Please wait

0001047862DEF 14AFALSEiso4217:USDiso4217:USDxbrli:shares00010478622024-01-012024-12-310001047862ed:CawleyMember2024-01-012024-12-310001047862ed:CawleyMember2023-01-012023-12-3100010478622023-01-012023-12-310001047862ed:CawleyMember2022-01-012022-12-3100010478622022-01-012022-12-310001047862ed:CawleyMember2021-01-012021-12-3100010478622021-01-012021-12-310001047862ed:CawleyMember2020-01-012020-12-310001047862ed:McAvoyMember2020-01-012020-12-3100010478622020-01-012020-12-310001047862ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMembered:CawleyMember2024-01-012024-12-310001047862ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMembered:CawleyMember2023-01-012023-12-310001047862ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMembered:CawleyMember2022-01-012022-12-310001047862ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMembered:CawleyMember2021-01-012021-12-310001047862ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMembered:CawleyMember2020-01-012020-12-310001047862ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembered:CawleyMember2024-01-012024-12-310001047862ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembered:CawleyMember2023-01-012023-12-310001047862ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembered:CawleyMember2022-01-012022-12-310001047862ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembered:CawleyMember2021-01-012021-12-310001047862ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembered:CawleyMember2020-01-012020-12-310001047862ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMembered:CawleyMember2024-01-012024-12-310001047862ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMembered:CawleyMember2023-01-012023-12-310001047862ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMembered:CawleyMember2022-01-012022-12-310001047862ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMembered:CawleyMember2021-01-012021-12-310001047862ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMembered:CawleyMember2020-01-012020-12-310001047862ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembered:CawleyMember2024-01-012024-12-310001047862ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembered:CawleyMember2023-01-012023-12-310001047862ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembered:CawleyMember2022-01-012022-12-310001047862ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembered:CawleyMember2021-01-012021-12-310001047862ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembered:CawleyMember2020-01-012020-12-310001047862ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMembered:CawleyMember2024-01-012024-12-310001047862ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMembered:CawleyMember2023-01-012023-12-310001047862ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMembered:CawleyMember2022-01-012022-12-310001047862ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMembered:CawleyMember2021-01-012021-12-310001047862ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMembered:CawleyMember2020-01-012020-12-310001047862ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembered:CawleyMember2024-01-012024-12-310001047862ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembered:CawleyMember2023-01-012023-12-310001047862ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembered:CawleyMember2022-01-012022-12-310001047862ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembered:CawleyMember2021-01-012021-12-310001047862ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembered:CawleyMember2020-01-012020-12-310001047862ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembered:CawleyMember2024-01-012024-12-310001047862ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembered:CawleyMember2023-01-012023-12-310001047862ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembered:CawleyMember2022-01-012022-12-310001047862ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembered:CawleyMember2021-01-012021-12-310001047862ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembered:CawleyMember2020-01-012020-12-310001047862ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembered:CawleyMember2024-01-012024-12-310001047862ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembered:CawleyMember2023-01-012023-12-310001047862ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembered:CawleyMember2022-01-012022-12-310001047862ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembered:CawleyMember2021-01-012021-12-310001047862ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembered:CawleyMember2020-01-012020-12-310001047862ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMembered:McAvoyMember2020-01-012020-12-310001047862ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembered:McAvoyMember2020-01-012020-12-310001047862ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMembered:McAvoyMember2020-01-012020-12-310001047862ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembered:McAvoyMember2020-01-012020-12-310001047862ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMembered:McAvoyMember2020-01-012020-12-310001047862ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembered:McAvoyMember2020-01-012020-12-310001047862ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembered:McAvoyMember2020-01-012020-12-310001047862ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembered:McAvoyMember2020-01-012020-12-310001047862ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001047862ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001047862ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001047862ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001047862ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001047862ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001047862ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001047862ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001047862ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001047862ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001047862ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2024-01-012024-12-310001047862ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2023-01-012023-12-310001047862ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2022-01-012022-12-310001047862ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2021-01-012021-12-310001047862ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2020-01-012020-12-310001047862ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310001047862ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310001047862ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310001047862ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310001047862ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310001047862ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001047862ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001047862ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001047862ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001047862ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001047862ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310001047862ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001047862ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310001047862ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310001047862ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310001047862ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001047862ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001047862ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001047862ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001047862ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001047862ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001047862ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001047862ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001047862ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001047862ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-31000104786222024-01-012024-12-31000104786212024-01-012024-12-31000104786232024-01-012024-12-31000104786242024-01-012024-12-31000104786252024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by Registrant ☑

Filed by Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Consolidated Edison, Inc.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rule 14a-6(i)(1) and 0-11.

| | | | | |

| Consolidated Edison, Inc. 4 Irving Place, New York, NY 10003 Dated: April 9, 2025 |

Timothy P. Cawley

Chairman of the Board

Chief Executive Officer

Dear Stockholders:

The Annual Meeting of Stockholders of Consolidated Edison, Inc. with the Board of Directors and the Company’s management is scheduled for Monday, May 19, 2025, at 10:00 a.m., Eastern Daylight Time, remotely by visiting www.virtualshareholdermeeting.com/ED2025. We encourage stockholders to log into the virtual meeting by following the instructions provided in the proxy materials. The virtual meeting offers the same participation opportunities as an in-person meeting.

The accompanying Proxy Statement, provided to stockholders on or about April 9, 2025, contains information about matters to be considered at the Annual Meeting. At the Annual Meeting, stockholders will be asked to vote on the election of Directors, to ratify the appointment of independent accountants for 2025, and to approve, on an advisory basis, named executive officer compensation. We encourage you to vote in advance of the Annual Meeting, even if you plan to attend.

Based on stockholders’ and our experiences at our recent annual stockholder meetings, held virtually, we believe our virtual meeting format offers stockholders the same opportunities to participate as an in-person meeting and allows us to provide consistent opportunities for engagement to all stockholders, regardless of their geographic location. Therefore, we plan to hold the 2025 Annual Meeting by means of remote communications only.

Sincerely,

Timothy P. Cawley

| | | | | |

| Consolidated Edison, Inc. 4 Irving Place, New York, NY 10003 Dated: April 9, 2025 |

Notice of Annual Meeting of Stockholders

| | | | | | | | | | | | | | |

| | Monday, May 19, 2025 at 10:00 a.m., Eastern Daylight Time | | Virtual Annual Meeting Website Address: www.virtualshareholdermeeting.com/ED2025 |

Please see the 16-digit voting control number that can be found on your voting instruction form, Notice of Internet Availability of proxy materials or email, as applicable, provided with your proxy materials to access the virtual Annual Meeting website.

| | | | | | | | | | | |

| Location: | | The 2025 Annual Meeting will be held by means of remote communications only. Based on stockholders’ and our experiences at our recent annual stockholder meetings, held virtually, we believe our virtual meeting format offers stockholders the same opportunities to participate as an in-person meeting and allows us to provide consistent opportunities for engagement to all stockholders regardless of their geographic location. Therefore, we plan to hold the 2025 Annual Meeting by means of remote communications only. | |

| | | | | | | | | | | |

| Items of Business: | | a.To elect as the members of the Board of Directors the ten nominees named in the Proxy Statement (attached hereto and incorporated herein by reference); b.To ratify the appointment of PricewaterhouseCoopers LLP as independent accountants for 2025; c.To approve, on an advisory basis, named executive officer compensation; and d.To transact such other business as may properly come before the meeting, or any adjournment or postponement of the meeting. | |

By Order of the Board of Directors,

Sylvia V. Dooley

Vice President and Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDERS’ MEETING TO BE HELD ON MONDAY, MAY 19, 2025. THE COMPANY’S PROXY STATEMENT AND ANNUAL REPORT, PROVIDED TO STOCKHOLDERS ON OR ABOUT APRIL 9, 2025, ARE AVAILABLE AT WWW.CONEDISON.COM/EN/INVESTORS/SHAREHOLDER-SERVICES

| | | | | | | | |

| | |

| IMPORTANT! Whether or not you plan to attend the meeting, we urge you to vote your shares of Company Common Stock by telephone, by internet, or by completing and returning a proxy card or a voter instruction form, so that your shares will be represented at the Annual Meeting. | |

| | |

Table of Contents

| | | | | | | | |

| SUMMARY |

|

| Proxy Statement Summary | |

| ▪ | 2025 Annual Meeting of Stockholders | |

| ▪ | Stockholder Voting Matters | |

| ▪ | Corporate Governance Practices | |

| ▪ | Changes to Incentive Programs for 2024 and New Equity Award Grant Policy | |

| ▪ | Compensation Policies and Governance Practices | |

| PROXY STATEMENT |

|

| Election of Directors | |

| ▪ | Proposal No. 1 Election of Directors | |

| ▪ | Information about the Director Nominees | |

| ▪ | Skills and Experience of Director Nominees | |

| The Board of Directors | |

| ▪ | Meetings and Board Members’ Attendance | |

| ▪ | Corporate Governance | |

| ▪ | Leadership Structure | |

| ▪ | Risk Oversight | |

| ▪ | Cybersecurity Risk Oversight | |

| ▪ | Corporate Sustainability | |

| ▪ | Human Capital | |

| ▪ | Proxy Access | |

| ▪ | Related Person Transactions Policy | |

| ▪ | Board Members’ Independence | |

| ▪ | Standing Committees of the Board | |

| ▪ | Selection of Director Candidates | |

| ▪ | Compensation Consultant | |

| ▪ | Communications with the Board of Directors | |

| Stockholder Engagement | |

| ▪ | Overview | |

| ▪ | Stockholder Engagement Highlights | |

| Director Compensation | |

| | | | | | | | |

| ▪ | Overview | |

| ▪ | Elements of Compensation | |

| ▪ | Stock Ownership Guidelines | |

| ▪ | Long Term Incentive Plan | |

| ▪ | Stock Purchase Plan | |

| ▪ | Director Compensation Table | |

| Stock Ownership | |

| ▪ | Stock Ownership of Directors and Executive Officers | |

| ▪ | Stock Ownership of Certain Beneficial Owners | |

| Independent Accountants Ratification | |

| ▪ | Proposal No. 2 Ratification of the Appointment of Independent Accountants | |

