Please wait

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As filed with the Securities and Exchange Commission on April 16, 2025 |

| | | | | | | Registration No. 333-264102 |

| | | | | | | | | | |

| UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

| | | | | | | | | | |

| Washington, D.C. 20549 |

| | | | | | | | | | |

| | | | | | | | | | |

FORM N-4 |

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

| | | | | | | | | | |

| | | Pre-Effective Amendment No. _¨ | | | |

| | | Post-Effective Amendment No. 3 x | | | |

| | | (Check appropriate box or boxes.) | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Athene Annuity and Life Company |

(Name of Insurance Company) |

| | | | | | | | | | |

| 7700 Mills Civic Parkway |

| West Des Moines, IA 50266-3862 |

| (888) 266-8489 |

| | | | | | | | | | |

| | | | | | | | | | |

| (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) |

| | | | | | | | | | |

| | | | Blaine Doerrfeld | | | | |

| | | | Athene Annuity and Life Company | | | | |

| | | | 7700 Mills Civic Parkway | | | | |

| | | | West Des Moines, IA 50266-3862 | | | | |

| | | | (888) 266-8489 | | | | |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

| | | | | | | | | | |

| | Copy to: | | |

| | | | |

| | Stephen E. Roth, Esq. | | |

| | Eversheds Sutherland (US) LLP | | |

| | 700 Sixth Street, N.W. | | |

| | Washington, DC | | |

| | 20001-3980 | | |

| | | | | | | | | | |

| Approximate date of commencement of proposed sale to the public: Continuously on and after the effective date of this Registration Statement. |

|

It is proposed that this filing will become effective (check appropriate box): |

¨ | immediately upon filing pursuant to paragraph (b) |

x | on 04/30/2025 pursuant to paragraph (b) |

| ¨ | 60 days after filing pursuant to paragraph (a)(1) |

| ¨ | on [ MM/DD/YYY] pursuant to paragraph (a)(1) of rule 485 under the Securities Act of 1933 (“Securities Act”) |

|

If appropriate, check the following box: |

| ¨ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment |

|

Check each box that appropriately characterizes the Registrant: |

| ¨ | New Registrant (as applicable, a Registered Separate Account or Insurance Company that has not filed a Securities Act registration statement or amendment thereto within 3 years preceding this filing) |

| ¨ | Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”)) |

| ¨ | If an Emerging Growth Company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act |

| x | Insurance Company relying on Rule 12h-7 under the Exchange Act |

| ¨ | Smaller reporting company (as defined by Rule 12b-2 under the Exchange Act) |

Athene ® Amplify

Single Purchase Payment Index-Linked

Deferred Annuity Contract

Issued by:

Athene Annuity and Life Company

7700 Mills Civic Parkway

West Des Moines, IA 50266-3862

Tel. (888) 266-8489

This prospectus describes the Athene ® Amplify Single Purchase Payment Index-Linked Deferred Annuity Contract (the Contract) issued by Athene Annuity and Life Company (the Company, we or us) that is designed for retirement or other long-term investment purposes. The Company does not allow additional Purchase Payments after the initial Purchase Payment. Contracts under this prospectus are no longer available for sale.

The Contract offers index-linked investment options (Index-Linked Segment Options) that provide returns (Segment Credits) based on changes in the value of a broad-based index or indices (the Reference Index). The Contract also offers a Fixed Segment Option that determines Segment Credits at a guaranteed interest rate. The Contract is a complex investment and involves risks, including the potential loss of principal and previously applied Segment Credits.

•Currently, each Index-Linked Segment Option offered has either a Buffer Rate of 10% or 20% , or a Floor Rate of 10%. A Buffer Rate establishes the maximum amount of negative index performance that we will absorb before applying a negative Segment Credit on an Index-Linked Segment Option with a Buffer Rate. A Floor Rate establishes the maximum amount of negative Index Change that may be applied to determine a Segment Credit on the Segment End Date on an Index-Linked Segment Option with a Floor Rate. This means you could lose up to 90% of the amount you invest in an Index-Linked Segment Option with a 10% Buffer Rate due to poor investment performance , up to 80% with a 20% Buffer Rate , and up to 10% with a 10% Floor Rate . For currently offered Index-Linked Segment Options with a Buffer Rate , the Buffer Rate will always be at least 10%. F or currently offered Index-Linked Segment Options with a Floor Rate, the Floor Rate will always be no greater than 10%. For any future Index-Linked Segment Options with a Buffer Rate offered under this Contract, the Buffer Rate will always be at least 5%. With a 5% Buffer Rate, you could lose up to 95% of the amount you invest in an Index-Linked Segment Option with a Buffer Rate due to poor investment performance. For any future Index-Linked Segment Options with a Floor Rate offered under this Contract, the Floor Rate will be no greater than 20%. With a 20% Floor Rate, you could lose up to 20% of the amount you invest in an Index-Linked Segment Option with a Floor Rate due to poor investment performance.

•Each Point-to-Point and Performance Blend Segment Option has a Cap Rate, which limits the maximum positive index performance that may be reflected in the Segment Credit. We guarantee that Cap Rates will never be less than 2% for an Index-Linked Segment Option with a 1-year Segment Term Period, 4% for an Index-Linked Segment Option with a 2-year Segment Term Period, and 12% for an Index-Linked Segment Option with a 6-year Segment Term Period.

You may elect a Segment Option with a six-year Segment Term Period only during the first Contract Year. The Performance Blend Segment Option is available only with a six-year Term Period. Six-year Segment Options are not available for renewal. Two-year Segment Options are not available for renewal after the first six Contract Years. For additional information about each Index-Linked Segment Option and the Fixed Segment Option see Appendix A: Investment Options Available Under the Contract.

The Contract is not a short-term investment and is not appropriate for an investor who needs ready access to cash. Withdrawals or a surrender could result in Withdrawal Charges, negative Interim Value adjustments, taxes and tax penalties, as applicable. Required Minimum Distributions can be withdrawn anytime during a Segment Term Period and when applicable, will be required on an ongoing basis. Therefore, this Contract may not be an appropriate investment for taking these distributions. While Withdrawal Charges may not apply, Required Minimum Distributions could still result in negative Interim Value adjustments, taxes and tax penalties, as applicable. Under extreme circumstances, you could lose up to 100% of your investment from a negative Interest Adjustment on money allocated to an Index-Linked Segment Option. Under extreme circumstances, you could lose up to 100% of your investment from a negative Equity Adjustment on money allocated to an Index-Linked Segment Option. Please consult a Financial Professional regarding the appropriateness of taking these types of withdrawals from this contract.

All guarantees under the Contract are obligations of the Company and are subject to its creditworthiness, financial strength, and claims paying ability. For additional information on risk associated with owning the Contract see the “Principal Risks of Investing in the Contract” section.

Neither the Securities and Exchange Commission (SEC) nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Additional information about certain investment products, including annuity contracts offering index-linked investment options has been prepared by the Securities and Exchange Commission’s staff and is available at investor.gov.

You should read this prospectus and retain a copy for future reference. This prospectus is not an offer to sell the Contract in any jurisdiction in which it may not be legally sold.

The date of this prospectus is April 30, 2025

1. Glossary

Accumulation Phase: The period of time between the Contract Date and the Annuity Date, unless the Contract is terminated.

Administrative Office: Mail Processing Center, P.O. Box 1555, Des Moines, IA 50306-1555; (888) 266-8489.

Aggregate Index Change: Used in the calculation of the Segment Credit on the Performance Blend Segment Option. This Segment Option uses three indices in its calculation. On the Segment End Date, we calculate the Index Change for each of these indices. The Aggregate Index Change is the sum of the Index Change for the best performing index multiplied by Index Allocation Percentage 1 (50%) plus the Index Change for the second best performing index multiplied by Index Allocation Percentage 2 (30%) plus the Index Change for the third best performing index multiplied by Index Allocation Percentage 3 (20%).

Annuitant, Joint Annuitant: The Annuitant is the natural person named on the Contract Schedule whose life determines the Annuity Payments made under your Contract. We will allow you to name two natural persons on the application as Joint Annuitants. If there is a Joint Annuitant, the Joint Annuitant must be the Annuitant’s spouse.

Annuity Date: The Contract Anniversary on or first following the later of the Annuitant attaining age 95, or the 10th Contract Anniversary. In the case of Joint Annuitants, the Annuity Date will be set based on the age of the older Joint Annuitant. You may select an earlier Annuity Date, which may be any time after the Contract Date, by Notice provided to us. The revised Annuity Date must be at least 10 days after our receipt of your Notice.

Annual Interest Rate: The annual rate used to calculate Segment Credits on the Fixed Segment Option.

Annuity Payments: Payments paid to you or your designated payee in accordance with the terms and conditions of the Settlement Option elected by the Owner. The payments are made by us and commence on the Annuity Date.

Annuity Phase: The phase of the Contract when Annuity Payments are being made.

Beneficiary: The person(s) or entity(ies) named by the Owner to receive the Death Benefit.

Buffer Rate: The amount of negative Index Change tha t we will absorb when calculating Segment Credits for an Index-Linked Segment Option with a Buffer Rate . A negative Segment Credit will apply for any negative Index Change or Aggregate Index Change in excess of the Buffer Rate.

Business Day: Any day of the week except for Saturday, Sunday, and U.S. Federal holidays where U.S. stock exchanges are closed. Our Business Day ends at 4:00 p.m. Eastern Time.

Cap Rate: The maximum positive Index Change that will be used in the calculation of Segment Credits that may be applied to a Segment Option on the Segment End Date. There is one Cap Rate per Segment Term Period, which applies to the entire Segment Term Period.

Cash Surrender Value: The Interim Value adjusted for any applicable Withdrawal Charge. You may surrender your Contract by making a written request to our Administrative Office at any time before the Annuity Date and before the Death Benefit becomes payable.

Company (“we”, “us”, “our”, “ours”): Athene Annuity and Life Company.

Contract: The Single Purchase Payment Index-Linked Deferred Annuity Contract described by this prospectus.

