replace other GAAP measures as an indicator of actual operating performance. Our measures may not be comparable to other companies' similarly titled measures. 54 Appendix

Additional Merger Related Disclosures 55 Appendix No Offer or Solicitation This document is for informational purposes only and is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Important Information and Where to Find It Black Hills intends to file a registration statement on Form S-4 with the SEC to register the shares of Black Hills’ common stock that will be issued to NorthWestern Energy stockholders in connection with the proposed transaction. The registration statement will include a joint proxy statement of NorthWestern and Black Hills that will also constitute a prospectus of Black Hills. The definitive joint proxy statement/prospectus will be sent to the stockholders of each of NorthWestern and Black Hills in connection with the proposed transaction. Additionally, NorthWestern and Black Hills will file other relevant materials in connection with the merger with the SEC. Investors and security holders are urged to read the registration statement and joint proxy statement/prospectus when they become available (and any other documents filed with the sec in connection with the transaction or incorporated by reference into the joint proxy statement/prospectus) because such documents will contain important information regarding the proposed transaction and related matters. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by NorthWestern or Black Hills through the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of NorthWestern or Black Hills at travis.meyer@northwestern.com or investorrelations@blackhillscorp.com, respectively. Before making any voting or investment decision, investors and security holders of NorthWestern and Black Hills are urged to read carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto (and any other documents filed with the SEC in connection with the transaction) because they will contain important information about the proposed transaction. Free copies of these documents may be obtained as described above. Participants in Solicitation NorthWestern, Black Hills and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of each of NorthWestern and Black Hills in connection with the proposed transaction. Information regarding the directors and executive officers of NorthWestern and Black Hills and other persons who may be deemed participants in the solicitation of the stockholders of NorthWestern or of Black Hills in connection with the proposed transaction will be included in the joint proxy statement/prospectus related to the proposed transaction, which will be filed by Black Hills with the SEC. Information about the directors and executive officers of NorthWestern and their ownership of NorthWestern common stock can also be found in NorthWestern’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed on February 13, 2025, under the header “Information About Our Executive Officers” and its Proxy Statement on Schedule 14A, which was filed on March 12, 2025, under the headers “Election of Directors” and “Who Owns our Stock”. Information about the directors and executive officers of Black Hills and their ownership of Black Hills common stock can also be found in Black Hills’ filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed on February 12, 2025, under the header “Information About Our Executive Officers,” and its Proxy Statement on Schedule 14A, which was filed on March 14, 2025, under the headers “Election of Directors” and “Security Ownership of Management and Principal Shareholders,” and other documents subsequently filed by Black Hills with the SEC. To the extent any such person's ownership of NorthWestern’s or Black Hills’ securities, respectively, has changed since the filing of such proxy statement, such changes have been or will be reflected on Forms 3, 4 or 5 filed with the SEC. Additional information regarding the interests of such participants will be included in the joint proxy statement/prospectus and other relevant documents regarding the proposed transaction filed with the SEC when they become available.

Thank youDelivering a bright future 56