| ▪ | Fees Paid to PricewaterhouseCoopers LLP | |

| Audit Committee Matters | |

| ▪ | Audit Committee Report | |

| Advisory Vote | |

| ▪ | Proposal No. 3 Advisory Vote to Approve Named Executive Officer Compensation | |

| Compensation Discussion and Analysis | |

| ▪ | Table of Contents | |

| ▪ | Introduction | |

| ▪ | Executive Summary | |

| ▪ | Executive Compensation Philosophy and Objectives | |

| ▪ | Role of Compensation Committee and Others in Determining Executive Compensation | |

| ▪ | Compensation Elements | |

| ▪ | Retirement and Other Benefits | |

| ▪ | Risk Mitigation | |

| ▪ | Tax Deductibility of Pay | |

| Summary Compensation Table | |

| Grants of Plan-Based Awards Table | |

| Outstanding Equity Awards Table | |

| Option Exercises and Stock Vested Table | |

| Pension Benefits | |

| ▪ | Pension Plan Benefits | |

| ▪ | Defined Benefit Pension Table | |

| | | | | | | | |

| Non-Qualified Deferred Compensation | |

| ▪ | Deferred Income Plan | |

| ▪ | Savings Plan | |

| ▪ | Non-Qualified Deferred Compensation Table | |

| Potential Payments Upon Termination of Employment or Change in Control | |

| ▪ | Equity Acceleration | |

| ▪ | Incremental Retirement Amounts | |

| ▪ | Termination Without Cause or a Resignation for Good Reason | |

| ▪ | Payments Upon Termination of Employment in Connection with a Change in Control | |

| ▪ | Section 280G Reduction | |

| ▪ | Death Benefit | |

| Compensation Committee Report | |

| Compensation Risk Management | |

| Pay Ratio | |

| Pay Versus Performance | |

| Delinquent Section 16(a) Reports | |

| Certain Information as to Insurance and Indemnification | |

Questions and Answers About the 2025 Annual Meeting and Voting | |

| ▪ | Proxy Materials | |

| ▪ | Voting and Related Matters | |

| ▪ | Annual Meeting Information | |

Stockholder Proposals for the 2026 Annual Meeting | |

| ▪ | Proposals for Inclusion in 2026 Proxy Statement | |

| ▪ | Director Nominations for Inclusion in 2026 Proxy Statement (Proxy Access) | |

| ▪ | Other Proposals or Nominations to Come Before the 2026 Annual Meeting | |

| Other Matters to Come Before the Meeting | |

Appendix A Reconciliation of Non-GAAP Financial Measures | |

Forward-Looking Statements

This Proxy Statement contains forward-looking statements that are intended to qualify for the safe-harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Forward-looking statements are statements of future expectations and not facts. Words such as “forecasts,” “expects,” “estimates,” “anticipates,” “intends,” “believes,” “plans,” “will,” "target," "guidance," "potential," "goal," "consider" and similar expressions identify forward-looking statements. The forward-looking statements reflect information available and assumptions at the time the statements are made and speak only as of that time. Actual results or developments might differ materially from those included in the forward-looking statements because of various factors including, but not limited to, those discussed under “Risk Factors,” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

Non-GAAP Financial Measures

The materials herein include a discussion of adjusted earnings and adjusted earnings per share, which are financial measures that are not determined in accordance with generally accepted accounting principles in the United States of America (GAAP). Please refer to the table set forth in Appendix A for a reconciliation of the Company's reported net income for common stock to adjusted earnings and reported earnings per share to adjusted earnings per share.

Proxy Statement Summary

This section highlights the proposals to be acted upon, as well as information about Consolidated Edison, Inc. (the “Company”), that can be found in this Proxy Statement and does not contain all of the information that you need to consider. Before voting, please carefully review the complete Proxy Statement and the Annual Report to Stockholders of the Company provided to stockholders on or about April 9, 2025, which includes the consolidated financial statements and accompanying notes for the fiscal year ended December 31, 2024, and other information relating to the Company’s financial condition and results of operations. References to “Con Edison of New York,” “Orange & Rockland,” and “Con Edison Transmission” throughout this Proxy Statement refer to the Company’s subsidiaries, Consolidated Edison Company of New York, Inc., Orange and Rockland Utilities, Inc., and Con Edison Transmission, Inc. and its subsidiaries, respectively.

2025 Annual Meeting of Stockholders (“Annual Meeting”)

Based on stockholders’ and our experiences at our recent annual meetings, held virtually, we believe our virtual meeting format offers stockholders the same opportunity to participate as an in-person meeting and allows us to provide consistent opportunities for engagement to all stockholders, regardless of their geographic location. Therefore, we plan to hold the 2025 Annual Meeting by means of remote communications only.

| | | | | | | | | | | |

| Date and Time | | Monday, May 19, 2025, at 10:00 a.m., Eastern Daylight Time |

| Virtual Annual Meeting Website Address | | www.virtualshareholdermeeting.com/ED2025 |

| Please use the 16-digit voting control number that can be found on your voting instruction form, Notice of Internet Availability of proxy materials or email, as applicable, provided with your proxy materials to access the virtual Annual Meeting website. |

| Record Date & Voting | | Stockholders of record at the close of business on March 24, 2025 are entitled to vote at the Annual Meeting. On March 24, 2025, 360,200,271 shares of Common Stock were outstanding. Each outstanding share of Common Stock is entitled to one vote. |

| Admission | | Please follow the instructions contained in “Who Can Attend the Annual Meeting?” on page 97. |

| Proxy Website | | www.conedison.com/en/investors/shareholder-services |

| | | | | |

| Consolidated Edison, Inc. Proxy Statement 1 |

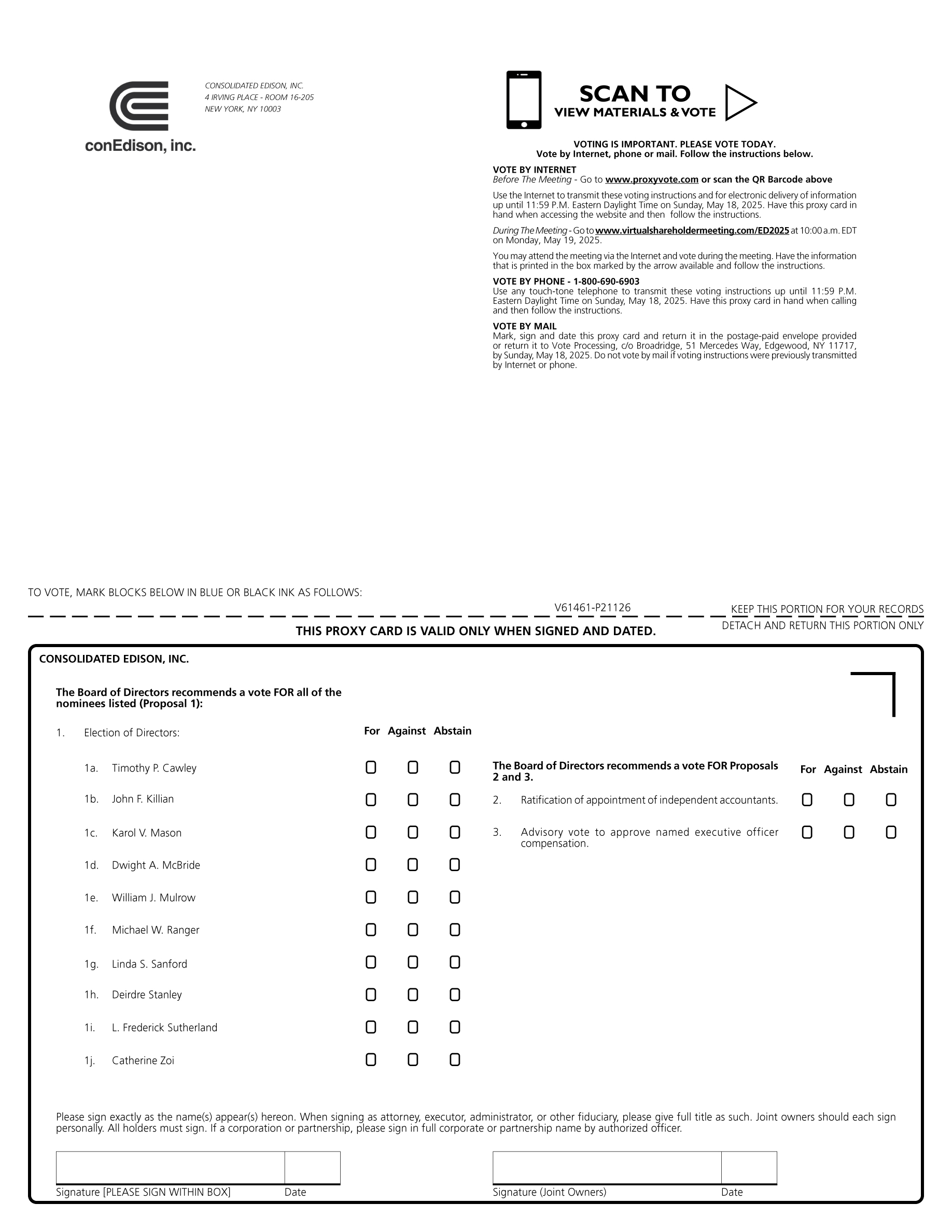

Stockholder Voting Matters

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Management Proposals | Board’s Voting

Recommendation | | Vote Required

For Approval(1) | | Broker

Discretionary

Voting Allowed | | Page References

(for more detail) | |

| | | | | | | | | |

| Proposal No. 1 | Election of Directors | For Each

Nominee | | Majority of

Votes Cast | | No | | 8 | |

| Proposal No. 2 | Ratification of the Appointment of Independent Accountants | For | | Majority of

Votes Cast | | Yes | | 39 | |

| Proposal No. 3 | Advisory Vote to Approve Named Executive Officer Compensation | For | | Majority of

Votes Cast | | No | | 41 | |

Footnote:

(1)The presence at the Annual Meeting, either by means of remote communication or by proxy, of holders of a majority of the outstanding shares of Company Common Stock is required to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes (shares held by a broker or nominee that does not have discretionary authority to vote on a particular matter and has not received voting instructions from its clients) are counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting but are not considered votes cast with respect to any of the Proposals, and have no effect on the vote, provided that a broker or nominee may vote in its discretion only on the Ratification of the Appointment of Independent Accountants (Proposal No. 2).