Contract Anniversary: Any twelve-month anniversary of the Contract Date. For example, if the Contract Date is January 19, 2024, then the first Contract Anniversary is January 19, 2025.

Contract Date: The date your Contract is issued, as shown on the Contract Schedule.

Contract Value: The Contract Value at any time is equal to the sum of the Segment Values.

Contract Year: The twelve-month period that begins on the Contract Date and each Contract Anniversary. For example, if the Contract Date is January 19, 2024, then the first Contract Year is the twelve-month period that includes January 19, 2024 through January 18, 2025.

Crediting Method: Used to determine the calculation of the Segment Credits. Crediting Methods include the Point-to-Point Crediting Method, Performance Blend Crediting Method, and Fixed Crediting Method. Each Crediting Method has distinct methodology to calculate Segment Credits.

Death Benefit: During the Withdrawal Charge Period, the Death Benefit will be equal to the greater of the Interim Value or the Purchase Payment less net proceeds from prior Withdrawals. After the Withdrawal Charge Period, the Death Benefit will be equal to the Interim Value. The Death Benefit will be calculated as of the date of death. If the Owner is changed or an additional Owner is added during the Withdrawal Charge Period, the Death Benefit will equal the Interim Value unless the Contract is continued by a surviving spouse.

Equity Adjustment: A positive or negative adjustment to Segment Value that is applied to any Withdrawal from an Index-Linked Segment Option on a day other than a Segment End Date. The Equity Adjustment is equal to zero on the Segment End Date. The Equity Adjustment does not apply to the Fixed Segment Option.

Financial Professional: A registered representative of a broker-dealer that has a selling agreement with our principal underwriter, Athene Securities.

Fixed Crediting Method: The Crediting Method in which Segment Credits are determined daily based on the declared Annual Interest Rate.

Fixed Segment Option: The Segment Option that calculates Segment Credits daily based on the Fixed Crediting Method. The Fixed Segment Option does not include a Reference Index.

Free Withdrawal: A Withdrawal amount on which no Withdrawal Charge applies. An Interest Adjustment and Equity Adjustment will still apply.

Floor Rate: The maximum negative Index Change that may be applied in the calculation of Segment Credits for an Index-Linked Segment Option with a Floor Rate on the Segment End Date.

Good Order: A request, including an application, is in Good Order if it contains all the information we require to process the request. Good Order also includes delivering information on the correct form, with any required certifications, guarantees, and/or signatures, to our Administrative Office.

Holding Account: An account that holds the Purchase Payment until it is allocated to the Segment Options according to the Segment Allocation Percentages you select. Interest is credited daily to the Holding Account at the

Holding Account Fixed Interest Rate.

Holding Account Fixed Interest Rate: The annual rate used to calculate interest credited on amounts held in the Holding Account.

Index Allocation Percentage: The percentage used to calculate the portion of Index Change from each Reference Index that will be used in the Aggregate Index Change for a Performance Blend Segment Option.

Index Change: The percentage change in the Index Price of the Reference Index for the selected Segment Option, as measured from the Segment Start Date to the Segment End Date.

Index-Linked Segment Option: Any Segment Option that is not the Fixed Segment Option. An Index-Linked Segment Option includes a Reference Index.

Index Price: The Index Price for any date, including any Segment Start Date, Segment End Date, Annuity Date or date of death is the closing price of the Reference Index on that date. The closing price of the Reference Index is the price determined and published by the provider of the Reference Index at the end of each Business Day. Any change in price after the closing price has been published will not be reflected.

Interim Value: The Interim Value at any time is equal to the sum of the Segment Interim Values.

Interest Adjustment: A positive or negative adjustment to the Segment Value that is applied to any Withdrawal during the first six years of the Contract, including Withdrawals taken on a Segment End Date. The Interest Adjustment approximates the change in value of debt instruments supporting the Contract, which we sell to fund the Withdrawal. The Interest Adjustment does not apply to any Withdrawal taken after the first six Contract Years.

IRA Account: A traditional, Roth, or other Individual Retirement Account established for the Owner and the Owner’s beneficiaries, through which a Contract may be purchased.

Non-Qualified Contract: A Contract that is not qualified for special tax treatment under the Internal Revenue Code.

Notice, Notify, Notifying: Requests and information that you sign and that we receive and accept at our Administrative Office in any form offered by and acceptable to us.

Owner (“you”, “your”): The Contract Owner named in the application, or their successor or assignee if you provide Notice and the Company has acknowledged the assignment. If no Owner is named on the application, the Annuitant will be the Owner. If Joint Owners are named, all references to the Owner shall mean the Joint Owners. Joint Owners must be Spouses.

Participation Rate: A percentage that is multiplied by any positive Index Change, after the application of the Cap Rate, in the calculation of the Segment Credit. This percentage will not be less than 100%. There is one Participation Rate per Segment Term Period, which applies to the entire Segment Term Period.

Performance Blend Crediting Method: A Crediting Method in which the Segment Credit is determined based on on a weighted average of three Reference Indices., as measured from the Segment Start Date to the Segment End Date, and the applicable Cap Rate, Participation Rate, and Buffer Rate. This Crediting Method calculates an Aggregate Index Change using three underlying indices, rather than an Index Change based on a single underlying index.

Performance Blend Segment Option: A type of the Index-Linked Segment Option that calculates Segment Credits using the Performance Blend Crediting Method.

Point-to-Point Crediting Method: A Crediting Method in which the Segment Credit is determined based on the performance of the Reference Index and the applicable Cap Rate, Participation Rate, and a Floor or Buffer Rate. The Reference Index performance is determined by observing the Index Price only on the Segment Start Date and Segment End Date.

Point-to-Point Segment Option: A type of Index-Linked Segment Option that calculates Segment Credits based on the Point-to-Point Crediting Method.

Premium Tax: The amount of tax, if any, charged by the state or municipality in which your Contract is issued.

Purchase Payment: The amount you pay to us under your Contract, as shown on the Contract Schedule. The Purchase Payment is due on the Contract Date. We may limit the amount of Purchase Payment that we will accept for your Contract.

Qualified Contract: A Contract that qualifies for special tax benefits under the Internal Revenue Code, such as a Section 408(b) Individual Retirement Annuity.

Reference Index: The index or indices used in the calculation of the Segment Credit for a Segment Option.

Right to Cancel Period: The period of time you may examine your Contract after you receive it. The Right to Cancel Period may vary according to state law.

Securities Act: The Securities Act of 1933, as amended.

Segment Credit: The amount we credit to each Segment Option according to the terms of the Segment Option and Crediting Method. Segment Credits are credited to the Fixed Segment Option daily based on the Annual Interest Rate. Segment Credits on the Fixed Segment Option cannot be negative. Segment Credits are credited to Index-Linked Segment Options on the Segment End Date based on the performance of the Reference Index subject to the applicable Cap Rate, Participation Rate, and Floor Rate or Buffer Rate. Segment Credits on Index-Linked Segment Options may be negative amounts, which will reduce the Segment Value.

Segment End Date: The last day of a Segment Term Period. The Segment Credit for Index-Linked Segment Options is calculated and applied to the Segment Value on the Segment End Date. The next Segment Start Date coincides with the Segment End Date.

Segment Fee: An annualized rate that is assessed daily as a percentage of the Segment Fee Base on Index-Linked Segment Options. The Segment Fee amount for that Segment Option is then deducted daily from that Segment Option’s Segment Value during the Accumulation Phase. The Segment Fee will never reduce the Segment Value below zero. The Segment Fee does not apply to the Fixed Segment Option.

Segment Fee Base: The initial Segment Fee Base for each Segment Option during each Segment Term Period is the Segment Value on the Segment Start Date. The Segment Fee Base on any other day in the Segment Term Period is the Segment Value on the Segment Start Date less any Withdrawals deducted from the Segment Option through the prior Business Day. We use the Segment Fee Base to determine the Segment Fee amount we will deduct from that Segment Option’s Segment Value.

Segment Interim Value: The Segment Value adjusted for any applicable Equity Adjustment and Interest Adjustment.

Segment Options: Segment Options include Index-Linked Segment Options and the Fixed Segment Option available under your Contract. Each Segment Option will have a Segment Term Period. Each Point-to-Point and Performance Blend Segment Option will also have a Reference Index, a Cap Rate, a Participation Rate, a Floor or Buffer Rate, and will be subject to a Segment Fee. The Performance Blend Segment Option will also have Index Allocation Percentages. The Segment Options available on the first Segment Start Date following your Contract Date will be shown on the Contract Schedule.

Segment Start Date: The first date of a Segment Term Period.

Segment Term Period: The Segment Term Period for each Segment Option will be shown on the Contract Schedule. The Segment Term Period ends on the Segment End Date. Upon expiration of each Segment Term Period, a new Segment Term Period will begin. Please see the “Setting Your Segment Start Date and Segment End Date” section for further details.

Segment Value: On the initial Segment Start Date, the Segment Value is equal to the portion of the Purchase Payment plus any Holding Account interest allocated to the Segment Option. On any other day, the Segment Value is equal to the Segment Value on the Segment Start Date decreased by any Segment Fee amounts applied to that Segment Option since the Segment Start Date, increased by Segment Credits applied to the Segment Option, increased by amounts transferred from another Segment Option, decreased by amounts transferred into another Segment Option, and decreased by Withdrawals from the Segment Option. Segment Credits are applied daily to the Fixed Segment Option and are applied to Index-Linked Segment Options only on the Segment End Date. Transfers between Segment Options will occur only on a Segment End Date.

Separate Account: The segregated account, established by the Company under Iowa Law in which we hold reserves for our obligations under the Contract. The portion of the assets of the Separate Account equal to the reserves and other Contract liabilities with respect to the Separate Account will not be chargeable with liabilities arising out of any other business we may conduct. As Owner of the Contract, you do not participate in the performance of assets held in the Separate Account and do not have any direct claim on them. The Separate Account is not registered under the Investment Company Act of 1940.

