MANAGEMENT REPORT | |||||||||||||||||||

Annual review | Sustainability statement | Financial statements and additional information | |||||||||||||||||

|  |  |  |  | |||||||||||||||

3 4 7 8 9 10 11 | 12 13 14 20 26 32 | 35 36 37 39 41 | 45 51 71 132 | 82 120 125 131 | |||||||||||||||

– – – | 4 | ||

Sharpening our focus for a new era |  | ||||

As we reflect on 2025 and look towards the future, we write at a pivotal moment in Novo Nordisk’s journey. The past year has been one of profound transformation; testing our resilience, sharpening our focus and positioning us for sustainable success in an increasingly dynamic healthcare landscape. | |||||

For decades, Novo Nordisk flourished in the diabetes market, building expertise patient by patient, innovation by innovation. Our entry into obesity treatment – a field we pioneered and shaped – thrust us into an era of unprecedented growth that, frankly, surprised even us. This huge demand changed everything: people with obesity actively seeking our medicines, self-paying consumers seeking faster access and a global spotlight on our every move. This extraordinary period taught us important lessons about serving consumer-driven markets. We discovered that people living with obesity face completely different challenges than those living with diabetes. Instead of fear, they often feel shame or stigmatisation. Instead of conventional clinical support, they want discretion. This realisation demanded different approaches than our traditional physician- focused model, forcing us to rethink our traditional approaches to patient care and market access. The competitive landscape has evolved just as dramatically. Where we once enjoyed clear market leadership in obesity treatment, virtually every major pharmaceutical company now recognises this as an attractive market. This competition, whilst challenging, validates the therapeutic area we pioneered and drives continued innovation for patients. We are not intimidated by this new reality; after all, our century-long experience in diabetes has taught us how to compete successfully in crowded markets. What sets us apart remains compelling: unmatched global reach, extensive manufacturing investments and an unparalleled understanding of metabolic diseases. We have also seen encouraging recognition from the World Health Organization, which has acknowledged the multiple health benefits of GLP-1 treatments and has committed to exploring ways to expand access globally. This growing institutional support opens exciting new pathways to bring our life-changing treatments to more people with obesity and diabetes, wherever they are. | |||||

Chair of the Board of Directors Lars Rebien Sørensen (left) and President and CEO Maziar Mike Doustdar (right). | |||||

– – – | 5 | ||

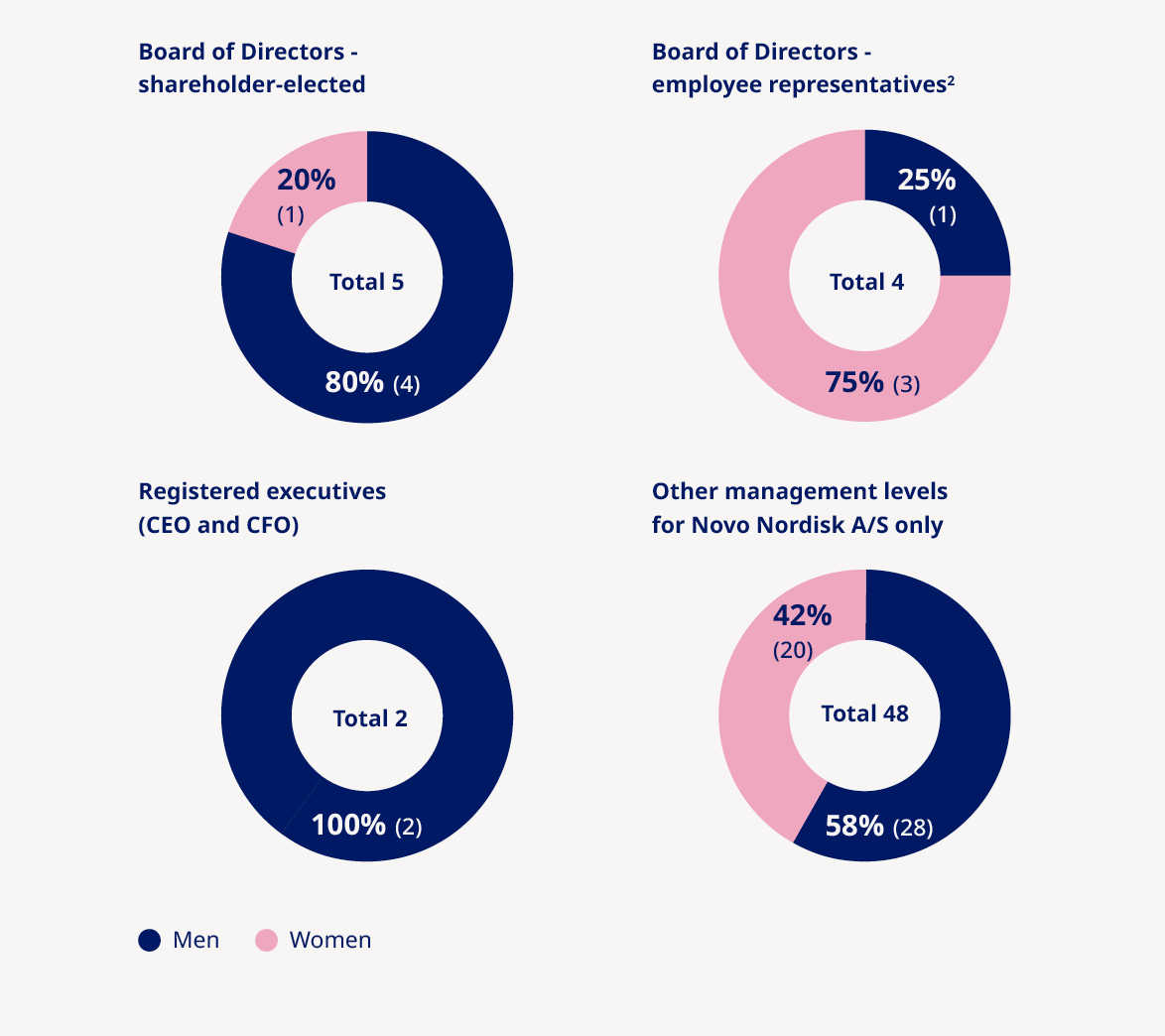

In response to these market shifts, we have made decisive changes to remain the leader in obesity and diabetes care. We have refocused our strategy on these core therapeutic areas – not as a limitation, but as recognition that serving the two billion people living with obesity, overweight or diabetes provides massive opportunities for growth and impact. This sharpened focus reflects our DNA: throughout our history, we have always succeeded when concentrating our efforts where we make the greatest difference. Operationally, we have merged our research and development functions to accelerate innovation without compromise, creating seamless progression from early research through clinical development. We have also simplified governance structures to increase our operational speed whilst maintaining our commitment to ethics and compliance. The most challenging decision of 2025 was the reduction of our workforce – the largest in our company’s history. After scaling up rapidly during a period of hyper-growth, we recognised staffing levels had become unsustainable as market dynamics shifted, requiring difficult but necessary action to ensure financial discipline. We approached this with deep respect for those colleagues affected, conducting the process swiftly and with dignity, consistent with the Novo Nordisk Way. These actions preserved our ability to redirect resources towards obesity and diabetes growth opportunities essential to serving patients and driving our future success. Furthermore, changes to the composition of our Board reflect our commitment to having the right competencies for this new business reality. Following dialogue between Novo Nordisk’s Board and the board of the Novo Nordisk Foundation, different visions for the pace and extent of board renewal made an extraordinary general meeting necessary to provide clarity on governance. Our reconfigured Board stands ready to support management in responding rapidly to market conditions in this dynamic environment. Moving forward, we are committed to constructive engagement with shareholders, ensuring that their perspectives help shape the road ahead. Our path forward centres on expanding access whilst accelerating innovation. We will develop products for different patient needs, price points and preferences. Just as we serve people living with diabetes with multiple insulin formulations, we will build a comprehensive obesity portfolio offering diverse treatment options. This means developing therapies that address the full spectrum of patient circumstances – from those seeking the highest efficacy outcomes to those who need different delivery methods, dosing frequencies or treatment profiles that better suit their individual needs. A significant milestone has been the record-breaking launch of the Wegovy® pill – the world’s first and only once-daily oral GLP-1 therapy approved for weight management. This breakthrough addresses patient preferences whilst leveraging the proven efficacy and safety profile of semaglutide, positioning us uniquely in an increasingly competitive field. | With our expanding treatment options, we view the upcoming loss of exclusivity for semaglutide in certain markets as an opportunity, not a threat. When you have multiple ways to serve patients, patent cliffs become stepping stones to broader access. Generic competition will expand access to obesity treatments, creating a stronger foundation for next-generation innovations whilst our oral formulation, higher-strength versions and novel mechanisms will serve diverse patient needs. As our transformation continues, so does our long-standing commitment to sustainable business practices. The triple bottom line – balancing financial performance with social responsibility and environmental stewardship – remains fundamental to our identity. Long-term value creation requires attention to these broader impacts, and we continue to invest in sustainable practices whilst setting realistic, achievable targets that we can deliver upon. Throughout this evolution, we remain anchored by the same patient-first obsession that has guided us for more than a century. Every decision and every innovation must ultimately serve the health and wellbeing of the more than 45.6 million patients who depend on us today, and the hundreds of millions more we aim to serve in future. This patient-centric approach extends across our entire value chain: from researchers designing molecules with real-world patient needs in mind, to pricing strategies reflecting diverse affordability requirements, to commercial approaches that meet people where and how they want to access care. As we look to 2026 and beyond, we are not promising a rapid return to the extraordinary growth rates of recent years. Market conditions have evolved, competition has intensified and expanding access to our life-changing medicines means finding new ways to reach more patients whilst continuing to invest in the breakthrough treatments of tomorrow. In response, we are building a stronger, more focused organisation that can deliver sustainable value whilst fulfilling our mission to defeat obesity, diabetes and related comorbidities. The year ahead will test our resolve and capabilities. We face it with confidence, knowing that our renewed focus, strengthened competencies and uncompromising commitment to people with serious chronic diseases position us well for the challenges and opportunities ahead. Thank you for your continued trust and support as we write Novo Nordisk’s next chapter. | ||||||

|  | ||||||

Lars Rebien Sørensen Chair of the Board of Directors | Maziar Mike Doustdar President and CEO | ||||||

– – – | 6 | ||

Q&A WITH THE CEO Leading through change |  | The soaring demand for obesity treatment has also highlighted critical patient safety issues with unapproved compounded products that do not undergo rigorous review for safety, effectiveness and quality. This reinforces why authentic, thoroughly tested medicines matter. Our responsibility extends beyond serving people with obesity to actively seeking to protect them from the safety and efficacy risks posed by unapproved compounded products. How does Novo Nordisk’s portfolio strategy address these diverse patient needs? Reaching millions more people means we need a portfolio that works for everyone – from affordable options to cutting-edge treatments. In obesity, we are building a strong pipeline with higher-dose and oral formulations of Wegovy® and exciting next-generation therapies like zenagamtide (amycretin) and CagriSema. But that is just part of the story. We are also focused on diabetes with the continued rollout of Awiqli® and the EU approval of Kyinsu® (IcoSema), plus we are preparing for the launch of denecimig (Mim8) for people living with haemophilia A. Different patients have different motivations and preferences. Some need treatment to address serious underlying health risks, others to improve their quality of life. Some prefer oral medications whilst others are comfortable with injections. Our portfolio must reflect this segmentation. The impending loss of exclusivity for semaglutide actually strengthens this approach. Generic competition will help establish an affordable foundation whilst we build differentiated innovations on top of that. We will not shy away from business development activities that complement our focused strategy, ensuring we serve people with serious chronic diseases with as many treatment options as needed. What should stakeholders expect as Novo Nordisk moves forward? As we enter 2026, I want to set realistic expectations. As you can see in our financial outlook for the year ahead, we are projecting a sales decline in 2026 and are not promising a rapid return to the extraordinary growth rates of recent years. We are focused on sustainable, long-term value creation by expanding our reach and advancing our pipeline. This means providing access to many more people while building the foundation for future growth. We are pursuing impact growth, measured by how many additional people gain access to life-changing treatments, rather than revenue growth for its own sake. This means building sustainable competitive advantages through breakthrough science, strategic partnerships and access programmes that serve people with serious chronic diseases regardless of their economic circumstances. What gives you confidence in Novo Nordisk’s future? When you reflect on the history of Novo Nordisk, you can see that it has never been one smooth ride. Innovation is never a straight line – what has made us successful over the past 102 years is our ability to show resilience and create new innovations time and again. That same spirit drives us today. The hundreds of millions of people we are yet to reach represent an enormous opportunity. We have the right people, guided by the right values, to meet that challenge whilst living up to our triple bottom line principle. Most importantly, I see colleagues who genuinely care about the patients we serve. That focus on putting patients’ health and wellbeing first remains our greatest strength. This combination of proven resilience and untapped potential is why our best years are still ahead of us. | ||||||

In his first Annual Report as CEO, Maziar Mike Doustdar reflects on a challenging year, the strength of Novo Nordisk's foundations and his vision for sustainable growth through innovation and expanded access. | ||||||||

This has been a difficult year for Novo Nordisk. How do you reflect on your first six months as CEO? It has been a difficult year for our employees and our shareholders. We said goodbye to many good colleagues and we were not able to meet our growth expectations, which has been tough on our colleagues and shareholders alike. Our hyper-growth period led to unsustainable increases in staffing and costs that required difficult but necessary corrections to ensure we could redirect resources towards obesity and diabetes growth opportunities – the areas that will ultimately serve patients. But I have no doubt that the foundations of this company are as strong as ever. We serve millions of people across obesity, diabetes and rare diseases, with so many more yet to reach. During my first six months as CEO, I have interacted with colleagues from across the value chain, and I am more persuaded each time that we have an incredibly talented workforce. What strikes me most is the sense of purpose that guides us: an unwavering commitment to innovation and a genuine obsession to serve patients that has defined our 102-year journey, always guided by the Novo Nordisk Way. How do you view the competitive landscape in obesity treatment? We have pioneered an area of unmet need that has created robust competition, and competition has always served innovation and the needs of patients. What motivates me is that the obesity market contains hundreds of millions of people with diverse needs; this is not a constraint, it is an enormous opportunity for a company with our capabilities. The competitive environment has also taught us valuable lessons about truly understanding our patients. For example, we have learned that some people living with obesity prefer accessing treatment through online providers from the privacy of their homes rather than in traditional clinical settings. Understanding these real patient preferences is crucial to our success. | ||||||||