Director Nominees

| | | | | | | | | | | | | | |

| Timothy P. Cawley |

| | | | |

| Age: 60 Director Since: 2020 Not Independent Chairman of the Board

| Primary Occupation / Career Highlights Chairman, President and Chief Executive Officer of the Company; Chairman and Chief Executive Officer of Con Edison of New York; former President of Con Edison of New York | Committee Membership •Executive (Chair) | Other U.S.-Listed Public Company Boards — |

| John F. Killian |

| | | | |

| Age: 70 Director Since: 2007 Independent | Primary Occupation / Career Highlights Former Executive Vice President and Chief Financial Officer, Verizon Communications Inc. | Committee Membership •Audit (Chair) •Corporate Governance and Nominating •Executive •Management Development and Compensation | Other U.S.-Listed Public Company Boards 1 |

| Karol V. Mason |

| | | | |

| Age: 67 Director Since: 2021 Independent | Primary Occupation / Career Highlights President, John Jay College of Criminal Justice | Committee Membership •Corporate Governance and Nominating •Safety, Environment, Operations and Sustainability | Other U.S.-Listed Public Company Boards — |

| | | | | |

2 Consolidated Edison, Inc. Proxy Statement | |

| | | | | | | | | | | | | | |

| Dwight A. McBride |

| | | | |

| Age: 57

Director Since: 2021

Independent | Primary Occupation / Career Highlights Gerald Early Distinguished Professor and Senior Advisor to the Chancellor, Washington University in St. Louis | Committee Membership •Management Development and Compensation •Safety, Environment, Operations and Sustainability | Other U.S.-Listed Public Company Boards — |

| William J. Mulrow |

| | | | |

| Age: 69 Director Since: 2017 Independent | Primary Occupation / Career Highlights Senior Advisory Director, Blackstone | Committee Membership •Finance •Management Development and Compensation •Safety, Environment, Operations and Sustainability | Other U.S.-Listed Public Company Boards 2 |

| Michael W. Ranger |

| | | | |

| Age: 67 Director Since: 2008 Independent Lead Director | Primary Occupation / Career Highlights Senior Managing Director, Diamond Castle Holdings LLC | Committee Membership •Audit •Corporate Governance and Nominating (Chair and Lead Director) •Executive •Finance •Management Development and Compensation | Other U.S.-Listed Public Company Boards — |

| Linda S. Sanford |

| | | | |

| Age: 72 Director Since: 2015 Independent | Primary Occupation / Career Highlights Former Senior Vice President, Enterprise Transformation, International Business Machines Corporation | Committee Membership •Audit •Corporate Governance and Nominating •Finance | Other U.S.-Listed Public Company Boards 1 |

| Deirdre Stanley |

| | | | |

| Age: 60 Director Since: 2017 Independent | Primary Occupation / Career Highlights Former Executive Vice President and General Counsel, The Estée Lauder Companies, Inc. | Committee Membership •Corporate Governance and Nominating •Management Development and Compensation (Chair) | Other U.S.-Listed Public Company Boards — |

| | | | | |

| Consolidated Edison, Inc. Proxy Statement 3 |

| | | | | | | | | | | | | | |

| L. Frederick Sutherland |

| | | | |

| Age: 73 Director Since: 2006 Independent | Primary Occupation / Career Highlights Former Executive Vice President and Chief Financial Officer, Aramark Corporation | Committee Membership •Audit •Finance (Chair) •Management Development and Compensation | Other U.S.-Listed Public Company Boards 1 |

| Catherine Zoi |

| | | | |

| Age: 63 Director Since: 2024 Independent | Primary Occupation / Career Highlights Former Chief Executive Officer, EVgo Inc. | Committee Membership •Finance •Safety, Environment, Operations and Sustainability | Other U.S.-Listed Public Company Boards — |

•Proposal No. 1: Election of Directors. The Board of Directors has nominated ten Directors for election at the Annual Meeting and recommends the election of each of the ten nominees. The table above provides certain information about the Director nominees.

•Proposal No. 2: Ratification of the Appointment of Independent Accountants. The Board recommends ratification of the appointment of PricewaterhouseCoopers LLP as independent accountants for 2025.

•Proposal No. 3: Advisory Vote to Approve Named Executive Officer Compensation. The Board recommends the approval of, on an advisory basis, the compensation of the Named Executive Officers.

Corporate Governance Practices

•Active, Year-Round, Stockholder Engagement. The Company engages with stockholders and accepts invitations to discuss matters of interest to them. Throughout 2024, the Company met with stockholders in a variety of formats including in-person and virtual formats, and discussed numerous topics, including Orange & Rockland’s regulatory proceeding for new rates, transmission opportunities, system reliability, the utilities' gas system long-term plans, New York State's clean energy goals and the Company's role in helping to achieve those goals, capital investment outlook and political matters, environmental, social and governance (“ESG”) matters, including reporting, corporate governance, political lobbying, our utilities’ Climate Change Vulnerability Studies and Adaptation and Resiliency plans, and the Company’s pursuit of Scope 1 net-zero-carbon-emission goals through its updated Clean Energy Commitment. The Company’s stockholder engagement team reports the results of their annual activities to the Corporate Governance and Nominating Committee and the Board to convey the feedback received from stockholders and to propose implementation of appropriate responses. During 2024, the Company engaged with stockholders holding in aggregate 42% of shares outstanding.

•Risk Oversight. The Board and its committees oversee the Company’s policies and procedures for managing risks that are identified through the Company’s enterprise risk management program.

•Cybersecurity Risk Oversight. The Board and the Audit Committee oversee the Company’s cybersecurity risk management. The Company complies with regulatory cybersecurity requirements and follows closely the development of new standards, regulations, and industry initiatives. For further information on the Company's cybersecurity risk management program, please see the "Cybersecurity Risk Oversight" section of this Proxy Statement.

•Strategic Planning. The Board oversees and reviews, at least annually, the Company’s strategic and business plans and objectives.

•Corporate Sustainability. The Company is firmly committed to sustainability, which is broadly overseen by the Board. The Board reviews and discusses various sustainability topics throughout the year and routinely considers environmental matters (including climate change) and assesses their impact on the Company’s operations, strategies and risk profile.

| | | | | |

4 Consolidated Edison, Inc. Proxy Statement | |

•Insider Trading. The Company maintains an Insider Trading Policy. The policy applies to all employees (and their family and household members) including executive officers, non-employee Directors and any entity that itself is controlled by persons covered by the policy. Under the policy, the Company complies with all applicable laws, rules and regulations governing the trading of its securities including as to transactions in its own securities. The Company believes the policy is reasonably designed to prevent improper insider trading and promote compliance with insider trading laws. A copy of the Insider Trading Policy was filed as Exhibit 19.1 to the Company's Annual Report on Form 10-K for the year ended December 31, 2024.

•Human Capital. The Company is committed to attracting, developing and retaining a talented and diverse workforce. It values and supports a wide range of employee needs and interests. The Company’s skilled and experienced workforce enables it to maintain best-in-class reliability and progress towards achieving a clean energy future. Human capital measures focus on employee safety, hiring the right talent, employee development and retention, and diversity of perspectives.

•Human Rights Statement. The Company has a Human Rights Statement that reinforces the Company’s commitment to protecting and advancing the human rights of all people, to conducting business in a manner that is ethical and respectful of those rights and in compliance with applicable laws, and to protecting international human rights under recognized standards. The Human Rights Statement builds on our employee Standards of Business Conduct, our policies on Equal Employment Opportunity, Sexual Harassment, and Employment of Veterans and People with Disabilities, and our Vendor Standards of Business Conduct.

•Annual Election of Directors. Each Director nominee has been recommended for election by the Corporate Governance and Nominating Committee and approved and nominated for election by the Board. If elected, the Director nominees, all of whom are current members of the Board, will serve for a one-year term expiring at the Company’s 2026 Annual Meeting of Stockholders. Each Director will hold office until his or her successor has been elected and qualified or until the Director’s earlier resignation or removal.

•Voting. In uncontested elections, each Director nominee may be elected by a majority of the votes cast at a meeting of the Company’s stockholders by the holders of shares entitled to vote in the election. In contested elections, each Director nominee may be elected by a plurality of the votes cast. The Company does not have a super-majority voting provision in its Restated Certificate of Incorporation.

•Board Composition. The current Directors have the combination of skills, backgrounds, experiences and perspectives necessary to oversee the Company’s business. Eleven of the twelve current Directors and nine of the ten Director nominees are independent. The Board strives to maintain an appropriate balance of tenure among Directors. Of the current Directors, they have an average age of 67 years, 50% have been on the Board for six years or less, 33% have been on the Board for seven to sixteen years, and 17% have been on the Board for over sixteen years.