Settlement Option: An option available under the Contract for receiving Annuity Payments, which we guarantee as to the dollar amount.

Spouses: Individuals who are recognized as legally married under Federal law.

Withdrawal: Unless otherwise specified, it is a Withdrawal of any type taken under your Contract, including a partial Withdrawal, a Required Minimum Distribution, a surrender of your Contract, payment of a Death Benefit or the application of Interim Value to a Settlement Option. Withdrawal refers to the amount of Contract Value withdrawn for such benefits before the application of Withdrawal Charges, Interest Adjustments, and Equity Adjustments. We do not treat the deduction of the Segment Fee amount as a Withdrawal.

Withdrawal Charge: The charge we assess when you surrender the Contract or make a partial withdrawal during the first six Contract Years. Any amounts withdrawn from the Contract Value are assessed a Withdrawal Charge. The Withdrawal Charge does not apply to the Free Withdrawal amount.

Withdrawal Charge Period: The Contract years during which you pay a Withdrawal Charge on amounts withdrawn. The Withdrawal Charge Period ends when the Withdrawal Charge Rate declines to 0% in the Withdrawal Charge Rate schedule set forth in your Contract Schedule.

Withdrawal Charge Rate: The percentage used to calculate the Withdrawal Charge.

2. Overview of the Contract

Purpose of the Contract

Athene ® Amplify is a Single Purchase Payment Index-Linked Deferred Annuity Contract that is designed for retirement or other long-term investment purposes. It is intended for long term investment purposes and is designed for investors who are looking for a level of protection for their principal, while providing potentially higher returns than are available from traditional fixed annuities. This Contract is not intended for someone who is seeking complete protection from downside risk or for investors who plan to take Withdrawals in excess of the annual Free Withdrawal amount or surrender the Contract during the first six Contract Years. The Contract can be purchased as either a Qualified Contract or a Non-Qualified Contract.

The Contract can be owned in the following ways:

•Sole Owner who is an individual or trust with a natural person as grantor; or

•Sole Owner who is an individual and his or her spouse as the Joint Owner or a trust with a natural person and his or her spouse as grantors (available for Non-Qualified Contract only).

We are not an investment adviser and do not provide any investment advice in connection with the Contract.

Phases of the Contract

The Contract has two phases: an Accumulation (Savings) Phase and an Annuity (Income) Phase.

Accumulation (Savings) Phase

During the Accumulation Phase, you can allocate your Contract Value to one or more of the available Index-Linked Segment Options and/or the Fixed Segment Option. For additional information about each Index-Linked Segment Options and the Fixed Segment Option see Appendix A: Investment Options Available Under the Contract.

Index-Linked Segment Options:

We will apply positive or negative Segment Credits to amounts allocated to the Index-Linked Segment Options on the Segment End Date based, in part, on the performance of the Reference Index. You could lose a significant amount of money if the Reference Index declines in value.

Each Index-Linked Segment Option will have a Buffer Rate or Floor Rate.

Buffer Rate

A Buffer Rate establishes the amount of loss attributable to negative Index Change that we will absorb before we apply a negative Segment Credit to the Segment Value for an Index-Linked Segment Option with a Buffer Rate on the Segment End Date. A negative Segment Credit will apply for any negative Index Change in excess of the Buffer Rate. Theoretically, for an Index-Linked Segment Option subject to a 10% Buffer Rate, the negative Index Change that is used to calculate the Segment Credit percentage may be as high as 90%, which could lead to substantial loss of principal and previously credited Segment Credits.

Currently, each Index-Linked Segment Option with a Buffer offered has a Buffer Rate of 10% or 20%. If the Index Change is -25%, a 10% Buffer Rate will limit the negative interest credited to -15%, which is the amount that exceeds the Buffer Rate. This means you could lose up to 90% of the amount you invest in an Index-Linked Segment Option with a 10% Buffer Rate due to poor investment performance, and up to 80% with a 20% Buffer Rate. For currently offered Index-Linked Segment Options with a Buffer Rate, the Buffer Rate will always be at least 10%. For any future Index-Linked Segment Options with a Buffer Rate offered under this Contract, the Buffer Rate will always be at least 5%. With a 5% Buffer Rate, you could lose up to 95% of the amount you invest in an Index-Linked Segment Option with a Buffer Rate due to poor investment performance.

Floor Rate

The Floor Rate establishes the maximum amount of negative Index Change that will be used in the determination of the Segment Credit for an Index-Linked Segment Option with a Floor Rate on a Segment End Date. For a Segment Option with a 10% Floor Rate, this means that any negative Segment Credit percentage will not be more than 10% in a Segment Term Period. Over multiple Floor Segment Term Periods, cumulative negative Segment Credits may exceed the Floor Rate established by the Segment Option because a negative Segment Credit up to the amount of the Floor Rate may be applied on each Segment End Date.

Currently, each Index-Linked Segment Option with a Floor offered has a Floor Rate of 10%. If the Index Change is -25%, a 10% Floor Rate will limit the negative interest credited to -10%, which is the amount that does not exceed the Floor Rate. This means you could lose up to 10% of the amount you invest in an Index-Linked Segment Option with a 10% Floor Rate due to poor investment performance. For currently offered Index-Linked Segment Options with Floor Rates, the Floor Rate will be no greater than 10%. For any future Index-Linked Segment Options with a Floor Rate offered under this Contract, the Floor Rate will always be no greater than 20%. With a 20% Floor Rate, you could lose up to 20% of the amount you invest in an Index-Linked Segment Option with a Floor Rate due to poor investment performance.

Each Index-Linked Segment Option will have a Cap Rate and a Participation Rate. If the Index Change is 12%, a 4% Cap Rate with a 100% Participation Rate will limit the positive Segment Credit to the Cap Rate of 4%, which is the Cap Rate multiplied by the 100% Participation Rate. We guarantee that Cap Rates will never be less than 2% for 1-year Segment Options, less than 4% for 2-year Segment Options and 12% for 6-year Segment Options. We guarantee that Participation Rates will never be less than 100% for all Segment Options.

You may elect a Segment Option with a six-year Segment Term Period only during the first Contract Year. The Performance Blend Segment Option is available only with a six-year Term Period. Six-year Segment Options are not available for renewal. Two-year Segment Options are not available for renewal after the first six Contract Years.

Fixed Segment Option:

The Contract provides one Fixed Segment Option. It is currently available with a 1-year Segment Term Period and credits interest daily at a declared Annual Interest Rate. A new Annual Interest Rate is declared for each Segment Term Period. The Annual Interest Rate will never be less than 1.00% .

Because the Fixed Segment Option does not have risk of poor investment performance and provides minimum values after the application of the Interest Adjustment that comply with Standard Nonforfeiture Law for Deferred Annuities, it is not registered under the Securities Act of 1933. Disclosures describing the Fixed Segment Option are subject to certain generally applicable provisions of the Federal securities laws regarding the accuracy and completeness of disclosure.

If amounts are withdrawn from the Fixed Segment Option during the first six years of the Contract, we will apply an Interest Adjustment. This may result in a significant reduction to the net proceeds you receive from the Withdrawal. Withdrawal Charges, taxes, and tax penalties may also apply.

Additional information about each Index-linked Segment Option and the Fixed Segment Option is provided in Appendix A: Investment Options Available Under the Contract.

Annuity (Income) Phase

You enter the annuity phase when you annuitize your Contract. During the annuity phase, you will receive a stream of fixed income payments for the annuity payout period you elect. You can elect to receive annuity payments (1) for the life of the Annuitant; (2) for life of the Annuitant with a guaranteed period; (3) in monthly installment payments for the period required for the sum of monthly payments to equal the total amount applied to the option and, thereafter, for life of the Annuitant; (4) for the joint lifetimes of two Annuitants and in equal amount for the remaining lifetime of the survivor; or (5) in monthly payments for a fixed period elected. When you annuitize, your Segment Value is converted to income payments and you will no longer be able to make any additional withdrawals from your Contract. All accumulation phase benefits, including the Death Benefit, terminate upon annuitization. The Annuity Phase ends when we make the last payment under your selected Settlement Option.

Contract Features

Segment Fee

The Contract includes a Segment Fee that is deducted daily from each Index-linked Segment Option at an annualized rate of 0.95% based on the Segment Value. See the “Charges and Adjustments” section for more information.

Access to Your Money

During the Accumulation Phase before any Death Benefit becomes payable, you may access your Contract Value by surrendering the Contract or taking a partial Withdrawal. Partial Withdrawals will reduce your Contract Value and the potential for positive Segment Credits that you may receive. Proceeds payable on a partial Withdrawal or surrender may also be subject to Withdrawal Charges, Interest Adjustments and Equity Adjustments, and an additional 10% federal tax penalty if made before the Owner is age 59½.

Death Benefit

During the Accumulation Phase, your Contract pays your beneficiaries a Death Benefit if the Owner dies or, if the Owner is a non-natural person (like a trust), the Annuitant dies. During the Withdrawal Charge Period, the Death Benefit is equal to the greater of:

1.The Purchase Payment less net proceeds from prior Withdrawals; and

2.The Interim Value on the date of death.

After the Withdrawal Charge Period, the Death Benefit will be equal to the Interim Value on the date of death. Net proceeds from prior Withdrawals are equal to the Contract Value withdrawn after the application of Withdrawal Charges, Interest Adjustments, and Equity Adjustments. Withdrawals do not include any Segment Fee amounts.

If the Owner is changed or a new Owner is added during the Withdrawal Charge Period, the Death Benefit will be equal to the Interim Value on the date of death.

Interim Value Adjustments

Any Withdrawal (including any Free Withdrawal amount or surrender of your Contract) or payment of a Death Benefit from an Index-Linked Segment Option on any date prior to the Segment End Date will be subject to an Equity Adjustment. Any Withdrawal or payment of a Death Benefit during the first six Contract Years will be

subject to an Interest Adjustment. You could lose a significant amount of money due to the application of these

adjustments. The Equity Adjustment will generally be negatively affected by poor market performance, increases in

volatility of index prices, and decreases in interest rates. The Interest Adjustment will generally be negatively

affected by increases in interest rates. The Interim Value may be less than the amount allocated to the Segment

Options or less than the amount you would receive had you held amounts allocated to Segment Options until the

Segment End Dates. All other factors being equal, the Interim Value will be lower the earlier a Withdrawal or

surrender is made during a Segment Term Period.