– – – | 7 |

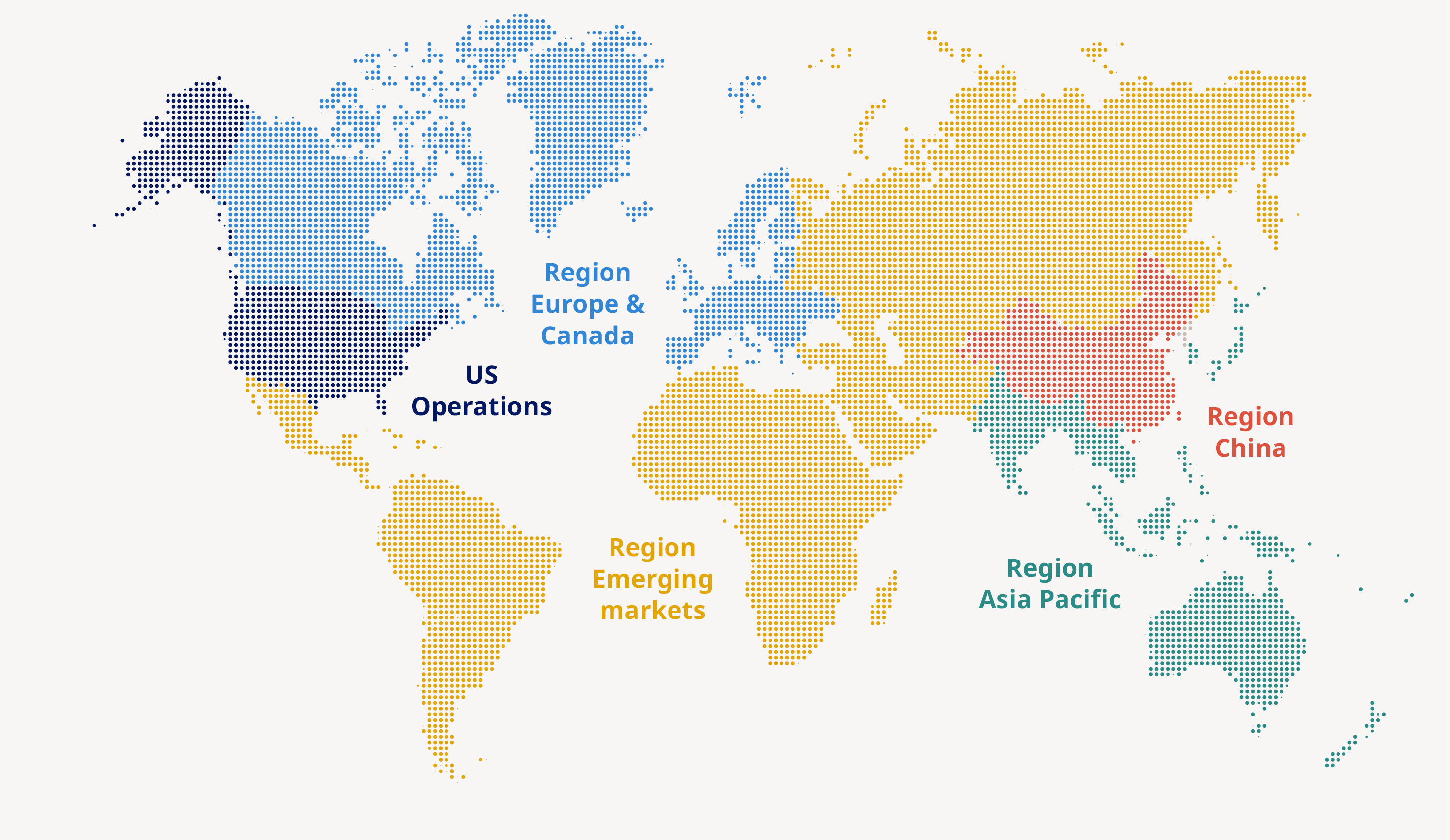

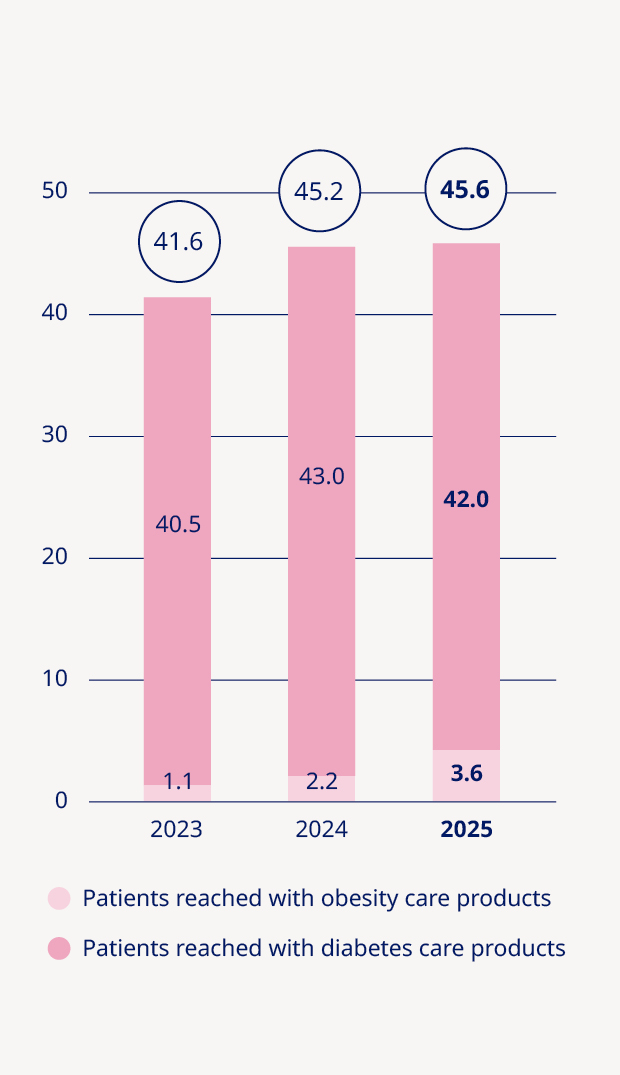

2025 at a glance Novo Nordisk is a leading global healthcare company, founded in 1923 and headquartered in Denmark. | GEOGRAPHICAL AREAS | 45.6 million people living with obesity and diabetes reached (45.2 million in 2024) | 6.4% sales growth as reported (25% in 2024) | ||||

| |||||||

52 countries with Wegovy® available (17 in 2024) | 11.70 dividend per share (DKK 11.40 in 2024) | ||||||

673 submissions and approvals of new products (593 in 2024) | 69,505 employees worldwide (77,349 in 2024) | ||||||

KEY EVENTS | ||||||||||||||

| ||||||||||||||

Acquisitions and licencing to enhance portfolio of treatments. Included the acquisition of Akero Therapeutics, Inc. and its phase 3 asset (MASH) and licence agreements with The United Laboratories (triple receptor agonist) and Septerna, Inc. (small molecules). | Maziar Mike Doustdar appointed as president and chief executive officer of Novo Nordisk. Maziar Mike Doustdar, formerly executive vice president of International Operations, succeeded Lars Fruergaard Jørgensen in the role. | Wegovy® approved in the US for the treatment of MASH. The Food and Drug Administration (FDA) approval positioned Wegovy® as the first and only GLP-1 treatment approved for MASH, complementing proven weight loss and cardiovascular benefits. | Company-wide transformation plan to streamline operations and reinvest for growth. Included a global workforce reduction of around 9,000 positions with annualised savings of DKK 8 billion from 2026 and onwards redirected to obesity and diabetes growth opportunities. | Expanded affordability options to bring our GLP-1s to more Americans. Expanding access and affordability for our semaglutide medicines on top of existing initiatives such as lower self-pay prices and collaborations with select telehealth providers. | Advanced pipeline programmes and submitted new medicines for approval. Key progress included advancing zenagamtide (amycretin) to initiate phase 3 trials in 2026, and filing weight management medicine CagriSema to the FDA. | FDA approval and launch of Wegovy® pill in the US. First and only approved once- daily oral GLP-1 medicine for weight management. With efficacy on par with injectable semaglutide and more optionality, this advancement opens new possibilities for the more than 100 million people living with obesity in the US. | ||||||||

– – – | 8 |

Five-year overview |

Financial performance | Change | ||||||

DKK million | 2021 | 2022 | 2023 | 2024 | 2025 | 2024-25 | |

Net sales | 140,800 | 176,954 | 232,261 | 290,403 | 309,064 | 6.4% | |

Sales growth as reported | 10.9% | 25.7% | 31.3% | 25.0% | 6.4% | ||

Sales growth in constant exchange rates1 | 13.8% | 16.4% | 35.6% | 25.7% | 10.3% | ||

Operating profit | 58,644 | 74,809 | 102,574 | 128,339 | 127,658 | (0.5%) | |

Operating profit growth as reported | 8.3% | 27.6% | 37.1% | 25.1% | (0.5%) | ||

Operating profit growth in constant exchange rates1 | 12.7% | 14.6% | 43.7% | 26.2% | 6.0% | ||

Depreciation, amortisation and impairment losses | 6,025 | 7,362 | 9,413 | 19,107 | 21,982 | 15.0% | |

EBITDA1,2 | 64,669 | 82,171 | 111,987 | 147,446 | 149,640 | 1.5% | |

EBITDA growth as reported1, 2 | 8.0% | 27.1% | 36.3% | 31.7% | 1.5% | ||

EBITDA growth in constant exchange rates1, 2 | 12.0% | 14.9% | 42.4% | 32.7% | 7.3% | ||

Net financials | 436 | (5,747) | 2,100 | (1,148) | 2,882 | ||

Profit before income taxes | 59,080 | 69,062 | 104,674 | 127,191 | 130,540 | 2.6% | |

Effective tax rate3 | 19.2% | 19.6% | 20.1% | 20.6% | 21.5% | ||

Net profit | 47,757 | 55,525 | 83,683 | 100,988 | 102,434 | 1.4% | |

Adjusted net profit1 | 49,146 | 57,370 | 86,229 | 110,557 | 116,407 | ||

Purchase of property, plant and equipment | 6,335 | 12,146 | 25,806 | 47,164 | 60,140 | 28% | |

Purchase of intangible assets | 1,050 | 2,607 | 13,090 | 4,145 | 29,973 | 623% | |

Cash used for acquisition of businesses | 18,283 | 7,075 | — | 82,163 | — | ||

Free cash flow1 | 29,319 | 57,362 | 68,326 | (14,707) | 28,295 | ||

Total assets | 194,508 | 241,257 | 314,486 | 465,630 | 542,902 | 17% | |

Net debt1 | (5,031) | 2,319 | 8,950 | (69,713) | (95,424) | 37% | |

Equity | 70,746 | 83,486 | 106,561 | 143,486 | 194,047 | 35% | |

1. See Non-IFRS financial measures. 2. EBITDA is defined as ’net profit’, adjusted for 'income taxes', 'financial items', 'depreciation and amortisation' and 'impairment losses and reversals'. 3. See Financial definitions and ratios. 4. Total dividend for the year including interim dividend of DKK 3.75 per share, corresponding to DKK 16,663 million, which was paid in August 2025. The remaining DKK 7.95 per share, corresponding to DKK 35,312 million, will be paid subject to approval at the Annual General Meeting in March 2026. 5. Total number of patients reached by obesity and diabetes products. 6. GHG: Greenhouse Gas. | |||||||

Financial ratios | Change | ||||||

DKK million | 2021 | 2022 | 2023 | 2024 | 2025 | 2024-25 | |

Gross margin3 | 83.2% | 83.9% | 84.6% | 84.7% | 81.0% | ||

Sales and distribution costs in percentage of sales | 26.3% | 26.1% | 24.4% | 21.4% | 20.8% | ||

Research and development costs in percentage of sales | 12.6% | 13.6% | 14.0% | 16.6% | 16.8% | ||

Cash to earnings1 | 61.4% | 103.3% | 81.6% | (14.6%) | 27.6% | ||

Operating margin3 | 41.7% | 42.3% | 44.2% | 44.2% | 41.3% | ||

Net profit margin3 | 33.9% | 31.4% | 36.0% | 34.8% | 33.1% | ||

Return on invested capital1 | 69.0% | 73.6% | 88.5% | 63.9% | 39.3% | ||

Share performance and capital allocation | |||||||

Basic earnings per share/ADR in DKK3 | 10.40 | 12.26 | 18.67 | 22.67 | 23.06 | 1.7% | |

Diluted earnings per share/ADR in DKK3 | 10.37 | 12.22 | 18.62 | 22.63 | 23.03 | 1.8% | |

Adjusted diluted earnings per share/ADR in DKK1 | 10.67 | 12.62 | 19.18 | 24.77 | 26.17 | 5.7% | |

Total number of shares (million), end of year | 4,620 | 4,560 | 4,510 | 4,465 | 4,465 | 0.0% | |

Dividend per share in DKK4 | 5.20 | 6.20 | 9.40 | 11.40 | 11.70 | 2.6% | |

Total dividend (DKK million)4 | 23,711 | 27,950 | 41,987 | 50,683 | 51,975 | 2.5% | |

Dividend payout ratio3 | 49.6% | 50.3% | 50.2% | 50.2% | 50.7% | ||

Share repurchases (DKK million) | 19,447 | 24,086 | 29,924 | 20,181 | 1,388 | (93%) | |

Closing share price (DKK) | 368 | 469 | 698 | 624 | 325 | (48%) | |

Sustainability performance | |||||||

Total number of patients reached (in millions)5 | 34.9 | 36.9 | 41.6 | 45.2 | 45.6 | 1% | |

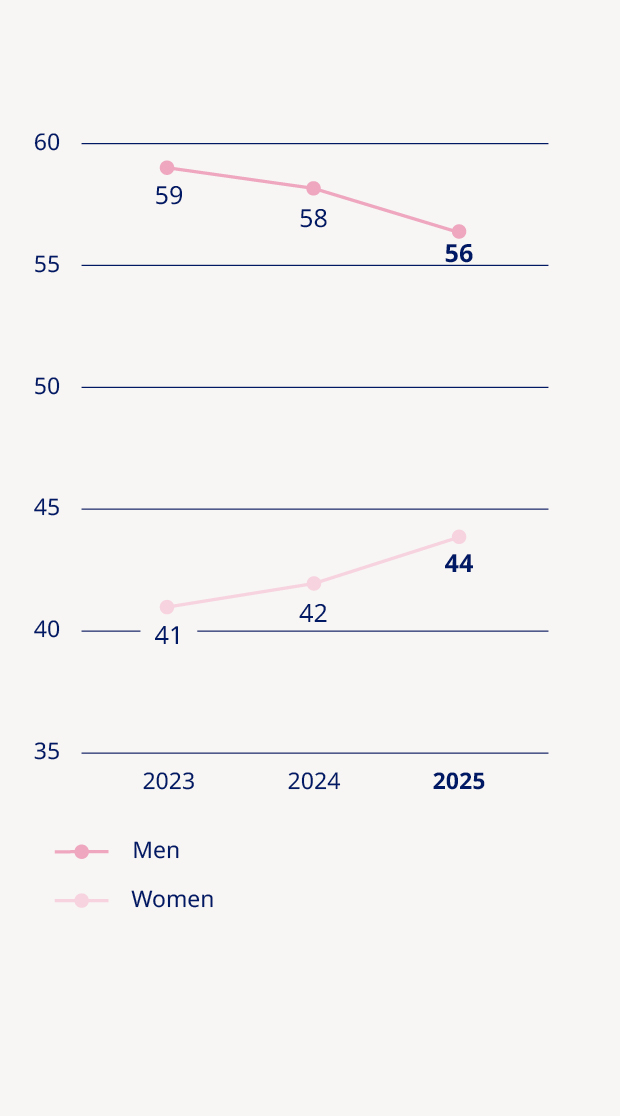

Total number of employees (headcount) | 48,478 | 55,185 | 64,319 | 77,349 | 69,505 | (10%) | |