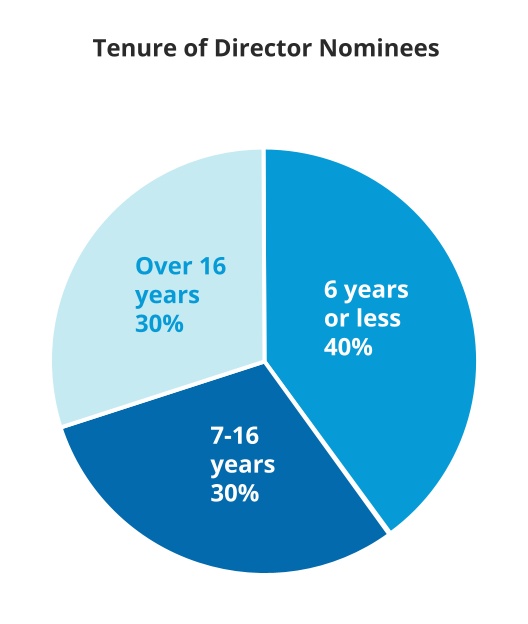

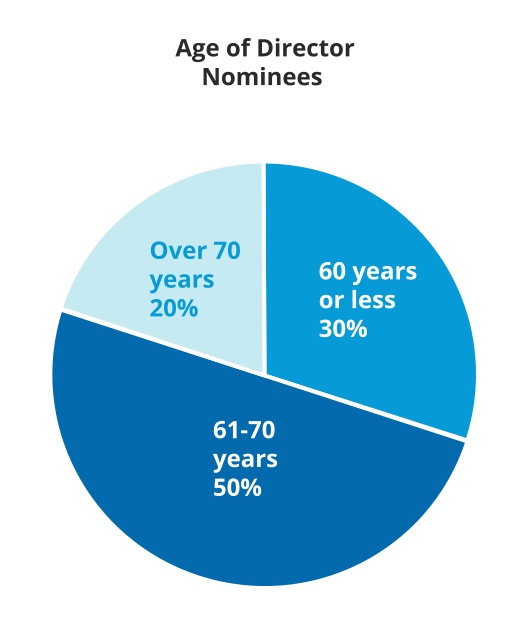

The Corporate Governance and Nominating Committee recommends candidates for election or re-election to the Board and reviews the qualifications of potential Director candidates. When recommending to the Board the slate of Director nominees for election at the Annual Meeting, the Corporate Governance and Nominating Committee strives to maintain an appropriate balance of tenure, diversity of perspectives, and skills on the Board. The Director nominees have an average age of 66 years, 40% have been on the Board for six years or less, 30% have been on the Board for seven to sixteen years, and 30% have been on the Board for over sixteen years. The Corporate Governance and Nominating Committee identifies candidates through a variety of means, including recommendations from members of the Board, suggestions from senior management, and submissions by the Company’s stockholders. When a professional search firm is used, the Corporate Governance and Nominating Committee, consistent with any applicable legal requirements, directs the firm to provide a diverse slate of candidates for the Board’s consideration, including, but not limited to, diverse candidates with respect to skills, background, age, gender, ethnicity, race, nationality, geography and sexual orientation.

•Independent Lead Director. The Board has an independent Lead Director who is the Chair of the Corporate Governance and Nominating Committee and has numerous duties and significant responsibilities, including acting as a liaison between the independent Directors and the Company’s management and chairing the executive sessions of independent Directors.

•Frequent Executive Sessions. The Company’s independent Directors meet in executive session not fewer than three times per year.

| | | | | |

| Consolidated Edison, Inc. Proxy Statement 5 |

•Annual Board and Committee Self-Assessments. The Board and each of its committees perform an annual self- assessment to evaluate the effectiveness of the Board and its committees in fulfilling their respective obligations. Each committee reports the results of its self-evaluation to the Board. The Corporate Governance and Nominating Committee coordinates the self-evaluation process and, following the self-evaluation process, discusses with the Board follow-up matters, as appropriate.

•Membership on Public Company Boards. Directors who are executive officers of a public company may serve on no more than one other public company board and none did so in 2024. All other Directors may serve on no more than three other public company boards and none did so in 2024.

•Proxy Access. The Board has adopted proxy access, which enables certain stockholders of the Company to include their own director nominees in the Company’s Proxy Statement and form of proxy, along with candidates nominated by the Board if the stockholders and the nominees proposed by the stockholders meet the requirements set forth in the Company’s By-laws.

•Special Meetings. Special meetings may be called by stockholders holding at least 25% of the Company’s outstanding shares of Common Stock who are entitled to vote at such meeting.

Changes to Incentive Programs for 2024 and New Equity Award Grant Policy

•Executive Incentive Plan Changes. The Management Development and Compensation Committee of the Board of Directors (the “MD&C Committee” or "Compensation Committee") approved the Consolidated Edison, Inc. Executive Incentive Plan, amended and restated, effective January 1, 2024, which provides for the annual incentive for the Named Executive Officers. This amended plan eliminated the detailed provisions specifying performance goals, target levels and weighting in the prior plan and replaced them with more flexible provisions by which the MD&C Committee will approve, on an annual basis, the specific performance goals, targets and incentive percentages for participants in the plan for that year. The amended plan also added other clarifying and administrative provisions to reflect market practices.

•Equity Award Grant Policy. In 2024, the Company adopted an Equity Award Grant Policy (the "Policy"). Although the Company does not currently issue stock options to its officers, employees or independent Directors (and has not since 2006), the Policy generally prohibits the granting of stock options or option-like instruments when the Company is in possession of material non-public information. It also sets forth the Company's current process for the awarding of non-option equity grants including annual grants to employees and independent Directors. In the event the Company were to change its practice and issue stock options or other option-like instruments, any such grant will generally be made when material non-public information, as described in the Company's Insider Trading Policy, has been sufficiently publicly disclosed by means of a filing with the Securities and Exchange Commission ("SEC"), a press release or other disclosure that satisfies the requirements for public disclosure of Regulation FD (Fair Disclosure) of the Exchange Act. For non-option equity awards to employees and officers, the grant will be made at the MD&C Committee's regularly-scheduled February meeting of each calendar year, unless circumstances arise where the MD&C Committee, or the Board determines it is advisable to grant the awards at another time as it may decide in its sole discretion. For non-option equity awards to independent Directors, the grant will be made on the first business day following the Annual Meeting (except for an independent Director who is appointed on a date other than the date of the annual grant, in which case the grant will be made on the date of the independent Director's first appointment). For non-option equity awards to employee and officer new hires and special grants to existing employees and officers, the grant will generally be made on the date of hire or promotion or event, as applicable, subject to the MD&C Committee's discretion.

| | | | | |

6 Consolidated Edison, Inc. Proxy Statement | |

Compensation Policies and Governance Practices

The Company’s culture promotes strong compensation and governance practices that support our pay-for-performance principles and closely align the executive compensation program with the interests of our stockholders.