3. Key Information

| | | | | | | | | | | | | | | | | | | | |

| FEES, EXPENSES | Location in Prospectus

|

Are There Charges or Adjustments for Early Withdrawals? | Yes. If you surrender your Contract or make a partial Withdrawal from the Contract greater than the Free Withdrawal amount during the first six Contract Years, you will be assessed a Withdrawal Charge of up to 8% of the Contract Value withdrawn less the Free Withdrawal amount. For example, if you make a withdrawal of $100,000 in the first Contract Year, you could pay a withdrawal charge of up to $8,000. This loss will be greater if there is a negative adjustment to the Interim Value, taxes, or tax penalties.

If you make a Withdrawal from your Contract, including a partial Withdrawal, Surrender, payment of a Death Benefit, annuitization, or exercise a Performance Lock, your Contract Value may be subject to an Equity Adjustment. Amounts withdrawn from any Segment Option during the first six Contract Years will be subject to an Interest Adjustment.

In extreme situations you could lose up to 100% of your Segment Value due to a negative Interest Adjustment on money allocated to an Index-Linked Segment Option.. For example, if you allocate $100,000 to a 2-year Index-Linked Segment Option and during the first six Contract Years withdraw the entire amount before the 2-year Segment Term Period has elapsed, you could lose up to $100,000 due to a negative Interest Adjustment. This loss will be greater (but never more than 100% of your investment) if you also pay a Withdrawal Charge, taxes or tax penalties.

In extreme circumstances you could also lose up to 100% of your Segment Value due to a negative Equity Adjustment on money allocated to an Index-Linked Segment Option. For example, if you allocate $100,000 to a 2-year Index-Linked Segment Option and during the first six Contract Years withdraw the entire amount before the 2-year Segment Term Period has elapsed, you could lose up to $100,000 due to a negative Equity Adjustment. This loss will be greater (but never more than 100% of your investment) if you also pay a Withdrawal Charge,taxes or tax penalties. | Fee Table

Charges and Adjustments – Withdrawal Charges

Charges and Adjustments – Interest Adjustment

Charges and Adjustments –Equity Adjustment;

Appendix B - Segment Interim Value Examples

Appendix C - Performance Lock Examples

|

| | | | | | | | | | | | | | | | | | | | |

Are There Transaction Charges? | No. The Contract does not impose any front-end load or charge on transfers between investment options. | N/A |

Are There Ongoing Fees and Expenses? | Yes. The Contract imposes a Segment Fee on amounts allocated to Index-Linked Segment Options.

In addition, there is an implicit ongoing fee on the Index-Linked Segment Options to the extent that your participation in index gains is limited by the Cap Rate. This means that your returns may be lower than index gains. In return for accepting this limit on index gains, you will receive some protection from index losses. This implicit fee is not reflected in the table below.

The table below describes the fees and expenses that you may pay each year depending on the Segment Options you choose. Please refer to your Contract Schedule for further information about the specific fees you will pay each year based on the options you have elected.

| Fee Table

Charges and Adjustments – Segment Fees

|

| | | | | | | | | | | | | | | | | | | | |

| | Annual Fee | Minimum | Maximum | | |

Base Contract1 | 0.9710% | 0.9710% |

1The Base Contract consists of the Segment Fee. The Segment Fee is calculated as a percentage of the Segment Fee Base for each Segment Option. |

| Because your Contract is customizable, the choices you make affect how much you will pay. To help you understand the cost of owning your Contract, the following table shows the lowest and highest cost you could pay each year, based on current charges. This estimate assumes you do not take any Withdrawals from the Contract, which could add Withdrawal Charges and negative adjustments to Segment Value that substantially increase costs. |

|

| Lowest Annual Cost: $888.46 | Highest Annual Cost: $888.46 | |

Assumes: - Investment of $100,000 - 5% annual appreciation - No Withdrawal charge No additional Purchase Payments, transfers, or withdrawals | Assumes: - Investment of $100,000 - 5% annual appreciation - No Withdrawal charge - No additional Purchase Payments, transfers, or withdrawals |

| RISKS | Location in Prospectus

|

| | | | | | | | | | | | | | | | | | | | |

Is There a Risk of Loss from Poor Performance? | Yes. You could lose money by investing in the Contract. Currently, each Index-Linked Segment Option offered has either a Buffer Rate of 10% or 20% or a Floor Rate of 10%. This means you could lose up to 90% of the amount you invest in an Index-Linked Segment Option with a 10% Buffer Rate due to poor investment performance, up to 80% with a 20% Buffer Rate, and up to 10% with a 10% Floor Rate. For currently offered Index-Linked Segment Options with a Buffer Rate, The Buffer Rate will always be at least 10%. For currently offered Index-Linked Segment Options with a Floor Rate, the Floor Rate will be no greater than 10%. For any future Index-Linked Segment Options with a Buffer Rate offered under this Contract, the Buffer Rate will always be at least 5%. With a 5% Buffer Rate, you could lose up to 95% of the amount you invest in an Index-Linked Segment Option with a Buffer Rate due to poor investment performance. For any future Index-Linked Segment Options with a Floor Rate offered under this Contract, the Floor Rate will be no greater than 20%. With a 20% Floor Rate, you could lose up to 20% of the amount you invest in an Index-Linked Segment Option with a Floor Rate due to poor investment performance. | Principal Risks of Investing in the Contract - Risk of Loss

|

| | | | | | | | | | | | | | | | | | | | |

Is this a Short-Term Investment? | No. The Contract is not a short-term investment and is not appropriate for an investor who needs ready access to cash because the Contract is designed to provide for the accumulation of retirement savings and income on a long-term basis. As such, you should not use the Contract as a short-term investment. Withdrawals may be subject to a Withdrawal Charge, federal and state income taxes and tax penalties. Withdrawals from an Index-Linked Segment Option before the Segment End Date may also be subject to a negative Equity Adjustment and Withdrawals taken from any Segment Option during the first six Contract Years may be subject to a negative Interest Adjustment. Segment Value in an Index-Linked Segment Option will be re-allocated following the Segment End Date according to your instructions. Any amounts withdrawn will also reduce your future growth potential from positive index performance because any subsequent positive Segment Credits will be lower due to the reduction in the Contract Value. If you want to transfer the Segment Value to one or more Segment Options, you must notify us at least two Business Days prior to the next Segment Start Date. If you do not request a transfer of Segment Value on the Segment End Date, your Segment Value will remain in the same Segment Option(s), subject to new Cap Rates, Participation Rates and Annual Interest Rates. | Principal Risks of Investing in the Contract - Liquidity Risk |

| | | | | | | | | | | | | | | | | | | | |

What Are the Risks Associated with the Investment Options? | An investment in the Contract is subject to the risk of poor investment performance and can vary depending on the performance of the Reference Index for the Index-Linked Segment Options under the Contract. Each Segment Option, including the Fixed Segment Option, will have its own unique risks. You should review the Segment Options before making an investment decision.

For investments in a Point-to-Point and Performance Blend Segment Option, the Cap Rate will limit positive index performance (e.g., limited upside). For example, if an Index-Linked Segment Option has a Cap Rate of 8% and the Index Change is 12%, the Segment Credit on the Segment End Date would be 8%

As a result, you may earn less than the index gain.

For investments in an Index-Linked Segment Option with a Buffer Rate, the Buffer Rate will limit negative returns (e.g., limited protection in the case of market decline). For example, if the Index-Linked Segment Option has a Buffer Rate of 10% and the Index Change is −25%, we will absorb the first 10% of negative index performance, and the Segment Credit will be -15% (the remaining amount of the negative index performance) on the Segment End Date.

For investments in an Index-Linked Segment Option with a Floor Rate , the Floor Rate will limit negative returns (e.g., limited protection in the case of market decline). For example: •If the Index-Linked Segment Option has a Floor Rate of 10% and the Index Change is −25%, the Segment Credit will be -10%, and we will absorb the remaining amount of the negative index performance (-15%) on the Segment End Date.