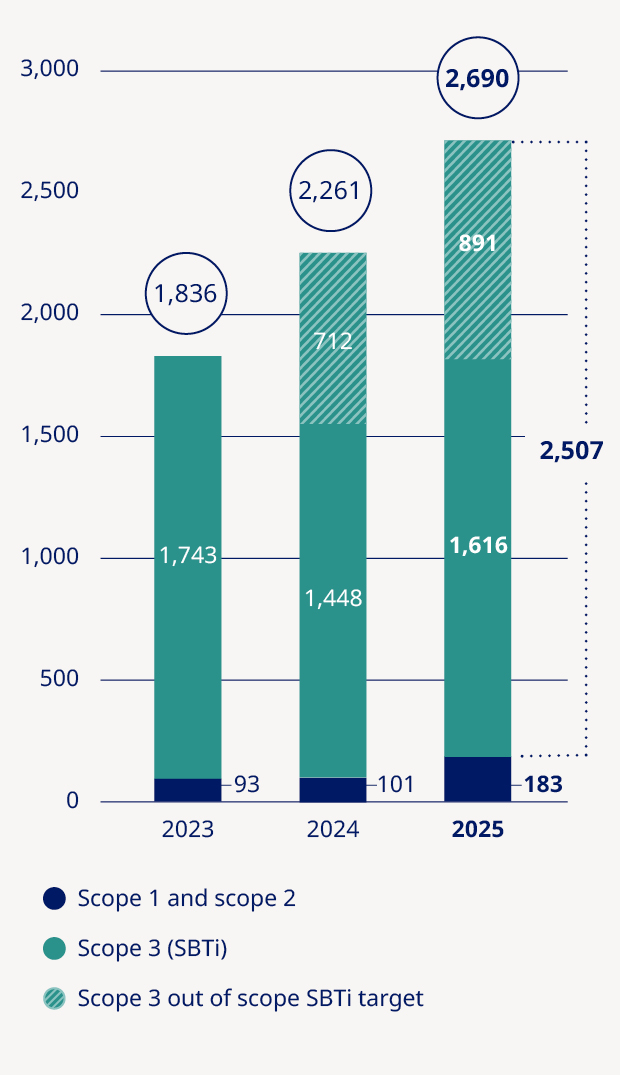

Total GHG6 emissions – market-based (1,000 tonnes CO2e) | — | — | 1,836 | 2,261 | 2,690 | 19% | |

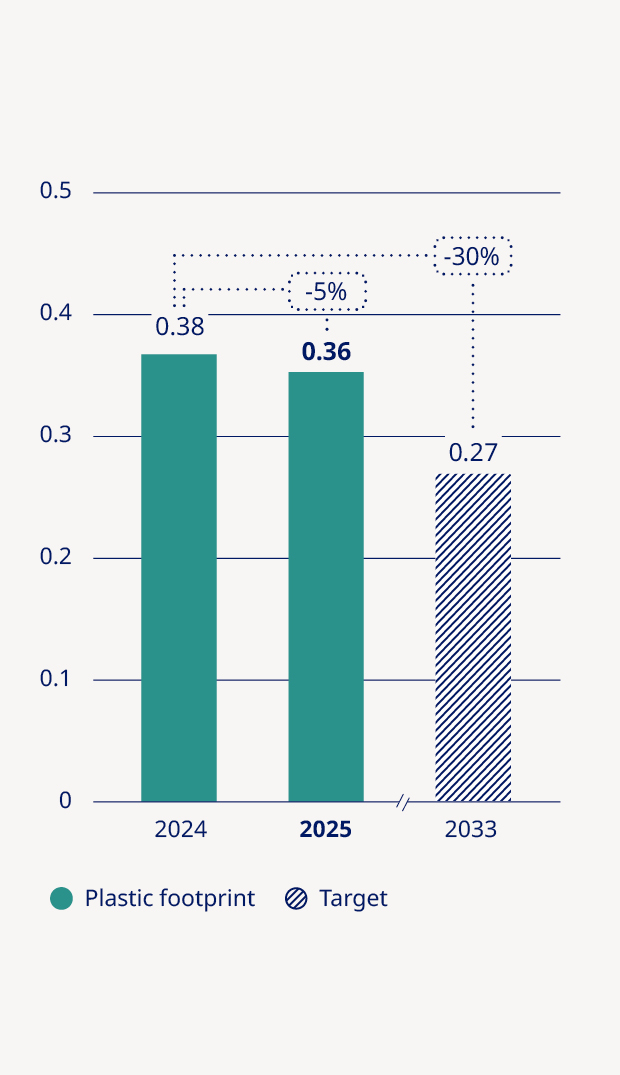

Plastic footprint per patient (kg/patient) | — | — | — | 0.38 | 0.36 | (5%) |

– – – | Novo Nordisk Annual Report 2025 / Annual review / Introducing Novo Nordisk / Purpose, strategy and culture | 9 |

Purpose, strategy and culture | |||||||

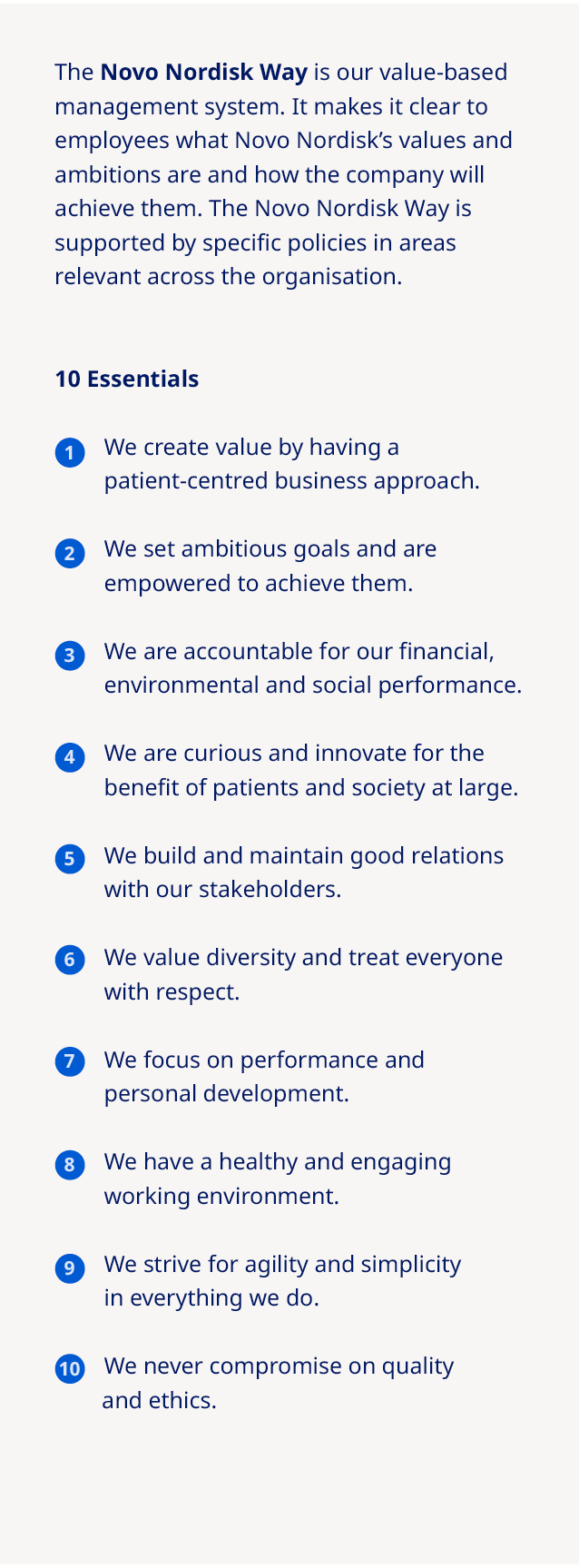

PURPOSE At Novo Nordisk, our purpose remains clear: driving change to defeat serious chronic diseases. Alongside our purpose, balancing our triple bottom line of financial, social and environmental responsibility remains fundamental to our identity. | CULTURE The Novo Nordisk Way Essentials 1 We create value by having a patient-centred business approach. 2 We set ambitious goals and are empowered to achieve them. 3 We are accountable for our financial, environmental and social performance. 4 We are curious and innovate for the benefit of patients and society at large. 5 We build and maintain good relations with our stakeholders. 6 We value diversity and treat everyone with respect. 7 We focus on performance and personal development. 8 We have a healthy and engaging working environment. 9 We strive for agility and simplicity in everything we do. 10 We never compromise on quality and ethics. | ||||||