| | | | | | | | | | | |

| | | |

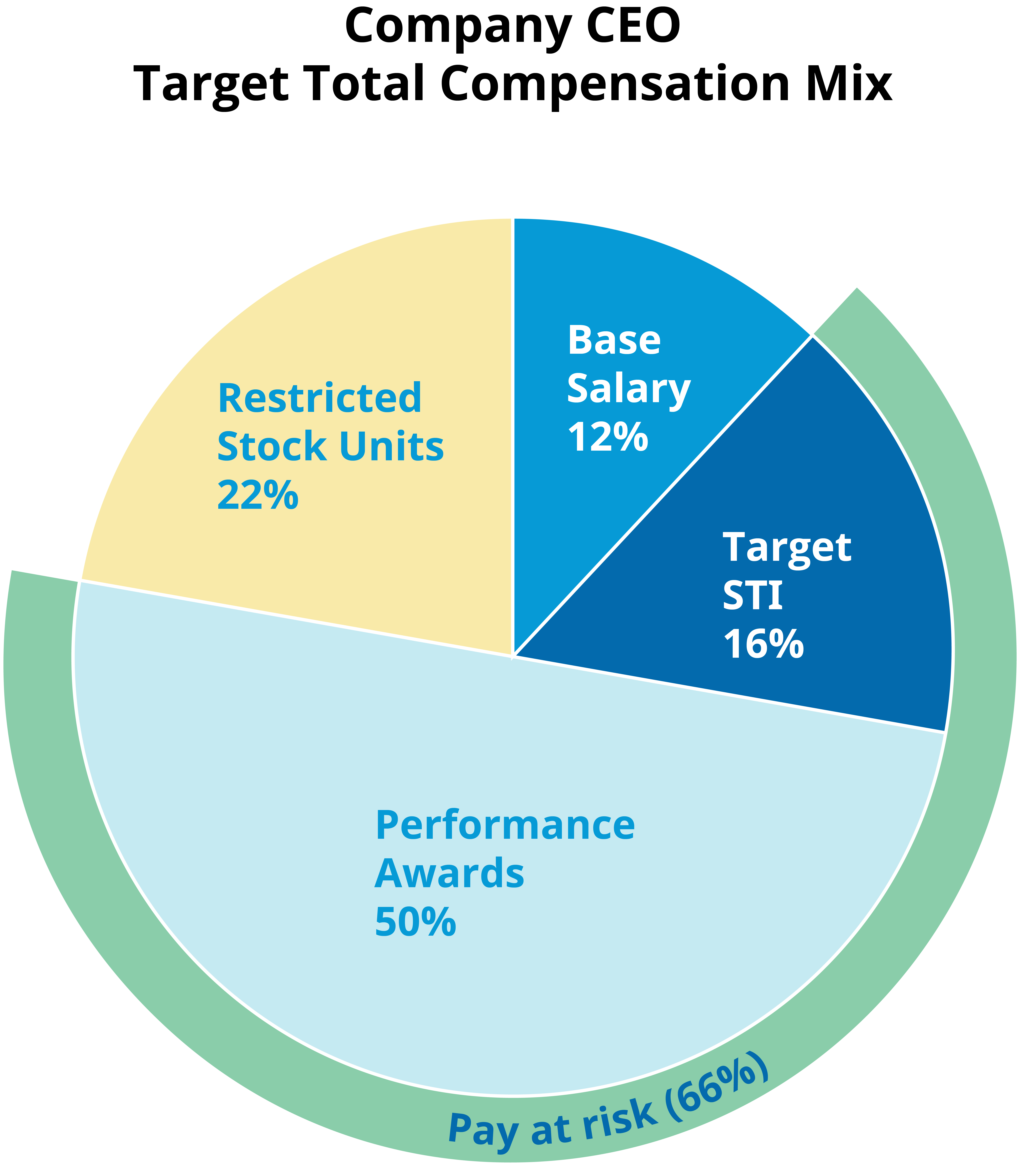

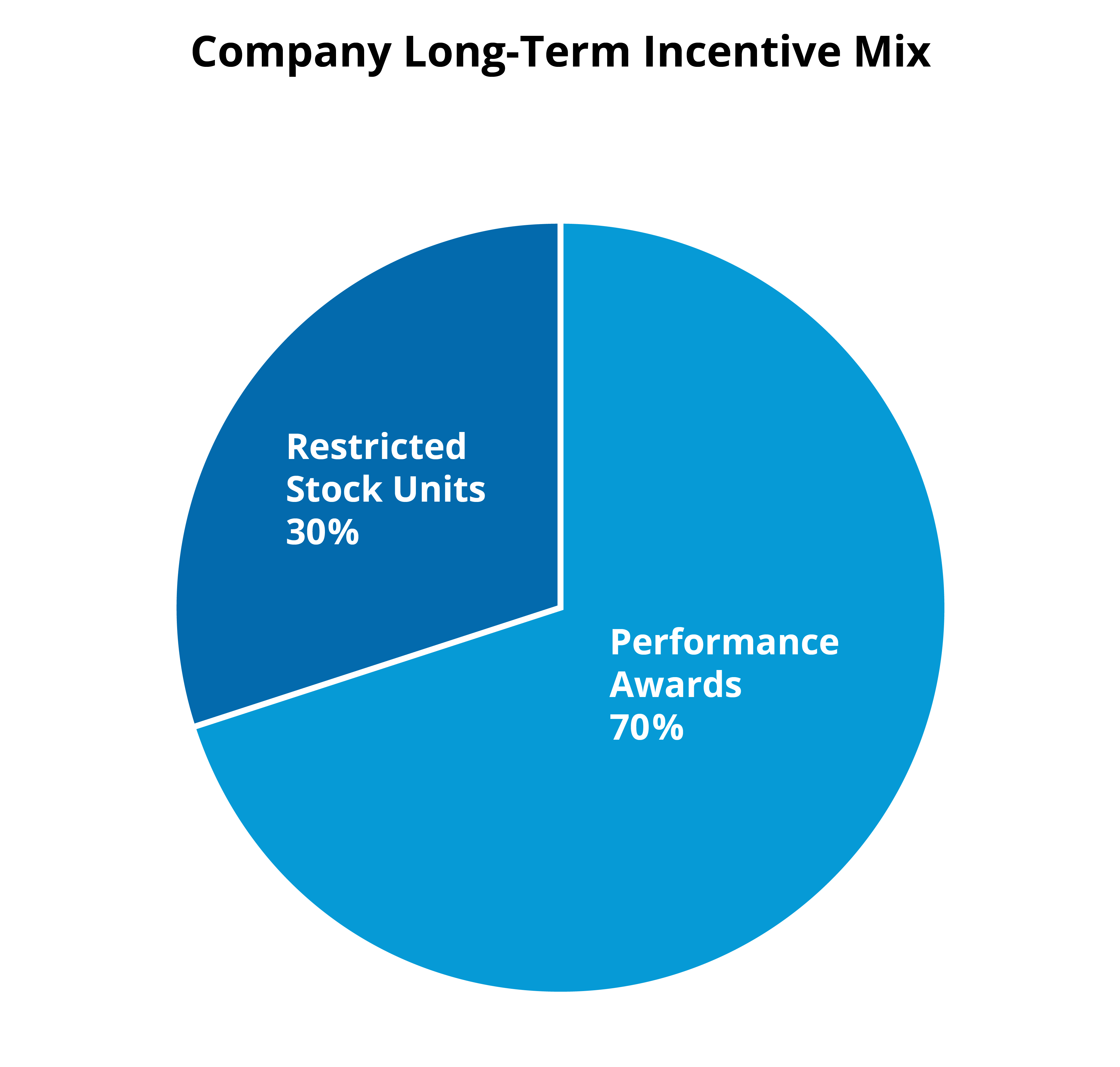

What We Do | | | Place a significant portion of the target total direct compensation for our Named Executive Officers “at risk” •70% of long-term incentive compensation was performance-based for 2024 (30% of long-term incentive compensation for 2024 was granted in the form of time-based restricted stock units) |

| | Mitigate compensation risk by: •balancing incentives between annual and long-term goals •tying incentives to multiple goals to reduce undue weight on any one goal •for annual incentive payouts, using non-financial performance factors to counterbalance financial performance goals •discouraging excessive focus on annual results and focusing on sustainable performance by providing significant long-term incentives •subjecting annual and long-term incentive plans to payment caps •giving the MD&C Committee discretion to reduce payouts •performing an annual risk assessment for annual and long-term incentive plans |

| | Maintain stock ownership guidelines for Directors and senior officers |

| | Maintain (i) a recoupment (clawback) policy to comply with the final Dodd-Frank clawback rules adopted by the SEC and the New York Stock Exchange requiring the Company to recover erroneously awarded incentive-based compensation received by current and former executive officers of the Company during the three fiscal years preceding the date the Company is required to prepare an accounting restatement due to material noncompliance with financial reporting requirements and (ii) a discretionary supplemental officer clawback policy covering all officers and other individuals designated as officers by the Company and selected subsidiaries, including former officers, allowing the MD&C Committee to recover incentive-based compensation, including all forms of bonuses and equity or equity-based awards (granted on or after January 1, 2024), in the event of a material accounting restatement for the preceding three fiscal years and for certain “cause” events occurring during the preceding one year period |

| | Maintain an environmental and sustainability performance measure in its operating objectives for short term annual incentives for the Named Executive Officers |

| | Maintain operating objective performance measures for cybersecurity, clean energy and electrification in its long-term incentive plan for the Named Executive Officers |

| | Limited perquisites for the Named Executive Officers of the Company |

| | Hold an annual say-on-pay vote (which received 93.19% stockholder support in 2024) |

| | | | | | | | | | | |

What We Don't Do | | | Enter into employment agreements (other than the arrangements as described herein for Mr. Andrews) |

| | Offer excessive executive perquisites |

| | Dilute stockholder value by issuing excessive equity compensation |

| | Grant stock options or have outstanding options |

| | Reprice options or buy out underwater options without stockholder approval |

| | Recycle shares for future awards except under limited circumstances |

| | Provide golden parachute excise tax gross-ups |

| | Offer excessive change in control severance benefits |

| | Negotiate equity awards with special treatment upon the Company’s change in control |

| | Provide single-trigger acceleration of vesting of outstanding equity awards |

| | Permit Directors, officers, financial personnel, and certain other individuals to: •short, hedge, or pledge Company securities or •hold Company securities in a margin account as collateral |

| | | | | |

| Consolidated Edison, Inc. Proxy Statement 7 |

Election of Directors

Proposal No. 1 Election of Directors

Ten Directors are to be elected at the Annual Meeting to hold office until the next annual meeting and until their respective successors are elected and qualified. Directors are not permitted to stand for election after having passed his or her 75th birthday and the Board has not granted an exemption of this policy in the last five years. Of the Board members standing for election, Timothy P. Cawley is the only Director nominee who is a current or former officer of the Company. In accordance with the Company's Corporate Governance Guidelines, Ellen V. Futter and Armando J. Olivera, who have served with distinction as Directors of the Company, are not standing for re-election because each has reached her or his 75th birthday. The Board has approved a resolution to reduce the number of Directors to ten, effectively immediately prior to the Annual Meeting.

The Corporate Governance and Nominating Committee recommends candidates for election or re-election to the Board and reviews the qualifications of possible Director candidates. When recommending to the Board the slate of Director nominees for election at the Annual Meeting, the Corporate Governance and Nominating Committee strives to maintain an appropriate balance of tenure, diversity of perspectives, and skills on the Board. The Corporate Governance and Nominating Committee also strives to ensure that the Board is composed of Directors who bring diverse viewpoints, perspectives, professional experiences and backgrounds, and effectively represent the long-term interests of stockholders. The Board and the Corporate Governance and Nominating Committee believe that striking an appropriate balance between fresh perspectives and ideas and the valuable experience and familiarity contributed by longer-serving Directors is critical to a forward-looking and strategic Board. The Corporate Governance and Nominating Committee identifies candidates through a variety of means, including professional search firms, recommendations from members of the Board, suggestions from senior management, and submissions by the Company’s stockholders. When a professional search firm is used, the Corporate Governance and Nominating Committee, consistent with any applicable legal requirements, directs the firm to provide a diverse slate of candidates for the Board’s consideration, including, but not limited to, diverse candidates with respect to skills, background, age, gender, race, ethnicity, nationality, geography and sexual orientation.

Each nominee was selected by the Corporate Governance and Nominating Committee and approved by the Board for submission to the Company’s stockholders.

The Company believes that all of the nominees will be able and willing to serve as Directors of the Company. All of the Directors also serve as Trustees of the Company’s subsidiary, Con Edison of New York.