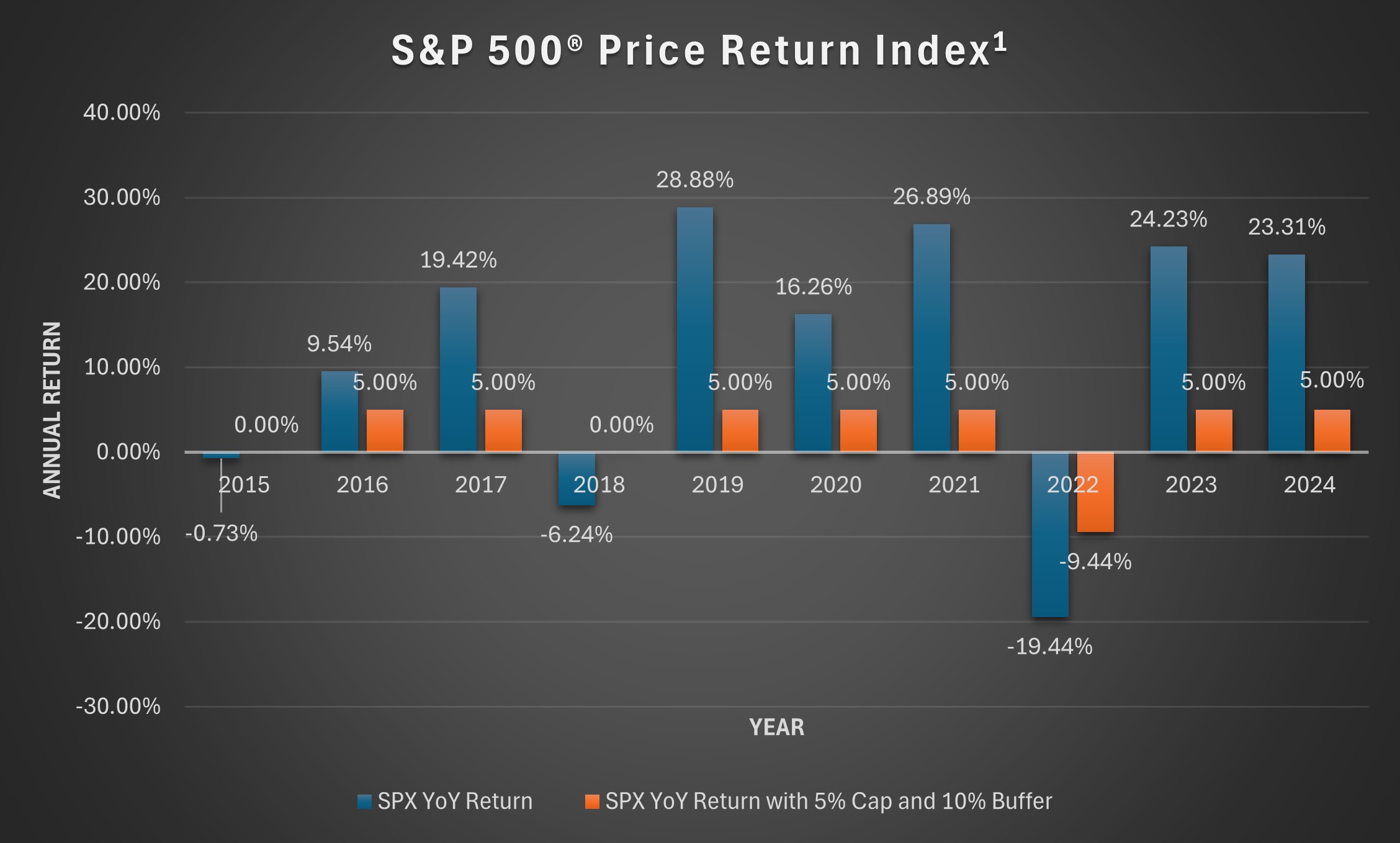

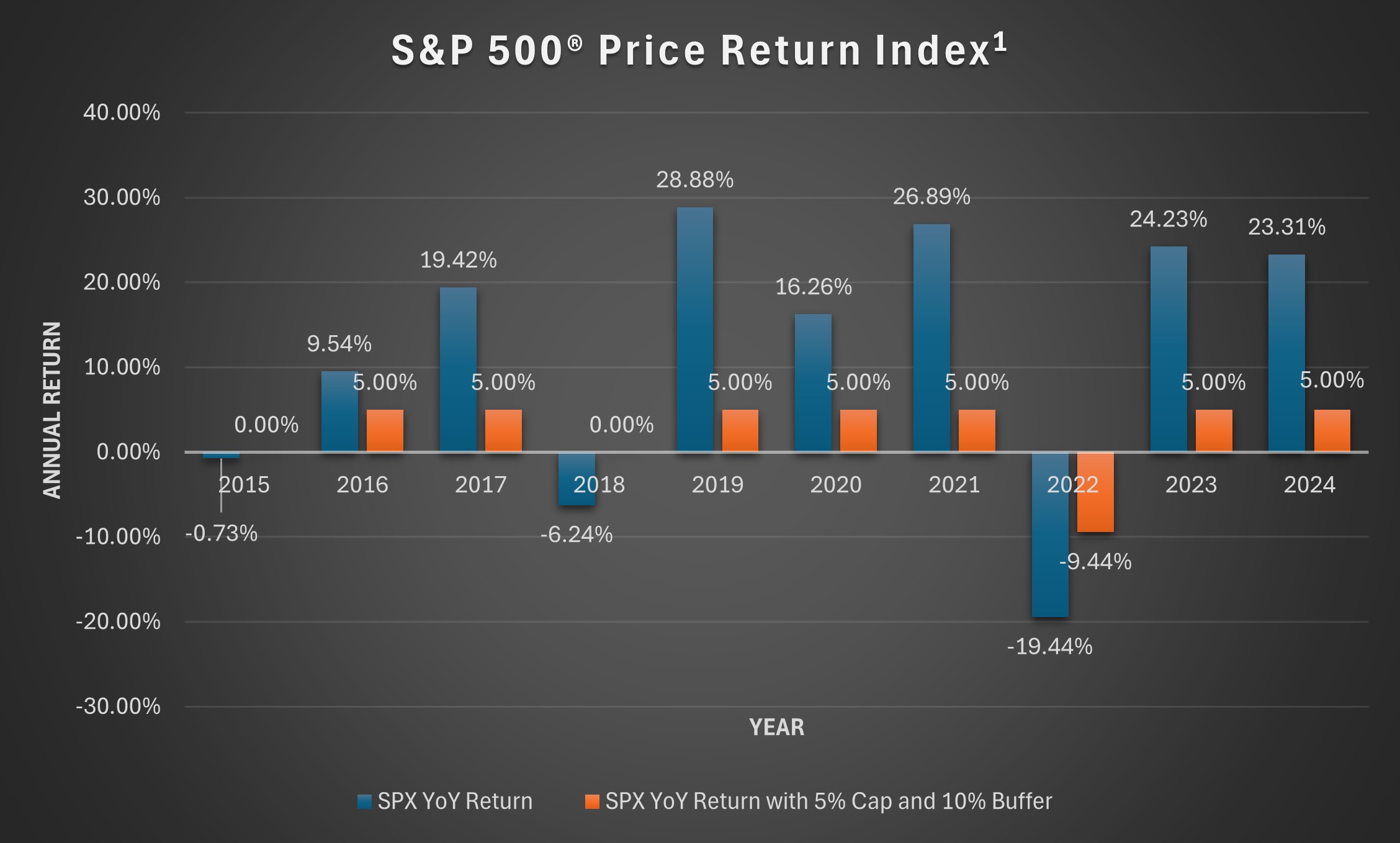

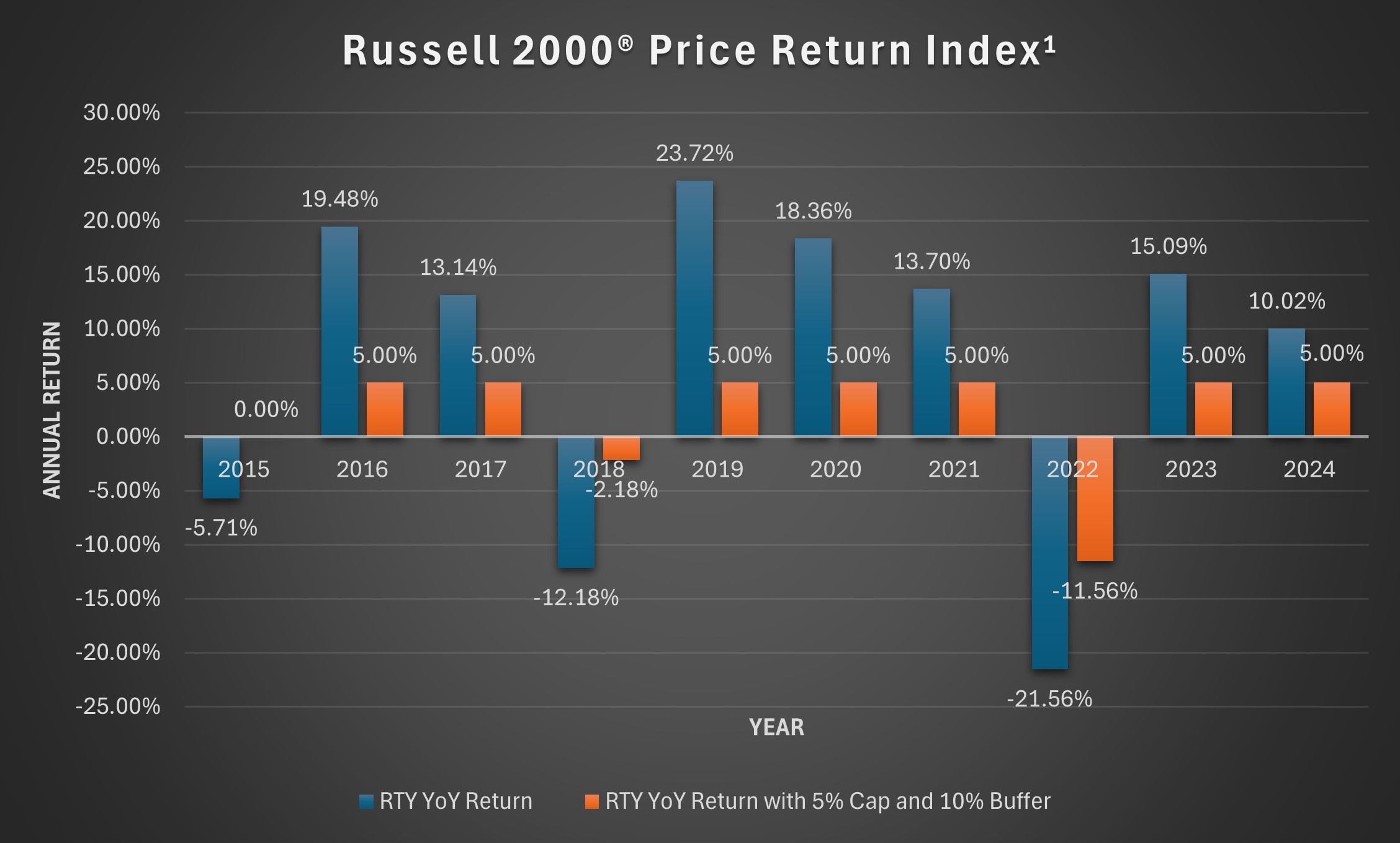

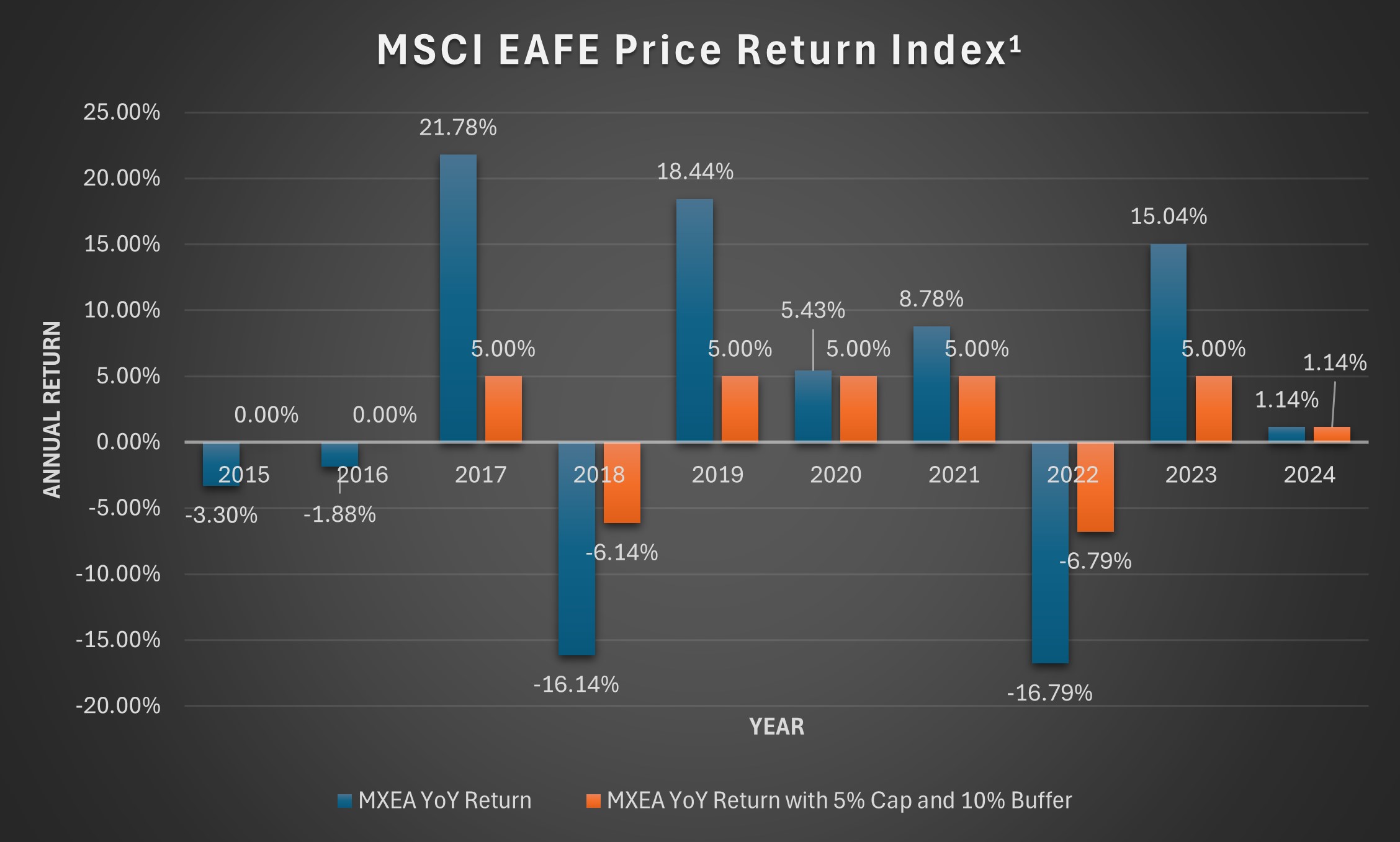

Each Reference Index is a price return index, not a total return index, and therefore does not reflect dividends paid on the securities composing the Reference Index. This will reduce the Index Change and will cause the Reference Index to underperform a direct investment in the securities composing the Reference Index.

| Principal Risks of Investing in the Contract |

| | | | | | | | | | | | | | | | | | | | |

What Are the Risks Related to the Insurance Company? | An investment in the Contract is subject to risks related to the Company. Any payment obligations under the Contract, including the Index-Linked Segment Options and the Fixed Option, guarantees and benefits, are subject to the Company’s claims-payment ability. You may obtain more information about the Company’s financial strength by contacting us at (888) 266-8489. | Principal Risks of Investing in the Contract - Our Financial Strength and Claims Paying Ability |

| RESTRICTIONS | Location in Prospectus

|

| | | | | | | | | | | | | | | | | | | | |

Are There Restrictions on the Investment Options? | Yes. You cannot transfer out of an Index-Linked Segment Option to another Segment Option prior to the Segment End Date. If you do not want to remain in an Index-Linked Segment Option until the Segment End Date, your only options are to make a Withdrawal out of an Index-Linked Segment Option or surrender the Contract. The amount you would receive would be based on the Interim Value. For Withdrawals and surrenders, Withdrawal Charges may also apply.

We will notify you of the Cap Rate and Participation Rate for the new Segment Term Period for each Index-Linked Segment Option at least 15 days prior to the Segment End Date of the prior Segment Term Period. You may elect a Segment Option with a six-year Segment Term Period only during the first Contract Year. The Performance Blend is available only with a six-year Segment Term Period. Six-year Segment Option are not available for renewal Two-year Segment Options are not available for renewal after the first six Contract Years. Segment Options available beyond the Withdrawal Charge Period will be limited to one-year Segment Term Periods. If you do no request a transfer or withdraw the Segment Value, Segment Options with six-year and two-year Segment Term Periods ending on or after the last day of the Withdrawal Charge Period will follow the default re-allocation rules noted in Appendix A.

If the publication of a Reference Index is discontinued or the calculation of the Index is substantially changed, we have the right to substitute an alternative index prior to the Segment End Date. If we substitute an index for an existing Index-Linked Segment Option during a Segment Term Period, we will not change the Buffer Rate, Floor Rate, Cap Rate or the Participation Rate. We will attempt to choose a new index that has a similar objective and risk profile to the existing Reference Index.

| The Insurance Company and Investment Options - The Segment Options

Principal Risks of Investing in the Contract -Discontinuation or Substitution of an Index |

| | | | | | | | | | | | | | | | | | | | |

Are There Any Restrictions on Contract Benefits? | Yes. •There are restrictions and limitations relating to benefits offered under the Contract (Death Benefit, Free Withdrawals, Required Minimum Distributions, Confinement Waiver, Terminal Illness Waiver). •Except as otherwise provided in the prospectus, the Confinement Waiver, Terminal Illness Waiver, and Guaranteed Minimum Death Benefit may not be terminated by the Company. Please see the “Confinement Waiver”, “Terminal Illness Waiver”, and “Death Benefit” sections for information about actions that can cause these benefits to terminate. •Withdrawals will reduce the Death Benefit, perhaps by more than the amount withdrawn.

| Benefits Available Under the Contract

Appendix C -State Variation Chart |