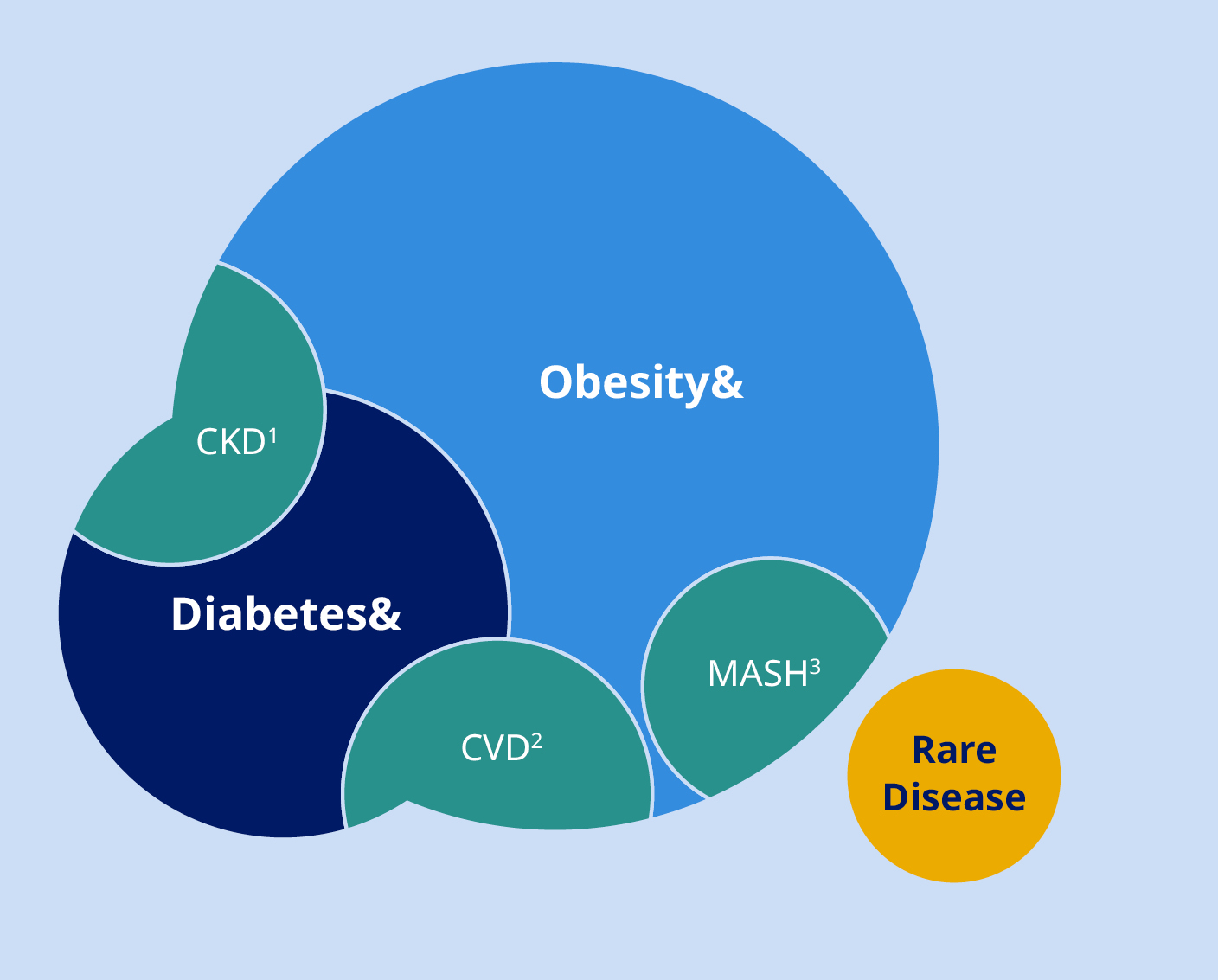

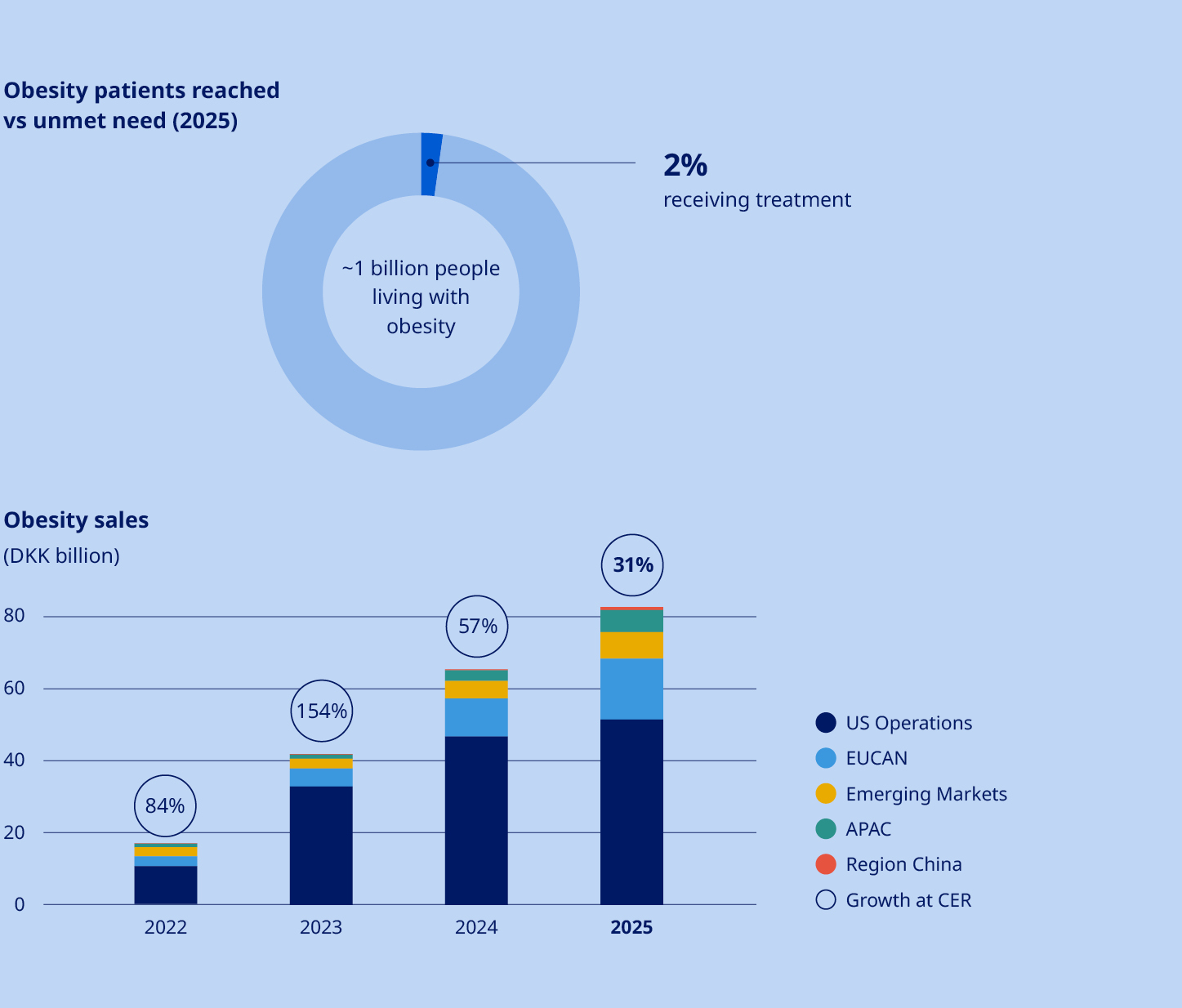

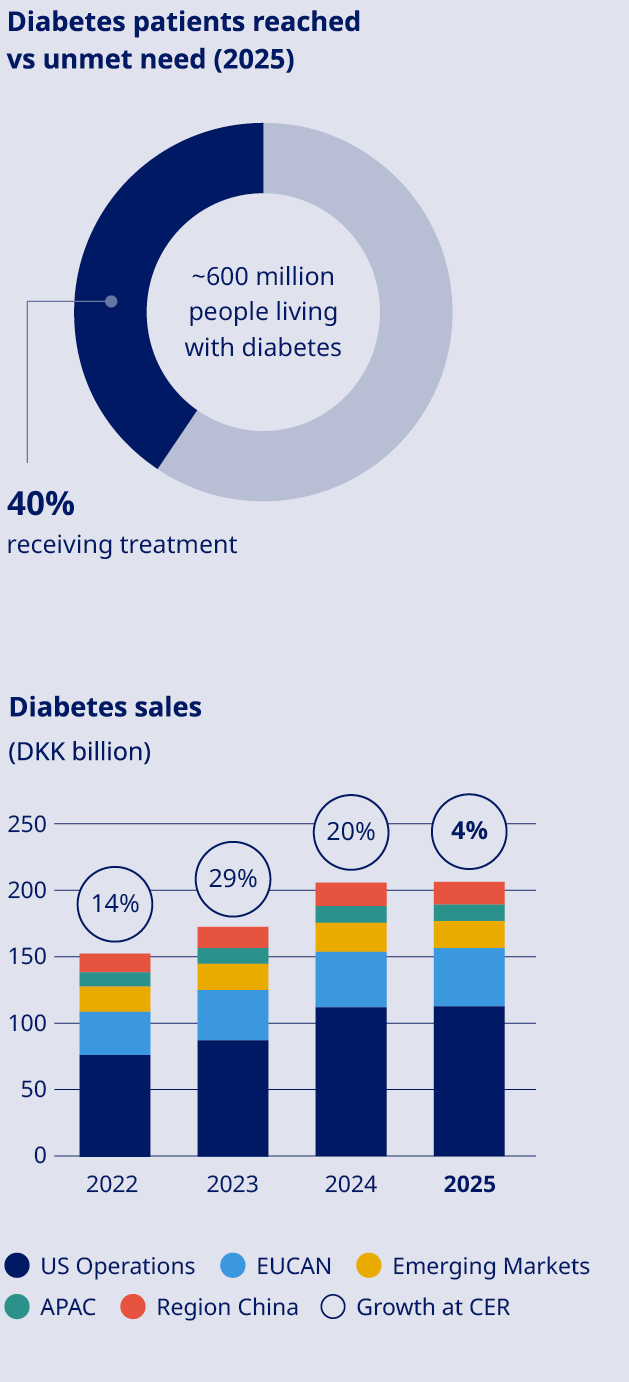

STRATEGY Our strategy focuses on leading in Obesity, Diabetes & related comorbidities, through patient centricity, innovation and affordable access. In Obesity, we will lead by addressing patients’ diverse needs and supporting them throughout their care journey. In Diabetes, we will strengthen leadership with a cardiorenal focus. In addition, we will continue to strengthen Rare Disease leadership in rare blood and rare endocrine disorders. Significant unmet need persists with almost 1 billion people living with obesity and around 600 million living with diabetes. This represents a major opportunity and obligation to serve many more patients. The updated strategy marks a shift from expansion into new, dedicated therapy areas as standalone (CVD, CKD, MASH) towards going deeper into our core areas, Obesity and Diabetes. |  | ||||||

1. Chronic kidney disease. 2. Cardiovascular disease. 3. Metabolic dysfunction-associated steatohepatitis. | |||||||

– – – | 10 |

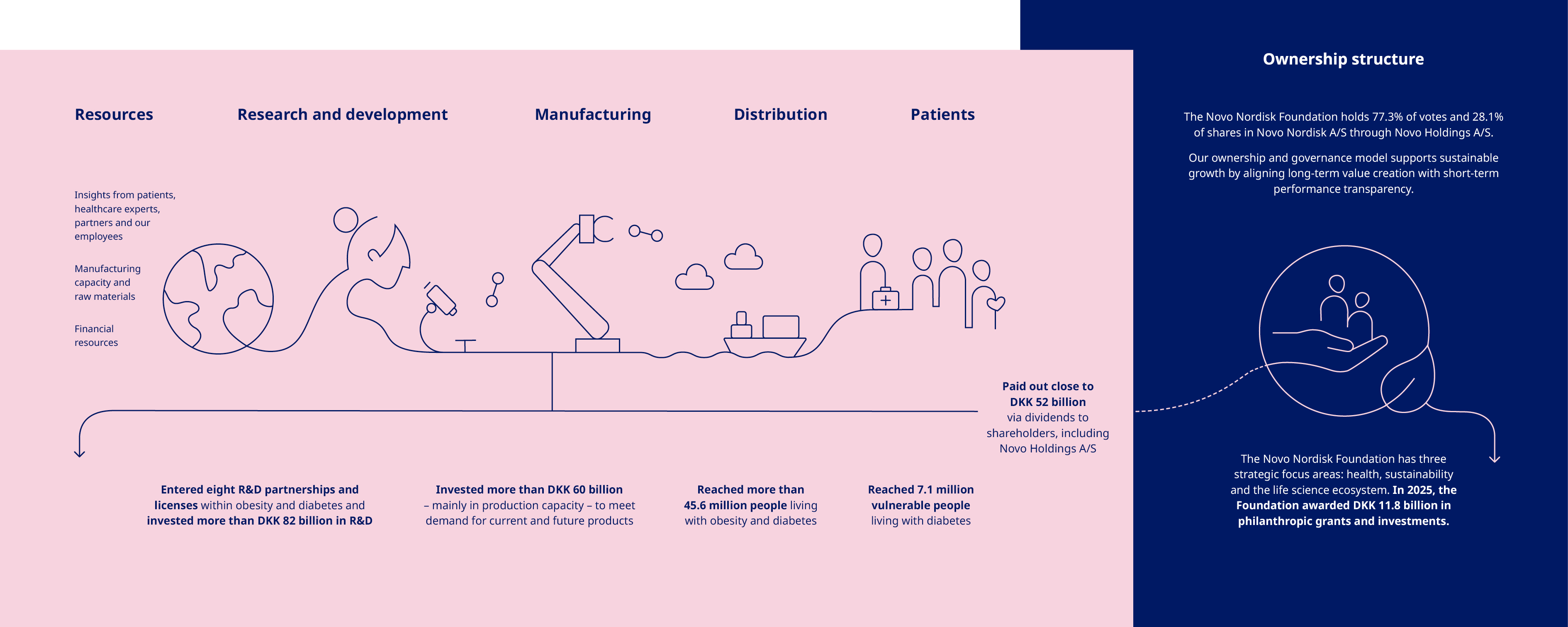

Value creation | |||

We focus on creating lasting value for society and our business with a strong commitment to our triple bottom line. Following the Novo Nordisk Way, we are dedicated to delivering long-term value for people with serious chronic diseases, our employees, partners, shareholders and society. Our value chain covers every stage from identifying new treatments through R&D, manufacturing, supplier partnerships and distribution to the people we serve. | |||

| |||

– – – | Novo Nordisk Annual Report 2025 / Annual review / Introducing Novo Nordisk / Inside the discovery of semaglutide | 11 |

The molecule that changed everything: Inside the discovery of semaglutide |  | The breakthrough came through clever chemistry: attaching a fatty acid to semaglutide. This allowed the drug to bind with albumin, a natural blood protein, creating a protective shield that prevented breakdown by the kidneys and kept it circulating in the body for longer. What surprised them most was semaglutide’s superior efficacy. The engineering for once-weekly dosing had also created a more potent GLP-1 receptor agonist than ever before. “We set out to create a weekly GLP-1 therapy – that was the task,” Jesper reflects. “But we had also created something much more potent, with unique properties leading to significantly greater effects on both blood sugar and appetite regulation.” Today, their molecule has evolved beyond its original injectable form. Novo Nordisk has successfully developed oral semaglutide – first as Rybelsus® for diabetes, and more recently as the Wegovy® pill, the first and only FDA-approved oral GLP-1 therapy for weight management. Semaglutide now represents the vast majority of our revenue. Clinical trials continue confirming its unforeseen potential in cardiovascular, kidney and liver diseases – research that reinforces Thomas’s evolving perspective: “I used to be sceptical about treating obesity with medicine, but I’m now convinced that it’s both meaningful and necessary,” he says. “It lowers the risk of various comorbidities, and it saves society money in the long run.” Although their names are on the patent, the pair are quick to credit colleagues across Novo Nordisk who have also played key roles in bringing their invention to life. “Successful drug development is always a team effort,” Jesper adds. “It’s fantastic knowing you’ve been part of creating something with such a profound impact on human health.” The journey so far, born from a reluctant chemist’s leap into the unknown, has already changed millions of lives – and the story continues. | |||||||

A chance encounter with peptide chemistry led a team of Novo Nordisk scientists on a seven-year journey to create one of modern medicine’s most transformative treatments. | |||||||||

Jesper Lau (left) and Thomas Kruse (right). | |||||||||

Thomas Kruse still remembers the moment he was asked to park his expertise in organic chemistry and move into peptides. It was spring 2002, and the Danish researcher had spent nearly a decade crafting small molecules in Novo Nordisk’s laboratories. But his boss, then-Chief Scientific Officer Mads Krogsgaard Thomsen, had a different vision – one that would ultimately reshape how the world treats obesity and diabetes. “I sometimes describe myself as one of Mads Krogsgaard’s guinea pigs,” Thomas jokes. The transition to peptide engineering wasn’t easy, but this reluctant shift would become the foundation for the creation of semaglutide, a medicine now changing millions of lives worldwide. By late 2002, Thomas had been joined by Jesper Lau, another chemist who shared the daunting task of establishing Novo Nordisk’s new protein and peptide engineering department. Together with laboratory technician Paw Bloch (who is now enjoying his retirement) and a team of “repurposed” small molecule scientists, they embarked on a seemingly impossible task: creating a once-weekly injectable GLP-1 receptor agonist. The scientific challenge was formidable. Natural GLP-1 – which stimulates insulin production and regulates appetite – has a half-life of just minutes; far too short for therapeutic use. The team needed to extend this dramatically whilst maintaining potency. Years of painstaking work followed. The team synthesised compound after compound. Semaglutide was compound number 217 – meaning 216 previous attempts had fallen short. “The real challenge was solving several difficult technical problems at once,” Jesper explains. “It was about half-life, optimal potency and physical stability.” | |||||||||

Unlocking the value of semaglutide Broader adoption of semaglutide can relieve pressure on health systems by reducing obesity- and diabetes- related complications, hospitalisations and productivity losses. According to a detailed UK analysis from 2023, GLP-1 medicines can reduce hospitalisations and bed days by almost 10%, potentially saving approximately GBP 1.68 billion vs glucose‑only care by 2040. With global healthcare costs related to chronic diseases projected to surge 56% – from USD 10.2 trillion today to an estimated USD 15.9 trillion worldwide by 2050 – scaling access to semaglutide offers a unique path to a healthier society and more sustainable public finances. Source: Novo Nordisk. Unlocking the full value of GLP‑1 for people, health systems and society. 2025. Available at: https:// www.novonordisk.com/content/dam/nncorp/global/en/media/ pdfs/novo-nordisk-unlocking-the-power-of-glp-1.pdf (The contents of the company's website do not form a part of this Form 6-K) | UK modelling shows expanded GLP-1 use could deliver... 8% fewer CV events 7% fewer hospitalisations 7% fewer bed days – than a glucose management approach |  | GBP ~1.68 billion in UK cost savings by 2040 | ||||||

| |||||

Strategic Aspirations | |||||

– – – | Novo Nordisk Annual Report 2025 / Annual review / Strategic Aspirations / Strategic Aspirations 2025 | 13 |

Strategic Aspirations 2025 | Strategic Aspirations 2025 | Progress in 2025 | |||||||

Financials | Deliver solid sales and operating profit growth | •Sales growth of 10% (CER) •Operating profit growth of 6% (CER), impacted by one-off restructuring costs related to a company- wide transformation as well as acquisition of three former Catalent sites •Had Novo Nordisk not incurred such restructuring costs, of around DKK 8 billion, operating profit would have increased by 13% (CER) | |||||||

Drive operational efficiencies | •Operational leverage reflecting sales growth when adjusting for restructuring costs | ||||||||

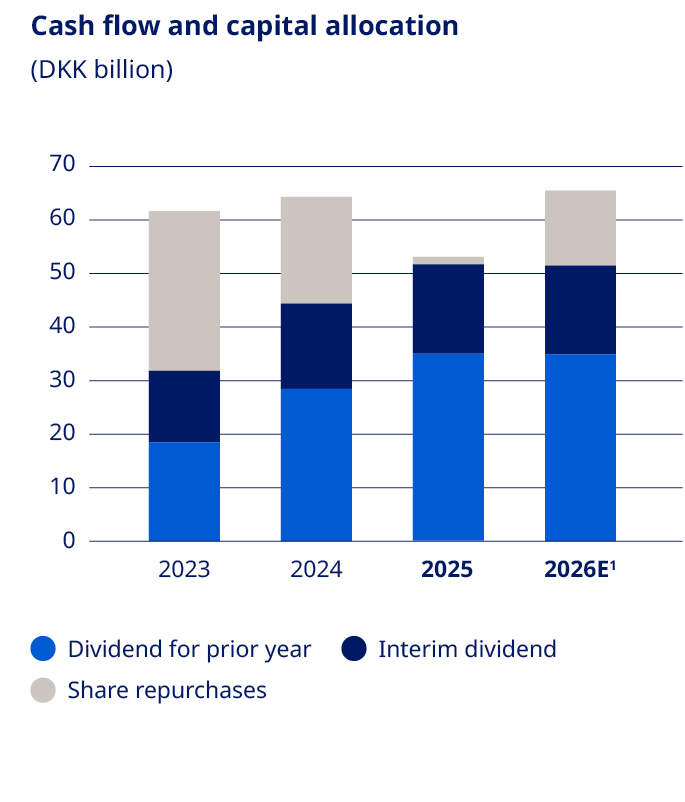

Enable attractive capital allocation to shareholders | •Free cash flow of DKK 28.3 billion •DKK 52 billion returned to shareholders | ||||||||