Shares represented by every properly executed proxy will be voted at the Annual Meeting for or against the election of the Director nominees as specified by the stockholder giving the proxy. If one or more of the nominees is unable or unwilling to serve, the shares represented by the proxies will be voted for any substitute nominee or nominees as may be designated by the Board.

| | | | | | | | |

| The Board recommends FOR Proposal No. 1 Each of the ten Director nominees must receive a majority of the votes cast at the Annual Meeting or by proxy to be elected (meaning the number of shares voted “for” a Director nominee must exceed the number of shares voted “against” that Director nominee), subject to the Board’s policy regarding resignations by Directors who do not receive a majority of “for” votes. Abstentions and broker non-votes are voted neither “for” nor “against” and have no effect on the vote. | |

| | | | | |

8 Consolidated Edison, Inc. Proxy Statement | |

Election of Directors | Proposal 1

Information About the Director Nominees

The Board and the Corporate Governance and Nominating Committee consider the qualifications of Directors and Director candidates individually and in the broader context of the Board’s overall composition and the Company’s current and future needs. The Board believes, as a whole, it should possess a combination of skills, backgrounds, experiences and perspectives, necessary to oversee the Company’s business. The Board has adopted Corporate Governance Guidelines (the "Guidelines") to assist it in exercising its responsibilities to the Company and its stockholders. In evaluating Director candidates and considering incumbent Directors for renomination to the Board, the Board and the Corporate Governance and Nominating Committee consider various factors. Pursuant to the Guidelines, the Corporate Governance and Nominating Committee reviews with the Board factors relating to the composition of the Board (including its size and structure), the diversity of perspectives of the Board (including, but not limited to, diversity of skills, background, age, gender, ethnicity, race, nationality, geography and sexual orientation), and the skills and characteristics of Director nominees, including independence, integrity, judgment, business experience, areas of expertise, and availability for service to assure that the Board contains an appropriate mix of Directors to best further the Company’s long-term business interests. For incumbent Directors, the Corporate Governance and Nominating Committee also considers past performance of the Director on the Board.

The current Director nominees bring to the Company the benefit of their qualifications, leadership, skills, and the diversity of their perspectives which provide the Board, as a whole, with the skills and expertise that reflect the needs of the Company. See the following pages for information about each Director nominee, including their age as of the date of the Annual Meeting, business experience, period of service as a Director, public or investment company directorships, and other directorships. Please see the skills matrix that follows for the skills and experience of the Director nominees.

| | | | | |

| Consolidated Edison, Inc. Proxy Statement 9 |

Election of Directors | Proposal 1

Skills and Experience of Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skill or Attribute | Timothy P.

Cawley | John F.

Killian | Karol V.

Mason | Dwight A.

McBride | William J.

Mulrow | Michael W.

Ranger | Linda S.

Sanford | Deirdre

Stanley | L. Frederick

Sutherland | Catherine

Zoi |

| | | | | | | | | | |

CEO

(for profit) | | | | | | | | | | |

| CEO (non-profit/ University) | | | | | | | | | | |

| Executive at Public Co. | | | | | | | | | | |

| Capital Markets / Financial Services | | | | | | | | | | |

| CFO / Accounting | | | | | | | | | | |

Communications

/ PR | | | | | | | | | | |

| Consumer Services | | | | | | | | | | |

| Corporate Governance | | | | | | | | | | |

| Cybersecurity | | | | | | | | | | |

| Electric / Gas Operations | | | | | | | | | | |

| Ethics & Compliance | | | | | | | | | | |

Financial

Expert | | | | | | | | | | |

| Government | | | | | | | | | | |

Human Capital Management | | | | | | | | | | |

Investor

Relations | | | | | | | | | | |

| Leadership | | | | | | | | | | |

| Legal | | | | | | | | | | |

| M&A | | | | | | | | | | |

| Regulated Company | | | | | | | | | | |

Risk

Management | | | | | | | | | | |

Strategic

Planning | | | | | | | | | | |

| Sustainability / Environmental / Climate Change | | | | | | | | | | |

| Technical / Engineering | | | | | | | | | | |

| Technology | | | | | | | | | | |

| Utility / Energy | | | | | | | | | | |

| | | | | |

10 Consolidated Edison, Inc. Proxy Statement | |

Election of Directors | Proposal 1

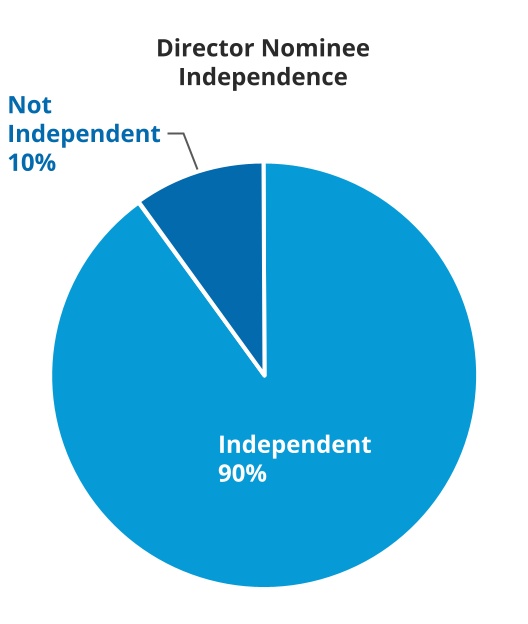

The makeup of the Director nominees is set forth in the pie charts that follow.

| | | | | |

| Consolidated Edison, Inc. Proxy Statement 11 |

Election of Directors | Proposal 1

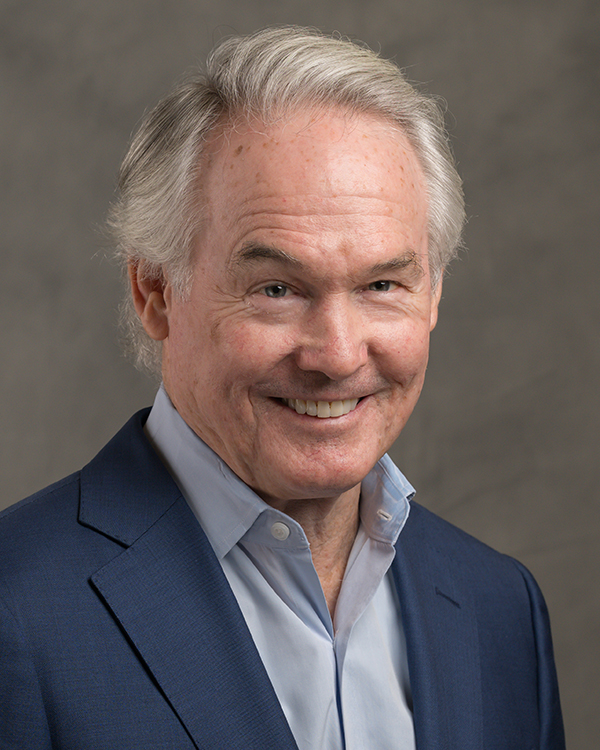

Timothy P. Cawley

| | | | | | | | | | | | | | |

Director Since: 2020 | Age: 60 | | | |

| | | | | | | | |

| | Career Highlights Mr. Cawley has been Chairman of the Board of the Company and Con Edison of New York since January 1, 2022 and President and Chief Executive Officer of the Company and Chief Executive Officer of Con Edison of New York since December 29, 2020. Mr. Cawley was President of Con Edison of New York from January 1, 2018 through December 31, 2020 and was President and Chief Executive Officer of Orange & Rockland from December 2013 through November 2017. He was Senior Vice President of Central Operations for Con Edison of New York from December 2012 through November 2013, having joined Con Edison of New York in July 1987. Other Directorships Mr. Cawley is Chairman of the Board and a Trustee of Con Edison of New York, Chairman of the Board and Director of Orange & Rockland and Chairman of the Board and Director, Con Edison Transmission, Inc. He is also a Director of the American Gas Association (a member of the Executive and Safety Committees), the Edison Electric Institute (a member of Executive Committee) and the Partnership for New York City (a member of Executive Committee), and a Board member of the Trust for Governors Island. Mr. Cawley has previously served as a Director of the Hudson Valley Economic Development Corporation, the Hudson Valley Pattern for Progress, the New Jersey Utilities Association, the Orange County Partnership, and the Rockland Economic Development Corporation. Attributes and Skills Mr. Cawley has leadership, engineering, financial, and operations experience, as well as knowledge of the utility industry and the Company’s business. Mr. Cawley's experience from his leadership positions at the Company's subsidiaries supports the Board in its oversight of the Company's management, financial, operations and strategic planning activities, and the Company's relationships with stakeholders. |