| TAXES | Location in Prospectus |

What are the Contract’s Tax Implications? | You should consult with a tax professional to determine the tax implications of an investment in, and payments received under, the Contract. Withdrawals will be subject to ordinary income tax and may be subject to tax penalties. Generally, you are not taxed until you make a Withdrawal from the Contract. There is no additional tax benefit to the investor if the Contract is purchased as a Qualified Contract. | Taxes |

| CONFLICTS OF INTEREST | Location in Prospectus

|

How are Financial Professionals Compensated? | Some financial professionals may receive compensation for selling the Contract to you, both in the form of commissions and in the form of production incentives as explained in the “Distribution” section. Financial professionals may also receive additional compensation for enhanced marketing opportunities and other services (commonly referred to as “marketing allowances”). This conflict of interest may influence the financial professional to recommend this Contract over another investment. | Other Information - Distribution |

Should I Exchange My Contract? | Some financial professionals may have a financial incentive to offer a new contract in place of the one you already own. You should only exchange your Contract if you determine, after comparing the features, fees, and risks of both contracts, that it is preferable to purchase the new contract rather than continue to own your existing Contract. | Other Information - Distribution |

4. Fee Table

The following tables describe the fees, expenses, and adjustments that you will pay when buying, owning, and surrendering or making Withdrawals from a Segment Option or from the Contract. Please refer to your Contract Schedule for information about the specific fees you will pay each year based on the options you have elected.

The first table describes fees and expenses that you will pay at the time that you buy the Contract, surrender or make Withdrawals from a Segment Option or from the Contract, or transfer Contract Value between Segment Options. Charges designed to approximate certain taxes that may be imposed on us, such as premium taxes in your state, may also apply.

| | | | | |

Transaction Expenses |

Sales Load Imposed on Purchases (as a percentage of purchase payments) | None |

Withdrawal Charge (as a percentage of the amount withdrawn)1,2 | 8% |

Transfer Fee | None |

1The Withdrawal Charge percentage is deducted upon a withdrawal of amounts in excess of the 10% Free Withdrawal amount. For a complete description of charges, please see Charges and Adjustments – Withdrawal Charges in the prospectus and Appendix C- State Variation Chart.

2The amount of the Withdrawal Charge decreases over time, measured from the date the Purchase Payment is credited to the Contract. The Withdrawal Charge percentages are shown below.

| | | | | | | | | | | | | | | | | | | | | | | |

Contract Years Since Purchase Payment | 1 | 2 | 3 | 4 | 5 | 6 | 7+ |

Withdrawal Charge (%) | 8% | 8% | 7% | 6% | 5% | 4% | 0% |

The next table describes the adjustments, in addition to any transaction fees, that apply if all or a portion of the Contract Value is removed from a Segment Option or from the Contract before the expiration of a specified period.

| | | | | |

Adjustments |

Maximum Potential Loss Due to Equity Adjustment (as a percentage of Contract Value on the Segment Start Date)1 | 100% |

Maximum Potential Loss Due to Interest Adjustment (as a percentage of Contract Value withdrawn from an Index-Linked Segment Option)2 | 100% |

1Contract transactions subject to an Equity Adjustment are a partial Withdrawal, a Required Minimum Distribution, a surrender of your Contract, payment of a Death Benefit, a Performance Lock, or the application of Interim Value to a Settlement Option from an Index-Linked Segment Option on any date before the Segment Term End Date. See Charges and Adjustments – Interest Adjustment and Equity Adjustment for more information.