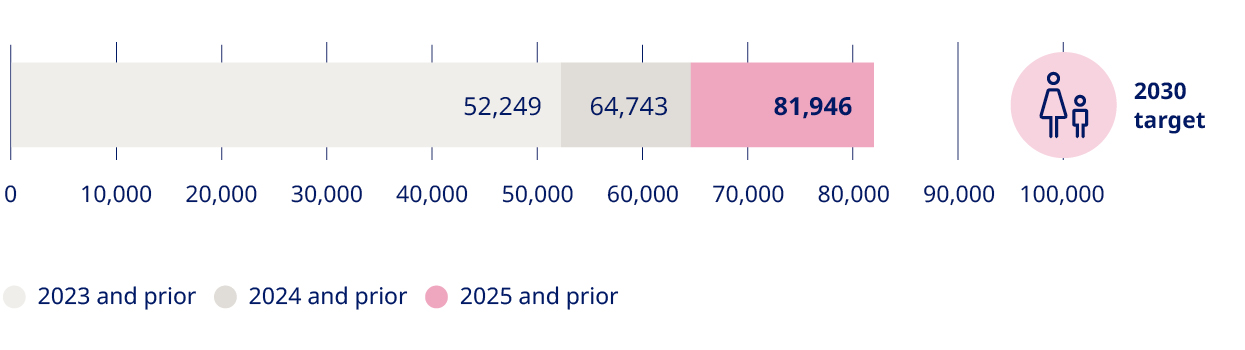

The 2025 Strategic Aspirations were introduced in 2019 and are set to conclude this year: • Sales have more than doubled, reaching DKK 309 billion in 2025 with a compound annual growth rate (CAGR) of 17%. • Operating profit has more than doubled, reaching DKK 128 billion in 2025 with a CAGR of 16%. • Obesity care sales have increased from DKK 6 billion in 2019 to DKK 82 billion in 2025. • Rare Disease positioned for sustained growth with late-stage pipeline of denecimig (Mim8) and etavopivat. • DKK 306 billion has been returned to shareholders from 2020 to 2025. • Treatment provided to 46 million people living with obesity and diabetes, an increase of ~16 million patients since 2019. Novo Nordisk expects to introduce new Strategic Aspirations as part of Capital Markets Day on 21 September 2026. Until that time, reporting and tracking of progress will continue across key dimensions of the Novo Nordisk business. | Innovation and therapeutic focus | Develop superior treatment solutions for Obesity | •In-license agreements of a triple agonist and two oral molecules •Novo Nordisk to advance subcutaneous and oral zenagamtide (amycretin) for weight management into phase 3 •Semaglutide 2.4 mg approved in the US for the treatment of MASH •Phase 3 programme with cagrilintide initiated •Closing of Akero acquisition and its phase 3 FGF21 analogue in MASH •Semaglutide 7.2 mg submitted in the EU and in the US •Wegovy® pill for weight management approved in the US and submitted in the EU •Phase 1a/2b trial initiated with UBT251, a triple agonist •CagriSema submitted for regulatory approval in the US | ||||||

Further raise innovation bar for Diabetes treatment | •Ozempic® approved by EMA for the treatment of peripheral arterial disease in the EU •Resubmission of Awiqli® in the US for treatment of type 2 diabetes •Phase 3 trial with coramitug initiated in people living with Amyloid Transthyretin (ATTR) cardiomyopathy •IcoSema (Kyinsu®) approved in the EU for the treatment of type 2 diabetes in adults •Evoke phase 3 trials did not demonstrate a statistically significant reduction in Alzheimer's disease progression •Phase 3 trial with CagriSema, REIMAGINE 2 and 3, in diabetes successfully completed •Phase 2 trial successfully completed with subcutaneous and oral zenagamtide (amycretin) | ||||||||

Strengthen and progress Rare disease pipeline | •Alhemo® approved in the US for the treatment of haemophilia A and B without inhibitors •Sogroya® non-replacement indications submitted in the US and Japan •Denecimig (Mim8) submitted for regulatory approval in the EU and in the US •Closing of the acqusition of clinical-stage MASP-3 inhibitor zaltenibart •Sogroya® approved in China | ||||||||

Commercial execution | Strengthen Diabetes leadership to more than one-third | •Diabetes value market share declined by 3.6 percentage points to 30.1% (MAT) | |||||||

More than DKK 25 billion in Obesity care sales by 2025 | •Obesity care sales increased by 31% (CER) to DKK 82.3 billion | ||||||||

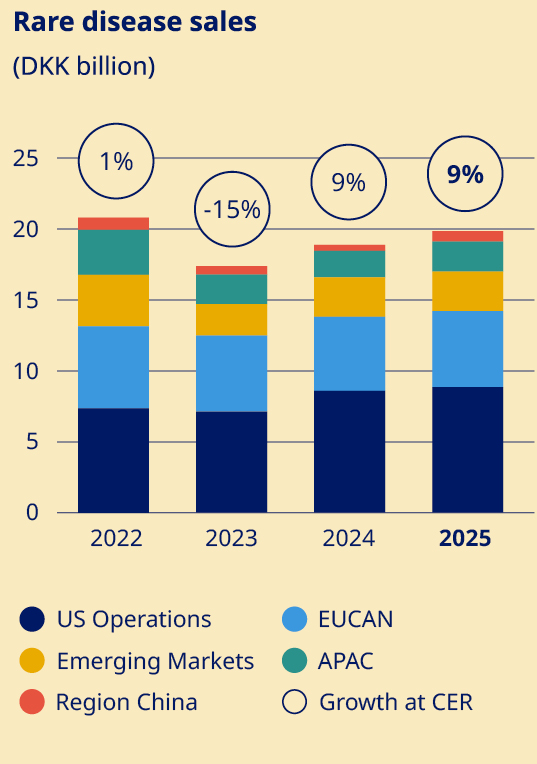

Secure a sustained growth outlook for Rare disease | •Rare disease sales increased by 9% (CER) to DKK 19.6 billion | ||||||||

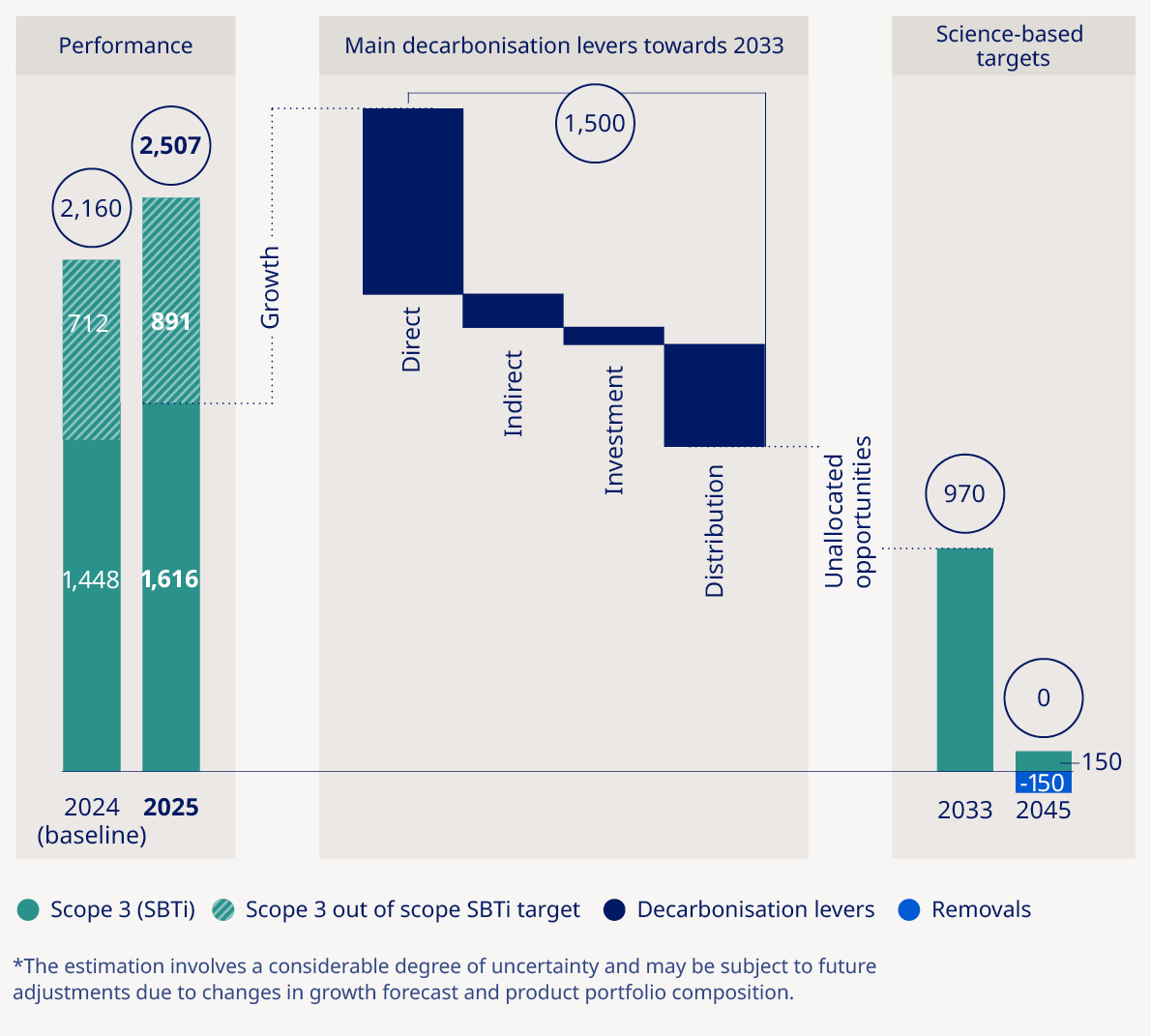

Purpose and sustainability | Progress towards zero environmental impact | •Overall CO2e emissions (scope 1, 2 and full scope 3) increased by 19% compared to 2024 | |||||||

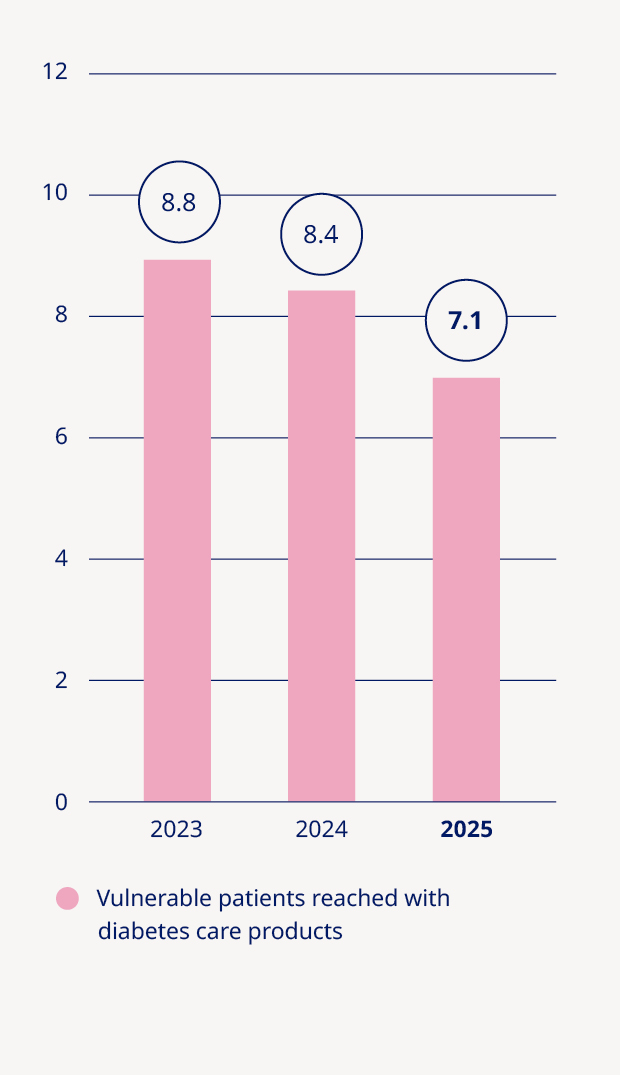

Adding value to society and being recognised as a sustainable employer | •Medical treatment provided to 42.0 million people living with diabetes and 3.6 million people living with obesity |

– – – | 14 |

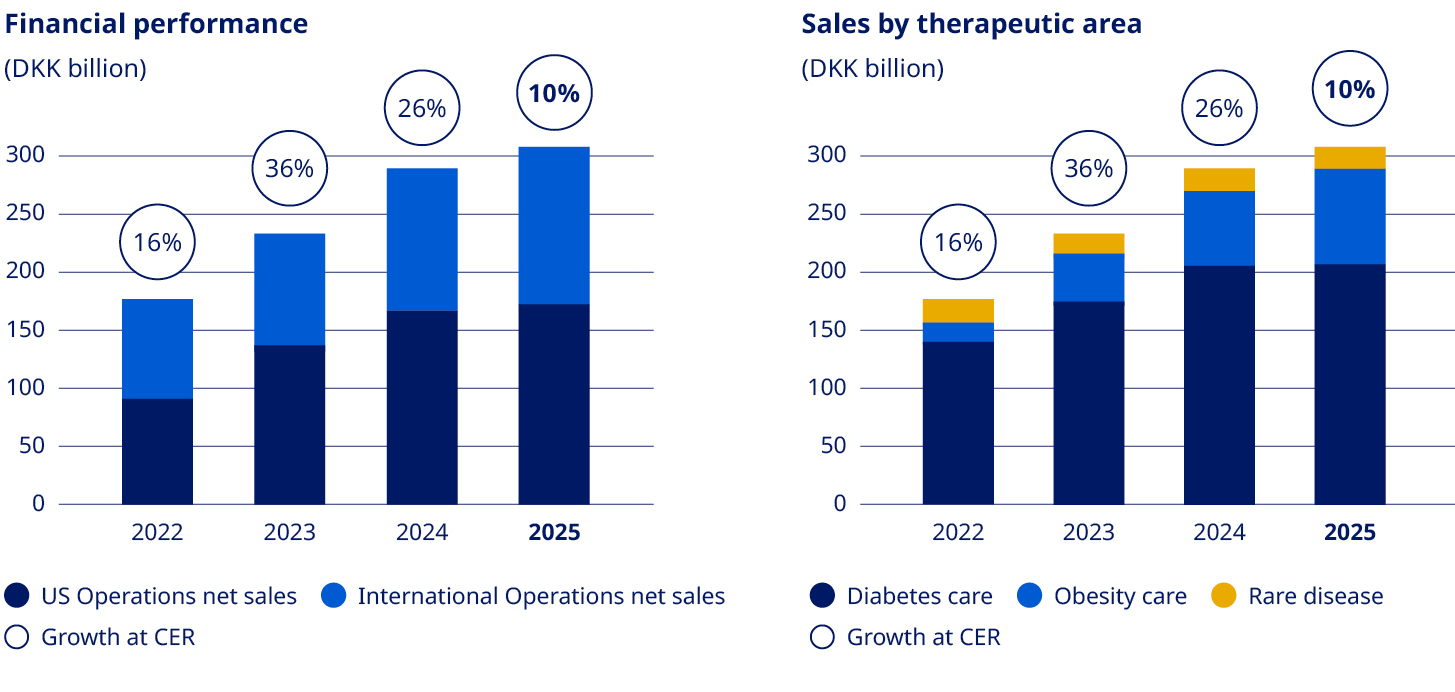

| 2025 performance Financial performance Sales increased by 6% measured in Danish kroner and by 10% at CER to DKK 309,064 million in 2025. Novo Nordisk’s 2025 sales and operating profit performance measured at CER were within the ranges provided in November 2025. The effective tax rate, capital expenditure, free cash flow as well as depreciation, amortisation and impairment losses were all in line with the guidance. Geographic sales development Sales in US Operations increased by 3% measured in Danish kroner and by 8% at CER. Sales in International Operations increased by 10% measured in Danish kroner and by 14% at CER. Sales in EUCAN increased by 15% measured in Danish kroner and by 16% at CER. Sales in Emerging Markets increased by 3% measured in Danish kroner and by 8% at CER. Sales in APAC increased by 19% measured in Danish kroner and by 25% at CER. Sales in Region China increased by 1% measured in Danish kroner and by 5% at CER. Sales development across therapeutic areas Sales of Obesity care products increased by 26% measured in Danish kroner and by 31% at CER. Sales in Diabetes care remained unchanged in Danish kroner and increased by 4% at CER. Rare disease sales increased by 5% measured in Danish kroner and by 9% at CER. In the following sections, unless otherwise noted, market data are based on moving annual total (MAT) from November 2024 and November 2025 provided by the independent data provider IQVIA. EUCAN covers Europe and Canada, Emerging Markets covers mainly Latin America, the Middle East and Africa. APAC covers Japan, Korea, Oceania, and Southeast Asia. Region China covers Mainland China, Hong Kong and Taiwan.  | |||