Board Committees: •Executive (Chair) | |

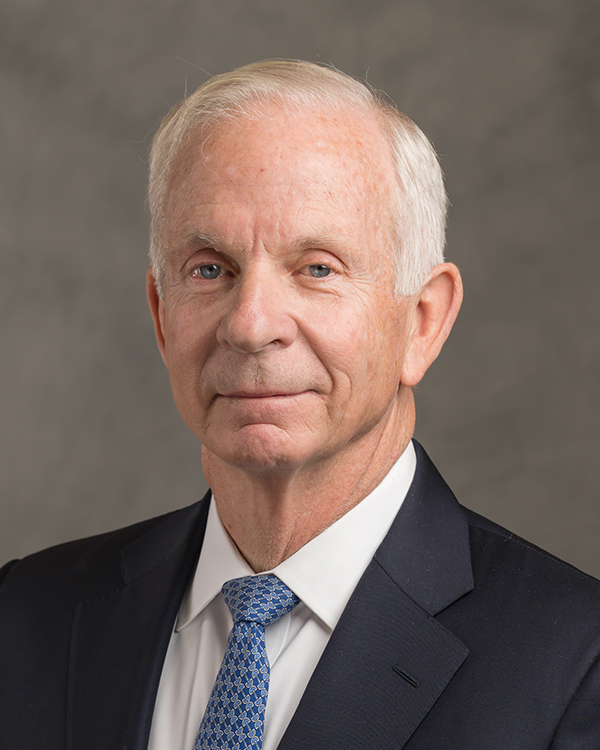

John F. Killian

| | | | | | | | | | | | | | |

Director Since: 2007 | Age: 70 | | | |

| | | | | | | | |

| | Career Highlights Mr. Killian was the Executive Vice President and Chief Financial Officer of Verizon Communications Inc., a telecommunications company, from March 2009 to November 2010. He was the President of Verizon Business, Basking Ridge, NJ from October 2005 until February 2009, the Senior Vice President and Chief Financial Officer of Verizon Telecom from June 2003 until October 2005, and the Senior Vice President and Controller of Verizon Corporation from April 2002 until June 2003. Mr. Killian also served in executive positions at Bell Atlantic and was the President and Chief Executive Officer of NYNEX CableComms Limited. Other Directorships Mr. Killian is a Trustee of Con Edison of New York and Goldman Sachs Trust 1 and 2, was a Director of Houghton Mifflin Harcourt Company until it became a private company in April 2022, and is a Trustee Emeriti of Providence College. Mr. Killian also served as a Trustee and Chairman of the Board of Providence College until 2018. Attributes and Skills Mr. Killian has leadership experience at regulated consumer services companies, including experience with financial reporting and internal auditing. Mr. Killian’s experience from his leadership positions at Verizon Communications, Inc., Bell Atlantic and NYNEX CableComms Limited supports the Board in its oversight of the Company’s auditing, financial, operating, and strategic planning activities, and the Company’s relationships with stakeholders. |

Board Committees: •Audit (Chair) •Corporate Governance and Nominating •Executive •Management Development and Compensation | |

| | | | | |

12 Consolidated Edison, Inc. Proxy Statement | |

Election of Directors | Proposal 1

Karol V. Mason

| | | | | | | | | | | | | | |

Director Since: 2021 | Age: 67 | | | |

| | | | | | | | |

| | Career Highlights Ms. Mason has been President of John Jay College of Criminal Justice, a senior liberal arts college in the City University of New York system focused on educating students through a justice lens, since August 2017. Ms. Mason was an Assistant Attorney General for the Office of Justice Programs within the United States Department of Justice from June 2013 until January 2017 and a Deputy Associate Attorney General within the United States Department of Justice from April 2009 until February 2012. Ms. Mason was an attorney at the law firm of Alston & Bird LLP from November 1983 until April 2009, where she served as a partner from January 1990 until April 2009 and served again, as a partner, from February 2012 through May 2013. Ms. Mason was a Judicial Law Clerk for The Honorable Judge John F. Grady of the United States District Court for the Northern District of Illinois from October 1982 until October 1983. Other Directorships Ms. Mason is a Trustee of Con Edison of New York and has been a member of the Independent Rikers Commission since November 2023 and the Board of the Volcker Alliance since January 2025. Ms. Mason is also on the Advisory Board of Carolina Performing Arts at the University of North Carolina at Chapel Hill (“UNC-Chapel Hill”), the Institute for Arts and Humanities at UNC-Chapel Hill, and the Fines and Fees Justice Center. Ms. Mason served as a Trustee and Vice Chairman of UNC-Chapel Hill and served on the Arts & Sciences Foundation and National Development Council of UNC-Chapel Hill. Ms. Mason also served as a Director or Trustee of the Woodruff Arts Center until 2013, the Children’s HealthCare of Atlanta until 2009, the High Museum of Art until 2009, the National Black Arts Festival until 2000, Wesley Homes until 2008, and the City of Atlanta-Fulton County Recreation Authority until 1998. Attributes and Skills Ms. Mason has experience leading a prominent public liberal arts college that focuses on educating students through a justice lens. Ms. Mason also has legal experience. Ms. Mason’s experience from her leadership position at John Jay College of Criminal Justice, City University of New York, and her legal experience, supports the Board in its oversight of the Company’s operations, risk management, strategic planning, and relationships with stakeholders. |

Board Committees: •Corporate Governance and Nominating •Safety, Environment, Operations and Sustainability | |

| | | | | |

| Consolidated Edison, Inc. Proxy Statement 13 |

Election of Directors | Proposal 1

Dwight A. McBride

| | | | | | | | | | | | | | |

Director Since: 2021 | Age: 57 | | | |

| | | | | | | | |

| | Career Highlights Dr. McBride has been the Executive Director of the Center for the Study of Race, Ethnicity & Equity since June 2024 and the Gerald Early Distinguished Professor and a Senior Advisor to the Chancellor at Washington University in St. Louis since August 2023. Previously, Dr. McBride served as President of The New School in New York City from April 2020 to August 2023. Prior to joining The New School, Dr. McBride served as Provost and Executive Vice President for Academic Affairs at Emory University (since 2017). Dr. McBride previously held other academic leadership roles that all together span more than two decades, including faculty positions at the University of Pittsburgh, the University of Illinois at Chicago, Northwestern University, Emory University, and The New School, where he has taught various courses in English and American literature, African American studies, gender and sexuality studies, cultural studies, and performance studies. Dr. McBride has published six books, numerous essays, and is the Founding Co-Editor of the James Baldwin Review. Other Directorships Dr. McBride is a Trustee of Con Edison of New York, the Institute of International Education (since 2021) and the Dan David Prize (since 2021). Most recently (beginning January 2025), he joined the board of the St. Louis Art Museum. Dr. McBride has also served as a Trustee of The Cooper Union (until 2020), as a Director of the Illinois Humanities Council (until 2017), the Association of American Colleges & Universities (until 2016), the About Face Theater Company (until 2012), and the Center on Halsted (until 2009). Attributes and Skills Dr. McBride has extensive experience in higher education and leadership experience at universities and other large and complex organizations with diverse stakeholders. Dr. McBride’s executive experience from the considerable leadership positions he has held in academia along with his service on other boards, supports the Board in its oversight of the Company’s operations and management activities, strategic planning, and relationships with stakeholders. |

Board Committees: •Management Development and Compensation •Safety, Environment, Operations and Sustainability | |

William J. Mulrow

| | | | | | | | | | | | | | |

Director Since: 2017 | Age: 69 | | | |

| | | | | | | | |

| | Career Highlights Mr. Mulrow is a Senior Advisory Director since May 2017 at Blackstone, the world’s largest alternative asset management firm. Previously, he served as Secretary to former New York State Governor Andrew Cuomo from January 2015 to April 2017 and was a Senior Managing Director at Blackstone from April 2011 to January 2015. From 2005 to 2011, he was a Director of Citigroup Global Markets Inc. Mr. Mulrow also held various management positions at Paladin Capital Group, Gabelli Asset Management, Inc., Rothschild Inc., and Donaldson, Lufkin & Jenrette Securities Corporation. In addition, Mr. Mulrow served in a number of other government positions, including Chairman of the New York State Housing Finance Agency and State of New York Mortgage Agency. Other Directorships Mr. Mulrow is a Trustee of Con Edison of New York. Mr. Mulrow also serves as a Director and member of the Nominating and Governance Committee at JBG Smith Properties and a Director and member of the Compensation and Nominating and Governance Committees at Titan Mining Corporation. Mr. Mulrow also served as a Director of Arizona Mining, Inc. until 2018. Attributes and Skills Mr. Mulrow has leadership experience in both the public and the private sectors. Mr. Mulrow also has financial, accounting and asset management experience from his leadership positions at Blackstone, New York State government, and his service on other boards, which supports the Board in its oversight of the Company’s financial and strategic planning activities. |

Board Committees: •Finance •Management Development and Compensation •Safety, Environment, Operations and Sustainability | |

| | | | | |

14 Consolidated Edison, Inc. Proxy Statement | |

Election of Directors | Proposal 1

Michael W. Ranger

| | | | | | | | | | | | | | |

Director Since: 2008 | Age: 67 | | | |

| | | | | | | | |

| | Career Highlights Mr. Ranger has been Senior Managing Director of Diamond Castle Holdings LLC, a private equity investment firm, since 2004. Additionally, Mr. Ranger served as President and Chief Executive Officer of Covanta Holding Corporation from 2020 until November 2021. Mr. Ranger was an investment banker in the energy and power sector for twenty years, including at Credit Suisse First Boston, Donaldson, Lufkin and Jenrette, DLJ Global Energy Partners, and Drexel Burnham Lambert. Mr. Ranger was also a member of the Utility Banking Group at Bankers Trust. Other Directorships Mr. Ranger is a Trustee of Con Edison of New York. He is a Trustee of the Atlantic Health System and was the Chairman of the Board of Trustees at St. Lawrence University Board until February 2023. Mr. Ranger also served as a Director of KDC Solar LLC through 2019, and Covanta Holding Corporation until November 2021. Attributes and Skills Mr. Ranger has leadership experience at a private equity firm he co-founded and at various investment banking companies. Mr. Ranger has extensive investment and investment banking experience in the energy, utility, and power sector. Mr. Ranger’s experience from his investment activities in the energy and power sector, and his service on other boards, supports the Board in its oversight of the Company’s corporate governance and financial and strategic planning activities. |