2Withdrawals from your contract (including both partial Withdrawals and a surrender of your contract) during the first six years will be subject to an Interest Adjustment. The Fixed Segment Option is subject to Standard Nonforfeiture Law for Individual Deferred Annuities, and a negative Interest Adjustment will not cause the amount

payable upon Withdrawal from the Fixed Segment Option to be less than the minimum nonforfeiture amount required by the laws of the state in which it was issued. See Charges and Adjustments – Interest Adjustment and Equity Adjustment for more information.

The next table describes the fees that you will pay each year during the time that you own the Contract.

| | | | | |

Annual Contract Expenses |

Administrative Expenses | None |

Base Contract Expenses (as a percentage of average account value or Contract Value)1 | 0.95 | % |

Optional Benefit Expenses (as a percentage of benefit base or other (e.g., average account value) | None |

1Base Contract Expenses consist of the Segment Fees. Segment Fee is calculated as a percentage of the Segment Fee Base for each Segment Option.

In addition to the fees described above, we may limit the amount you can earn on the Index-Linked Segment Options. This means your Segment Credits may be lower than the positive Index Change. In return for accepting this limit on index gains, you will receive some protection from index losses.

5. General Description of Contracts

Owner, Joint Owners

Owner means the person entitled to the ownership rights under the Contract, as named in the application. The Owner names the Annuitant or Joint Annuitant. If Joint Owners are named, as permitted for Non-Qualified Contracts only, all references to Owner shall mean Joint Owners. Joint Owners must be one another’s Spouse as of the Contract Date and must both be natural persons. All rights described in your Contract may be exercised by you, subject to the rights of any assignee on record with us and any irrevocably named Beneficiary. You may request to change an Owner by Notifying us. We will not be bound by an assignment until we acknowledge it. If your Contract is assigned, the assignment will take effect as of the date you signed the Notice, unless you specify otherwise, subject to any payments made or actions taken by us prior to receipt of this Notice. We have no liability under any assignment for our actions or omissions done in good faith. We shall not be liable for any tax consequences you may incur due to a change of Owner designation.

Annuitant, Joint Annuitants

The Annuitant is the natural person named on the Contract Schedule. The Annuitant is the person whose life determines the Annuity Payments made under your Contract. We will allow you to name two natural persons on the application to serve as Joint Annuitants. If there is a Joint Annuitant, the Joint Annuitant must be the Annuitant’s spouse.

Beneficiary

The following rules apply unless otherwise permitted by us in accordance with applicable law:

•No Beneficiary has any rights in your Contract until the Beneficiary is entitled to the Death Benefit. If the Beneficiary, including an irrevocable Beneficiary, dies before that time, all rights of that Beneficiary will end at their death.

•If no Beneficiary has been named or if no Beneficiary is alive at the time of death of the Owner or Annuitant whose death caused the Death Benefit to be payable, then the Beneficiary is the estate of the deceased Owner or Annuitant whose death caused the Death Benefit to be payable. If the death of both Joint Annuitants or Joint Owners, as applicable, occurs simultaneously, the estates of both will be the Beneficiary in equal shares. This paragraph does not apply if there is a named Beneficiary and such Beneficiary is an entity.

•If you have not designated how the Death Benefit is to be distributed and two or more Beneficiaries are entitled to the Death Benefit, the surviving Beneficiaries and any Beneficiaries that are entities will

share the Death Benefit equally.

•Unless you Notify us otherwise, if you have designated how the Death Benefit is to be distributed and a Beneficiary dies prior to the time such Beneficiary is entitled to the Death Benefit, the portion of the Death Benefit designated to the deceased Beneficiary will be divided among the surviving Beneficiaries and Beneficiaries that are entities on a pro rata basis. In other words, each surviving Beneficiary’s or each entity Beneficiary’s interest in the Death Benefit will be divided by the sum of the interests of all such surviving or entity Beneficiaries to determine the percentage each Beneficiary will receive of the deceased Beneficiary’s original interest in the Death Benefit.

Change of Annuitant

Prior to the Annuity Date, you may change the Annuitant by Notifying us. A change will take effect as of the date you signed the Notice. The Annuitant may not be changed in a Contract which is owned by a non-natural person, unless the Contract is being continued by a surviving spouse as sole Beneficiary.

The Annuitant cannot be changed on or after the Annuity Date.

Change of Beneficiary

Prior to the date the Death Benefit becomes payable, you may change a Beneficiary by Notifying us. You may name one or more contingent Beneficiaries. The interest of any named irrevocable Beneficiary cannot be changed without the written consent of that Beneficiary. A change will take effect as of the date you signed the Notice. Any change is subject to payment or other action taken by us before the Notice was received by us.

State Specific Contract Considerations

The Contract and its Endorsements will be issued in accordance with the laws of the state in which it was issued. Contracts issued in your state may provide different features and benefits from, and impose different costs than, those described in this prospectus because of state law variations. State specific legal requirements, among other things, may impact the following features:

•Right to Cancel Period;

•Issue Age Limitations;

•Withdrawal Charge Schedule;

•Annuity Date Provisions;

•Terminal Illness and Confinement Waivers; and

•Availability of Certain Features.

This prospectus describes the material rights and obligations of an Owner. It also sets forth the maximum fees and charges for all Contract features and benefits. See the “Charges and Adjustments” section for additional information. Material state variations are disclosed in the attached “Appendix C - State Variation Chart”. You should read and retain your Contract, amendments, and/or endorsements along with a copy of this prospectus.

The Separate Account

The Separate Account, in which we hold reserves for obligations we provide under the Contract, is established under Iowa law. The portion of the assets of the Separate Account equal to the reserves and other Contract liabilities with respect to the Separate Account will not be chargeable with liabilities arising out of any other business we conduct. Owners do not participate in the performance of assets held in the Separate Account and do not have any claim on such assets. The Separate Account is not registered under the Investment Company Act of 1940.

We own the assets of the Separate Account, as well as any favorable investment performance on those

assets. We are obligated to pay all money we owe under the Contract. If the obligation exceeds the assets of the Separate Account, funds will be transferred to the Separate Account from our General Account. We may, as permitted by applicable State law, transfer all assets allocated to the Separate Account to our General Account. We guarantee all benefits relating to your value in the Contract, regardless of whether assets supporting it are held in the Separate Account or our General Account. An Owner should look to the financial strength of the Company for its claims-paying ability to pay amounts owed under the contract. Our current plans are to invest assets held in the Separate Account in debt securities, including corporate bonds, mortgage-backed and asset-backed securities, and government and agency issues and derivative instruments. We may also invest in interest rate swaps. We, however, are not obligated to invest the assets according to any particular plan, except as we may be required to by applicable State insurance laws.

The General Account

The General Account holds all our assets other than assets in our Separate Accounts. The General Account assets support the guarantees under the Contract as well as our other general obligations. The General Account is not registered under the Investment Company Act of 1940. The guarantees in your Contract are subject to the Company’s financial strength and claims-paying ability. The General Account is subject to the regulation and supervision by the Iowa Insurance Department and to the insurance laws and regulations of all jurisdictions where we are authorized to do business.

Assets in the General Account are not segregated for the exclusive benefit of any particular Contract or obligation. General Account assets are also available to the insurer’s general creditors and the conduct of its routine business activities, such as the payment of salaries, rent and other ordinary business expenses. For more information about the Company’s financial strength, you may review its financial statements and/or check its current rating with one or more of the independent sources that rate insurance companies for their financial strength and stability. Such ratings are subject to change and have no bearing on the performance of the Segment Options to which you may allocate your Contract Value.

Amendments to the Contract

The Contract may be amended to conform to changes in applicable law or interpretations of applicable law. Changes in the Contract may need to be approved by the state insurance departments. The consent of the Owner to an amendment will be obtained to the extent required by applicable law.

Misstatement of Age or Gender

If the age of an Owner or Annuitant has been misstated and, as of your Contract Date, their correct age exceeded the maximum issue age permitted by the Company, we will refund the Purchase Payment paid less any prior Withdrawals or distributions and we will void your Contract. The maximum age for the Contract is 84.

If the age or gender of an Annuitant has been misstated (but the age as of the Contract Date did not exceed

the maximum issue age noted above), the amount we will pay will be that which the Purchase Payment paid would have purchased if the correct age and gender had been stated. Age will be calculated as the age at the last birthday of that Annuitant. Any underpayments made by us will be immediately paid in one sum with interest compounded at the rate of 1.00% per year. Any overpayments made by us will be charged against the next succeeding Annuity Payment or payments with interest compounded at the rate of 1.00% per year.

6. Purchases and Contract Value

You are required to purchase the Contract through a registered representative of a broker-dealer that has a selling agreement with our principal underwriter, Athene Securities. Athene Securities is a wholly owned subsidiary of Athene Holding Ltd. (Athene). The Contract may not be available through all selling broker-dealers. Some selling broker-dealers may not offer and/or limit the offering of certain features or options as well as limit the availability of Contracts, based on issue age or other criteria established by the selling broker-dealer.

The Contract is a Single Purchase Payment Index-Linked Deferred Annuity. The Contract may be

individually or jointly owned. The Contract issued in your state may provide different features and benefits from, and impose different costs than, those described in this prospectus because of state law variations. These differences may include rights to cancel, issue age limitations, and the general availability of certain features. This prospectus describes the material rights and obligations of an Owner. It also sets forth the maximum fees and charges for all Contract features and benefits. All material state variations to the Contract, as well as state variations to the Right to Cancel, are disclosed in the attached “Appendix C - State Variation Chart”. You should read and retain your Contract, amendments, and or/endorsements along with a copy of this Prospectus.