– – – | 15 |

Obesity care Sales of Obesity care products increased by 26% measured in Danish kroner and by 31% at CER to DKK 82,347 million. Sales growth was driven by both US Operations and International Operations. The volume growth of the global branded GLP-1 obesity market was 104%. Novo Nordisk is the global market leader with a branded volume market share of 59.6%. In International Operations, tirzepatide is categorised under GLP-1 diabetes only in IQVIA data, despite having indications for diabetes and obesity in most launched countries. Diabetes care Sales in Diabetes care remained unchanged in Danish kroner and increased by 4% at CER to DKK 207,109 million, mainly driven by growth of GLP-1-based products. Novo Nordisk's global diabetes value market share decreased by 3.6 percentage points over the last 12 months to 30.1%. The market share development was driven by market share losses in US Operations and International Operations. GLP-1-based therapies for type 2 diabetes Sales of GLP-1-based products for type 2 diabetes increased by 2% measured in Danish kroner and by 6% at CER to DKK 152,202 million. The estimated global GLP-1 share of total diabetes prescriptions increased to 8.1% compared with 6.7% 12 months ago. It is possible for a patient to have a prescription for more than one diabetes treatment. Novo Nordisk has a value market share of 45.8%. •Ozempic® sales increased by 6% measured in Danish kroner and by 10% at CER to DKK 127,089 million. Sales growth was driven by both US Operations and International Operations. US sales were positively impacted by gross-to-net sales adjustments. •Rybelsus® sales decreased by 5% measured in Danish kroner and by 2% at CER to DKK 22,093 million. Sales growth was driven by International Operations, offset by decreasing sales in US Operations. Sales in US and International operations are negatively impacted by a reprioritisation of activities towards other GLP-1 treatments. •Victoza® sales decreased by 45% measured in Danish kroner and by 43% at CER to DKK 3,020 million. The decline was driven by the GLP-1 diabetes market moving towards once-weekly treatments and in line with portfolio priorities in both US Operations and International Operations. Insulin sales Sales of insulin decreased by 4% measured in Danish kroner and by 1% at CER to DKK 53,137 million. Rare disease Rare disease sales increased by 5% measured in Danish kroner and by 9% at CER to DKK 19,608 million. Rare endocrine disorders Sales of rare endocrine disorder products increased by 19% measured in Danish kroner and by 24% at CER to DKK 5,959 million. Rare blood disorders Sales of rare blood disorder products decreased by 2% measured in Danish kroner and increased by 2% at CER to DKK 11,955 million. | Development in costs and operating profit The cost of goods sold increased by 32% measured in Danish kroner and by 31% at CER to DKK 58,788 million, resulting in a gross margin of 81.0%, measured in Danish kroner, compared with 84.7% in 2024. The decline in gross margin is impacted by amortisations and depreciations related to the three former Catalent manufacturing sites as well as one-off restructuring costs related to the company-wide transformation. In addition, costs are related to ongoing capacity expansions and negative currency impacts, partially countered by a positive product mix, driven by increased sales of GLP-1-based treatments. Sales and distribution costs increased by 4% measured in Danish kroner and by 7% at CER to DKK 64,310 million. The increase in costs is driven by both US Operations and International Operations. In US Operations, the cost increase is mainly driven by promotional activities related to Wegovy®. In International Operations, the increase is primarily related to the Wegovy® launches and promotional activities. Sales and distribution costs amount to 20.8% as a percentage of sales, including impact from one-off restructuring costs related to the company-wide transformation. Research and development costs increased by 8% measured in Danish kroner and by 10% at CER to DKK 52,039 million, driven by investments within Obesity care, reflecting increased late-stage clinical trial activity, increased early research activities, and increased development investments related to the cardiovascular portfolio. This is partially countered by the impairment loss related to ocedurenone of DKK 5.7 billion and other impairments of intangible assets in 2024. Research and development costs amounted to 16.8% as a percentage of sales, including one-off restructuring costs related to the company-wide transformation. | ||||

Administration costs increased by 13% measured in Danish kroner and by 16% at CER to DKK 5,969 million, or 1.9% of sales. Administration costs are impacted by severance costs related to previously announced changes in Executive Management and one-off restructuring costs related to the company- wide transformation. Other operating income and expenses (net) showed a loss of DKK 300 million compared to a loss of DKK 2,103 million in 2024. Other operating income in 2024 was impacted by impairments related to a partnership agreement of a company and transaction costs related to the Catalent transaction. Operating profit decreased by 1% measured in Danish kroner and increased by 6% at CER to DKK 127,658 million, mainly impacted by one-off restructuring costs related to the company-wide transformation during the third quarter of around DKK 8 billion and by impacts |  | ||||

– – – | 16 |

related to the acquisition of the three former Catalent manufacturing sites. This is partially countered by the impairment loss related to ocedurenone in 2024. Had Novo Nordisk not incurred such restructuring cost amounting to around DKK 8 billion, operating profit would have increased by 6% in Danish kroner and 13% at CER. Financial items (net) and tax Financial items (net) showed a net gain of DKK 2,882 million, compared with a net loss of DKK 1,148 million in 2024. This primarily reflects gains from hedging the US dollar, which is partly offset by financing costs related to the funding of the Catalent transaction. In line with Novo Nordisk’s treasury policy, the most significant foreign exchange risks for Novo Nordisk have been hedged, primarily through foreign exchange forward contracts. The foreign exchange result was a net gain of DKK 6,007 million compared with a net loss of DKK 1,023 million in 2024. At the end of December 2025, a positive market value of financial contracts of DKK 4,339 million had been deferred for recognition in 2026. The effective tax rate was 21.5% in 2025, compared with an effective tax rate of 20.6% in 2024. Net profit increased by 1% to DKK 102,434 million and diluted earnings per share increased by 2% to DKK 23.03. | 2026 outlook Novo Nordisk will from 2026 present outlook for sales and operating profit using new non-IFRS measures of adjusted sales growth and adjusted operating profit growth. For further details, please see Company Announcement No 4 / 2026. | |||||

Guidance | Full-year expectations 3 February 2026 | |||||

Adjusted sales growth | ||||||

at CER | -5% to -13%1 | |||||

as reported in Danish kroner | Around 3 percentage points lower than at CER | |||||

Adjusted operating profit growth | ||||||

at CER | -5% to -13%1 | |||||

as reported in Danish kroner | Around 5 percentage points lower than at CER | |||||

1. On a non-adjusted basis, the mid-point of sales and operating profit growth guidance for 2026, both at CER, would be -1% and 11%, respectively | ||||||

Key modelling considerations | ||||||

Financial items (net) | Gain of around 2.3 bDKK | |||||

Effective tax rate | 21% to 23% | |||||

Capital expenditure (PP&E) | Around 55 bDKK | |||||

Free cash flow | Between 35 and 45 bDKK | |||||

Note: Expectations are as reported in Danish kroner, if not otherwise stated Note: Free cash flow defined as net cash generated from operating activities, less purchase of property, plant and equipment | ||||||

Cash flow and capital allocation Free cash flow in 2025 was DKK 28.3 billion compared to DKK (14.7) billion in 2024. The increase in free cash flow compared to last year is mainly due to the USD 11.7 billion acquisition of the three former Catalent manufacturing sites in 2024, partially countered by increased capital expenditures. Capital expenditure for property, plant and equipment was DKK 60.1 billion compared with DKK 47.2 billion in 2024, primarily reflecting investments in additional capacity for active pharmaceutical ingredient (API) production and fill-finish capacity for both current and future injectable and oral products. Capital expenditure related to intangible assets was DKK 30.0 billion in 2025 compared with DKK 4.1 billion in 2024, reflecting business development activities, mainly related to the acquisition of Akero Therapeutics, Inc. |  1. Expectations for 2026. | Adjusted sales growth is expected to be -5% to -13% at CER, with fluctuations in growth rates expected across quarters. Given the current exchange rates versus the Danish krone, adjusted sales growth reported in Danish kroner is expected to be 3 percentage points lower than at CER, primarily due to depreciation of the USD/DKK exchange rate. The outlook reflects expectations for sales growth within International Operations and expectations for a sales decline within US Operations. In 2026, the global GLP-1 market expansion is assumed to continue, enabling Novo Nordisk to increase patient reach and expand volumes. This is countered by lower realised prices, including the MFN ("Most Favoured Nations") agreement in the US and the loss of exclusivity for the semaglutide molecule in certain markets in International Operations. Lastly, positive impacts related to US gross-to-net sales adjustments during 2025 are not anticipated to reoccur. In International Operations, the outlook is based on current growth trends, including continued volume penetration from GLP-1 treatments and market expansion, mainly within obesity, as well as intensifying competition and negative impacts from the compound patent expiry of the semaglutide molecule in certain markets. Novo Nordisk continues to roll-out Wegovy® in more markets during 2026 and expects to introduce the 7.2 mg dose in a number of countries. In US Operations, the outlook is based on current prescription trends for the injectable GLP-1 portfolio, intensifying competition as well as negative impact from reduced obesity medication coverage in Medicaid. Further, lower realised prices linked to investments in market access, amplified by the MFN agreement with the US Administration to bring GLP-1s to more Americans at a lower cost is assumed. | ||||

– – – | 17 |

Novo Nordisk further focuses on expanding access to Wegovy®, particularly in the self-pay channel through NovoCare® Pharmacy and collaborations with telehealth organisations. Uptake related to the launch of Wegovy® pill in January 2026 is reflected in the outlook, based on a range of assumptions related hereto such as market penetration, potential negative impact on the growth of the injectable obesity medication category as well as channel mix. Adjusted operating profit growth is expected to be -5% to -13% at CER. Adjusted operating profit growth reported in Danish kroner is expected to be 5 percentage points lower than at CER. The expectation for adjusted operating profit growth primarily reflects the sales outlook, combined with targeted investments in current and future growth opportunities within R&D and Commercial, partly funded by re- investment of savings from the company-wide transformation in 2025 as well as further optimisation initiatives. Within R&D, investments are related to the continued expansion and progression of the early and late-stage pipeline mainly within Obesity and Diabetes, and includes impact related to acquisition of Akero Therapeutics, Inc. Commercial investments are mainly related to the GLP-1 portfolio within Obesity and Diabetes. Key modelling considerations Novo Nordisk expects financial items (net) for 2026 to amount to a gain of around DKK 2.3 billion. This is driven by gains on hedged currencies, mainly the US dollar, partially countered by increased interest expenses related to net debt. The effective tax rate for 2026 is expected to be in the range of 21-23%. Capital expenditure is expected to be around DKK 55 billion in 2026 compared to DKK 60 billion in 2025, reflecting the expansion of the global supply chain. The investments will create additional capacity and flexibility across the supply chain, including the manufacturing of active pharmaceutical ingredients (API), additional aseptic production and finished production processes as well as packaging capacity. In the coming years, the capital expenditure investments are expected to decline. To better reflect the underlying cash generation, Novo Nordisk, as of 2026, defines free cash flow as net cash generated from operating activities, less purchase of property, plant and equipment. The free cash flow is expected to be DKK 35-45 billion, reflecting the lower sales, primarily within US Operations, and related cash flow implications amplified by the US gross-to-net system, combined with CAPEX expenditure. All of the above expectations are based on assumptions that the global or regional macroeconomic and political environment will not significantly change business conditions for Novo Nordisk during 2026, including energy and supply chain disruptions, the potential implications from major healthcare reforms and legislative changes, taxation changes, including changes in tariffs, duties and pricing policies, (incl Most Favoured Nations in the US), as well as outcome of legal cases, and that the currency exchange rates, especially the US dollar, will remain at the current level versus the Danish krone. The guidance is also based on assumptions in relation to the estimation of gross-to-net developments in the US. Finally, the guidance does not include the financial implications of any new significant business development transactions. Novo Nordisk has hedged expected net cash flows in a number of invoicing currencies, and, all other things being equal, movements in key invoicing currencies will impact Novo Nordisk’s operating profit as outlined in note 4.4 on Financial risks. | Forward-looking statements Novo Nordisk’s statutory Annual Report 2025, Form 20-F, any quarterly financial reports, and written information released, shown, or oral statements made, to the public in the future by or on behalf of Novo Nordisk, may contain certain forward-looking statements relating to the operating, financial and sustainability performance and results of Novo Nordisk and/or the industry in which it operates. Forward-looking statements can be identified by the fact that they do not relate to historical or current facts and include guidance. Words such as ‘believe’, ‘expect’, ‘may’, ‘will’, ‘plan’, ‘strategy’, ‘transition plan’, ‘prospect’, ‘foresee’, ‘estimate’, ‘project’, ‘anticipate’, ‘can’, ‘intend’, ‘target’ and other words and terms of similar meaning in connection with any discussion of future operating, financial or sustainability performance identify forward-looking statements. Examples of such forward-looking statements include, but are not limited to: •Statements of targets, future guidance, (transition) plans, objectives or goals for future operations, including those related to operating, financial and sustainability matters, Novo Nordisk’s products, product research, product development, product introductions and product approvals as well as cooperation in relation thereto; •Statements containing projections of or targets for revenues, costs, income (or loss), earnings per share, capital expenditures, dividends, capital structure, net financials and other financial measures; •Statements regarding future economic performance, future actions and outcome of contingencies, such as legal proceedings; and •Statements regarding the assumptions underlying or relating to such statements. These statements are based on current plans, estimates, opinions, views and projections. Although Novo Nordisk believes that the expectation reflected in such forward-looking statements are reasonable, there can be no assurance that such expectation will prove to be correct. By their very nature, forward-looking statements involve risks, uncertainties and assumptions, both general and specific, and actual results may differ materially from those contemplated, expressed or implied by any forward-looking statement. Factors that may affect future results include, but are not limited to, global as well as local political, economic and environmental conditions, such as interest rate and currency exchange rate fluctuations or climate change, delay or failure of projects related to research and/or development, unplanned loss of patents, interruptions of supplies and production, including as a result of interruptions or delays affecting supply chains on which Novo Nordisk relies, shortages of supplies, including energy supplies, product recalls, unexpected contract breaches or terminations, government-mandated or market- driven price decreases for Novo Nordisk’s products, introduction of competing products, reliance on information technology including the risk of cybersecurity breaches, Novo Nordisk’s ability to successfully market current and new products, exposure to product liability and legal proceedings and investigations, changes in governmental laws and related interpretation thereof, including on reimbursement, intellectual property protection and regulatory controls on testing, approval, manufacturing and marketing, and taxation changes, including changes in tariffs and duties, perceived or actual failure to | |||