Board Committees: •Audit •Corporate Governance and Nominating (Chair and Lead Director) •Executive •Finance •Management Development and Compensation | |

| | | | | |

| Consolidated Edison, Inc. Proxy Statement 15 |

Election of Directors | Proposal 1

Linda S. Sanford

| | | | | | | | | | | | | | |

Director Since: 2015 | Age: 72 | | | |

| | | | | | | | |

| | Career Highlights Ms. Sanford was Senior Vice President Enterprise Transformation, International Business Machines Corporation (IBM), a multinational technology and consulting corporation, from January 2003 to December 2014. Ms. Sanford joined IBM in 1975. Ms. Sanford was also a consultant to The Carlyle Group serving as an Operating Executive from 2015 to July 2018. Ms. Sanford earned a CERT Certificate in Cybersecurity Oversight from the National Association of Corporate Directors. Other Directorships Ms. Sanford is a Trustee of Con Edison of New York and The Interpublic Group of Companies, Inc. Ms. Sanford also formerly served as a Director of ITT Corporation, RELX PLC (formerly Reed Elsevier PLC) and Pitney Bowes. Ms. Sanford is also a Trustee of New York Hall of Science and also serves as a Trustee Emeriti of St. John’s University and Rensselaer Polytechnic Institute. She also served as a Director or Trustee of the Partnership for New York City through January 2015, the State University of New York through May 2015, the Business Council of New York State through May 2015, and the ION Group through January 2021. Attributes and Skills Ms. Sanford has leadership experience at an international technology company, including experience with information technology, data analytics, cybersecurity, manufacturing, customer relations, and corporate planning and transformation. Ms. Sanford’s experience from her leadership positions at IBM, and her service on other boards, supports the Board in its oversight of technology, relationship with stakeholders, and financial and strategic planning activities. |

Board Committees: •Audit •Corporate Governance and Nominating •Finance | |

Deirdre Stanley

| | | | | | | | | | | | | | |

Director Since: 2017 | Age: 60 | | | |

| | | | | | | | |

| | Career Highlights Ms. Stanley was Executive Vice President and General Counsel to The Estée Lauder Companies, Inc., one of the world’s leading manufacturers and marketers of quality skin care, makeup, fragrance, and hair care products from October 2019 until April 2, 2024. Ms. Stanley was Executive Vice President and General Counsel to Thomson Reuters from 2008 until October 2019, where she also served as Corporate Secretary to the Board of Directors. Ms. Stanley was Senior Vice President and General Counsel to The Thomson Corporation from 2002 to 2008, when it combined with Reuters PLC to form Thomson Reuters. Prior to 2002, Ms. Stanley held various legal and senior executive positions at InterActive Corporation (previously USA Networks, Inc.) and GTE Corporation (a predecessor company to Verizon). She was also an attorney with the law firm of Cravath, Swaine & Moore. Other Directorships Ms. Stanley is a Trustee of Con Edison of New York. Ms. Stanley is also a Trustee of the Hospital for Special Surgery and a Trustee of The Dalton School. Ms. Stanley also served as a Director of Refinitiv from October 2018 through October 2019. Attributes and Skills Ms. Stanley has leadership, legal and operations experience at an international news and information company and a global consumer products company, including experience with mergers and acquisitions, corporate governance, and risk management. Ms. Stanley’s experience from her leadership positions at The Estée Lauder Companies and Thomson Reuters Corporation, her legal experience and service on other boards supports the Board in its oversight of the Company’s operations, risk management, strategic planning, and relationships with stakeholders. |

Board Committees: •Corporate Governance and Nominating •Management Development and Compensation (Chair) | |

| | | | | |

16 Consolidated Edison, Inc. Proxy Statement | |

Election of Directors | Proposal 1

L. Frederick Sutherland

| | | | | | | | | | | | | | |

Director Since: 2006 | Age: 73 | | | |

| | | | | | | | |

| | Career Highlights Mr. Sutherland was the Executive Vice President and Chief Financial Officer of Aramark Corporation, Philadelphia, PA, a provider of food services, facilities management, and uniform and career apparel, from 1997 to 2015. Prior to joining Aramark in 1980, Mr. Sutherland was Vice President, Corporate Banking, at Chase Manhattan Bank, New York. Other Directorships Mr. Sutherland is a Trustee of Con Edison of New York and a Director and the Chair of the Audit Committee of Colliers International Group Inc. and was a Director and the Chair of the Audit Committee of Sterling Check Corp. until its acquisition in November 2024. Mr. Sutherland is also a Trustee of Episcopal Community Services, a Philadelphia-based anti-poverty agency, a Trustee and Chair of the Audit and Compliance Committee of Duke University, a Trustee of the National Constitution Center, and a Trustee of People’s Light, a not-for-profit professional theater. Attributes and Skills Mr. Sutherland has leadership experience at an international managed services company, including experience with financial reporting, internal auditing, mergers and acquisitions, financing, risk management, corporate compliance, and corporate planning. Mr. Sutherland also has corporate banking experience. Mr. Sutherland’s experience from his leadership positions at Aramark Corporation and Chase Manhattan Bank supports the Board in its oversight of the Company’s financial reporting, auditing, and strategic planning activities. |

Board Committees: •Audit •Finance (Chair) •Management Development and Compensation | |

Catherine Zoi

| | | | | | | | | | | | | | |

Director Since: 2024 | Age: 63 | | | |

| | | | | | | | |

| | Career Highlights Ms. Zoi was a Director and the Chief Executive Officer of EVgo Inc., an electric vehicle fast charging station network, from 2017 until her retirement in November 2023. Prior to joining EVgo Inc., Ms. Zoi has held numerous, senior executive and board positions in the energy industry, government, academia and non-profit sectors, including serving in the Obama Administration as the Assistant Secretary and Acting Under Secretary at the Department of Energy. Other Directorships Ms. Zoi is a currently a director of SPAN.IO, Inc., a manufacturer of at-home smart electric panels, and Chair of the Board of Directors of Scale Microgrid Solutions, LLC, a vertically integrated distributed energy company, and was a director of Soli Organic, Inc., an agricultural technology company from February 2022 until January 2025, and was formerly the founder and a director of Odyssey Energy Solutions, Inc., a software company for the distributed energy sector. Attributes and Skills Ms. Zoi has considerable management and leadership experience as a former Chief Executive Officer in an industry that is complimentary to that of the Company. Her experience from her leadership in both government and private enterprise supports the Board in its oversight of the Company’s sustainability, operations and strategic planning activities. |

Board Committees: •Finance (since May 20, 2024) •Safety, Environment, Operations and Sustainability | |

| | | | | |

| Consolidated Edison, Inc. Proxy Statement 17 |

The Board of Directors

Meetings and Board Members’ Attendance

During 2024, the Board consisted of the following members: Timothy P. Cawley, Ellen V. Futter, John F. Killian, Karol V. Mason, Dwight A. McBride, William J. Mulrow, Armando J. Olivera, Michael W. Ranger, Linda S. Sanford, Deirdre Stanley, L. Frederick Sutherland and Catherine Zoi. Ms. Zoi joined the Board in February 2024. The Board of Directors held 11 meetings in 2024. At its meetings, the Board considered a wide variety of matters such as the Company’s strategic planning, its financial condition and results of operations, its capital and operating budgets, personnel matters, human capital management, diversity, equity and inclusion, sustainability, succession planning, cybersecurity, risk management, industry issues, accounting practices and disclosure, and corporate governance practices.

In accordance with the Company’s Corporate Governance Guidelines, the Chair of the Corporate Governance and Nominating Committee, Mr. Ranger, serves as independent Lead Director and, as such, chairs the executive sessions of the independent Directors. The Board routinely holds executive sessions at which only the independent Directors meet. The Company’s independent Directors met eight times in executive session during 2024.

During 2024, each member of the Board attended more than 75% of the combined meetings of the Board of Directors and the Board Committees on which he or she served during the period that he or she served. Directors are expected to attend the Annual Meeting. All of the Directors, who then served on the Board, attended the 2024 Annual Meeting of Stockholders, which was held virtually.

Corporate Governance

The Company’s corporate governance documents, including its Corporate Governance Guidelines, the charters of the Audit, Corporate Governance and Nominating, Management Development and Compensation, and the Safety, Environment, Operations and Sustainability Committees, and the Standards of Business Conduct, are available on the Company’s website at www.conedison.com/en/investors/shareholder-services. The Standards of Business Conduct apply to all Directors, officers, and employees. The Company intends to post on its website at www.conedison.com/en/investors/shareholder-services, any amendments to its Standards of Business Conduct and a description of any waiver from a provision of the Standards of Business Conduct granted by the Board to any Director or executive officer of the Company within four business days after such amendment or waiver. To date, there have been no such waivers.

Leadership Structure

The current Board consists of a majority of independent Directors (92%). The nominees are also a majority of independent Directors (90%). As discussed in the Corporate Governance Guidelines, the Board selects the Company’s Chief Executive Officer and Chairman of the Board in the manner that it determines to be in the best interest of the Company’s stockholders. The Company’s leadership structure combines the role of the Chief Executive Officer and Chairman. The Board believes that this leadership structure is appropriate for the Company due to a variety of factors, including Mr. Cawley’s long-standing knowledge of the Company and the utility industry and his extensive leadership, engineering, financial and operations experience.

The Board has an independent Lead Director. Pursuant to our Corporate Governance and Nominating Committee Charter, the Board appoints the members of that Committee annually, one of whom is designated as the Chair of the Committee and the Lead Director of the Board. The Corporate Governance Guidelines further provide that the Lead Director:

(1)acts as a liaison between the independent Directors and the Company’s management;

(2)chairs the executive sessions of independent Directors and has the authority to call additional executive sessions as appropriate;

(3)chairs Board meetings in the Chairman’s absence;

(4)coordinates with the Chairman on agendas and schedules for Board meetings, information flow to the Board, and other matters pertinent to the Company and the Board;

(5)is available for consultation and communication with major stockholders as appropriate; and

(6)performs such other duties assigned to the Lead Director by the Board.

| | | | | |

18 Consolidated Edison, Inc. Proxy Statement | |

Mr. Ranger has served as Lead Director of our Board since January 2018 and has been a Director since 2008. He is an independent director under New York Stock Exchange standards. In addition to his Lead Director role, his governance responsibilities include chairing the Corporate Governance and Nominating Committee that manages governance risk and advises the Board on corporate governance matters, oversees the Committees and their annual charter reviews, and develops policies to operate the Board to maximize its effectiveness and he also oversees the Board’s succession planning and recruitment efforts.