The Contract has two periods: an Accumulation Phase and an Annuity Phase. During the Accumulation Phase, the Contract Value accrues Segment Credits on a tax-deferred basis based on the Segment Options that you select. If you select Index-Linked Segment Options, the Segment Credits may be positive or negative based on the performance of the Reference Index. The Contract Value may also grow on a tax-deferred basis based on a declared Annual Interest Rate associated with the Fixed Segment Option. You will be taxed on Contract gains when you make a Withdrawal or receive an Annuity Payment. An Interest Adjustment will apply if you take a Withdrawal at any time during the first six Contract Years, including on a Segment End Date. An Equity Adjustment will apply if you take a Withdrawal from an Index-Linked Segment Option on any date other than a Segment End Date. Contract Withdrawals taken during the first six years of the Contract are subject to a Withdrawal Charge of up to 8%.

The Annuity Phase commences when you or a designated payee begin receiving Annuity Payments under the Contract. At the start of the Annuity Phase, you can choose a Settlement Option offered under the Contract. Annuity Payments will start on the Annuity Date and continue based on the Settlement Option you elect. The Contract offers Annuity Payments based on the life of the Annuitant or Joint Annuitant or on any other basis acceptable to the Company. The Annuity Phase ends when we make the last Annuity Payment under your selected Settlement Option.

Purchasing the Contract

The minimum issue age permitted by the Company is 0. The maximum issue age permitted by the Company is 84. These age limitations apply to Owners (if natural persons) and Annuitants.

The Purchase Payment is the amount you pay to us under your Contract. The minimum Purchase Payment without prior approval by the Company is $10,000. The Purchase Payment cannot exceed $1,000,000 without prior approval by the Company. We do not accept additional Purchase Payments.

Once we receive your Purchase Payment and all necessary information in Good Order at our Administrative Office, we issue the Contract and allocate your payment to the Holding Account. A request is in Good Order if it contains all the information we require to process the request. If you do not give us all the information we need, we will contact you or your Financial Professional.

If you have questions about the information we require, or whether you can submit certain information by fax, email, or over the web, please contact our Administrative Office.

We do not begin processing your application or Purchase Payment until we receive it at our Administrative Office. A Purchase Payment is “received” when it arrives at our Administrative Office at the address listed in the Glossary regardless of how or when you submitted the payment. If we receive a Purchase Payment at the wrong address, we will send it to the address listed in the Glossary, which may delay processing.

We are not liable for applications that we do not receive. A manually signed application sent by fax, email or over the web is considered the same as an application delivered by mail. Our electronic systems (fax, email or website) may not always be available; any electronic system can experience outages or slowdowns which may delay application processing. Although we have taken precautions to help our systems handle heavy use, we cannot promise complete reliability. If you experience problems, please submit your application by mail to our

Administrative Office. We reserve the right to discontinue or modify our electronic application policy at any time and for any reason.

Allocation of Purchase Payment

You may allocate your Purchase Payment to any available Segment Option based on the Segment Allocation Percentages you select. Your Segment Allocation Percentages must be whole percentages ranging from 0% to 100%, and the sum of the Segment Allocation Percentages must equal 100% at all times. You must submit your Segment Allocation Percentages on the Segment Allocation Form with your application, which will establish your Segment Allocation Percentages on the Contract Date. After the Contract Date, you may change your Segment Allocation Percentages by transferring all or part of your Segment Value to another Segment Option on any Segment End Date. Please see the “Transfers Between Segment Options by Request” section for details on how to transfer among available Segment Options after the initial Segment Term Period.

On the Contract Date, the Purchase Payment will be placed in the Holding Account where it will earn daily interest at a rate equal to the daily Holding Account Fixed Interest Rate. The Purchase Payment will be held in the Holding Account and accrue interest from the Contract Date to the day before the Segment Start Date. Contracts which have been issued through the end of the Business Day prior to a scheduled Segment Start Date will participate in that Segment Start Date. Contracts which have been issued on or after a scheduled Segment Start Date will participate in the following Segment Start Date. Please see the “Setting Your Segment Start Date and Segment End Date” section for details on how Segment Start Dates are determined. On the Segment Start Date, your Contract Value in the Holding Account will be transferred to the Segment Options based on the Segment Allocation Percentages you select.

Example 1

The Contract is issued (in Good Order) when funds equal to $100,000 are received on the 2nd of the month. The next available Segment Start Date is on the 8th of that month. The funds will be immediately allocated to the Holding Account and accumulate at a Holding Account Fixed Interest Rate of 2%. $100,000 accumulated with six days of interest (from the 2nd through the 7th) equates to $100,032.56 = $100,000 x (1 + 2%)^(6/365). On the 8th of the month, $100,032.56 will be allocated to the Segment Options in accordance with the Segment Allocation Percentages specified in the Segment Allocation Form. The table below shows an example allocation.

| | | | | | | | | | | | | | | | | |

Segment

Option Method | Floor or Buffer Rate | Segment Term Period | Index | Allocation % | Value on Segment Start Date |

| Fixed | - | - | - | 10% | $10,003.26 |

| Floor | 10% | 1-Year | S&P 500® | 20% | $20,006.51 |

| Buffer | 10% | 1-Year | Russell 2000® | 20% | $20,006.51 |

| Buffer | 10% | 2-Year | S&P 500® | 40% | $40,013.02 |

| Buffer | 20% | 6-Year | S&P 500® | 10% | $10,003.26 |

| Total | 100% | $100,032.56 |

Right to Cancel

You will have 20 days to review your Contract after you receive it (the “Right to Cancel Period”). State variations may apply and may require that you have more than 20 days to review the Contract (See the “State Specific Contract Considerations” section for more information).

If you exercise your right to cancel, the Contract will terminate and we will refund your Purchase Payment less any Withdrawals, unless applicable state or federal law requires otherwise. No Withdrawal Charge, Interest Adjustment, or Equity Adjustment will apply, and Segment Fees will not be deducted, if you exercise your right to cancel your Contract during this period. Surrendering the Contract during the Right to Cancel Period could have tax consequences. Please consult with your Financial Professional and/or tax advisor for more information.

Setting Your Segment Start Date and Segment End Date

There are two dates each month when a new Segment Term Period may start. Your initial Segment Term Period will start on the 8th or 22nd day of the month, at which time your Purchase Payment plus any Holding Account interest will be allocated to the Segment Option(s) you have selected. Contracts which have been issued through the end of the Business Day prior to a scheduled Segment Start Date will participate in that Segment Start Date. Contracts which have been issued on or after a scheduled Segment Start Date will participate in the following Segment Start Date.

If the intended date for the initial Segment Start Date is not a Business Day, the Index Price from the prior Business Day will be used. If the date for the Segment End Date is not a Business Day, the Index Price from the prior Business Day will be used. The Segment End Date for maturing Segments will coincide with the next Segment Start Date. Below are some examples showing the effect holidays and weekends have on selecting the Index Prices for the Segment Start Date and Segment End Date.

| | | | | | | | |

If Segment End Date is

scheduled on a holiday: | Segment End Date Index

Price will be from: | Next Segment Start Date

Index Price will be from: |

Wednesday the 8th | Tuesday, the 7th | Tuesday, the 7th |

If Segment End Date is

scheduled on a weekend: | Segment End Date Index

Price will be from: | Next Segment Start Date

Index Price will be from: |

Saturday the 22nd | Friday, the 21st | Friday, the 21st |

| | |

If initial Segment Start Date

is scheduled on a holiday: | Initial Segment Start Date Index Price will be from: | |

Friday the 22nd | Thursday, the 21st | |

If initial Segment Start Date

is scheduled on a weekend: | Initial Segment Start Date Index Price will be from: | |

Sunday, the 8th | Friday, the 6th | |

Contract Values

Withdrawals from Contract Value will be subject to an Interim Value calculation and the deduction of any applicable Withdrawal Charge. The proceeds you receive from the Withdrawal in the form of a partial Withdrawal, a surrender of the Contract, or the payment of the Death Benefit will be calculated by applying the Interim Value calculation to the Contract Value, as described below, and deducting any applicable Withdrawal Charge from the Interim Value.

We will calculate your Interim Value at the end of each Business Day and will publish the value on our customer portal (www.athene.com/MyAthene-login) on the following Business Day. We reserve the right to not publish the Interim Value for any reason we choose. You may determine the Interim Value as of the previous Business Day by calling our Administrative Office. The Interim Value is equal to the sum of the Segment Interim Values.

The Contract Value at any time is equal to the sum of the Segment Values.

Segment Value

The Segment Value for any Segment Option on the initial Segment Start Date is the amount of the Purchase Payment and Holding Account interest allocated to the Segment Option. On any other day, your Segment Value for a Segment Option is equal to A - B + C + D - E - F, where:

A is the Segment Value as of the previous day;

B is the Segment Fee amount deducted from the Segment Option on this date;

C is the amount of any Segment Credit applied to the Segment Option on this date;

D is any amount transferred from your Contract’s other Segment Options to this Segment Option on this date;

E is any amount transferred from this Segment Option to your Contract’s other Segment Options on this date; and

F is any Withdrawals deducted from the Segment Option on this date.

Index-Linked Segment Option Segment Credits will be applied only on a Segment End Date. Transfers to and from a Segment Option will occur only on a Segment End Date.

Segment Credits applied to your Segment Value and any transfer requests will be reflected on your next account statement. You may determine the amount of any Segment Credit that has accrued to the Fixed Segment Option by calling our Administrative Office. Unless you have requested transfers, exercised a Performance Lock, or taken a Withdrawal, your Segment Value at the beginning of the new Segment Term Period will equal your Segment Value as of the Segment End Date after the application of the Segment Credit and Segment Fees.

7. The Insurance Company and Investment Options

The Insurance Company

Athene Annuity and Life Company is a life insurance company organized under the laws of Iowa. The statutory home office of the Company is 7700 Mills Civic Parkway, West Des Moines, Iowa 50266. The telephone number of the Company is (888) 266-8489.

The Segment Options