– – – | 18 |

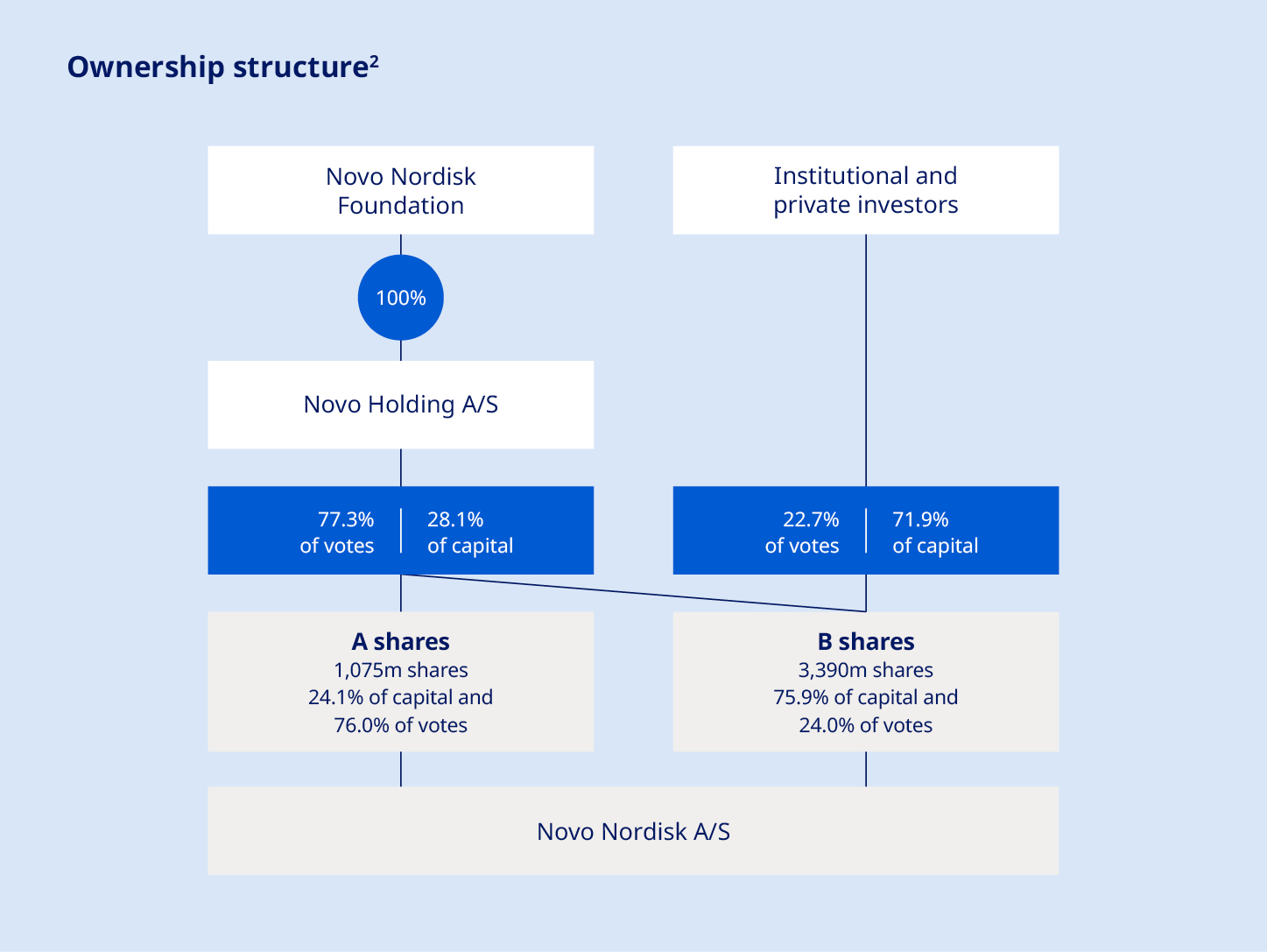

adhere to ethical marketing practices, investments in and divestitures of domestic and foreign companies, unexpected growth in costs and expenses, strikes and other labour market disputes, failure to recruit and retain the right employees, failure to maintain a culture of compliance, epidemics, pandemics or other public health crises, effects of domestic or international crises, civil unrest, war or other conflict and factors related to the foregoing matters and other factors not specifically identified herein. For an overview of some, but not all, of the risks that could adversely affect Novo Nordisk’s results or the accuracy of forward-looking statements in the Annual Report 2025, reference is made to the overview of risk factors in ‘Risk management’ of the Annual Report 2025. None of Novo Nordisk or its subsidiaries or any such person's officers, or employees accept any responsibility for the future accuracy of the opinions expressed in the Annual Report 2025, Form 20-F, any quarterly financial reports, and written information released, shown, or oral statements made, to the public in the future by or on behalf of Novo Nordisk or the actual occurrence of the forecasted developments. Unless required by law, Novo Nordisk has no duty and undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise. Shares and capital structure Through open and proactive communication, Novo Nordisk aims to provide the basis for fair and efficient pricing of our shares. |  The company’s A shares are not listed and are held by Novo Holdings A/S3, a Danish public limited liability company wholly owned by the Novo Nordisk Foundation. According to the Articles of Association of the Foundation, the A shares cannot be divested. Special rights attached to A shares include pre-emptive subscription rights in the event of an increase in the A share capital and pre-emptive purchase rights in the event of a sale of A shares, while B shares take priority for liquidation proceedings. A shares take priority for dividends below 0.5%, and B shares take priority for dividends between 0.5 and 5%. However, in practice, A and B shares receive the same amount of dividend per share. As of 31 December 2025, Novo Holdings A/S held a B share capital of a nominal value of DKK 17,756,050. Together with the A shares, Novo Holdings A/S’s total ownership amounted to a nominal value of DKK 125,243,250. Novo Holdings A/S ownership is reflected in the ‘Ownership structure’ chart. | |||||||

Share capital and ownership Novo Nordisk’s share capital of DKK 446.5 million is divided into A and B share capital. The A and B shares are calculated in units of DKK 0.10, amounting to 4.5 billion shares. The A share capital, consisting of 1,075 million shares, has a nominal value of DKK 107,487,200 and the B share capital, consisting of 3,390 million shares, has a nominal value of DKK 339,012,800. Each A share of a nominal value of DKK 0.10 carries 100 votes and each B share of a nominal value of DKK 0.10 carries 10 votes. Novo Nordisk’s B shares are listed on Nasdaq Copenhagen and on the New York Stock Exchange (NYSE) as American Depository Receipts (ADRs). The general meeting has authorised the Board of Directors to distribute extraordinary dividends, issue new shares in accordance with the Articles of Association and repurchase shares in accordance with authorisations granted. |  | |||||||

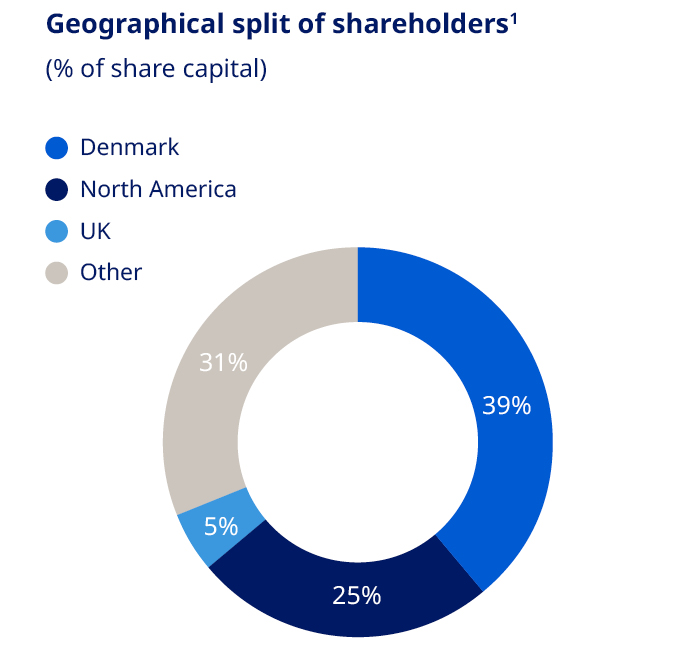

1. Split of shareholders is denoted according to the location of legal deposit-owners. 2. Treasury shares are included; however, voting rights of treasury shares cannot be exercised. 3. Novo Holdings A/S’s registered address is Tuborg Havnevej 19, DK-2900 Hellerup, Denmark. | ||||||||

– – – | 19 |

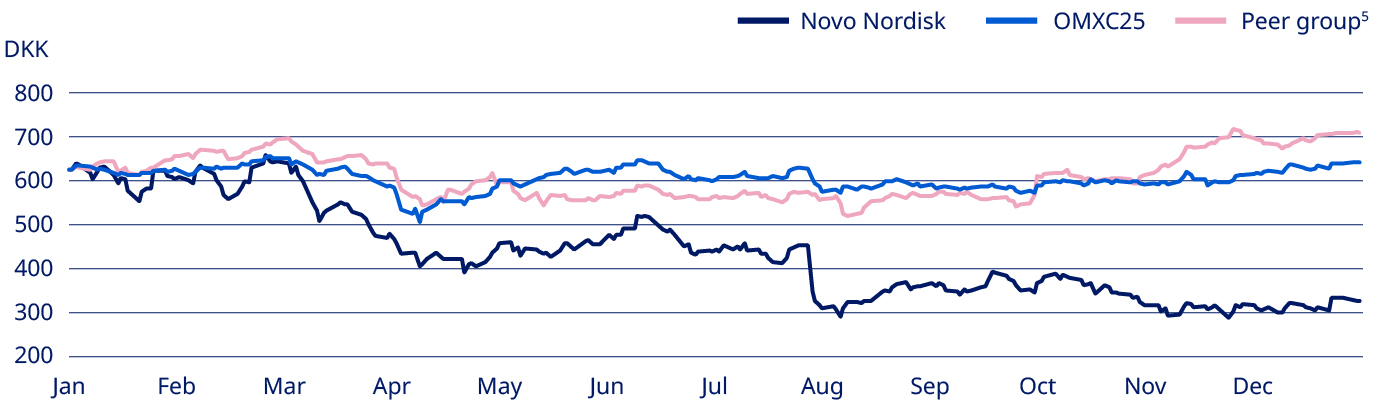

There is no complete record of all shareholders; however, based on available sources of information, as of 31 December 2025 it is estimated that shares were geographically distributed as shown in the ‘Geographical split of shareholders’ chart. As of 31 December 2025, the free float of listed B shares was 94.13% (of which approximately 15.31% are listed as ADRs), excluding Novo Holdings A/S and Novo Nordisk’s holding of shares. As of 31 December 2025, Novo Holdings A/S and Novo Nordisk’s holding of B shares equaled 198,935,780 shares and had a nominal value of DKK 19,893,578. For details about the share capital, see note 4.3 to the consolidated financial statements. Capital structure Novo Nordisk’s Board of Directors and Executive Management consider that the current capital and share structure of Novo Nordisk serves the interests of the shareholders and the company well. Novo Nordisk’s capital structure strategy offers a balance between long-term shareholder value creation and competitive shareholder return in the short-term. In 2025, Novo Nordisk issued Eurobonds totaling EUR 10 billion. The total outstanding Eurobonds as of the end of 2025 amounted to EUR 16.3 billion. For details on issuance of Eurobonds, refer to note 4.6 in the Consolidated financial statements. Dividend policy The company’s dividend policy, which applies a pharmaceutical industry benchmark to ensure a competitive payout ratio for dividend payments, may be complemented by share repurchase programmes. The final dividend for 2024 paid in 2025 after the AGM in March was equal to DKK 7.90 per A and B share of DKK 0.10, as well as for ADRs. The total dividend for 2024 was DKK 11.40 per A and B share of DKK 0.10, corresponding to a payout ratio of 50.2%. The 2024 pharma peer group average was 58.9%. In August 2025, an interim dividend was paid equaling DKK 3.75 per A and B share of DKK 0.10, as well as for ADRs. For 2025, the Board of Directors will propose a final dividend of DKK 7.95 to be paid in March 2026, equivalent to a total dividend for 2025 of DKK 11.70 and a payout ratio of 50.7%. The company expects to distribute an interim dividend in August 2026. Further information regarding this interim dividend will be announced in connection with the financial report for the first six months of 2026. Dividends are paid from distributable reserves. Novo Nordisk does not pay a dividend on its holding of treasury shares. Share repurchase programme for 2026 For the next 12 months, Novo Nordisk has decided to implement a new share repurchase programme. The expected total repurchase cash value of B shares, for the 12 months beginning 2026, is up to DKK 15 billion. The total programme may be reduced in size if significant business development opportunities arise during 2026. Novo Nordisk expects to conduct the new share repurchase programme according to the safe harbour rules under the EU Market Abuse Regulation (MAR). | Share price development Between the end of December 2024 and end of December 2025, Novo Nordisk’s share price decreased from DKK 624 to DKK 325, a decrease of -48%. The total market value of Novo Nordisk’s B shares, excluding treasury shares and Novo Holdings A/S shares, was DKK 1,037,935,269,555 as of 30 December 2025. | |||||||

Share price performance 2025 Novo Nordisk share price and indexed peers4 (%)  | ||||||||

2026 financial calendar | ||||||||

Annual General Meeting 2026 | 26 Mar 2026 | |||||||

Ex-dividend, B shares | 27 Mar 2026 | |||||||

Ex-dividend, ADRs | 30 Mar 2026 | |||||||

Record date, B shares and ADRs | 30 Mar 2026 | |||||||

Payment, B shares | 31 Mar 2026 | |||||||

Payment, ADRs | 7 Apr 2026 | |||||||

Financial statement for the first three months of 2026 | 6 May 2026 | |||||||

Financial statement for the first six months of 2026 | 5 Aug 2026 | |||||||

Ex-dividend, B shares | 14 Aug 2026 | |||||||

Ex-dividend, ADRs | 17 Aug 2026 | |||||||

Record date, B shares and ADRs | 17 Aug 2026 | |||||||

Payment, B shares | 18 Aug 2026 | |||||||

Payment, ADRs | 25 Aug 2026 | |||||||

Capital Markets Day | 21 Sep 2026 | |||||||

Financial statement for the first nine months of 2026 | 4 Nov 2026 | |||||||

Financial statement for 2026 and Annual Report 2026 | 3 Feb 2027 | |||||||

4. OMXC25 and pharmaceutical industry development have been rebased to Novo Nordisk share price in January 2025. 5. AstraZeneca, Bristol-Meyers, Eli Lilly, GlaxoSmithKline, Lundbeck, Merck, Novartis, Pfizer, Roche and Sanofi. | ||||||||

– – – | 20 |

| We are not standing still. Our commercial strategy is built for real‑world impact: expanding access, protecting patient safety and competing where it counts. Guided by our purpose of driving change to defeat serious chronic diseases, we bring scale, speed and responsibility to the challenge, reaching 45.6 million people living with obesity and diabetes in 2025. Central to this approach is defending and expanding our leadership in the increasingly competitive market for GLP-1 therapies, where we hold close to 43% market share of global volumes. Powered by semaglutide, these game-changing medicines address two of the world’s most pressing health challenges: obesity, impacting over 1 billion people worldwide, and diabetes, affecting around 600 million. Semaglutide is the only molecule that demonstrates cardiovascular protection in both diseases. Our portfolio spans injectable and oral options with FDA‑approved indications to reduce risk of heart attack, stroke or cardiovascular (CV) death – giving us unmatched therapeutic breadth. We are acting urgently to strengthen our portfolio through targeted investment in next‑generation therapies and business development. Our pipeline across obesity, type 2 diabetes and related comorbidities continues to advance, whilst we enhance optionality by tailoring solutions to individual needs. Building this market taught us that what works for diabetes does not necessarily work for obesity – people with obesity have different concerns, different needs and often prefer more discreet ways to access treatment. Executing this strategy demands market-specific approaches deployed at speed. “We are acting urgently to strengthen our portfolio through targeted investment in next‑generation therapies and business development” The US remains our biggest market and demands our boldest moves. We are transforming our position through multiple direct-to-consumer pathways by rapidly expanding our NovoCare® direct-to-patient platform to simplify access and reduce costs, forging new telehealth collaborations and securing retail pharmacy agreements including CVS to improve continuity of care. From 2026, our new agreement with the US Administration – once finalised – will lower prices across Medicare Part D and Medicaid programmes whilst piloting broader obesity coverage – significantly expanding Wegovy® access. We are also pursuing legal action against unlawful sales and marketing of mass compounded drugs, working with regulators, law enforcement and healthcare professionals to protect patients, the US drug approval framework and market integrity. Outside the US, we are turning challenges into opportunities. As semaglutide nears loss of exclusivity in certain key markets, we are acting decisively, launching second brands in lower‑priced segments, fast‑tracking differentiated devices and sharpening our channel strategies, while reinforcing quality and pharmacovigilance as generics enter the market. We are playing to win. Backed by robust evidence and patient‑centred execution, we are not just competing in an increasingly challenging landscape – we are reshaping it. Every decision, every initiative and every innovation is driven by our unwavering commitment to get our life-changing medicines to the people who need them – faster than ever before. | |||

– – – | 21 |

OBESITY& RELATED COMORBIDITIES | ||||

Expanding the global reach and impact of Wegovy® | Obesity is one of the defining health challenges of our time, impacting almost 1 billion people worldwide. Our goal is to translate scientific leadership into choice, access and evidence – bringing new options to patients and meeting needs across related comorbidities. In 2025, our obesity portfolio delivered 31% sales growth at constant exchange rates (CER), reaching 3.6 million people worldwide. We have recently expanded the Wegovy® brand with two new offerings: higher‑dose Wegovy® (semaglutide 7.2 mg), which demonstrated 20.7% weight loss in phase 3 studies, and the Wegovy® pill, offering 16.6% weight loss and the convenience of once-daily oral dosing. The latter is the world’s first and only oral GLP‑1‑based medicine to be approved for chronic weight management and is now being produced domestically in the US, with API manufactured at our Clayton, North Carolina site and tablets made and packed at our Durham, North Carolina site. Momentum continued across launches and label expansions. By the end of 2025, Wegovy® had almost doubled its global footprint to reach 52 countries – with further roll‑outs planned in 2026, subject to local regulatory approvals. In the US, the label was expanded to include treatment of adults with metabolic dysfunction-associated steatohepatitis (MASH) with moderate to advanced liver fibrosis – an important milestone given the high overlap between obesity and metabolic liver disease. “By the end of 2025, Wegovy® had almost doubled its global footprint to reach 52 countries” New clinical and real‑world evidence further strengthened the profile of Wegovy® in obesity care. Real‑world data from STEER show a 57% lower risk of heart attack, stroke or death associated with Wegovy® compared with tirzepatide. STEER was conducted among adults with overweight or obesity and established cardiovascular disease, without type 2 diabetes, during periods of continuous treatment (no treatment gaps longer than 30 days). While observational by design and subject to the usual limitations of real‑world data, these findings add to growing evidence that Wegovy® delivers proven cardiovascular protection in addition to meaningful weight loss benefits for appropriate patients. Beyond clinical endpoints, we are also advancing understanding of how obesity treatments affect everyday life. INFORM, a survey‑based real‑world evidence study, suggested that people taking Wegovy® experienced reduced food noise – persistent, intrusive and unwanted thoughts about food – and improved mental wellbeing. These insights are important for sustained behaviour change and long‑term outcomes, reinforcing the role of GLP‑1 therapy alongside lifestyle support. | |||

| ||||

– – – | 22 |

OBESITY& RELATED COMORBIDITIES | ||||

Breaking down obesity care barriers in the US | Obesity care in the US is at an inflection point. Demand for GLP‑1 medicines is surging, while access remains limited by uneven insurance coverage, affordability barriers and administrative hurdles. In parallel, the spread of unapproved compounded products poses quality and safety risks and can disrupt continuity of care. We are acting across the system – providing near‑term relief for self‑pay patients, partnering to broaden coverage and safeguarding patient safety – so more people can access authorised, FDA‑approved medicines through trusted pathways. To provide immediate relief for self-paying patients, in November 2025, we introduced an introductory self‑pay offer of USD 199 per month for the first two doses (0.25 mg and 0.5 mg) of Wegovy® or Ozempic® for new self‑pay patients through 31 March 2026, and lowered the standard monthly self‑pay price to USD 349 thereafter. These offers are available across more than 70,000 pharmacies nationwide, with home delivery through NovoCare® Pharmacy and telehealth partners, and are designed to help patients afford authentic, FDA‑approved semaglutide medicines and reduce the lure of unapproved, compounded alternatives. “We introduced an introductory self‑pay offer of USD 199 per month for the first two doses (0.25 mg and 0.5 mg) of Wegovy® or Ozempic®” Patient safety underpins everything we do. With the expiry of all FDA grace periods for shortage‑based semaglutide compounding in May 2025, it is now illegal under US compounding laws to make or sell compounded semaglutide drugs, with rare exceptions. Since then, we have stepped up action – pursuing legal remedies against unlawful marketing and sales, and working with regulators, law enforcement, healthcare professionals, patient and provider groups and other stakeholders to protect patients and uphold the integrity of the FDA drug approval framework. We are raising awareness among healthcare professionals and consumers about the safety and efficacy risks of unapproved compounded products, while expanding access to FDA‑approved medicines through trusted pathways, including NovoCare® Pharmacy and telehealth partners. In addition, we have agreed to a framework with the US Administration to lower semaglutide prices across Medicare Part D (government insurance for seniors), Medicaid (government insurance for low-income Americans) and direct‑to‑patient channels from 2026 onwards, and to broaden coverage through a Medicare pilot programme for Part D beneficiaries with qualifying comorbidities. This agreement is a significant step toward expanding access to authentic, FDA-approved obesity and diabetes medicines for millions of people living in the US. We are finalising details and remain committed to constructive dialogue. | |||

| ||||

– – – | 23 |

DIABETES& RELATED COMORBIDITIES | ||||||||||

Additional Ozempic® benefits drive strengthened diabetes leadership | Simplifying insulin treatment with once-weekly options | |||||||||

The global burden of diabetes and related complications is vast. By developing products that meet the complex needs of people living with diabetes, our innovations create long- term value for health systems and society. In 2025, we reached 42 million people with our diabetes portfolio, delivering 4% sales growth at CER. Against this backdrop, the clinical profile of semaglutide – our flagship GLP-1 innovation – continued to strengthen. Regulatory authorities in Europe and the US now recognise its cardiovascular benefits, with the FDA approving Rybelsus® (oral semaglutide) to reduce the risk of major adverse cardiovascular events in adults with type 2 diabetes at high risk. Rybelsus® is the only oral GLP‑1 therapy shown to lower blood glucose and body weight with a confirmed cardiovascular benefit, highlighting the comprehensive benefits of semaglutide. Meanwhile, Ozempic® – the injectable form of semaglutide approved for the treatment of type 2 diabetes – is proving its worth in new areas. The phase 3b STRIDE study showed that Ozempic® helped people with peripheral arterial disease walk further without pain, leading European regulators to update the medicine's label to reflect these mobility and quality-of-life improvements. In the US, the FDA approved Ozempic® – based on results from the FLOW trial – to reduce the risk of kidney disease progression, kidney failure and cardiovascular death in adults with type 2 diabetes and chronic kidney disease (CKD), making Ozempic® the only medicine in its class with a CKD indication. |  | For many adults with diabetes, basal insulin is essential yet burdensome: daily injections, complex titration and busy schedules can hinder adherence. Awiqli® – the world’s first and only once‑weekly basal insulin – reduces the treatment burden, helping both people with diabetes and healthcare professionals stay focused on achieving and maintaining individual glycaemic targets. As a once‑weekly option, it reduces the weekly injection burden from seven to one. Awiqli® is approved in the EU and 12 other countries, with launches progressing across markets. In the US, we resubmitted the Biologics License Application to the FDA in September 2025, following a 2024 action letter. Further reviews are underway in other markets and additional approvals are expected in 2026. This rollout is underpinned by evidence from ONWARDS – five phase 3a trials in about 4,000 adults with type 2 diabetes – where change in HbA1c was the primary endpoint, supporting clinical decision‑making. Alongside Awiqli®, our once‑weekly portfolio advanced with the European Commission’s approval of Kyinsu® (IcoSema), a once‑weekly combination of basal insulin icodec and the GLP‑1 RA semaglutide. The decision, based on the COMBINE phase 3a programme where all three trials met primary endpoints, confirms a well‑tolerated safety profile and expands options for adults insufficiently controlled on basal insulin or GLP‑1 RAs. |  | |||||||

Nathalia de Souza Santos lives with type 1 diabetes in Brazil. | ||||||||||

– – – | 24 |

RARE DISEASE | PRODUCTION | |||||||||

Expanding therapeutic impact in rare bleeding and growth disorders | Strategic investments to expand manufacturing capacity | |||||||||

Novo Nordisk has a rich legacy and an enduring commitment to people living with rare diseases. Our portfolio is focused on innovative medicines that combine strong efficacy profiles with simple administration to ease the treatment burden. In 2025, our rare disease portfolio delivered 9% sales growth at CER, with Sogroya® leading in the long‑acting growth hormone segment across launch markets and Alhemo® expanding its presence in haemophilia prophylaxis. Sogroya®, our long-acting growth hormone treatment, gained significant momentum in 2025 as new international consensus guidance standardised the approach to paediatric growth hormone deficiency. This clinical framework – covering diagnosis, dosing and weekly monitoring regimens – is helping clinicians deliver more consistent care and expanding access to treatment. Building on this foundation, we maintained Sogroya®’s leadership across its first five launch markets whilst expanding into France, Argentina and Canada, with further entries planned for 2026. In rare bleeding disorders, the FDA and EMA approved expanded use of Alhemo® for people aged 12 or older with haemophilia A or B without inhibitors, broadening access and sustaining our momentum in this therapy area while addressing the remaining unmet needs in haemophilia B. |  | In February 2025, the FDA declared the shortage of semaglutide injectables resolved, confirming that supply meets or exceeds current and projected US demand. To ensure consistent, sustainable access to authentic, FDA‑approved medicines, we are continuing to expand US manufacturing capacity and to strengthen our supply chain. Patient safety and uninterrupted care remain our top priorities. Following the FDA’s declaration, we continue to work closely with regulators and supply partners to ensure consistent availability and reduce the risk of interruptions as demand continues to evolve. We strive to operate our US production facilities around the clock and have accelerated capital expenditure, including approximately USD 2 billion in US manufacturing in 2025 and plans to invest a further USD 5.6 billion towards 2028. These investments will add new lines, increase fill‑finish and packaging capacity, and significantly expand multiple US sites to address national supply needs. This complements ongoing work to scale production across our global manufacturing network, with major expansions underway in Denmark, France, Brazil and China. Following our 2024 acquisition of three fill‑finish sites formerly operated by Catalent Inc., these facilities are now being transitioned into our network. Once fully integrated, they will enhance flexibility and optionality across the supply chain and complement our significant internal expansions. |  | |||||||

Expansion at our Clayton, North Carolina site in the US. | ||||||||||

“Our portfolio is focused on innovative medicines that combine strong efficacy profiles with simple administration to ease the treatment burden” | “Patient safety and uninterrupted care remain our top priorities” | |||||||||

– – – | 25 |

Product overview1 | Patent status for products with marketing authorisation | |||||||||||||||||

OBESITY& | RARE DISEASE | |||||||||||||||||

GLP-1 •Saxenda®, liraglutide 3.0 mg •Wegovy®, semaglutide 2.4 mg •Wegovy® pill, semaglutide 25 mg Obesity delivery systems •Saxenda®, FlexTouch® •Wegovy®, Single Dose Device and FlexTouch® | GLP-1 •Victoza®, liraglutide •Ozempic®, semaglutide •Rybelsus®, oral semaglutide Pre-filled delivery systems •FlexTouch®, U100, U200, U700 •FlexPen® •InnoLet® •Ozempic®, FlexTouch® Durable delivery systems •NovoPen® 6 •NovoPen® 5 •NovoPen® 4 •NovoPen Echo® Plus •NovoPen Echo® Other delivery systems •PumpCart®, NovoRapid® and Fiasp® cartridge to be used in pump •Penfill® cartridge Oral antidiabetic agents •NovoNorm®, repaglinide Glucagon •GlucaGen®, glucagon (vial and Hypokit®) •Zegalogue®, dasiglucagon Needles •NovoFine® Plus •NovoFine® •NovoTwist® •NovoFine® AutoCover® | Rare blood disorders •NovoSeven®4, eptacog alfa •NovoEight®5, turoctocog alfa •Esperoct®, turoctocog alfa pegol, N8-GP •Alhemo®, concizumab •Refixia®6, nonacog beta pegol, N9-GP •NovoThirteen®7, catridecacog Rare haemato-renal disorders •Rivfloza™, nedosiran Rare endocrine disorders •Norditropin®, somatropin •Sogroya®, somapacitan Pre-filled human growth hormone delivery systems •FlexPro® Other delivery systems •PenMate®, automatic needle inserter for FlexPro® Hormone replacement therapies •Vagifem®8, estradiol hemihydrate •Activelle®, estradiol/norethisterone acetate •Eviana®, estradiol/norethisterone acetate •Kliogest®, estradiol/norethisterone acetate •Novofem®, estradiol/norethisterone acetate •Trisequens®, estradiol/norethisterone acetate •Estrofem®, estradiol | The patent expiry dates for products with marketing authorisation1 are shown in the tables below. The dates provided are for expiry in the US, China, Japan and Europe of patents on the active ingredient, unless otherwise indicated, and include actual and estimated extensions of patent term, when applicable. For several products, in addition to the active ingredient patent, Novo Nordisk holds other patents on manufacturing processes, formulations or uses that may be relevant for exclusivity beyond the expiration of the active ingredient patent. Furthermore, regulatory data protection and/or orphan exclusivity may apply. | |||||||||||||||

DIABETES& | Product | US | China | Japan | Europe2 | |||||||||||||